We live in a world of global disequilibrium and distortions which are likely to be with us for many years, and for clients the key question is how do you preserve and build capital under these conditions? In 1970, Alvin Toffler argued that society was undergoing tremendous structural change from a technological and social perspective that would overwhelm people leaving them disconnected and disoriented. Some 46 years later, the rapid rise in anti-establishment sentiment in Europe and the United States reflects the frustration of many people who are experiencing lower living standards, growing income inequality, a loss of confidence in government and declining optimism about the future. In addition to these issues, the Brexit vote reflects a growing sentiment of loss of sovereignty and self-determination. Globalization and technological advances have not benefited populations equally leaving many feeling disenfranchised.

The global economy remains volatile and unbalanced, but in the face of the many challenges the S&P 500 and Dow Jones Industrial Indices continue to make new highs. In light of the current geopolitical, economic and social conditions, investors should expect the continuation of the historically low interest-rate environment. Low rates are limiting options for capital to achieve returns and pushing investors to seek alternatives. We would caution market participants not to make investment decisions today using only traditional investment thinking with respect to current interest rates and equity valuations given the characteristics of the global economy. In a growth-challenged environment, investors should expect the United States to remain among the healthiest economies with the U.S. dollar and treasuries continuing to be in high demand. The U.S. economy is improving as indicated by the strength of consumer spending and housing activity. Many U.S. corporations had previously lowered earnings expectations for Q2, and therefore are able to meet or exceed expectations leading to higher share prices. In our view, the outlook for current interest rates, inflation rates and corporate profits continues to create favorable conditions for the second half of the year for well-positioned U.S. businesses.

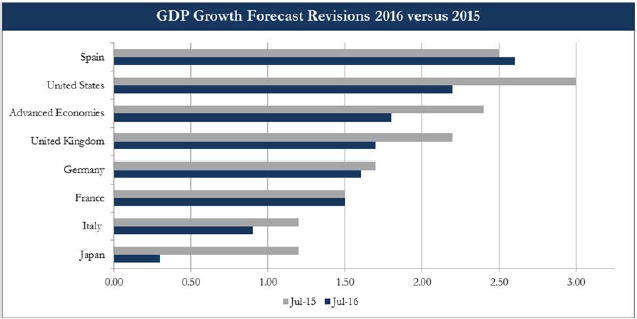

The chart above from the International Monetary Fund shows the most recent lowered growth projections for many of the developed economies. Governments are facing many difficult choices from geopolitical, economic and social perspectives in the months ahead. To deal with the economic challenges, central banks will continue to employ the most aggressive monetary policy actions in history. These policies have been implemented in various forms and to varying degrees of success. Unfortunately as aggressive as monetary policy has been, fiscal policy has been insufficient to support growth, and in some countries including several in Europe, it has been contractionary. While perhaps well-intended, austerity policies have had the effect of virtually guaranteeing slow to no-growth outcomes and high unemployment, especially among youth. A strong fiscal policy response is required to match monetary policy efforts which are nearer their limits. While we have written about the need for productive fiscal policy initiatives for several years, the level of frustration expressed by populations around the world may finally force politicians to act as voters are determined to challenge the political status quo.

The Post-Brexit EU and the UK

“The unique feature of the EU is that, although these are all sovereign, independent states, they have pooled some of their ‘sovereignty’ in order to gain strength and the benefits of size. Pooling sovereignty means, in practice, that the Member States delegate some of their decision-making powers to the shared institutions they have created, so that decisions on specific matters of joint interest can be made democratically at European level. The EU thus sits between the fully federal system found in the United States and the loose, intergovernmental cooperation system seen in the United Nations.

