What Matters Now: Revisiting Dr. Ed’s Roaring 2020s Forecast

“There’s a case to be made that if inflation takes off, we could need to go higher on interest rates. Of

course, if the economy weakens dramatically from the uncertainty … that could bring interest rates down. But both of those things are possible at the same time, and that’s what makes this such a complicated environment to navigate.”

~ Neel Kashkari, President of the Minneapolis Federal Reserve Bank, April 9, 2025

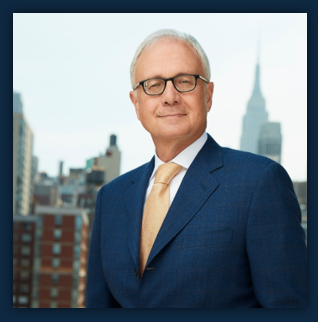

Uncertainty remains a key feature of this environment and will be accompanied by periods of elevated market volatility like we have experienced since the April 2nd tariff announcement. This uncertainty is resulting from the radical trade policies emanating from Washington as well as the reactions from foreign nations. In less than 90 days, the Trump Administration’s policies have shaken the world order in a highly disorderly manner. The pace of Executive Order issuance and the lack of transparency as to the specific goals of the President’s policies have raised global economic policy uncertainty to record levels as illustrated in Chart 1. This is leaving policymakers, business owners, consumers, and market participants struggling to figure out how to respond.

There has been a dramatic shift in investor sentiment as the unconventional policies of the Trump Administration, which were welcomed in November, are now causing fears of a global growth slowdown, potentially leading to a recession. These fears were growing even before the Administration’s tariff announcements, which considerably exceeded expectations, sending shock waves throughout the world before being postponed for 90 days. Under these circumstances, it is difficult, if not impossible, for corporations to embark on multi-year capital spending decisions with short-term spending continuing only in areas of need and clear opportunity with assured rates of return. The benefit of periods characterized by heightened volatility lies in the potential for negative sentiment to generate significant undervaluation among premier companies. This can encompass both high-quality businesses within well-defined growth sectors and companies exhibiting robust balance sheets coupled with strong and increasing dividend yields.

Chart 1. Global Economic Policy Uncertainty Index

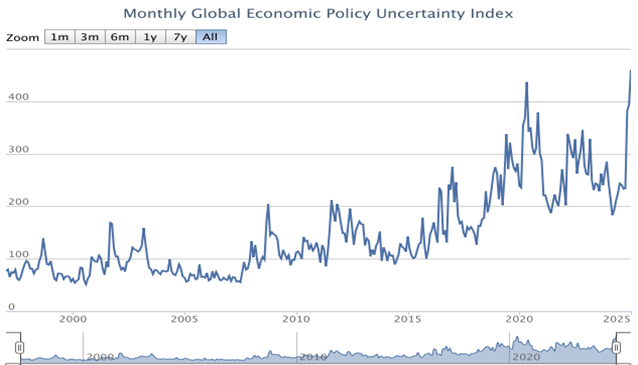

Three of the five primary areas of the Trump Administration’s focus – immigration, deregulation, and the lowering of energy costs – have generally been viewed favorably. On the other hand, efforts on public sector reform have received mixed reviews, while its tariff policy has not been well understood and poorly received. Chart 2 illustrates the increase in the effective tariff rate based on the April 2nd announcement by the U.S. The President’s decision to dismantle the post-World War II economic order, built on freer trade and globalization and championed by the United States, represents a risky undertaking. His aim is to reshape the world economy to prioritize U.S. interests and rectify real and perceived trade imbalances affecting the nation.

Chart 2. President Trump’s Announced Tariffs Would Be Highest in 100 Years

This period is particularly challenging due to the lack of clarity and predictability surrounding tariffs and policy goals. The 90-day delay in tariff implementation, coinciding with difficult negotiations, will likely maintain the elevated volatility. This policy ambiguity complicates the task for central bankers in setting appropriate policy, hinders corporations from making long-term investments, and discourages consumer spending amid rising living costs.

