Author: Aaron Jacobstein

COVID-19 – The Problem, The Response and The Post-Pandemic World

“Leaders are dealing with the crisis on a largely national basis, but the virus’ society-dissolving effects do not recognize borders. While the assault on human health will – hopefully – be temporary in nature, the political and economic upheaval it has unleashed could last for generations. No country, not even the U.S., can in a purely national effort overcome the virus. Addressing the necessities of the moment must ultimately be coupled with a global collaborative vision and program. If we cannot do both in tandem, we will face the worst of each.”

– Henry A. Kissinger, excerpts from WSJ Op-ed, April 3, 2020

The COVID-19 pandemic has presented us with an extraordinary medical, economic and social challenge the likes of which no one has previously experienced. The virus has changed almost every aspect of our lives and threatened our economic security, but it has also taken too many lives with many more to follow. There is no way to minimize the global tragedy, but we are heartened by the resolve of people all over the world, especially health care professionals and other essential workers, as we battle through this difficult period. We want to remind each of our clients that we are here to guide you through your specific challenges, and to convey our appreciation for the concerns that have been expressed for the health and safety of our team. We are fortunate to have such terrific clients and value the trust placed in us each day. While we continue to work on a remote basis, we assure everyone that we are here to assist through this difficult period. To that end, we are going to be publishing shorter, more frequent Outlooks until the spread of this disease is arrested to keep everyone informed of our latest thinking as the situation remains very fluid. This note will frame the key problems facing policymakers, the scope of the monetary and fiscal policy response, what the post-pandemic world may result in and the investment implications.

Framing the Problem

The coronavirus pandemic and mandated lockdowns imposed by governments around the world have pushed the global economy into the sharpest downturn since the Great Depression. The challenge for policymakers has been in three key areas – offering income replacement for those who lose their jobs, making available loans and grants to offset revenue loss for companies, particularly small businesses, and providing liquidity to allow the economy and capital markets to function properly. As a result of shutdowns, businesses are laying off employees at a rate and scale that is unprecedented. For the week ending March 21st, U.S. unemployment claims were 3.28 million persons which was 4.7x the highest recorded total of 695,000 back in 1982. The jobless claims then doubled for the week ending March 28th with 6.6 million reported which brought the unemployment rate over 10%. The unemployment figure may well exceed 20% if the lockdown is more prolonged. It is important to note that once the lockdown is reversed unemployment will decline rapidly. It is for this reason that St. Louis Federal Reserve Bank President James Bullard said he expected that the unemployment rate may spike up to around 30% but will decline rapidly in the subsequent quarters possibly returning to 4% levels as business activity resumes. It is clear that the combination of job losses, business shutdowns and the overall slowdown in the economy will reduce personal consumption, business investment and trade. Therefore, it has been up to the government to minimize the damage through monetary and fiscal policy.

Addressing the Policy Response

As discussed above, policymakers are working to minimize the negative effects of the COVID-19 pandemic with a focus on keeping the capital markets functioning properly, getting money into the hands of the unemployed and helping minimize small business failures. The global commitments from central banks and governments are estimated to be in excess of 13% of global GDP which is roughly $90 trillion and could exceed 20% of global GDP depending on the timing of scientific breakthroughs. The United States has initially committed over $5 trillion or more than 20% of U.S. GDP. In late March, the Federal Reserve responded to pricing issues in the fixed income markets which were functioning in a disorderly fashion. The Fed acted quickly to inject liquidity into the system with a commitment of more than $2 trillion to start and a promise to do whatever is necessary to support the economy. We would commend Fed Chair Jay Powell and the Board of Governors for their decisive and extensive response, having clearly learned from the 2008 experience. Given the limitations of interest rate policy in a near-zero-rate environment, Congress needed to act to address those who were losing their jobs or experiencing wage reductions and to try to prevent businesses from closing that would not have without the mandated lockdown. The initial commitment by the House and Senate was estimated to be between $2-2.5 trillion. It remains to be seen whether the money will get to those who need it most – the unemployed and the small businesses – in a timely fashion. Congress is already drafting additional proposals including one to extend or expand new unemployment benefits and provide additional support to protect small businesses. These programs have been defensive and reactive.

