Please download the slides above.

Author: stav

Disruptions and Opportunities

Download Outlook Now

Charting Economic Realignment

The global economy is facing a series of destabilizing shocks intensified by the Russian invasion of Ukraine. In addition to creating a tragic humanitarian crisis, the war is disrupting global supply chains, food, energy, trade, and geopolitics. While the current environment bears some resemblance to past periods such as the 1970s, it also has several distinctive characteristics.

Executive Summary

In our previous Outlook, we highlighted significant shifts in the global economy and markets. While some nations were rebounding from pandemic-related challenges before the Russian invasion of Ukraine, others faced exacerbated economic, social, and political issues. The uncertain duration and severity of the conflict raise concerns of an inflationary slump and potential global recession. Though not our base case, investors should exercise caution given the variable outcomes and potential policy missteps. Furthermore, recent market downturns have created opportunities to invest in high-quality businesses at unusually low valuations.

Over the past decade, investors benefited from aggressive monetary and fiscal policies. However, the current landscape necessitates a shift from accommodative to restrictive policies to counter rising inflation, accelerated by the Ukraine conflict. Simultaneously, governments face budgetary constraints amidst essential investment programs, such as green energy transition and infrastructure improvements. The convergence of pandemic aftermaths and geopolitical tensions has eroded consumer and business confidence, presenting challenges for policymakers. Investing in beneficiaries of prevailing challenges, such as digitalization and healthcare advancements, remains crucial, albeit with an anticipated lag in realizing benefits. The uncertain economic outlook, compounded by financial tightening, suggests continued market volatility, emphasizing the importance of strategic investment decisions. We have capitalized on available opportunities to initiate or enhance positions in companies poised to thrive amid ongoing disruptions.

Outlook Highlights

Transition to Contractionary Monetary Policies

As inflationary pressures mount, central banks worldwide are transitioning from accommodating to tightening monetary policies, marking a significant shift in investment dynamics and risk assessment.

Budgetary Constraints and Strategic Spending

Governments face the daunting task of allocating funds to vital sectors such as energy and infrastructure amidst fiscal limitations, posing challenges to their capacity for stimulating economic revitalization and sustainable development.

Market Retrenchment and Premium Assets

The recent market downturn has precipitated a decline in valuations for top-tier enterprises, creating a ripe environment for discerning investors to acquire quality assets at favorable prices, thereby positioning themselves for long-term growth and resilience.

Revamping of Global Economic Strategies

The confluence of pandemic aftermaths and geopolitical upheavals has spurred a profound reassessment of economic strategies and priorities on a global scale, heralding transformative shifts with far-reaching implications for financial markets and investment landscapes.

Our Perspective

Navigating the current economic terrain requires a focus on sectors that are direct beneficiaries of the unfolding global changes. While immediate market conditions may seem daunting, the underlying secular trends, such as advancements in technology and shifts in global manufacturing, provide a roadmap for strategic investments. Investors should look beyond short-term disruptions, focusing on areas with potential for significant medium to long-term growth. Despite the challenges, the evolving economic environment presents opportunities for investors who can identify and capitalize on these trends effectively.

Disclaimer

The information provided in this report is for informational purposes only and is not intended as investment advice, or an offer or solicitation for the purchase or sale of any financial instrument. This report is provided on the condition that it does not form a primary basis for any investment decisions. The opinions and analyses included in this report are based on current market conditions and are subject to change. ARS Investment Partners, LLC will not be responsible for any investment decisions based on this report. Please consult with a qualified financial advisor before making any investment decisions.

Want More of The Outlook?

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.

Weighing the Prospects of Trump’s Policies against Political and Economic Realities

In our Outlook (October 13th) published before the Presidential election, we described a world at an inflection point. Monetary policy, which had succeeded in stabilizing economies and markets after the financial crisis, appeared to be reaching its limits. We wrote that “without proper fiscal policy, investors should expect more of the same low growth, low interest rates and low inflation … we have experienced for some time.” The election result in the U.S. is being interpreted as a call for change, and some of the initiatives being proposed echo the policies that we have called for in this Outlook for years. These include investing in U.S. infrastructure, making corporate tax policy globally competitive, repatriating cash held overseas by U.S. corporations and reducing the regulatory burden on businesses. Importantly for investors, there is a renewed sense of confidence and optimism developing from U.S. businesses and consumers as the long-awaited fiscal policy initiatives appear to be on the way to complement the accommodative monetary policy stance of the Federal Reserve. The outlook for corporate earnings (higher), inflation rates (slightly higher) and interest rates (trending higher, but continuing to be well below historical norms) remains supportive of equity investments.

The current optimism for future policy changes should be balanced against the market conditions present today. Whenever rapid changes occur in the markets as we have seen in the post-election period, it often gives us pause as the global economy needs time to adjust. We cannot help but notice that markets are already giving significant credit for legislation that could take many months to pass, and possibly then only after considerable debate and compromise. Furthermore, the confirmation process for Cabinet positions may be contentious and drawn out. Even as new laws are passed, they often require several months for their benefits to flow through the economy. While we are awaiting those benefits, what economic impact will rising interest rates, and oil and gas prices have in the meantime? And what impact will a sharply rising dollar have on developing economies whose depreciating currencies make it more difficult for them to service their dollar-denominated debts? We also wonder whether investors are postponing making security sales until January in anticipation of lower tax rates in the New Year?

These are some of the questions we are asking as we witness a growing chorus of optimists, many of whom were so cautious just six weeks ago.

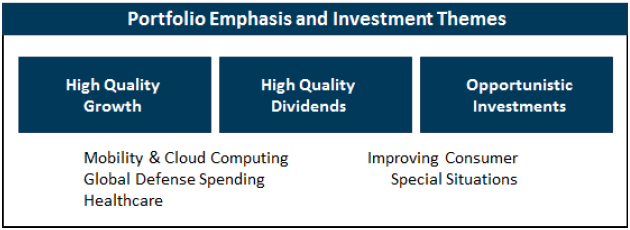

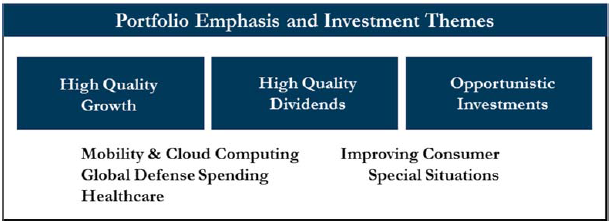

In balancing the opportunities presented by the transition from an economy supported primarily by monetary policy to one which also has added fiscal policy initiatives, investors should consider an investment strategy with three elements – owning quality growth companies, owning quality companies with strong balance sheets and reasonable dividend growth prospects, and owning opportunistic investments with specific catalysts. An added challenge for market participants, many of whom were over-allocated to fixed income, will involve the timing of getting back into the equity market given the uncertainty as to the timing of policy implementation and anticipated market volatility in 2017. Near-term uncertainties aside, equity investors with a longer-term view should continue to be rewarded in the coming years as the recovery continues.

The Handoff of Monetary Policy to Fiscal Policy Likely to Begin in 2017

“The projections in this Economic Outlook offer the prospect that fiscal initiatives could catalyse private economic activity and push the global economy to the modestly higher growth rate of around 3.5% by 2018. Durable exit from the low-growth trap depends on policy choices beyond those of the monetary authorities – that is, of fiscal and structural, including trade policies – as well as on concerted and effective implementation.”

“Escaping the Low-Growth Trap”, OECD, Economic Outlook No. 100, 10/28/16

The challenges in the world cannot be erased by one election as economic headwinds such as excessive indebtedness, aging demographics, underfunded pensions, excess capacity and declining productivity (not to mention environmental) are structural in nature and will take years to address. Of more immediate concern is the adjustment process the global economy must undergo due to the rapid strengthening of the U.S. dollar and nearly 1% rise in Treasury bond yields. The suddenness of these moves is driving capital outflows from China, Europe and developing nations into the United States. As many European and developing nations have already been experiencing anemic growth, the challenges posed by a stronger U.S. dollar and rising interest rates come at an inopportune time. China’s currency reserves have declined by over $1 trillion in recent years and are approaching the $3 trillion level. Recently the Euro has reached a multi-year low, Italy is dealing with the need to form another new government and to strengthen a weak banking system, the region is struggling with immigration issues, and austerity programs have fueled anger and anti-establishment sentiment in many nations.

