Consistent with past actions, Congress has once again taken the easy path while leaving others the hard work of addressing our nation’s long-term fiscal problems. The passage of a bipartisan federal budget by the Senate and the House, which followed the massive tax cuts passed in 2017, represents an inflection point for U.S. fiscal policy, and one which has important implications for stock and bond market investors. The current concerns about growing deficits and national debt levels are pushing interest rates higher, yet only somewhat higher than the recent historic lows. At the same time, markets are experiencing greater volatility after an extended period of extremely low volatility. Due to the increase in the federal budget deficit, we are modestly adjusting our expectations for interest rates, inflation rates and market volatility, but we are not changing our positive views on corporate earnings and the companies benefitting from this environment. We remain focused on the secular beneficiaries we have defined previously and would remind our readers that the drivers for these businesses remain firmly in place, notwithstanding these changed fiscal and monetary conditions. Moving forward, investors should expect even greater capital flows to the beneficiaries of this Outlook, particularly leading defense, technology and healthcare companies as well as those benefitting from increases in consumer spending globally. One important consequence of the changes in our Outlook is that we anticipate that there may be fewer winning companies in 2018.

Will Corporate Earnings Continue to Rise in 2018?

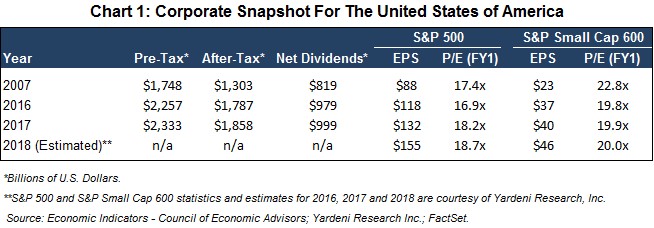

As we wrote in our January 31st Outlook, “we expect corporate profits to increase supported by a synchronized global economic expansion with subdued inflation… this market rise is being driven by rising corporate earnings rather than just an expansion of price/earnings (P/E) multiples which often is a characteristic of the later stages of a market advance.” This view remains unchanged. However, there are two key questions for investors to consider following the tax cuts and increased deficit spending, these are – will the benefits be short-lived and how broadly will they benefit companies? The recent pullback notwithstanding, we believe that 2018 and likely 2019 will see a continuation of the growth in pre-tax and after-tax profits (as highlighted in Chart 1), but that the changes in fiscal and monetary policies will create an unequal playing field for U.S. corporations and small businesses. Well-respected investment strategist Ed Yardeni, of Yardeni Research, Inc., forecasts S&P 500 earnings of $155 in 2018 and $166 in 2019. Yardeni Research projects the S&P 500 will reach 3100 by the end of the year which is up from 2726 as of the time of this writing, and that target is based on the belief that the forward P/E will be 18.7. We have followed Ed’s work for some time, and he has been very effective defining the environment for many years. We expect that those businesses with strong balance sheets, the ability to raise prices, invest aggressively to offset inflationary pressures and increase productivity will be rewarded, and those that cannot will be penalized. Ironically for businesses, the budget deal adds additional near-term fiscal stimulus, and increased deficit spending will increase demand which should further boost corporate earnings.

What are the Pros and Cons of the Recently Approved Budget?

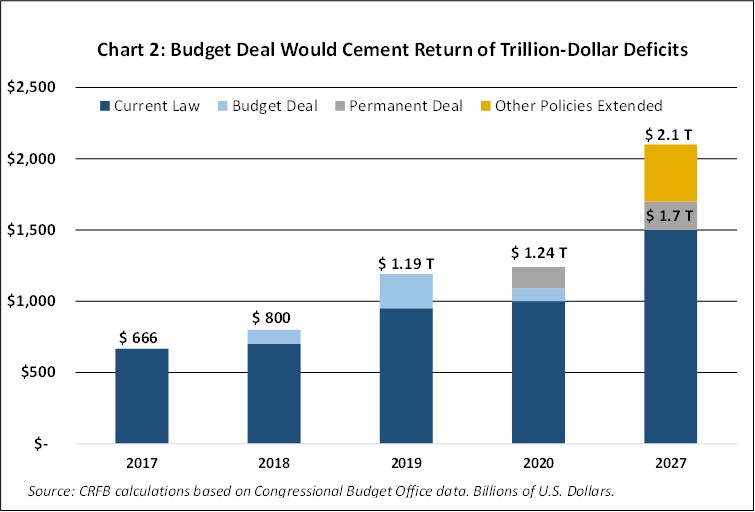

The budget deal is one with a few near-term positives and many longer-term negatives. On the positive side, the Senate and House are significantly boosting defense spending after years of underinvestment following sequestration. This spending increase comes at a critical time as our military needs to upgrade, replace and modernize to maintain its strength. The challenges of sequestration were evident in the deadly naval accidents that have occurred in recent years. In short, the U.S. was putting the brave men and women of our armed services at greater risk than necessary. These multi-year spending increases are meaningful in a world where the geopolitical picture remains unstable with potential troubles looming with Russia, North Korea, China and the Middle East. Some needed domestic social programs also received additional funds including the Children’s Health Insurance Program. Additionally, the budget suspends the debt ceiling until March of 2019 so that neither party can hold the nation hostage for political gain until then. On the negative side, The Committee for a Responsible Federal Budget (CRFB) estimates that the budget increases will add $300-400 billion to the deficit and possibly add more than $1.5 trillion of new debt over the next decade. According to the CRFB press release, “this deal represents budgeting at its worst – each party is giving the other its wish list with all the bells and whistles included and asking future generations to pick up the tab.” The CRFB estimates have the federal deficit rising from roughly $665 billion in 2017 to projected $1.2 trillion dollars in 2019 and over a trillion dollars for the foreseeable future as shown in the Chart 2.

