“There’s a case to be made that if inflation takes off, we could need to go higher on interest rates. Of

course, if the economy weakens dramatically from the uncertainty … that could bring interest rates down. But both of those things are possible at the same time, and that’s what makes this such a complicated environment to navigate.”

~ Neel Kashkari, President of the Minneapolis Federal Reserve Bank, April 9, 2025

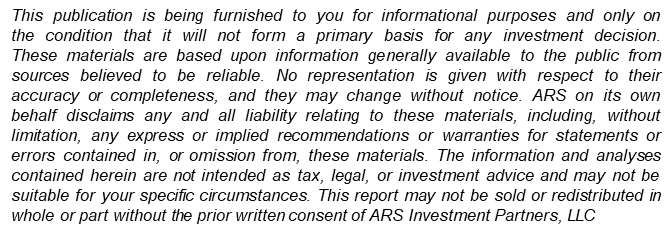

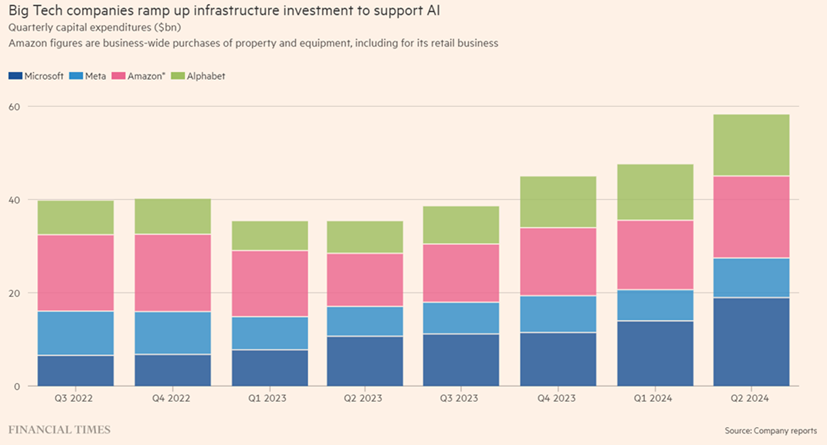

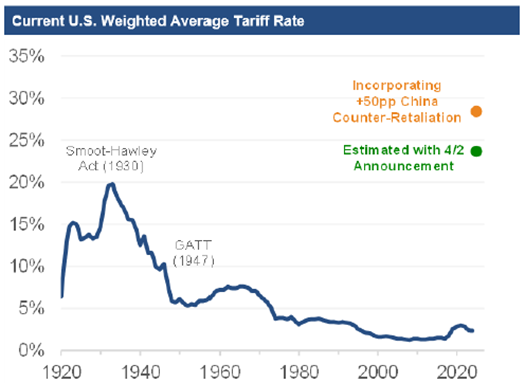

Uncertainty remains a key feature of this environment and will be accompanied by periods of elevated market volatility like we have experienced since the April 2nd tariff announcement. This uncertainty is resulting from the radical trade policies emanating from Washington as well as the reactions from foreign nations. In less than 90 days, the Trump Administration’s policies have shaken the world order in a highly disorderly manner. The pace of Executive Order issuance and the lack of transparency as to the specific goals of the President’s policies have raised global economic policy uncertainty to record levels as illustrated in Chart 1. This is leaving policymakers, business owners, consumers, and market participants struggling to figure out how to respond.

There has been a dramatic shift in investor sentiment as the unconventional policies of the Trump Administration, which were welcomed in November, are now causing fears of a global growth slowdown, potentially leading to a recession. These fears were growing even before the Administration’s tariff announcements, which considerably exceeded expectations, sending shock waves throughout the world before being postponed for 90 days. Under these circumstances, it is difficult, if not impossible, for corporations to embark on multi-year capital spending decisions with short-term spending continuing only in areas of need and clear opportunity with assured rates of return. The benefit of periods characterized by heightened volatility lies in the potential for negative sentiment to generate significant undervaluation among premier companies. This can encompass both high-quality businesses within well-defined growth sectors and companies exhibiting robust balance sheets coupled with strong and increasing dividend yields.

