Strong anti-establishment pressures have brought the global economic and geopolitical situation to an inflection point leaving investors wondering where we go from here? The statement above from the International Monetary Fund report prepared for the G-20 Finance Ministers and Central Banker Governors’ Meetings held in China this past July sums up the concerns quite appropriately – action is needed and it is needed now. Without proper fiscal policy, investors should expect more of the same low growth, low interest rate and low inflation economy we have experienced for some time. It is our expectation that should the long-awaited fiscal policy response begin, the impact would be quite positive. The global economy has been suffering from a basic lack of demand relative to supply. Moreover, the increase in economic and political uncertainty has lowered confidence, suppressed investment and spending, and contributed to the insufficient fiscal policy response. Moreover the inability of political systems to respond has been fueling the mounting resentment and anger among broad segments of the population. As a result of the global challenges, monetary policy initiatives have been the most accommodative in history and will remain highly accommodative for an indeterminate period. Yet in spite of unprecedented monetary support for the system, the global economy continues to struggle with growth that has been too slow for too long, with the benefits shared unequally. On October 4th, the IMF updated its forecast for global growth projecting 3.1% for 2016 with a slight increase to 3.4% in 2017. Leading central bankers, including Federal Reserve Chair Janet Yellen and ECB President Mario Draghi, have been imploring governments to implement strong fiscal policy actions to support monetary policy initiatives as only fiscal policy and structural reforms can solve the secular problems facing the global economy. Any observer of the world’s infrastructure conditions cannot fail to see the enormous opportunity for positive change that would result from immediate investments in this area.

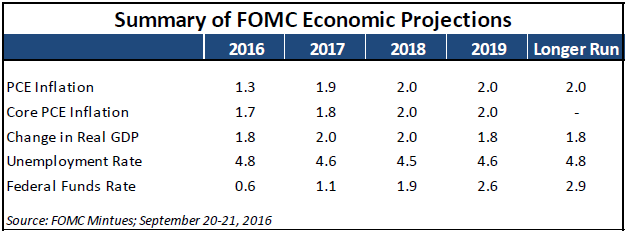

The chart above illustrates the economic projections from the recent Federal Open Market Committee (FOMC). The committee forecasts U.S. growth to run between 1.8% and 2.0% for the next three years. Amid significant global uncertainty, market participants are now spending considerable time trying to determine the effect of the U.S. presidential election and Federal Reserve policy on investment strategy. Given the many problems facing the world including rising and excessive debt levels, worsening demographics, growing pension liabilities and increasing hostilities to name a few, the world is at an inflection point both economically and politically. Widespread dissatisfaction likely will make the above FOMC projections wrong and should force politicians to act in favor of expansion rather than contraction or the status quo. In this Outlook, ARS will briefly frame the problem of growth for the global economy and the U.S., discuss several critical policy initiatives required by leaders to create higher and more sustainable growth, and finally describe the investment implications for our clients.

Critical Policy Initiatives to Return to Growth

Global Growth Initiatives

“To lift growth and counter risks, G-20 policymakers will need to follow a broad-based approach that simultaneously provides better-balanced demand support where needed, address private sector balance sheet items, and implement structural reforms.”

Global Prospects and Policy Challenges, International Monetary Fund

One of the main challenges of a prolonged period of low growth accompanied by eight years of aggressive and highly accommodative monetary policy is that politicians have had the cover to avoid taking necessary policy actions. Without a crisis to prompt an immediate policy response like the world experienced following the Lehman Brothers collapse, it has been impossible to get meaningful action from politicians. As a consequence, anti-establishment sentiment has risen to extremely high levels across the developed world, and many elected officials are afraid to sponsor the programs or enact the structural reforms they know are needed to return to growth. Christine LaGarde, Managing Director of the IMF, in a recent speech once again implored governments to use structural reforms, fiscal and monetary policies in a “country-specific way to make them mutually reinforcing”. Ms. LaGarde discouraged protectionism, encouraged inclusiveness in growth, and even suggested cooperation and, if needed, coordination between nations. However, the economic challenges, particularly those of the developed nations, are fueling populist sentiment against global trade and immigration because they are perceived to be costing jobs and growth particularly for young people in nations where unemployment is very high. Businesses and individuals are fed up with politicians who have allowed ideological beliefs to prevent the application of sound business and economic judgment. Free trade and immigration are two of the key issues for political parties around the world and also for politicians in the U.S. election.

