“Making monetary policy is sometimes compared to driving a car, with policymakers pressing on the accelerator or the brakes, depending on whether the economy needs to be sped up or slowed down at that moment. That analogy is imperfect, however, for at least two reasons. First, the main effects of monetary policy actions on the economy are not felt immediately but instead play out over quarters or even years. Hence, unlike the driver of a car, monetary policymakers cannot simply respond to what lies immediately in front of them but must try to look well ahead–admittedly, a difficult task. Second, the effects of monetary policy on the economy today depend importantly not only on current policy actions, but also on the public’s expectations of how policy will evolve. The automotive analogy clearly breaks down here, for it is as if the current speed of the car depended on what the car itself expects the driver to do in the future.”

– Federal Reserve Chairman Ben Bernanke 11/19/13

“There is no widely accepted reason why inflation is running as low as it is in the face of extraordinary accommodative policy from the Fed. We don’t have a good story as to why this is…you would have expected to see more inflation by this point. We haven’t seen it. That’s what makes me worried more than anything.” Federal Reserve Bank of St. Louis President James Bullard 12/8/13

In recent months, investors have been heavily focused on the impact of the Federal Reserve’s “tapering” on the economy and markets. Tapering refers to a reduction in the Federal Reserve’s program of monthly purchases of $85 billion of treasuries and mortgage bonds using newly-created money. This program has been carried out in recent years in an effort to drive bond prices higher and interest rates lower to stimulate asset prices and lending. We believe that the market’s focus on tapering is misplaced and that the more important aspect of monetary policy is the continuation of the Fed’s low short-term interest rate policy for a prolonged period.

While mindful of the potential for future inflationary conditions, the Federal Reserve remains focused on the more immediate threat of deflation described in our last Outlook. The three major deflationary forces restraining growth in the US are persistent unemployment and the mismatch between labor force skills and available jobs, wage stagnation issues and continued consumer deleveraging. With recent developments in state and local government pension plan policy, we can add a fourth deflationary force which is the potential reduction in public sector pension obligations to its beneficiaries. The $407 billion reduction of the federal deficit from 2012-2013 is yet another deflationary force as it results from higher taxes and lower spending.

As the minutes of recent meetings suggest, the Federal Reserve believes that maintaining its accommodative policy in the form of low interest rates is essential until economic growth has effectively offset the deflationary forces described above. This was reinforced by the release of the Federal Open Market Committee (FOMC) minutes on December 18th, in which the Committee stated, “that it likely will be appropriate to maintain the current target range for the federal funds rate well past the time that the unemployment rate declines below 6-1/2 percent, especially if projected inflation continues to run below the Committee’s two percent longer-run goal.” As Chairman Bernanke highlights, the effectiveness of these monetary policy initiatives must be evaluated on not just their immediate impact but that of the intermediate to longer term. We believe that the Federal Reserve would view a premature withdrawal from its current highly- accommodative stance as a mistake similar to the monetary policy errors of the United States in the 1930’s and Japan in the 1990’s. The Federal Reserve is concerned about acting on good economic news which may not be sustainable. One might argue that the recent comments from the Federal Reserve’s Bullard reflect concerns about deflationary conditions which are much harder to reverse rather than inflationary ones.

Importantly for equity investors, an enduring low interest rate structure coupled with rising corporate profits is very constructive for equity valuations. Current global economic conditions which foster an environment for continued growth of corporate profits should, in turn, lead to increasing capital expenditures, gradual improvement in employment, and further strength in equity returns relative to other investment choices. Short of an exogenous event, we do not anticipate a recession that would derail the current positive trends in place, supporting equity valuations and further multiple expansion in the coming years. In a fragile, deflation-prone and slow-growth environment, investors should be aware that not every company or sector benefits equally. Security selection rather than market participation will become increasingly important, and the scarcity of businesses with premium growth rates, strong balance sheets and “wide-moat” competitive advantages becomes more highly valued. As detailed in our October 28th Outlook, we remain constructive on the potential for equity returns driven both by rising corporate profits and price-earnings multiple expansion resulting from the distinct characteristics of the prolonged, low-growth business cycle which we are experiencing.

Focus on Interest Rates, Inflation and Corporate Profits

For much of the past two years, market participants have been focused on the political dysfunction in Washington and the timing of the tapering of the bond purchasing program known as quantitative easing. Recent developments out of Washington such as a bipartisan, two-year budget agreement should help to allay one of the major concerns. Since last May when Federal Reserve Chairman Ben Bernanke suggested that the central bank may begin to taper bond purchases, investors have been trying to anticipate the timing, amount and impact of the tapering. Implicit in the market’s focus on tapering is an assumption that quantitative easing has been responsible for the market’s appreciation, and that therefore any tapering would leave the market vulnerable to a decline. While it may be valid to say that quantitative easing helped to kick-start the economy and inflate asset values coming out of the financial crisis, we attribute the recent market appreciation to an improving economic backdrop, combined with low inflation, low interest rates and rising corporate profitability. Moreover, even as tapering begins, it would be a mistake to assume that the Federal Reserve under Mr. Bernanke’s successor Janet Yellen would not immediately reverse itself should the economy begin to falter. We also believe that Ms. Yellen will keep a close eye on 10-year Treasury bond yields and the impact on mortgage rates, and will be sensitive to any actions that might jeopardize the ongoing recovery of employment and the housing market. Federal Reserve Committee members were disturbed by the sharp rise in interest rates that occurred this summer after Mr. Bernanke first suggested the potential to initiate tapering in 2013. The Yellen-led Fed will take pains to make it clear that tapering should not be confused with a near-term increase in benchmark short-term rates.

