“The good news is that the recovery continues; we have growth; we are not in a crisis. The not-so-good news is that the recovery remains too slow, too fragile, and risks to its durability are increasing. Certainly, we have made much progress since the great financial crisis. But because growth has been too low for too long, too many people are simply not feeling it. This persistent low growth can be self-reinforcing through negative effects on potential output that can be hard to reverse. The risk of becoming trapped in what I have called a “new mediocre” has increased.”

Christine Lagarde, Managing Director of the IMF, April 5, 2016

Our recent Outlooks discussed the monetary policy actions being implemented and their investment implications. Today there are almost as many perspectives on the global economy as there are stocks and bonds traded in the markets, but there seems to be consensus that the world will be challenged to achieve sustainable growth based on the debt, demographic, social and political headwinds. Recently the International Monetary Fund (IMF) downgraded its projections for global growth from 3.4% to 3.2% for 2016 and from 3.8% to 3.5% in 2017. Whether we are in Ms. Lagarde’s “new mediocre” or Larry Summer’s “secular stagnation” camp, it has been clear to us for several years that the global economy requires more support than the accommodative and, in some cases, aggressive monetary policies that have been implemented to date. In her recent speech, Ms. Lagarde suggested that the interconnectedness and internationalism of the global economy will require a three-pronged approach involving structural reforms, growth-friendly fiscal policies and continued support of monetary policies to achieve growth targets. Critics suggest that the answer lies with less government, not more. A stronger argument can be made for better regulation, a more harmonized global tax system, support for smart infrastructure programs and continued monetary policy support. Today’s reality is that technology and globalization have made the world much smaller and more interdependent, and too many policies in place today are not reflective of the world we live in. This Outlook continues to focus on building capital in the “new mediocre” economy described by Ms. Lagarde.

The global economy continues to undergo an adjustment process that is fostering significant changes in foreign exchange rates, interest rates, and commodity prices. As a consequence investors should expect continued shifts in capital flows. It is our view that one of the defining characteristics of investing will be a return to “P.O.S.S.” or plain old stock selection. In our March 23rd Outlook Note, we described the key characteristics of companies we require for inclusion in client portfolios. Key areas for emphasis are on owning high-quality growth and high-quality dividend growth companies as well as undervalued beneficiaries of the current environment. Our focus remains on selecting companies benefitting from positive trends in mobility and cloud computing, changes in the financial and healthcare industries, rising defense spending, improving U.S. consumer spending and the shift to a more service-oriented global economy led by China. We continue to target companies that are gaining market share, maintaining or improving profit margins, increasing free cash flow, restructuring to gain more efficiency, increasing pricing power and/or growing dividends. Companies that are able to more aggressively invest in organic or acquisition growth for their businesses will be more highly rewarded. This is an environment that will favor companies with strong, qualitative fundamentals. New companies or old ones with the ability to promote change, disrupt the competition and gain market share will be among the most attractive opportunities. Our investment professionals are required to answer the following questions.

- What is going to drive the business going forward?

- Is management of high quality?

- Is the business getting better or worse?

- Are margins, earnings and free cash flows improving or getting worse?

- Is the business gaining or losing market share?

- What is the risk and reward to purchasing at the current price?

- In terms of portfolio construction, is it purposely adding a similar exposure to other companies already owned or is it providing exposure to a new area?

