What Matters Now: Why a Pandemic Recession Requires a Different Approach

“It is a paradox that in our time of drastic rapid change, when the future is in our midst devouring the present before our eyes, we have never been less certain about what is ahead of us.”

– Eric Hoffer

The world is being tested by the COVID-19 crisis in ways it has not been previously challenged and this pandemic has become a defining event in our lifetimes. This crisis has accelerated and augmented many of the negative and positive trends which have been in place for a considerable period of time prior to the pandemic and will continue to impact many aspects of our lives well into the future. The measures taken to counter the virus have inflicted significant damage to families as far too many lives and livelihoods have been lost. The world is experiencing a period of heightened uncertainty which is likely to persist at least until the virus is contained and people feel confident that it is safe to return to many of the activities that are currently being prohibited, restricted, or avoided. Given the sharp contrasts between this recession and past ones, investors should consider viewing the current landscape through a very different lens than used during previous crises. We are in the midst of the most unusual economic period in United States history, and one in which the stock market has seemingly disconnected from the pandemic-driven economic reality.

It has been an extraordinary time for all given how much the world has changed in a few months. While we do not pretend to have all the answers, there are a few critical factors that we believe are being underappreciated and/or misunderstood by market participants which have had and are having significant impacts on investment strategy. Among the most critical factors are the differences between this pandemic recession and a typical economic recession; the impact of global policy initiatives on the markets; and the acceleration of the technology revolution. Crises always benefit some businesses while disadvantaging others, and this virus has created an environment where investors can continue to build and protect capital by investing in the problem-solvers.

Why is this Pandemic Recession Different from a Typical Economic Recession?

“The uniqueness of this crisis – a crisis that results from a policy to tackle a health emergency and to save lives through containment measures. This means that in contrast to the Great Financial Crisis (GFC), this crisis is truly exogenous, not the result of the unravelling of previous financial imbalance; truly uncertain, in the specific sense that the wide range of possibilities depends on unpredictable non-economic factors; and truly global – despite how the GFC is generally portrayed, many countries did not actually experience it.”

– Claudio Borio, Head of the Monetary and Economic Department at the of the Bank of International Settlements (BIS)

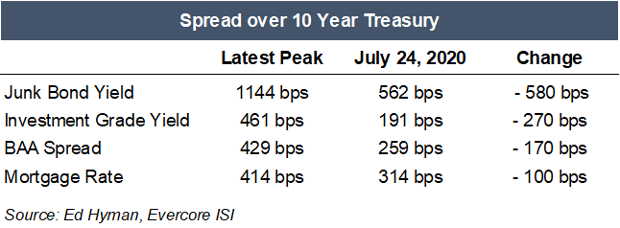

Coming into the year, the United States had record low unemployment rates, historically low interest rates, muted inflation and rising corporate profits. It was a positive backdrop for a continuation of the longest economic expansion in U.S. history. Before COVID-19 hit, the U.S. and global economies were gradually improving as the massive stimulus initiatives, which had been previously implemented, were supporting gradual growth. Then came the pandemic. What is so different about this pandemic recession? It resulted from a lockdown of economic activity which caused a sudden and severe shock to both supply and demand. This immediately led to lower spending, forced savings, a dramatic increase in unemployment and business bankruptcies and closures. A typical economic recession results from central bank tightening of economic conditions to combat an overheating economy. In the months leading up to the 2001 recession, oil prices were rising rapidly, the federal reserve was tightening interest rates and the tech bubble was about to burst. In contrast, this pandemic recession has seen oil prices collapse, historic monetary and fiscal policy responses, technological advances and the acceleration of the prospect of scientific breakthroughs. This is the most all-encompassing policy response by the Federal Reserve, global central bankers and fiscal policymakers that has ever occurred both in the speed and magnitude of its implementation. These policy initiatives are being implemented at a time when the developed world is facing continuing deflationary pressures that have been ongoing for many years. The effectiveness of the policy response has been demonstrated by the sharp reversal in economic activity as seen by the rebounds in housing, employment, vehicle production, inventory rebuilds and, importantly for investors, in the stock prices in many markets. It is also evidenced by the decline in interest rates on many securities and on mortgage rates which have hit a record low.

A major factor in answering “where do we go from here?” lies in the ability of the medical and scientific communities to deploy proper testing, effective treatment and to discover a vaccine. As controversial as it sounds, it also requires better behavior on the part of everyone to help contain the spread by exercising recommended precautions such as distancing and wearing masks. Only then can we begin the process to return to a better sense of normalcy, but even then, daily life is likely to be quite different. Until then, investors should expect the second half of the year to be volatile as the world continues to struggle with reopening the global economy. While we believe that innovation and science will win in the end, the road to recovery will be bumpy with unsettling news headlines adding to the already high level of uncertainty and unease. It is due to these factors, that most investors need to be grounded in their investment approach and not try to time or be swayed by short-term market swings.