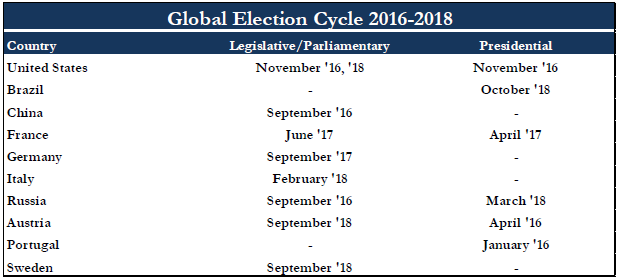

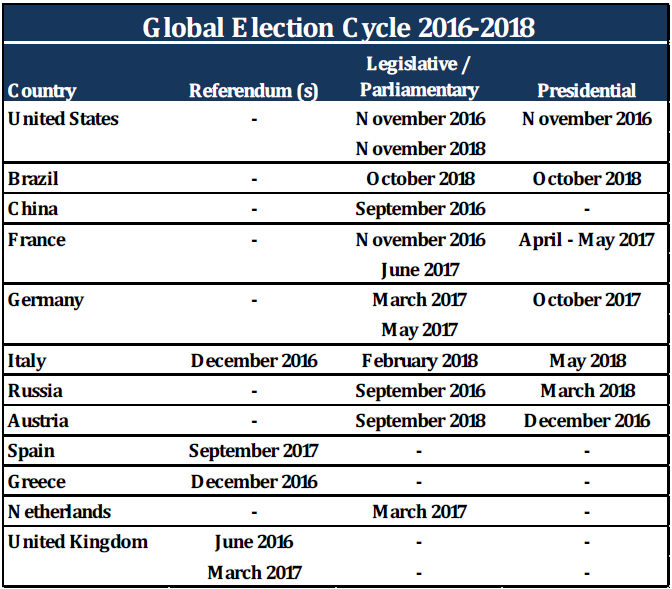

We continue to believe that the global economy could be at an important inflection point in which fiscal policy initiatives, encouraged by the OECD and other leading institutions, begin to be implemented and become supportive of monetary policy. In recent months the economic data out of Europe has improved, and its sustainability may accelerate the introduction of more pro-growth initiatives. As the chart highlights, there are several important elections coming up in 2017 and 2018, and the pressure is growing for Europe to replace its austerity orientation with pro-growth fiscal policy initiatives. The European Central Bank (ECB) President Mario Draghi has repeatedly called upon governments to implement fiscal policy to support the ECB’s highly aggressive monetary policy initiatives. Until these countries adopt more pro-growth policies, the U.S. will remain a magnet for capital flows and among the strongest economies in the world.

Reasons for Cautious Optimism

For several years, we have discussed the United States being the standout economy among developed nations. While the post-financial crisis recovery has been muted, the U.S. has continued to be a global leader due to its adaptability, innovation and resilience. Prior to the November election, the U.S. economy was slowly but steadily improving. The Federal Reserverecently announced that based on the improvements in economic data and its projections for 2017, the FOMC anticipates three rate hikes next year. Per the Council of Economic Advisors November 2016 Economic Indicators report, U.S. corporate pre-tax earnings were projected to exceed $2.26 trillion with an increase of $78.3 billion for 2016 alone. After-tax earnings for U.S. companies were estimated to be $1.69 trillion with an increase of $57 billion. Personal income rose at an annual rate of $98.7 billion and is forecast to be over $16.3 trillion, while wages and salaries rose $45.2 billion in October. U.S. consumer net worth rose to an estimated $92.8 trillion in the third quarter, and unemployment declined to 4.6% in the most recent report.

The Trump campaign platform identified four major economic policies which have created excitement about the future – infrastructure spending, corporate and individual tax reductions, lowering regulatory burdens and the repatriation of corporate cash held overseas. In 2016, taxes on corporate income were forecast to be $565 billion which represents a 25% rate as many large corporations were paying well below the 35% statutory rate. The President-elect has proposed lowering the rate to 15%, while the House plan targeted a 20% rate. Even a 10% reduction in corporate taxes would improve after-tax profits by over $56 billion with small and medium sized businesses benefiting significantly. For consumers, any reduction in personal income taxes would be welcome. Personal income taxes are estimated to be $1.99 trillion in 2016, and much of the benefit of lower taxes would likely be spent. Additionally, if the new Administration is effective in its commitment to reduce unnecessary regulatory burdens, small and mid-sized companies would again benefit significantly as would large corporations. In speaking with small-business owners, lowering regulatory requirements for them may be the most important element of the Trump platform as it would make doing business less complex and costly. Estimates vary for the total amount of U.S. corporate cash held overseas ranging from $2-3 trillion dollars. If corporations are incented to bring home some portion of this cash, there could be a significant ripple effect throughout the economy. If $1.5 trillion were to be repatriated at a 10% tax rate, the government would receive $150 billion and corporations would have $1.35 trillion for increased capital expenditures, dividends and/or share buybacks.

These policies are forecast to widen the deficit by anywhere from $3-6 trillion over the next decade, but those numbers could vary significantly depending on the ability of these fiscal policies to raise GDP growth and tax receipts. It remains to be seen whether the President-elect’s campaign anti-trade rhetoric becomes a reality, but this would likely offset the positives of the fiscal policy initiatives described above. Given the selection of Rex Tillerson, the CEO of Exxon Mobile, as Secretary of State as well as other Cabinet appointments, we anticipate that the Trump Administration trade policies will be more pragmatic than the campaign rhetoric would suggest.

Investment Implications

This Outlook highlights the positive potential for change in key areas over the medium term. With investor sentiment potentially getting ahead of itself in recent weeks, we approach the New Year a little guarded but with an opportunistic bent. Over the medium term, however, we see investment opportunities in many of the areas we have emphasized over the past year, including companies with strong secular growth characteristics, high quality companies with attractive and growing dividend payouts, opportunistic investments in out-of-favor areas in the market, industries with special catalysts, and U.S. domestically-oriented businesses (especially small capitalization companies). Recently we have also increased exposure to companies that will be direct beneficiaries of new administration priorities, such as infrastructure investment and defense spending. We are also focused on defensive, divided-paying stocks that have been discarded by the market and have become more attractive since the election. With the U.S. economy and consumer confidence improving, the outlook for small capitalization stocks has also improved. As previously mentioned, the more domestically-oriented, smaller market capitalization companies should be major beneficiaries of the proposed tax cuts, the stronger U.S. dollar, infrastructure spending, lower regulatory burdens, repatriation of overseas cash from larger corporations and increased merger and acquisition activity. The combination of these forces should increase after-tax earnings for these companies. In the New Year, we will take advantage of any market dislocations to build positions in the beneficiaries of our Outlook.

Important Update

We are also pleased to announce that effective December 20, 2016, the firms of Somerset Capital Advisers, LLC led by Michael Schaenen and Ross Taylor and Artemis Wealth LLC and PS Management, Inc. led by Sean Lawless, have formally merged with A.R. Schmeidler & Co., Inc. The firm has been renamed ARS Investment Partners, LLC. The combination of our firms will allow us to better service our clients’ evolving needs in the coming years. In January 2017, we will be introducing two new investment strategies which leverage the collective capabilities of our expanded team – the ARS Focused Small Cap Strategy and the ARS Focused ETF Strategy. The ARS Focused Small Cap Strategy intends to invest in companies with market capitalizations ranging from $100 million to $2.5 billion. The strategy employs a high-conviction approach resulting in a portfolio of 15-20 small-cap companies. The portfolio is long biased, while attempting to mitigate risk via cash levels, prudent short sales, inverse ETF’s (Exchange Traded Funds) and option strategies.

