Please download the slides above.

Author: Rachel Shulman

Everything’s Changed

Download Outlook Now

The World at a Historic Inflection Point

We are living in unprecedented times. As the world navigates through the remnants of a global pandemic, it now faces a new and devastating challenge—the war in Ukraine. This conflict has reshaped the geopolitical and economic landscapes, presenting new realities that demand our immediate attention and action.

Executive Summary

We are heartbroken by the ongoing situation in Ukraine. The remarkable leadership of President Zelensky and the courage of the Ukrainian people continue to inspire the global community. Their fight for freedom serves as a stark reminder of its high cost—a cost many of us often overlook.

This conflict emerged at a critical juncture for the global economy, already grappling with the fallout from a pandemic-induced contraction, surging inflation, and heightened uncertainty. The war has exacerbated these challenges, impacting the most vulnerable populations in fragile regions. The extent to which this conflict reshapes the global economic landscape remains uncertain and heavily contingent on future developments.

This Outlook explores the direct and cascading effects of the war across various economic sectors and regions. It underscores the immediate need for strategic recalibration in response to shifting global economic dynamics, with significant implications for investment and policy decisions.

Outlook Highlights

Global Economic Impact

The conflict has intensified existing uncertainties, slowing down the recovery process and exacerbating inflation across the globe. The most profound economic burdens will fall on Ukraine and Russia, followed by the world’s most economically vulnerable nations.

Investment Shifts

The current situation demands a reassessment of investment strategies. Historical low interest rates and favorable policies are being replaced by an era of higher inflation and slower growth, requiring a shift to more resilient investment opportunities.

Strategic Adjustments

In response to the crisis, there has been a noticeable shift in global capital flows. Investors and nations alike are reevaluating their economic and security strategies to mitigate future risks and safeguard their economic interests.

Long-term Economic Forecasts

The long-term impact of the war is still uncertain, with potential lasting effects on global trade, energy supplies, and economic alliances. This uncertainty underscores the importance of strategic flexibility and forward-thinking in policy and investment decisions.

Our Perspective

The war in Ukraine is reshaping the world in profound ways. As ARS Investment Partners, we remain steadfast in our commitment to navigating these turbulent times through our proven investment philosophy. This approach combines macro-economic analysis and fundamental company research to anticipate shifts in the global economic landscape and position our investments accordingly. Our focus is on identifying and capitalizing on the secular themes that will define the future economic order.

Disclaimer

The information provided in this report is for informational purposes only and is not intended as investment advice, or an offer or solicitation for the purchase or sale of any financial instrument. This report is provided on the condition that it does not form a primary basis for any investment decisions. The opinions and analyses included in this report are based on current market conditions and are subject to change. ARS Investment Partners, LLC will not be responsible for any investment decisions based on this report. Please consult with a qualified financial advisor before making any investment decisions.

Want More of The Outlook?

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.

What Matters Now: Implications of the War in Europe

What Matters Now: Shifting from the Fed to Fundamentals, Investment Opportunities for 2022

Please download the slides above.

What Matters Now: Private Equity Approach to the Public Market

Please download the slides above.

As the Pandemic Matures, Different and More Equity Opportunities Emerge

Download Outlook Now

Navigating Some Subtle and Some Not-So-Subtle Shifts

As the pandemic continues to evolve, it ushers in a new era of equity investment opportunities that are both varied and robust. Despite the pessimistic headlines, the landscape for common stock investing offers increasingly positive prospects that go beyond what is immediately apparent.

Executive Summary

Despite a backdrop of widespread economic uncertainty, the outlook for corporate profits, interest rates, and inflation rates remains fundamentally positive, supporting a bullish perspective for equity investments. This positive outlook is anchored in the transformational changes outlined in our previous communications, which continue to redefine the future economic landscape. As we transition from government to corporate and consumer-driven economic growth, the investment opportunities are not only broadening but also becoming increasingly accessible to those who navigate these shifts with insight.

Our outlook for 2022 is optimistic, driven by the potential in emerging sectors and undervalued companies that were overshadowed during the pandemic. The investment terrain is changing, and success will hinge on the ability to adapt to these evolving market dynamics and capitalize on the accelerating shifts in market leadership.

