As we end 2011, we are sharing our thoughts on building capital and protecting purchasing power in a complex and dynamic $65 trillion global economy filled with investment opportunity but also risks with over $200 trillion in global credit and an estimated $700 trillion in derivatives. This has been a particularly volatile year for the US stock market and we are disappointed that 2011 has not met our desires for investment returns. In recent Outlooks we discussed the debt problems of Europe and most of the developed world and its impact on global economic growth. Investors are coming to grips with the fact that sovereign debt is no longer an AAA-rated, risk-free asset class, which has wide-ranging implications for the structure of the capital markets, and therefore investment policy, security valuation and risk assessment. Further complicating matters is that the U.S. Congress has been dysfunctional at a time in which thoughtful governance is needed, and this is unlikely to change before next year’s election.Since 2008 we have been of the view that governments would need to implement appropriate monetary and fiscal policies to stimulate growth while addressing longer-term debt and deficit problems. In the developed world, economic policy decisions have fallen short of what is needed to deal with these dual problems. The inability of policymakers both here and in Europe to provide a credible response has damaged investor confidence and increased market volatility. Although short-term interest rates are at or near zero percent, investors should not conclude that monetary policy is sufficiently accommodative. Recent swings in the US dollar are reflective of the lack of liquidity in the global system and the high regard for the US dollar and US treasury securities as safe havens during times of uncertainty. The newly-established currency-swap lines between the Fed and five other central banks and the strong demand by European banks for the European Central Bank’s (ECB) recently created, unlimited three-year loan facility have resulted in the ECB lending $640 billion to more than 500 banks. This highlights the pressing need for more global liquidity and the inevitability of additional currency creation. This process has begun despite resistance from some European leaders as roughly $250 billion of the new facility represented quantitative easing (the creation of new currency).

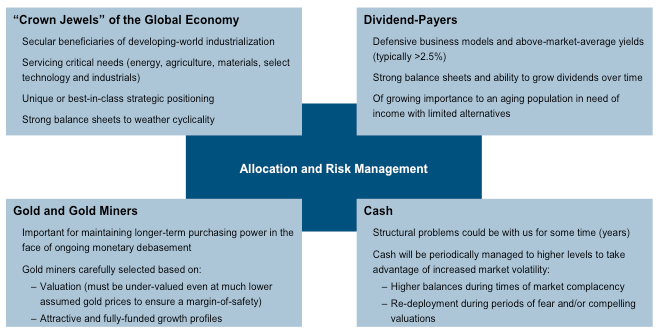

These concerns have left many investors confused and struggling to make sense of it all. We believe that one of the important implications is that market participants have been increasingly using the equity markets to wager on transient perceptions of macro opportunities (“risk-on”) or concerns (“risk-off”) rather than on business valuations and fundamentals. This short-term perspective reminds us of Warren Buffet’s expression from his mentor Benjamin Graham—in the long term the market is a weighing machine, reflecting business fundamentals and cash flows; in the short-term the market is a voting machine, reflecting popular perceptions. We view the market as a medium of exchange that allows investors to trade dollars for the ownership of shares of world-class businesses and not as a short-term trading vehicle. While we expect to see continued market volatility next year, our research has identified many businesses that are selling at particularly attractive valuations as the short-term perceptions of global problems have created a mismatch between current market prices and the real world values of these businesses.Heading into 2012, there remain many challenges for world leaders to address including but not limited to: the European sovereign debt and deficit problems, the well-publicized US deficit, housing and employment problems and growing concerns about China’s continued GDP growth and a possible real estate-related credit bubble. To be clear—there is also some good news. Developing market governments are seeing inflation pressures ease, giving them the cover needed to begin easing monetary policy and shifting focus from fighting inflation to stimulating growth as evidenced by the approximately 50 policy initiatives announced by governments and global central banks since August. These easing initiatives are the fuel for cyclical growth over the next two-to-three quarters which would help build on the recent improvement in US economic indicators. Next year we will again be striking the delicate balance of managing between the forces of deleveraging on the one hand, and industrialization and growth on the other hand, to build capital and protect purchasing power. Given this background of significant opportunity but also meaningful risk, ARS has been constructing portfolios with allocations to four key areas described in our November Outlook: “crown jewels” of the global economy, high dividend payers, gold/gold miners and cash. We describe each in detail below.