The ARS Focused ETF Strategy is designed to concentrate investments in ETFs that provide the greatest exposure to ARS’ highest-conviction themes. This may lead to investments in “narrow” industry ETFs. Typically, the portfolio will focus on 5-10 themes that will result in 10-20 ETF investments. These new offerings are just one example of the benefits of our firms coming together. We are delighted to expand our investment and service capabilities with these talented and experienced managers whom we have known for several years. We look forward to introducing you to our new colleagues at the earliest opportunity.

We want to wish all of our clients and readers Happy Holidays and a healthy, joyful and prosperous New Year!

The World is at an Inflection Point – Update

Outlook Notes – November 14, 2016

Our October 13th Outlook was titled “The World is at an Inflection Point” as we believed that the global anti-establishment sentiment had become so strong that we were closer to major shifts than many had realized. The Trump win combined with the Republican sweep of the Senate and House was the strongest statement yet of the anger and dissatisfaction with the status quo. The United States election results reflected the frustration of large segments of the population who were left behind and felt underserved by government institutions. While many details of the new administration’s economic and foreign policy initiatives remain unknown, it is our expectation that long-awaited fiscal and structural reform is coming. We have long believed that such reform is necessary to support accommodative monetary policy. There are several policy responses under discussion which, if implemented, will stimulate growth, including increases in infrastructure and defense spending, reductions in corporate and personal taxes, a reduction in regulatory burdens on companies, and the repatriation of approximately $2 trillion dollars of cash held overseas by U.S. corporations. The effect of these initiatives would lead to increases in corporate investment, consumer spending, employment growth and wages. For some of these policies to be effective, the new administration needs to dial back its anti-trade rhetoric.

Overseas, the U.S. election outcome is being viewed as a wake-up call for government leaders to act to avoid similar election results. Consequently, investors should anticipate shifts in policy initiatives by European governments, especially in Germany, as anti-establishment pressures continue to build. Investors should also expect market volatility over the coming months as the impact of the U.S. election unfolds and as we learn which campaign slogans become actual policy initiatives. Failure by governments to follow through with substantive change could lead to further economic, social and political stresses. However, if in fact the U.S. and Europe begin to embrace fiscal reform, it could prove to be the most defining moment of the post-crisis period for the developed and developing worlds.

The United States remains the largest economy, and the collective strengths of the nation should help keep the U.S. in that position. It is now time for political ideology to be put aside and to get on with fixing the areas that need fixing. The current record-low interest-rate environment has been giving governments, both at home and abroad, a unique opportunity to use low-cost debt to make the needed investments essential to foster a return to a stronger growth environment. The opportunity will not be with us indefinitely and now is the time to capitalize on this low interest-rate structure. Importantly for investors, if this inflection point results in our addressing our needs through the implementation of effective fiscal policy and the structural reforms mentioned in our recent Outlooks, the economic prospects for the U.S. would change dramatically.

The World is at an Inflection Point

Strong anti-establishment pressures have brought the global economic and geopolitical situation to an inflection point leaving investors wondering where we go from here? The statement above from the International Monetary Fund report prepared for the G-20 Finance Ministers and Central Banker Governors’ Meetings held in China this past July sums up the concerns quite appropriately – action is needed and it is needed now. Without proper fiscal policy, investors should expect more of the same low growth, low interest rate and low inflation economy we have experienced for some time. It is our expectation that should the long-awaited fiscal policy response begin, the impact would be quite positive. The global economy has been suffering from a basic lack of demand relative to supply. Moreover, the increase in economic and political uncertainty has lowered confidence, suppressed investment and spending, and contributed to the insufficient fiscal policy response. Moreover the inability of political systems to respond has been fueling the mounting resentment and anger among broad segments of the population. As a result of the global challenges, monetary policy initiatives have been the most accommodative in history and will remain highly accommodative for an indeterminate period. Yet in spite of unprecedented monetary support for the system, the global economy continues to struggle with growth that has been too slow for too long, with the benefits shared unequally. On October 4th, the IMF updated its forecast for global growth projecting 3.1% for 2016 with a slight increase to 3.4% in 2017. Leading central bankers, including Federal Reserve Chair Janet Yellen and ECB President Mario Draghi, have been imploring governments to implement strong fiscal policy actions to support monetary policy initiatives as only fiscal policy and structural reforms can solve the secular problems facing the global economy. Any observer of the world’s infrastructure conditions cannot fail to see the enormous opportunity for positive change that would result from immediate investments in this area.

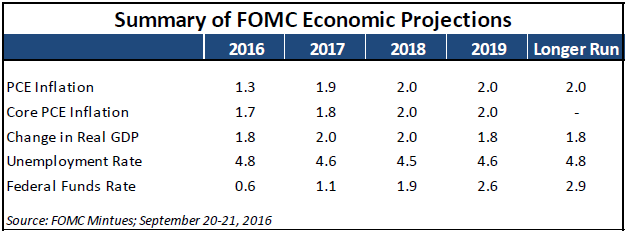

The chart above illustrates the economic projections from the recent Federal Open Market Committee (FOMC). The committee forecasts U.S. growth to run between 1.8% and 2.0% for the next three years. Amid significant global uncertainty, market participants are now spending considerable time trying to determine the effect of the U.S. presidential election and Federal Reserve policy on investment strategy. Given the many problems facing the world including rising and excessive debt levels, worsening demographics, growing pension liabilities and increasing hostilities to name a few, the world is at an inflection point both economically and politically. Widespread dissatisfaction likely will make the above FOMC projections wrong and should force politicians to act in favor of expansion rather than contraction or the status quo. In this Outlook, ARS will briefly frame the problem of growth for the global economy and the U.S., discuss several critical policy initiatives required by leaders to create higher and more sustainable growth, and finally describe the investment implications for our clients.

Critical Policy Initiatives to Return to Growth

Global Growth Initiatives

“To lift growth and counter risks, G-20 policymakers will need to follow a broad-based approach that simultaneously provides better-balanced demand support where needed, address private sector balance sheet items, and implement structural reforms.”

Global Prospects and Policy Challenges, International Monetary Fund

One of the main challenges of a prolonged period of low growth accompanied by eight years of aggressive and highly accommodative monetary policy is that politicians have had the cover to avoid taking necessary policy actions. Without a crisis to prompt an immediate policy response like the world experienced following the Lehman Brothers collapse, it has been impossible to get meaningful action from politicians. As a consequence, anti-establishment sentiment has risen to extremely high levels across the developed world, and many elected officials are afraid to sponsor the programs or enact the structural reforms they know are needed to return to growth. Christine LaGarde, Managing Director of the IMF, in a recent speech once again implored governments to use structural reforms, fiscal and monetary policies in a “country-specific way to make them mutually reinforcing”. Ms. LaGarde discouraged protectionism, encouraged inclusiveness in growth, and even suggested cooperation and, if needed, coordination between nations. However, the economic challenges, particularly those of the developed nations, are fueling populist sentiment against global trade and immigration because they are perceived to be costing jobs and growth particularly for young people in nations where unemployment is very high. Businesses and individuals are fed up with politicians who have allowed ideological beliefs to prevent the application of sound business and economic judgment. Free trade and immigration are two of the key issues for political parties around the world and also for politicians in the U.S. election.

U.S. Growth Initiatives

“The U.S. lacks an economic strategy, especially at the Federal level. The implicit strategy has been to trust the Federal Reserve to solve our problems through monetary policy. A national economic strategy will require action by business, state and local governments, and the Federal government… Overall, we believe that dysfunction in America’s political system is now the single most important challenge to U.S. economic progress.”