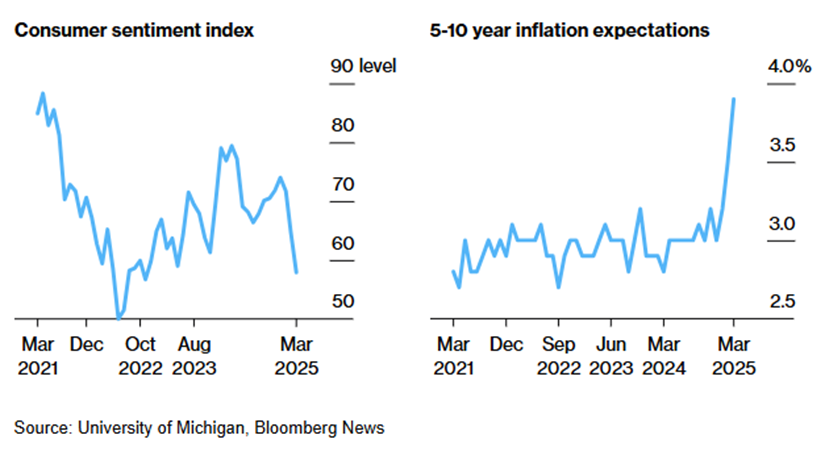

Consequently, this uncertainty is significantly impacting consumer sentiment and investor confidence, as long-term inflation expectations have seen their largest jump since 1993. Chart 3 illustrates this shift from optimism to pessimism, driven by concerns that the U.S. economy is heading toward stagflation, defined as simultaneously rising inflation with slowing growth.

Chart 3. Univ. of Michigan Surveys Reflect the Rapid Swing in Expectations

Next, we will discuss four key areas that are changing due to current conditions, what it means for the world, and the investment implications for the economy and markets. While these times are full of uncertainties, we are reminded of a quote from legendary investor Warren Buffett, “You know, people talk about this being an uncertain time. You know, all time is uncertain. I mean, it was uncertain back in, in 2007, we just didn’t know it was uncertain. It was uncertain on September 10th, 2001. It was uncertain on October 18th, 1987, you just didn’t know it.” As Mr. Buffett knows, successful stock market investing isn’t about avoiding risk, but about embracing uncertainty to find opportunities. This involves buying well-positioned businesses at a discount to their intrinsic value.

The interplay of forces in the world economy will significantly affect four critical areas in the year ahead: geopolitics, consumer/business/investor behavior, fiscal policy, and monetary policy. These forces will also influence global trade and exchange rates, as well as the rising cost of living. We briefly address each of these areas below:

GEOPOLITICS: For global investors, the United States was once seen as the pillar of stability in the post-World War II world. This trust stemmed largely from the belief, held by both allies and adversaries, that the U.S. commitment to the rule of law and the established global order was essential for the past 75 years of growth. Now, however, these foundational commitments are being questioned both at home and abroad. This shift marks a departure from a long era of globalization towards increasing fragmentation, reversing trends established over decades. The President’s current foreign policy approach carries the risk of alienating allies and driving them towards China, rather than just incentivizing manufacturing in the U.S.

FISCAL POLICY: Greater demands are being placed on governments at a time when most nations have either too much debt or too little fiscal space to manage additional expenditures. Therefore, they will need to run larger fiscal deficits, slow spending, or raise taxes. For investors, one of the most significant changes is U.S. fiscal policy shifting from excessive fiscal and monetary stimulus to austerity to rein in government spending, while Europe and China have announced significant increases in stimulus spending. For Europe, the stimulus is long overdue and should contribute to increasing growth if EU nations move to act in a more unified manner. Germany’s economy is estimated to reach $5.7 trillion in 2025, with growth forecast to rise 1.7%. In Europe’s largest economy, recent proposals from the incoming Chancellor Merz call for an estimated $600 billion in spending on defense and $528 billion on infrastructure and climate investments over several years, with the EU calling for an additional $528 billion in defense spending for the region. For Europe overall, and Germany in particular, this stimulus spending should provide a significant economic boost, but it comes at a time when both have been suffering from political, cyclical, and secular challenges, making a successful outcome difficult.

As the second largest economy in the world and a rival to the United States hegemony, China has been struggling since the pandemic and is dealing with its own economic issues including slowing growth, problems in real estate markets, worsening demographics, an unbalanced economy, and concerns about its ability to export products to its two biggest markets – the U.S. and E.U. Since the U.S. elections, many investors were expecting a significant increase in China’s already existing stimulus measures earlier this year. However, China waited for tariff announcements and has now further implemented stimulus measures. These will likely serve only to cushion its economy, while China continues exporting its excess capacity to the rest of the world.