Future programs will be designed to foster growth and put the nation back on the offensive. Most importantly, we have come to the point where we can anticipate the long overdue program to address our nation’s healthcare, educational, digital and physical infrastructure. In that respect, we would propose that the United States Federal budget be split between an investment side and an expenditure side. The infrastructure budget would be in the investment category and each program would be evaluated for its expected return on investment. This would allow for future programs to be better funded and assessed on their merits.

Thoughts on the Post-Pandemic World

The pandemic has significantly changed our daily lives and could well transform the way we live, learn, govern and work after it has run its course. As long-term investors, we must make judgments as to what the post- pandemic world might look like so that we can invest not just for the next quarter or two, but for the next several years. Here are our initial thoughts on some of the changes in the behaviors of consumers, businesses and governments.

For consumers, we see a greater focus on lowering household debt, increasing savings rates, and changes in where we live and how we work. With students of all ages being forced to learn online, we see an acceleration of the changes occurring within our educational system and broadening of student internet access. We are already experiencing a necessary increase in telemedicine which we expect to accelerate as well as more personalized medical approaches that will incorporate more advanced medical technologies. We should expect to see greater use of medical rapid-testing technology to enable the public to gain access to such places as theme parks, sporting events, concerts, museums and even office buildings. From a business perspective, it is likely that more companies will support increased remote work arrangements which have important implications for the commercial real estate market and for increased use of technology as businesses look to reduce high-cost office space. Corporations will seek to create more flexible and resilient supply chains, bringing back to the United States production of some critical parts of supply chains to avoid future disruptions due to trade conflicts or shutdowns such as we are currently experiencing. We also could see the relationship between government and business altered considerably for some industries due to the bailouts and loan programs as well as for national security reasons. Furthermore, the path to growth will likely require sizable public-private partnerships, both domestic and cross-border, to address national needs such as infrastructure, cyber- defense and healthcare. As the quote from former Secretary of State Henry Kissinger points out, governments will need to be more collaborative and that begins with the U.S. and China. Depending on the behavior of global leaders, we may see closer relationships with other nations, a further fragmenting of the post-WWII global order, greater strains on the European Union project and renewed calls for modernizing the role of global institutions such as the WTO (World Trade Organization) and the United Nations. A failure to address the growing inequality issue, which is being exacerbated by the pandemic, could lead to serious social instability, and now is the time for government, business and public to act.

Investing for the Near-Term and Beyond

As we said in our March 23rd Outlook, things will get worse before they get better, but they will certainly get better once we begin to arrest the spread of the virus. In terms of sequencing, we believe that the stock market will begin the bottoming process as the trajectory of new cases begins to decline and likely well before the economy itself bottoms. The recent focus for client portfolios has been to use the market pullback to upgrade quality, fine-tune sector and industry weightings and avoid the companies that are heavily indebted. We have been initiating new positions in high-quality companies that previously were selling at considerably higher valuations, while harvesting tax losses in securities we still like but believe the risk/reward in holding them is not as favorable.

While no one can say with any precision where we go from here, there are a few questions the investment team is asking to help guide us in navigating the near term and longer term.

- What is the length of shutdown and severity of the economic damage?

- Will the policy response be effective and what are the possible unintended consequences?

- How difficult will it be to restart the economy and begin to return to growth?

- And finally, what does this mean for individual companies and industries?

Based on our preliminary views of what the post-pandemic world might look like, our portfolios will continue to reflect many of the same themes we have emphasized for the past few years. The impact of the virus has not only reinforced our convictions but has also augmented these themes. ARS portfolios will continue to emphasize healthcare companies, focusing on biotech/bioscience, pharmaceutical and high tech testing equipment among other areas; technology companies including cloud, 5G, semiconductors and capital equipment, cybersecurity, AI (Artificial Intelligence) and machine learning; companies with strong balance sheets and quality dividends; defense companies as the world is not getting any safer; and a few special situation companies that will benefit from an increase in post-crisis merger and acquisition activity. We favor the U.S. economy over the rest of the world and the U.S. stock market over other markets. There are some unique opportunities being created in the U.S. stock market, and we suggest that those waiting for an opportunity to participate should begin to incrementally build positions in world-class companies with a view to adding on future price declines. Given the nature of the world today, we favor a cautious and measured but still opportunistic approach to investing. Disciplined investors who are taking a longer-term view should be well rewarded.