Harvard Business School Survey on U.S. Competitiveness

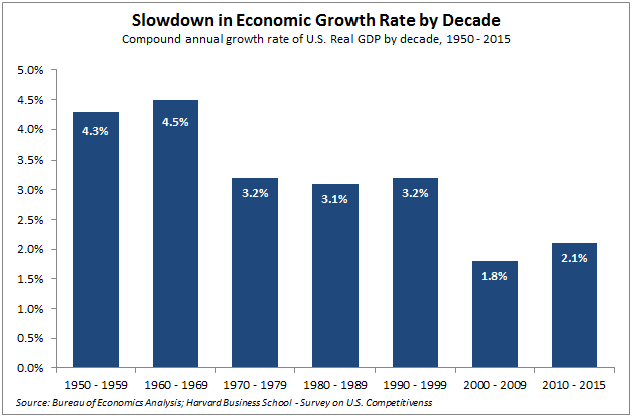

As the following chart highlights, our nation has experienced a slowdown in economic growth over many decades. According to the recently released Harvard Business School (HBS) report entitled “Problems Unsolved and a Nation Divided”, U.S. economic growth averaged 4.3% annually from 1950-1969, then declined to 3.2% from 1970-1999 and recently has been around 2%. With both presidential candidates struggling to articulate their economic programs, it is appropriate to share the Eight-Step Plan of federal policy priorities highlighted in the HBS report. The report puts forth the following policy recommendations: simplify the corporate tax code with lower statutory rates and no loopholes; move to a territorial tax system like other leading nations; ease immigration of highly-skilled individuals; aggressively address distortions and abuses in the international trading system; improve logistics, communications and energy infrastructure; simplify and streamline regulation; create a sustainable federal budget, including reform of entitlements; and responsibly develop America’s unconventional energy advantage. The report cited public education and health care as two other areas that need to be addressed on a state and local level.

While there is nothing new or earthshattering about the areas highlighted, it is clear from the recent presidential campaign process that Americans are fed up with the status quo and want Washington to act more responsibly. At least three of the priorities from the HBS plan – tax reform, easing the immigration of skilled individuals and investing in our infrastructure – are fairly straight-forward opportunities. More importantly, these issues require immediate action. In a recent CNBC interview, former President Bill Clinton called for a lowering of the current corporate tax rate. During his presidency the rate was around the international average of 39% but it is well above the average of 24% today. Mr. Clinton proposed lowering corporate taxes as close to the international average as possible with all corporations paying a minimum tax rate. He also favored repatriation of overseas cash. In the U.S., small businesses are often not able to receive the same tax benefits as multinationals, yet small businesses are the key drivers for employment growth and productivity improvement. With minimum wages rising and increasing regulatory burdens, small business formation and the associated job creation have been lackluster in recent years. A lower and more competitive corporate tax structure would provide an important boost to the economy.

A recent Deloitte study estimates that there are three and a half million manufacturing jobs needed to be filled over the next decade with two million of those job openings likely going unfilled due to the skills gap. Throughout the school systems there needs to be a change: students need to be taught the skills required for the jobs based on 21st Century technology. In the short-term, the U.S. should be easing the immigration of skilled labor through the H1-B visa process. Canada, for example, allows for almost three times as many visas to be issued annually than does the U.S. and has approximately one-tenth of the population.

The growing need to improve our infrastructure has been developing for more than a decade as the required spending has risen from $1.3 trillion to nearly $4 trillion today. Last month’s train accident in Hoboken, New Jersey is just the most recent example that the U.S. can no longer postpone making these critical investments. This is one area that Mr. Trump and Ms. Clinton can both agree on as they each have made infrastructure spending a prominent feature of their economic platforms. The key issue is whether either candidate can get the necessary support from the House and Senate to act.

Investment Implications and Opportunities

With the presidential election less than one month away and a possible interest rate hike by the Federal Reserve before year end, investors should expect volatility to be with us following a fairly quiet few months. Our portfolio strategy remains consistent with the themes prominent currently in client portfolios with some important additional considerations. The first is that we believe the global economy could be at an inflection point as fiscal stimulus is critical at this stage to support growth. We believe this would be a significant positive for the economy. Consequently, there has been an increase in activity in our client portfolios reflecting the desirability of investing in the beneficiaries including technology, energy and materials companies. A second is that there are several investable areas where the opportunities are not necessarily dependent on the outcome of the election or economic growth, but rather benefit from individual industry or company-specific tailwinds. One such area is in computer technology as the fast-growing memory and storage space is experiencing a tightening in the supply and demand dynamics leading to increased pricing power for providers, some of whom also offer very attractive dividend yields. In the healthcare sector, the medical device companies are benefiting from strong demographic demand, as they are not subject to the growing negative narrative over drug pricing. The third is the buying opportunity that is developing in high-quality dividend stocks, including utilities, whose prices have pulled back in anticipation of interest rate increases by the Federal Reserve. The fourth is the expectation of the strengthening U.S. dollar which tends to act as a contractionary force for overseas economies to the degree that they need to import commodities which are traded in dollars. In addition, dollar-denominated debt becomes more expensive to service in a rising dollar scenario, particularly for emerging economies. The equity markets will react negatively if the dollar strengthens too quickly or too much. The final consideration relates to the structure of the market as mutual fund and hedge fund liquidations combined with seasonal tax-selling between now and year end can create mispricings of shares and potential buying opportunities.

Our portfolio strategy continues to focus on three areas of emphasis – high-quality growth, high-quality dividend payers and opportunistic investments. Our focus remains on selecting companies benefitting from positive trends in cloud computing and mobility, changes in the healthcare industry, rising defense spending, increasing U.S. consumer spending and the shift to a more service-oriented global economy led by China and India. We continue to target companies that are gaining market share, maintaining or improving profit margins, increasing free cash flow, restructuring to gain more efficiency, increasing pricing power and growing dividends. Companies that are able to more aggressively invest in the future growth of their businesses will be more highly rewarded. This is an environment that will continue to reward companies with strong, qualitative fundamentals.

The United States remains the leading nation from a geopolitical and economic perspective, and the collective strengths of the nation should help keep the U.S. in that position. However, we are at an inflection point and now is the time for political ideology to be put aside and to get on with fixing the areas that need fixing. Tax reform, infrastructure, education, job creation, health care and entitlement programs, including state and local pension plans and inequality need to be addressed immediately. The current record low interest-rate environment has been giving governments, home and abroad, a unique opportunity use low-cost debt to make the needed investments essential to foster a return to a stronger growth environment. The opportunity will not be with us forever and now is the time to capitalize on this historic interest rate structure. Importantly for investors, if this inflection point results in our addressing our needs through the implementation of smart fiscal policy and the structural reforms mentioned above, the outlook for the United States economy becomes materially better.

Difficult Economic and Political Choices Lie Ahead

We live in a world of global disequilibrium and distortions which are likely to be with us for many years, and for clients the key question is how do you preserve and build capital under these conditions? In 1970, Alvin Toffler argued that society was undergoing tremendous structural change from a technological and social perspective that would overwhelm people leaving them disconnected and disoriented. Some 46 years later, the rapid rise in anti-establishment sentiment in Europe and the United States reflects the frustration of many people who are experiencing lower living standards, growing income inequality, a loss of confidence in government and declining optimism about the future. In addition to these issues, the Brexit vote reflects a growing sentiment of loss of sovereignty and self-determination. Globalization and technological advances have not benefited populations equally leaving many feeling disenfranchised.

The global economy remains volatile and unbalanced, but in the face of the many challenges the S&P 500 and Dow Jones Industrial Indices continue to make new highs. In light of the current geopolitical, economic and social conditions, investors should expect the continuation of the historically low interest-rate environment. Low rates are limiting options for capital to achieve returns and pushing investors to seek alternatives. We would caution market participants not to make investment decisions today using only traditional investment thinking with respect to current interest rates and equity valuations given the characteristics of the global economy. In a growth-challenged environment, investors should expect the United States to remain among the healthiest economies with the U.S. dollar and treasuries continuing to be in high demand. The U.S. economy is improving as indicated by the strength of consumer spending and housing activity. Many U.S. corporations had previously lowered earnings expectations for Q2, and therefore are able to meet or exceed expectations leading to higher share prices. In our view, the outlook for current interest rates, inflation rates and corporate profits continues to create favorable conditions for the second half of the year for well-positioned U.S. businesses.