It is for this reason that we believe that investors should focus more on the interest rate structure, and what we expect to be a continuation of the zero interest rate policy known as ZIRP. While it has been hard for many to comprehend the world of zero interest rates of which we have written about for five years, it may be even harder to accept the idea that the Federal Reserve must attempt to anchor short-term rates near zero to support our slow growth economy for an extended period. Tapering has always been inevitable and is a reflection of a gradually improving economy and the diminishing returns from printing $85 billion a month.

One reason that the fears of tapering may be overdone is that much of these dollars sit in banks as excess reserves rather than flowing through the system in the form of expanded credit.

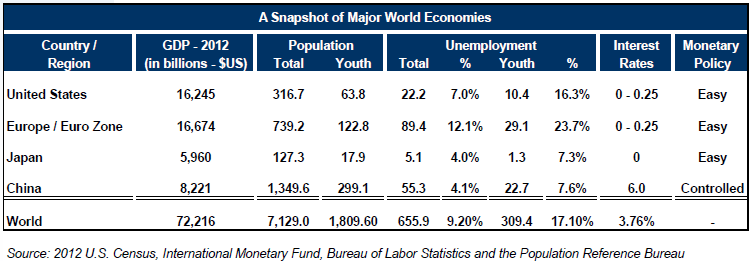

In a world where it is easy to identify concerns, be it the political dysfunction in Washington, tensions in the Middle East, the slowing of China’s economy, unemployment problems or fears of another investment bubble, US corporations continue to produce and innovate every day which has led to a steady increase in corporate pre-tax profits estimated to exceed $2.3 trillion in 2013. The chart above highlights some changes in the key metrics for the US over the past ten years and since the onset of the financial crisis. Looking back on the past five years, one must marvel at the resilience of the United States economy and its businesses. Record profits, fortress balance sheets, historic levels of cash on hand and significant returns of capital through dividends and stock buybacks, all speak to the remarkable economic machine that is the US economy as does the extraordinary increase in energy production in the US which is benefiting US corporations, lowering input costs, rapidly reducing energy imports, raising tax revenues and improving our balance of trade. However, the US has more to do to address the key structural impediments to US growth. While our nation works to address these issues, investors should be careful to not let these challenges mask the many investment opportunities that strong and growing US businesses will offer in the coming months and years. It would not be an understatement that US corporations and their shareholders have been and remain the biggest beneficiary of the interest rate policy decisions of the post-crisis period.

ECB and BOJ Also Fighting Deflationary Challenges With Low Interest Rate Policies

“Underlying price pressures in the euro area are expected to remain subdued over the medium term…At the same time, inflation expectations for the euro area over the medium to long term continue to be firmly anchored in line with our aim of maintaining inflation rates below, but close to, two percent. Such a constellation suggests that we may experience a prolonged period of low inflation…Our monetary policy stance will remain accommodative for as long as necessary…In this context, the Governing Council confirmed its forward guidance that it continues to expect the key ECB interest rates to remain at present or lower levels for an extended period of time. This expectation continues to be based on an overall subdued outlook for inflation extending into the medium term, given the broad-based weakness of the economy and subdued monetary dynamics. We are monitoring developments closely and are ready to consider all available instruments.” President of ECB Mario Draghi 12/5/13

One of the unique characteristics of the post-crisis economy has been the use of unconventional monetary policy by central banks around the globe. For investors, it has been a challenge to try to interpret, anticipate and react to these policies as there is little to no historical precedent for quantitative easing or near-zero interest rates in the developed world.

The aggressive and immediate actions of the Federal Reserve to combat the deflationary forces beginning in 2008 have aided the economy and financial assets, in particular, putting the US ahead of Europe and Japan in getting its economy on the road to recovery. Importantly, the European Central Bank (ECB) and Bank of Japan (BOJ) have joined the Federal Reserve in stating their intention to keep their highly accommodative policies in place for the foreseeable future. The ECB has the challenge of trying to support a multi-national economy that is experiencing a form of internal devaluation stemming from the wage and benefit cuts, job losses and restructuring that is occurring in individual countries in Europe. As shown in the following chart, the unemployment problem that continues and the associated social stresses experienced in a prolonged deleveraging and restructuring process will continue to weigh on economic growth as consumer and government spending remain under pressure. This scenario creates short-term issues as well as longer-term loss of productivity from its youth population, a condition often referred to as “scarring” which can affect a country’s economy and social structure for decades. Against this backdrop, Mr. Draghi feels compelled to assure the markets that he will use all means to allow the region to return to a more normal growth environment.

As a result of the continuation of the highly accommodative monetary policies of the Federal Reserve, the European Central Bank (ECB) and the Bank of Japan, the developed economies are experiencing a synchronized global expansion.

Investment Implications

Due to the unprecedented nature of the post-crisis economic environment, we caution investors not to rely too heavily on historic comparisons in determining future outcomes. We will continue to focus on interest rates, inflation and corporate profits rather than the pacing of tapering to determine the outlook for the equity markets. The conditions heading into 2014 are positive for equity markets as we expect the low inflation and low interest environment to continue for a prolonged period. The outlook for corporate profits continues to be greatly influenced by lower domestic energy costs when compared to overseas economies. We remain constructive on the equity markets and in particular the following themes: America’s industrial and manufacturing resurgence, energy companies and the beneficiaries of the US shale gas development, the evolution of media consumption and the importance of proprietary content, growth in data and mobility, the financial, housing and auto recovery, companies with attractive and growing earnings and dividends, industry disrupters, and companies with special situations or company-specific drivers. While the global economy is in a low-growth mode, the shareholders of those US companies with strong earnings growth should continue to be well-rewarded.

The team at A.R. Schmeidler would like to thank you for the trust you place in us each and every day. We extend our deepest appreciation to all of our clients and offer our warmest wishes for health and happiness for the New Year.