“The major powers have yet to undertake globally cooperative responses to the new and increasingly grave challenges to human well-being – environmental, climatic, socioeconomic, nutritional, or demographic. And without basic geopolitical stability, any effort to achieve the necessary global cooperation will falter… As China’s influence grows and as other emerging powers – Russia, India or Brazil for example – compete with each other for resources, security, and economic advantage, the potential for miscalculation and conflict increases.”

– Zbigniew Brzezinski – excerpt from “Strategic Vision”

The annexation of Crimea by Russia and the potential for change for other former Soviet Union Republics, particularly those with heavy minority Russian populations, has sparked the potential rise of separatism. The interconnectivity and interdependency of Russia and Europe present a difficult challenge for world leaders and institutions including the IMF, the United Nations, the G-8 and G-20 in dealing with the immediate and long-term consequences. Concurrently, China’s economic slowdown and emerging financial weaknesses driven by the country’s bad debts are also weighing on the global markets. As China reorients its economy to a more domestically-driven one, it is also facing critical water and air pollution issues which have become existential problems. Elsewhere in the world, many other emerging nations are facing higher inflation and slower growth. Additionally there is an ongoing battle for control of Syria as well as the lack of political, economic and social institutions in many Middle Eastern nations which are continuing a pattern of ongoing instability. These unfolding events continue to significantly influence currencies, global growth, capital flows, immigration, trade and global energy policy. In light of these dynamics, the United States is arguably better positioned in many ways for a prolonged period of growth than it has been at any time in the last 50 years.

The United States is in the midst of a multi-year economic and industrial expansion which we believe is not being fully recognized. This business cycle differs from previous ones and is attributable in large part to our growing energy independence which has led to the revitalization of the manufacturing sector.

- Historically low inflation levels

- The continuation of the low interest rate environment driven by highly accommodative monetary policy

- Improving balance of payments through a declining energy trade deficit and improving manufacturing revenues

- Technology advances driven by the U.S. innovation edge

- Improving Federal and State finances supported by rising tax receipts

- Stronger consumer confidence

Seizing the U.S. Moment

A critical element of our investment process is defining the global environment in which businesses operate and identifying key trends driving investment capital. For much of the last decade, the biggest beneficiaries of global capital flows were the BRIC economies led by China. In recent quarters, there has been a significant reversal of flows from these and other emerging economies into the U.S. and Europe as slowing emerging market growth, rising inflation and economic uncertainty have driven investors to seek safer havens. As highlighted in our December 2013 Outlook, ARS believes that the United States is currently the best-positioned economy among the major economies. It was among the first to enter the recession and the first to recover. Often overlooked in the discussions about the relative merits of the U.S. economy are the depth of our capital markets, the quality and dependability of our institutional systems and the commitment to the Rule of Law. In conversations with clients, the status of the U.S. Dollar as a reserve currency is sometimes called into question. However, it is fundamental that the strength of a currency is a product of an economy’s ability to produce. Consequently, the reemergence of the power of the U.S. industrial base underpins the reserve status of the U.S. Dollar. (Look no further than the Sterling’s loss of currency reserve status after the fall of the British Empire). At this time, the U.S. should continue to attract capital to many areas of the economy, in particular, industrial, energy and technology companies as well as other beneficiaries which include health care, financials and consumer discretionary companies.

The U.S. industrial sector is in a multi-year expansion, infrastructure rebuild and investment cycle as many neglected needs are no longer postponable. The energy renaissance currently underway is nothing less than a game-changer. A cyclical recovery in key industries combined with important secular trends is stimulating a U.S. industrial resurgence. Pent up demand in autos, residential and non-residential construction is supporting a gradual recovery in those industries. For the longer term, U.S. industry is benefitting from the availability of lower-cost energy and the renewed cost advantage of domestic production. The following will detail the infrastructure and industrial needs, the dynamics of the energy renaissance and the advantaged position for U.S. corporations to make the investments necessary to drive this growth opportunity.

Infrastructure and Industrial Needs

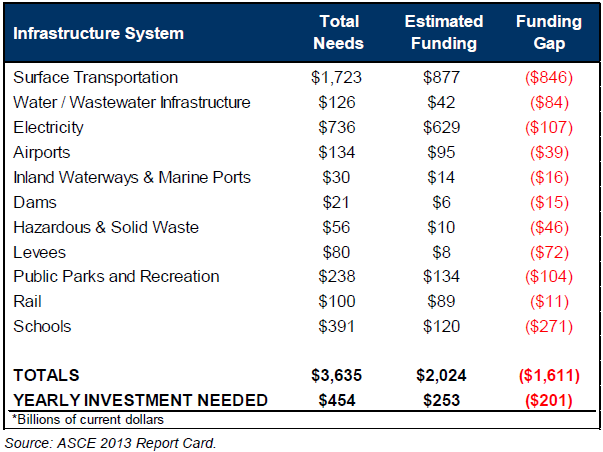

The need for adequate infrastructure investment is a topic about which we have written for many years as it is critical in meeting our societal needs as well as in maintaining our competitiveness in an increasingly global economy. Every four years the American Society of Civil Engineers (ASCE) releases its updated report on the status of the U.S. infrastructure, and once again it is clear how far behind the U.S. has fallen on critical investments in areas including roads, bridges, rails, power generation and transit. The most recent report determined that the cost to bring our infrastructure to a state of good repair has risen from $1.3 trillion in 2001 to $2.2 trillion in 2009 and to $3.6 trillion in 2013. The report further details that current committed and funded budgets leave a shortfall of $1.6 trillion out of the $3.6 trillion needed to be spent. A lack of allocated funds continues to hold back adequate investment in infrastructure; however, these investments have been postponed for too long and now need to be addressed. There is increasing focus and dialogue in Washington as to how infrastructure investment should be funded while at the same time struggling with the federal deficit and future entitlement obligations. In the past, the U.S. relied heavily on federal, state and local government spending, but now corporations are an increasingly important source of funding for these projects. Corporations are sitting with record overseas cash balances which, because of our outdated tax code, are stranded in the face of these accumulating needs. Under current tax policy, these funds are being used to create foreign jobs and take advantage of non-U.S. investment opportunities, often with foreign-born U.S. educated graduate students to the great detriment of the United States.

The ASCE report also highlights that the continued neglect of the U.S. infrastructure will cost U.S. businesses an estimated $1.2 trillion between now and 2020 through lost productivity and waste. For example, the railroad system, which transports 43% of the nation’s intercity freight and about 33% of exports, is one area of need which is highlighted. The U.S. rail network is made up of more than 160,000 miles of track, 76,000 rail bridges, and 800 tunnels across the nation used for moving freight and passengers. While the railroads have increased investment over the past twenty years, the needs of a changing U.S. economy are not being met and will require significantly more investment. The Association of American Rail Cars reported that major railroads delivered 9,300 carloads of crude oil in 2008 and this has grown to 434,000 carloads of crude oil in 2013. Moreover, the growth of our energy sector has resulted in the requirement to upgrade the safety of railroad cars used to transport oil as the result of several accidents transporting oil. New standards from the Department of Transportation (DOT) will require almost 80,000 railcars to be retrofitted or replaced. Recently, the Burlington Northern Railroad, which is owned by Warren Buffett’s Berkshire Hathaway, ordered 5,000 tank cars at an estimated cost of more than $500 million; while the industry backlog for these railcars now extends into 2016.