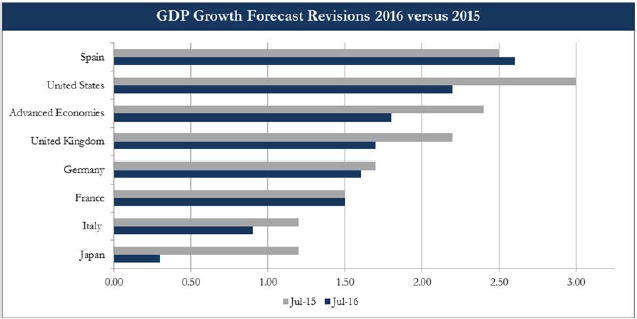

The chart above from the International Monetary Fund shows the most recent lowered growth projections for many of the developed economies. Governments are facing many difficult choices from geopolitical, economic and social perspectives in the months ahead. To deal with the economic challenges, central banks will continue to employ the most aggressive monetary policy actions in history. These policies have been implemented in various forms and to varying degrees of success. Unfortunately as aggressive as monetary policy has been, fiscal policy has been insufficient to support growth, and in some countries including several in Europe, it has been contractionary. While perhaps well-intended, austerity policies have had the effect of virtually guaranteeing slow to no-growth outcomes and high unemployment, especially among youth. A strong fiscal policy response is required to match monetary policy efforts which are nearer their limits. While we have written about the need for productive fiscal policy initiatives for several years, the level of frustration expressed by populations around the world may finally force politicians to act as voters are determined to challenge the political status quo.

The Post-Brexit EU and the UK

“The unique feature of the EU is that, although these are all sovereign, independent states, they have pooled some of their ‘sovereignty’ in order to gain strength and the benefits of size. Pooling sovereignty means, in practice, that the Member States delegate some of their decision-making powers to the shared institutions they have created, so that decisions on specific matters of joint interest can be made democratically at European level. The EU thus sits between the fully federal system found in the United States and the loose, intergovernmental cooperation system seen in the United Nations.

Excerpt from EU publication “How the European Union Works”

The European Union (EU) was created in the aftermath of the Second World War based on the ideals of a peaceful, united and prosperous Europe. The intent was to foster economic cooperation with the idea that countries that trade with one another become economically interdependent and so more likely to avoid conflict. The EU functioned relatively well from an economic perspective when economies were doing better, but when the strains of slow growth and rising unemployment manifested themselves in recent years, resentments and doubts developed about the European project. The series of economic crises experienced by the region since 2009 highlighted the structural flaws of the EU initiative. There are three primary issues complicating the current situation in Europe and the UK. First, the emphasis on austerity programs for many nations fostered deep resentments toward Brussels (headquarters of the EU) and Germany, and allowed anti-European parties to rise in influence. Second, the economic recovery has been uneven and slow to materialize in part because the European approach, in contrast to the U.S. one, did not properly recapitalize the banking system. Third, the civil war in Syria, with the disruptive involvement of Russia, led to the massive migration of refugees to Europe, and the Union was unprepared for the challenges and not unified in its approach to address them.

For voters in the United Kingdom (UK) and many others in Europe, concerns about sovereignty, self-determination, immigration, employment and a loss of national identity have fueled populist movements. In October, Italy is holding a referendum on the proposed structural changes of Mateo Renzi, its Prime Minister. While at the same time, the Italian government wants to bail out the banks with capital injections, but under EU rules a bail-in must occur whereby shareholders, bondholders and bank depositors share in the losses. We believe that the ECB will try to finesse an arrangement that protects bank depositors, shareholders and creditors for Italy as a one-off situation. Italy, which is the EU’s third largest economy, otherwise could at some point be the next shoe to drop after Brexit. Furthermore, the recent coup attempt in Turkey could heighten immigrant flows into Europe which in turn could result in rising nationalistic sentiment, further weakening the Euro and slowing economic growth. With many leading nations facing elections in the next 12 months, politicians must carefully weigh their policy options.

As things stand today, the future of the European Union (EU) is uncertain as is its relationship with the UK. Undoing 40 years of political and economic integration would be a complex and difficult process. Fortunately, the leadership transition in the UK was expeditious as Theresa May was introduced as David Cameron’s successor on July 13th and many of the key cabinet positions have already been filled. This will allow plans for the Brexit process to begin to be formulated with the current relationship between Norway and the EU potentially being used as a model. The Brexit process could take some time to be completed as negotiating trade agreements and the free movement of individuals are complicated issues with important implications for the involved nations.

Global Disequilibrium and the Upcoming Elections

One of the key questions facing European leaders is whether the Brexit vote leads to an unraveling or forces greater integration of the EU given the large cultural differences and different histories of its members. Germany is determined to see the EU remain intact. Competing interests make a solution difficult, but not impossible. Aside from the economic benefits of the Union, the EU provided a stronger foundation for the security of its member nations. However, the fourth terrorist attack in France in the past 12 months will advance the position of Marine Le Pen, the far-right leader who is President of the National Front (FN), a national-conservative political party in France which has made immigration and national security a key element of its platform. As the chart below highlights, several of the key decision makers will be forced to balance doing what is right for their own nations with doing what is right for Europe while also trying to get re-elected. The favorability ratings for many incumbents are deteriorating, and key elections in France, Germany and Italy will complicate matters while lengthening the process. In the US, the improbable rise of Donald Trump as the Republican nominee for President and the surprising showing of Bernie Sanders on the Democratic side are reflections of the anti-establishment sentiment here at home which is an outgrowth of the inability of Congress to effectively address the needs of the nation. The likely change of leadership in so many nations has added an element of unpredictability and uncertainty to the outlook.

However, there seems to be one area of common need globally and that is the need to invest in infrastructure to stimulate growth and increase productivity. Unlike the previous 30 years, the global economy can no longer rely on credit-fueled growth by the private sector to the same degree as in the past because of the excessive debt already in the system. Two critical elements required for stronger growth are infrastructure spending and structural change. Both Donald Trump and Hillary Clinton have made infrastructure spending a prominent part of their platforms to drive economic growth for the U.S. In Europe, the challenge will be whether Germany can make the ideological shift with respect to supporting a move away from austerity for the Southern tier nations by increasing spending to promote economic growth in the EU. The need for increased infrastructure spending is real and no longer able to be postponed. McKinsey Global Institute in a 2013 report estimated that the required global infrastructure spending needs by 2030 were in excess of $57 trillion and growing. At the time, it was estimated that the required global spending was greater than the total value of the existing global infrastructure. For the United States, a 2013 American Society of Civil Engineers report projected the spending needs to be in excess of $3.6 trillion and rising. The current record low interest-rate environment has presented governments a unique opportunity to use low-cost debt to fund the needed investments essential to foster a return to a stronger-growth environment. Importantly the return on investment would be higher than the cost of capital.

Global and NATO Defense Spending

The disequilibrium discussed in this Outlook is being manifested in many areas with a critical one being that the world is a less-safe place with the tragic terror attack in Nice and the failed coup being the most recent examples. As a consequence, global defense spending is likely to increase from the current levels of approximately $1.7 trillion. The United States, which accounts for 39% of global defense spending at approximately $670 billion annually, had slowed spending in recent years as a result of the financial crisis and the budget sequestration. That trend is now reversing and the initial policy statements from each presidential candidate support the need for an increase in U.S. defense spending. The target amount for NATO nations, ex the United States, is 2% of GDP or an estimated $320 billion per year. From the Middle East to Europe to Asia, countries are increasing defense spending at a significant rate with Russia planning $320 billion by 2020, China intending to increase spending over 7% annually, and now Japan is considering a constitutional change to increase its spending as well. The United States is also working to enhance South Korea’s Ballistic Missile Defense (DMB) system as North Korea continues its aggressive development of its nuclear program.

