As an exceptional year in the equity markets draws to a close, many investors have been caught either underweight the primary beneficiaries or out of the U.S. stock market altogether even as the major stock indices regularly reached new highs. The strong equity market returns are a consequence of stronger than expected corporate earnings and a synchronized global expansion that had begun some years ago and which should continue into 2018. At the same time, we are witnessing growing divergences between the haves and the have-nots as well as an extreme degree of political partisanship in the U.S. that has affected the ability of Congress to address the needs of the people. The world is undergoing a rapid transformation that continues to redefine lives faster than most people are able to absorb. There are several powerful forces impacting the global economy – namely, technological advances, accommodative central bank policies, debt burdens, cybersecurity, globalization and demographic trends among others. It is in this setting that many market participants are particularly uncomfortable because there is no playbook for investors as we are in an economic, geopolitical and social environment with little historical comparison.

As it stands today, the tax reform plan out of Washington D.C. should have the effect of increasing capital spending which in turn will improve productivity, keep a lid on interest rates and inflation, and continue the favorable backdrop for equity investing. Importantly, rapid and ongoing technological advances are being introduced to every industry which should continue to promote productivity improvements. Further productivity improvements would suggest that the U.S. unemployment rate could fall below 4% without triggering a significant inflation response; this arguably runs counter to prevailing opinion. This Outlook will address the reasons why inflation has been subdued relative to expectations, the growing disparity between those benefiting and those not from today’s financial conditions, risks to consider in the system and our investment strategy heading into next year. We have included a new section to this Outlook to share the views of some corporate executives from their recent earnings reports regarding important changes impacting their industries. While many challenges remain for the United States and the world overall, global growth is on the rise and leading U.S. companies should continue to have growing earnings and cash flows. At a time when many have suggested that the multi-year economic expansion would start to fade, it has begun to accelerate with strong results from the United States, China and Europe which further supports our constructive outlook for 2018.

The Inflation Paradox

“It is also possible that this year’s low inflation could reflect something more persistent. Indeed, inflation has been below the Committee’s objective for most of the past five years… To generate a sustained boost in economic growth without causing inflation that is too high, we need to address these underlying causes. In this regard, Congress might consider policies that encourage business investment and capital formation, improve the nation’s infrastructure, raise the quality of our educational system, and support innovation and the adoption of new technologies.”

– Janet Yellen, Federal Reserve Chair, remarks before the Joint Economic Committee November 19, 2017

- The difficulty of getting inflation to the 2% level has confounded central bankers in spite of the fact that we have experienced the most highly accommodative and unconventional policies in history which were designed to stimulate economies through increased lending. Through a combination of zero interest rate policies and quantitative easing (QE or printing of money) initiatives, global central banks’ balance sheets increased by approximately $15 trillion, but much of this did not work its way into the system as planned. When the Federal Reserve announced its initial QE program, several politicians, Wall Street executives and professional investors were highly critical of what they thought was such an inflationary policy. As it turned out, several factors have worked against plans for fostering a healthy level of inflation. These included the lack of appropriate fiscal stimulus to support the monetary policies and, importantly, the fact that the money simply did not get lent out as intended. In past recessions, consumers would have had pent up demand to borrow and spend, but this time consumers focused on paying down debt. For businesses, capital spending was directed toward increasing efficiency and making sure that they had the most competitive pricing structure for their products.

While we expect inflation rates to rise modestly going forward, the forces contributing to subdued inflation in the U.S. economy are as follows:

- The inability of most companies to increase prices

- Technological advances which are decidedly deflationary

- Debt levels that are high and rising

- Globalization continuing to lower input costs

- Highly accommodative monetary policy allowing for productive investments to further lower costs

Noted investment strategist, Ed Hyman of Evercore ISI recently highlighted two other unusual inflation headwinds. “First, many deals lead to cost-cutting, which keeps downward pressure on wages. And it should be noted that the corporate tax cuts could be deflationary. That is, companies might take tax cuts as an opportunity to lower prices.” The other day the Wall Street Journal reported that grocery stores were absorbing the price increases in many food items rather than pass them on to customers for fear of driving business to new, lower-cost competitors. The combination of greater internet access and smartphone use makes price increases difficult if not impossible as consumers have more immediate price information at the point of sale when making purchasing decisions.

Investors should not anticipate directional shifts in these forces, nor should they anticipate dramatic changes in the trajectory of inflation barring an exogenous event such as a terrorist attack or geopolitical misstep. Globalization and technological advances are a part of a secular trend, while the accommodative monetary policy stance from global central banks should adjust only gradually over several years. Additionally, the amount of debt in the global economy continues to grow so it is safe to say that debt will continue to weigh on inflation expectations. At the same time, there is still $11 trillion in global government bonds with negative yields and interest rates should remain low with only a gradual upward bias as the global economy improves. Based on the parameters of the tax reform bill, we are not completely confident that what is being presented as a pro-growth initiative will materialize and may in fact be counterproductive in promoting balanced growth because there are so many moving parts in the analysis of the details.

