For the past three quarters, ARS has expressed the view that event-driven or general economic concerns were masking several positives in the US and around the world. The global economy has proven to be more resilient than many expected due to several factors including historically low interest rates and inflation rates, aggressive policy actions, and gradual improvement of several important economic indicators in the US (housing, unemployment and consumer confidence) and China (inflation and manufacturing). Further, there even have been signs of changing sentiment towards Europe, which has weighed heavily on the global economy the past few years, as yields in the most economically challenged countries have declined from crisis levels. In recent months, central banks have embarked on a yet more expansive monetary policy at a time when the global business cycle is showing signs of reaccelerating. Unlike previous business cycles where central bank policy was neutral to becoming restrictive as conditions improved, central bank policy is now designed to address the chronic unemployment problem in the developed world which has negatively impacted economic output. There are several positive developments in the world’s second (China) and third (Japan) largest economies which should aid global growth this year. These and other forces discussed in this Outlook have the potential to reverse the multi-year trend of fund flows from equities into fixed income. In recent weeks, two of the world’s most powerful institutions – the US government (the world’s largest borrower) and the Chinese government (the world’s largest lender) – have sent important messages to market participants that will have broad implications for investors in 2013 and beyond. Since the introduction of its zero interest rate policy (ZIRP) and quantitative easing (QE), the Federal Reserve has made it clear that its policies are designed to favor borrowers (governments, corporations and homeowners) by devaluing the massive amounts of debt outstanding, while attempting to inflate asset values. These same policies are negatively impacting lenders (bondholders), especially those living on a fixed income and pension funds that cannot meet their required rates of return. The impact of the Fed policy is not lost on China, nor should it be on other investors. To be more specific, China intends to increase its ownership of non-Chinese corporations by diversifying out of fixed income investments. Since the US and China represent about 34% of global gross domestic product (GDP), the policies implemented and investments made by these two nations impact the rest of the world. With anemic and in some cases negative real rates of return on fixed income and a global economy that continues to grow, we may soon be in the early innings of a rotation of dollars from fixed income to equities. For investors with the ability to differentiate between the headline stories and real economic activity, there are important investment opportunities as the global economy reaccelerates.

Short-Term Concerns Creating Long-term Opportunities

The uncertainty of the past two years had investors shifting out of the equity markets and flooding to the perceived safety of bonds ignoring the fact that many bonds were offering and still provide negative real rates of return (inflation adjusted) over time. Investors have been worried about a range of issues from the US to Europe to China. When pressed about concerns, investors cite one or all of the following topics which are frequently discussed in the media: the US fiscal cliff, the debt and deficit problems of the US and Europe, the slowdown in China in 2010-2011, the 20-year malaise of the Japanese economy and escalating tensions in the Middle East. In 2013, one of the critical issues for investors to monitor will be movements in inflation as it is the low levels that allow developed nations’ central banks to maintain their aggressive monetary policies and for developing economies to focus on fostering growth. Short-term concerns regarding the US have created the very conditions for investors to reallocate to relatively undervalued US equities from bonds. There are several large sources of assets (individuals, pension plans), a portion of which we believe will rotate out of cash or fixed income into equities. In addition to a portion of China’s growing foreign exchange reserves which are being shifted into equity assets, there is in the US approximately $2 trillion of corporate cash, $3 trillion of money fund assets and large amounts of bond maturities coming due in the next several months. Importantly, there is also more than $7 trillion held in FDIC insured accounts and the unlimited FDIC insurance coverage for non-interest bearing transaction accounts ended January 1st. With the aggregate equity market capitalization of the US at approximately $16.6 trillion, a meaningful portion of these assets returning to equity markets in the pursuit of higher real returns as the global economy expands would have a significant impact on common stock prices.