Chart 1. Global Economic Policy Uncertainty Index

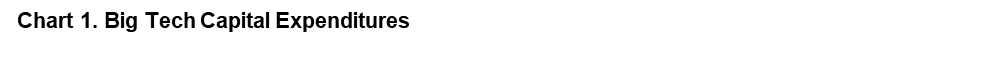

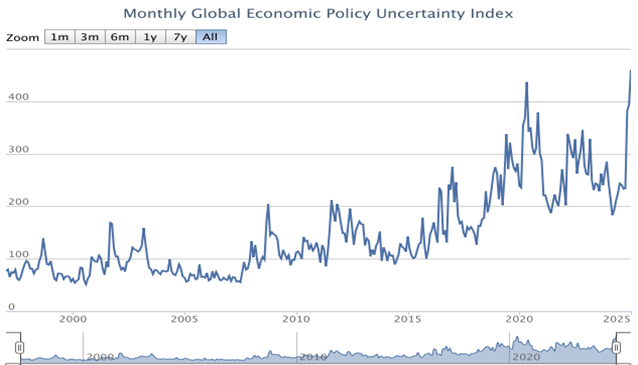

Three of the five primary areas of the Trump Administration’s focus – immigration, deregulation, and the lowering of energy costs – have generally been viewed favorably. On the other hand, efforts on public sector reform have received mixed reviews, while its tariff policy has not been well understood and poorly received. Chart 2 illustrates the increase in the effective tariff rate based on the April 2nd announcement by the U.S. The President’s decision to dismantle the post-World War II economic order, built on freer trade and globalization and championed by the United States, represents a risky undertaking. His aim is to reshape the world economy to prioritize U.S. interests and rectify real and perceived trade imbalances affecting the nation.

Chart 2. President Trump’s Announced Tariffs Would Be Highest in 100 Years

This period is particularly challenging due to the lack of clarity and predictability surrounding tariffs and policy goals. The 90-day delay in tariff implementation, coinciding with difficult negotiations, will likely maintain the elevated volatility. This policy ambiguity complicates the task for central bankers in setting appropriate policy, hinders corporations from making long-term investments, and discourages consumer spending amid rising living costs.

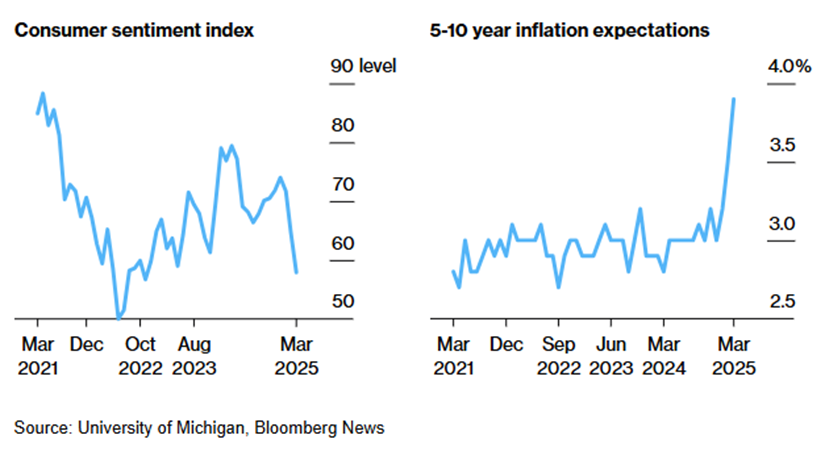

Consequently, this uncertainty is significantly impacting consumer sentiment and investor confidence, as long-term inflation expectations have seen their largest jump since 1993. Chart 3 illustrates this shift from optimism to pessimism, driven by concerns that the U.S. economy is heading toward stagflation, defined as simultaneously rising inflation with slowing growth.

Chart 3. Univ. of Michigan Surveys Reflect the Rapid Swing in Expectations

Next, we will discuss four key areas that are changing due to current conditions, what it means for the world, and the investment implications for the economy and markets. While these times are full of uncertainties, we are reminded of a quote from legendary investor Warren Buffett, “You know, people talk about this being an uncertain time. You know, all time is uncertain. I mean, it was uncertain back in, in 2007, we just didn’t know it was uncertain. It was uncertain on September 10th, 2001. It was uncertain on October 18th, 1987, you just didn’t know it.” As Mr. Buffett knows, successful stock market investing isn’t about avoiding risk, but about embracing uncertainty to find opportunities. This involves buying well-positioned businesses at a discount to their intrinsic value.

What Is Changing for the World?