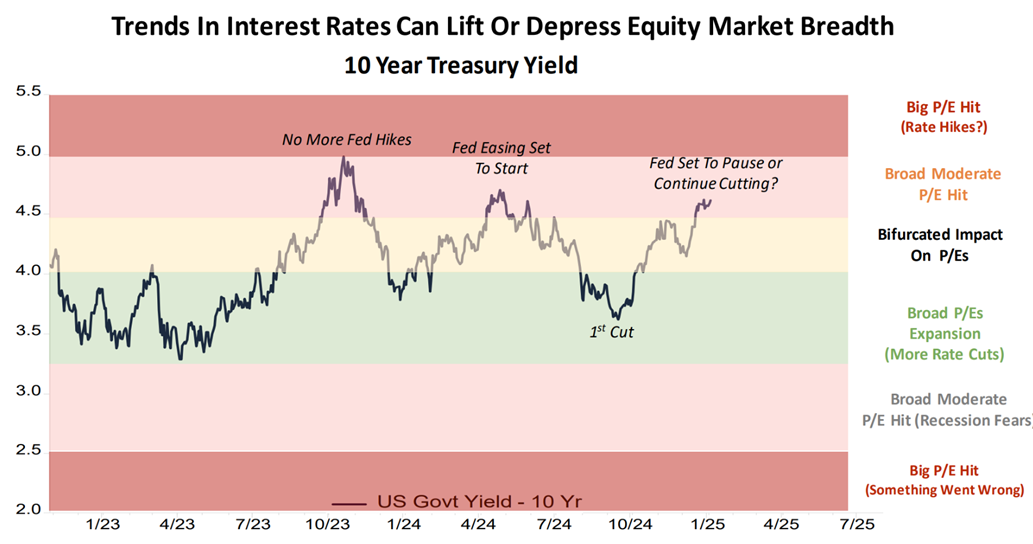

MONETARY POLICY: Risks of inflation are decidedly more two-sided than expected at the start of the year. Chart 3 highlights the challenges for central banks in this environment, with consumer sentiment declining and inflation expectations rising. If central banks cut interest rates aggressively in the face of higher inflationary expectations, the cuts could spur inflation and force them to reverse policy course. If too slow to cut, central banks risk a recession. At the time of this writing, the market expects the Federal Reserve to cut rates four times in 2025. That is not our base case as ARS has been in the “higher-for-longer” camp on interest rates and would expect the Fed to move at a more measured pace unless there is a financial crisis. As Fed Chair Jerome Powell said last Friday, “While uncertainty remains elevated, it is becoming increasingly clear that the tariffs will be significantly larger than expected. The same is likely to be true of the economic effects, which will include higher inflation and lower growth… Our obligation is to keep longer-term inflation expectations well-anchored to make certain a one-time increase in the price level does not become an ongoing inflation problem.” While expectations remain for multiple rate cuts from the Fed, European Central Bank (ECB), and the People’s Bank of China, investors may find conditions limit the ability of central banks to cut as aggressively as market participants may desire. Importantly, the inflationary concerns speak to the value of owning equities and hard assets in this environment.

CONSUMER/BUSINESS/INVESTOR BEHAVIOR: In times of heightened uncertainty, consumers and businesses tend to restrict spending, which reduces corporate earnings and can lead to rising unemployment and possibly a recession. At the same time, corporate expenses are increased by the impact of tariffs. Tariffs will lead to one of three outcomes for corporations: the company can absorb the increased costs, it can pass the increase to the consumer, or it can share the increase with the consumer. In any case, the cost of living will rise to a higher level, and the economy will slow. The magnitude of each is currently unknown.

“Maintaining stability in the new era will be a formidable task. It will require an absolute commitment to our inflation target, the ability to parse which types of shocks will require a monetary action, and the agility to react appropriately. Trade fragmentation and higher defense spending in a capacity-constrained sector may push up inflation. Yet U.S. tariffs could also lower demand for EU exports and redirect excess capacity from China into Europe, which could push inflation down.”