Excerpt from EU publication “How the European Union Works”

The European Union (EU) was created in the aftermath of the Second World War based on the ideals of a peaceful, united and prosperous Europe. The intent was to foster economic cooperation with the idea that countries that trade with one another become economically interdependent and so more likely to avoid conflict. The EU functioned relatively well from an economic perspective when economies were doing better, but when the strains of slow growth and rising unemployment manifested themselves in recent years, resentments and doubts developed about the European project. The series of economic crises experienced by the region since 2009 highlighted the structural flaws of the EU initiative. There are three primary issues complicating the current situation in Europe and the UK. First, the emphasis on austerity programs for many nations fostered deep resentments toward Brussels (headquarters of the EU) and Germany, and allowed anti-European parties to rise in influence. Second, the economic recovery has been uneven and slow to materialize in part because the European approach, in contrast to the U.S. one, did not properly recapitalize the banking system. Third, the civil war in Syria, with the disruptive involvement of Russia, led to the massive migration of refugees to Europe, and the Union was unprepared for the challenges and not unified in its approach to address them.

For voters in the United Kingdom (UK) and many others in Europe, concerns about sovereignty, self-determination, immigration, employment and a loss of national identity have fueled populist movements. In October, Italy is holding a referendum on the proposed structural changes of Mateo Renzi, its Prime Minister. While at the same time, the Italian government wants to bail out the banks with capital injections, but under EU rules a bail-in must occur whereby shareholders, bondholders and bank depositors share in the losses. We believe that the ECB will try to finesse an arrangement that protects bank depositors, shareholders and creditors for Italy as a one-off situation. Italy, which is the EU’s third largest economy, otherwise could at some point be the next shoe to drop after Brexit. Furthermore, the recent coup attempt in Turkey could heighten immigrant flows into Europe which in turn could result in rising nationalistic sentiment, further weakening the Euro and slowing economic growth. With many leading nations facing elections in the next 12 months, politicians must carefully weigh their policy options.

As things stand today, the future of the European Union (EU) is uncertain as is its relationship with the UK. Undoing 40 years of political and economic integration would be a complex and difficult process. Fortunately, the leadership transition in the UK was expeditious as Theresa May was introduced as David Cameron’s successor on July 13th and many of the key cabinet positions have already been filled. This will allow plans for the Brexit process to begin to be formulated with the current relationship between Norway and the EU potentially being used as a model. The Brexit process could take some time to be completed as negotiating trade agreements and the free movement of individuals are complicated issues with important implications for the involved nations.

Global Disequilibrium and the Upcoming Elections

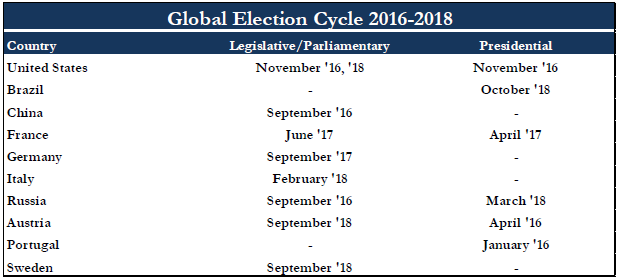

One of the key questions facing European leaders is whether the Brexit vote leads to an unraveling or forces greater integration of the EU given the large cultural differences and different histories of its members. Germany is determined to see the EU remain intact. Competing interests make a solution difficult, but not impossible. Aside from the economic benefits of the Union, the EU provided a stronger foundation for the security of its member nations. However, the fourth terrorist attack in France in the past 12 months will advance the position of Marine Le Pen, the far-right leader who is President of the National Front (FN), a national-conservative political party in France which has made immigration and national security a key element of its platform. As the chart below highlights, several of the key decision makers will be forced to balance doing what is right for their own nations with doing what is right for Europe while also trying to get re-elected. The favorability ratings for many incumbents are deteriorating, and key elections in France, Germany and Italy will complicate matters while lengthening the process. In the US, the improbable rise of Donald Trump as the Republican nominee for President and the surprising showing of Bernie Sanders on the Democratic side are reflections of the anti-establishment sentiment here at home which is an outgrowth of the inability of Congress to effectively address the needs of the nation. The likely change of leadership in so many nations has added an element of unpredictability and uncertainty to the outlook.