The interplay of forces in the world economy will significantly affect four critical areas in the year ahead: geopolitics, consumer/business/investor behavior, fiscal policy, and monetary policy. These forces will also influence global trade and exchange rates, as well as the rising cost of living. We briefly address each of these areas below:

GEOPOLITICS: For global investors, the United States was once seen as the pillar of stability in the post-World War II world. This trust stemmed largely from the belief, held by both allies and adversaries, that the U.S. commitment to the rule of law and the established global order was essential for the past 75 years of growth. Now, however, these foundational commitments are being questioned both at home and abroad. This shift marks a departure from a long era of globalization towards increasing fragmentation, reversing trends established over decades. The President’s current foreign policy approach carries the risk of alienating allies and driving them towards China, rather than just incentivizing manufacturing in the U.S.

FISCAL POLICY: Greater demands are being placed on governments at a time when most nations have either too much debt or too little fiscal space to manage additional expenditures. Therefore, they will need to run larger fiscal deficits, slow spending, or raise taxes. For investors, one of the most significant changes is U.S. fiscal policy shifting from excessive fiscal and monetary stimulus to austerity to rein in government spending, while Europe and China have announced significant increases in stimulus spending. For Europe, the stimulus is long overdue and should contribute to increasing growth if EU nations move to act in a more unified manner. Germany’s economy is estimated to reach $5.7 trillion in 2025, with growth forecast to rise 1.7%. In Europe’s largest economy, recent proposals from the incoming Chancellor Merz call for an estimated $600 billion in spending on defense and $528 billion on infrastructure and climate investments over several years, with the EU calling for an additional $528 billion in defense spending for the region. For Europe overall, and Germany in particular, this stimulus spending should provide a significant economic boost, but it comes at a time when both have been suffering from political, cyclical, and secular challenges, making a successful outcome difficult.

As the second largest economy in the world and a rival to the United States hegemony, China has been struggling since the pandemic and is dealing with its own economic issues including slowing growth, problems in real estate markets, worsening demographics, an unbalanced economy, and concerns about its ability to export products to its two biggest markets – the U.S. and E.U. Since the U.S. elections, many investors were expecting a significant increase in China’s already existing stimulus measures earlier this year. However, China waited for tariff announcements and has now further implemented stimulus measures. These will likely serve only to cushion its economy, while China continues exporting its excess capacity to the rest of the world.