Energy Renaissance

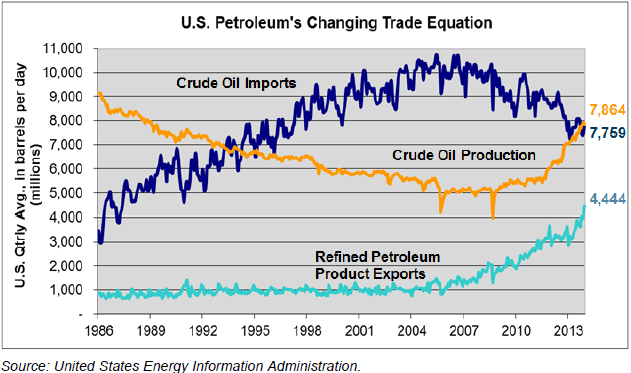

Since the 1970’s, the U.S. has had a growing dependency on foreign oil to meet its energy needs, which has had several negative implications for the country. Now a shift is underway to rapidly move the U.S. towards energy independence. The renewed vitality of this industry is being made possible by new technologies for extracting oil and gas from basins such as the Eagle Ford, Marcellus, Permian, Bakkan and Niobrarra. Geologists have known about the presence of additional hydrocarbons in these basins for decades but have only recently been able to access them economically. The result has been a surge in U.S. oil and gas production -from 5 million barrels of crude oil and 7 billion cubic feet of gas per day in 2007 to over 8 million barrels and 8.8 billion cubic feet per day today. The revitalization of this sector is having a profoundly positive impact on the United States. The increase in domestic production has reduced our need for imports and improved the U.S. balance of trade. The rise in domestic production has also led to lower prices for energy, giving domestic manufacturers a critical cost advantage over their international competitors (with natural gas costs of less than $5 per mcf at home compared with prices of $9 to as high as $18 per mcf in Europe and Asia). This cost advantage has led companies with high energy input costs to invest in new production plants in the U.S., particularly in the manufacturing and chemical industries. According to a report released recently at the IHS World Petro-chemicals conference in Houston, the energy-intensive manufacturing sectors added over 196,000 U.S. jobs between 2010 and 2012 due in large part to the energy renaissance.

At the same time that U.S. manufacturers are enjoying lower energy costs, rising wage inflation in China has reduced the labor cost advantage of relocating production there, which is significantly reducing and in some cases reversing the trend of offshoring. Corporations are planning on building an additional 48 factories and plant expansions at a cost of more than $100 billion as a result of the natural gas boom in the U.S. In addition, IHS Chemical estimates that $125 billion in petrochemical investments related to U.S. shale gas have been announced to date with additional announcements likely to come. Foreign direct investment in U.S. manufacturing is on the rise. As an example BASF, one of Germany’s most important industrial companies, is in the process of moving some of its operations to the United States from Germany. As European nations come to grips with the harsh reality that they must reduce their reliance on Russia as the primary source of natural gas, there have been calls for Europe and the U.S. to form a long-term energy trade relationship. While it will take time for exported energy to make a large impact on Europe, formalizing such a relationship is hard to reverse and sends an important message to Russia.

Corporate Profits and Capital Expenditure Growth

“CEO expectations for overall economic growth are well below our economy’s potential. This underscores why the Roundtable put forward a clear, simple economic growth strategy earlier this year. It starts with the idea that increased private-sector capital investment is the critical foundation for economic growth, and its key planks are fiscal stability, business tax reform, expanded trade and immigration reform. These issues have broad support, they are critical to driving job growth and we urge Congress to act on them this year.”

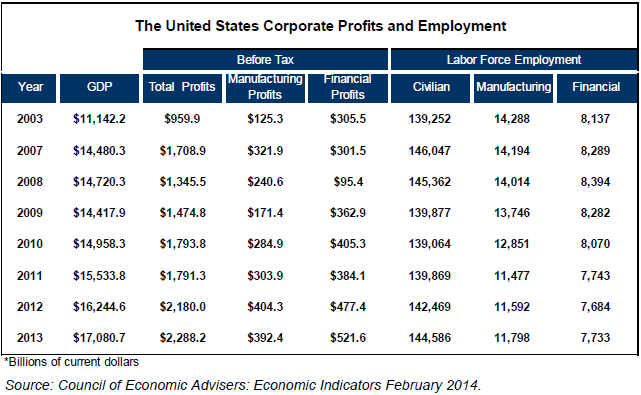

– Randall L. Stephenson, Chairman of the Business Roundtable and CEO of ATT Inc. We expect U.S. corporate profits to continue to increase over the next several years. As highlighted in the chart, pre-tax profits have risen from nearly $960 billion in 2003 to just shy of $1.35 trillion in 2008 to over $2.2 trillion today. In past Outlooks, we have discussed the manufacturing renaissance that is taking place as evidenced by manufacturing pre-tax profits having doubled from $171 billion in 2009 to $392 billion in 2013. With interest rates remaining at low levels, U.S. corporations have been able to refinance debt at reduced costs allowing

companies to repurchase stock, reinvest in their businesses and bring cost savings to the bottom line. Unfortunately for the unemployed, employment growth has substantially lagged the growth in corporate profits as companies are benefiting from

technology-driven productivity gains.

