“Leaders are dealing with the crisis on a largely national basis, but the virus’ society-dissolving effects do not recognize borders. While the assault on human health will – hopefully – be temporary in nature, the political and economic upheaval it has unleashed could last for generations. No country, not even the U.S., can in a purely national effort overcome the virus. Addressing the necessities of the moment must ultimately be coupled with a global collaborative vision and program. If we cannot do both in tandem, we will face the worst of each.”

– Henry A. Kissinger, excerpts from WSJ Op-ed, April 3, 2020

The COVID-19 pandemic has presented us with an extraordinary medical, economic and social challenge the likes of which no one has previously experienced. The virus has changed almost every aspect of our lives and threatened our economic security, but it has also taken too many lives with many more to follow. There is no way to minimize the global tragedy, but we are heartened by the resolve of people all over the world, especially health care professionals and other essential workers, as we battle through this difficult period. We want to remind each of our clients that we are here to guide you through your specific challenges, and to convey our appreciation for the concerns that have been expressed for the health and safety of our team. We are fortunate to have such terrific clients and value the trust placed in us each day. While we continue to work on a remote basis, we assure everyone that we are here to assist through this difficult period. To that end, we are going to be publishing shorter, more frequent Outlooks until the spread of this disease is arrested to keep everyone informed of our latest thinking as the situation remains very fluid. This note will frame the key problems facing policymakers, the scope of the monetary and fiscal policy response, what the post-pandemic world may result in and the investment implications.

Framing the Problem

The coronavirus pandemic and mandated lockdowns imposed by governments around the world have pushed the global economy into the sharpest downturn since the Great Depression. The challenge for policymakers has been in three key areas – offering income replacement for those who lose their jobs, making available loans and grants to offset revenue loss for companies, particularly small businesses, and providing liquidity to allow the economy and capital markets to function properly. As a result of shutdowns, businesses are laying off employees at a rate and scale that is unprecedented. For the week ending March 21st, U.S. unemployment claims were 3.28 million persons which was 4.7x the highest recorded total of 695,000 back in 1982. The jobless claims then doubled for the week ending March 28th with 6.6 million reported which brought the unemployment rate over 10%. The unemployment figure may well exceed 20% if the lockdown is more prolonged. It is important to note that once the lockdown is reversed unemployment will decline rapidly. It is for this reason that St. Louis Federal Reserve Bank President James Bullard said he expected that the unemployment rate may spike up to around 30% but will decline rapidly in the subsequent quarters possibly returning to 4% levels as business activity resumes. It is clear that the combination of job losses, business shutdowns and the overall slowdown in the economy will reduce personal consumption, business investment and trade. Therefore, it has been up to the government to minimize the damage through monetary and fiscal policy.