~ Christine Lagarde, President of the European Central Bank, March 12, 2025

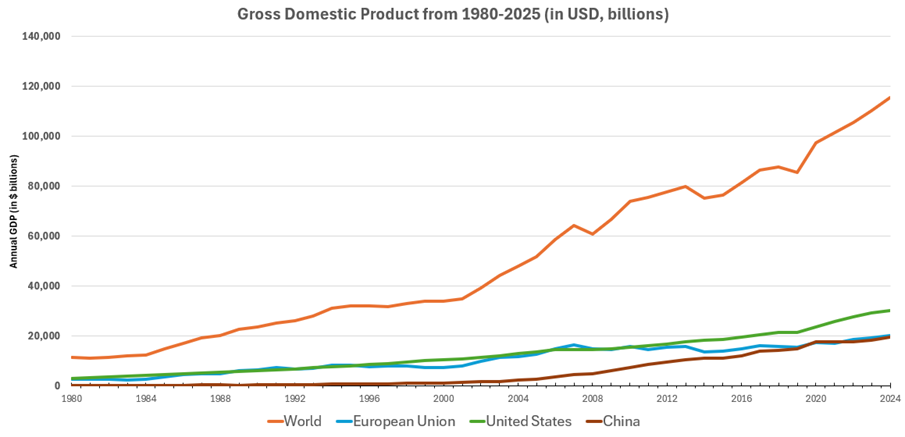

Since the start of the year, sentiment has shifted. Optimism about the strong U.S. economy has given way to fears of a global recession and stagflation, triggered by the Trump Administration’s unconventional policies. As a result, investors should anticipate a period of slower growth, renewed inflationary pressures, capital flows shifting from U.S. equities to other asset classes and geographies, a weaker dollar, and fewer rate cuts from the Fed. Regardless of the final level of tariffs, the cost of living will increase, and that makes the need for nations to increase productivity even more important. Even if the tariffs work as the Administration hopes, there will be timing differences that will create short-term dislocations in areas such as the availability of skilled labor and the timing of tax revenues received from onshoring deals. Yet, we have been through challenges before, and the strength and resilience of the U.S. economy have allowed the nation not only to survive but also to thrive and grow. Chart 4 shows the World, European Union, China, and the United States GDP growth from 1980-2025. When the decade of the 1980s began, the S&P 500 was at 107.94 in January of 1980 and was recently trading at around 5000, while U.S. corporate pre-tax profits rose from $309 billion to $4.3 trillion. For all the problems we have faced since the inflation bubble burst in the early 1980s to today, the world continues to grow, but it is never in a straight line.

Chart 4. Comparison of World, U.S., EU, and China GDP 1980-2025

Today, investors have options that they have not had in many years, as market participants invested with the belief that “there is no alternative” to the U.S. But that may be changing. Europe and China are beginning to offer new opportunities for equity investors, while the current interest rate levels are making both public and private credit more attractive relative to equities as well. In the short term, capital flows may move away from U.S. equity markets as we have seen recently, but ARS expects flows to return as the inherent strengths of the United States economy reassert themselves. While tariff policy is dominating the headlines right now, there are several positives that are not being recognized enough for the U.S. economy. Reshoring should reaccelerate after slowing the past two years, efforts to rein in government spending will help with the debt and deficit financing, low taxes for small/medium sized businesses and the possibilities of tax credits for reshoring and building plants in the U.S. should help increase spending, while investments in improving productivity should help offset rising labor costs and reduce inflation.