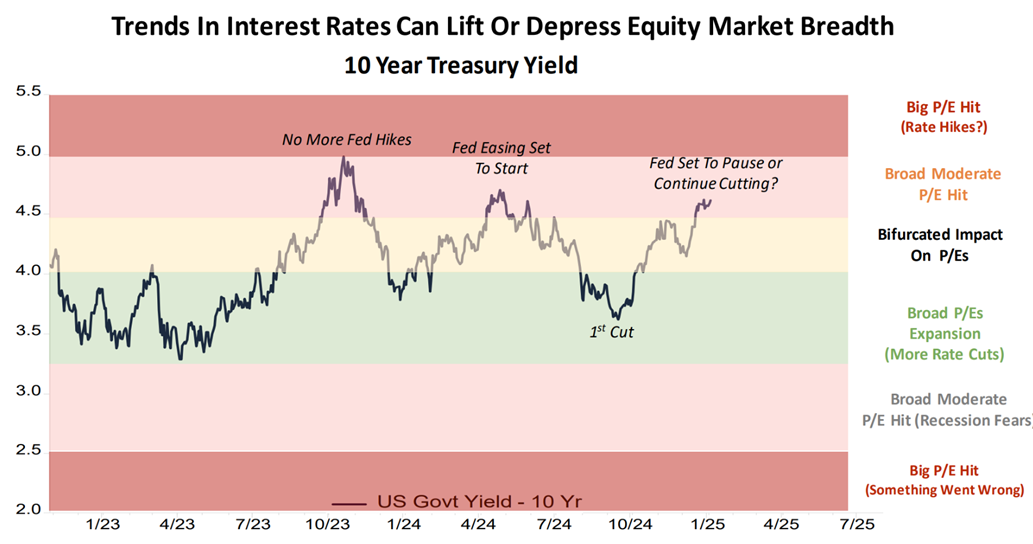

MONETARY POLICY: Risks of inflation are decidedly more two-sided than expected at the start of the year. Chart 3 highlights the challenges for central banks in this environment, with consumer sentiment declining and inflation expectations rising. If central banks cut interest rates aggressively in the face of higher inflationary expectations, the cuts could spur inflation and force them to reverse policy course. If too slow to cut, central banks risk a recession. At the time of this writing, the market expects the Federal Reserve to cut rates four times in 2025. That is not our base case as ARS has been in the “higher-for-longer” camp on interest rates and would expect the Fed to move at a more measured pace unless there is a financial crisis. As Fed Chair Jerome Powell said last Friday, “While uncertainty remains elevated, it is becoming increasingly clear that the tariffs will be significantly larger than expected. The same is likely to be true of the economic effects, which will include higher inflation and lower growth… Our obligation is to keep longer-term inflation expectations well-anchored to make certain a one-time increase in the price level does not become an ongoing inflation problem.” While expectations remain for multiple rate cuts from the Fed, European Central Bank (ECB), and the People’s Bank of China, investors may find conditions limit the ability of central banks to cut as aggressively as market participants may desire. Importantly, the inflationary concerns speak to the value of owning equities and hard assets in this environment.

CONSUMER/BUSINESS/INVESTOR BEHAVIOR: In times of heightened uncertainty, consumers and businesses tend to restrict spending, which reduces corporate earnings and can lead to rising unemployment and possibly a recession. At the same time, corporate expenses are increased by the impact of tariffs. Tariffs will lead to one of three outcomes for corporations: the company can absorb the increased costs, it can pass the increase to the consumer, or it can share the increase with the consumer. In any case, the cost of living will rise to a higher level, and the economy will slow. The magnitude of each is currently unknown.

The Investment Implications of a Disorderly World

“Maintaining stability in the new era will be a formidable task. It will require an absolute commitment to our inflation target, the ability to parse which types of shocks will require a monetary action, and the agility to react appropriately. Trade fragmentation and higher defense spending in a capacity-constrained sector may push up inflation. Yet U.S. tariffs could also lower demand for EU exports and redirect excess capacity from China into Europe, which could push inflation down.”