COVID-19, the Market, and Your Portfolio

From Wuhan to Wall Street to Main Street:

“Think of what is happening as a huge paradigm shift for economies, institutions and social norms and practices that, critically, are not wired for such a phenomenon. It requires us to understand the dynamics, not only to navigate them well but also to avoid behaviors that make the situation a lot worse.”

– Mohamed El Erian

In just two short months, the world as we knew it has changed as a result of the worst global pandemic since the Spanish Flu in 1918. Coming into the year, we were positive on the outlook for the U.S. economy and the secular themes we have defined in previous Outlooks, a view that was confirmed by the positive economic numbers and the stock market returns through mid-February. However, we did not anticipate the outbreak of the Coronavirus (COVID-19) which started in Wuhan, China and subsequently has morphed into a global pandemic. This has turned the longest bull market in U.S. history into a bear market in just about one month. The pandemic has served as a painful reminder of the interconnections and interdependencies of the world, and has exposed many of the economic, political and social vulnerabilities which had been building up in the global system since the financial crisis. We expect the economy to get worse before it gets better, but it will surely get better. Furthermore, the uncertainty and fear many are feeling are now creating substantial opportunities in the equity markets. The market decline has left some of America’s best and most valuable corporations selling for unusually attractive valuations today.

It is important to understand that the actions by governments and businesses to prevent the spread of the virus are purposefully disruptive to global commerce as they are protecting the populations at the expense of short-term production, spending and growth. The U.S. economy, which continued to be quite strong coming into the year, is now falling into a recession. Because the impact of the coronavirus will not be shared equally as small businesses and employees in certain industries will bear the brunt of the pain, the federal government proposals are targeting these segments as many small businesses are already closing and the unemployment rate is rising rapidly. Some businesses will only recover a portion of the lost revenue, but others like those in the entertainment, restaurant, travel and hospitality industries will take longer to recover. That is why for some businesses the economic impact might be characterized as a slowdown, while for others a recession, and for a few a depression as more than a few industries and companies will be more permanently impacted.

While we do not in any way minimize the severity of the coronavirus, we would underscore that its economic impact will be temporary in nature as it is the result of severe, short-term supply and demand disruptions around the world rather than a collapse of the global banking system as we experienced in 2008. The recent “whatever it takes” policy initiatives by the Federal Reserve to ensure liquidity for the system is unprecedented in scale and only strengthens our view that interest rates are likely to stay low for the foreseeable future. In spite of this and other recent monetary policy actions, central bankers now have a more limited toolkit with which to stimulate growth. Therefore, fiscal policy has to and will be playing a major role. Many European countries are recommending fiscal responses of 1% of gross domestic product (GDP), and we expect them to be required do more. In the United States, Democrats and Republicans are negotiating a massive stimulus well in excess of $1.5 trillion. Unless the U.S. can stop the contagion sooner than later, the cost to the government may be much higher, possibly in the $4-5 trillion range. For perspective, the U.S. GDP was forecast to be just over $21 trillion for 2020.

One solution we would propose requires a two-pronged approach. First would be an immediate one-month shutdown in the U.S. of non-essential services to stop the contagion in its tracks, similar to what has been done in China. This would allow the government to arrest the spread of the virus sooner and to get the proper testing and health support services in place, while allowing our world-class pharmaceutical companies and universities’ research laboratories to buy some more time to develop a treatment and eventually a vaccine to counter the virus. Next, the government could focus on getting businesses and industries crippled by the crisis as well as those who become unemployed back on the road to recovery. Congress could grant the Treasury the ability to borrow from the Federal Reserve whatever amounts would be required to support and heal the economy. The financial resources that the government has are almost unlimited as long as the Treasury is given the powers to borrow directly from the Federal Reserve rather than in the open market which would tend to have the effect of pushing interest rates higher. The Federal Reserve Bank, which has a balance sheet already in excess of $4 trillion, is more than capable of providing additional large sums of money. We believe these steps would stop a pandemic recession from triggering a financial recession and support a more rapid economic recovery.