Outlook Highlights

Broadening Investment Opportunities

As the market evolves, investment opportunities are diversifying beyond the pandemic-driven sectors, offering promising prospects in areas like cloud/data management, semiconductor and capital equipment, and renewable energy.

Economic Shifts

The post-pandemic economy in the United States is expected to be fueled increasingly by corporate and consumer spending, transitioning from the previously dominant government expenditure.

Market Resilience

Despite current volatility and elevated inflationary levels, the fundamental drivers of security valuation—corporate profits, interest rates, and inflation—are supportive of strong equity returns.

Strategic Investment Necessities

Success in the current market will require not only identifying companies with strong potential for revenue and earnings growth but also those that have been undervalued by the market due to extreme concentrations of investments in a few sectors.

Our Perspective

In navigating these transformative times, ARS Investment Partners, LLC remains committed to identifying and leveraging the secular trends that will shape global growth. Our focus continues on companies with robust management teams, consistent earnings growth, and strong dividend policies. As we move forward, our strategy will adapt to maintain alignment with the evolving economic environment, ensuring that we remain positioned to capitalize on the opportunities that these changes invariably bring.

Disclaimer

The information provided in this report is for informational purposes only and is not intended as investment advice, or an offer or solicitation for the purchase or sale of any financial instrument. This report is provided on the condition that it does not form a primary basis for any investment decisions. The opinions and analyses included in this report are based on current market conditions and are subject to change. ARS Investment Partners, LLC will not be responsible for any investment decisions based on this report. Please consult with a qualified financial advisor before making any investment decisions.

Want More of The Outlook?

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.

ARS Education Series: Protecting Your Family and Your Business from Cyber Attacks

Please download the presentation slides above.

Looking At the World Through a Different Lens

While short-term investors are concerned about the political dysfunction in Washington D.C., the Delta variant slowing Gross Domestic Product (GDP) growth, the dramatic remake of the Chinese economy, ongoing supply chain disruptions, rising debt levels, and inflationary pressures, we believe they have been somewhat discounted by the markets, and there is a much bigger story to be told. The American economy is using innovation, entrepreneurialism, and some thoughtful pro-growth government initiatives to position itself for the post-pandemic world. Last month some of our team visited six Midwest cities and met with entrepreneurs, government officials, business, and community leaders as well as university students. We walked away feeling excited about the potential for the United States in the post-pandemic period from both a market and economic perspective. ARS believes that investors should take advantage of the aforementioned fears to position their portfolios for the opportunities that lie ahead.

Excessive focus on near-term concerns often distracts from the sub-set of companies that stand to benefit from the current environment, especially those experiencing price inelasticity of demand for their products. An important fundamental concept for investors to understand in the coming period, price inelasticity reflects goods that typically tend to have few substitutes, few competitors and are considered necessities by users. Given the current supply-chain woes and inflationary pressures, the ability of companies to offset any increase in production costs will enable them to increase earnings and cash flow from operations and should be worth more over time. Among the areas of investment opportunity where there is inelastic demand are semiconductor chips and equipment, cloud providers, select commodities producers including steel, rare earth materials, copper and even some fossil fuel producers as each should continue to see strong pricing power, demand, and earnings growth. This point cannot be over-emphasized.

We continue to view the United States as the best market on a risk/reward basis due in large part to our nation’s innovative and entrepreneurial spirit despite recent hang-ups in D.C. Larger amounts of money than ever before are being invested in the transformation of the economy. This will continue to generate greater productivity, record earning power and greater tax revenues for the United States over time and will also reduce inflationary pressures which have developed as a consequence of the pandemic. Because the profound transformations occurring will continue to be the defining themes for the markets and the economy, positive investment returns should be a consequence of the focus on the digital, monetary, fiscal, healthcare and climate transformations that support productivity improvements and rising living standards which will offset the potential for long-term inflation from taking hold. Under present conditions, we define the companies for our research focus that will be among the specific beneficiaries of the forces we describe below.

In a world awash in liquidity, asset values will continue to benefit from accommodative monetary policy initiatives and an interest rate structure that has never been so low. Corporations have unit labor costs rising at the same time the marginal cost of capital is at such low rates allowing for technology substitutions to be executed to lower costs over time. We are investing in greater efficiencies in the economy. The initial pandemic lockdowns and the subsequent challenges in reopening the global economy have led to significant pricing pressures in the near term, but we anticipate that the logistics logjam will clear suddenly and that these short-term pricing pressures will evaporate. While we are experiencing short-term inflationary pressures, investors should not assume that these pressures must lead to a longer-term inflation problem. Our research continues to identify companies with the potential to increase earnings, assets, and cash flows against this backdrop. There must be a particular emphasis on those companies driving the digital transformation as technology producers or users require these productivity improvements to thrive in the post-pandemic world.

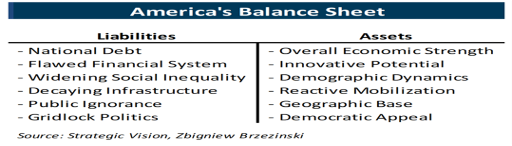

Remembering What Makes the United States Special

Americans live in an amazing country, one that is flawed as our elected officials in Washington continue to remind us, but also one where people can accomplish things through innovation and hard work that were once unimaginable as demonstrated by the creation of two highly effective vaccines in less than 18 months. As the chart below from Zbigniew Brzezinski’s 2003 book Strategic Vision highlights, the United States has its share of short comings, but it is a highly resilient and adaptable nation with some unique strengths that we need to continue to build on. We have a system based on the rule of law with the deepest and most mature capital markets system in the world. It is this capital market system that funds the growth and innovation that continues to raise living standards for so many. While we share similar demographic challenges with many other leading nations, the United States remains an attractive destination for many immigrants looking to better their lives. If we do not squander the opportunity to attract and retain highly skilled talent from around the world, then we will continue to be one of, if not the leading economic powers for many years to come.

Table 1. America’s Balance Sheet

To accomplish this, the United States must remain competitive from a tax, infrastructure, immigration, and business-friendly perspective as well as maintain the dollar’s reserve currency status. Yes, we must address inequality, climate change, and other key issues, but we need smart policies that bring people together rather than divide them. Our nation is at its best when we come together to help each other as we did after the 9/11 attacks and not when we are divided as we are today. We need true leaders and principled officials focused on the best outcome for our nation, rather than ideologues. The strength of the United States going forward will be determined in large part by our overall economic strength, our ability to remain technology and innovation leaders, to use our democratic appeal and practical immigration policies to offset our demographic challenges, and by our ability to put partisanship aside for the greater good as the challenges are significant, but so is our ability to solve them.

Exciting Stories from the American Midwest

As mentioned above, we visited Chicago, Detroit, Ann Arbor, Cincinnati, Columbus, and Cleveland in September and met with senior government officials, business leaders, entrepreneurs, students, and other investors. The trip served as an important reminder of what is really going on in our states and cities and told a story of innovation, entrepreneurial spirit and how government can plan beyond an election cycle to put a state or city on track for sustainable growth. There are great success stories in each city: however, for the purpose of this Outlook, we will focus on an organization called JobsOhio, and how two Ohio-based companies are driving innovation – Cintrifuse in Cincinnati and Nottingham Spirk in Cleveland. Anyone meeting leaders at JobsOhio, Cintrifuse and Nottingham Spirk could not help but come away with a completely different perspective on the state of our nation than one would get from the daily news headlines. These leaders see problems as opportunities waiting for a solution.

JobsOhio

In the aftermath of the Great Financial Crisis, Ohio was faced with double-digit unemployment and had lost 400,000 jobs. Leaders knew something had to be done as businesses were leaving the state which then ranked 48th in its prospects for growth and job creation. Then in 2011, leadership decided to launch JobsOhio, a private nonprofit corporation designed to drive job creation and new capital investment in Ohio through business attraction, retention, and expansion efforts. Unlike other economic development organizations, JobsOhio has a unique funding model in that it uses no tax dollars or other public dollars to support it. Rather it uses revenues from the JobsOhio Beverage System (JOBS) to which it leased the rights for 25 years. The organization’s design enables it to make the kind of long-term investments needed to solve complex challenges such as supporting the development of new cutting-edge industries and businesses to serve new large total addressable markets. JobsOhio focuses on supporting high- value industries including advanced manufacturing, aerospace and aviation, automotive, autonomous mobility, energy and chemicals, financial services, food and agribusiness, healthcare, logistics and distribution, military, and technology. Ironically, this list of industries closely matches the “strategically vital” industries the Chinese government highlighted in its “Made in China 2025” 5-year plan. Because of the funding source, industry focus and thoughtful design, JobsOhio should be closely looked at by other states as a model to attract and retain businesses and keep young talent at home. Corporate America is taking notice as companies including Amgen, AWS, First Solar, Google, Peloton, Sarepta Therapeutics, Ultium Cells, and Upstart, among others, have all made recent major investments in Ohio.