Growing Divergences in Global Fortunes

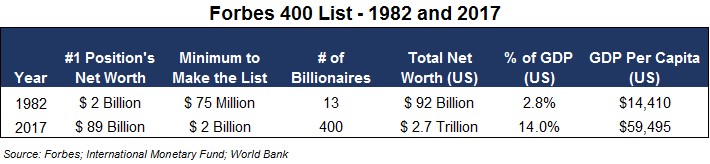

To better understand the mounting concerns about income inequality, one can look at a comparison of the Forbes 400 lists of the wealthiest people in the United States in 1982 and today. In 1982, the total wealth of the Forbes 400 list was equivalent to 2.8% of U.S. GDP, but today that has grown to almost 15%. During those 35 years, U.S. GDP per capita grew four-fold, while the net worth of the Forbes 400 grew 29-fold. As of the most recent figures, the top three wealthiest Americans have a net worth of over $250 billion or more wealth than the bottom half of Americans combined. The 2017 Forbes 400 have a total net worth of more than $2.65 trillion or more than the GDP of the United Kingdom or the bottom 64% of the U.S. population. At the same time, one in five U.S. households have zero or a negative net worth with 60% of those not having enough savings to cover a $500 emergency. This degree of income inequality is not unique to the U.S., and has been one of the contributing factors to the rise of populism globally as well as the polarization of political parties in many nations. Increasing concerns about those being left behind has also led to support for consideration of Universal Guaranteed Income programs. As part of the solution for the United States, Congress may need additional spending to promote skills training initiatives as well as make significant investments in our digital, education and transportation infrastructures.

There has also been considerable evidence of an uneven distribution of the benefits from global growth in the U.S. and global stock markets. Of the returns of the S&P 500 this year through 11/21/17, roughly 28% has come from a handful of technology-related companies, and 71% of the returns were from the top 50 companies. Perhaps there is no better example of a narrowing of beneficiaries than Apple which introduced its first iPhone in 2007. Today Apple has a market capitalization of approximately $900 billion making it the largest company in the S&P 500. To highlight just how uneven the playing field really is one can look at Apple’s corporate cash of $269 billion which would rank as the 11th largest company in terms of market capitalization in the S&P 500, and on a net cash basis (subtracting debt) it would rank as the 35th largest company in the S&P 500. Most of the largest companies in the world today are technology companies with China’s Tencent, Alibaba and Baidu also among the world’s fastest growing and largest in terms of market capitalization.

Insights from the Q3 Earnings Calls

In this Outlook, we wanted to present some insights shared by corporate executives from the third quarter conference calls and earnings transcripts. Industries and companies are being transformed and redefined, and the winners are proactively driving the changes and adapting, while the losers are being disrupted or just plain overrun. Several key takeaways from the earnings reports include the impact of technological advances on the ability to deliver better products with lower costs and greater value. Perhaps the biggest takeaway is that the changes coming in the next few years will likely be unlike anything we have seen to date. A recent China Daily article cited a report from the Boston Consulting Group which forecasts for China “that as information technologies continue to revolutionize industries like retail, entertainment, finance and manufacturing, the country’s digital economy will reach about $16 trillion by 2035, up from $1.4 trillion in 2015.” This year China’s GDP is estimated to be nearly $12 trillion. We remain convinced that market participants continue to underestimate the pace and magnitude of the changes that lie ahead in the coming years as things that were once unimaginable become reality. While these companies may or may not be owned in client accounts, we have chosen these excerpts or quotes as they highlight some of the longer-term changes occurring across industries that will impact the competitive landscape.

In Technology – IoT, mobility, data, 5G and China

Applied Materials CEO Gary Dickerson, excerpt from Q3 transcript

“We are at the start of a completely new wave of growth. The Internet of Things, big data and artificial intelligence have the potential to transform entire industries and create trillions of dollars of economic value. From transportation and health care to entertainment and retail, future success is dependent on capturing, storing, and understanding vast amounts of data. This is driving major innovations in sensors, memory, storage, and especially compute, which is key to turning raw data into valuable information.”

BOINGO CEO David Hagan, excerpt from Q3 earnings transcript

“In the immediate term, the continued acceleration of mobile data growth continues to put capacity constraints on existing macro cellular networks, which in turn drives the need for products like Wi-Fi offload and small cells. In the longer term, as 5G comes to fruition in 2019 and beyond, this provides an opportunity for an incredible long-term cycle.”

