Economic and Investment Implications of Industrialization and Deleveraging

After a period of carefully orchestrated efforts by governments and central banks to repair the global financial system, the world has seen a resumption and acceleration of the divergences between the developing and developed economies that had existed prior to the crisis. The robust foreign reserve balances and resurgent growth of the developing nations contrast sharply with the growing fiscal deficits and slower recoveries in much of the developed world. The emerging economies led by China and India continue to be the drivers of global growth; however, the imbalances between these export-driven nations and the consumption-driven economies have continued. Government budgets have been severely damaged in the developed world as reduced tax revenues, increased entitlement costs and fiscal stimulus programs have increased deficits.

At the same time we are witnessing a powerful productivity-driven resurgence of corporate profitability. Leading businesses that are positioned to succeed globally represent standout investment opportunities based on their strong balance sheets, attractive valuations and dividend yields. Portfolios should be represented in the companies that own, produce and distribute the increasingly rare materials needed for industrialization and infrastructure development, as well as companies whose products and services help to raise productivity or living standards globally, such as in technology and healthcare. Fixed income portfolios should continue to emphasize relatively shorter-term maturities in the one to four-year range.

Global Imbalances Highlighting Winners and Losers

A massive wealth transfer from developed to developing economies partly defines the global economic condition, and is a consequence of the growing imbalances in the system. Importantly, the growth of the world economy is now being driven by the developing nations rather than the US, Europe and Japan. The International Monetary Fund estimates emerging economies will grow 6% in 2010 versus 2% for advanced economies. The developing economies are undergoing a rapid multi-decade industrialization that is raising living standards and creating a large new middle class. The resulting imbalances have increased because they are primarily export-driven and favor the developing, low cost nations, and yet they are unsustainable to the extent they rely on ongoing high consumption by the developed nations.

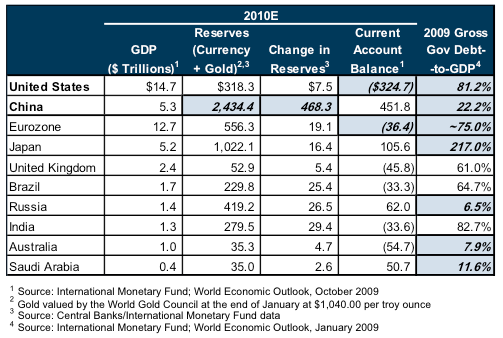

The following table highlights two competing forces at work in today’s global economy. The first is that China’s strong current account balance allowed the country to grow its reserves by nearly $470 billion in 2009 to $2.4 trillion (a nearly 25% increase) despite the global slowdown, while the US and Eurozone continued to amass near-record current account deficits. The second is the contrast between the healthy gross government debt-to-GDP levels of many of the exporting and resource-rich nations (China, Saudi Arabia, Australia, etc.) and the bloated levels of the developed economies. Sovereign debt among the developed nations has exploded to the point where it is nearing or has exceeded 80% of GDP—a level historically viewed as unsound.

Comparison of Sovereign Financial Condition

($ in billions, except GDP)

| 2010E | |||||

|---|---|---|---|---|---|

| GDP ($ Trillions)1 |

Reserves (Currency + Gold)2,3 |

Change in Reserves3 |

Current Account Balance1 |

2009 Gross Gov Debt- to-GDP4 |

|

| United States | $14.7 | $318.3 | $7.5 | ($324.7) | 81.2% |

| China | 5.3 | 2,434.4 | 468.3 | 454.8 | 22.2% |

| Eurozone | 12.7 | 556.3 | 19.1 | (36.4) | ~75.0% |

| Japan | 5.2 | 1,022.1 | 16.4 | 105.6 | 217.0% |

| United Kingdom | 2.4 | 52.9 | 5.4 | (45.8) | 61.0% |

| Brazil | 1.7 | 229.8 | 25.4 | (33.3) | 64.7% |

| Russia | 1.4 | 419.2 | 26.5 | 62.0 | 6.5% |

| India | 1.3 | 279.5 | 29.4 | (33.6) | 82.7% |

| Australia | 1.0 | 35.3 | 4.7 | (54.7) | 7.9% |

| Saudi Arabia | 0.4 | 35.0 | 2.6 | 50.7 | 11.6% |

1 Source: International Monetary Fund; World Economic Outlook, October 2009

2 Gold valued by the World Gold Council at the end of January at $1,040.00 per troy ounce

3 Source: Central Banks/International Monetary Fund data

4 Source: International Monetary Fund; World Economic Outlook, January 2009

China Looms Large Over the Global Economy

The world is approaching an inflection point in global economic leadership. The developed nations are attempting to address the imbalances discussed earlier as the Obama administration’s recent goal of doubling exports over the next five years highlights. These divergences are an important reason for the friction between the US and China with respect to China’s exchange rate policy. On March 16th, more than 100 members of Congress called on the Obama administration to identify China as a currency manipulator with the goal of pressuring China to allow its currency to appreciate, thereby making US exports more competitive and raising the prices of US imports from China.

As the largest creditor nation, China does not want to be told what to do (certainly not publicly) and will continue to put its own interests first. China’s government has argued that appreciating the Yuan would work against its own goals, which include maximizing employment, and it believes that imbalances can be better addressed through initiatives to stimulate its domestic economy and internal consumption, such as infrastructure development and wage increases and subsidies targeted at rural areas. Ultimately, China is likely to allow for a modest revaluation of the Yuan, both for political reasons and to address emerging concerns over inflation.

With its massive foreign reserves, China was able to take control of is own destiny during the financial crisis through a $586 billion domestic stimulus plan designed to offset the impact of the global recession on its exports. This program significantly contributed to global growth by increasing demand for industrial goods, household appliances, agricultural products and basic materials. China sold more than 13 million cars in 2009, surpassing the US for the first time in history, and has sold nearly 2.9 million cars in the first 2 months of 2010. More cars require more steel, iron ore, copper, rubber, rare earth materials, technology and oil. China’s daily oil imports are now 4.8 million barrels a day up from 2.2 million barrels just a few years ago and is now the world’s second largest consumer of oil after the US, yet its per capita oil consumption is only one-eighth that of the US. As part of its long-term plan, the Chinese government has identified several critical industries, such as automobiles and energy, that the government will continue to control and manage while allowing other industries to operate in a more free-market fashion. For the past few years, China has been using its growing surpluses to diversify its dollar holdings and to secure strategic resources through investments around the world. China is not alone in securing critical resources as India is now considering a $238 billion fund to acquire energy reserves for its future needs.

Excessive Sovereign Indebtedness Remains a Risk, with Implications for Currencies and Interest Rates

Sovereign debt concerns have weighed on world markets and currencies in recent months. Swelling budget deficits, credit downgrades and refinancing risks for many developed countries such as Greece have underscored three fundamental concepts.

First, Greece’s financial challenges have highlighted the fragility of the European Union (EU) and are pressuring its members to clarify previously unspoken assumptions regarding member state relationships and interdependencies never fully addressed when it was created. Stronger EU nations are understandably reluctant to allocate national resources toward weaker members whom they view to have been fiscally irresponsible and are sensitive to the moral hazard implications of bailouts.

Again however, the interconnectivity and interdependencies of countries comes to the fore. Abandoning Greece would risk jeopardizing other over-indebted EU members such as Spain, Ireland, Italy and Portugal by causing investors and lenders to flee, driving up financing costs. Furthermore, exporting EU countries, in particular Germany, were direct beneficiaries of the excessive debt assumed by the debtor countries who borrowed to finance imports and consumption. Clearly we have not seen the last of sovereign credit risks in the EU and the leading members will ultimately need to support Greece and other countries if they expect to contain additional financial stresses in the months ahead and preserve the EU structure over the longer term.

Second, recent turmoil has illustrated the US dollar’s unique role as the world’s principle reserve currency. Concerns surrounding the structure of the EU accentuated by Greece’s recent challenges have weakened the Euro and driven market participants to the dollar. Hence the dollar has been appreciating despite the fact that the fiscal profile of the US has deteriorated dramatically from when the US was the world’s leading creditor nation. Further complicating matters, a stronger dollar is making US exports less competitive in the global market and represents an obstacle to the recovery of the US economy and the goal of doubling US exports. Over the longer term, no currency can remain a store of value and purchasing power if its supply grows in excess of demand and there are no hard assets to back it. The US administration clearly has a strong incentive to see the dollar weaker over time and we believe this is likely to lead to an environment ripe for global competitive devaluations and supportive of hard asset valuations.

Third, deleveraging is likely to require the Federal Reserve and Central Banks of developed economies globally to keep interest rates low for some time. Coming out of the financial crisis, we described a period during which the US government, consumers and corporations needed to repair the damage to their balance sheets that resulted from the excessive debt taken on this past decade. Many corporations have done a standout job rebuilding their balance sheets and S&P 500 companies are now sitting on record cash balances. However, while consumers have begun reducing their debts and increasing savings, this repair will take many years due to persistently high levels of unemployment.

Recent US employment numbers indicated that 8.4 million jobs have been lost since December 2007, and the economy must create 14.7 million new jobs or just over 400,000 jobs per month for the next three years in order to bring unemployment back to more normalized levels. Although private sector employment may be stabilizing, states and local governments will be contributing to additional layoffs as they bring budgets into balance in 2010. As discussed in recent Outlooks, many states and municipalities barely navigated fiscal 2009 with heavy financial support from the Federal stimulus package.

Without further support, these states and municipalities face a genuine crisis and will likely be forced into more dramatic cost cuts, which are contractionary. In addition to rising public sector layoffs, the nascent cyclical recovery in consumer spending that we have recently witnessed is also threatened by local tax rates scheduled to increase in 2011.

At the Federal level, the government budget deficit and debt has grown considerably as it became the lender and spender of last resort in 2009. Clearly the Federal budget must eventually be put on a sustainable path. Mexico and Japan have already been downgraded by the rating agencies and Moody’s recently warned that the AAA credit rating of the US could be jeopardized if the US continues on its present fiscal path. We are also mindful of the longer-term risks to inflation that come from excessive deficits, and that these risks grow as the actions needed to address the problem are postponed.

However, for now, excess global capacity in manufacturing, housing and labor markets is keeping inflation low, and any attempts to address budget and fiscal deficits at the Federal level in the current environment will produce greater economic weakness at the wrong time of the economic cycle. According to Janet L. Yellen, President of the Federal Reserve Bank of San Francisco, the US faces the prospect of a sub-par jobs recovery until 2013. Yellen is a well-known and respected economist who was recently nominated as Vice Chairwoman of the Federal Reserve Board. In her opinion, the current rate of inflation is undesirably low, and monetary policy cannot deliver the same kick to the economy that it has in the past and she calls the underutilization of the economy the most worrisome challenge for price stability over the next few years. Under these conditions, we question how successful the removal of monetary stimulus programs would be and we expect that the US and other developed nations around the world will likely feel the need to keep interest rates low for some time.

Resurging Corporate Profits

One significant bright spot in the US economy has been the dramatic improvement in the balance sheets, profitability and cash flows of leading corporations. Unprecedented layoffs, restructurings and inventory reductions have positioned leading companies for record profitability as revenues recover. In fact, it was precisely because the financial crisis was as severe as it was that companies were emboldened to react as decisively as they did, taking actions that might have been viewed as too extreme or unpopular under less trying circumstances. Companies with strong international sales are also benefiting from the resurging growth in the emerging economies, particularly those whose products represent essential resources or technologies required for higher living standards, productive growth and industrialization.

The financial strength of leading corporations is further evidenced by the growing number of companies now raising their dividends, with over 60 increases year-to-date versus 47 for the same period last year. In addition, S&P 500 companies excluding financials are currently sitting with more than $900 billion in cash on their balance sheets, setting the stage for increases in mergers and acquisition activity. Recently, there have been two major acquisitions in the energy sector with Exxon buying XTO Energy, and BP announcing the purchase of some major offshore assets from Devon Energy, including valuable Gulf of Mexico properties. Since merger and acquisition activity has historically tracked GDP growth, we would expect this trend to continue.

Portfolio Implications

Companies that are best positioned to benefit from the divergences between the developed and the developing world should continue to be prime candidates for investment portfolios. This includes the companies that own, produce and distribute the increasingly rare materials needed for industrialization and infrastructure development, such as oil, iron ore, copper and thermal and metallurgical coal, as well as companies whose products and services help to raise productivity or living standards globally. In 2009, we built positions in select technology companies that are poised to benefit from the product upgrade cycle as well as agricultural companies whose products are essential for enhancing food production to meet the needs of a growing world population. With the passage of the healthcare bill, we also believed that many out-of-favor pharmaceutical and biotech companies are well positioned to benefit.

As we have written in many Outlooks, we also expect this uniquely low interest rate environment to encourage capital to flow to high dividend payers, all other things being equal. With many companies realizing higher cash flow generation, rising profit margins and strengthening balance sheets, we expect dividend increases to continue. American multinational corporations with attractive dividend yields represent important investments under current circumstances as cash earning virtually nothing seeks a meaningful rate of return. We are investing in select world-class franchises trading near their lowest P/E multiples of recent decades despite having solid balance sheets, strong cash flow generation and high and rising dividend yields.

With respect to the fixed income market, we have chosen to stay relatively short term due to the concern that inflation could rise over time therefore causing longer term interest rates to rise, resulting in lower bond prices. Thus far, the excess capacity in manufacturing, housing and labor has kept inflation subdued, as evidenced by ongoing strong demand at US Treasury auctions despite record issuances.

However should sovereign debt risks rise, the US would not be immune from concerns over excessive deficits. In addition, the sheer volume of Treasury issuance expected over the next few years may ultimately overwhelm demand and result in higher interest rates. Compounding the challenge is the potential competition for investor demand stemming from state and local governments’ financing needs to help close their deficits, and the desire of investors to add to their municipal holdings in anticipation of the expiration of the Bush tax cuts and additional tax increases, which will result in higher taxes on earned and unearned income.

While many investors have expressed concerns about investing in the broad market, ARS believes that this is a time for thoughtful security selection as we expect to see continued separation and performance for those companies that are well positioned to benefit from the global divergences and imbalances described above.