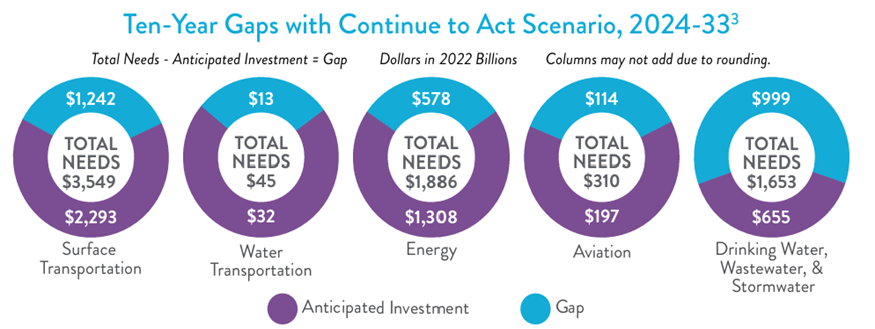

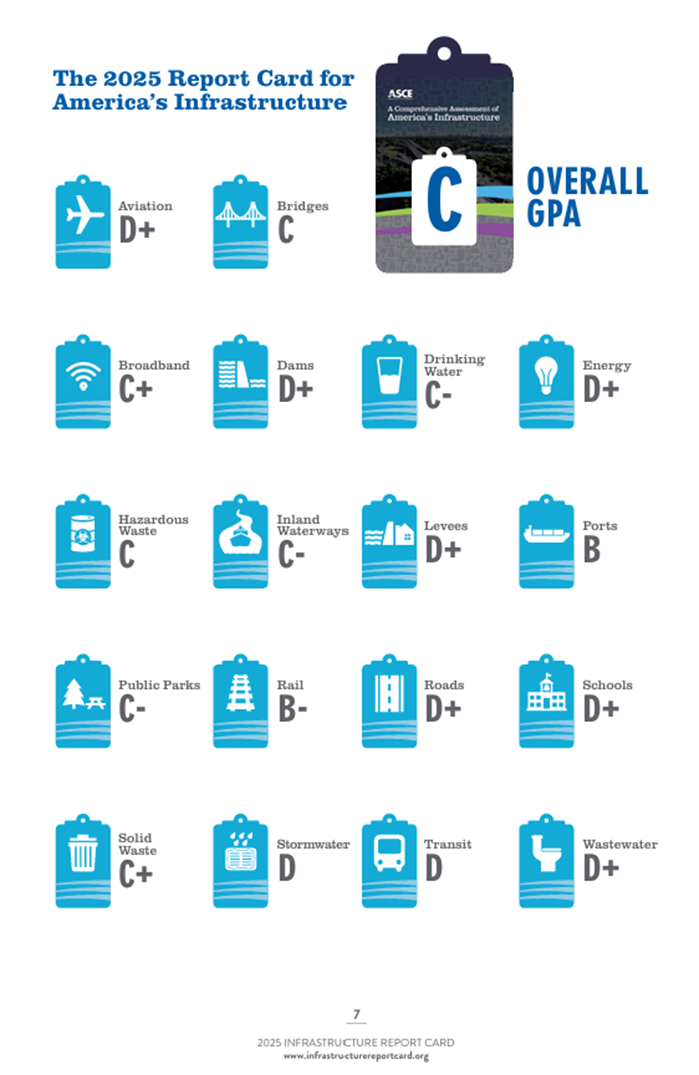

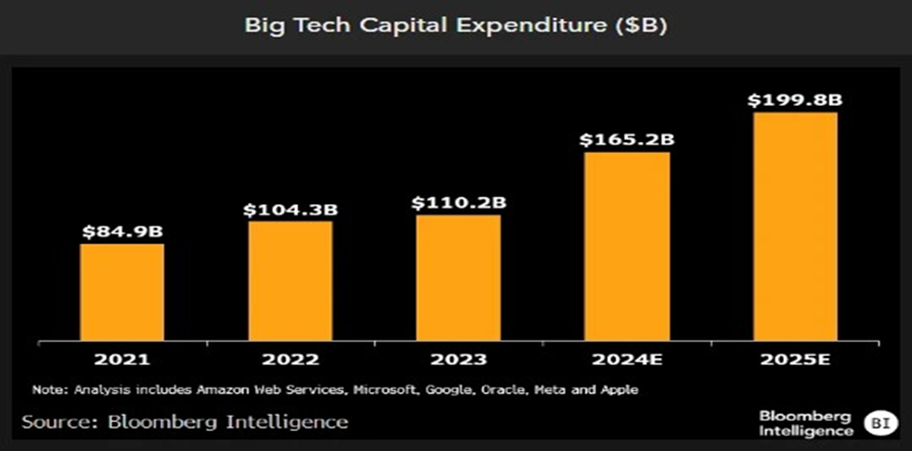

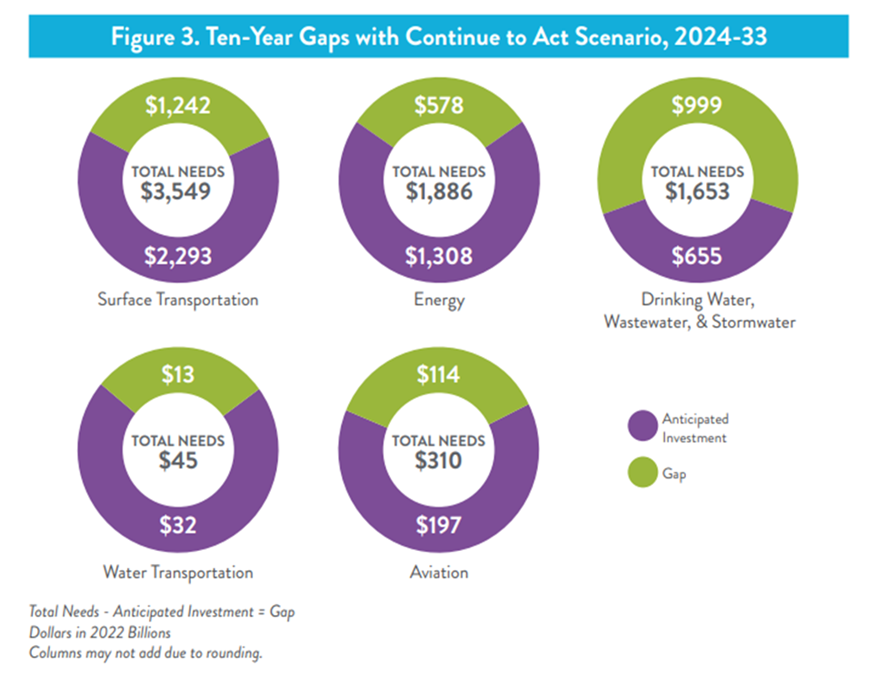

Three of our favored investment themes involve companies improving productivity through innovation, particularly artificial intelligence, to offset higher costs; national security (including defense, energy, and industrial companies); and those companies involved in rebuilding and modernizing our nation’s infrastructure. Long time readers of the Outlook know ARS has reviewed the ASCE Infrastructure Report Card since it was introduced decades ago. The study evaluates the current state of U.S. infrastructure and what is needed to keep our system in a state of good repair. The U.S. received a grade of C in this year’s report, which is up from the 2021 report (See appendix). However, much work remains and will require significant spending, as shown in Chart 5. The funding gaps are considerable in surface and water transportation, water, energy, and aviation. As the federal government cuts spending, a greater burden will be on state and local governments to step up, which will be a challenge for many states.

Chart 5. ASCE Infrastructure Report Card 2025 -Funding Gaps in Critical Areas

In normal times, investing requires investors to make decisions with incomplete information, but today’s environment is anything but. Therefore, the range of potential outcomes is even wider than it has been in the past. Rather than get caught up in the short-termism so prevalent today, the ARS approach looks at the secular trends driving capital flows over the next 3-5 years to allow us to move away from consensus thinking, while looking for businesses selling for attractive risk-adjusted valuations over the next 12-18 months. In uncertain times such as this one, market participants will be well served investing in the areas of required