GDS CEO William Wei Huang, Aug 8, 2017, Q3 Call

“Cloud adoption continued to takeoff in China. Currently it is around a $2 billion market in terms of annual revenue, representing around 1% of total IT spend. But we share the view of the leading industry players that it is rapidly heading towards a $20 billion to $30 billion market. This transformation is happening at a faster pace in China than in the U.S. Alibaba and Tencent are reporting consistent triple-digit growth rates for their Cloud business. In our view, cloud service providers together with some of the large internet companies’ account for more than 70% of new demand for data center capacity.”

Defense

KRATOS CEO Eric DeMarco, excerpt from Q3 transcript

“Over the past 20-plus years, the U.S. military has focused on winning the fight at hand, the war on terrorism in Afghanistan, Iraq and elsewhere. During that time, our nation’s adversaries have been investing heavily in new technologies and systems to catch up with and potentially surpass the United States and its allies’ national security capabilities. In response, innovation, technology infusion and recapitalization of systems to address peer and near-peer adversarial capabilities and U.S. operational readiness has begun. As a

result of these perceived threats, national security and defense related budgets are anticipated to increase globally, including for the U.S. and its allies.”

Raytheon CEO Tom Kennedy, October 26, 2017, Q3 Call

“One area where we are seeing strong demand is within Integrated Air and Missile Defense… GMD (Ground-based Midcourse Defense System) is the United States’ anti-ballistic missile system for intercepting incoming warheads in space during the midcourse phase of flight. It is a major component of our country’s defense strategy to counter intercontinental ballistic missile threats. We also continue to see very strong demand for Integrated Air and Missile Defense solutions in the international market. For example, earlier this month, Congress was notified of a $15 billion sale of seven THAAD fire unites and related equipment to Saudi Arabia. In addition, Japan has indicated that it is pursuing missile defense solutions to protect its homeland.”

Automotive

Visteon, CEO Sachin Lawande, October 26, 2017, Q3 Call

“The emergence of smartphone integration technologies such as Car Play and Android Auto have created the new product category of display audio, which extends the traditional audio system with smartphone projection technologies. Display audio is rapidly becoming the preferred option for entry infotainment …Infotainment systems are also undergoing a transformation from the traditional closed and proprietary systems of today that are not upgradable, to connected application platforms with support for web services and downloadable apps. Advanced cybersecurity and over-the-air update capabilities have emerged as key requirements of both display audio and infotainment systems.”

NVIDIA CEO, Jen-Hsun Huang, November 9, 2017

“In automotive… we announced DRIVE PX Pegasus, the world’s first AI computer for enabling Level 5 driverless vehicles. Pegasus will deliver over 320 trillion operations per second, more than 10x its predecessor. It’s powered by four high-performance AI processors in a supercomputer the size of a license plate.”

Energy

Anadarko Petroleum Chairman, Robert Walker, excerpt from Q3 earnings transcript

“You’ve heard us, and heard a lot of our competitors talking about the use of big data and the use of artificial intelligence, and in particular, machine learning. I think all of us are in very early innings… And so I’m pretty optimistic that our ability as an industry to lower our break evens will largely come in the future from technological advances and the applications of technology that we’ve not historically either used or used fully.”

Risks in the System

While we remain positive on the outlook for the continuation of the synchronized expansion of the global economy for 2018, we must keep in mind the risks present in the system that can impact longer-term investment strategies. The risks we are focused on are geopolitical, social and economic. The geopolitical risks are top of mind as investors remain concerned about missteps relating to North Korea’s nuclear provocations, the ongoing proxy war between Saudi Arabia and Iran, tensions in the North China Sea, questions about the European project and shifting U.S. positions on foreign policy. From a social perspective, growing income inequality, education gaps and changes in the skills needed to compete in the job market going forward are among the primary concerns. In addition, the growing populist movement and ongoing concerns about immigration will continue to affect social conditions.