At the recent NATO Summit in Warsaw, participants highlighted that member nations were facing “a range of security challenges and threats that originate both from the east and from the south; from state and non-state actors; from military forces and from terrorist, cyber, or hybrid attacks.” The group cited Russia as the most significant threat and has committed both personnel and increased spending to protect its members from Putin’s highly aggressive actions. NATO nations are committing additional ground forces to the Baltic region. NATO also stressed as a critical security issue the shifts in tactics by ISIS to bring terrorism to Europe and in particular to France and Belgium. The instability of the Middle East and North Africa are contributing to the ongoing refugee crisis. This is also adding to security concerns for members as most are unprepared to handle the volume of refugees which is taxing domestic security forces.

From an investment perspective, U.S. defense companies represent a relatively small percentage weighting in the S&P 500, so most institutional portfolios have a representation in defense of approximately 1.8% or less. The top 5 defense companies have a market capitalization of about $280 billion. It is our view that these businesses represent important investments that generate significant cash, maintain high and/or growing backlogs, improving profit margins, raising dividends and repurchasing stock. These businesses are not as dependent on economic activity as are others, but rather on national security needs and geopolitical conditions.

Testing the Limits of Monetary and Interest Rate Policy

The absence of supportive fiscal policy is forcing central banks to rethink the limits of monetary policy initiatives. Following meetings between Ben Bernanke, the former Federal Reserve Chair, and the heads of the Bank of Japan to discuss its battle with deflationary pressures, there has been increased speculation regarding the possible introduction of “helicopter money”. This is an unconventional policy that blends elements of monetary and fiscal initiatives by printing large sums of money to finance government programs in order to stimulate the economy. The central bank gives the government money with no interest and no expectation of payment at a later date to distribute in the form of spending. While many are skeptical about the likelihood of its being introduced, we would caution that investors were also skeptical of the likelihood of quantitative easing and “lower-for-longer” interest rates as well. Prior to the financial crisis, interest rates were always a positive number. With $11.5 trillion in government bonds outstanding carrying negative interest rates, the historic level of interest rates is no longer the standard. Due to the development of negative interest rates as a policy tool and the prospects of even further unconventional monetary policy initiatives, gold has become of greater interest to investors in 2016. While there are divergent views regarding gold, the economics of the current environment have arguably made gold less expensive to own then at any time in the past. Gold is considered a hedge against excessive currency creation as well as economic, geopolitical and financial instability.

Investment Implications

“America has been dealt an extraordinary hand, and I am optimistic about our future. Our universities are second to none. We have many of the best businesses on the planet – small, medium and large. Americans are among the most entrepreneurial and innovative people in the world, from those who work in entry-level jobs on the factory floor to Bill Gates… We face many challenges. But they can be overcome…”

Jamie Dimon, Chairman and Chief

Executive of JPMorgan Chase in a recent NY Times Op-ed

As we have often stated in previous Outlooks, the resilience and adaptability of the U.S. have and will continue to make our economy standout relative to others and perpetuate the view as a safe haven for capital. These attributes become even more important in times of the global disequilibrium we see today. Even with the many challenges we face, opportunities exist to build and protect capital. Our portfolio strategy continues to focus on three areas of emphasis – high-quality growth, high-quality dividends and opportunistic investments. Our focus remains on selecting companies benefitting from positive trends in cloud computing and mobility, changes in the financial and healthcare industries, rising defense spending, increasing U.S. consumer spending and the shift to a more service-oriented global economy led by China and India. We continue to target companies that are gaining market share, maintaining or improving profit margins, increasing free cash flow, restructuring to gain more efficiency, increasing pricing power and/or growing dividends. Companies that are able to more aggressively invest in the future growth of their businesses will be more highly rewarded as there is a growing view that many corporations have only been able to financially engineer their performance improvements through share buybacks. This is an environment that will reward companies with strong, qualitative fundamentals. Furthermore with more than $11.5 trillion of government debt carrying a negative yield, central bank bond buying is creating distortions in the bond market forcing rates even lower, crowding out individual bond buyers and forcing investors to seek alternative sources of income in the equity markets.

Potential leadership changes could have a profound impact on the economic policies implemented in 2016 and beyond. For the United States specifically if the upcoming election brings about fiscal and structural changes which have been deferred for a long time, the result would be a material improvement in the economic outlook. The current record low interest-rate environment is giving governments a unique opportunity use low-cost debt to make the needed investments essential to foster a return to a stronger growth environment. With slow growth and deflationary pressures, we expect markets to continue to ascribe greater value to companies with the best industry-demand fundamentals and internal growth characteristics. The dynamics of the global economy strongly suggest an environment which offers investors the opportunity to build capital and protect income. The disequilibrium discussed in this Outlook has been adding to market volatility over the past few years, temporarily distorting the values of quality businesses and presenting investors with attractive buying opportunities. We expect this trend to continue. Investors should remain focused on taking advantage of the businesses that are benefitting from the positives in the U.S. and global economies.

Building Capital in the “New Mediocre” Global Economy

“The good news is that the recovery continues; we have growth; we are not in a crisis. The not-so-good news is that the recovery remains too slow, too fragile, and risks to its durability are increasing. Certainly, we have made much progress since the great financial crisis. But because growth has been too low for too long, too many people are simply not feeling it. This persistent low growth can be self-reinforcing through negative effects on potential output that can be hard to reverse. The risk of becoming trapped in what I have called a “new mediocre” has increased.”

Christine Lagarde, Managing Director of the IMF, April 5, 2016

Our recent Outlooks discussed the monetary policy actions being implemented and their investment implications. Today there are almost as many perspectives on the global economy as there are stocks and bonds traded in the markets, but there seems to be consensus that the world will be challenged to achieve sustainable growth based on the debt, demographic, social and political headwinds. Recently the International Monetary Fund (IMF) downgraded its projections for global growth from 3.4% to 3.2% for 2016 and from 3.8% to 3.5% in 2017. Whether we are in Ms. Lagarde’s “new mediocre” or Larry Summer’s “secular stagnation” camp, it has been clear to us for several years that the global economy requires more support than the accommodative and, in some cases, aggressive monetary policies that have been implemented to date. In her recent speech, Ms. Lagarde suggested that the interconnectedness and internationalism of the global economy will require a three-pronged approach involving structural reforms, growth-friendly fiscal policies and continued support of monetary policies to achieve growth targets. Critics suggest that the answer lies with less government, not more. A stronger argument can be made for better regulation, a more harmonized global tax system, support for smart infrastructure programs and continued monetary policy support. Today’s reality is that technology and globalization have made the world much smaller and more interdependent, and too many policies in place today are not reflective of the world we live in. This Outlook continues to focus on building capital in the “new mediocre” economy described by Ms. Lagarde.

The global economy continues to undergo an adjustment process that is fostering significant changes in foreign exchange rates, interest rates, and commodity prices. As a consequence investors should expect continued shifts in capital flows. It is our view that one of the defining characteristics of investing will be a return to “P.O.S.S.” or plain old stock selection. In our March 23rd Outlook Note, we described the key characteristics of companies we require for inclusion in client portfolios. Key areas for emphasis are on owning high-quality growth and high-quality dividend growth companies as well as undervalued beneficiaries of the current environment. Our focus remains on selecting companies benefitting from positive trends in mobility and cloud computing, changes in the financial and healthcare industries, rising defense spending, improving U.S. consumer spending and the shift to a more service-oriented global economy led by China. We continue to target companies that are gaining market share, maintaining or improving profit margins, increasing free cash flow, restructuring to gain more efficiency, increasing pricing power and/or growing dividends. Companies that are able to more aggressively invest in organic or acquisition growth for their businesses will be more highly rewarded. This is an environment that will favor companies with strong, qualitative fundamentals. New companies or old ones with the ability to promote change, disrupt the competition and gain market share will be among the most attractive opportunities. Our investment professionals are required to answer the following questions.

- What is going to drive the business going forward?

- Is management of high quality?

- Is the business getting better or worse?

- Are margins, earnings and free cash flows improving or getting worse?

- Is the business gaining or losing market share?