Reflections on US Debt and Deficits

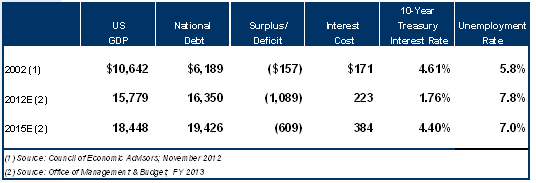

Our analysis of the Office of Management and Budget (OMB) report shows that as long as we are running $1 trillion deficits, the statutory debt limit (also know as the debt ceiling) will need to be raised by at least $1 trillion annually, and that will likely mean a fight in Congress each year unless a long-term deal is struck to reign in the deficits or the annual debt ceiling is eliminated. Unfortunately for Americans, figures from the OMB show debt reaching $19.4 trillion by the end of 2015 with deficits declining from an estimated $1.326 trillion to $609 billion prior to the most recent fiscal cliff agreement. These assumptions do not take into account an increase in the deficits due to the extension of the Bush tax cuts for incomes of less than $400,000 (individuals) or $450,000 (joint). The OMB had previously assumed we will be adding $3 trillion to our national debt. Among the many troubling assumptions had been for interest rates on the debt in 2015 to average 1.9% with the additional $3 trillion issued at approximately 0.50%. As a result of the recent legislation, the deficits will increase further unless there are significant cost reductions agreed to which we will not know until February or March when the Treasury will no longer be able to maneuver around the debt ceiling. In light of recent developments, the analysis of the OMB projections makes it hard to see how many of these assumptions can come to pass.

Changes in Key Economic Figures 2002 – 2012 – 2015

For investors, there are four important implications. First, the solution to the deficit can best be achieved through a meaningful revamping of the receipts (tax reform) and expenditures (addressing entitlements) over the intermediate to long-term to get our fiscal house in order. Second, the Federal Reserve could be forced to attempt to maintain its current interest rate policy to control interest costs for some years. Third, bond investors will be challenged to achieve positive real rates of return in the coming years. Fourth, ownership of businesses, equity investing, offers better relative value and improved prospects for building capital and protecting purchasing power over the longer-term.

The New Playbook for Central Bankers

“Central banks should consider more radical measures – such as commitments to keep rates on hold for extended periods and numerical targets for unemployment – when rates are near zero. If yet further stimulus were required, the policy framework itself would likely have to be changed.” – Mark Carney, the next governor of the Bank of England 12/11/12

“The Committee currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored.”– Statement from the FOMC meeting 12/12/12

“I will direct the energies of my entire cabinet towards implementing bold monetary policy, flexible fiscal policy and a growth strategy that encourages private investment.” – Shinzo Abe, the new prime minister of Japan 12/26/12

With interest rates at historic lows for the foreseeable future and massive quantitative easing (currency creation) being implemented in many developed nations, central bankers are reinforcing the fact that they will do whatever it takes to avoid deflation. Prior to the 2008 financial crisis, managing inflation was the cornerstone of monetary policy as bankers would raise rates to curb inflation and lower rates to stimulate growth and improve employment. The new toolbox for central bankers in developed nations includes greater international cooperation, longer-term currency swap arrangements, zero interest rate policies, unprecedented amounts of currency creation and a rethinking of the policies that have been the norm for decades. Because the developed world is undergoing the largest deleveraging in history with record deficits, austerity policies have required central banks to take it upon themselves to combat deflation and contraction.

From the comments above, it is clear not only that the mindset of central bankers has changed, but there is a willingness to break free from the old methods and to aggressively work to stimulate their respective economies. To date, monetary policy has carried much of the burden as global fiscal policy has not been sufficiently stimulative. At the forefront of unconventional policy is Ben Bernanke of the Federal Reserve who has been the most aggressive in implementing tools including the recent open-ended QE 3 program, and now he is being joined by others such as Mark Carney and Mr. Abe as illustrated by the quotes above. This past July, the ECB’s Mario Draghi made his now famous pledge to do “whatever it takes” to preserve the Euro. In Japan, Mr. Abe is pressuring the Bank of Japan (BOJ) to target a 2% inflation rate from the current 1%, and launch a program of “unlimited” quantitative easing to fight the more than decade-long deflation and to weaken the yen to boost exports. In addition to monetary initiatives, Mr. Abe is planning to introduce large-scale fiscal stimulus. Japan has had 5 recessions in 15 years and now has gross public debt to GDP of 236% with little to show for it. The market has responded in anticipation of proposed actions by Japan as evidenced by the weakening of the yen. The proposals by Mr. Abe also call into question the independence of the BOJ and will be closely watched by others. The actions of the US and Japan may force the ECB and European governments to respond with additional measures as the strengthening of the Euro raises the price of exports and negatively impacts the competitive position of European companies. We are reminded once again of the interconnections and interdependencies in the global economy.

Impact of Global Monetary Policy on China

“With foreign reserves of $3 trillion in hand, we will not sit back and watch the assets depreciate with the third round of quantitative easing. We must inject it into the real economy and make our contribution to global prosperity. An increase in overseas investment by Chinese companies is an inevitable trend.” – Chen Deming, Commerce Minister of China (November 2012)

Although China may be concerned about its contribution to global prosperity, much of the concern stems from its ability to export to the rest of the world as it remains the world’s leading exporter. In order to serve its long-term interests, China will work to secure the resources it needs to meet its goals. While central banks are working on a new playbook, China has developed its own focusing on strategic overseas acquisitions. It is not interested in receiving little short-term return on its fixed income investments and risking significant loss of purchasing power over the longer term. The comment from the Minister of Commerce provides critical insight into the nation’s current plans to reduce its foreign reserves by investing in non-Chinese companies that will support its long-term priorities and achieve a sustainable level of growth. There are several recent examples of this strategy including the China Investment Corporation’s (CIC) acquisition of the 10% stake in the company that owns London’s Heathrow airport. CIC was established in 2007 to invest some of China’s foreign exchange reserves. In perhaps its largest overseas acquisition to date, CNOOC, the China National Offshore Oil Corporation, received approval from the Canadian government to acquire Nexen, a Canadian oil and gas company, for $15 billion. In addition, PetroChina purchased a stake in the Browse liquefied natural gas project in Australia for $1.63 billion. These acquisitions are consistent with the government’s 5-year plan to 2015 which has identified seven strategic emerging industries which serve as a guide for political and economic policies. These are energy conservation and environmental protection, new information technology, biotechnology (medical and agricultural), high-end manufacturing (aviation, rail, smart grid, machinery), renewable and alternative energy, new materials in support of emerging industries and new-energy vehicles.

As the world’s second largest economy and one of the most important contributors to global GDP growth (estimated to be between $420 billion and $560 billion), China has recently announced a once-in-a-decade leadership transition, and we are beginning to see some important areas of focus—reducing corruption and rebalancing its export-dependent economy. At this stage of its industrialization process, China has to carefully balance growth programs (fiscal stimulus) with managing inflation (monetary policy), while working to migrate another 300 million people to cities from farms over the next 20 years which is a key initiative to increase domestic consumption and living standards. Similar to other rapidly-industrializing countries, China experienced several policy missteps in recent years leading to a rapid rise in inflation in 2011, and government officials will be working to avoid a repeat through more effective monetary policy and tighter controls around housing and improved lending standards. China is adjusting to its own version of the “new normal” which means that 10% or greater GDP growth may be a thing of the past, and the new expectation should be in the 5-8% range. The significant decline in inflation from a high of 6.5% last year to around 2% last month has paved the way for a much more positive outlook for 2013.

Investment Implications

During the past 16 months over 325 stimulative policy initiatives have been implemented around the globe, including interest rate reductions, tax rate cuts, lower reserve rate requirements and quantitative easing initiatives. The two key issues that have driven our investment thinking over the past few quarters have been the anticipated improvement of leading economic indicators (driven by these stimulus initiatives and lower inflation) and the massive monetization by central banks. It has been our belief that the combination of these two forces has been underestimated by the markets as the focus of the media continues to be on negative headline issues. ARS research will continue to identify those companies whose businesses are well positioned to increase earnings, free cash flow and assets in an economy that is expected to improve but nevertheless exhibits fits and starts due to the multitude of competing global forces. Our research has identified several companies that we will be adding to portfolios in early 2013. As we wrote in recent investment outlooks, ARS continues to favor the following areas:

Beneficiaries of the Revitalization of Industrial America: A sea change for US industry and corporate America (about which we have written for six months) is underway. Wage increases from overseas competitors, low natural gas prices and, for the first time in many years, increasing oil and natural gas production in the United States are contributing to a resurgence in US manufacturing and its competitiveness. The current low interest rate environment also gives companies access to historically low-cost capital to finance expansion and pursue shareholder-friendly policies such as return of cash through dividends and share buybacks. New technologies such as 3D printing are providing companies with the opportunity to bring elements of manufacturing back home. Apple and Ford have recently announced new US manufacturing initiatives which serve as excellent examples of the opportunities for US companies.

Select Media and Technology Companies: Internet traffic continues to swell and is expected to grow by a factor of four in as many years. Mobility, cloud computing, machine-generated information and internet video are among the underlying drivers of internet use. Data center companies and owners of wireless spectrum will be key beneficiaries as businesses and consumers demand access to data anytime and anywhere. We also see opportunities in the media industry, which we believe is approaching an important inflection point as content companies (producers of original programming), are set to benefit from the emergence of novel distribution outlets. High-quality content owners will benefit from an expanding customer base that can be serviced at negligible incremental costs, positioning them to benefit from the disruptive era in video distribution that is occurring.

Energy and Strategic Resource Opportunities: Equities in this sector rebounded in the third quarter after being hurt by several compounding factors over the past 12 months. ARS believes that many of these factors are temporary in nature, but together they conspired to drive energy company valuations to the lowest levels in a decade when measured by valuations of cash flow and/or reserves, with several companies in ARS’ portfolios trading for less than 4x cash flow from operations. These companies are well-positioned to benefit from a cyclical recovery in the US and the developing world as well as growing secular demand for energy in the developing world and expected increasing US reliance on natural gas in the coming decade. The attractive valuations also make the mid-sized exploration and production companies appealing acquisition candidates to strategic buyers. Importantly, some companies have shifted the emphasis of their capital deployment from purely long-term growth projects to a balance of growth and return of free cash flow to shareholders which we expect to be well received in the coming quarters.

Financials: Several forces have combined to lead us to add financials selectively to portfolios. While US and European banks made headlines with trading losses, fines and regulatory issues in 2012, there continue to be opportunities to buy businesses at attractive valuations of earnings and tangible book value. Several of these investments remain particularly well positioned to benefit from a continued recovery in the US housing sector and improvement of the US economy.

Dividend Growers:With interest rates at historic lows, investors should look to benefit from the attractive dividends currently available from select corporations with strong balance sheets and policies of raising payouts over time. We note that S&P 500 companies have increased dividends each year from $196 billion in 2009 to an estimated $281 billion in 2012 for an increase of 43%. Recent legislation has removed fears of dividend income being taxed at ordinary income rates as the new level will be up to 23.8% depending on the tax bracket.

Beneficiaries of Currency Devaluation: After a period of consolidation, 2013 should be another constructive year for gold prices, as efforts to devalue currencies are ramping up. The recent announcements by Japan to depreciate their currency may trigger another round of currency devaluation, and gold has tended to be a standout performer during such times. The open-ended nature of the new QE initiatives makes the upside for gold quite different from recent years when these programs had a defined end. We believe that gold and undervalued mining companies with growth potential, low production costs and strong cash flows should have continued representation in ARS client portfolios.

Opportunistic use of Cash: Because business cycles have tended to be shorter in the current environment of near-zero interest rates and fluctuating inflation, it can be prudent to periodically hold higher cash balances in accounts, particularly during times of greater market complacency and lower margins-of-safety in company valuations. As importantly, it provides the buying power to be opportunistic to purchase shares of companies at attractive valuations.

For our clients and readers, the team at A.R. Schmeidler wishes you a happy, healthy and prosperous New Year.

AR Schmeidler is pleased to announce that Gregory S. Markel has joined our team as a Portfolio Manager and Research Analyst. With 24 years in the business, Greg is an experienced and respected investment professional having worked for several well-known asset managers including FrontPoint Stadia, State Street Research & Management and Fidelity. He has a B.A. from Brown University and an M.B.A. from The Wharton School at the University of Pennsylvania. Please join us welcoming Greg to our firm.