Please download the presentation slides above.

Author: Rachel Shulman

What Matters Now: Today’s Economic Dislocations and Resulting Investment Opportunities

Investing in an Environment Unlike Any Other

This economic environment of the United States has never existed before. Current conditions are a manifestation of the distortions in the economy and the markets brought about by the pandemic and subsequent policy responses. Today’s challenge in building and protecting capital requires investors to view the world differently than in past cycles because current investment conditions are truly unique. The transformation of the economy is being reflected in the equity market’s shift to the industries and companies benefiting from a broad reopening and expansion of economic activity and away from the beneficiaries of the pandemic. The former concentration of capital came at the expense of a broad number of companies and industries which could not do well during a stay-at-home lifestyle and a remote-work environment. Subsequently, many previously neglected areas have taken on a new investment life, some of which we see as cyclical winners and some as secular winners. We continue to believe that many are underappreciating the magnitude of the rapid digitalization of the $22 trillion U.S. economy which will continue to occur over many years and have material societal benefits.

While there are critical social, political, and economic challenges that global leaders continue to struggle to address, the near-term headlines often serve as a distraction from what matters most from an investment perspective which is the outlook for corporate earnings, inflation, and interest rates that serve as the basis for equity valuations. Even with temporary, near-term inflationary pressures building, corporate earnings should continue to rise as the economy recovers, and interest rates and inflation rates remain historically low. These conditions are favorable for the companies that can raise prices to increase earnings as opposed to those companies whose earnings will be negatively impacted by their inability to absorb higher costs and pass on price increases. Some argue that innovation and productivity will continue to improve overall economic activity and suppress inflation pressures, while others argue that proposed tax increases, growing deficits, and rising inflationary pressures will slow economic activity and depress stock market valuations. From our perspective, the inflationary surge is a function of a short-term mismatch between consumer demand and production levels. The unprecedented monetary and fiscal policy responses to the virus are increasing the debate about how governments and markets should think about debt, deficits, and inflation. Lost in the debates is the fact that the U.S. economy and corporate earnings should remain strong for the next few years, notwithstanding episodes of volatility along the way.

Given this unique nature of the post-pandemic period, investors should remain focused on the businesses that are the primary beneficiaries of the secular transformations we have written about in recent Outlooks, especially those benefiting from the ongoing digital transformation which is still in the early innings. As this transformation further develops, it should drive the innovation and productivity growth needed to foster a more sustainable and balanced economy. Further augmenting these trends is the real concern to re-shore and rebalance supply chains away from geographic and politically challenged regions. As the cyclical inflationary pressures are absorbed by the global system, long-term inflation should remain muted allowing central banks to keep rates lower for longer, but not likely as low as currently projected by the Fed. This, in turn, should support some of the expansive fiscal policy initiatives needed to address climate, equality, health, and other long-term issues that are priorities for governments. In contrast to the post-WWII boom which was also characterized by pent-up demand and savings for products that had existed, the post-pandemic boom will also be characterized by products and services that had never existed and are creating new, large total addressable markets. This Outlook will lay out the case for near-term inflation rising and then moderating, will focus on the growth of the digital economy and how innovation and productivity will impact the overall economic prospects for the U.S. and global economies, and then focus on the investment opportunities that will be at the forefront for investors over the next 12 months and beyond.

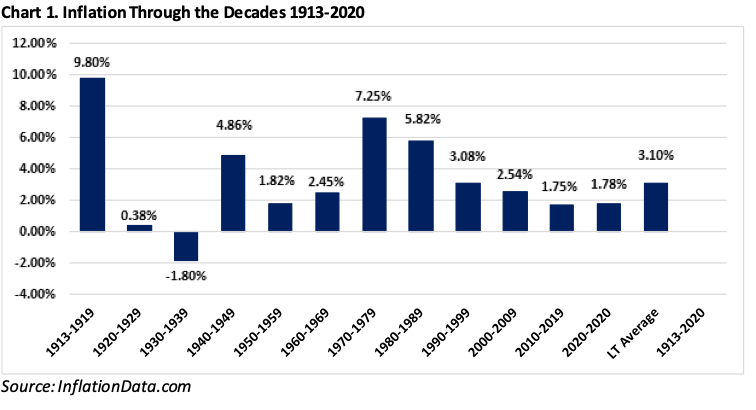

Understanding the Short-Term and Longer-Term Outlook for Inflation

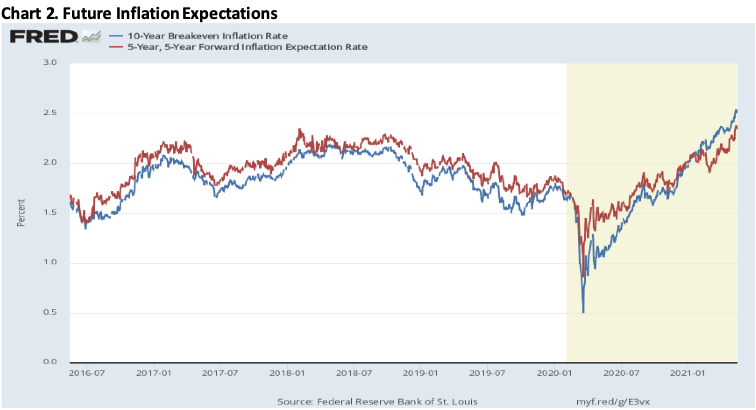

One of the most widely debated topics among investors involves the outlook for inflation as the battle lines are being drawn between a growing number of market participants and the Federal Reserve on whether the recent rise in inflation is becoming more permanently embedded in the system or is transitory in nature. As shown in Chart 1, inflation has averaged 3.10% from 1913 to 2020, but has been in a downward trend since the 1970s and was crushed by then Fed Chair Paul Volker beginning in 1981. For some time, the ARS team has held the view that four secular forces – technology advances, globalization, debt levels, and demographics – were creating a more deflation-prone economy. Three of the four forces are still intact with trade tensions and the resulting supply-chain disruptions having reversed some of the positive, deflationary tendencies stemming from globalization. However, as indicated in Chart 2, the market expects inflation to rise from last year’s depressed levels, but forecasts inflation rates rising to around 2.4% in five years. We continue to side with Treasury Secretary Janet Yellen and Federal Reserve Chair Jay Powell in their beliefs that recent upward pressure on inflation rates will be transitory in nature. The basis for our view is that pent-up consumer demand and severely drawn down inventories, which are causing price hikes, will be satisfied and short-term production shortfalls due to the pandemic are in the process of being corrected. Because the substantial level of shortfalls is so large, it could take longer to be corrected but nevertheless equilibrium will be restored, and inflationary pressures will abate.

The cyclical forces pushing up inflation involve supply-chain disruptions, labor shortages, skills mismatches between job openings and available talent, commodity price pressures, and pent-up demand alongside monetary and fiscal stimulus. Unlike the 1970s inflationary period where cost-of-living wage increases were contractual and administered prices were more the norm, the current period is very different as companies can more easily substitute capital for labor to manage the rise in compensation costs, while new and non-traditional competitors make passing on price increases far more difficult for many companies. One of the key factors that will determine whether wage inflation will be more permanent or transitory is the wage bill. The wage bill is the total amount of wage a company or industry pays annually while the wage rate is the unit cost of an hour of work. There has been a great deal of debate on raising the minimum wage rate, but wage rates matter less to companies than their total costs of labor which is their wage bill. If wage rates rise, but the wage bill does not rise proportionately then the inflation concerns will prove to be misplaced. The companies that thrive in the upcoming period will be the ones that are able to grow their revenues and earnings using innovation and productivity improvements to keep the wage bill from impacting profitability.