Nottingham Spirk and Cintrifuse

In Cleveland, a visit to the beautiful 60,000 square foot facility of the Nottingham Spirk Innovation Center In Cleveland, a visit to the beautiful 60,000 square foot facility of the Nottingham Spirk Innovation Center highlighted a firm at the cutting edge of disruptive innovation and one that is inventing and improving many of the healthcare and consumer products we use every day. Nottingham Spirk is an open innovation and product development firm that was established in 1972. It uses the latest technologies such as 3D printing to design, test and develop its products, and its approach has significantly reduced the time and cost to bring new products to market. Nottingham Spirk uses vertical integration in its facility where the entire product development cycle – from focus group facilitation to product design and mechanical engineering – is executed. Cincinnati-based Cintrifuse has one goal which is “to make Greater Cincinnati the number one tech start-up hub in the Midwest and among the most attractive innovation hubs in our nation.” Cintrifuse’s approach leverages its venture fund to access cutting edge technologies, generate strong financial returns and create investment pools for entrepreneurs; to connect the region’s largest corporations with the innovations and innovators they need to stay ahead of their peers; and they work with entrepreneurs to start new businesses and connect them with leading corporations in the area. According to its website, Cintrifuse has over 600 startups in the pipeline half of which are attracting seed and later stage investments.

By partnering with firms like JobsOhio, Nottingham Spirk and Cintrifuse, companies have access to unique industry insights, design, and manufacturing expertise as well as marketing and branding support. While we are highlighting just these initiatives in Ohio, there are many other organizations like these around the country including Ben Franklin Technologies of NE Pennsylvania which has helped launch many companies, create new products and markets, and to develop cutting-edge innovations and create jobs. Finally, we would recommend spending some time listening to college students discuss their hopes, dreams, and concerns if you want an optimistic view of the future as our nation turns out some of the world’s finest students. When we combine strong leadership and innovation with talent and supportive government programs and policies, then there is virtually nothing that the American economic engine cannot achieBy partnering with firms like JobsOhio, Nottingham Spirk and Cintrifuse, companies have access to unique industry insights, design, and manufacturing expertise as well as marketing and branding support. While we are highlighting just these initiatives in Ohio, there are many other organizations like these around the country including Ben Franklin Technologies of NE Pennsylvania which has helped launch many companies, create new products and markets, and to develop cutting-edge innovations and create jobs. Finally, we would recommend spending some time listening to college students discuss their hopes, dreams, and concerns if you want an optimistic view of the future as our nation turns out some of the world’s finest students. When we combine strong leadership and innovation with talent and supportive government programs and policies, then there is virtually nothing that the American economic engine cannot achieve.

The Climate Transformation and the Challenge of Getting There

“The climate crisis is real, and energy transition is a necessity, and we must accelerate it — but it’s not a flick of a switch. If we want to solve climate change, we need to do so while at the same time insulating the global economy from extreme energy shocks.”