Crown Jewels” of the Global Economy

Companies in this category are leaders in large, growing and essential sectors, often having some combination of barriers-to-entry in the form of a unique product offering, structural cost advantages and/or dominant brands. Companies meeting these criteria that make it into ARS portfolios will also have strong balance sheets and attractive valuations offering a distinct margin-of-safety. Examples of companies meeting these criteria include leading low-cost producers of inputs required for industrialization in the developing world, undervalued energy providers with valuable reserves in politically-safe jurisdictions, industrial leaders with dominant market shares or a branded provider of a disruptive, game-changing consumer service or product.After the sell-off in economically-sensitive companies over the summer and fall, many of our investments in this category are selling for 5-10x earnings and high free cash flow yields of 10%-15%. Free cash flow is what is available to shareholders after all other company obligations. It can be used toward dividends, debt repayment, share repurchases, and acquisitions, and can be a powerful determinant of future investment returns.Some of these companies are approaching valuation levels last seen near the bottom of the financial crisis despite having substantially stronger balance sheets. For example:•One leading global natural resource producer was recently selling for as similar a multiple of free cash flow as it sold for early in 2009 (approximately 7x). However, at that time, the company had just completed a large acquisition and was saddled with high-cost debt. Today, this same company has generated so much free cash flow that it has paid off virtually all of its debt and now has net cash on its balance sheet of nearly $2 billion.•A second producer is the sole global source outside of China for an important category of raw materials. In our models, we are assuming a long-term price for the products that this company sells that is more than 40% below the current market price. Using these conservative assumptions, this company is currently trading for approximately 2.5x 2012 estimated run-rate cash flow. Several independent energy exploration and production companies are currently trading for approximately 4-5x cash flow and are pricing in long-term oil prices of well below $80 per barrel—estimated to be the global marginal cost for new oil exploration and development. A few of these companies are trading below $15 per barrel of proven oil reserves, which is under the average reserve acquisition cost of the leading large cap integrated oil companies, making them attractive potential acquisition candidates.

We believe that these companies are not yet getting adequate credit from the marketplace for their strikingly cheap valuations and healthy balance sheets that in most cases are significantly stronger than in 2008. By their nature, these businesses have meaningful exposure to economic cycles, and their quoted stock prices are apt to fluctuate with the ups and downs of the broader market over any given short-term period. However, all of these companies are also benefitting from strong secular trends underlying their longer-term growth potential. While we cannot predict when these companies’ valuations will be better recognized, by acquiring these marquee franchises at prices below their fair value, we believe that their strong market positions and exposure to faster-growing end markets will result in superior returns over time. These “crown jewels” will continue to form a core anchor of ARS equity portfolios while they remain at these compelling valuations.

High-Quality Dividend Payers

In our December 2008 Outlook, we wrote “the Federal Reserve will have to maintain a historically low interest rate policy for the foreseeable future.” This outcome seemed unlikely to many at a time when much of the market was concerned about inflation, but two years later, Federal Fund rates remain at zero percent, and the Federal Reserve recently indicated it would hold rates at these levels at least through mid-2013. As ARS has written more recently, with an average debt maturity of 54 months and a federal debt level expected to reach $16 trillion next year, a 1% increase in interest rates would swell government borrowing costs by $160 billion per year—enough to wipe out nearly all of the cost savings over the next decade currently being contemplated by congress. In short, ARS does not believe that the Federal Reserve can afford to raise rates, and it would not surprise us to see short rates remain near current levels for several years.

In such an environment where cash and short-term debt is earning near zero, large amounts of higher-yielding bonds are maturing and the baby boomer generation is in greater need of income as its members enter retirement, we believe high-quality stocks with above-average dividend yields, ample dividend coverage and strong balance sheets are paramount for client portfolios. ARS has identified high-quality equities with dividend yields of between 2.5% and 4.5% (compared with market average yields of closer to 2%) and P/E ratios, in many cases, of between 8-14x. These companies appear to be undervalued in the absolute and look particularly compelling relative to fixed income offerings currently available in the market. A further benefit is that many of these companies are in defensive sectors such as healthcare, consumer staples, telecom and utilities, with strong, defensible franchises that tend to outperform at times when market fears over deleveraging risks are at their greatest. During times of volatility, these companies continue to pay investors attractive dividends as they wait for better times to return. Importantly, having an anchor in these investments can make it easier to weather the ups and downs in the more cyclically-exposed areas of client portfolios. Additionally, the income that these equities generate can increase over time as dividends are raised. For these reasons, high-quality dividend paying stocks will take on increasing importance in investors’ portfolios in the current environment.

Gold

Although gold has increasingly been in the news in recent months, 10 years ago when ARS first began investing in gold miners, the industry was a forgotten asset class. Although the US dollar is estimated to have lost more than 90% of its purchasing power since the establishment of the Federal Reserve System in 1913, most Americans alive today have never lived through a sudden and dramatic currency debasement. Because of that, except for a brief period in the 1970’s, gold has never been taken seriously as an asset class in the US.