Addressing the Policy Response

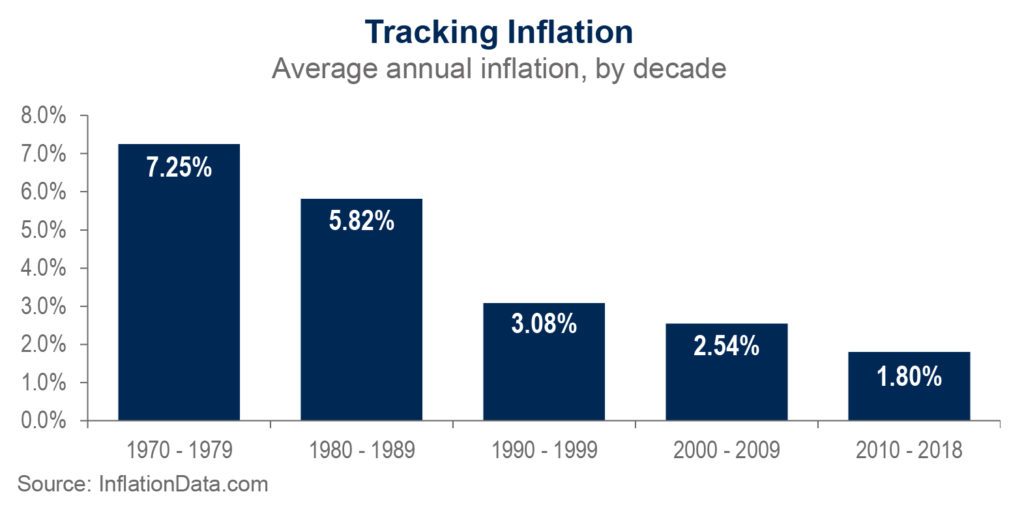

As discussed above, policymakers are working to minimize the negative effects of the COVID-19 pandemic with a focus on keeping the capital markets functioning properly, getting money into the hands of the unemployed and helping minimize small business failures. The global commitments from central banks and governments are estimated to be in excess of 13% of global GDP which is roughly $90 trillion and could exceed 20% of global GDP depending on the timing of scientific breakthroughs. The United States has initially committed over $5 trillion or more than 20% of U.S. GDP. In late March, the Federal Reserve responded to pricing issues in the fixed income markets which were functioning in a disorderly fashion. The Fed acted quickly to inject liquidity into the system with a commitment of more than $2 trillion to start and a promise to do whatever is necessary to support the economy. We would commend Fed Chair Jay Powell and the Board of Governors for their decisive and extensive response, having clearly learned from the 2008 experience. Given the limitations of interest rate policy in a near-zero-rate environment, Congress needed to act to address those who were losing their jobs or experiencing wage reductions and to try to prevent businesses from closing that would not have without the mandated lockdown. The initial commitment by the House and Senate was estimated to be between $2-2.5 trillion. It remains to be seen whether the money will get to those who need it most – the unemployed and the small businesses – in a timely fashion. Congress is already drafting additional proposals including one to extend or expand new unemployment benefits and provide additional support to protect small businesses. These programs have been defensive and reactive.

Future programs will be designed to foster growth and put the nation back on the offensive. Most importantly, we have come to the point where we can anticipate the long overdue program to address our nation’s healthcare, educational, digital and physical infrastructure. In that respect, we would propose that the United States Federal budget be split between an investment side and an expenditure side. The infrastructure budget would be in the investment category and each program would be evaluated for its expected return on investment. This would allow for future programs to be better funded and assessed on their merits.

Thoughts on the Post-Pandemic World

The pandemic has significantly changed our daily lives and could well transform the way we live, learn, govern and work after it has run its course. As long-term investors, we must make judgments as to what the post- pandemic world might look like so that we can invest not just for the next quarter or two, but for the next several years. Here are our initial thoughts on some of the changes in the behaviors of consumers, businesses and governments.

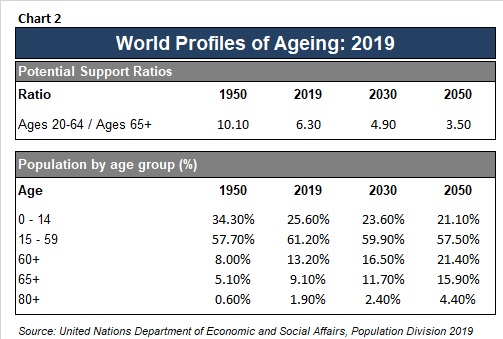

For consumers, we see a greater focus on lowering household debt, increasing savings rates, and changes in where we live and how we work. With students of all ages being forced to learn online, we see an acceleration of the changes occurring within our educational system and broadening of student internet access. We are already experiencing a necessary increase in telemedicine which we expect to accelerate as well as more personalized medical approaches that will incorporate more advanced medical technologies. We should expect to see greater use of medical rapid-testing technology to enable the public to gain access to such places as theme parks, sporting events, concerts, museums and even office buildings. From a business perspective, it is likely that more companies will support increased remote work arrangements which have important implications for the commercial real estate market and for increased use of technology as businesses look to reduce high-cost office space. Corporations will seek to create more flexible and resilient supply chains, bringing back to the United States production of some critical parts of supply chains to avoid future disruptions due to trade conflicts or shutdowns such as we are currently experiencing. We also could see the relationship between government and business altered considerably for some industries due to the bailouts and loan programs as well as for national security reasons. Furthermore, the path to growth will likely require sizable public-private partnerships, both domestic and cross-border, to address national needs such as infrastructure, cyber- defense and healthcare. As the quote from former Secretary of State Henry Kissinger points out, governments will need to be more collaborative and that begins with the U.S. and China. Depending on the behavior of global leaders, we may see closer relationships with other nations, a further fragmenting of the post-WWII global order, greater strains on the European Union project and renewed calls for modernizing the role of global institutions such as the WTO (World Trade Organization) and the United Nations. A failure to address the growing inequality issue, which is being exacerbated by the pandemic, could lead to serious social instability, and now is the time for government, business and public to act.