We expect the equity markets to bottom concurrent with the spread of the disease abating but before we see the economy improving. At the same time, investors will likely be feeling maximum discomfort with the economic outlook. Therefore, we would caution investors against overreacting to such conditions. We hold above-average cash balances to take advantage, in a measured way, of the values being presented over the coming period. Importantly, we are confident that the secular themes defined in recent? Outlooks – technology disruption, improvements in healthcare, defense to protect against global instability, quality growth in a low-growth economy, those with strong balance sheets and companies with safe dividends in a low-interest-rate world – not only remain intact but are being reinforced and even augmented by the conditions of the global economy. While we are not by any means calling a market bottom, we have come so far so fast that we expect that investors who are patient, disciplined and opportunistic with owning and buying quality growth companies and those with safe dividends will be rewarded. Going forward, we believe that this crisis will change many of the aspects of the way we live, learn and work.

During this once-in-a-100-year event, we want to remind our clients that in times like these it is paramount not to let fear and panic drive investment behavior. Market declines are always difficult to experience but keeping perspective and focusing on goals are critical to successful investing. This in no way minimizes the recent declines in accounts but serves as a reminder that successful investing always requires taking a longer-term view.

“Basically, price fluctuations have only one significant meaning for the true investor. They provide him with an opportunity to buy wisely when prices fall sharply and sell wisely when they advance a great deal. At other times he will do better if he forgets about the stock market.” ?

– Benjamin Graham, legendary investor and father of Graham & Dodd value investing

ARS Focused All Cap Portfolio and Outlook Update

Learnings From the 2019 Lessons From a Life Well Lived Client Survey

From an early age, we’re taught that money is not a “polite” topic of conversation – even within families. Often, there is an emotional overlay to family financial discussions that can add another layer of complication.

That is reflected in the reality that less than 40 percent of North Americans have an up-to-date will or estate plan. This is an increasingly urgent issue given that a major intergenerational wealth transfer will take place over the next 20 years, and its beneficiaries may not be well-prepared to manage it on their own.

As a trusted advisor, here are ARS’ five top tips for you and your family to both become better educated and to break the taboo around discussing money:

- Start saving and investing earlier in life. Your older self will thank you!

- Avoid surprises at all costs. Strive to be more involved in your financial well-being, focused on long-term planning, mindful of short-term gratification and disciplined with your commitment to those plans.

- Begin financial conversations with your family, starting with an initial discussion about shared values, goals and priorities.

- Assemble a team of trusted advisors comprised of an investment advisor, a trust and estate attorney, and an accountant. Remember to regularly review and update important documents (e.g., your wills, beneficiary forms, trusts and estate documents).

- Having a meaningful discussion about money is just the beginning! Plan to keep family members updated and try to gather for a regular review once a year.

In a 2019 survey, we asked respondents about how their life goals aligned with their financial goals. Looking back, what would you tell your younger self about saving and investing? How well are you communicating that insight with your family? What are your priorities going forward? Please click above for a summary of the results and key takeaways.

ARS Focused Small Cap Strategy – Update Call

The Times They Are A-Changin’

The Decade of Disruption

“We live in an era of disruption in which powerful global forces are changing how we live and work. The rise of China, India, and other emerging economies; the rapid spread of digital technologies; the growing challenges to globalization; and, in some countries, the splintering of long-held social contracts are all roiling business, the economy, and society. These and other global trends offer considerable new opportunities to companies, sectors, countries, and individuals that embrace them successfully—but the downside for those who cannot keep up has also grown disproportionately.”

– McKinsey Global Institute Report, January 2019

As a new decade dawns, the rate and magnitude of the coming changes will require investors to identify and embrace the most investable themes in a world that may at times feel un-investable. To protect and build capital in this type of environment, investors should focus on the primary beneficiaries of a few critical secular themes in the new decade of disruption and avoid the companies that are being disrupted. These secular themes are continuing technological advances and the powerful demographic shifts involving aging, automation and inequality. Climate change is becoming a more actionable investment theme across all equity strategies, and investment professionals may have to play catch up. These three themes will have profound implications for investment strategy and are closely linked to other important factors including the adjustments in monetary policy, fiscal policy, debt burdens, political disequilibrium, geopolitical conflicts and deflationary global forces. Successful investing in the coming year will require a high level of conviction at a time when many aspects of our lives could be experiencing significant change.

