“In Europe, the only way to proceed is to proceed as we have always done, namely by following a pragmatic, step-by-step, flexible and rectifiable approach; proceeding only ever as far and as fast as the peoples and governments of Europe actually desire.”

– German Finance Minister, Wolfgang Schauble, article in the Frankfurter Allgemeine Zeitung, 7/4/15

“Major debt overhangs are only solved after deep write-downs of the debt’s face value. The longer it takes for the debt to be cut, the bigger the necessary write-down will turn out to be. Nobody should understand this better than the Germans. It’s not just that they benefited from the deal in 1953, which underpinned Germany’s postwar economic miracle. Twenty years earlier, Germany defaulted on its debts from World War I, after undergoing a bout of hyperinflation and economic depression.”

– Eduardo Porter, NY Times 7/7/15

The global economy suffers from too much debt and too little growth. According to the McKinsey Global Institute, global debt from 2007 to the second quarter of 2014 had grown by $57 trillion to approximately $199 trillion or 286% of Gross Domestic Product (GDP) while global GDP has grown by roughly $17 trillion during that period. While a tentative deal was reached on July 12th between Greece and its creditors, the terms are onerous and will be difficult to implement at best. If economic recovery continues to disappoint there will inevitably be write-downs of debt globally, particularly for Greece, as the financing required to generate sufficient growth renders the debt dynamics unsustainable. The sooner politicians and creditors come to accept that write-downs will be required, the lower the ultimate economic cost will be and the sooner economies will return to sustainable growth. Greece, which has been the poster child of the broader debt problem, has seen its GDP of $319 billion in 2007 decline to an estimated $207 billion in 2015 while its debt has grown from $349 billion to approximately $380 billion as years of political and economic malpractice now have the nation on the brink of collapse. The current global economic and geopolitical dynamics strongly suggest a continuation of low interest rates, low inflation rates and low growth for the foreseeable future as the global economy cannot tolerate a normalization of interest rates to historical levels under present conditions. The ongoing divergences continue to place strains on the world’s economy and capital markets leading to continued periods of volatility.

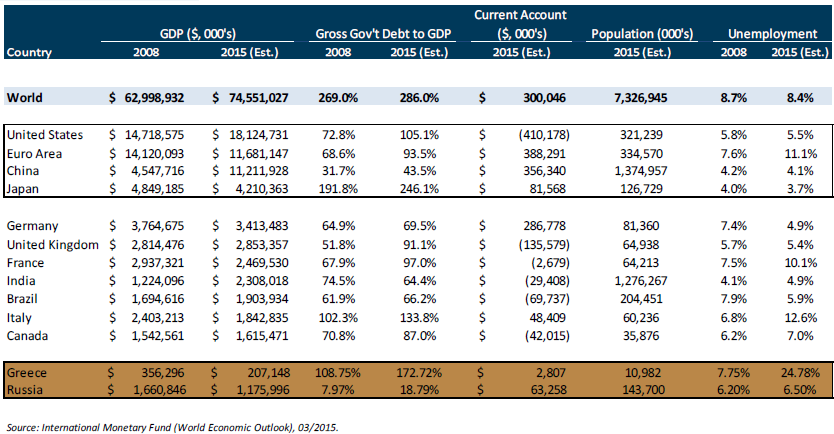

The chart below highlights the changes in the major global economies and Greece in GDP, debt and current accounts from year-end 2008 to projected year-end 2015 as well as the estimated 2015 population and unemployment figures. It illustrates the divergences between the stronger economies and the weaker ones. Some countries were able to grow GDP with debt growth at manageable levels such as the United States, Germany and the UK, while achieving improvements in unemployment. At the same time, the chart helps explain the challenges for the 19 members of the Eurozone as well as the specific challenges facing Greece and Italy which have significantly lower GDP, rising debt ratios and unemployment. The “no” vote by the people of Greece in its national referendum sent a resounding message to its creditors, European leaders (particularly Germany and France) and the rest of the world that the debt problems that have plagued the global economy since 2007 are not being effectively resolved with current monetary and fiscal policies. The vote expressed the frustration of the Greeks with the current situation as the majority of voters actually want to stay in the Eurozone, but cannot tolerate the continuation of austerity-driven policies which have put them in a depression without the hope of a positive future. Years of austerity, rising unemployment and growing income inequality in Greece have sown the seeds for contagion to other weak economies in the Eurozone. The issue of inequality has become a concern for politicians globally.