The Next Phase of Technology Disruption

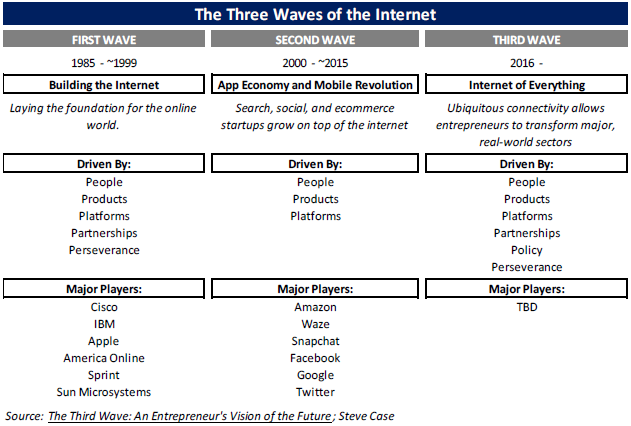

“The entrepreneurs of this era are going to challenge the biggest industries in the world, and those that most affect our daily lives. They will reimagine our healthcare system and retool our education system. They will create products and services that make our food safer and our commute to work easier. The Third Wave of the Internet will be defined not by the Internet of Things; it will be defined by the Internet of Everything. We are entering a new phase of technological evolution, a phase where the Internet will be fully integrated into every part of our lives… As the third wave gains momentum, every industry leader in every economic sector is at risk of being disrupted.”

Steve Case, excerpt from

“The Third Wave, An Entrepreneur’s Vision of the Future”

There are many examples of how technology is being tested globally to help change the way public and private sector entities do business, and we are in the early stages of understanding the potential to improve efficiency, lower costs and increase quality. As we transition to the Third Wave as described by Steve Case, the United States is arguably best positioned due to its ability to innovate and adapt. Three examples of potential technology disruption are occurring in national security, healthcare, and insurance as discussed below. Los Alamos National Laboratory (Los Alamos) is a multidisciplinary research institution engaged in strategic science on behalf of national security which enhances national security by ensuring the safety and reliability of the U.S. nuclear stockpile, developing technologies to reduce threats from weapons of mass destruction, and solving problems related to energy, environment, infrastructure, health, and global security concerns. Los Alamos is partnering with a major U.S. tech company to research a new storage tier to enable massive data archiving for supercomputing. The joint effort is aimed at determining innovative new ways to keep massive amounts of stored data available for rapid access, while also minimizing power consumption and improving the quality of data-driven research. These companies are working together on power-managed disk and software solutions for deep-data archiving, which represents one of the biggest challenges faced by organizations that must juggle increasingly massive amounts of data using very little additional energy.

The healthcare industry is another area ripe for the type of change that Steve Case described in the Third Wave. At roughly 17% of U.S. GDP, spending on healthcare is one of the best opportunities for technology to raise the quality of care at lower costs. In a recent research study by Technavio, global big data spending in the healthcare industry is expected to experience a compounded annual growth rate of 42% over the period from 2014-2019. According to the report, “Big data in the healthcare industry is tremendous because of its volume, variety, and velocity required to manage it. This includes a wide variety of data ranging from patient data in electronic medical records, clinical data, data from sensors monitoring vital signs, emergency care data to news feeds… It also supports a wide range of healthcare functions such as disease surveillance, clinical decision support, and population health management.”

Finally, the Financial Times recently reported that “a new wave of gadgets is set to wipe $20 billion off car insurance prices globally over the next five years. Growing use of collision-warning systems, blind-spot information and sophisticated parking assistance will be so successful in cutting accidents that insurers will have to lower their rates.” Swiss Re and Here, a mapping company, reported that by 2020 more than two-thirds of cars will have some connectivity and could lower accidents by an estimated 25-50% on roads and highways. (This highlights both the deflationary aspect of technology advances and the quality-of-life benefits.)

Very importantly as we look ahead, the existing price structure that is built into today’s global system is undergoing displacement by these disruptive technologies which lower costs at a potentially accelerating rate. As this transpires all businesses are subject to these deflationary forces and must evolve to compete. Three important implications of the third wave are increased productivity, growing unemployment pressures, and the need for improved education and training for workers to be able to adapt to changing labor market requirements. A critical negative consequence is that technological advances may also foster greater inequality as education and skills differences in workers are exacerbated. The abnormally low interest rate structure augments this trend as the lower cost of capital helps to promote investment in these disruptive businesses.

Areas of Portfolio Emphasis

In the “new mediocre” environment, key areas for emphasis in portfolios are on owning high-quality growth and high-quality dividend growth companies as well as undervalued beneficiaries of the current environment. Our focus remains on selecting companies benefitting from positive trends in cloud computing and mobility, changes in the financial and healthcare industries, rising defense spending, increasing U.S. consumer spending and the shift to a more service-oriented global economy led by China. We continue to target companies that are gaining market share, maintaining or improving profit margins, increasing free cash flow, restructuring to gain more efficiency, increasing pricing power and/or growing dividends. Companies that are able to more aggressively invest in the future growth of their businesses will be more highly rewarded as there is a growing view that many corporations have only been able to financially engineer their performance improvements with strong, qualitative fundamentals. The following details many of the reasons for our portfolio emphasis.

Mobility and Cloud Computing

“Initially described in the 2010 National Broadband Plan and authorized by Congress in 2012, the auction will use market forces to align the use of broadcast spectrum with 21st century consumer demands for video and broadband services. It will preserve a robust broadcast TV industry while enabling stations to generate additional revenues that they can invest into programming and services to the communities they serve. And by making valuable “low-band” airwaves available for wireless broadband, the incentive auction will benefit consumers by easing congestion on wireless networks, laying the groundwork for “fifth generation” (5G) wireless services and applications, and spurring job creation and economic growth.”

From the FCC website on the “Broadcast Incentive Auction”

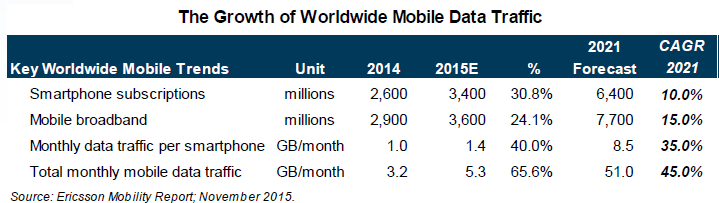

The global economy is benefiting from rapid technological advances including the dynamic growth in mobility, connectivity, search, memory, data management, storage and devices. Over the next several years, the technological advances of multi-tracking capability, the more efficient usage of battery power and an even more connected world means that the internet will experience no letup in its disruptive power over more traditional ways of living and conducting business. About 70 percent of Americans use data-enabled smartphones, and the total number of connected devices now exceeds our population. Globally, connected devices are forecast to increase from 15 billion in 2015 to 28 billion in 2021. Three of the most important beneficiaries are cloud computing, data colocation and mobile-service providers. The resulting content demand is accelerating the development of devices that can process and transfer data with high speed while storing ever-increasing amounts of data as shown in the chart below.

In the U.S., the Federal Communications Commission (FCC) is in the process of holding an incentive auction for valuable 600 MHz spectrum to help wireless providers meet the growing demand for data consumption. Spectrum is the range of electromagnetic radio frequencies used to transmit sound, data, and video across the country. It is what carries voice between cell phones, television shows from broadcasters to your TV, and online information from one computer to the next, wirelessly. The last auction generated significant demand and companies paid over $45 billion to acquire spectrum, and this auction has a wide range of expectations as spending may be as low as $18 billion and as high as $60 billion. This auction is important as it will make available “low-band” airwaves for wireless broadband. According to the FCC, “the incentive auction will benefit consumers by easing congestion on wireless networks, laying the groundwork for “fifth generation” (5G) wireless services and applications, and spurring job creation and economic growth.” 5G or fifth-generation is the next wireless broadband technology and will provide better speeds and coverage than the 4G technology. Huawei, a major player in the Chinese mobile market, believes 5G will provide speeds 100x faster than 4G LTE offers. 5G also increases network expandability up to hundreds of thousands of connections. The need for faster speed and great volume of data usage is why the spectrum assets are so highly valued. Investors should also anticipate increased demand for the devices that are best able to meet these requirements and satisfy growing consumer demand.

It is estimated that corporations spend about $3.7 trillion annually on information technology (IT) and will be shifting spending to adjust to the realities of a more connected world with far greater data. As a result, the adoption of the cloud, which began slowly, has started to rapidly accelerate. The benefits for businesses of moving their IT workloads to the cloud include reduced costs, greater flexibility, more scalability and better services. Over the long term, companies moving to the cloud avoid having to build, expand, maintain and upgrade data centers, can be faster to market with new products and services and react more quickly to competitive threats. Among the areas which benefit will be data centers, cloud service providers, data analytics and management providers, cyber-security companies, semiconductor producers, mobile advertisers and device makers.