Investors should keep in mind that the Federal Reserve has been trying to stimulate the economy since the Great Financial Crisis in 2008 using quantitative easing (QE or the printing of money) and low interest rates to support its dual mandate of price stability and maximum employment levels. To date, the economy has struggled to reach the 2% inflation target set out by the Fed but was on track for its maximum employment goals prior to the pandemic which has introduced renewed concerns about the impact of longer-term economic scarring for segments of the economy. Chart 2 presents two measures of expected inflation followed by the Federal Reserve which are 10-year breakeven inflation rate and the 5-year, 5-year forward inflation expectation rate. While each indicates that inflation pressures are on the rise, they are not inconsistent with the Federal Reserve’s stated goal of letting inflation run higher to allow the economy to return to more appropriate levels of price stability and employment. It is understandable for market participants to react to headlines about inflation pressures rising as the cost for items like lumber, homes, used cars, and commodities rise sharply on the re-opening of the economy. However, investors should expect some of these pressures to dissipate after the initial wave of pent-up demand is met. Importantly from a market perspective, the digital transformation should re-emerge as the more dominant theme after the economy adjusts to the distortions in inflation measures stemming from the collapse in prices experienced in the early stages of the pandemic in the second quarter of 2020.

The Growth of the Digital Economy – Innovation and Productivity

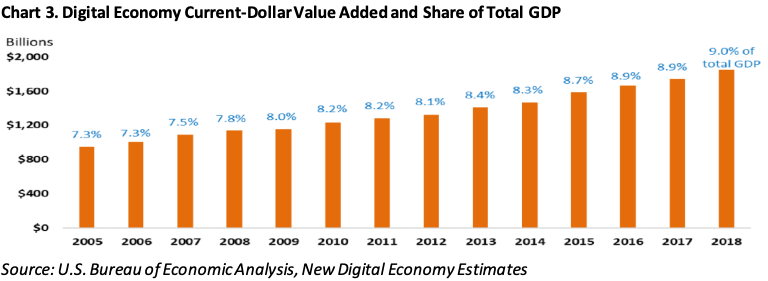

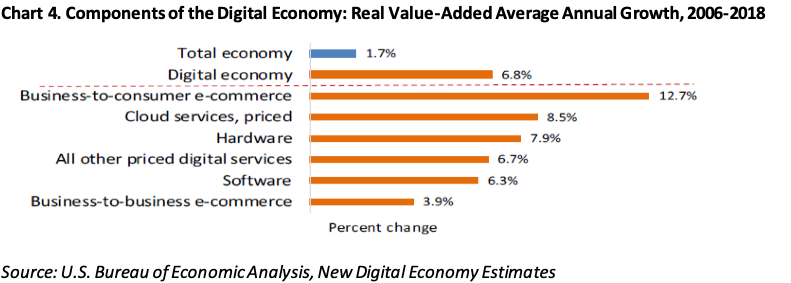

If the politicians in Washington are to effectively manage the nation through its social, economic, and political challenges, they will need to combine smart bi-partisan leadership and clear priorities with a commitment to supporting the continued growth of the digital economy. Since the Great Financial Crisis, the U.S. digital economy’s share of gross domestic product (GDP) has been on the rise and is reshaping business and daily lives in America as shown Chart 3. The COVID-19 pandemic has accelerated the digital economy’s growth rates and increased its share of GDP. From 2006-2018, the overall economy grew 1.7% annually, while the digital economy grew 6.8% annually as shown in Chart 4. The digital economy grew at an average annual rate of more than 3 times that of the overall economy. For that same period, business-to-consumer e-commerce grew over 12% a year on average and cloud services also grew very strongly at 8.5%. Bear in mind that these were pre-pandemic figures, and these growth rates have been exceeded in the past twelve months.

As Microsoft’s CEO Satya Nadella recently stated, “The next decade of economic performance for every business will be defined by the speed of their digital transformation.” This means that a greater share of capital expenditures will be dedicated to the rapid advancement of technological breakthroughs to create new products, new markets, new ways of solving health issues, lower costs, increase competitiveness, and gain market share. But not all companies and industries will benefit equally. The healthcare, manufacturing, and financial services sectors stand to be among the primary beneficiaries. The enormity of this century’s transformation is exemplified by the rapidity of the COVID-19 vaccine development which took a matter of days to analyze the code necessary to create the vaccines. The use of A.I. (artificial intelligence) to successfully handle the exponential growth of data generation has led to a digital transformation to create value from the enormous volumes of data. This is leading to an explosion of new drugs, therapies, and the prospect of revolutionizing medicine. In turn, the prospect of improving healthcare outcomes enabling longer and better lives leading to greater productivity and cost savings with big implications for government finance as healthcare cost represents approximately 17% of GDP. As the digital economy continues to become a larger part of the overall economy, it will bring with it both significant opportunities and challenges for policymakers, populations, business leaders, and investors.

The Power of the Digital Economy to Increase Output and Lower Costs

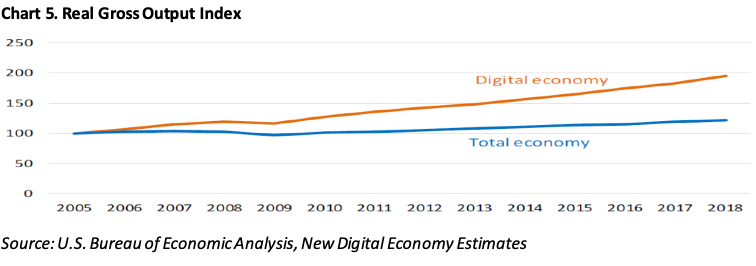

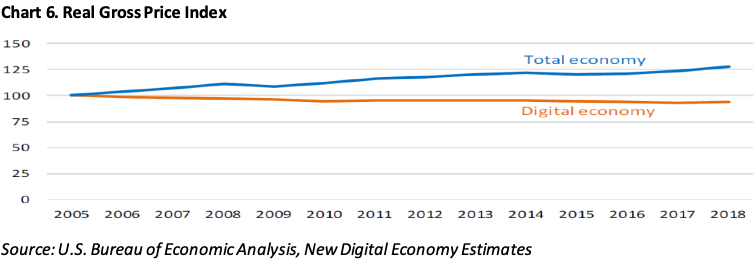

The expansion of the digital economy comes at a perfect time for the United States and other nations that are struggling to deal with the aftermath of two of the most disruptive economic events in recent history – the Great Financial Crisis and the COVID-19 pandemic, which occurred less than 15 years apart. Economies around the world are battling a lack of sustainable growth, rising deficits, high debt levels, growing frustration, and a lack of trust between populations and their governments. Technological advances will allow economies to be more efficient by increasing productive capacity. As shown in Charts 5 and 6, the digital economy has grown at a much higher rate than the overall economy, while at the same time technology is lowering prices. Chart 5 compares real gross output, which is the annual measure of total economic activity in the production of goods and services between the digital and overall economy. Chart 6 compares the real gross price index of the digital to the overall economy. Real gross price index measures inflation in the prices of goods and services in the U.S. In summary, these two charts show that the digital economy is becoming a larger percent of the economy and lowering prices in the process. As stated in past Outlooks, productivity is the antidote to inflation, and these charts illustrate this concept clearly.

For the United States’ economy to realize its potential, the government and corporations must commit to investing in the digital transformation at higher levels than ever before as aggressive global competition for technology leadership grows in importance. In 2020, China’s digital economy was estimated to be 7.8% of its GDP with a target of reaching 10% of GDP by 2025. China is also becoming a leader in patents issued across the key areas of technology including artificial intelligence, drones, cybersecurity, and quantum computing. For the United States to continue to be a technology leader, it needs to invest in infrastructure for 5G, research and development for innovation, up-skilling and re-skilling existing workers, and better educating our youth for the digital age. As many leading nations are experiencing record low fertility rates and rapidly aging populations, the digital transformation can partially offset the demographic challenges these countries are facing.