Ultimately, an agreement was reached at the Euro Summit held on July 12th – 13th between European and Greek leaders. Greek Premier Alexis Tsipras accepted worse terms than were previously offered to his predecessors (which he severely criticized), and the last one that the voters rejected in the referendum. At the time of this writing, the deal must be voted on by seven governments including the Greek parliament. We remain skeptical that the agreement will allow Greece to service its debt and return to sustainable growth without debt relief. European politicians continue to struggle with balancing Europe’s best options with complicated domestic politics. The remainder of The Outlook will address the resurgence of U.S. economic leadership, the complexities involved with reaching a positive outcome in Europe, China’s economic struggles, a proposed economic solution from the Bank of International Settlements (BIS) (known as the central bankers’ bank) and the investment implications for the second half of 2015.

The United States

“Looking further ahead, I think that many of the fundamental factors underlying the U.S. economic activity are solid and should lead to some pickup in the pace of economic growth in the coming years. In particular, I anticipate that employment will continue to expand and the unemployment rate will decline further.”

– Federal Reserve Chair Janet Yellen, 7/10/15

For some time, we have written that the United States has been and remains the standout global economy because of its many strategic competitive advantages over all other major economies. The strength of an economy is reflected in its currency and the U.S. dollar’s position as the world’s reserve currency has been strengthened recently as the structural flaws of the other reserve currencies, the Euro and the Yen, have been underscored. As a result of the debt crisis playing out in Europe, the Euro has been losing some of its status as a reserve currency as central banks have been selling Euros and buying Dollars. Similarly the structural challenges of Japan continue to call attention to its long-term ability to promote growth, and thus adding uncertainty to its currency status. At the same time, China’s reserve currency aspirations for the Renminbi need to be reset as the recent government actions of stock market manipulation will certainly raise questions about whether its capital markets system is ready to support reserve currency status.

The fact that the Federal Reserve has ended its quantitative easing program and is moving closer to gradually raising interest rates while these others are continuing their quantitative easing programs is supportive of the U.S. dollar’s continued strength and indicative of an improving economy. The United States has seen gradual improvements in employment, wages, various housing measures, consumer net worth and consumer confidence. Aside from keeping inflation rates and interest rates low, the benefits of low oil prices remain supportive of consumers and manufacturers as well. As a more domestically-driven economy, the U.S. does not need a weaker currency to stimulate growth. The reliance on exports for growth is why so many nations have embarked on competitive currency devaluation over the years.

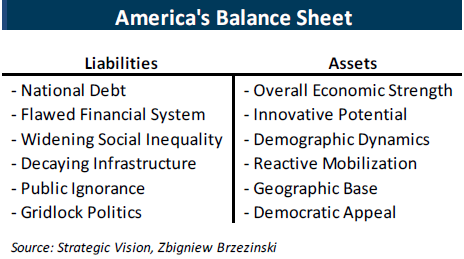

The United States for all its flaws is a remarkable economy because of its resilience and adaptability. In his fascinating book titled “Strategic Vision”, Zbigniew Brzezinski put U.S. assets and liabilities into perspective. Interestingly even our liabilities look relatively good compared to those of most of the other leading nations. Debt, social inequality and decaying infrastructure are common issues for most nations, and our financial system for all its imperfections has the world’s deepest and most mature capital markets system. Our assets are equal or superior to any nation, and in challenging times they allow the United States to rebound and prosper. The positive attributes of the U.S. cannot be taken for granted, especially our democratic appeal and our innovative potential.

Europe

“On the brink of bankruptcy, Greece is in a worse state than before the bailout … The effort to restore Greece to normalcy has been a failure, because of poor policies, fundamental problems in Greece’s dysfunctional state and a pitiful lack of leadership in Greece and among policy makers in Europe and at the I.M.F. The collapse of the parties that had mismanaged Greece for decades created a vacuum that Syriza, a coalition of the radical left, filled with promises: It would continue to procure bailout funds, scrap austerity, undo reforms and still keep the country within the Eurozone … Those citizens (and taxpayers in other countries) have paid a price for the failed bailout; now the Greeks face even greater hardship, whether we stay in the euro or are forced out.”