However, there seems to be one area of common need globally and that is the need to invest in infrastructure to stimulate growth and increase productivity. Unlike the previous 30 years, the global economy can no longer rely on credit-fueled growth by the private sector to the same degree as in the past because of the excessive debt already in the system. Two critical elements required for stronger growth are infrastructure spending and structural change. Both Donald Trump and Hillary Clinton have made infrastructure spending a prominent part of their platforms to drive economic growth for the U.S. In Europe, the challenge will be whether Germany can make the ideological shift with respect to supporting a move away from austerity for the Southern tier nations by increasing spending to promote economic growth in the EU. The need for increased infrastructure spending is real and no longer able to be postponed. McKinsey Global Institute in a 2013 report estimated that the required global infrastructure spending needs by 2030 were in excess of $57 trillion and growing. At the time, it was estimated that the required global spending was greater than the total value of the existing global infrastructure. For the United States, a 2013 American Society of Civil Engineers report projected the spending needs to be in excess of $3.6 trillion and rising. The current record low interest-rate environment has presented governments a unique opportunity to use low-cost debt to fund the needed investments essential to foster a return to a stronger-growth environment. Importantly the return on investment would be higher than the cost of capital.

Global and NATO Defense Spending

The disequilibrium discussed in this Outlook is being manifested in many areas with a critical one being that the world is a less-safe place with the tragic terror attack in Nice and the failed coup being the most recent examples. As a consequence, global defense spending is likely to increase from the current levels of approximately $1.7 trillion. The United States, which accounts for 39% of global defense spending at approximately $670 billion annually, had slowed spending in recent years as a result of the financial crisis and the budget sequestration. That trend is now reversing and the initial policy statements from each presidential candidate support the need for an increase in U.S. defense spending. The target amount for NATO nations, ex the United States, is 2% of GDP or an estimated $320 billion per year. From the Middle East to Europe to Asia, countries are increasing defense spending at a significant rate with Russia planning $320 billion by 2020, China intending to increase spending over 7% annually, and now Japan is considering a constitutional change to increase its spending as well. The United States is also working to enhance South Korea’s Ballistic Missile Defense (DMB) system as North Korea continues its aggressive development of its nuclear program.

At the recent NATO Summit in Warsaw, participants highlighted that member nations were facing “a range of security challenges and threats that originate both from the east and from the south; from state and non-state actors; from military forces and from terrorist, cyber, or hybrid attacks.” The group cited Russia as the most significant threat and has committed both personnel and increased spending to protect its members from Putin’s highly aggressive actions. NATO nations are committing additional ground forces to the Baltic region. NATO also stressed as a critical security issue the shifts in tactics by ISIS to bring terrorism to Europe and in particular to France and Belgium. The instability of the Middle East and North Africa are contributing to the ongoing refugee crisis. This is also adding to security concerns for members as most are unprepared to handle the volume of refugees which is taxing domestic security forces.

From an investment perspective, U.S. defense companies represent a relatively small percentage weighting in the S&P 500, so most institutional portfolios have a representation in defense of approximately 1.8% or less. The top 5 defense companies have a market capitalization of about $280 billion. It is our view that these businesses represent important investments that generate significant cash, maintain high and/or growing backlogs, improving profit margins, raising dividends and repurchasing stock. These businesses are not as dependent on economic activity as are others, but rather on national security needs and geopolitical conditions.