Financials

While low interest rates in the U.S. and negative interest rates in some parts of the world have been weighing on bank stocks, our research continues to identify certain financial companies, including real estate-related companies, that should benefit from the continuation of a low interest rate environment and the easy access to financing as capital from around the world seeks higher returns. Select financial businesses with differentiated models that have generated strong profits, despite a falling interest rate environment, should remain attractive investments relative to peers. These include select regional banks and insurers. A potential game-changing technology for financial institutions lies just over the horizon. It is the “blockchain” technology which essentially provides a virtual transaction system and is referred to as a “distributed ledger technology”. Major financial institutions are making multi-billion dollar investments in this technology which may radically change the way companies process transactions on behalf of customers in the future. The Australian Stock Exchange (ASX) has announced that US-based firm Digital Asset will help it develop solutions for the Australian equity market using blockchain technology as the Exchange is looking to replace or upgrade its main trading and settlement systems. A World Economic Forum white paper issued in June 2015 stated that “decentralized systems, such as the blockchain protocol, threaten to disintermediate almost every process in financial services.” While the technology may be a few years away from broad usage, the potential impact is not to be underestimated once concerns about security, scale and confidentiality have been addressed.

Healthcare

Notwithstanding concerns about government involvement in setting prices for the industry, the healthcare sector also aligns closely with our longer-term Outlook as an aging global population will provide a strong secular tailwind for healthcare demand. According to the World Health Organization (WHO), in most countries, the proportion of people age 60 or older is growing faster than any other age group due to longer life expectancy and declining fertility rates. The U.S. Census Bureau estimates that in the U.S., the number of people age 65 years and over will increase by 30% between 2012 and 2020. The Affordable Care Act is having the effect of adding to the number of people covered in the healthcare system. These factors are expected to drive demand for healthcare services, including pharmaceuticals and medical devices as well as the companies that provide these services.

An aging population will also drive healthcare demand in large developing countries such as China. Moreover, demand in these markets will also benefit from increased per capita spending as their populations insist on better quality care. In August 2015, China unveiled plans to roll out medical insurance to cover all critical illnesses for its population of 1.4 billion by year-end. China has a two-fold problem of having to deal with the consequences of air and water pollution that are affecting a large part of its population. China drug spending is expected to grow by nearly 8% per year through 2020, and according to McKinsey & Co. China’s overall healthcare spending will nearly triple to $1 trillion by 2020, up from $357 billion in 2011. Greater spending suggests greater volumes of healthcare consumption, but there will also be a “trade up” from drugs and devices that are locally-sourced or generic to best-in-class patented drugs and devices sold by the leading global pharmaceutical and device companies. We expect a select group of pharmaceutical, biotech and medical device companies to be beneficiaries of these spending trends. We also favor companies with strong balance sheets and healthy dividend coverage. These companies should benefit from investor demand for sustainable income streams as well as their ability to raise dividends and make accretive acquisitions. Although we are mindful of the increased political attention being placed on drug pricing in the U.S., we believe that those companies with healthy research and development budgets that can demonstrate genuine superiority for their drugs and innovate breakthrough therapies will see less impact from pricing pressures. Additionally, device makers should not be impacted by the negative political narrative regarding pricing. On the contrary, they stand to be beneficiaries.

Global Defense Spending

“Europe faces a very different and much more challenging security environment, one with significant, lasting implications for U.S. national security interests. Russia is blatantly attempting to change the rules and principles that have been the foundation of European security for decades. The challenge posed by a resurgent Russia is global, not regional, and enduring, not temporary. The situation on the ground in Eastern Ukraine is volatile and fragile, and we remain convinced the best way to bring the conflict to an acceptable, lasting solution is through a political settlement, one that respects state sovereignty, and territorial integrity.”