- What is the risk and reward to purchasing at the current price?

- In terms of portfolio construction, is it purposely adding a similar exposure to other companies already owned or is it providing exposure to a new area?

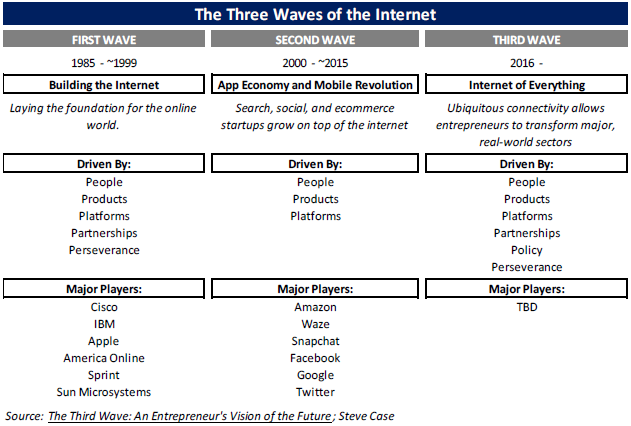

The Next Phase of Technology Disruption

“The entrepreneurs of this era are going to challenge the biggest industries in the world, and those that most affect our daily lives. They will reimagine our healthcare system and retool our education system. They will create products and services that make our food safer and our commute to work easier. The Third Wave of the Internet will be defined not by the Internet of Things; it will be defined by the Internet of Everything. We are entering a new phase of technological evolution, a phase where the Internet will be fully integrated into every part of our lives… As the third wave gains momentum, every industry leader in every economic sector is at risk of being disrupted.”

Steve Case, excerpt from

“The Third Wave, An Entrepreneur’s Vision of the Future”

There are many examples of how technology is being tested globally to help change the way public and private sector entities do business, and we are in the early stages of understanding the potential to improve efficiency, lower costs and increase quality. As we transition to the Third Wave as described by Steve Case, the United States is arguably best positioned due to its ability to innovate and adapt. Three examples of potential technology disruption are occurring in national security, healthcare, and insurance as discussed below. Los Alamos National Laboratory (Los Alamos) is a multidisciplinary research institution engaged in strategic science on behalf of national security which enhances national security by ensuring the safety and reliability of the U.S. nuclear stockpile, developing technologies to reduce threats from weapons of mass destruction, and solving problems related to energy, environment, infrastructure, health, and global security concerns. Los Alamos is partnering with a major U.S. tech company to research a new storage tier to enable massive data archiving for supercomputing. The joint effort is aimed at determining innovative new ways to keep massive amounts of stored data available for rapid access, while also minimizing power consumption and improving the quality of data-driven research. These companies are working together on power-managed disk and software solutions for deep-data archiving, which represents one of the biggest challenges faced by organizations that must juggle increasingly massive amounts of data using very little additional energy.

The healthcare industry is another area ripe for the type of change that Steve Case described in the Third Wave. At roughly 17% of U.S. GDP, spending on healthcare is one of the best opportunities for technology to raise the quality of care at lower costs. In a recent research study by Technavio, global big data spending in the healthcare industry is expected to experience a compounded annual growth rate of 42% over the period from 2014-2019. According to the report, “Big data in the healthcare industry is tremendous because of its volume, variety, and velocity required to manage it. This includes a wide variety of data ranging from patient data in electronic medical records, clinical data, data from sensors monitoring vital signs, emergency care data to news feeds… It also supports a wide range of healthcare functions such as disease surveillance, clinical decision support, and population health management.”

Finally, the Financial Times recently reported that “a new wave of gadgets is set to wipe $20 billion off car insurance prices globally over the next five years. Growing use of collision-warning systems, blind-spot information and sophisticated parking assistance will be so successful in cutting accidents that insurers will have to lower their rates.” Swiss Re and Here, a mapping company, reported that by 2020 more than two-thirds of cars will have some connectivity and could lower accidents by an estimated 25-50% on roads and highways. (This highlights both the deflationary aspect of technology advances and the quality-of-life benefits.)

Very importantly as we look ahead, the existing price structure that is built into today’s global system is undergoing displacement by these disruptive technologies which lower costs at a potentially accelerating rate. As this transpires all businesses are subject to these deflationary forces and must evolve to compete. Three important implications of the third wave are increased productivity, growing unemployment pressures, and the need for improved education and training for workers to be able to adapt to changing labor market requirements. A critical negative consequence is that technological advances may also foster greater inequality as education and skills differences in workers are exacerbated. The abnormally low interest rate structure augments this trend as the lower cost of capital helps to promote investment in these disruptive businesses.

Areas of Portfolio Emphasis

In the “new mediocre” environment, key areas for emphasis in portfolios are on owning high-quality growth and high-quality dividend growth companies as well as undervalued beneficiaries of the current environment. Our focus remains on selecting companies benefitting from positive trends in cloud computing and mobility, changes in the financial and healthcare industries, rising defense spending, increasing U.S. consumer spending and the shift to a more service-oriented global economy led by China. We continue to target companies that are gaining market share, maintaining or improving profit margins, increasing free cash flow, restructuring to gain more efficiency, increasing pricing power and/or growing dividends. Companies that are able to more aggressively invest in the future growth of their businesses will be more highly rewarded as there is a growing view that many corporations have only been able to financially engineer their performance improvements with strong, qualitative fundamentals. The following details many of the reasons for our portfolio emphasis.

Mobility and Cloud Computing

“Initially described in the 2010 National Broadband Plan and authorized by Congress in 2012, the auction will use market forces to align the use of broadcast spectrum with 21st century consumer demands for video and broadband services. It will preserve a robust broadcast TV industry while enabling stations to generate additional revenues that they can invest into programming and services to the communities they serve. And by making valuable “low-band” airwaves available for wireless broadband, the incentive auction will benefit consumers by easing congestion on wireless networks, laying the groundwork for “fifth generation” (5G) wireless services and applications, and spurring job creation and economic growth.”

From the FCC website on the “Broadcast Incentive Auction”

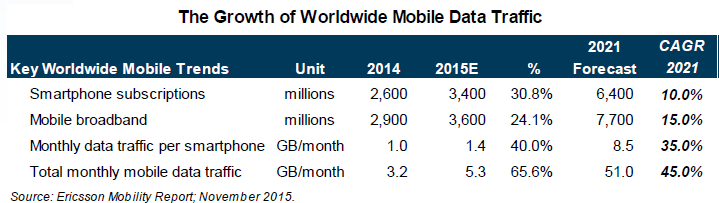

The global economy is benefiting from rapid technological advances including the dynamic growth in mobility, connectivity, search, memory, data management, storage and devices. Over the next several years, the technological advances of multi-tracking capability, the more efficient usage of battery power and an even more connected world means that the internet will experience no letup in its disruptive power over more traditional ways of living and conducting business. About 70 percent of Americans use data-enabled smartphones, and the total number of connected devices now exceeds our population. Globally, connected devices are forecast to increase from 15 billion in 2015 to 28 billion in 2021. Three of the most important beneficiaries are cloud computing, data colocation and mobile-service providers. The resulting content demand is accelerating the development of devices that can process and transfer data with high speed while storing ever-increasing amounts of data as shown in the chart below.

In the U.S., the Federal Communications Commission (FCC) is in the process of holding an incentive auction for valuable 600 MHz spectrum to help wireless providers meet the growing demand for data consumption. Spectrum is the range of electromagnetic radio frequencies used to transmit sound, data, and video across the country. It is what carries voice between cell phones, television shows from broadcasters to your TV, and online information from one computer to the next, wirelessly. The last auction generated significant demand and companies paid over $45 billion to acquire spectrum, and this auction has a wide range of expectations as spending may be as low as $18 billion and as high as $60 billion. This auction is important as it will make available “low-band” airwaves for wireless broadband. According to the FCC, “the incentive auction will benefit consumers by easing congestion on wireless networks, laying the groundwork for “fifth generation” (5G) wireless services and applications, and spurring job creation and economic growth.” 5G or fifth-generation is the next wireless broadband technology and will provide better speeds and coverage than the 4G technology. Huawei, a major player in the Chinese mobile market, believes 5G will provide speeds 100x faster than 4G LTE offers. 5G also increases network expandability up to hundreds of thousands of connections. The need for faster speed and great volume of data usage is why the spectrum assets are so highly valued. Investors should also anticipate increased demand for the devices that are best able to meet these requirements and satisfy growing consumer demand.

