The global economy is undergoing an adjustment process that has increased market volatility while presenting specific investment opportunities for investors who understand the complexity of today’s paradigm shift. There is a lack of pricing power, and in certain industries there are deflationary forces resulting from surplus capacity, aging demographics, excessive borrowings and rapid technological advances. Therefore it is important to have an understanding of the subtle impacts that pricing changes will have on corporate profits and to identify industries and companies that are positioned to prosper in this environment. A focus of our team in 2015 is to target investments in companies that can maintain or even improve profit margins. Importantly, companies that can improve profitability in a world of increasing pricing pressures should command premium valuations in the market, and those shares should be purchased on any market pullbacks.

Against this backdrop, the U.S. is and should continue to be the standout economy as evidenced by the strength of the U.S. dollar. The stronger dollar is enabling the U.S. to import goods at lower prices which, in turn, translates into a rise in real purchasing power for consumers. According to Visa, the U.S. fuel price decline since last June amounts to approximately $60 per month for the average consumer. The typical consumer saves about 50% or $30 per month, pays down debt with 25% and spends approximately 25%. These statistics on fuel savings would indicate an outlook for continued, gradual consumer repair in the U.S. We currently favor undervalued companies whose earnings are primarily domestically driven as well as multinationals with above-average growth potential to offset the impact of foreign exchange headwinds on earnings. While we still favor companies with stable and growing dividends, our focus is on finding companies that can demonstrate solid profitability in an economy that will prove somewhat more challenging for corporate profits overall. The strong dollar is also making exports more expensive and less competitive fostering the need for further technology investments in order to lower costs. Under these conditions, technology companies should continue to benefit from the need for businesses to improve productivity and efficiency. Additionally, equity markets in Europe and Japan are benefiting from the aggressive monetary policies of the European Central Bank (ECB) and the Bank of Japan (BOJ) to offset deflationary pressures and inflate assets in an attempt to promote growth.

Specific examples of sectors that benefit from our Outlook include:

In this Outlook we will discuss the ramifications of the adjustment process underway in the global economic system, describe the complex geopolitical forces at work in the Middle East, address the impact of technological change on our lives, and we close with the key investment considerations affecting our investment decisions in 2015.

Adjusting to Rapid Economic Change

“The extraordinary monetary policy accommodation that the Federal Reserve has undertaken in response to the crisis has contributed importantly to the economic recovery, though the recovery has taken longer than we expected … But a smooth path upward in the federal funds rate will almost certainly not be realized, because, inevitably, the economy will encounter shocks—shocks like the unexpected decline in the price of oil, or geopolitical developments that may have major budgetary and confidence implications, or a burst of greater productivity growth, as the Fed dealt with in the mid-1990s.”

– Stanley Fisher, Federal Reserve Vice Chairman, March 23, 2015

The global economy has entered a period of adjustment resulting from the rapid changes in currencies, oil prices, interest rates and central bank policies which will take time to work through the system. The economic

imbalances have been best exemplified by the rapid rise of the U.S. dollar and the sharp decline in oil prices since last June. On a global trading basis, currency moves make imports and exports either more or less expensive. In this case, a stronger dollar makes imports into the United States less expensive and exports more expensive. For the U.S., the stronger currency means that our $2.9 trillion of imported goods cost less which will benefit consumers’ spending power. This is an important dynamic for the U.S. economy which is 70% consumer driven, and when combined with lower gasoline prices, increases discretionary income and purchasing power. The lower import prices also enhance the purchasing power of those living on a fixed income in a near-zero interest rate environment. For Europe, the weaker Euro makes its exports more competitive providing a much needed boost for the Eurozone. China, whose currency is tied to a rising U.S. dollar making its exports more expensive, is becoming less competitive at a time when it needs to increase exports to slow its decline in GDP growth to a more manageable level. If the U.S. dollar remains strong, China may find it necessary to devalue its currency to support its exports. A strong dollar also has important implications for the global bond market as there is more than $9.2 trillion of dollar-denominated debt held by foreigners. As the dollar has appreciated against other currencies, the cost of servicing dollar-denominated debt has become more difficult to manage. Since many of these holders were already experiencing economic difficulties and capital outflows, the higher cost of debt has increased economic stress and pushed more capital to the U.S. and other strong economies.

“The U.S. is recovering faster than many have expected, which would make it the No.1 engine of growth for the global economy.”