Is the Impact of the Policy Initiatives Both Misunderstood and Underestimated?

“We’re not thinking about raising rates. We’re not even thinking about thinking about raising rates.”

– Jerome Powell, Federal Reserve Board Chair, June 29, 2020

The second factor is the impact of monetary and fiscal policy on the economy and the markets. Back in 2008, we were among the minority of investors believing that Fed policy was deflationary not inflationary. In our December 2008 Outlook, we wrote that “the Federal Reserve will have to maintain a historically low interest rate policy for the foreseeable future. To accomplish this goal the Federal Reserve must increase the supply of dollars, which will cheapen the currency and weaken the exchange rate.” In March of 2009, then Federal Reserve Chair Ben Bernanke announced the introduction of quantitative easing (QE) or the printing of money. Since then, interest rates have continued to move to near zero in the United States and below zero in many European countries. This left many market participants to believe that the central banks have exhausted most, if not all, of the tools in the monetary policy toolbox.

On March 23rd, the Fed announced QE4 and it is hard to appreciate how difficult the financial conditions were in the fixed income markets leading up to that decision. Two of the biggest sponsors of money market funds had to infuse $2.6 billion in liquidity to help meet redemptions. This action by the Fed was underappreciated by market participants with respect to both the fragility in the system and the subsequent impact it has had on the capital markets. Consistent with its mandate of full employment and price stability, the Federal Reserve’s pandemic policies were designed to give market participants confidence that the capital markets were able to function properly and to provide liquidity to those companies that would not have needed it without the pandemic. It also ensured that companies could continue to access the capital markets which in and of itself promotes growth.

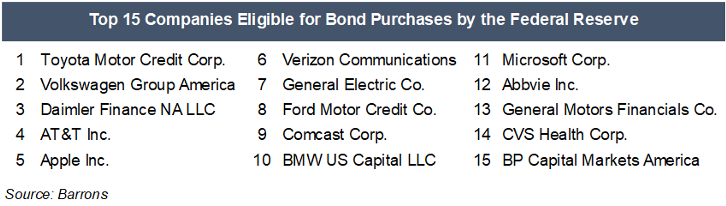

We see something uniquely unusual that investors might be missing. In June, the Federal Reserve embarked on a program called the Secondary Market Corporate Credit Facility (Facility) to further support the capital markets as it began a program to lend, on a recourse basis, to a special purpose vehicle (SPV). The SPV will purchase in the secondary market eligible individual corporate bonds; eligible corporate bond portfolios in the form of exchange traded funds (ETFs); and eligible corporate bond portfolios that track a broad market index. In total, the Facility and the Primary Market Corporate Credit Facility (PMCCF) can purchase up to $750 billion of assets. Critically, the Fed’s action to buy bonds not only supported the bond market, but it also supported the equity market. Above is a partial list of companies whose debt the Federal Reserve is buying. Equity owners are at the bottom of the capital structure placing them behind lenders exposing them to both credit and equity risk. The bond buying program has reduced the risk of equity ownership in so far as it has reduced the credit risk of company ownership, thereby making equity ownership potentially more valuable. These policies have created a condition that has never existed before which requires a more tailored approach to equity valuation. The current debt cycle has been irreversibly changed, and this has enabled some companies to recapitalize using equity and others to refinance debt at lower rates, thereby buying additional time for the economy to recover. The policy actions of the central banks have been further supported by immediate and massive fiscal responses.

Are the Markets Still Underestimating the Technology Revolution?

“As unfortunate as it has been, the virus has allowed the country to achieve the same amount of progress for digital adoption in two months as it would have in five years.”

– Mr. Vittorio Colao, head of the Italian government’s task force on reopening its economy

The third critical factor which is not fully appreciated is the acceleration of the digital transformation. Just as the Industrial Revolution changed our way of life, we are experiencing a technology revolution that is changing how we live, learn, work and govern. Think about how our lives have changed in just a few short months. Industry after industry is undergoing a rapid transformation. Microsoft CEO Sayta Nadella said recently, “We’ve seen two years’ worth of digital transformation in two months. From remote teamwork and learning, to sales and customer service, to critical cloud infrastructure and security—we are working alongside customers every day to help them adapt and stay open for business in a world of remote everything.” This digital transformation is in the early stages and has only just begun in earnest. It will impact every aspect of our lives. No industry can afford not to fully engage in the technology revolution as supply and demand destruction and changes in the way we live will require companies to do more with less staff and lower costs to compete in the post-COVID world.