General Philip Breedlove, NATO’s military commander,

Department of Defense Press Briefing, February 25, 2016

As a consequence of greater global conflict, global defense spending is likely to increase from the current levels of approximately $1.7 trillion after several years of spending cuts following the Great Recession. The United States, which accounts for 39% of spending globally at roughly $670 billion annually, had slowed spending in recent years as a result of the financial crisis and the budget sequestration. That trend is now reversing. NATO defense spending for 2015 is estimated to be $892.7 billion, and this figure should rise in 2016. The target amount for NATO nations is 2% of GDP yet only a handful of the member nations (the U.S., Poland, Greece, Estonia and the United Kingdom) are at that level. It was recently recommended that the United States increase support of Europe as concerns about Russia’s intentions mount. As global tensions continue to rise, it is expected that the United Arab Emirates (UAE), Saudi Arabia, India, France, South Korea, Japan, China, Russia and other affected governments will increase purchases of next-generation military equipment in response to threats to their national interests. Additionally China plans to increase its reported spending by 7% annually between now and 2020 which would bring it to $260 billion. Russia, in spite of its severe economic difficulties, has pledged to spend $300 billion by 2020 to rearm and modernize its military although that plan will likely be challenged by its budgetary issues given current oil prices. At the same time, it has been reported that Russia’s Vladimir Putin has plans to establish a new national guard which may number between 350,000-400,000 members as he prepares for potential social unrest.

The U.S. defense companies represent a relatively small percentage weighting in the S&P 500, so most institutional portfolios have a representation to defense of approximately 1.8% or less. It is our view that these businesses continue to represent strong investments that generate significant cash, have robust orders, maintain high and/or growing backlogs, and are raising dividends and repurchasing stock. These businesses are not dependent economic activity, but rather on national security issues and geopolitical conditions.

Improving Consumer

The decline in oil and natural gas prices has lowered costs for many consumers around the globe, putting more discretionary income in their pockets. At the same time, manufacturers and the producers of consumer products are benefitting from lower input costs as energy is a significant component of cost of goods sold. The consumer staples companies in particular are well positioned to benefit in an environment of uncertainty and low inflation. Because they sell the products that are consumed every day, their sales tend to be resilient, and their sizeable and growing dividend yields offer an attractive alternative to the low returns offered by fixed income securities. While low interest rates have penalized savers, lower mortgage rates have allowed the equity value of U.S homes to rebound from around $6 trillion in 2008 to over $12 trillion today. The recovery in home values combined with improvements in the labor market have led to improved consumer confidence and spending.

Although we see opportunities for consumer companies with a domestic focus, our research is also focused on those businesses positioned to benefit from long-term growth in consumer spending in developing markets. China in particular has seen a surge in its middle class over the past decade. According to Pew Research Center, the share of Chinese who are middle income jumped from 3% to 18% from 2001 to 2011. Today, those whose incomes are described as middle, upper-middle or high-income now represent well over 20% of the population, or close to 300 million people – approximately the size of the entire U.S. population. As China continues to rebalance its economy away from exports and infrastructure investment to consumer spending, we should expect consumer demand to continue to grow benefitting those multinational businesses with strong brands which are well positioned in that market.

In Conclusion

The U.S. economic outlook is positive but mixed, and the same may be said for the global economy. Investors should remain opportunistic in taking advantage of the businesses that are benefitting from the positives in the U.S. and global economies. As the United States heads into an election year, the fiscal policy discussions will become more active as each party defines its platform. Around the world, opposition parties have fared quite well in recent local and national elections as populations express their frustrations with the policies of incumbent parties. Potential leadership changes could have a profound impact on the economic policies implemented in 2016 and beyond. For the United States specifically, if the upcoming election brings about fiscal and structural changes which have been deferred for a long time, the result would be a material improvement in the economic outlook. With slow growth and deflationary pressures, we expect markets to ascribe greater value to those companies with the best industry-demand tailwinds and internal growth drivers. The dynamics of the global economy strongly suggest an environment which offers investors the opportunity to build capital and protect income.