Testing the Limits of Monetary and Interest Rate Policy

The absence of supportive fiscal policy is forcing central banks to rethink the limits of monetary policy initiatives. Following meetings between Ben Bernanke, the former Federal Reserve Chair, and the heads of the Bank of Japan to discuss its battle with deflationary pressures, there has been increased speculation regarding the possible introduction of “helicopter money”. This is an unconventional policy that blends elements of monetary and fiscal initiatives by printing large sums of money to finance government programs in order to stimulate the economy. The central bank gives the government money with no interest and no expectation of payment at a later date to distribute in the form of spending. While many are skeptical about the likelihood of its being introduced, we would caution that investors were also skeptical of the likelihood of quantitative easing and “lower-for-longer” interest rates as well. Prior to the financial crisis, interest rates were always a positive number. With $11.5 trillion in government bonds outstanding carrying negative interest rates, the historic level of interest rates is no longer the standard. Due to the development of negative interest rates as a policy tool and the prospects of even further unconventional monetary policy initiatives, gold has become of greater interest to investors in 2016. While there are divergent views regarding gold, the economics of the current environment have arguably made gold less expensive to own then at any time in the past. Gold is considered a hedge against excessive currency creation as well as economic, geopolitical and financial instability.

Investment Implications

“America has been dealt an extraordinary hand, and I am optimistic about our future. Our universities are second to none. We have many of the best businesses on the planet – small, medium and large. Americans are among the most entrepreneurial and innovative people in the world, from those who work in entry-level jobs on the factory floor to Bill Gates… We face many challenges. But they can be overcome…”

Jamie Dimon, Chairman and Chief

Executive of JPMorgan Chase in a recent NY Times Op-ed

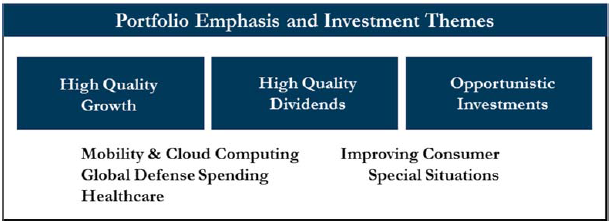

As we have often stated in previous Outlooks, the resilience and adaptability of the U.S. have and will continue to make our economy standout relative to others and perpetuate the view as a safe haven for capital. These attributes become even more important in times of the global disequilibrium we see today. Even with the many challenges we face, opportunities exist to build and protect capital. Our portfolio strategy continues to focus on three areas of emphasis – high-quality growth, high-quality dividends and opportunistic investments. Our focus remains on selecting companies benefitting from positive trends in cloud computing and mobility, changes in the financial and healthcare industries, rising defense spending, increasing U.S. consumer spending and the shift to a more service-oriented global economy led by China and India. We continue to target companies that are gaining market share, maintaining or improving profit margins, increasing free cash flow, restructuring to gain more efficiency, increasing pricing power and/or growing dividends. Companies that are able to more aggressively invest in the future growth of their businesses will be more highly rewarded as there is a growing view that many corporations have only been able to financially engineer their performance improvements through share buybacks. This is an environment that will reward companies with strong, qualitative fundamentals. Furthermore with more than $11.5 trillion of government debt carrying a negative yield, central bank bond buying is creating distortions in the bond market forcing rates even lower, crowding out individual bond buyers and forcing investors to seek alternative sources of income in the equity markets.

Potential leadership changes could have a profound impact on the economic policies implemented in 2016 and beyond. For the United States specifically if the upcoming election brings about fiscal and structural changes which have been deferred for a long time, the result would be a material improvement in the economic outlook. The current record low interest-rate environment is giving governments a unique opportunity use low-cost debt to make the needed investments essential to foster a return to a stronger growth environment. With slow growth and deflationary pressures, we expect markets to continue to ascribe greater value to companies with the best industry-demand fundamentals and internal growth characteristics. The dynamics of the global economy strongly suggest an environment which offers investors the opportunity to build capital and protect income. The disequilibrium discussed in this Outlook has been adding to market volatility over the past few years, temporarily distorting the values of quality businesses and presenting investors with attractive buying opportunities. We expect this trend to continue. Investors should remain focused on taking advantage of the businesses that are benefitting from the positives in the U.S. and global economies.