This is not the case in other countries around the world where citizens have less confidence in their policymakers or have experienced rapid currency debasement during their lifetimes. Currency debasement typically occurs when governments attempt to satisfy their nations’ debt service and other obligations through monetization, essentially newly-printed currency, leading to rapid inflation. During such periods, as the purchasing power of fiat currency declines, tangible assets and productive businesses tend to maintain their relative values to society and appreciate in fiat currency terms. For this reason, gold has tended to be a standout performer during times of currency debasement. As governments continue to pile up debts that politicians are unwilling to ask their citizens to pay, the risk of countries turning to their central banks to monetize these debts will continue to grow. Despite this risk, we are continually surprised by how little exposure the average investor has to gold and gold miners. The S&P 500 has only 0.8% exposure to gold mining stocks, and most gold mining companies are based outside of the US, giving traditional equity portfolio managers limited exposure to them. For these reasons, we believe that gold and/or undervalued gold mining companies should continue to comprise some portion of ARS client portfolios.

It should be noted that we have already begun to see the ascent of gold as an alternative to many currencies. Over the last 10 years, gold’s purchasing power relative to most currencies and to other commodities has risen significantly. At least some portion of this gain could be attributed to the market’s anticipation of future central bank monetization. However, we do not believe that risks of future currency debasement have been fully reflected in the gold price.

We believe that the gold miners in ARS client portfolios are currently discounting a long-term gold price of approximately $1,000-1,100 per ounce—considerably below the current spot price of roughly $1,615. One leading mid-cap gold producer in client portfolios has a fully-funded growth plan to more than double its gold production over the next five years. This company is currently trading for 5x 2012 estimated cash flow assuming a $1,615 gold price. However, even using a conservative assumption of just $1,000 per ounce of gold sold, this company would still be trading for under 8x cash flow. This valuation represents a significant margin-of-safety in the event that gold prices were to decline, while at the same time helping to preserve purchasing power in the event that gold continues to rise in dollar terms, as we expect it will.

Cash

As discussed in recent Outlooks, the excessive debt burdens of developed economies took several years to build up and will not resolve themselves quickly. It is quite possible that the tug-of-war between genuinely positive investment factors—developing world growth, healthy corporate balance sheets and attractive valuations, among other factors—and the concerns over slower growth and policy uncertainty, along with greater accompanying volatility is likely to be with us for some time. At times when the economy is undergoing cyclical expansion, investor complacency will rise and the market will appear to overlook underlying challenges. Often when the economy is softening, volatility will increase and secular leverage concerns will suddenly come back to the fore. Moreover, there is evidence that under the secular influence of deleveraging, business cycles are getting shorter. Intermediate-term economic cycles used to be heavily influenced by borrowing rates tied to changes in the Fed Funds rate by the Federal Reserve. With the federal funds rate held steady at zero, other factors such as inflation, which in turn is increasingly tied to swings in commodity costs, may be having a more pronounced influence on the economy. This is evidenced by 2011 being the second consecutive year to see periods of both rising and falling economic indicators.

Under these conditions, it can be prudent to periodically hold higher cash balances in accounts, particularly during times of greater market complacency and lower margins-of-safety in company valuations. Having higher cash balances can make it easier to ride out periods of heightened volatility. More importantly, it also provides the buying power to be opportunistic and purchase shares of favorite companies at very attractive valuations, such as we saw in September and are currently seeing now for selected companies

In Conclusion

As the year comes to a close, we are mindful of investment successes and opportunities missed. But more importantly, our focus is on what is and what shall be best for client portfolios as we begin a new year. In periods of difficult short-term performance, we reflect on the time-tested investment principals that have served us well over the course of 40 years. To that end, we remain very excited about the quality and valuations of the companies we own. By owning shares of some of the world’s leading global franchises selling for single digit multiples of earnings and cash flows, and in many cases with meaningful and rising dividends, we believe that our client portfolios are well positioned to build capital, and importantly protect purchasing power over the next 24-36 months as governments work to address the challenges of stimulating growth and reducing debts and deficits. Although the recent initiatives in Europe have not gone far enough to solve the continent’s challenges, and the US continues to experience election-cycle gridlock, we believe a portfolio allocated among industry leaders, high dividend payers, gold and, at times, cash, is well suited to building and preserving capital in portfolios over reasonable time periods.

We extend our deepest appreciation to all of our clients, and offer our warmest wishes for health and happiness for the New Year.