Download Outlook Now

Navigating the Complexities of Market

Dynamics in 2024

Following last year’s strong market performance, U.S. investors should see equity markets continue their upward trend, but it will not be a straight line. The outlook for the next 12 months will likely be determined by the impact of domestic and global politics which will affect the prices investors are willing to pay for current and future earnings of businesses.

Executive Summary

Following last year’s strong market performance, U.S. investors should see equity markets continue their upward trend, but it will not be a straight line. The outlook for the next 12 months will likely be determined by the impact of domestic and global politics which will affect the prices investors are willing to pay for current and future earnings of businesses. There remains continuing concern for the protection of purchasing power of the U.S. dollar given today’s levels of debt and deficits. We believe the current investments in technology, defense, industrials, materials, and healthcare companies will be important beneficiaries of this outlook, serving clients well over the next 12–24 months.

Outlook Highlights

Resilient Market Performance

Despite global uncertainties, the U.S. markets outperformed pessimistic expectations in 2023, with the S&P 500 closing the year at 4769.83, significantly above the forecasted 4000.

Key Investment Sectors

Continued investments in technology, healthcare, and defense are expected to yield considerable returns over the next 12 to 24 months.

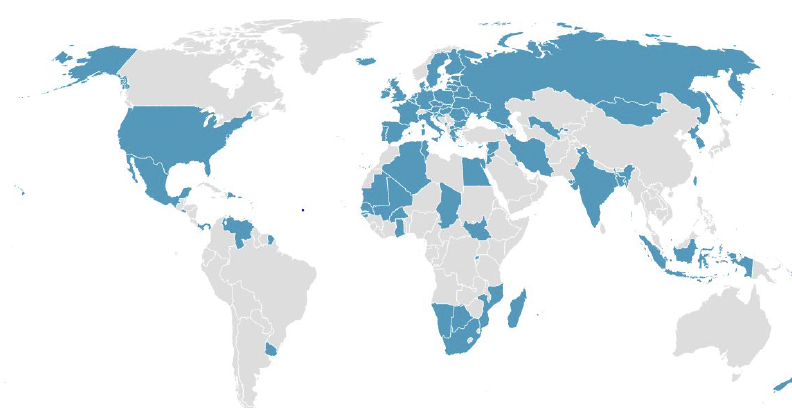

Geopolitical Influences

The upcoming global political events, including elections in over forty nations, will play a critical role in shaping economic and market outcomes.

Strategic Investments

ARS recommends focusing on companies that are essential to reindustrialization, productivity, and national security, given their potential to thrive amidst market fluctuations.

Our Perspective

The current landscape of high technology adoption and geopolitical shifts presents both challenges and opportunities. ARS’s strategic focus remains on sectors and companies poised for growth despite potential economic slowdowns. By prioritizing investments in industries driving technological advancements and infrastructure development, ARS aims to leverage the anticipated economic shifts to benefit our clients. Additionally, the firm advocates for a careful selection of equities over bonds to safeguard against the declining purchasing power of the U.S. dollar.

Disclaimer

The information provided in this report is for informational purposes only and is not intended as investment advice, or an offer or solicitation for the purchase or sale of any financial instrument. This report is provided on the condition that it does not form a primary basis for any investment decisions. The opinions and analyses included in this report are based on current market conditions and are subject to change. ARS Investment Partners, LLC will not be responsible for any investment decisions based on this report. Please consult with a qualified financial advisor before making any investment decisions.

Want More of The Outlook?

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.