Investment Implications

It is in a time like this that the best investment opportunities are often missed because of excessive focus on the heightened uncertainty stemming from the multitude of problems present in the system, and the fact that there is no historical precedent for the world we are living in today. The global system is undergoing massive transformations due the unusual political, social, economic and climate conditions, and the magnitude of the problems has required the use of unconventional monetary and fiscal policies by governments. The fallout from global trade tensions, population displacements from failed states, and the COVID-19 pandemic has forced governments and businesses to adapt to changing conditions and societal tensions. For the United States government, it forces the need to promote changes in infrastructure, immigration, and education policies. It is also forcing businesses to come to grips with conditions that they have not previously had to prioritize or even consider including equality, diversity, and opportunity. At the same time, it is requiring all businesses to accelerate the pace of innovation to improve their productivity to protect and grow market share and transition to this new post-pandemic world. Fortunately, from a purely financial point of view, the wherewithal to deal with the many needs and opportunities is available. As one need leads to another, and to keep up with the emerging requirements, significant structural changes to the educational system and immigration policies are required to produce the necessary labor force to deal with the 21st century needs. New and dangerous competitive challenges for democratic states from autocracies, which also possess advanced technologies, is now manifest in the area of cybersecurity. When one connects the dots, new investment opportunities present themselves to reveal the potential for large addressable markets.

Cybersecurity/space

This area has come to the forefront of concerns as the recent Colonial Pipeline ransomware attack has now raised additional national security concerns across the entire United States infrastructure. To protect the United States, national security has become the principal concern as ransomware is exacting an intolerable and dangerous toll on the national well-being. Correcting this problem will also require major upgrades and overhauls of both the national grid and our communications networks including GPS systems – long a need and now no longer postponable. Microsoft also recently announced that the Russian hacking group behind last year’s SolarWinds cyber-attack is at it again as it is targeting government agencies, think tanks, consultants, and non-governmental organizations. This also involves a shift and an increase in our national defense budget and goes beyond political posturing.

Essential Materials for Infrastructure and Climate

A new level of increased demand for essential and basic raw materials has emerged. Many materials are critical for addressing the United States’ and the world’s climate transformation, particularly for wind, solar, and the efficient transition from fossil fuels. And because we are competing with Europe and other regions for these resources, this creates even greater demand which will require additional investment spending to bring supply into better balance. Steel, copper, and rare earth materials are among the areas on which we are focusing. The trade tensions between the United States and China are forcing companies to consider reshoring and onshoring to ensure dependable supplies of the inputs needed to compete, particularly in areas where future demand is certain to outstrip the previous supply capabilities of the global system.

Semiconductor technology

Semiconductor technology is the lifeblood of technological advancement for everything from smartphones, electric vehicles, robotics, medical research, wireless spectrum, and broadband to datacenters and gaming. However, the combination of the pandemic and trade tensions has created supply shortages that will persist for some time. Few countries will be able to compete effectively on the world stage without a dependable and resilient domestic supply of the chips to support their digital transformations. It is important to note that bringing supply and demand into balance can take 2-3 years to build additional manufacturing capacity. To that end, the Senate is considering a bi-partisan bill that would authorize over $500 billion to compete with China in the race for technology supremacy. The bill includes over $50 billion for domestic semiconductor production and $100 billion for research into artificial intelligence and machine learning, robotics, high-performance computing, and other advanced technologies. This follows previous announcements by Taiwan Semiconductor and Samsung to build facilities to produce state-of-the-art facilities in Texas and Arizona with each facility costing upwards of $10-15 billion dollars. China is a formidable competitor in this area as it has become the leading nation in terms of patents in the most important areas supporting advanced technologies.

Healthcare

The use of A.I. to successfully handle the exponential growth of data generation has led to a digital transformation to create value from enormous volumes of data. This is leading to an explosion of new drugs, therapies, and the prospect of revolutionizing medicine. The benefits of digitalization are being realized in healthcare, and the pandemic illustrated this in two key areas – the dramatic growth of telemedicine and the research and development of new vaccines and medicines. Similar to the ability of companies to transition their employees to remote work, doctors were able to transition many patients to telemedicine visits instead of office visits. In the pre-pandemic period, it took approximately 10 years to bring a new drug to market, and the industry was able to bring 2-4 vaccines to the market in less than 1 year. These are just two examples of opportunities to improve the quality of healthcare and to lower costs which will be even more important given the demographic challenges associated with the longer lifespans of a rapidly aging global population. The prospect of better healthcare enabling longer and better lives should lead to greater productivity with big implications for U.S. government finance.

High Quality Dividend Payers

High quality companies with defined dividend policies represent superior opportunities for investors who focus on income. For investors, the bond market will represent a poor asset class in a rising rate environment. Investors holding U.S. Treasury bonds with a 10-year maturity yielding 1.6% could lose nearly 8% of their principal value in the event of a 1% increase in rates. Conversely, equity investors can find many high-quality companies with dividend yields well in excess of Treasury rates and with both the reality and the prospect of increasing dividends.

The conditions for capital appreciation are noteworthy in stocks of all market capitalizations and in particular in smaller capitalization companies. We continue to focus on the investment opportunities which grow out these and our other observations of what changes and opportunities are presenting themselves in the markets. We anticipate companies will redefine themselves to improve productivity and better compete in the coming period through merger and acquisition activity and spinoffs. Notwithstanding the significant advancements of many of the leading beneficiaries of this Outlook over the past two years, periods of market volatility should be viewed both as the pause that refreshes and an opportunity to add to investments at more attractive prices. This is particularly true for companies which have significantly increased their revenues and earnings and continue to have bright prospects for significant growth over the intermediate term. Because the economy is progressing so rapidly, the companies with embedded advantages will continue to fetch the best market valuations as a result of great investor interest. To do so, they must innovate and embrace the latest technologies, while assuring themselves of the needed elements to remain at the forefront of competition.

Published by the ARS Investment Policy Committee:

Brian Barry, Stephen Burke, Sean Lawless, Nitin Sacheti, Michael Schaenen, Andrew Schmeidler, Arnold Schmeidler, P. Ross Taylor.

The information and opinions in this report were prepared by ARS Investment Partners, LLC (“ARS”). Information, opinions and estimates contained in this report reflect a judgment at its original date and are subject to change. This report may contain forward-looking statements and projections that are based on our current beliefs and assumptions and on information currently available that we believe to be reasonable. However, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements.

ARS and its employees shall have no obligation to update or amend any information contained herein. The contents of this report do not constitute an offer or solicitation of any transaction in any securities referred to herein or investment advice to any person and ARS will not treat recipients as its customers by virtue of their receiving this report. ARS or its employees have or may have a long or short position or holding in the securities, options on securities, or other related investments mentioned herein.

This publication is being furnished to you for informational purposes and only on condition that it will not form a primary basis for any investment decision. These materials are based upon information generally available to the public from sources believed to be reliable. No representation is given with respect to their accuracy or completeness, and they may change without notice. ARS on its own behalf disclaims any and all liability relating to these materials, including, without limitation, any express or implied recommendations or warranties for statements or errors contained in, or omission from, these materials. The information and analyses contained herein are not intended as tax, legal or investment advice and may not be suitable for your specific circumstances. This report may not be sold or redistributed in whole or part without the prior written consent of ARS Investment Partners, LLC.

What Matters Now: Finding an Alternative Income Source to the Increasingly Risky Bond Market

Please download the presentation slides above.