Investing for the Near-Term and Beyond

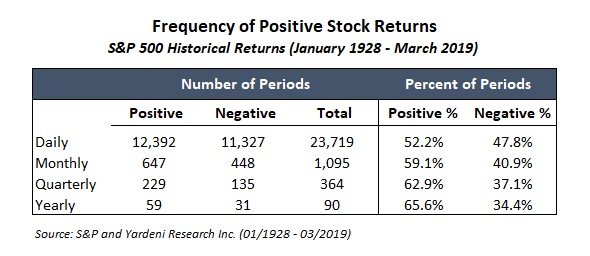

As we said in our March 23rd Outlook, things will get worse before they get better, but they will certainly get better once we begin to arrest the spread of the virus. In terms of sequencing, we believe that the stock market will begin the bottoming process as the trajectory of new cases begins to decline and likely well before the economy itself bottoms. The recent focus for client portfolios has been to use the market pullback to upgrade quality, fine-tune sector and industry weightings and avoid the companies that are heavily indebted. We have been initiating new positions in high-quality companies that previously were selling at considerably higher valuations, while harvesting tax losses in securities we still like but believe the risk/reward in holding them is not as favorable.

While no one can say with any precision where we go from here, there are a few questions the investment team is asking to help guide us in navigating the near term and longer term.

- What is the length of shutdown and severity of the economic damage?

- Will the policy response be effective and what are the possible unintended consequences?

- How difficult will it be to restart the economy and begin to return to growth?

- And finally, what does this mean for individual companies and industries?

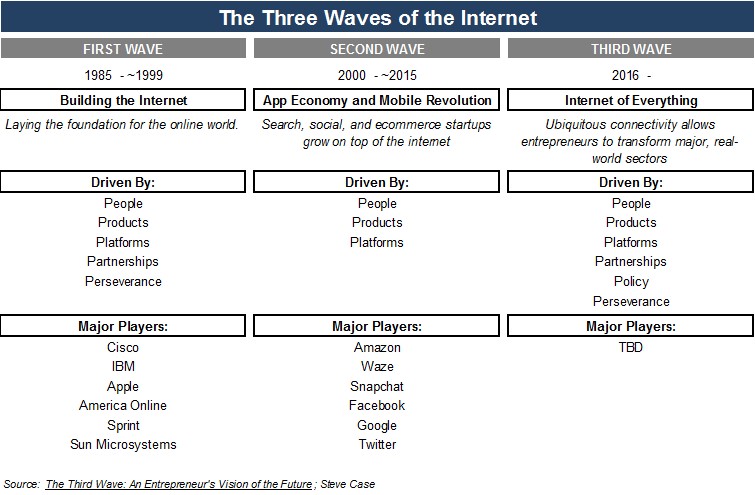

Based on our preliminary views of what the post-pandemic world might look like, our portfolios will continue to reflect many of the same themes we have emphasized for the past few years. The impact of the virus has not only reinforced our convictions but has also augmented these themes. ARS portfolios will continue to emphasize healthcare companies, focusing on biotech/bioscience, pharmaceutical and high tech testing equipment among other areas; technology companies including cloud, 5G, semiconductors and capital equipment, cybersecurity, AI (Artificial Intelligence) and machine learning; companies with strong balance sheets and quality dividends; defense companies as the world is not getting any safer; and a few special situation companies that will benefit from an increase in post-crisis merger and acquisition activity. We favor the U.S. economy over the rest of the world and the U.S. stock market over other markets. There are some unique opportunities being created in the U.S. stock market, and we suggest that those waiting for an opportunity to participate should begin to incrementally build positions in world-class companies with a view to adding on future price declines. Given the nature of the world today, we favor a cautious and measured but still opportunistic approach to investing. Disciplined investors who are taking a longer-term view should be well rewarded.