Key to the technology revolution is the confluence of advances in 5G, computing power, artificial intelligence, machine learning, robotics, blockchain and 3D printing. These combined with the growth of the software development industry have enabled innovation to proceed at a rate much faster than previously experienced. One only needs to look at the healthcare sector and the efforts by pharmaceutical companies to develop, test and, bring to market a vaccine for the COVID-19 virus as an example of the ability of technology to solve complex problems in a fraction of the time it previously would have taken. While most investors understand that these advances are occurring, they have not adjusted their portfolio exposures to acknowledge the transformation. There will be few industries, companies or households that will not be impacted.

The Investment Implications of the Post-COVID World

It seems like investors have been navigating uncharted waters since the Great Financial Crisis in 2008. As we entered this year, the strength of the U.S. economy and the continued recovery of the rest of the world had investors feeling generally comfortable. Then came the COVID-19 virus, and now we are battling an invisible enemy and a highly uncertain future. The

current environment requires a new playbook for investors especially after the more than 40% rebound in many stock markets since March. There are several issues that make this period a particularly challenging one. First is the belief that the policymakers have exhausted all the tools at their disposal. This is not a point of view shared by the ARS team. Second is that the lockdown has caused permanent damage to the economy as many jobs lost in recent months will not return and too many of the unemployed and underemployed may never be able to find jobs at similar or better wages. Again, we do not share that view as history offers many examples of technology displacement being more than offset by the creation of new jobs. According to a report from the Boston Consulting Group, 85% of the jobs that today’s learners will be doing in 2030 have not been invented yet. The United States and other nations have a skills gap to address to take advantage of the opportunities in new jobs that will be created in the coming months and years. We have written in detail about our concerns about the skills gap and the need to transform our educational system to reflect the changes required. Debt and deficits are also a concern for investors and properly so, but those are issues to address in the post-COVID period. At the present time, policymakers should continue to focus on supporting the economy until they are confident that we are on a path to more sustainable growth.

ARS remains focused on identifying those businesses that are the problem solvers for the COVID and post-COVID world while avoiding those that are negatively impacted by this disease. To protect and build capital in this difficult climate, investors should continue to focus on the secular beneficiaries, particularly those on the cutting edge of the digital transformation across industries. Many of these companies have rebounded so strongly that their valuations have become overextended or have discounted strong earnings prospects well into the future. We continue to own some of these in our portfolios. In those cases where the current valuation reflects growth rates beyond reasonable math, ARS is either reducing the position in case it just moved too far too fast, or liquidating the position if the price is too speculative based on reasonable standards of valuation. We are investors, not speculators. We also continue to hold higher than normal cash levels to take advantage of the volatility in the markets. Our primary areas of focus remain on those companies driving the digital transformation, industry leaders and innovators providing healthcare solutions and on defense companies as the geopolitical climate remains challenged, particularly considering the current state of U.S. and China relations. During the quarter, ARS initiated a position in a gold mining company in response to growing concerns about currencies, debt and deficits. Interesting and perhaps surprising to many since the year 2000, gold has provided similar returns to investors as U.S. equities have delivered.

The standard of equity valuation for ARS begins with the outlook for corporate profits, interest rates and inflation rates. While corporate profits will be lower in 2020 than 2019 and might not return to previous highs until sometime in 2022, there is wide dispersion in the outlook for earnings across sectors, industries and individual companies. Therefore, this is an ideal environment for active strategies to outperform passive strategies. Interest rates will likely remain low for an extended period of time as the debt levels around the world will not be able to be serviced at higher interest rate levels without weakening economic activity and thereby putting further downward pressure on deflationary forces. While the economy has been more deflation-prone than inflation-prone for many years, it would not surprise us to see inflation pick up slightly in the coming quarters as supply chain disruptions may cause some transitory pressures.

We continue to believe that it is a time to be both cautious and opportunistic. We would remind investors that the sudden decline and rebound in the equity markets reflected the forces described in this Outlook. We continue to favor individual stocks, cash and gold over bonds, and believe that policymakers must continue to provide the necessary support to manage through this COVID-19 period. As we said at the start of the Outlook, crises always benefit some businesses while disadvantaging others, and that is certainly the case at present. The fact is that there are far more people employed than unemployed in the United States today. Clearly, certain industries and their workers, particularly those in the leisure, travel and hospitality, are being severely impacted but these represent a smaller part of the total employment base than those that stand to benefit from the digital transformation that is presently occurring and that lies ahead.

This economic description does not in any way minimize the awful tragedy affecting so many individuals and their families. It is easy and completely understandable to emphasize the challenges present in the global system, but from an investment perspective, one must balance those concerns with today’s opportunities as well as the new opportunities that are in the process of developing. We remain vigilant in identifying those companies that are the beneficiaries while working to avoid those companies that are being negatively impacted. In today’s rapidly changing environment, one must stand ready to seize the opportunities presented, be quick to course- correct as necessary, while remaining grounded in a proven investment process to protect and build capital in this unusual period in history.