What Matters Now: Investing in Today’s Critical Transformations Through ETFs

Please download the presentation slides above.

What Matters Now: Preparing for the Post-Pandemic World

Transitioning to the Post-Pandemic World

“The COVID-19 pandemic has demonstrated that no institution or individual alone can address the economic, environment, social and technological challenges of our complex, interdependent world. The pandemic itself will not transform the world, but it has accelerated systemic changes that were apparent before its inception. The fault lines that have emerged in 2020 now appear as critical crossroads in 2021.”

– Excerpt from World Economic Forum website on the Davos 2021 agenda

Last year presented challenges that no one anticipated. While the battle against the COVID-19 virus is far from over, the rollout of vaccines has provided a light at the end of the tunnel. This is a welcome relief for consumers, businesses and governments after one of the most difficult and uncertain periods in history. Last year could not end quickly enough for most, and it will appropriately be remembered more for the devastation to lives and livelihoods stemming from the COVID-19 pandemic than the returns of the market or any individual stock. As policymakers continue to work to arrest this terrible virus and to heal the global system, there are five critical forces that should drive the recovery and, importantly for investors, help to determine those industries and companies that will be the primary beneficiaries of the resulting capital flows. The five forces involve pent-up demand, vaccine distribution, massive liquidity, low interest rates, and productivity improvements. The combined effect of these forces will lead to both strong economic growth and healthy returns for investors in well-selected equities.

To be sure, there are fundamental issues such as tackling a decaying infrastructure system, income inequality, civil unrest, fixing the education system, enhancing cyber security, and reducing the political divisiveness that need to be addressed immediately so that the country can then move onto important longer-term concerns such as deficits, debt levels, tax policy, entitlements, and demographic challenges. Under these circumstances, market participants should emphasize actively managing their portfolios as a narrow range of securities should benefit disproportionately from the complex dynamics of the global economy. That said, the acceleration of the systemic changes described by the World Economic Forum will create a relatively small number of well-defined opportunities for market participants. A January 4th article from McKinsey stated, “2021 will be the year of transition. Barring any unexpected catastrophes, individuals, businesses, and society can start to look forward to shaping their futures rather than just grinding through the present. The next normal is going to be different. It will not mean going back to the conditions that prevailed in 2019.” Given the many challenges facing the world, these times suggest investors should continue to be both cautious and opportunistic in 2021. However, better times are ahead for the economy, and market participants have already started to look past many of the near-term concerns and are focusing on opportunities developing for the post-COVID economy.

Pent-up Demand – Consumers, Corporations and Governments

“The great comeback of 2021 is surely coming, at least according to the new picture I have in my head, and it will be led and fed by the idea of pent-upness. There’s so much pent-up desire for joy out there. Surely it will begin to explode in late spring, with vaccines more available and a spreading sense that things are easing off and be fully anarchic by summer. Growth will come back, people will burst out, it’s going to be exciting.”

– Peggy Noonan, The Wall Street Journal, December 31, 2020

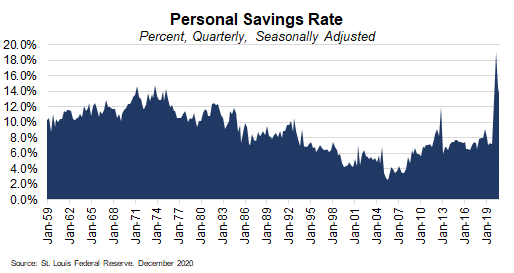

After being locked down and unable to take part in what were our normal activities prior to the pandemic, most people are eager to return to living without restrictions. As Peggy Noonan sums up quite well, there is so much pent-up demand not only from consumers, but also from governments and corporations that the effect may be similar to that of a coiled spring. As shown in the chart, the lockdowns forced savings rates to extreme levels and consumers have spending power that will be unleashed once economies reopen likely in the second half of the year. We have not seen this type of pent-up demand since the post-WWII period. Back then it was ending the war that ignited the resumption of spending, this year it will be the distribution of vaccines that will get things started.

The consumer is just one part of the pent-up demand; governments and corporations will also be increasing spending this year. President Biden has proposed a $1.9 trillion stimulus plan, and this would be in addition to the $3 trillion fiscal stimulus in 2020. For corporations, there is little choice but to increase capital spending in 2021 to acquire the most advanced technologies in order to effectively compete. Investors should anticipate that much of corporate spending in the manufacturing sector will be directed to increasing capacity and upgrading plants and equipment with the newest technologies to lower costs and meet increasing demand. While many market prognosticators are forecasting a rapid increase in inflation, that is not the base case for ARS. Our team believes that we might experience a modest rise in inflation this year but expect it to be transitory.

Vaccine Distribution

“In the aftermath of the presidential election, the US has its last best chance to reset the fight against the coronavirus. Such a reset will require restoring the working relationship between the national government and the states. And the first true test of this strengthened relationship will be the distribution of vaccines.”

– Boston Consulting Group, November 30, 2020, “Only a Reset Can Defeat the Virus”

The COVID-19 pandemic has been a human and economic catastrophe, and the battle is far from over as new mutations are creating additional concerns. But with the vaccine roll out underway, it’s possible to be cautiously optimistic that we will be shifting away from the lockdowns and restrictions so prevalent today to the next normal which should begin in earnest later this year. The Biden Administration has taken a fresh approach to fight the virus and it started with designing a strategy that plays to the distinct strengths of the federal and state/local governments. As the BCG highlights, “Federal and state governments have different strengths. By virtue of its borrowing and purchasing power, the federal government excels at funding and procurement. Its expertise and broad perspective also position the federal government to establish evidence-based national standards and offer tailored regulatory relief. The states’ strength derives from local knowledge and service delivery. They clearly see the reality in the field that can be fuzzy to federal officials.” It is safe to say that the lack of proper coordination and communication between federal and state officials as well as with the drug manufacturers had prevented a more effective response to the distribution process.

The ability of biotechnology and pharmaceutical companies to produce not one, but several effective vaccines in just a few months has put the United States and global economies on track for potentially a strong recovery in the second half of the year. However, there are many manufacturing and logistical problems to be addressed which would suggest that not only does the United States need better coordination on all levels of government, but that corporations need to pitch in to assist in helping solve these complex challenges. This would not only provide a public service but also accelerate the time to get their businesses closer to the post-COVID environment. The world continues to experience episodes of heightened uncertainty which are likely to persist at least until the virus is contained and people feel more confident that it is safe to return to many of the activities that are currently being prohibited, restricted, or avoided. As we said in our August Outlook, “While we believe that innovation and science will win in the end, the road to recovery will be bumpy with unsettling news headlines adding to the already high level of uncertainty and unease.” That has been the case the past few months and may continue to be until the current supply and logistical difficulties are resolved and herd immunity is achieved.

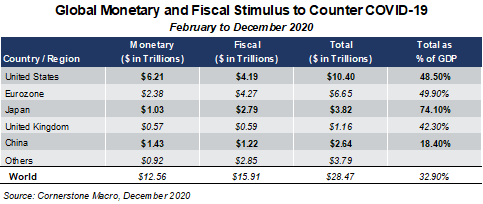

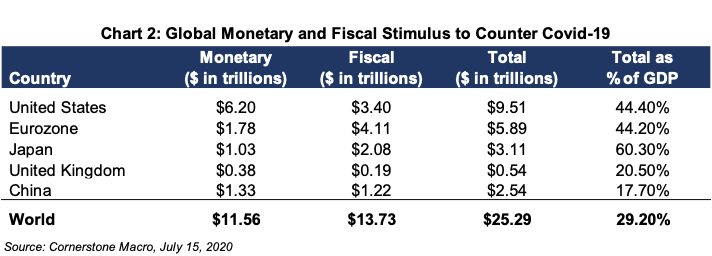

Liquidity

One of the most fascinating aspects of 2020 was the speed and magnitude of the policy response from governments around the world, not just in lowering benchmark interest rates, but also by pumping an unprecedented amount of liquidity into the global system. Nowhere was this more evident than in the U.S. as shown in the following chart. As one can see, the United States’ combined monetary and fiscal policy responses last year was equivalent to over 48% of gross domestic product (GDP). And that does not take into account this year’s initial stimulus proposal which would bring total stimulus in the U.S. to over 50% of gross domestic product. Globally, governments and central banks have provided stimulus equal to more than 33% of global GDP and this figure continues to rise.