It is estimated that corporations spend about $3.7 trillion annually on information technology (IT) and will be shifting spending to adjust to the realities of a more connected world with far greater data. As a result, the adoption of the cloud, which began slowly, has started to rapidly accelerate. The benefits for businesses of moving their IT workloads to the cloud include reduced costs, greater flexibility, more scalability and better services. Over the long term, companies moving to the cloud avoid having to build, expand, maintain and upgrade data centers, can be faster to market with new products and services and react more quickly to competitive threats. Among the areas which benefit will be data centers, cloud service providers, data analytics and management providers, cyber-security companies, semiconductor producers, mobile advertisers and device makers.

Financials

While low interest rates in the U.S. and negative interest rates in some parts of the world have been weighing on bank stocks, our research continues to identify certain financial companies, including real estate-related companies, that should benefit from the continuation of a low interest rate environment and the easy access to financing as capital from around the world seeks higher returns. Select financial businesses with differentiated models that have generated strong profits, despite a falling interest rate environment, should remain attractive investments relative to peers. These include select regional banks and insurers. A potential game-changing technology for financial institutions lies just over the horizon. It is the “blockchain” technology which essentially provides a virtual transaction system and is referred to as a “distributed ledger technology”. Major financial institutions are making multi-billion dollar investments in this technology which may radically change the way companies process transactions on behalf of customers in the future. The Australian Stock Exchange (ASX) has announced that US-based firm Digital Asset will help it develop solutions for the Australian equity market using blockchain technology as the Exchange is looking to replace or upgrade its main trading and settlement systems. A World Economic Forum white paper issued in June 2015 stated that “decentralized systems, such as the blockchain protocol, threaten to disintermediate almost every process in financial services.” While the technology may be a few years away from broad usage, the potential impact is not to be underestimated once concerns about security, scale and confidentiality have been addressed.

Healthcare

Notwithstanding concerns about government involvement in setting prices for the industry, the healthcare sector also aligns closely with our longer-term Outlook as an aging global population will provide a strong secular tailwind for healthcare demand. According to the World Health Organization (WHO), in most countries, the proportion of people age 60 or older is growing faster than any other age group due to longer life expectancy and declining fertility rates. The U.S. Census Bureau estimates that in the U.S., the number of people age 65 years and over will increase by 30% between 2012 and 2020. The Affordable Care Act is having the effect of adding to the number of people covered in the healthcare system. These factors are expected to drive demand for healthcare services, including pharmaceuticals and medical devices as well as the companies that provide these services.

An aging population will also drive healthcare demand in large developing countries such as China. Moreover, demand in these markets will also benefit from increased per capita spending as their populations insist on better quality care. In August 2015, China unveiled plans to roll out medical insurance to cover all critical illnesses for its population of 1.4 billion by year-end. China has a two-fold problem of having to deal with the consequences of air and water pollution that are affecting a large part of its population. China drug spending is expected to grow by nearly 8% per year through 2020, and according to McKinsey & Co. China’s overall healthcare spending will nearly triple to $1 trillion by 2020, up from $357 billion in 2011. Greater spending suggests greater volumes of healthcare consumption, but there will also be a “trade up” from drugs and devices that are locally-sourced or generic to best-in-class patented drugs and devices sold by the leading global pharmaceutical and device companies. We expect a select group of pharmaceutical, biotech and medical device companies to be beneficiaries of these spending trends. We also favor companies with strong balance sheets and healthy dividend coverage. These companies should benefit from investor demand for sustainable income streams as well as their ability to raise dividends and make accretive acquisitions. Although we are mindful of the increased political attention being placed on drug pricing in the U.S., we believe that those companies with healthy research and development budgets that can demonstrate genuine superiority for their drugs and innovate breakthrough therapies will see less impact from pricing pressures. Additionally, device makers should not be impacted by the negative political narrative regarding pricing. On the contrary, they stand to be beneficiaries.

Global Defense Spending

“Europe faces a very different and much more challenging security environment, one with significant, lasting implications for U.S. national security interests. Russia is blatantly attempting to change the rules and principles that have been the foundation of European security for decades. The challenge posed by a resurgent Russia is global, not regional, and enduring, not temporary. The situation on the ground in Eastern Ukraine is volatile and fragile, and we remain convinced the best way to bring the conflict to an acceptable, lasting solution is through a political settlement, one that respects state sovereignty, and territorial integrity.”

General Philip Breedlove, NATO’s military commander,

Department of Defense Press Briefing, February 25, 2016

As a consequence of greater global conflict, global defense spending is likely to increase from the current levels of approximately $1.7 trillion after several years of spending cuts following the Great Recession. The United States, which accounts for 39% of spending globally at roughly $670 billion annually, had slowed spending in recent years as a result of the financial crisis and the budget sequestration. That trend is now reversing. NATO defense spending for 2015 is estimated to be $892.7 billion, and this figure should rise in 2016. The target amount for NATO nations is 2% of GDP yet only a handful of the member nations (the U.S., Poland, Greece, Estonia and the United Kingdom) are at that level. It was recently recommended that the United States increase support of Europe as concerns about Russia’s intentions mount. As global tensions continue to rise, it is expected that the United Arab Emirates (UAE), Saudi Arabia, India, France, South Korea, Japan, China, Russia and other affected governments will increase purchases of next-generation military equipment in response to threats to their national interests. Additionally China plans to increase its reported spending by 7% annually between now and 2020 which would bring it to $260 billion. Russia, in spite of its severe economic difficulties, has pledged to spend $300 billion by 2020 to rearm and modernize its military although that plan will likely be challenged by its budgetary issues given current oil prices. At the same time, it has been reported that Russia’s Vladimir Putin has plans to establish a new national guard which may number between 350,000-400,000 members as he prepares for potential social unrest.

The U.S. defense companies represent a relatively small percentage weighting in the S&P 500, so most institutional portfolios have a representation to defense of approximately 1.8% or less. It is our view that these businesses continue to represent strong investments that generate significant cash, have robust orders, maintain high and/or growing backlogs, and are raising dividends and repurchasing stock. These businesses are not dependent economic activity, but rather on national security issues and geopolitical conditions.

Improving Consumer

The decline in oil and natural gas prices has lowered costs for many consumers around the globe, putting more discretionary income in their pockets. At the same time, manufacturers and the producers of consumer products are benefitting from lower input costs as energy is a significant component of cost of goods sold. The consumer staples companies in particular are well positioned to benefit in an environment of uncertainty and low inflation. Because they sell the products that are consumed every day, their sales tend to be resilient, and their sizeable and growing dividend yields offer an attractive alternative to the low returns offered by fixed income securities. While low interest rates have penalized savers, lower mortgage rates have allowed the equity value of U.S homes to rebound from around $6 trillion in 2008 to over $12 trillion today. The recovery in home values combined with improvements in the labor market have led to improved consumer confidence and spending.

Although we see opportunities for consumer companies with a domestic focus, our research is also focused on those businesses positioned to benefit from long-term growth in consumer spending in developing markets. China in particular has seen a surge in its middle class over the past decade. According to Pew Research Center, the share of Chinese who are middle income jumped from 3% to 18% from 2001 to 2011. Today, those whose incomes are described as middle, upper-middle or high-income now represent well over 20% of the population, or close to 300 million people – approximately the size of the entire U.S. population. As China continues to rebalance its economy away from exports and infrastructure investment to consumer spending, we should expect consumer demand to continue to grow benefitting those multinational businesses with strong brands which are well positioned in that market.

In Conclusion