~ Christine Lagarde, President of the European Central Bank, March 12, 2025

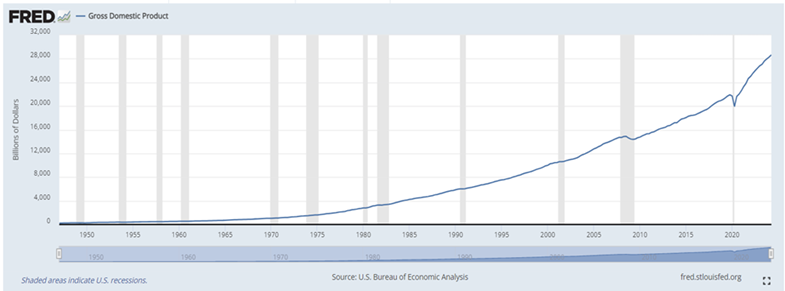

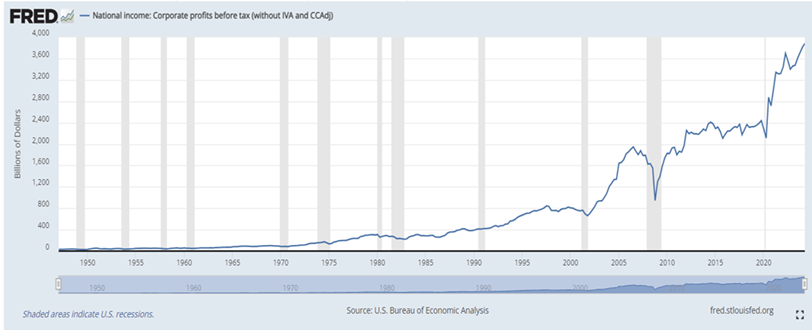

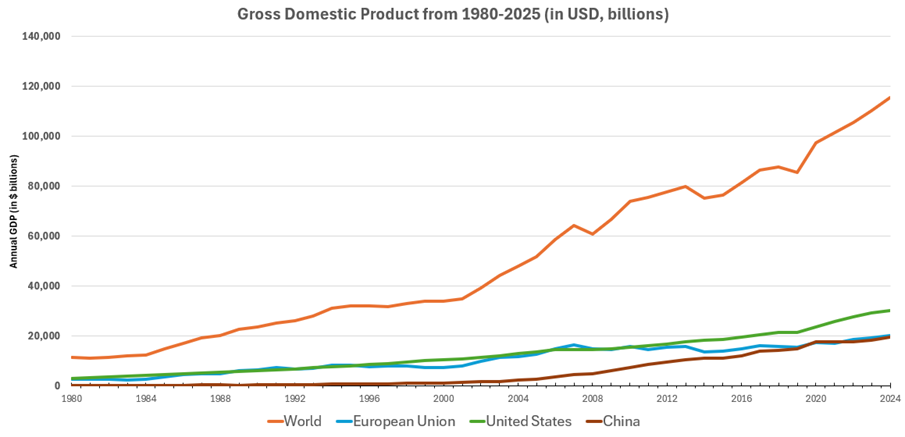

Since the start of the year, sentiment has shifted. Optimism about the strong U.S. economy has given way to fears of a global recession and stagflation, triggered by the Trump Administration’s unconventional policies. As a result, investors should anticipate a period of slower growth, renewed inflationary pressures, capital flows shifting from U.S. equities to other asset classes and geographies, a weaker dollar, and fewer rate cuts from the Fed. Regardless of the final level of tariffs, the cost of living will increase, and that makes the need for nations to increase productivity even more important. Even if the tariffs work as the Administration hopes, there will be timing differences that will create short-term dislocations in areas such as the availability of skilled labor and the timing of tax revenues received from onshoring deals. Yet, we have been through challenges before, and the strength and resilience of the U.S. economy have allowed the nation not only to survive but also to thrive and grow. Chart 4 shows the World, European Union, China, and the United States GDP growth from 1980-2025. When the decade of the 1980s began, the S&P 500 was at 107.94 in January of 1980 and was recently trading at around 5000, while U.S. corporate pre-tax profits rose from $309 billion to $4.3 trillion. For all the problems we have faced since the inflation bubble burst in the early 1980s to today, the world continues to grow, but it is never in a straight line.

Chart 4. Comparison of World, U.S., EU, and China GDP 1980-2025

Today, investors have options that they have not had in many years, as market participants invested with the belief that “there is no alternative” to the U.S. But that may be changing. Europe and China are beginning to offer new opportunities for equity investors, while the current interest rate levels are making both public and private credit more attractive relative to equities as well. In the short term, capital flows may move away from U.S. equity markets as we have seen recently, but ARS expects flows to return as the inherent strengths of the United States economy reassert themselves. While tariff policy is dominating the headlines right now, there are several positives that are not being recognized enough for the U.S. economy. Reshoring should reaccelerate after slowing the past two years, efforts to rein in government spending will help with the debt and deficit financing, low taxes for small/medium sized businesses and the possibilities of tax credits for reshoring and building plants in the U.S. should help increase spending, while investments in improving productivity should help offset rising labor costs and reduce inflation.