Why is this important? The liquidity injected into the system has allowed the global economy to absorb the shock of the pandemic and rebound from the brink of a severe recession, if not, a depression. It also allowed employment, consumer net worth, and corporate profits to rebound strongly since the March lows. All this liquidity sloshing around the global system has forced investors to seek opportunities to get a higher return on their money and has encouraged added risk-taking. This was clearly evidenced in the markets the last week in January as retail investors, using social media, turned the tables on a few hedge funds by executing a coordinated attack on the extreme short positions in GameStop shares which led to a “short-squeeze” that drove up the price of the company’s shares beyond reason. The implications of this and the unusual trading activity of other stocks have yet to be determined, but it is safe to say that we have not heard the last of this yet as investors can expect regulatory and other changes in the not-too-distant future.

Interest Rates

“When the time comes to raise interest rates, we’ll certainly do that, and that time, by the way, is no time soon,”

– Jay Powell, Federal Reserve Chair, in comments on January 14, 2021

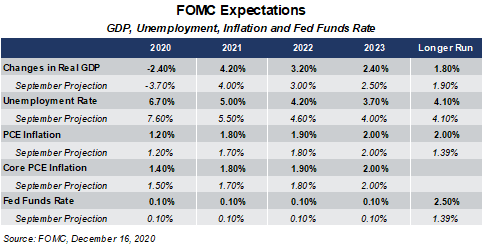

For investors, the outlook for interest rates, inflation rates and corporate profits are the critical determinants of equity valuations. Low interest rates are to the economy what blood is to the body as it promotes the flow of capital throughout the economy. Interest rate levels either retard or augment capital flows, and today’s historically low rates maximize the ability of capital to be deployed. Low interest rates allow for economies to heal and to grow by promoting consumption and capital expenditures by businesses. High interest rates slow economic activity by restricting investment, borrowing and risk taking. As Chair Powell and the rest of the Federal Reserve officials regularly remind us, they do not intend to raise rates any time soon. As shown in the following chart, Fed officials do not forecast federal funds rate increases before 2023. By anchoring rates near zero, the Federal Reserve is attempting to bring down other rates such as those for corporate debt as BAA yields have fallen to record low levels and mortgage rates have also come down to near-record low levels of 2.86% as of the time of this writing. The Federal Reserve is maintaining its laser-like focus on returning the economy to full employment even if inflation runs above its target in the near term. With the recent confirmation of Janet Yellen as Treasury Secretary, Chair Powell has a close ally to coordinate policy between the Federal Reserve and the Treasury Department. Secretary Yellen’s knowledge of the challenges of U.S. economy and the Federal Reserve’s policy intentions are unique. For market participants, the Yellen-Powell combination should provide a supportive backdrop for equity valuations.

Productivity

“What we are witnessing is the dawn of a second wave of digital transformation sweeping every company and every industry. Digital capability is key to both resilience and growth. It’s no longer enough to adopt technology to compete and grow.”

– Satyta Nardella, Chief Executive Officer, Microsoft Corporation

Productivity reflects the efficiency of an economy as well as serving as the determinant of the foreign exchange value of its currency. Productivity growth has been lackluster in the United States over the past few decades. The productivity improvements from technological advances have been most evident in the ability of the pharmaceutical industry to develop and bring to market multiple vaccines for COVID in record time. In addition, U.S. manufacturers have made their production lines so much more efficient that they can run shifts with a fraction of the workers required 20 years ago. This enables companies to bring back jobs and more effectively compete with foreign workers who are earning a fraction of the wages of U.S. workers. Furthermore, the scale of the shift to remote work due to the pandemic would not have been possible without advances in cloud computing, artificial intelligence, software and 5G. Productivity improvements are creating new large addressable markets in several areas such as green energy by lowering costs for electric vehicles, solar and wind power.

The digitalization of the economy is enabling companies, large and small, to do more with less time and expense. The growth of the digital economy is important for society as it aids nations in closing the gap between the actual and potential GDP of their economies by driving productivity growth, keeping inflation low and raising living standards. While much has been written about the loss of jobs due to technology, many studies have shown the longer-term benefits offset the negatives. However, in the nearer term it does put a greater burden on governments and companies to help those workers impacted to learn new skills to compete in the new workplace. Additionally, technological advances help create new industries, jobs and functions which can result in new and more efficient markets. The productive capacity of a nation is closely connected with its education system as it needs to prepare workers for multiple careers they will likely experience. Investors should anticipate that the expected increases in capital expenditures will lead to significant improvements in productivity while resulting in a strong growth, low inflation environment. The rapid adoption of new technologies creates a positive feedback loop with future technologies being brought to market at an accelerated pace. While certain types of jobs will disappear or see significant reductions in demand, the technological advances we see occurring at this time will create many new jobs which could well be better paying such as those being created in emerging industries like clean energy.

Investment Implications

As the economic recovery remains both fragile and fluid, we continue to be both opportunistic and cautious in our investment approach. As we have written throughout this piece, the powerful shifts in the global economy are creating large investment opportunities, and well-selected equities should reward investors over the next several years. There are investable ideas present in virtually all market environments, and investors should be able to achieve attractive absolute and relative returns over time by owning the businesses that are the beneficiaries of the secular trends. One issue that has been hard for many investors to grasp is the fact that a relatively small number of companies are prospering, while many others are struggling. Why has this been occurring? Because these successful companies have significant embedded advantages including scale, stronger balance sheets and better access to talent and capital. This enables them to commit more funds to increasing productivity by investing in innovation and technology advances. Last year, Amazon, Apple, Alphabet and Microsoft together increased their capital expenditures at a nearly 25% rate. This, in turn, led to higher earnings, better pay for employees, stronger market share, and ultimately greater shareholder value, while at the same time increasing their competitive positions. Investors should focus on companies with “embedded advantages” over their peers. It is for this reason that we feel the investment environment should favor active investment management over passive management and high conviction strategies over more diversified strategies. Additionally, this low-interest-rate environment favors companies with strong balance sheets, resilient business models, and the ability to raise their dividends. These conditions have led to a broadening of the market to include small capitalization companies that are drivers of some of the most important new innovations. We continue to identify a number of companies that are uniquely positioned to benefit and are strategically vital to enable the ongoing global transformation.

There are always risks to the economic outlook and that is certainly the case today. Among the key risks that would shift our positive views from our current position would be a sharp rise in inflation and the exchange rate for the U.S. dollar. Other risks include how we manage the expanding federal deficits, asset valuations, tax and regulatory increases, extreme weather, geopolitical uncertainties and, of course, the resolution to the current health crisis. The focus for client portfolios remains consistent with our recent Outlooks as we continue to favor the beneficiaries of the digital transformation involving cloud, cybersecurity, 5G and semiconductor chips as well as healthcare companies helping to lower healthcare costs in the U.S. In the past quarter, we have increased our emphasis on the clean energy transition and climate change but continue to be vigilant to avoid over-hyped areas of the market. Regardless, a number of leading companies, large and small, will continue to innovate, disrupt and evolve their business models to thrive in the coming years. As such, investors should be focused on benefiting from the powerful secular trends and not on speculating in shares of companies whose futures are behind them as they have either lost their way or will be unable to transition in their current forms to benefit in the post-pandemic world.