However, there are encouraging signs as corporate profits hit record levels and projections for capital expenditures are forecast to reach record levels of over $2 trillion this year. The move to increase capital expenditures may last several years reflecting the continued recovery and more positive outlook of many businesses. One area in which this can be seen is in the energy sector as international capital expenditures for exploration and production are expected to reach a record $524 billion this year – a 6.5% increase from 2013. U.S. oil and gas businesses are planning to increase spending by 5.2% in 2014 to $338 billion.

The Business Roundtable’s CEO Economic Outlook survey of over 122 CEO’s of leading corporations projects increases in sales, capital expenditures and hiring over the next six months. Seventy-two percent of chief executives participating in the most recent survey anticipate that sales will increase in the next six months, while forty-eight percent forecast higher capital expenditures. Interestingly, 56% of executives said “they would invest and hire more if Congress and the Administration were to cooperate on corporate tax and immigration reform and move forward on free trade agreements with the European Union and Pacific nations.”

Thoughts on Federal Reserve and European Central Bank Monetary Policies

“The Committee continues to anticipate, based on its assessment of these factors, that it likely will be appropriate to maintain the current target range for the federal funds rate for a considerable time after the asset purchase program ends, especially if projected inflation continues to run below the Committee’s 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored.”

“When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.”

– Excerpts from the Federal Reserve March 19, 2014 Press Release

There were a few key points worth noting about the most recent Federal Open Market Committee meeting and the first press conference of Janet Yellen as Chair of the Federal Reserve. The Committee judged the economy to be showing sufficient underlying strength to support improvement in labor market conditions but remained concerned about the ongoing challenges particularly for the long-term unemployed. The Committee expressed the view that winter weather conditions had an adverse effect on economic activity. We note that the release of pent up demand will have a positive impact on second, and possibly third quarter growth. Notwithstanding the weather effect, the FOMC decided to make a further measured $10 billion reduction in the pace of its monthly asset purchases. In a statement that surprised the market, Chair Yellen also suggested that the first rate hike could take place within six months after the bank ends its bond-buying program, which would mean that the first rate hike could occur as early as the spring of 2015 which was sooner than anticipated. We expect short-term rates to stay low for longer than that timeframe based on our outlook for employment and inflation. In changing its forward guidance, the FOMC adopted a more qualitative set of considerations rather than the quantitative measurement of a 6.5% unemployment rate target, because it had become too narrow a measure of true labor market conditions. The Federal Reserve emphasized that the need for the continuation of the current low-rate environment will be warranted for a period well beyond a set unemployment rate level reflecting the decline in the labor force participation rate which is proving to be a distinct challenge for the recovery of the labor market.

As we have written since 2008, ARS expected that excess capacity in the domestic and global economy constituted a deflationary risk for the developed economies which would necessarily encourage the Federal Reserve and the European Central Bank (ECB) to maintain highly accommodative policies for a considerable period of time. The ECB has been fighting deflationary pressures with one arm tied behind its back as Germany was not supportive of a quantitative easing program due to its historical experience

with inflation. However, just recently Germany has become supportive of a bond buying program (QE) by the ECB. The timing is noteworthy in view of the fact that Germany is a major trading partner of Russia, and economic sanctions will inevitably slow Germany’s growth as it is a highly export-driven economy. The EU nations have significant trading relations with Russia, and we expect the Russian economy to contract under these circumstances putting further pressure on the ECB to be more accommodative in the near term.