– China Investment Corp. Chairman Ding Xuedong discussing increasing U.S. investment this year

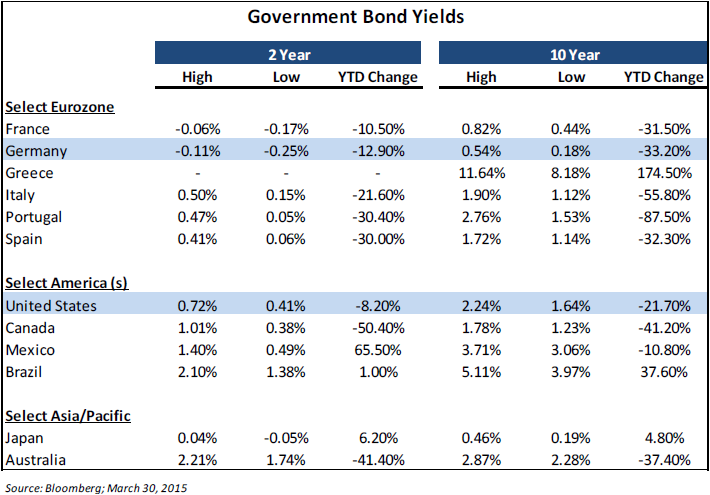

The U.S. is now the engine for growth in the global economy, and it is essential for the nation to maintain growth even at a slower rate given the fragility of the global system. This translates into the need for the Federal Reserve to continue a highly accommodative monetary policy for the foreseeable future. One of the challenges facing leaders is to implement monetary and fiscal policy changes while the global economy is in the midst of this adjustment process. In a speech on March 27th Federal Reserve Chair Janet Yellen stated that, “even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.” Ms. Yellen is clearly concerned that the global recovery remains fragile and the risk of the U.S. acting too early is greater than acting a little too late. We are experiencing interest rate adjustments as the nearly 1.8 percentage point spread between the German 10-year bund and the U.S. 10-year treasury demonstrates in the chart above. In a yield-starved world, investors can earn approximately 9 times more income by shifting from bunds to treasuries which would tend to attract more capital to the U.S. Furthermore, over 16% of government debt globally currently carries a negative yield. The major implication is that an increase in rates by the Federal Reserve will tend to attract foreign flows to the U.S. and these capital flows should act to suppress the rate increases, if not actually promote lower rates and a still stronger dollar. It is for this reason that we hold to our conviction that the overall level of interest rates in the U.S. will remain low for the foreseeable future. A prolonged period of low interest rates will extend this business cycle which should result in higher corporate earnings over time.

Growing Conflict in the Middle East

A growing geopolitical risk to the economic outlook is the increasing conflict in the Middle East. The complexity of the problem cannot be overstated. After the Arab Spring, these nations were left without the proper institutional structures to effectively govern, and therefore tribal structures are now filling the leadership void. Religious, political and sectarian hostilities built up over a millennium have reached a boiling point and have entered a military stage of conflict among the major regional powers. Suffice it to say, the Iranians view this as an opportunity to realize their long-term aspirations to become a hegemon in the region. ISIS, a Sunni-group, has secured significant territory in Iraq and has acted as a magnet drawing Iran, a Shiite-group, into the power struggle. A potential shift of control in Iraq and Yemen by the Iranians acting by proxy is altering the balance of power in the region and has major implications for the global oil market. The Iranian-supported actions in Yemen, which have toppled the government, have forced Saudi Arabia to take military action to protect its porous 1700 mile border with Yemen. With a Gross Domestic Product of only $36 billion in 2013, Yemen is one of the poorest and most economically underdeveloped nations, but is strategically

important bordering on the Red Sea and the Gulf of Aden which are transport routes accounting for 8% of global trade and 4% of global oil transport. In previous Outlooks, we discussed the potential for higher oil prices resulting from an upset in the Middle East. At this time, the effect on oil prices is unpredictable and will depend on the duration and severity of the conflict.

This is occurring as Russia continues its aggressive actions toward its neighbors with no signs that economic sanctions have thwarted Mr. Putin’s desire to reassert Russian control and influence. In a recent op-ed article in a Danish newspaper, Russia’s ambassador threatened Denmark with nuclear action if it signed up for the NATO missile defense program. “If it happens, then Danish warships will be targets for Russia’s nuclear weapons. Denmark will be part of the threat to Russia,” said Ambassador Mikhail Vanin. The increasing aggressiveness of nations and terrorist groups are making national security and defense spending higher priorities for most governments even while budgets are under intense pressure. This comes at a time when governments are attempting to reduce debt and deficits, and struggling to create the growth required to satisfy their people and avoid social unrest.