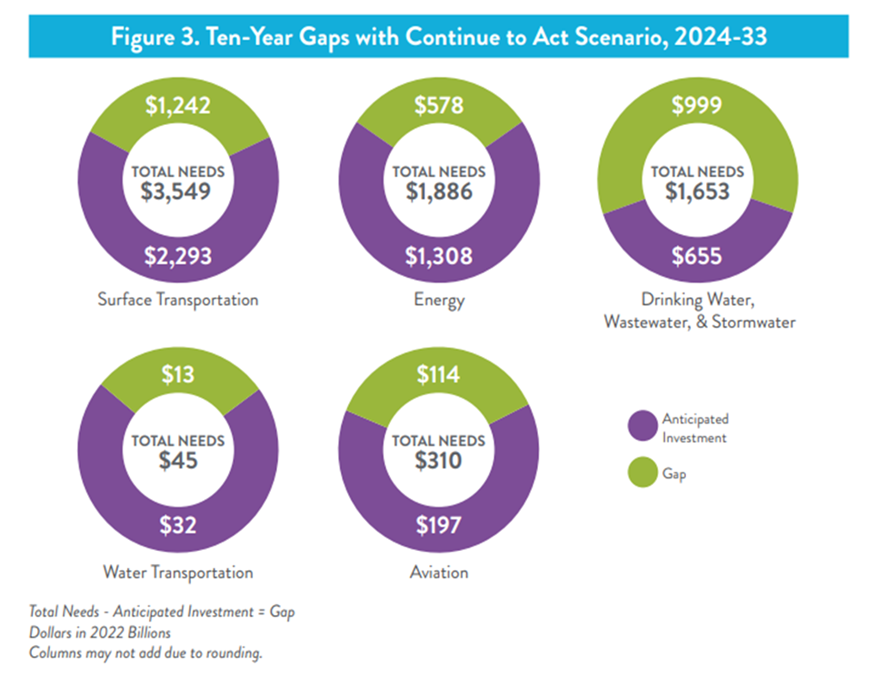

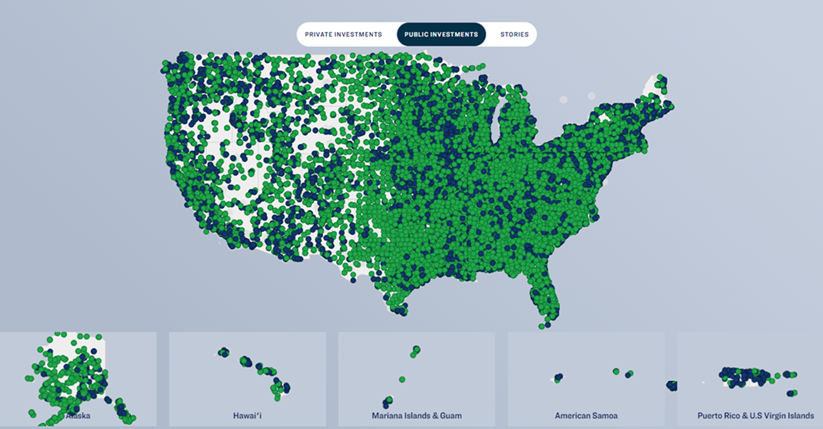

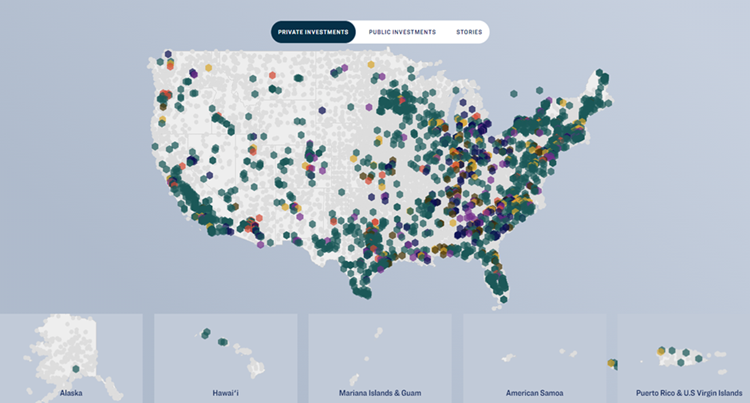

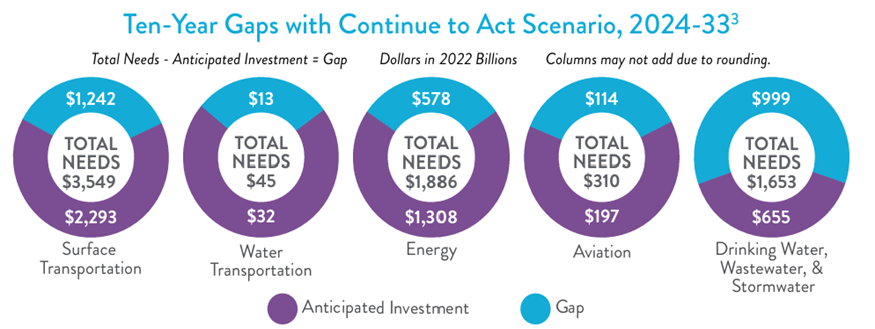

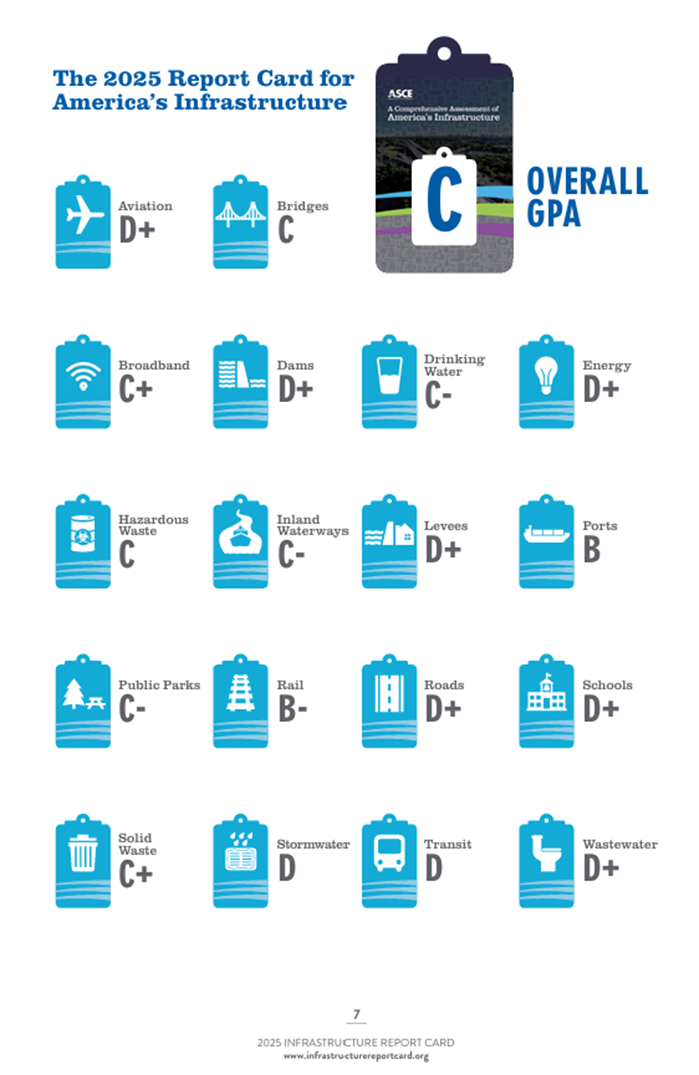

Three of our favored investment themes involve companies improving productivity through innovation, particularly artificial intelligence, to offset higher costs; national security (including defense, energy, and industrial companies); and those companies involved in rebuilding and modernizing our nation’s infrastructure. Long time readers of the Outlook know ARS has reviewed the ASCE Infrastructure Report Card since it was introduced decades ago. The study evaluates the current state of U.S. infrastructure and what is needed to keep our system in a state of good repair. The U.S. received a grade of C in this year’s report, which is up from the 2021 report (See appendix). However, much work remains and will require significant spending, as shown in Chart 5. The funding gaps are considerable in surface and water transportation, water, energy, and aviation. As the federal government cuts spending, a greater burden will be on state and local governments to step up, which will be a challenge for many states.

Chart 5. ASCE Infrastructure Report Card 2025 -Funding Gaps in Critical Areas

In normal times, investing requires investors to make decisions with incomplete information, but today’s environment is anything but. Therefore, the range of potential outcomes is even wider than it has been in the past. Rather than get caught up in the short-termism so prevalent today, the ARS approach looks at the secular trends driving capital flows over the next 3-5 years to allow us to move away from consensus thinking, while looking for businesses selling for attractive risk-adjusted valuations over the next 12-18 months. In uncertain times such as this one, market participants will be well served investing in the areas of required spending, including reindustrialization, national security (including defense, space, cybersecurity, and critical infrastructure), electrification, digitalization (including AI), productivity, and healthcare. As the United States and the world work through the current challenges, some of which are self-inflicted, we are reminded of a quote from Warren Buffett’s 2021 annual letter to shareholders on the U.S., “In its brief 232 years of existence … there has been no incubator for unleashing human potential like America. Despite some severe interruptions, our country’s economic progress has been breathtaking. Our unwavering conclusion: Never bet against America.”

Appendix

Published by the ARS Investment Policy Committee:

Stephen Burke, Sean Lawless, Nitin Sacheti, Greg Kops, Andrew Schmeidler, Arnold Schmeidler, P. Ross Taylor, Tom Winnick.

The information and opinions in this report were prepared by ARS Investment Partners, LLC (“ARS”). Information, opinions and estimates contained in this report reflect a judgment at its original date and are subject to change. This report may contain forward-looking statements and projections that are based on our current beliefs and assumptions and on information currently available that we believe to be reasonable. However, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements.

ARS and its employees shall have no obligation to update or amend any information contained herein. The contents of this report do not constitute an offer or solicitation of any transaction in any securities referred to herein or investment advice to any person and ARS will not treat recipients as its customers by virtue of their receiving this report. ARS or its employees have or may have a long or short position or holding in the securities, options on securities, or other related investments mentioned herein.