While impeachment proceedings, the Phase I deal with China, and the Iran situation have dominated the news flow so far this year, the market has instead continued to react favorably to the outlook for improving corporate earnings and lower-for-longer low interest rates. Notwithstanding negative headlines, we continue to view the United States as the standout economy due to the underlying strength of consumer spending, the efforts of state and local governments to invest in infrastructure and other critical programs, and the potential for corporations to significantly increase capital spending. Consequently, we continue to view the U.S. equity market as superior to foreign markets on a risk/reward basis. In the current environment, client portfolios should continue to emphasize many of the leading companies including healthcare companies, large cloud-service providers, display, telecommunications, mobile communications companies, semiconductor

capital equipment companies and chip manufacturers, as well as cyber, software, and defense companies. In this Outlook, we will discuss the investment implications of three of the most powerful forces that are reshaping our world. We believe the rate of change is in an accelerating state, and that this will force investors, policymakers and business leaders to come to grips with the implications of these changes so that they will not be left behind. Legacy companies must transition to adjust to the changing environment, and their success or failure will result in a revaluation of the businesses, which sets the stage for potential shifts in market leadership. To the degree that this environment fosters original thinking, active management should become more important than passive management.

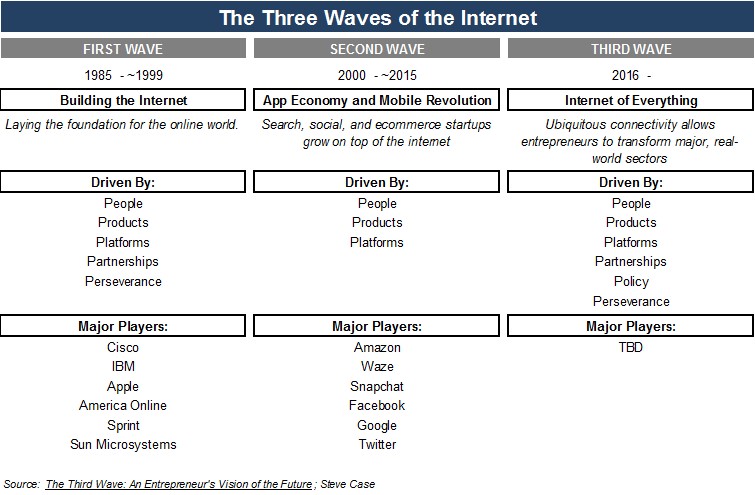

The Third Wave of Technology: The Start of the Transformational Phase

“Technological change is not additive; it is ecological. A new technology does not merely add something; it changes everything.”

– Neil Postman, American educator

In the past, we have written extensively about the Third Wave (see Chart 1) and the coming transformative opportunity that 5G would deliver for consumers and businesses. 5G is moving from pilot programs to becoming a reality as it moves to full deployment over time. This is a game changer in our view as the way we live and work is about to undergo unprecedented change. By solving complex data and storage problems and the latency issue, 5G facilitates breakthrough technologies and their applications that were once unimaginable. Many of the benefits of this transformation will be less transparent than the obvious download speeds of data and videos on our devices. But no less important, it will help drive down production costs for the products and services in daily use. This in turn fosters more innovation.

To help our readers understand the power of 5G and the related technological advances we focus on the healthcare industry which will be one of the biggest and most immediate beneficiaries. As many are aware, the $3.3 trillion of annual healthcare costs in the United States represent an estimated 16% of GDP, which is double most other developed nations. Technological advances should enable the U.S. to reduce costs and improve the delivery of health services, while extending average life expectancy. There are three major benefits that technology brings to the industry—more accessible and better treatment, improved care and efficiency, and software-specific programs to improve overall care and disease control. In the coming years, we will see new applications of predictive healthcare and the introduction of more personalized prevention and treatments to ensure better outcomes for individual patients.

Big Data Capabilities and Storage: One of the key inefficiencies in the healthcare system is the management, access and retrieval of medical records. Moving to an electronic health record system will address some inefficiencies as data entry into a computerized system is much less time-consuming than are paper-based systems. One study from the University of Michigan estimates that this switch alone could reduce the cost of outpatient care by 3%. Cloud storage of data helps improve efficiency and accessibility while reducing wastage. This also facilitates the research and development of new treatment protocols and lifesaving pharmaceutical formulations. As patient data is highly valuable, the critical weaknesses of electronic health record systems are being addressed such as security and data protection. According to some estimates, stolen health credentials have 10–20 times the value of credit card data.

Artificial Intelligence: A recent study published in Nature Medicine highlighted how doctors are using artificial intelligence (AI) during brain surgery to diagnose tumors with slightly greater accuracy, but in less than two and half minutes compared to 20 to 30 minutes by a pathologist. The greater speed and accuracy offered by AI means the patient will spend less time under anesthesia, while allowing surgeons to detect and remove otherwise undetectable tumor tissue according to the study.

Genomic Research and Personalized Services: According to the National Human Genome Research Institute, technological advances are lowering the cost of sequencing a human genome which fell from $14 million in 2006 to about $1000 in 2016, and costs continue to decline. Genomics is the study of a person’s genes (the genome) including interactions of those genes with each other and with the person’s environment. A genome is an organism’s complete set of DNA. As the costs of genomic sequencing continue to decline, it opens the way for personalized treatment and medical programs designed for an individual’s specific genetic makeup. While there are many ethical issues surrounding genetic research, the potential to lower costs, improve outcomes and extend lives is significant.

Wearable Technology: Continued advances in wearable technology will help transform healthcare by allowing doctors to more quickly and accurately diagnose, treat, and prevent debilitating health conditions, while increasing patients’ access to care. Healthcare is a major point of emphasis for research by Apple and Alphabet (Google) among others, and wearable devices are a significant potential revenue opportunity for many companies. Wearable devices are being designed to target the most common chronic diseases including heart disease, diabetes, hypertension, and respiratory diseases. Other types of wearable technology being introduced include: wireless headsets for EEG (electroencephalogram) tests which are less invasive; eye lens implants to help restore or improve eyesight; bionic suits to help workers lifting heavy weights in repetitive movements or the elderly being more ambulatory; and for robotics to assist doctors and nurses treat life-threatening health issues. Also being tested are smart scanners that can check someone’s vital signs with a simple touch of the forehead, and at some point in this decade, ingestible nanochips could help doctors monitor the body’s internal systems.

These are just a few of the many ways the healthcare industry will be reinvented in the future, and there will be many more advances involving the use of artificial intelligence, machine learning and blockchain technologies that will improve and extend our lives.

How Demographic Shifts Are Reshaping Our World

“Demographics, automation and inequality have the potential to dramatically reshape our world in the 2020s and beyond… In the next decade, they will combine to create an economic climate of increasing extremes but may also trigger a decade-plus investment boom. In the U.S., a new wave of investment in automation could stimulate as much as $8 trillion in incremental investments.”

– Excerpt from the Bain Consulting report, “Labor 2030: The Collison of Demographics, Automation and Inequality”

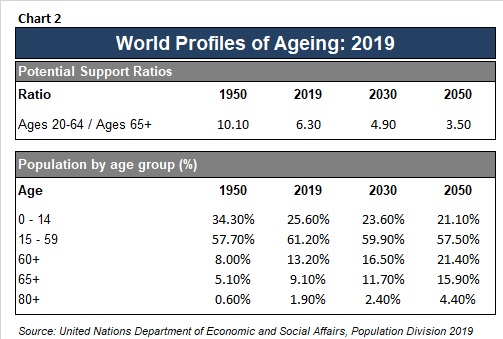

The unusual combination of rapidly aging populations, increasing workplace automation, and worsening income inequality will provide complex and interconnected challenges for policymakers for years to come. Changes in the demographic characteristics of a society have important implications for the structure of the workforce, government policy, and the overall economic outlook as most of the world’s leading economies are facing major headwinds from the demographic decline. According to data from World Population Prospects: the 2019 Revision, “by 2050, one in six people in the world will be over age 65 (16%), up from one in 11 in 2019 (9%)… In 2018, for the first time in history, persons aged 65 or above outnumbered children under five years of age globally. The number of persons aged 80 years or over is projected to triple, from 143 million in 2019 to 426 million in 2050.” This is the result of three factors – increases in life expectancy, declining fertility rates and unusual emigration patterns. Chart 2 highlights the projected trends toward an aging society as published in the United Nations report, World Population Prospects 2019.

As the world population ages, the Potential Support Ratio (PSR), or the ratio of the working-age population, 15 to 64, per one person 65 and older will become more important for investors. In 1950, the global PSR was 10.1 and it has dropped to 6.3 in 2019. By 2050 the PSRs are projected to be substantially lower at 3.5. The problem is most acute in Eastern and South-Eastern Asia with 261 million people aged 65 and over in 2019, Europe and North America (200 million), and Central and Southern Asia (119 million). By 2050, the United Nations forecasts the number of older persons doubling from 703 million to 1.5 billion. Concurrently, the birth rates in most developed nations are declining. According to a recent United Nations report, “The unprecedented shift towards a larger proportion of older persons and concomitant declines in workers is gradually and inexorably necessitating redesign of national economies.”

As a result of the demographic shifts, we anticipate greater social strains as governments are forced to address rising and, in many cases, unsustainable pension and healthcare obligations. As the yellow vest demonstrations in France have shown, the demonstrators do not want any adverse changes to their pension benefits, and one proposed change that was heavily criticized was raising the retirement age by only 2 years. The fact is that many of the future pension and healthcare obligations will not be able to be met without either lowering future benefits and/or raising taxes considerably due to fiscal constraints on governments in most developed nations. In addition, the aging issue will require a massive adjustment in the labor force that will necessitate greater use of automation, artificial intelligence solutions, and robotics in a variety of job functions in both the manufacturing and service sectors. New jobs will be created, jobs will be lost, and industries transformed in the process. This adjustment will create supply and demand imbalances in the work force for specific jobs, sometimes creating wage inflation for jobs in tight labor markets and sometimes leading to significant job elimination. There will be both inflationary and deflationary aspects of this shift that will pose additional challenges for monetary and fiscal policy.

Ironically, many nations may need to attract immigrants in order to have enough labor and consumption to drive economic growth and help meet future obligations, which for some countries would require a reversal of recent anti-immigration policies. Initially income inequality will likely be exacerbated as a result of the shift in the workplace as low-skilled, less-educated workers as well as older workers may not be as able to develop the skills required to compete for the better paying jobs. This low-interest rate environment enables businesses to be able to continue to invest in automation and lower labor costs through additional headcount reductions. This may push governments to consider skills-retraining and apprentice programs in conjunction with the private sector, a revamp of the educational system and ultimately to consider implementing some type of universal guaranteed income program.

Climate Change – We’re on the Eve of Destruction

“Climate crises in the next 30 years might resemble financial crises of recent decades: potentially quite destructive, largely unpredictable, and given the powerful underlying causes, inevitable.”

– Greg Ip, Wall Street Journal, January 17, 2020

From shifting weather patterns that threaten food production, to the terrible fires in Australia, to rising sea levels that increase the risk of flooding, among other problems, the impacts of climate change are being felt on every continent on an unprecedented scale. The problem is both man-made and due to natural causes and will require a multi-decade transition to address it. Attempts by governments to moderate the effects of climate change by controlling human activity are being undercut by the melting of the Arctic ice shield—250 billion tons of ice in 2019 alone—and the melting of the permafrost which is adding carbon dioxide and methane back into the atmosphere. There was a record melting of the permafrost in 2019, and this is critical as the melting causes erosion, the disappearance of lakes, landslides and ground subsidence. Whether you agree with the scientists or not, what is clear to the investment community is that changes in climate are having an immediate impact on supply chains, industries, living standards, water systems, food sourcing, global finance, and where people will live.

From an investment perspective, climate change is forcing immediate planning and spending that had previously been postponed. Capital spending related to climate change is going to be a much more important factor in economic activity this decade and beyond. This is forcing state, local, and federal governments as well as the private sector to respond with smart investment strategies. In many cases, it will require the continuation of low interest rates for an even longer period and greater investment spending which has repercussions for monetary and fiscal policy in a world already heavily indebted. Critically, the spending will be coming at a time when the global interest rate structure (the cost of capital) has never been lower, providing governments an ideal borrowing opportunity.

Our research efforts are focusing on the United States electrical grid and infrastructure systems as one of the most critical and immediate areas of need. The Fourth National Climate Assessment, released in 2018, noted, “Infrastructure currently designed for historical climate conditions is more vulnerable to future weather extremes and climate change.” Failure to address the nation’s grid will result in more problems like those experienced in California in the past year with rolling blackouts and wildfires. The current grid system in the U.S. is made up of three grids that are not well integrated. And one of the key issues will be transmitting energy between regions efficiently, particularly from the Southwest to the Northeast as well as from sparsely populated areas with energy supply surplus to more densely populated areas in supply deficit. The aging electrical grid system requires downtime to cool its transformers, and the shift to electric vehicles combined with rapid growth of the cloud and 5G would overwhelm the system as it stands today. The utilities are aware of the need to upgrade the electrical grid system, and four of them have announced capital expenditure plans in aggregate of more than $100 billion over the next three years. Our research continues to identify the companies benefiting from climate-related expenditures, especially those companies providing infrastructure solutions for the utility, pipeline, energy and communications industries.

As government and business leaders gather at the World Economic Forum Annual Meeting in Davos, the calls for action on climate are growing as evidenced by the theme for the event which is Stakeholders for a Cohesive and Sustainable World. Business leaders are paying attention as demonstrated by the recent pledge by Microsoft to become carbon negative in its emissions by 2030 and remove the amount of carbon it has emitted over the decades by 2050. This is a recognition of its role as a corporate leader in addressing the problem. Importantly for investors, the steps taken to address climate change will factor heavily into the valuations of companies going forward with some being helped and others being negatively impacted.

Investment Implications – Be Cautious and Opportunistic

“The future depends on what you do today.”

– Mahatma Gandhi

On the surface, the conditions described above might lead investors to be pessimistic about the prospects for the U.S. and global economies, and therefore the markets. However, it is these conditions that may very well set the stage for an extension of the current economic expansion, and perhaps an even longer run for this bull market notwithstanding the possibility of a near-term pullback. The reason for the more positive view is a continuation of the present low-growth, low-interest rate and deflation-prone environment which will enable the Federal Reserve and other central banks to continue their accommodative interest rate policies and avoid impeding capital flows. Barring a significant shift in the outlook for inflation, which we do not anticipate at this time, the Federal Reserve must work to keep interest rates low for the foreseeable future, and that would continue to provide a favorable backdrop for equity investing.

While much has been made of the income and wealth inequality experienced around the world, there is a similar dynamic playing out with corporations. The leading companies are prospering, and the rest are less so. Why? Because these companies are more productive, and the resulting productivity leads to higher earnings and better pay for employees. These companies tend to have better balance sheets and access to capital, enabling them to invest more heavily, and therefore enhance their productivity, grow market share, and ultimately increase shareholder value. Investors should focus on companies with “embedded advantages” over their peers. The leading technology companies offer excellent examples of businesses with embedded advantages. Alphabet, the parent of Google, dominates the worldwide search market ex-China. While there is talk of increased regulatory scrutiny and higher taxes for companies like Google, this would likely reduce the ability of others to compete by raising the cost of doing business and increasing the barriers to entry. There are companies with these embedded advantages in several industries that are benefiting from the secular themes described in this Outlook, and that is where investors should focus their dollars. It is for this reason that we feel the investment environment is set to favor active management over passive management, and high conviction strategies over more diversified strategies. Additionally, the low-interest rate environment favors companies with strong balance sheets, good business models, and the ability to raise their dividends. Companies with solid, above-market dividend yields should continue to be rewarded under these conditions.

There are always risks to the economic outlook and that is certainly the case today. Aside from the ever-present geopolitical risks, the risk of a massive cyber-attack on the U.S. infrastructure, government institutions or the financial system, or the risk of policy missteps, among the key risks that would change our positive views would be a sharp rise in inflation and in the U.S. dollar. As the world economy remains both fragile and fluid as highlighted by the coronavirus epidemic, we continue to be opportunistic and cautious in our investment approach. Climate change has now come to the fore as a secular trend. It now represents an immediate, multi-year investment opportunity. As we said at the start of this piece, the powerful shifts in the global economy are creating large opportunities, and well-selected equities should reward investors over the next several years. There are investable ideas present in virtually all market environments, and investors should be able to achieve both absolute and relative returns over time by owning the businesses that are the beneficiaries of the secular trends.