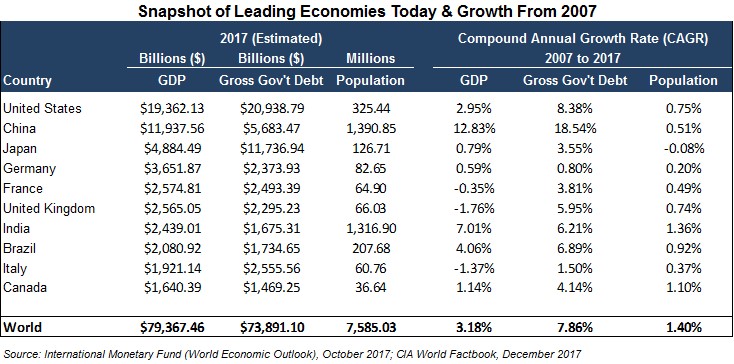

The fragility of the global economic system rests, in large part, on the fact that the excessive debt loads were amassed in a time when technological advances were not nearly as fundamental a part of the economic system as they are today. The rise in populism, nationalist sentiment and income inequality have been three of the unintended consequences of the monetary and fiscal policies that were implemented to aid the recovery following the global financial crisis. A few key policy decisions such as the use of quantitative easing (the printing of money) by central banks were designed to stimulate economic activity, but some austere fiscal policies were put in place which ran counter to the growth intention of monetary accommodation. These policies were implemented at a time when technological advances and globalization had already been negatively impacting employment in the developed nations. As you can see from the first chart below, the United States, China, India and Canada have benefited, while the United Kingdom, Spain, France and Italy have not. Japan, which is showing signs of improvement recently, has had almost 30 years of economic struggles and still faces significant debt and demographic challenges. The U.S., China and Canada are among the leaders in the development of new technologies, and this has played an important role in driving growth. The U.S., Canada and India also benefit from favorable demographic characteristics. The European nations and Japan have seen positive economic results in recent quarters, but are facing severe long-term demographic challenges.

Global debt remains high and continues to weigh on growth. Central bank policy remains a risk as each bank attempts to normalize interest rates and reduce the roughly $15 trillion that was added to central bank balance sheets since 2008. If the reduction in accommodation is not done in a measured way, then the central banks’ actions could tilt the global economy into a recession. For the U.S., there has never been a time when the Federal Reserve was reducing its balance sheet while the U.S., with the new tax law, will be running such large and growing fiscal deficits.

Investment Implications

“China has been busy creating a cashless society, where people can pay for so many things now with just a swipe of their cellphones — including donations to beggars — or even buy stuff at vending machines with just facial recognition, and India is trying to follow suit. These are big trends, and in a world where data is the new oil, China and India are each creating giant pools of digitized data that their innovators are using to write all kinds of interoperable applications — for cheap new forms of education, medical insurance, entertainment, banking and finance.”

– Thomas Friedman, NY Times, November 29, 2017

The investment outlook for 2018 remains positive for U.S. equities, especially those that are leading the transformation. Our ongoing portfolio strategy has three areas of focus – high-quality growth, high-quality dividends and opportunistic investments. The emphasis remains on selecting companies benefiting from disruptive technologies, rising defense spending, changes in the financial and healthcare industries, increasing U.S. consumer spending and the shift to a more service-oriented global economy led by China and India. Despite the potential for increasing government regulation, taxation and scrutiny, disruptive technology companies should continue to benefit as the Internet of Things (IoT) becomes more widely adopted and the industry moves closer to the introduction of 5G. We especially favor the leading companies with strong growth characteristics that are driving changes in cloud computing, big data, autonomous vehicles, the internet of things, artificial intelligence and augmented reality. We continue to concentrate on companies that are gaining market share, maintaining or improving profit margins, increasing free cash flow, restructuring to gain more efficiency, increasing pricing power and/or growing dividends. Strong balance sheet companies that can more aggressively invest in the future growth of their businesses should be more highly rewarded as will those with the ability to repatriate large overseas cash balances. U.S. small capitalization companies also stand to be significant beneficiaries of further improvements in the economy, tax reform, strong consumer spending and increases in capital expenditures. We remain cautious on fixed income investments given the risk/reward dynamics, expectations for a less accommodative monetary policy stance from central banks and gradual interest rate increases from the Federal Reserve and other central banks.

One factor that will likely weigh on investor sentiment is that the national debt is forecast to be rising by $1.5 trillion due to the tax plan and this is coming at the later stages of the business cycle. However continued capital spending will lower costs, keeping a lid on inflation rates and interest rates. Due to the uniqueness of the business cycle and the characteristics of the current environment described, we do not believe that the prospect for corporate earnings growth in 2018 is fully priced into the market. Furthermore, we do not believe that the benefits of tax cuts for small businesses and the likely subsequent investments in technology to improve productivity are being appreciated. As Wall Street analysts raise their earnings and market forecasts to reflect the lower corporate taxes and continued improvement in the U.S. and global economies, investors should see again positive equity market returns in 2018. The economic benefits of the reduction of unwieldly regulatory costs by the Trump Administration continues to feed through the system as many regulations have been delayed, suspended or overturned. While the tax plan does not effectively address critical issues regarding entitlements, education, infrastructure, inequality or deficits, it will likely provide a boost to the U.S. economy next year especially if corporations aggressively repatriate cash from overseas.

In a world that is rapidly changing, investors must recognize and appreciate the magnitude of the changes that will impact companies for many years. It is easy to get thrown off course from a long-term investment plan by short-term factors, so be careful not to confuse speculation with investing. Businesses that are proactively investing to redefine themselves will have a chance to compete, while those that do not will be left behind. As evidenced by the comments from business leaders in this Outlook, the investments in innovation will have a profound impact on our daily lives.