Amos Hochstein, U.S.’s top energy diplomat

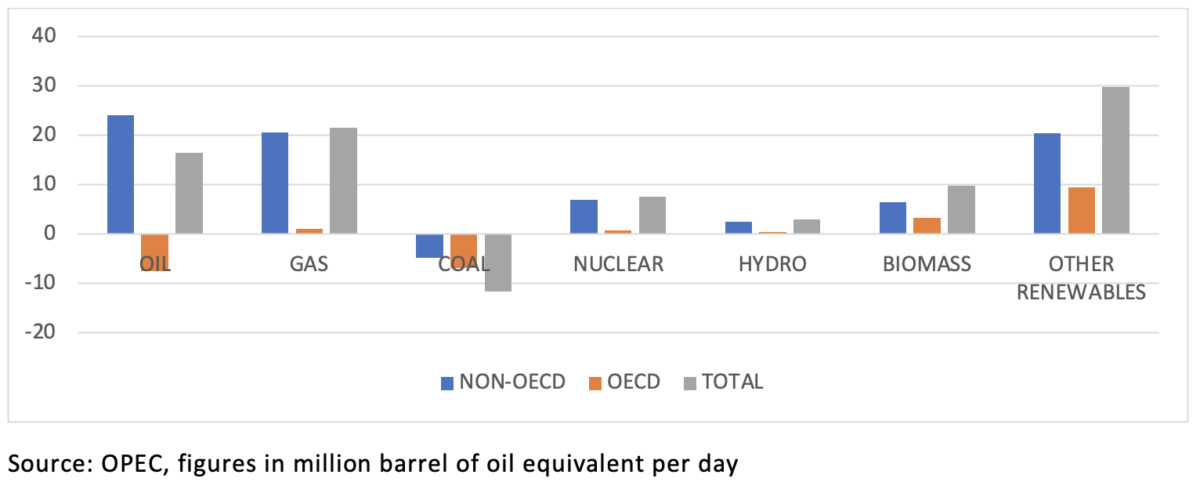

It is easy to get broad support for reducing the world’s dependence on fossil fuels but wanting to effect a transition and actually doing so are two very different things. This is especially true when we are still in the early stages of developing the green energy industry. Cost and infrastructure remain significant hurdles. It has been estimated that even if all the Paris Accord pledges were met, oil and gas would still be 46% of the world’s energy supply in 2040. It seems that climate activists wanted to address years of neglect in a shorter period than is feasible, and we are currently experiencing energy issues in the United Kingdom, Europe, China, and India just to name a few countries. For the United States, the green transition comes just a few years after the U.S. achieved energy independence once again. As opposed to China which relies on imports of oil and natural gas for much of its energy needs and will be slower than other leading nations to make the transition; and the Chinese are also increasing their coal production this year as they are experiencing severe power outages. As shown in Chart 1, fossil fuels will be key components of the energy supply for the foreseeable future. Rather than vilify the industry, green energy proponents should be focusing on working to ensure an effective transition. In fact, the major oil companies are diverting tens of billions of dollars of their excess cash flows from high-cost exploration and development to research into cleaner energy technologies. From a geopolitical perspective, the rush to make the climate transition has empowered Russia and OPEC to be the price setters as the U.S. producers will not invest in high-cost exploration and development. This has been the single most important determinant of the share prices of U.S. energy producers this year in the S&P 500.

Chart 1. Projected Growth in Energy Demand by Fuel Type – 2020-2045

In our view, there are three key considerations regarding the energy transition. The first is that the power grid systems will need to be upgraded, hardened, and modernized to deal with the increased demand, extreme climate events, and new energy use patterns. The second is that oil companies, in response to public pressure and shareholder activists, have been reducing their capital expenditure programs and drilling rig counts which are exacerbating a supply/demand imbalance that has led to higher-than-expected oil and gas prices. The third consideration is that success in expanding the use of green energy, especially for electric vehicles, will increase electricity consumption and timing of its usage. This begs the question as to how we produce that electricity and store and transport new renewable energy? Perhaps the most important question is how do we affect the transition without damaging growth prospects and fueling inflationary pressures? And how do we do it with an aging and antiquated grid system in the United States? Climate activists will need to embrace one challenging concept: the green energy transition will be powered in large part by fossil fuels which are experiencing reduced investment spending and lack of support from equity and bond investors. At a less than 3% weight in the S&P 500, the energy sector is one that will likely see its weighting increase in the coming period as it did back in the late 1970’s and the early 2000’s when each time its weighting more than doubled. One must wonder if the power problems being experienced around the world today are a precursor to our future energy transition challenges. After the pandemic, the climate transformation may be the most important scientific and political challenge for the rest of the century.