U.S. Growth Initiatives

“The U.S. lacks an economic strategy, especially at the Federal level. The implicit strategy has been to trust the Federal Reserve to solve our problems through monetary policy. A national economic strategy will require action by business, state and local governments, and the Federal government… Overall, we believe that dysfunction in America’s political system is now the single most important challenge to U.S. economic progress.”

Harvard Business School Survey on U.S. Competitiveness

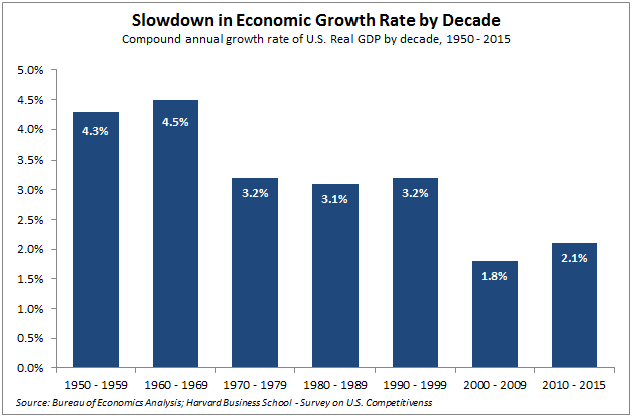

As the following chart highlights, our nation has experienced a slowdown in economic growth over many decades. According to the recently released Harvard Business School (HBS) report entitled “Problems Unsolved and a Nation Divided”, U.S. economic growth averaged 4.3% annually from 1950-1969, then declined to 3.2% from 1970-1999 and recently has been around 2%. With both presidential candidates struggling to articulate their economic programs, it is appropriate to share the Eight-Step Plan of federal policy priorities highlighted in the HBS report. The report puts forth the following policy recommendations: simplify the corporate tax code with lower statutory rates and no loopholes; move to a territorial tax system like other leading nations; ease immigration of highly-skilled individuals; aggressively address distortions and abuses in the international trading system; improve logistics, communications and energy infrastructure; simplify and streamline regulation; create a sustainable federal budget, including reform of entitlements; and responsibly develop America’s unconventional energy advantage. The report cited public education and health care as two other areas that need to be addressed on a state and local level.

While there is nothing new or earthshattering about the areas highlighted, it is clear from the recent presidential campaign process that Americans are fed up with the status quo and want Washington to act more responsibly. At least three of the priorities from the HBS plan – tax reform, easing the immigration of skilled individuals and investing in our infrastructure – are fairly straight-forward opportunities. More importantly, these issues require immediate action. In a recent CNBC interview, former President Bill Clinton called for a lowering of the current corporate tax rate. During his presidency the rate was around the international average of 39% but it is well above the average of 24% today. Mr. Clinton proposed lowering corporate taxes as close to the international average as possible with all corporations paying a minimum tax rate. He also favored repatriation of overseas cash. In the U.S., small businesses are often not able to receive the same tax benefits as multinationals, yet small businesses are the key drivers for employment growth and productivity improvement. With minimum wages rising and increasing regulatory burdens, small business formation and the associated job creation have been lackluster in recent years. A lower and more competitive corporate tax structure would provide an important boost to the economy.

A recent Deloitte study estimates that there are three and a half million manufacturing jobs needed to be filled over the next decade with two million of those job openings likely going unfilled due to the skills gap. Throughout the school systems there needs to be a change: students need to be taught the skills required for the jobs based on 21st Century technology. In the short-term, the U.S. should be easing the immigration of skilled labor through the H1-B visa process. Canada, for example, allows for almost three times as many visas to be issued annually than does the U.S. and has approximately one-tenth of the population.