Investment Implications

The United States is in a prolonged economic expansion, and the positive dynamics of the U.S. economy should remain in place for several years. At this time, the U.S. should continue to attract capital to several areas of the economy, in particular, industrial, energy, technology, health care, financial and consumer-discretionary companies. The particularly harsh winter, highlighted by heavy snow and below average temperatures in much of the country combined with drought conditions in the West, had an impact on the economy in the first quarter. Consequently, many industries should see a pickup in demand in the coming quarters. We share Ms. Yellen’s concerns for the slow pace of employment growth, particularly for the long-term unemployed. We anticipate a continuation of the low interest rate and low inflation environment in place since 2008. Given the Federal Reserve’s statement about maintaining the target federal funds rate below normal levels for some time, we see a favorable longer-term environment for equity investing as rates will more likely rise slowly as the Federal Reserve becomes less accommodative and the economy grows.

Because of this Outlook, ARS has been transitioning equity portfolios by adding companies with more U.S.-centric businesses, while reducing or eliminating positions in companies with a high percentage of foreign revenues which could be adversely impacted by geopolitical events as well as the stresses in the emerging economies. ARS portfolios include several key beneficiaries of the U.S. Industrial Renaissance from across the supply chain. Beginning at the energy production level, we have been focused on low-cost producers in the most prolific U.S. basins with strong management teams and significant organic production growth potential. ARS energy investments also have healthy balance sheets, minimal reliance on the capital markets and trade at significant discounts to their Net Asset Values. Once oil and gas has been extracted from the ground, it needs to be safely transported to refiners who can convert the raw hydrocarbons into finished products, such as fuel and heating oil. The

preferred method of transportation is by pipeline, and ARS investments with pipeline exposure enjoy both stable sources of cash flow as well as billions of dollars in growth projects over the next several years as new pipelines are constructed to connect our new oil and gas production to the nation’s refiners and end markets.

ARS also sees attractive opportunities in the refiners themselves. With the growth in U.S.-based oil production, West Texas Intermediate (“WTI”) crude oil that once traded at parity to internationally-sourced Brent crude oil now trades at a significant discount. As a result, U.S. refiners are able to purchase their raw materials (oil) at a discount to their global competitors and enjoy a significant cost advantage and thus higher margins. The U.S.refiners trade at low valuations relative to their earnings and cash flow reflecting the historical cyclicality of this sector, but we believe that these valuations do not adequately reflect the secular cost advantage that we expect these refiners to capture in the coming years. The growth in U.S. oil and gas supply has brought with it an increased need for the companies that service the producers. These energy service companies are essentially technology companies, dedicated to helping their clients extract the greatest level of production at the lowest possible cost. We have identified leaders in this field with earnings growth prospects significantly in excess of the broader market but that trade at comparable or discounted valuations.

The U.S. Industrial Renaissance also means growth in the transport of goods. The Railroads are benefiting from growing shipments of construction and auto supplies, grains and other commodities as well as the increased need for intermodal shipments (i.e., shipments across both highway and rail), and even the shipment of crude oil by rail as oil supply exceeds pipeline capacity. Railroads are among the most energy-efficient means of transport, capable of moving a ton of freight nearly 450 miles on a single gallon of fuel. They also enjoy high barriers-to-entry (imagine the difficulty of starting a new railroad today) and importantly, attractive valuations on a price-to-earnings, price-to-cash-flow and dividend yield basis. Lastly, ARS portfolios include the beneficiaries of the need to upgrade the U.S. infrastructure, including companies that supply crucial parts and services required for upgrading the U.S. electrical grid and transmission assets.

Our world is characterized by rapid change and increased uncertainty. It is during times like these that our investment team draws on its decades of experience and knowledge as well as the investment principles that are the foundation of our investment process. As always, ARS investments must stand on their own two feet, with strong management teams, high barriers-to-entry and enduring cost advantages, strong balance sheets and market valuations that we calculate are at discounts to fair value. Client portfolios are positioned with the potential downside risks in mind, while being able to participate in the opportunities in businesses which are at the forefront of the industrial, energy, technology and health care changes.