Investment Implications

Since the onset of the pandemic, market participants have been faced with an investing environment that is simply unlike any other mainly due to the unique character of the health situation, inflationary/deflationary forces, and technological advances. This is not an economy we’ve ever seen. While rising costs have led many investors to have a stronger inflationary bias, the view that more inflation is here to stay is not supported by investment activities occurring to substitute capital for labor (robotics and artificial intelligence), advances in manufacturing efficiency, and mergers and acquisition transactions to promote greater business activity and lower production costs. Infrastructure spending raises productivity and saves costs that would otherwise occur by avoiding needed repairs, restoration, and damage from climate change. Additionally, modernization of old infrastructure which yields better employment outcomes and higher living standards, by definition, is needed by the United States to better compete globally. Many of the inflationary concerns seem to ignore secular deflationary pressures that are a characteristic of the hidden forces at work. These include the demographic pressures from an ageing work force, overall debt levels in the system, lower costs thru technology improvements and breakthroughs, and communication advances. Solving the short-term supply chain and logistic bottlenecks will rapidly lower inflation expectations.

With respect to manufacturing, just-in-time inventory management had been considered to be an ideal way to manage manufacturing processes for many years. However, the recent experience of U.S. businesses running with low inventory levels has come to damage the economy, and therefore has been an impediment to lowering costs. Present economic conditions are accelerating the reshoring and onshoring of critical manufacturing capabilities drawing capital back from overseas as well as utilizing excess liquidity in the United States. Because the economy is awash in liquidity, there is no shortage of investment capital to fund critical initiatives. In the 3rd quarter alone, corporations completed a record $1.6 trillion in mergers and acquisitions transactions globally. Industries are rapidly being digitized. This yields higher living standards, new products, large new total addressable markets, and ways of doing business that had never existed before. We expect this economy to continue to produce outsized breakthroughs in products and services. Irrespective of the timing and amount of proposed fiscal policy initiatives, monetary policy must remain accommodative with interest rates needing to be kept low for longer even after the tapering of quantitative easing begins later this year or early next year.

In addition to the above, there are several key investment considerations which investors should incorporate into their investment strategy that we address below:

Price inelasticity – In the current environment, market participants should focus on those companies that are well-positioned to benefit from price inelasticity. These include companies involved with the infrastructure buildout; producers of copper, iron ore, steel, and rare earths; technology companies including cloud service providers; businesses involved in the green energy transition; and certain defense companies to name a few. Importantly, these companies should be strong market performers in the coming quarters irrespective of the economic cycle.

The Character of the Inflation Cycle – Perhaps the most widely debated topic at present is the state of inflation around the world as to whether or not it will be persistent or transitory. Our expectation is a little of both with inflation more persistent for longer than we originally anticipated and then transitory with the surprise being a possible faster easing of supply chain problems than the market currently anticipates which would ease inflationary pressures quickly in certain areas. While we see this as positive for the U.S., many emerging market economies are experiencing greater inflation pressures and their currencies will be more negatively impacted as will those nations dependent on imports of high-cost fossil fuels during the green transition.

Opportunity to Improve the State of Health Care – Unlike past business cycles, the United States needs a remake of its healthcare system, and we need to use technology to make healthcare more accessible, affordable, and adaptable to changing conditions such as future pandemics. The use of telemedicine, artificial intelligence, and data management to make our healthcare system more productive and efficient will help change economic output for the better, improve workforce demographics allowing workers to work more productively and potentially have longer careers as life expectancies continue to rise; and the combination of these should lead to increased future earnings for workers. We also need to recognize that the pandemic requires a global solution as one recent report indicated that 96% of people in low-income countries are still unvaccinated which will lead to highly divergent economic outcomes with potentially large geopolitical considerations. This is important because many leading scientists expect that pandemics may be more frequent in the future, so having a plan that would deliver better outcomes will benefit all. We continue to participate or take investment advantages of the convergence of technology with legacy industries through our cloud and software exposures.

Record Levels of Excess Cash Flows – The private sector has never had such high levels of cash flows available for investment and distribution to shareholders. This will allow companies to raise wages, invest to improve productivity, to reshape their businesses to focus on high-return, high-growth business lines through mergers and acquisitions, but also allow for greater returns to shareholders in the form of dividends and buybacks.

Disintermediation of Businesses – Another characteristic of this environment is the disintermediation of businesses by new non-traditional competitors much of which is being driven by new technologies which companies are adapting at a much faster rate than in the pre-pandemic period. In fact, McKinsey recently reported that in 2020 “half of the North American and European businesses surveyed had increased their investments in new technologies and 75% planned to accelerate these investments between 2020-2024.” Another interesting note from this report was that “companies digitized activities 20-25 times faster than they had previously thought possible.” Technologies have the ability to disintermediate many businesses in the banking, insurance, and housing industries to name a few, and much of this disruption will be highly damaging to incumbents. By following the capital expenditure plans of companies, investors can gain some insight into the future risks and opportunities of businesses.

Politics and Investing – Some politicians are viewing the pandemic as a chance to fix all historic ills and inequities which is admirable but needs to be matched with realistic and sound policies backed by good economic thinking. From antitrust cases to tax and vaccination policies, there are major issues that require strong, thoughtful leadership focused on the best outcomes and not the most short-term politically expedient ones. Another political problem is that the approach of governments to address climate change is actually helping the fossil fuel industry, but more concerning is that it is helping bad-actor, fossil fuel producing states such as Russia and Iran to benefit from higher prices and demand for oil and natural gas, including those products sold on the black market.

The diverse needs of the nations and economies will favor those companies that (i) can lower costs and increase productivity, (ii) have strong global franchises with meaningful barriers to entry, (iii) benefit from resource scarcity, and (iv) have rising demand. In our view, the best investment approach will be to focus on the intermediate beneficiaries of the conditions described in this outlook. When the pandemic first started, we wrote that generally things would get worse before they would get better, and they did. Then conditions worsened again with each new wave of the virus. This volatility has created negativity in the markets with many investors fearing a major pullback. While that is always a consideration, we believe that investors will be well rewarded by taking a longer-term view, balancing return expectations with realistic risk assessments and taking a somewhat contrarian view to find uncommon values in a market with big divergences between the corporate haves and have-nots. Fortunately, the next two decades should bring about more technology disruption than even occurred during the past two decades creating dramatic and timely improvements in productivity, health outcomes, economic growth, and accordingly improved living standards. The journey is always a little bumpy, but patient and opportunistic investors will be well rewarded.

Published by the ARS Investment Policy Committee:

Stephen Burke, Sean Lawless, Nitin Sacheti, Michael Schaenen, Andrew Schmeidler, Arnold Schmeidler, P. Ross Taylor.

The information and opinions in this report were prepared by ARS Investment Partners, LLC (“ARS”). Information, opinions and estimates contained in this report reflect a judgment at its original date and are subject to change. This report may contain forward-looking statements and projections that are based on our current beliefs and assumptions and on information currently available that we believe to be reasonable. However, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements.

ARS and its employees shall have no obligation to update or amend any information contained herein. The contents of this report do not constitute an offer or solicitation of any transaction in any securities referred to herein or investment advice to any person and ARS will not treat recipients as its customers by virtue of their receiving this report. ARS or its employees have or may have a long or short position or holding in the securities, options on securities, or other related investments mentioned herein.

ARS and its employees shall have no obligation to update or amend any information contained herein. The contents of this report do not constitute an offer or solicitation of any transaction in any securities referred to herein or investment advice to any person and ARS will not treat recipients as its customers by virtue of their receiving this report. ARS or its employees have or may have a long or short position or holding in the securities, options on securities, or other related investments mentioned herein.

This publication is being furnished to you for informational purposes and only on condition that it will not form a primary basis for any investment decision. These materials are based upon information generally available to the public from sources believed to be reliable. No representation is given with respect to their accuracy or completeness, and they may change without notice. ARS on its own behalf disclaims any and all liability relating to these materials, including, without limitation, any express or implied recommendations or warranties for statements or errors contained in, or omission from, these materials. The information and analyses contained herein are not intended as tax, legal or investment advice and may not be suitable for your specific circumstances. This report may not be sold or redistributed in whole or part without the prior written consent of ARS Investment Partners, LLC.

What Matters Now: Are Investors Using an Old Economy Playbook for a New Economy World?

Please download the presentation slides above.

What Matters Now: The Roaring 2020s – The Global Economic & Financial Outlook for the Rest of the Decade with Guest Dr. Ed Yardeni

Please download the presentation slides above.