What Matters Now: Turning Secular Trends into High Conviction Ideas

What Matters Now: Transformations Creating a Generational Opportunity to Build Capital

Please download the presentation slides above.

Six Critical Transformations and the Generational Opportunity to Build and Protect Capital

“The global COVID-19 pandemic shows few signs of relenting – in fact, in addition to its dual burden on lives and livelihoods, it is triggering civil unrest, new concerns about economic inequality, geopolitical tensions, and many other effects. The pandemic is more than an epidemiological event; it is a complex of profound disruptions.”

– McKinsey Global Institute

This rapidly changing world is presenting both interesting existing and new investment opportunities in the beneficiaries and profound challenges. In just a few months, the world has undergone critical transformations and, as highlighted in the McKinsey reference above, “a complex of profound disruptions”. Our lives continue to be reshaped in ways that were predictable prior to the COVID-19 virus and in ways that were not predictable. Many investors we speak with these days tend to be less aware of the dynamic opportunities available and more focused on the many uncertainties stemming from the resurgence of COVID-19 cases globally, rising geopolitical tensions, and the potential consequences of the upcoming U.S. election. It is important that serious, long-term investors not get sidetracked by the near-term uncertainties as we believe the six transformations described in this Outlook will provide a generational opportunity to protect and build capital in the beneficiaries even if future investment returns across the broad range of asset classes are lower than previously experienced.

As hopes for a 2020 resolution to the pandemic have faded, the economic consequences of business closures, high unemployment, lost incomes, and lower economic activity have become clearer. Investors should expect business closures and bankruptcies to continue or even accelerate in the coming months. The dramatic improvement in the unemployment rate experienced from May through August has begun to stall as companies announce new layoffs and furlough programs. Additionally, state and local government finances in the United States are being severely strained due to the virus, and this is accompanied by an increase in Federal spending needs placing even further pressures on the financial system. These developments have raised concerns with respect to the longer-term economic scarring that can occur whereby many of the long-term unemployed experience long-lasting damage to their individual economic situations as well as segments of the economy that may have become semi-permanently impacted.

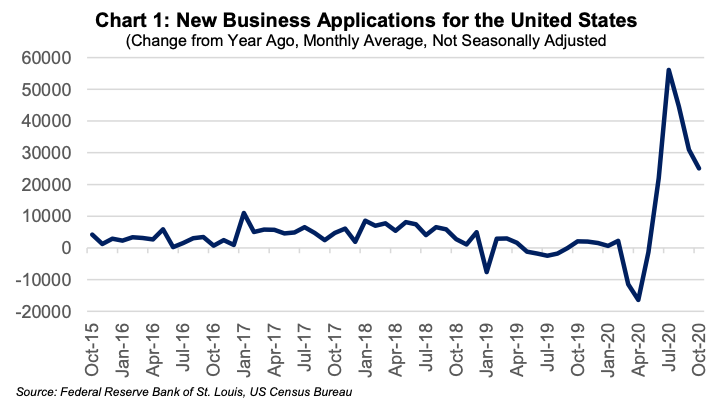

It is important to note that the United States has long been the most resilient, innovative and adaptive economy in the world. As seen in Chart 1, new business formations are up significantly this year over last year, one sign of entrepreneurs adapting to the evolving circumstances.

Despite the efforts by central banks and governments around the world to provide support to the global economy, more needs to be done. The next round(s) of fiscal initiatives should be structured to provide some immediate support and stimulus targeting productive investments to create sustainable, long-term growth. Smart support and stimulus can help the U.S. and other nations not only recover from the pandemic but also raise living standards. However, the pandemic recovery requires not just additional spending, but also a healthcare solution in the form of better testing, approved vaccines and treatments that are made widely available to allow a return to more normal activities on a global basis. This Outlook will frame the six critical transformations that are changing our world and their investment implications.

The Six Critical Transformations

“When we emerge from this corona crisis, we’re going to be greeted with one of the most profound eras of Schumpeterian creative destruction ever — which this pandemic is both accelerating and disguising… The reason the post-pandemic era will be so destructive, and creative is that never have more people had access to so many cheap tools of innovation, never have more people had access to high-powered, inexpensive computing, never have more people had access to such cheap credit — virtually free money — to invent new products and services, all as so many big health, social, environmental and economic problems need solving.”

– Thomas Friedman, NY Times, October 20, 2020

Since the financial crisis in 2008, societies have seemed to be struggling to accept, absorb and adapt to the pace and magnitude of the constant changes occurring all around. As Thomas Friedman points out, the COVID-19 pandemic has acted as another accelerant for change bringing forward by years the adoption of new ways of doing things, while affecting all aspects of our lives. Importantly, the transformations are also accelerating the greater adoption of technology which in turn drives the adoption of future innovations. The virus is forcing consumers, businesses and governments to embrace change as there is simply no other choice. There are six critical transformations occurring that are changing our world and will have an outsized impact on achieving more sustainable economic growth, increasing corporate profits and raising living standards. These transformations are the monetary and fiscal, the geopolitical and political, the digital, the social and societal, the climate and the educational. These transformations are highly interdependent, and therefore their proper management by policymakers as well as the private sector is essential to a successful transition. If done correctly, this would lead to a profoundly positive outcome for the United States as a country.

The Monetary and Fiscal Transformation

The global central banks have been working overtime this year in response to COVID-19. When the Federal Reserve announced new interest rate cuts and monetary easing in March as the virus was accelerating, investors initially viewed it as a temporary stimulus move. The Federal Reserve and other central banks have taken monetary accommodation to levels that were once unimaginable. With the Fed’s recent forecast that rates will remain low at least until 2023, more market participants are starting to believe we are in a period of semi-permanent near-zero interest rates perhaps like Japan has experienced since the 1990s. Most advanced economies cannot tolerate a return to a normal interest rate policy due to the current political and social dynamics, deflationary forces, debt levels, government spending needs and lack of sustainable growth. A premature return to a normal interest rate policy would immediately weaken economic activity and promote an unwanted downturn, a lesson learned by central bankers from the aftermath of the Great Depression. Therefore investors should anticipate that monetary policy will remain highly accommodative and understand that central banks have more tools, such as interest-rate caps, to bring to bear if necessary.

One of the most essential transformations involves the shift in attitude toward fiscal policy. During the period following the financial crisis, the prevailing view was to lean toward austerity rather than deficit spending as an answer to the debt and deficit problems present in the system. This was particularly true in Europe. Central banks have set the stage for a new era of fiscal policy by giving policymakers the ability to finance deficit spending with historically low interest rates. Governments have abandoned the policies of austerity and are replacing them with spending programs to address major needs such as infrastructure, clean energy, education, skills re-training programs, and healthcare. In the United States, the pandemic crisis has also led to a change in attitude among politicians in both parties with Republicans now supporting even greater deficit spending as our federal deficit as has reached $3.1 trillion and appears likely to increase further regardless of who wins the upcoming election. Investors should expect higher deficits in most advanced economies, new spending programs and possibly more public-private partnerships to address the most pressing social and economic issues.

What has been noteworthy in recent weeks have been the numerous calls for increased fiscal spending from Christine LaGarde, President of the European Central Bank, Federal Reserve Chair Jay Powell and several Federal Reserve Bank members including Lael Brainard, Neel Kashkari, and Charles Evans. One of the strongest messages about providing more fiscal stimulus came from IMF Managing Director Kristalina Georgieva, who said recently, “Public investment—especially in green projects and digital infrastructure—can be a game-changer. It has the potential to create millions of new jobs, while boosting productivity and incomes.” In a recent release, the IMF also stated that “policymakers have to address complex challenges to place economies on a path of higher productivity growth while ensuring that gains are shared evenly, and debt remains sustainable. Many countries already face difficult trade-offs between implementing measures to support near-term growth and avoiding a further buildup of debt that will be hard to service down the road.” The challenges are complex, and the problems can no longer be postponed, but the opportunity remains the best one to reverse the damage done by the pandemic and flawed policy responses of the past.

To meet the challenge from the IMF to invest, policymakers should consider splitting government spending plans into two categories – an operating budget and an investment budget. For the operating budget, the recommendation would be that all existing programs be reviewed to ensure that each expense is still necessary, the spend is being done effectively, and whether there are any opportunities to combine some operating expenses with investment expenses to maximize spending. For the investment budget, the recommendation would be evaluated in a manner similar to corporate capital programs with a return-on-investment approach over multiple years. This approach would avoid some of the waste that exists in government programs and allow for more efficient capital allocation.

The Geopolitical and Political Transformation

There has been a significant geopolitical transformation occurring for some time driven primarily by a few key factors – the pandemic, the shifting geopolitical landscape and each nation’s specific internal challenges. The COVID crisis restart has provided governments with a complex set of challenges as each works to protect the public, to manage the economic and social consequences of the pandemic, and to put the global economy on a sustainable growth trajectory. Top of mind is how to create a framework to think about managing the new stages of the pandemic and still address the ongoing and future needs of each nation. A recent report from the Boston Consulting Group discussed a framework employed by one government to make decisions to assess the varied interests that needed to be balanced. The report discussed an Australian state government that is “assessing each step in its reopening process against three dimensions: its potential economic benefits in terms of jobs and economic value creation, its potential social benefits in terms of improved mental health and social equity, and the degree of increased health risk from the kind of social interactions that are likely to occur.”

Other major factors to be considered are the implications of the apparent withdrawal of the U.S. as the global leader and the aspirations of China to play a leading role in the world. This is resulting in perhaps the most significant shift since the end of the Cold War with the former USSR and will have important implications for the global order for decades. We are moving to a bifurcated world with nations being forced to choose sides. This is evidenced by the measures taken by the United States to redefine its trade relationship with China, the actions surrounding technology leadership and the rising tensions in multiple parts of the globe. The changing geopolitical dynamics are forcing some nations to choose sides and allowing autocratic leaders like those in Russia and Turkey to take advantage of the global leadership void.

In addition to the geopolitical challenges, politicians are fighting battles on multiple fronts as they attempt to arrest the pandemic and manage the disruptions while attempting to navigate these six transformations. Countries are experiencing swings in national politics between the far left and the far right, and as with most things the pendulum tends to swing back from one extreme to the other after a period as the majority is typically underserved by the politics of either the far right or left. These swings are not ideal from an economic perspective as they lead to waste and suboptimal outcomes. At the same time, politicians in the U.S. and in other nations are dealing with near-term issues such as social unrest, weak national, state and local finances, significant spending requirements to address near and long-term issues, and highly divisive politics.

The Digital Transformation

Technology allows us to accomplish some of the most complicated and challenging endeavors faster, more effectively and less expensively. However, creative destruction comes at a cost with some old industries being carved out and those jobs lost, while new industries, companies and jobs are created. Some industries will see even more jobs created than are lost by obsolescence. Today technology adoption is occurring faster than ever due to ongoing innovation and the willingness and/or needs of governments, businesses and consumers to change. Corporations are embracing productivity-improvement technologies in response to the economic realities of the new business environment. With an estimated near $1 trillion investment for global deployment, 5G is a key enabler of the new technologies being pioneered including AI (artificial intelligence), cybersecurity, blockchain/bitcoin, advanced robotics, autonomous vehicles and drone delivery systems to name just a few. While much has been written about the pull forward of future demand due to the pandemic, one major aspect of the shift underway is accelerating the adoption of the next generation of technologies across a broad array of applications. In the United States, the government should play a critical role in ensuring that the right balance is struck between public and private sector roles in championing infrastructure and the US role as the global tech leader. Technology is so important to economic, political and military leadership that it is the focal point of continuing tensions between the U.S. and China. (Note: We invite readers to visit our website to hear our recent conference call on 5G).

The Social and Societal Transformation

While the economic and political changes tend to be the focus of our Outlooks, the social and societal ones are equally important for investors, and the pandemic has brought about some of the more critical forces for investors to consider. The COVID-19 virus has changed many aspects of how we live, learn, work and govern. All around the world, people’s daily lives have been changed in ways many could not have contemplated prior to the virus. This is evidenced by the shift from cities to the suburbs, from work in the office to working remotely, from in-person meeting to Zoom meetings and from mass transit to driving oneself. Some changes will be temporary, but others will be semi-permanent and still others permanent. This is impacting commercial and residential real estate values surrounding major cities, where, when and how we work, and how we educate our children. The virus has also forced companies to adopt technology more quickly to replace jobs completely or reduce tasks of workers.

The pandemic has also highlighted the need for societies to address essential services in which most developed nations have underinvested due to either the austerity bias discussed above or the lack of political will. In the United States, it has led to a shift in attitudes toward healthcare, educational costs and inequality, but it has also led to increased social unrest as evidenced by violent demonstrations in many cities. Governments’ roles in all aspects of our lives has increased because of the pandemic along with the many underlying problems that were below the surface and had been bubbling up for years.

The Climate Transformation

“The 21st-century energy system promises to be better than the oil age—better for human health, more politically stable and less economically volatile. The shift involves big risks. If disorderly, it could add to political and economic instability in petrostates and concentrate control of the green-supply chain in China. Even more dangerous, it could happen too slowly.”

– The Economist, September 17, 2020

One of the most controversial transformations involves climate change. From the melting of the permafrost to the wildfires in California to the rising water temperatures, climate transformation is clearly underway. The world has also seen rising air temperatures, changes in migration patterns and more violent storms. With the onset of the COVID-19 virus, oil demand dropped by 20% and prices collapsed. This has placed strains on oil-producing nations and the oil sector. Unlike past periods of oil price declines, this one has opened the door for clean energy transformation as governments, businesses and the public are now more focused on climate change than ever before. Supported by the current zero-interest-rate policies of central banks in the developed markets, governments are more aggressively pursuing green-infrastructure plans with the EU committing nearly $880 billion for clean energy initiatives and American Presidential candidate Joe Biden proposing a $2 trillion program to decarbonize the U.S. economy. China is also shifting to cleaner energy as its moves to reduce its carbon footprint and reliance on oil imports, while strengthening its global economic, military and political position. It is also about China playing to its other strengths. China has a dominant position in several aspects of the clean energy supply chain as it produces an estimated 72% of the world’s solar modules, 69% of its lithium-ion batteries and 45% of its wind turbines. The fact that it also has the leading position in the rare-earth materials necessary for the production and distribution of clean energy is another reason for its interest in green initiatives. China is positioned to be as dominant a player in clean energy as the Saudi’s have been in oil for decades.

The Economist also points out that “Today fossil fuels are the ultimate source of 85% of energy … A picture of the new energy system is emerging. With bold action, renewable electricity such as solar and wind power could rise from 5% of supply today to 25% in 2035, and nearly 50% by 2050.” For the transformation to take place, it will likely take a higher commitment from governments including changes to regulations, continued advances in technology to lower the costs of the transition, public-private partnerships to finance and support the required infrastructure spending, and a higher commitment from the public to support the transformation with their actions. There are potential negatives for investors as the transition may increase costs in the nearer term and lower earnings for some companies, but those companies with the balance sheets and foresight to embrace the transformation should separate themselves from their competition and increase their valuations.

The Educational Transformation

“The main hope of a nation lies in the proper education of its youth.”

– Erasmus

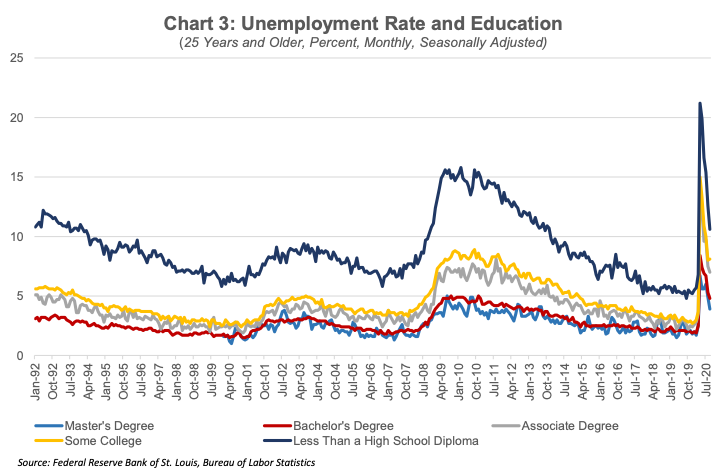

For all the progress made in society in the last hundred years, one area that has been slower to advance has been the nurturing of its most important asset – its children. Too many students today learn in a similar fashion as their parents and grandparents, and yet math and reading scores continue to decline. This is true in too many countries. As Alibaba founder Jack Ma has said, “If we do not change the way we teach, 30 years from now, we’re going to be in trouble.” If for no other reason, the rapid changes in technology require a new approach to education to provide the skills that are necessary for individuals to reach their potentials with the alternative of falling by the wayside. As shown in Chart 3, educational attainment plays a significant role in unemployment. The educational system needs to shift the focus from standard test scores as the basis for evaluating success to preparing students for a life of continuous learning. A recent World Economic Forum piece titled the Future of Jobs 2020 reported that the top 5 skills for 2025 are active learning and learning strategies, complex problem solving, critical thinking and analysis, creativity, originality and initiative, and analytical thinking and innovation as well as core social skills and emotional capabilities.

The educational system needs an immediate overhaul as it is at the core of many of societies’ challenges such as inequality, economic scarring and political divisiveness. Education is about much more than getting a good job. Without fixing the problems, the status quo opens the door for more populist politics as populations react aggressively to failed institutions, a lesson learned by several nations in the last decade. However, if done right, it can break cycles of poverty and oppression while lifting nations up. The stakes are high as democracies require a strong and growing middle class which results from an effective educational system.

Investment Implications – Looking Past the Near-Term Uncertainties

The global pandemic is now entering its next critical stage as the seasons change, new cases surge in parts of Europe, the United States, and the rest of the world. Meanwhile, the prospects for quality vaccines and therapeutics to be available in the quantity required for broad distribution to arrest the disease to allow for a return to normal activity remain, conservatively speaking, quarters away. As fall turns to winter in the northern hemisphere, we are beginning to see some troubling signs as recent announcements of severe new restrictions emerge. Politicians around the world are struggling to balance the health considerations with the social, political, and economic ones as a pandemic of this magnitude was something that few have ever experienced and something, we all hope we will not experience soon again.

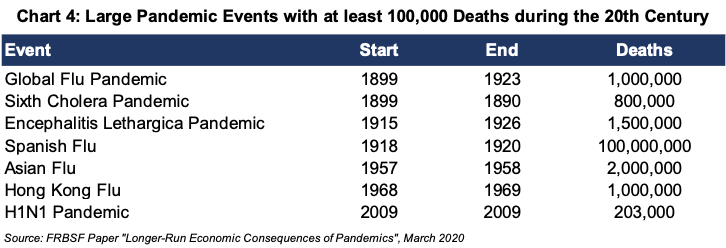

Given the unique issues associated with a major pandemic, many policymakers, central bankers and professional investors were forced to research past pandemics to better understand both nearer-term and longer-term implications. Our research has led us to an April 2020 working paper released by the San Francisco Federal Reserve Bank that studied the 15 largest pandemics with at least 100,000 deaths to determine the longer-term consequences (see Chart 4 for 20th Century pandemics). The Fed working paper concluded that past pandemics generally result in lower returns on assets and in lower interest rates. Additionally, labor shortages also developed due to the higher mortality rates at the time and therefore relatively better wage growth in the following decades. As it relates to the COVID-19 pandemic, we anticipate that the longer-term consequences can be similar to the findings of the San Francisco Fed working paper with one key exception: that we could anticipate better wages with the absence of inflationary wage pressures due to the use of technological advances, including robotics. The Spanish Flu, which lasted from February 1918 to April 1920, had four waves infecting about one-third of the world’s 1.5 billion people and killed an estimated 100 million as shown in the chart below, although some estimates of the number of deaths ranged from 40-75 million. The highest number of cases occurred in the second and third waves of the pandemic with the second wave starting in September 1918 and the third wave in early 1919 with the fourth wave ending in early 1920. We conclude that the economic effects of this pandemic will be felt for some time to come.

Periods of broad transformations are characterized by the elimination and creation of particular industries, companies and jobs. This process of creative destruction is one that the world has experienced many times in the past, is occurring now and will again in the future. Obviously for example, the leisure and travel industries, brick and mortar retail, specific areas of commercial real estate, restaurants and parts of the sharing economy have been severely damaged. If the 2008 financial crisis is any guide, then it could be 3-5 years before some of these businesses recover. On the other hand, the housing industry, the remote work beneficiaries, education and entertainment content providers, the auto market, and the technology enablers that allow companies and consumers to transition during this virus have been and are likely to continue to be among the primary beneficiaries. From a market perspective, the sudden decline in February and March as well as the subsequent rebound in the markets has been astounding to say the least, but the popularity and the success of the winners has had the effect of distorting company valuations just as the valuations of some of the 2020 laggards have as well. The valuation gaps and the uncertainties about the possible post-election policy changes are leaving investors wondering, “Where do we go from here?”

After lowering interest rates to near zero, the Federal Reserve has indicated that rates are likely to remain at or near zero until at least 2023. It is also our view that the world remains more deflation prone, and that any inflationary pressures are likely to be transitory in nature. Overall corporate earnings should continue to rebound off the lows and are likely return to 2019 levels sometime in 2021. The earning power of the winners will continue to distinguish and separate themselves from the broader market. Many of the 2020 COVID winners should continue to attract capital as their earning power expands giving these companies the resources to finance further innovation and expansion. With respect to 2020 laggards, some can reverse their performance in 2021 given that corporate earnings are poised to rebound. Mergers, acquisitions and restructurings are also playing an important role in redefining the business models for many companies. Therefore, we would caution investors not to follow the much-discussed rotation from so called “growth to value” as any market shifts can be more subtle. The one area where investors may realize better returns in 2021 is with companies that have solid balance sheets, reasonable growth and quality dividends. These companies have been underperformers this year as the market lost confidence in their ability to maintain dividend payments due to revenue disruptions, and now there is better clarity around their prospects.

The uncertainty of the impact of the upcoming election on markets has weighed on investors’ minds for several weeks. Interestingly for investors, there have been 6 Democratic administrations for a total of 48 years and 7 Republican administrations for a total of 39 years. The common perception is that Republican administrations would be more favorable for the markets, but the reality is that the average annual returns for Democratic administrations is 10.50% and for Republican ones is 6.90%. Regardless, we would advise market participants to look past the nearer-term issues and focus on the beneficiaries of the six critical transformations and the generational opportunity to build and protect capital.