– Nikos Konstandaras, in a WSJ Op-ed on 7/4/15

The debt problems of Greece and other nations in the EU have exposed philosophical and institutional flaws of the European unification program. In a reversal of its previous position, the IMF issued a report on July 2nd that stated that haircuts on Greek debt are probably necessary to resolve its economic problem. This report was critical for two reasons. First, it represented a shift in thinking at the IMF in the ability of austerity programs and reforms to achieve the goal of a realistic return to growth putting the IMF at odds with Germany and its finance minister. Second, it puts debt relief on the table in a meaningful way as it is not just being requested by those with the debt, but put out by one of the most important creditors. The suggestion of debt relief by the IMF at that stage of the negotiations created added problems for European leaders, especially Angela Merkel as the Germans have been staunchly against write-downs and softening the financial discipline required of nations as specified in the Euro agreement. In recent years, Germany has solidified its political and economic leadership role within the EU and globally.

“There’s no question that the Eurozone has lost credibility.”

– Wolfgang Schauble, 7/14/15 press interview reported by CNBC

The Euro Summit highlighted the power and influence that Germany has within the Eurozone and the European Union, but it has come at a cost and at a time when the European project faces existential decisions with respect to social (employment and immigration), strategic (defense spending and financial integration) and political (Euro-sceptics versus the anti-austerity) issues that must be addressed. The coalition governments and parliamentary structure of most European nations can now suffer greater fragmentation making it particularly challenging to implement long-term reforms to achieve sustainable growth. Politics and economics are not mixing well as diverging short-term needs and long-term solutions are rarely aligned, particularly in a “union” where only the currency is common. In fact, many believe, including the Germans, that Greece would be best served by having its own currency. You cannot have a successful union when the economic circumstances of its members are so divergent. Angela Merkel, one of the most highly regarded world leaders today, continues to find herself in the difficult position of deciding what is best for Europe, for Germany and for her political future as the right solution will not be viewed equally by all.

China

After growing into the world’s second largest economy over the past 25 years, China is experiencing both a decelerating economy with growing debt burdens and a severe stock market correction. Since the financial crisis of 2007, China has been aggressively exerting itself as a military, political and economic power on the global stage. This push has included its previously stated desire to achieve reserve currency status. While Greece has captured much of the headlines and has investors worried about contagion risks, China is also of concern. Just as China’s rapid growth benefited so many countries including Brazil, Australia, Germany and Canada, its slowdown has been equally painful to those same nations. As most developing economies have experienced, transitioning from investment and export-led growth to consumption-led growth is difficult at best. In China’s case, this effort will be augmented by its creation of the Asian Infrastructure Investment Bank (AIIB) which will have initial funding of $100 billion. Interestingly, the U.S. as well as Japan has refused to participate in the AIIB in what is now a 57 country membership.

To add to its economic challenge, China’s stock market has declined roughly 30% in the last few weeks after a 100% plus gain in the previous 6 months. In an unusual sign of panic, the Chinese government has taken a series of extreme actions to stem the decline. As developed as the U.S. capital market system is, the actions to manage its stock market decline provide a reminder to investors that China’s capital market system is far less developed. However, it is worth noting that China is not the first country to aggressively intervene in its stock market, nor will it be the last. China is clearly struggling as an economy in transition, but it has a long-term plan that it is executing against, a growing middle class and an ability to learn and adapt.

The BIS Solution to the Debt and Growth Problem

“The aim is to replace the debt-fuelled growth model that has acted as a political and social substitute for productivity-enhancing reforms. The dividend from lower oil prices provides an opportunity that should not be missed. Monetary policy, overburdened for far too long, must be part of the answer, but it cannot be the whole answer.”

– Excerpt from the BIS 85th Annual Report

Established on May 17, 1930, the Bank for International Settlements (BIS) is the world’s oldest international financial organization with 60 member central banks, representing countries from around the world that together make up about 95% of world GDP. The mission of the BIS is to serve central banks in their pursuit of monetary and financial stability, to foster international cooperation in those areas and to act as a bank for central banks. Since the start of the financial crisis in 2007, central banks have played a major role in working to return the global economy to a sustainable growth path, but highly accommodative monetary policy alone has proven insufficient and meaningful fiscal policy is required. Therefore, strong political leadership must emerge to move the global economy out of the current debt problem. The dilemma for voters is that the message and actions required for appropriate change are not the populist ones that win elections. Any politician can make promises, but the world needs statesmen now more than ever as the solutions are hard and the reform process takes time.