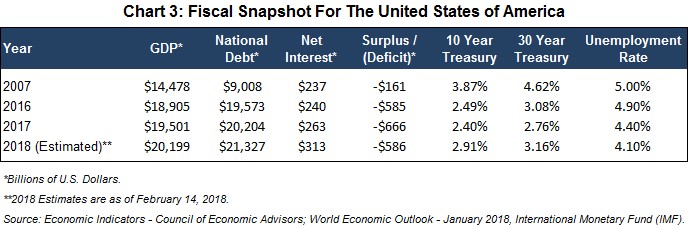

One of the critical issues facing investors is the inherent conflict between this expansionary fiscal policy and the Federal Reserve’s efforts to normalize monetary policy by raising interest rates and reducing its balance sheet. This is happening while leadership of the Federal Reserve is transitioning from Janet Yellen to Jerome Powell. In response to this concern, Treasury yields (which had been gradually rising for two years) have moved up more aggressively over the past eight weeks rising nearly half of a percentage point on the 10-year Treasury bond. We will be closely monitoring the rate of change of Treasury yields, the foreign exchange value of the dollar, and the appetite of buyers to purchase the new supply of Treasuries that is required to fund the growing federal deficit. Conversely, we would not be surprised if interest rates stall or move down to the lower end of the trading range in the near term, as rapid changes are often met with counter-trend moves. With the national debt forecast to rise to $21.5 trillion this year and the economy in its best position to continue its expansion since the financial crisis, this is not an ideal time for the government to be adding more stimulus to the economy. Unfortunately, our elected officials have “kicked the can down the road” once again by not addressing entitlements in this process and by not allocating the proper spending to infrastructure needs which require over $4.6 trillion just to maintain the system in a state of good repair. We believe many of our infrastructure needs can no longer be postponed, and state finances are such that they cannot be relied on to foot a significant portion of the bill. This would argue for even higher deficits in the years to come as the inevitable infrastructure problems will need to be financed through additional deficit spending by the federal government.

Quick Thoughts on Active versus Passive Management, Leveraged Products and Derivatives

“The inherent irony of the efficient market theory is that the more people believe in it and correspondingly shun active management, the more inefficient the market is likely to become.”

– Seth Klarman, founder of the Baupost Group

Many investors have moved to passive investing through mutual funds or exchange traded funds (ETFs) based on the belief that markets are efficient. We do not share that belief as our philosophy has always been that securities trade in an auction market with inherent inefficiencies. The market volatility of the past few weeks provided a reminder that passive investing assures investors that they participate fully in the markets’ returns achieving both 100% of the upside and 100% of the downside in the market moves. Given that we are at an inflection point in policy, this sets the stage for a narrowing of opportunities and a more favorable backdrop for active management. Therefore, we believe that investors taking a passive approach should consider increasing the actively-managed portion of their portfolios. As a reminder to our readers of the dangers of leveraged products and the use of derivatives, we would point to the $2.2 billion Credit Suisse low-volatility product that recently lost 96% of its value overnight and is now being closed.

Investment Implications of the Outlook

“The only other thing I’d say is that too many investors look at the present. The present is already in the price. You have to think out of the box and sort of visualize eighteen to twenty four months from now what the world is going to be and what securities might trade at. What a company’s been earning doesn’t mean anything. What you have to look at is what people think it’s going to earn. If you can see something in two years is going to be entirely different than the conventional wisdom, that’s how you make money.”

– Stanley Druckenmiller, legendary investor, speaking at the USC Marshall School of Business

This is an interesting time for investors as the contemporaneous shifts in U.S. fiscal and monetary policy regimes, occurring at a later stage in the business cycle, will have important implications for investment strategy. We believe that the ability to distinguish between the companies that benefit from rising deficits, higher interest rates and modest inflationary pressures, from those that get hurt, is going to be critical for investors. Historically markets eventually come under pressure during periods of rising interest rates, but within the market not all companies are treated equally. We strongly believe that fewer companies will benefit from this environment, and that the market will react to support those companies at the expense of the rest of the broader market. Those that benefit from the conditions highlighted above will be rewarded with premium valuations. Capital is already flowing to the defense, the technology and the healthcare companies, and we expect those flows to continue and possibly accelerate. Interestingly, companies attempting to fight inflationary pressures will likely add further to their technology spend in an effort to counter those pressures. Our emphasis remains on selecting companies benefiting from disruptive technologies, rising defense spending, changes in the financial and healthcare industries, increasing U.S. consumer spending and the shift to a more service-oriented global economy led by China and India. Companies with strong balance sheets that can more aggressively invest in the future growth of their businesses should be more highly rewarded as will those with the ability to repatriate large overseas cash balances. U.S. small capitalization companies also stand to be significant beneficiaries of further improvements in the economy, tax reform, strong consumer spending and increases in capital expenditures. We continue to remain cautious on fixed income investments given the risk/reward dynamics, and would suggest that investors consider reducing their allocations and shortening their maturities to reduce the risk of capital losses.

While we remain positive on the outlook for corporate earnings to rise and the continuation of the synchronized expansion of the global economy for 2018, we must keep in mind the risks present in the system that can impact longer-term investment strategies. In the coming months, one risk we will closely monitor will be the rate and magnitude of change in interest rates. We described many of these risks in detail in our December 2017 Outlook. Businesses that are proactively investing to redefine themselves will have a chance to compete, while those that do not will be left behind.

For our regular readers, we have not changed our fundamental views on the economy but recognize that an important shift in fiscal policy has occurred, and therefore it is a time to be even more selective and opportunistic in portfolio construction and asset allocation.