Congress’s recent passage of tax legislation should temporarily improve business and consumer confidence, while lifting some of the burden from the Federal Reserve which now does not have to go it alone in boosting economic activity. The extension of the Bush tax rates has provided some temporary relief to many small business owners, who had otherwise faced significant tax increases in the coming year. The payroll tax deduction component is expected to save workers $120 billion in taxes. A portion of this deduction will go into savings or debt pay-down, and some portion will be spent on imported goods which will tend to increase the U.S. trade deficit. However, at least some portion of the $120 billion tax reduction should provide economic stimulus. The Federal Reserve’s second program of quantitative easing, dubbed QE2 which is targeted at $600 billion and extends to June 2011, is also supporting the near-term outlook for U.S. equities. Many U.S. companies are prospering and enjoying significantly higher growth and strong earnings resulting from cost cuts made during the financial crisis. This continues to encourage corporations to enact dividend increases, share buybacks, and to engage in further merger and acquisition activity. We expect these trends to continue in 2011.

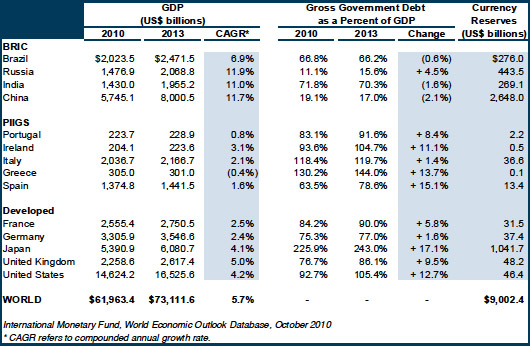

Much has been written about the developing economies’ increased role in global GDP growth. The chart below lists the annual projected GDP and debt for several leading countries as well as their currency reserves. This chart clearly highlights those countries that are projected to benefit from their current growth initiatives for many years. One of the noteworthy points from the chart is that the developing countries continue to generate currency reserve growth while the developed economies, with some exceptions, continue to compound their debt burdens. The numbers below also demonstrate the muted expected growth in the developed world.

Global GDP, Debt and Currency Reserves Overview Statistics

Because the United States is the leading power, largest economy and source of leading-edge innovation, it must foster global solutions, not just national ones. It must embark on pro-growth policies at the same time that deficit reduction is addressed. The U.S. needs to immediately address its shortfall in essential infrastructure and education investment, which unfortunately is not happening. While Asian demand can and will generate some U.S. job growth bringing global trade into somewhat better balance, international cooperation is vital. Without international cooperation on addressing the imbalances, currency wars and potential trade friction are likely to persist or increase.

At the same time the European economies must reform themselves rather than rely on austerity to address debt issues. Austerity programs without growth initiatives will just promote stagnation and social stress and cannot contribute to global solutions. Higher growth leads to higher employment and low or no growth leads to further weakening of the financial system with increasing bank liabilities and further economic contraction. Moreover, global financial markets require global financial regulations, otherwise there will always be a race to the bottom with those countries with the weakest regulations attracting the largest capital flows resulting in future financial instability.

The world’s population has nearly doubled over the last 40 years. However, most of that growth has occurred in the developing world. Following World War II, the western world and Japan rapidly built or re-built their industrial infrastructures, while South America, Africa, the communist blocs and Asia ex Japan remained relatively impoverished and agrarian-based. Thus the developing markets had relatively limited demand for the necessities of industrialization despite their growing populations. As the developed world matured, demand for many key commodities began to slow, leading to lower prices, and in turn, reduced investment in new production. Throughout the 1980’s and 1990’s, prices for key commodities remained depressed, and producers mined their highest-grade and most profitable ore bodies just to stay in business. All the while, the world’s population continued to increase by nearly 75 million each year.

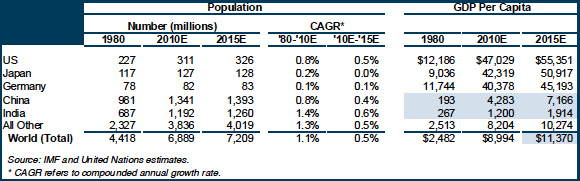

Beginning in the late 1970’s and accelerating after the fall of the Soviet Union, key political changes began to unfold in the developing world as several of the largest countries by population began implementing market-based reforms for their economies leading ultimately to China’s admission to the World Trade Organization (WTO) in 2001. Developing countries with large populations and lower labor costs had a key cost advantage allowing them to gain market share and increase their per-capita wealth as global free trade expanded. As the following chart illustrates, China and India, the world’s two largest countries by population, have rapidly been expanding their GDP per capita, allowing several hundred million people to transition from subsistence living to having discretionary income. Even with the continued rapid growth that is forecast by the IMF for these countries between now and 2015, China and India are still expected to have GDP per capita well below the world average, and substantially below those in the developed world:

World Population and Wealth per Capita

With increasing GDP per capita, developing nations could begin to afford some of the relative luxuries long taken for granted in the developed world, beginning with improving diets (primarily larger quantities of protein and more varied fruits and vegetables), and eventually including new appliances, electronics, automobiles, larger homes or apartments and increased access to modern healthcare. These changes in consumer behavior gradually led to increased demand for key raw materials. This increased demand is occurring after a 30-year period in which producers made only limited investment in their businesses due to weak developed-world demand. As a result, the world is structurally under-invested in key strategic areas creating a shortage of supply and causing prices to rise.

One of the areas in which the implications of global growth are clear is in agriculture. In addition to having 75 million more mouths to feed each year, improving incomes per capita are having a dramatic impact on grain demand. The reason for this is that as people emerge from poverty, their first priority is to improve their diets. In China and India, for every incremental dollar earned, the amount spent on food (often increased protein) is 0.40 and 0.70 cents respectively, compared with under 0.10 cents in the U.S. Protein is also more grain-intensive—each kilogram of chicken, pork or beef produced requires feed grains of two, four and seven kilograms respectively; therefore rising incomes can have an exponential impact on the need for grain. Furthermore, while population has nearly doubled and incomes have risen, the amount of farmable land per capita has been cut in half since 1970. This makes it critical for farmers to be as efficient as possible with the land and resources available.

There are already several signs that food supplies are becoming tight. In 2010, China was forced to import significant quantities of corn for the first time since 1996. Also, several agricultural commodities hit all-time or multi-decade highs in 2010, including cocoa, sugar, cotton and coffee among others. Rising food prices and the need to produce ever-growing quantities of grain on a limited land base mean the world will need more fertilizer and modern farm equipment in the years ahead to maximize yields. Two of the key components of fertilizer are mined out of the ground and are owned and controlled by a handful of global companies making those companies very well-positioned to benefit from continued growth in populations and incomes.

Another critical demand driver for key resources will be automobile ownership in the developing world. This year China is on-track to produce more than 18 million cars—more than the U.S. and Canada combined. Yet history would suggest that China’s auto production has room to grow substantially from these already impressive levels. Auto ownership in China is less than 50 vehicles per one thousand families. This compares with approximately 100 for Brazil, 250 for South Korea, 450 for Japan and over 800 for the U.S. Traditionally there has been a strong correlation between auto ownership and GDP per capita, and indeed the ownership levels just described are directly proportionate with the GDP per capita levels of those respective countries. If auto ownership in China moves in proportion to its expected growth in GDP per capita as forecasted by the IMF, total auto ownership could nearly double by 2015, and various estimates have China’s annual auto production increasing to 20-30 million, up from just 13 million in 2009. We expect this substantial increase in production to result in continued strong demand for iron ore and the coking coal used in the production of steel.

This rapid increase in automobile ownership in China and the developing world also helps explain why global oil demand declined by less than 2% following the financial crisis of 2008 compared with a nearly 10% peak-to-trough decline during the recessions of the early 1980’s. As the developed world slowly recovers from recession and the developing world continues to industrialize, we expect demand for energy sources of all types to remain strong. Over the last 5 years, China and India have gone from being self-sufficient in coal resources (indeed, both were net exporters) to being significant importers of both thermal and coking coal; and state-owned or state-influenced energy companies of both countries have been making acquisitions and striking long-term supply agreements around the world to ensure future adequate supplies. It is also worth noting that over 3.6 billion people in the world do not have adequate electricity and approximately 2 billion people have no electricity at all. For these reasons, we expect the owners and producers of oil, coal and other basic materials suppliers to be significant beneficiaries of the developing world’s industrialization in the years ahead.

Portfolio Implications

In this connection, the opportunity for investors is to understand these global dynamics, identify the businesses positioned to benefit and select those securities offering the best combination of risk and reward. The industries and companies that produce the vital goods and services in support of rising living standards and increasing industrial capacity will be the drivers and the beneficiaries of global growth and should be the focus for investment security selection. In addition, with interest rates still near historic lows, high-quality companies with attractive and growing dividend yields will continue to attract capital as income-oriented investors seek alternatives to the paltry yields currently available in the fixed income market.

Given the debt levels and growing deficits in the developed world, our fixed income approach should continue to be a conservative one restricting maturities to no more than the 5-8 year range unless presented with unusual opportunities. We also think it is prudent to be sensitive to the quality of municipal issuers given the budget gaps facing state and local governments.

On behalf of the team at A.R. Schmeidler, we wish you and your families a safe, happy and fulfilling New Year.