The growing need to improve our infrastructure has been developing for more than a decade as the required spending has risen from $1.3 trillion to nearly $4 trillion today. Last month’s train accident in Hoboken, New Jersey is just the most recent example that the U.S. can no longer postpone making these critical investments. This is one area that Mr. Trump and Ms. Clinton can both agree on as they each have made infrastructure spending a prominent feature of their economic platforms. The key issue is whether either candidate can get the necessary support from the House and Senate to act.

Investment Implications and Opportunities

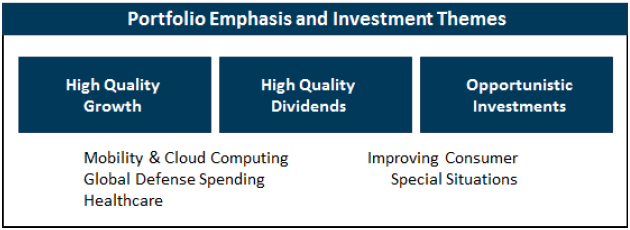

With the presidential election less than one month away and a possible interest rate hike by the Federal Reserve before year end, investors should expect volatility to be with us following a fairly quiet few months. Our portfolio strategy remains consistent with the themes prominent currently in client portfolios with some important additional considerations. The first is that we believe the global economy could be at an inflection point as fiscal stimulus is critical at this stage to support growth. We believe this would be a significant positive for the economy. Consequently, there has been an increase in activity in our client portfolios reflecting the desirability of investing in the beneficiaries including technology, energy and materials companies. A second is that there are several investable areas where the opportunities are not necessarily dependent on the outcome of the election or economic growth, but rather benefit from individual industry or company-specific tailwinds. One such area is in computer technology as the fast-growing memory and storage space is experiencing a tightening in the supply and demand dynamics leading to increased pricing power for providers, some of whom also offer very attractive dividend yields. In the healthcare sector, the medical device companies are benefiting from strong demographic demand, as they are not subject to the growing negative narrative over drug pricing. The third is the buying opportunity that is developing in high-quality dividend stocks, including utilities, whose prices have pulled back in anticipation of interest rate increases by the Federal Reserve. The fourth is the expectation of the strengthening U.S. dollar which tends to act as a contractionary force for overseas economies to the degree that they need to import commodities which are traded in dollars. In addition, dollar-denominated debt becomes more expensive to service in a rising dollar scenario, particularly for emerging economies. The equity markets will react negatively if the dollar strengthens too quickly or too much. The final consideration relates to the structure of the market as mutual fund and hedge fund liquidations combined with seasonal tax-selling between now and year end can create mispricings of shares and potential buying opportunities.

Our portfolio strategy continues to focus on three areas of emphasis – high-quality growth, high-quality dividend payers and opportunistic investments. Our focus remains on selecting companies benefitting from positive trends in cloud computing and mobility, changes in the healthcare industry, rising defense spending, increasing U.S. consumer spending and the shift to a more service-oriented global economy led by China and India. We continue to target companies that are gaining market share, maintaining or improving profit margins, increasing free cash flow, restructuring to gain more efficiency, increasing pricing power and growing dividends. Companies that are able to more aggressively invest in the future growth of their businesses will be more highly rewarded. This is an environment that will continue to reward companies with strong, qualitative fundamentals.

The United States remains the leading nation from a geopolitical and economic perspective, and the collective strengths of the nation should help keep the U.S. in that position. However, we are at an inflection point and now is the time for political ideology to be put aside and to get on with fixing the areas that need fixing. Tax reform, infrastructure, education, job creation, health care and entitlement programs, including state and local pension plans and inequality need to be addressed immediately. The current record low interest-rate environment has been giving governments, home and abroad, a unique opportunity use low-cost debt to make the needed investments essential to foster a return to a stronger growth environment. The opportunity will not be with us forever and now is the time to capitalize on this historic interest rate structure. Importantly for investors, if this inflection point results in our addressing our needs through the implementation of smart fiscal policy and the structural reforms mentioned above, the outlook for the United States economy becomes materially better.