Technological Advances Are Being Felt Everywhere

In this Outlook, we also highlight one of the major investment themes for client portfolios. The rate of technological change continues to be disruptive for many industries as old leaders are forced to reinvent themselves or lose position, while new leaders experience rapid growth in market share and market capitalization. “And so what we want to do at Apple, that’s our objective, we want to change the way you live your life,” said CEO Tim Cook, at the Goldman Sachs Conference discussing the potential for the Apple Watch. Industries disrupted by companies such as Apple and Google include computer, music, mobile phone, laptop, publishing and advertising, with the TV and watch industries now in various stages of disruption. Technology companies increasingly benefit from global consumers’ thirst for instant information and need for greater mobility and connectivity. Greater connectivity is being driven by the improvements in the functionality of mobile devices, expanded global coverage, and increased options for smartphones, tablets and computers. The availability of 3G and 4G mobile networks is making it possible to access and store unprecedented volumes of data at faster speeds, and companies now are working on the next generation of 5G technologies.

“The numbers tell one part of the story. There are currently almost 7 billion mobile phone subscriptions globally, or one for every person on Earth. More than a third of these are smartphone subscriptions. Global smartphone sales are expected to have grown 18 percent in 2014, led by big emerging markets such as China, India, and Indonesia, as average unit prices fall. Mobile Internet penetration worldwide has doubled from 18 percent in 2011 to 36 percent today; by 2017, mobile access will exceed fixed-line access, with 54 percent penetration compared with 51 percent. At that point, mobile will account for almost 60 percent of all spending on Internet access.”

– Excerpt from a recent Boston Consulting Group report of growth of global mobile internet economy

From the introduction of the iPod in October 2001 to this year’s introduction of the Apple Watch to research on self-driving cars and connected homes, technology continues to change the way we live and work. For an aging global population, technology is also changing many aspects of the healthcare industry from diagnosis to treatment and delivery. Client portfolios are represented in many of the leading technology, healthcare, pharmaceutical and consumer companies that are the primary beneficiaries of these changes. Conversely, the telecom industry among others is experiencing powerful deflationary pressures with consumers increasingly wanting more services and paying less as companies compete with each other to lower prices to maintain and increase market share. At the same time, businesses are consuming greater amounts of data each day and need to store, retrieve and manipulate far more data than before. The beneficiaries of these trends are content providers, data storage and cloud-computing companies, semiconductors and semiconductor manufacturers, and those that make amplifiers and filters that allow data to be transmitted without interference. These devices are changing the way we live and conduct business, and therefore portfolio strategy should reflect such shifts in information and mobile technology.

Key Considerations for Investment Strategy

“In other words, just because we removed the word “patient” from the statement doesn’t mean we are going to be impatient. Moreover, even after the initial increase in the target funds rate, our policy is likely to remain highly accommodative to support continued progress toward our objectives of maximum employment and 2 percent inflation.”

– Janet Yellen, Chairwoman of the Federal Reserve

Emerging from the financial crisis, the global system needed to reduce debt or deleverage. Unfortunately the global economy has not been growing fast enough to outpace the cost of debt servicing and deleveraging. To make matters worse, global debt has grown by an estimated $57 trillion to approximately $199 trillion (or 286% of global GDP) since 2007 according to a report by the McKinsey Global Institute. Global central banks, including the Federal Reserve, the ECB and BOJ as well as the People’s Bank of China (PBOC), have been aggressively fighting the deflationary forces and buying time, but monetary policy alone has not been enough. If the growth problem just required low interest rates and monetary stimulus, then the problem would already be solved. But the problem is structural in nature and requires fiscal policy to augment the monetary actions to increase demand, reduce unemployment and stimulate growth. Significant changes to fiscal policy are required to support Central Bank initiatives and address the structural impediments to growth. The combination of the economic and geopolitical dynamics discussed above strongly suggests a continuation of low interest rates, low inflation and low growth for the foreseeable future.

Core to our investment Outlook are the following six key considerations for investors in 2015: