“We have forgotten that history is fundamentally tragic. The French have to prepare for this threat, bear in mind that there will probably be more attacks. It’s a war, not a conventional one but a war. I know some countries have refused to use that term to avoid giving terrorists the pleasure, but we have to say things as they are.”

French Prime Minister Manuel Valls,

as quoted in the Financial Times on 11/26/15

The world is characterized by a series of crises which are the result of an accumulation of failed domestic, foreign, social and economic policies by governments globally. Following the tragic terrorist attacks in France and California as well as the downing of a Russian plane by the Turkish military near the Syrian border, we are reminded that the world is growing increasingly more dangerous and fragile. These events, as well as the deteriorating situation in the Middle East and the resulting refugee crisis, are undermining confidence as investors head into the New Year. Given the considerable shocks to the system this year, the global economy has held up fairly well in large part due to central banks delivering the most accommodative monetary policy response in history. Because monetary policy has its limits, new fiscal policy initiatives and structural changes are required to achieve a sustainable growth trajectory for the future. In light of the insufficient fiscal policy responses to date, current global economic dynamics strongly suggest a continuation of low interest rates, low inflation rates and slow growth for the foreseeable future as the global economy cannot tolerate a normalization of interest rates to historical levels under present circumstances, nor could the global economy withstand a recession at this time.

As we head into 2016, several themes are being reflected in client portfolios. These themes include: defense, mobility and cloud computing, healthcare, financials, and the shift to a more service-oriented global economy. The energy sector, due to the dramatic decline in oil and natural gas prices as well as stresses in the high yield market and increased violence in the Middle East which is the epicenter of global supply, is a developing opportunity. The search for safe income in a yield-starved world continues to be important. In addition to these themes, investors should seek to identify companies that reflect the following characteristics: improving business, market-share gainers, improving margins, increasing free cash flows, ability to increase pricing power and/or grow dividends. With slow growth and deflationary pressures, we expect markets to ascribe greater value to those companies with the best industry demand tailwinds and internal growth drivers. Moreover those companies positioned to benefit from the record merger and acquisition activity should continue to attract strong market interest. In 2016, investors should expect an environment of continued market volatility and a potential narrowing of investment opportunities. The United States is well positioned as its economy continues on its slow-growth path. Its consumers and companies benefit from lower energy prices, its dollar remains relatively strong and its interest rates stay well below historical standards. The following pages describe in greater detail the major considerations and the primary themes that benefit from this Outlook.

Major Investment Considerations

The global economy is undergoing significant changes from a social, political and economic perspective. This year global markets have faced a variety of issues, from the Greek debt crisis to China’s currency devaluation to the latest terrorist attacks, which have increased overall market volatility. Additionally Russia’s military involvement in Syria has changed the dynamics of politics in the Middle East and not necessarily for the better, while the recent terrorist attacks in Paris and San Bernardino provided a painful reminder that the fight against terrorism is ongoing and expanding, and one which will be waged not only on foreign soil but also at home. The fight could be a long one since we are dealing with extremists attracting new members from a growing pool of the disenfranchised ripe for radicalization.

Now that the Federal Reserve has begun the process of raising interest rates, this should further affect capital flows continuing to place strains on the world economy and capital markets. The International Monetary Fund (IMF) is projecting worldwide growth of 3.6% for next year which is greater than this year’s, however, we do not believe this is likely to be achieved. Nevertheless the continuing economic recovery in the United States has enabled the Federal Reserve to begin raising interest rates as it announced on December 16th. Short-term moves notwithstanding, this will likely keep the U.S. dollar relatively strong, and higher rates would then continue to attract capital from other markets. China has continued its accommodative monetary policy and fiscal spending to help achieve an acceptable level of slowing growth while it attempts to keep social stresses under control. Following its currency achieving reserve currency status at the IMF, it should be anticipated that China will manage its currency lower to support its exports and adjust to the recent Federal Reserve rate increase. However, other emerging market and commodity-producing nations, particularly those dependent on China for previous growth, will likely remain under pressure. Europe continues to see modest improvement in economic activity but also faces wide differences of opinion among its member nations regarding several critical policy initiatives, including fiscal, monetary and more recently refugee-related issues. In contrast to the Federal Reserve interest rate increase, Mario Draghi of the European Central Bank (ECB) has once again let the markets know that the ECB “will do what it must” to achieve its inflation targets by extending and expanding the current quantitative easing program. In addition, Japan has struggled to create inflation and continues its highly accommodative approach to its fiscal and monetary policy.

As we have been writing for some time, the level of global debt continues to remain elevated having risen by over $57 trillion since 2008 to an estimated total of $200 trillion. One of the biggest risks to the 2016 economic outlook are the emerging markets which have a long history of debt busts, such as the 1980’s Latin American crisis and the late 1990’s Asian crisis. Emerging markets may be stressed next year based on a strong U.S. dollar outlook combined with higher U.S. interest rates and an extended period of low commodity prices and reduced demand. Traditionally, these debt busts have ended suddenly and require a severe economic adjustment. European nations such as Greece continue to face debt troubles as well as a growth rate which has not been sufficient to allow them to work out of their problems. Here at home overall U.S. household borrowing has climbed to $12.1 trillion which is the highest level in over 5 years, and there have been $70 billion in subprime autos loans originated in the past 6 months alone according to a recent report from the Federal Reserve Bank of New York. In order to avoid a future global debt crisis, it is important that governments implement effective fiscal policies to raise national income and tax receipts allowing borrowers to better manage debt and reduce deficits.

In conclusion, the global economy requires a period of sustained growth improvement in order to begin to return to a more normalized interest rate structure. Short of this, we will require an abnormally low rate structure to persist for an indefinite period. Due to the concerns discussed in this Outlook, the actions of central banks and governments remain highly accommodative and pro-growth oriented to create a sustained level of demand with the aim of avoiding a global recession. This is a critical point as monetary policy is clearly nearing its limits, and government leaders may not have the political will to use fiscal stimulus to combat another global recession.

Investment Implications

The conditions described above suggest that the opportunities for investors will be more focused than in recent years as the beneficiaries of such an environment will be fewer than the past 7 years making thoughtful security selection and asset allocation decisions even more important. The Outlook also suggests that elevated volatility will remain present for three primary reasons: the global economy has become progressively more accident-prone and fragile; the post-crisis regulatory environment has affected liquidity in the markets; and the structure of the market has changed due to high frequency traders (HFT) and exchange traded funds (ETF). This volatility has led to price distortions which, in turn, create opportunities for those investors who are prepared to take advantage. Looking ahead to 2016, those companies that are gaining market share, improving profit margins, increasing free cash flow, increasing pricing power and/or growing dividends should be favored in the market. Coming out of the Paris Climate Change Conference, investors will now be seeking to identify the resulting beneficiaries. Based on the global divergences described in this Outlook, we expect United States markets to remain attractive from a risk/reward perspective. While other markets may outperform the U.S., we believe that there is better certainty at home as the United States remains the leading global economy. Below we will address each of the primary investment themes in greater detail.

Mobility and the Cloud

“Everything has the ability to become smart – a smartwatch, smart clothes, a smart TV, a smart home and a smart car. However, in almost all cases, this “smartness” runs on software in the cloud, not the object or the device itself.”

Werner Vogels, Amazon’s Chief Technology Officer in a recent blog

While we do not underestimate our reader’s understanding of the vast changes occurring with technology today, we believe that the growth and innovation we will experience over the next several years remain underappreciated. One of the biggest impacts of the technological advances is the shift taking place in the global economy as it moves from a manufacturing-based economy to more of a service-based one. Two of the most disruptive technologies today are mobility and cloud computing. Cloud computing is defined as the use of a network of remote servers hosted on the internet to store, manage, and process data, rather than a local server or a personal computer. The rapid growth of the “internet of things” and the resulting content demand are accelerating the development of devices that can process and transfer data with high speed while storing ever increasing amounts of data. Over the next several years, the technological advances of multi-tracking capability, the more efficient usage of battery power and the incorporation of the “internet of things” means that the internet will experience no letup in its disruptive power over more traditional ways of living and conducting business. The global economy is benefiting from rapid technological advances including the large increase in the availability of wireless spectrum and the dynamic growth in mobility, connectivity, search, memory, data management, storage and devices. Billions of people around the world, who currently have little or no access to internet, will become connected in the coming years. The introduction of 4G LTE is helping accelerate the growth of mobility. 4G means the fourth generation of data technology for cellular networks. LTE stands for Long Term Evolution and is short for a very technical process for high-speed data for phones and other mobile devices. Efforts are underway to develop the 5th generation version.

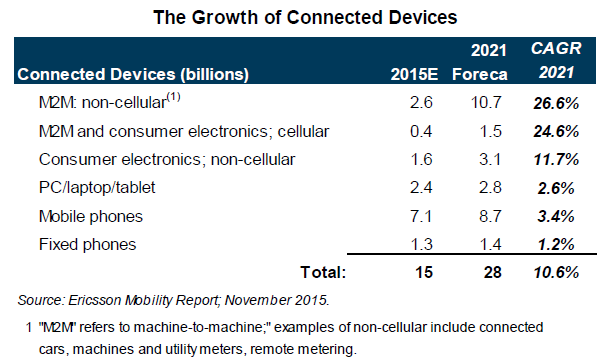

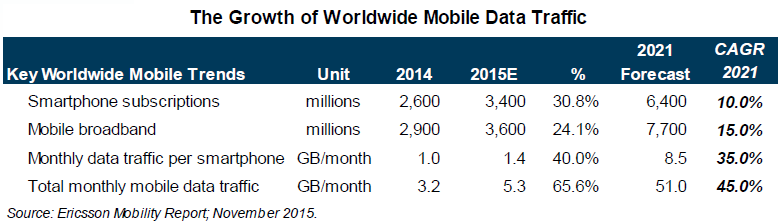

In a recently released Ericsson Mobility report (November 2015), Ericsson forecast that in 2021 there will be 28 billion connected devices and that almost 70 percent of all mobile data traffic will be from video. According to the report, today “there are as many mobile subscriptions as there are people in the world, and every second, 20 new mobile broadband subscriptions are activated.” As the numbers of subscribers grow and technology advances, so does data consumption as demonstrated by the 65% growth in Q3 2015 versus Q3 2014. As shown in the chart below, total monthly mobile data traffic growth is estimated to experience a 45% compounded annual growth rate between 2015 and 2021. These figures reflect greater adoption and use of mobility by both consumers and businesses.

It is estimated that corporations spend about $3.7 trillion annually on information technology (IT) and will be shifting spending to adjust to the realities of a more connected world with far greater data. As a result, the adoption of the cloud, which began slowly, has started to rapidly accelerate. The benefits for businesses of moving their IT workloads to the cloud include reduced costs, greater flexibility, more scalability and better services. Over the long term, companies moving to the cloud avoid having to build, expand, maintain and upgrade data centers, can be faster to market with new products and services and react more quickly to competitive threats. Among the areas which benefit will be data centers, cloud service providers, data analytics and management providers, cyber-security companies, semiconductor producers, mobile advertisers and device makers.

Defense

There are at least three geopolitical issues that investors should consider as we move into 2016 – Russian relations with Europe and NATO, the progressively more complex dynamics of the Middle East and the threat of an incident in the South China Sea. The situation in Syria has created strange bedfellows with most involved countries supporting the fight against ISIS, but also on opposing sides in their support of President Bashar Hafez al-Assad or the Syrian rebels. As a consequence of greater global conflict, global defense spending is likely to increase from the current levels of approximately $1.7 trillion after several years of spending cuts following the Great Recession. The United Arab Emirates (UAE), Saudi Arabia, India, France, South Korea, Japan, China, Russia and other affected governments are expected to continue to increase purchases of next-generation military equipment in response to threats to their national interests. The United States, which accounts for 39% of spending globally at roughly $670 billion annually, had slowed spending in recent years as a result of the financial crisis and the budget sequestration. That trend is now reversing.

Additionally China plans to increase its reported spending by 7% annually between now and 2020 which would bring it to $260 billion. China’s actual spending is estimated to be much higher as it has been aggressively seeking to raise its profile on the global stage. Russia, in spite of its severe economic difficulties, has pledged to spend $300 billion by 2020 to rearm and modernize its military although that plan will likely be challenged by its budgetary issues given current oil price levels. As the sanctions are soon to be removed on Iran, the Saudis are increasing their spending in response to the proxy war being fought between these two nations in Yemen. On November 20th the U.N. Security council unanimously voted to call countries around the world to take “all necessary measures” to fight ISIS.

NATO defense spending for 2015 is estimated to be $892.7 billion and this figure should rise in 2016. The target amount for NATO nations is 2% of GDP yet only a handful of the member nations (the U.S., Poland, Greece, Estonia and the United Kingdom) are at that level.

The U.S. defense companies represent a relatively small percentage weighting in the S&P 500, so most institutional portfolios have a representation to defense of approximately 1% or less. It is our view that these businesses represent strong investment opportunities as they should continue to generate significant cash, have robust orders, maintain high and/or growing backlogs, and are raising their dividends and buying back stock. These companies do not rise and fall based as much on economic activity, but more so on geopolitical conditions. Therefore defense companies should have a more meaningful representation in client portfolios.

Healthcare

The healthcare sector also aligns closely with our Outlook as an aging global population will provide a strong secular tailwind for healthcare demand. According to the World Health Organization (WHO), in most countries, the proportion of people age 60 or older is growing faster than any other age group due to longer life expectancy and declining fertility rates. The U.S. Census Bureau estimates that in the U.S., the number of people age 65 years and over will increase by 30% between 2012 and 2020. This is expected to drive demand for healthcare services, including drugs and medical devices as well as the companies that provide these services.

An aging population will also drive healthcare demand in large developing countries such as China. Moreover, demand in these markets will also benefit from increased per capita spending as their populations insist on better quality care. In August 2015, China unveiled plans to roll out medical insurance to cover all critical illnesses for its population of 1.4 billion by year-end. China drug spending is expected to grow by nearly 8% per year through 2020, and according to McKinsey & Co., China’s overall healthcare spending will nearly triple to $1 trillion by 2020, up from $357 billion in 2011. Greater spending suggests greater volumes of healthcare consumption, but there will also be a “trade up” from drugs and devices that are locally-sourced or generic to best-in-class patented drugs and devices sold by the leading global pharmaceutical and device companies. We expect a select group of pharmaceutical, biotech and medical device companies to be beneficiaries of these spending trends. We also favor companies with strong balance sheets and healthy dividend coverage.

These companies should benefit from investor demand for sustainable income streams as well as their ability to make accretive acquisitions. Although we are mindful of the increased attention being placed on drug pricing in the U.S., we believe that those companies with healthy research and development budgets that can demonstrate genuine superiority for their drugs will see relatively minimal impact from pricing pressures.

Financials

Certain financial companies, including real estate-related companies, should benefit from the continuation of the low interest rate environment and the easy access to financing as capital from around the world seeks higher returns. Major real estate markets such as New York, London and Toronto to name a few, continue to attract foreign investors shifting assets from weaker economies to stronger ones. In addition, those businesses that have generated strong profits in recent years despite a falling interest rate environment, such as the banks, should become more attractive investments due to net interest margin improvement following future Federal Reserve rate increases. In addition, these institutions should see lower legal costs after years of intense regulatory scrutiny.

Improving Global Consumer

The decline in oil and natural gas prices is lowering fuel and heating bills for most consumers around the globe, putting more discretionary income in their pockets. At the same time, manufacturers and the producers of consumer products are benefitting from lower input costs as energy can be a significant component of cost of goods sold. The consumer staples companies in particular are well positioned to benefit in an environment of rising uncertainty and low inflation. Because they sell the products we consume every day, their sales tend to be very resilient, and their sizeable and growing dividend yields offer an attractive alternative to the low returns offered by fixed income securities.

Although we see opportunities for consumer companies with a domestic focus, our research is also focused on those businesses positioned to benefit from long-term growth in consumer spending in developing markets. China in particular has seen a surge in its middle class over the past decade. According to Pew Research Center, the share of Chinese who are middle income jumped from 3% to 18% from 2001 to 2011. Today, Chinese whose incomes are described as middle, upper-middle or high-income represent well over 20% of the population, or close to 300 million people – approximately the size of the entire U.S. population. As China continues to rebalance its economy from exports and infrastructure investment to consumer spending, we expect consumer demand to continue to grow, benefitting those multinational businesses with strong brands which have positioned themselves well in that market.

As the United States heads into an election year, the fiscal policy discussions will become more active as each party defines its platform for the United States. Around the world, opposition parties have fared quite well in recent local and national elections as populations express their frustration with the austerity policies of incumbent parties. These leadership changes could have a profound impact on the economic policies implemented in 2016. With slow growth and deflationary pressures, we expect markets to ascribe greater value to those companies with the best industry demand tailwinds and internal growth drivers. This is a secular trend, and strongly suggests a continuation of a low interest rate, low inflation rate and slow growth environment for the foreseeable future.

We wish our clients and friends a safe, healthy and happy holiday season and a prosperous New Year. We thank you for the trust you place in us every day, and assure you that we are committed to providing the highest level of investment management service to help you achieve your goals.