The Bank for International Settlements (BIS) states that “the current malaise may to a considerable extent reflect a failure to come to grips with how financial developments interact with output and inflation in a globalized economy. For some time now, policies have proved ineffective in preventing a build-up and collapse of hugely damaging financial imbalances, whether in the advanced or in emerging market economies. These have left long-lasting scars in the economic tissue, as they have sapped productivity and misallocated real resources across sectors and over time.” The BIS argues that there is too much emphasis on short-term demand policies and not enough effort on addressing the social issues. In its report, the BIS highlights that what is required is “a triple rebalancing in national and international policy frameworks; away from illusory short-term macroeconomic fine-tuning towards medium-term strategies; away from overwhelming attentions to near-term output and inflation toward a more systemic response to slower-moving financial cycles; and away from a narrow own-house-in-order doctrine to one that recognizes the costly interplay of domestic focused policies.”

Interestingly the BIS report argues that the current low interest rate policies are creating a prolonged cycle of lower interest rates. The report also suggests that the global economy must work to limit or reduce the highly damaging financial booms and busts which tend to scar the global economy for some time and impede the ability to return to a healthy and sustainable expansion. We note that in recent years, there has been a visible increase in the shorter-term orientation of many market participants which has led to price volatility that creates a distortion of business valuations. Investors have to distinguish between price changes due to short-term trading (speculators) versus changes in the underlying business fundamentals. This volatility can lead to investor confusion about the quality of their holdings due to exaggerated short -term moves in portfolio values.

The Investment Implications

“Based on my outlook, I expect that it will be appropriate at some point later this year to take the first step to raise the federal funds rate and thus begin normalizing monetary policy … Let me stress that this initial increase in the federal funds rate, whenever it occurs, will by itself have only a very small effect on the overall level of monetary accommodation provided by the Federal Reserve … Because there are some factors, which I mentioned earlier, that continue to restrain the economic expansion, I currently anticipate that the appropriate pace of normalization will be gradual, and that monetary policy will need to be highly supportive of economic activity for quite some time.”

– Federal Reserve Chair Janet Yellen, 7/10/15

As discussed in our last three Outlooks, the current global economic and geopolitical dynamics strongly suggest a continuation of low interest rates, low inflation rates and low growth for the foreseeable future as the global economy cannot tolerate a normalization of interest rates to historical levels under the present conditions. Investors should expect volatility to persist as the debt problem and divergences continue. Under these conditions, investors should expect an extended business cycle which should result in higher corporate earnings and healthy equity valuations over time. The United States remains the standout economy and we should see moderate improvement in economic activity in the second half of the year. As we have written about for over a year, investors should not be concerned about the Federal Reserve raising rates this year, but the focus should be on the rate of the increases which Ms. Yellen has stated will be gradual and policy will remain highly accommodative. Only much stronger growth rates (resulting in higher corporate profits) in the U.S. would warrant a more rapid increase in interest rates by the Federal Reserve. Under present conditions, areas of focus include:

- Technology companies that are benefiting from unprecedented innovation and are helping their corporate customers drive down operating costs. These companies are familiar with operating successful businesses in price competitive environments. In addition, opportunities are developing from rapid technological advances including the large increase in the availability of wireless spectrum and the dynamic growth in mobility, connectivity, search, device sales, memory, data management and storage;

- Financial companies that benefit from continued low interest rates and easy access to financing such as real estate related companies as well as those businesses that have generated strong profits in recent years despite a falling interest rate environment, such as the banks which stand to benefit from a stabilization in net interest margins, and a continuing decline in costs;

- Healthcare companies with technology-enabled breakthroughs, strong product pipelines and growing dividends;

- Consumer companies with pricing power that can increase profit margins, improve overall profitability and benefit from lower input costs and stronger consumer spending;

- Company-specific stories—companies with compelling valuations and strong company-specific catalysts or growth drivers; and

- Industrial investments with well-defined end-market demand, including defense, power generation and aerospace companies.

As always there are risks to our investment Outlook that we factor into our views. These include higher stock market valuations, illiquidity in the bond market, slowly rising labor costs, structural headwinds in developed markets (including demographic challenges and heavy debt burdens), rising student loan debt in the U.S., slower growth in China and ongoing geopolitical risks. We view the set up for the second half of 2015 as an environment which will favor active management and domestically-oriented companies. Our research continues to identify strong businesses that are well positioned to benefit from the conditions described. At the present time, client portfolios reflect companies with the following characteristics: market share gainers, improving margins, increasing free cash flows, ability to increase pricing power and growing dividends. In a low-growth environment, we also expect the market to assign premium valuations to high-growth companies due to the scarcity value of such assets.