spending, including reindustrialization, national security (including defense, space, cybersecurity, and critical infrastructure), electrification, digitalization (including AI), productivity, and healthcare. As the United States and the world work through the current challenges, some of which are self-inflicted, we are reminded of a quote from Warren Buffett’s 2021 annual letter to shareholders on the U.S., “In its brief 232 years of existence … there has been no incubator for unleashing human potential like America. Despite some severe interruptions, our country’s economic progress has been breathtaking. Our unwavering conclusion: Never bet against America.”

Appendix

Published by the ARS Investment Policy Committee:

Stephen Burke, Sean Lawless, Nitin Sacheti, Greg Kops, Andrew Schmeidler, Arnold Schmeidler, P. Ross Taylor, Tom Winnick.

The information and opinions in this report were prepared by ARS Investment Partners, LLC (“ARS”). Information, opinions and estimates contained in this report reflect a judgment at its original date and are subject to change. This report may contain forward-looking statements and projections that are based on our current beliefs and assumptions and on information currently available that we believe to be reasonable. However, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements.

ARS and its employees shall have no obligation to update or amend any information contained herein. The contents of this report do not constitute an offer or solicitation of any transaction in any securities referred to herein or investment advice to any person and ARS will not treat recipients as its customers by virtue of their receiving this report. ARS or its employees have or may have a long or short position or holding in the securities, options on securities, or other related investments mentioned herein.

“Both optimists and pessimists contribute to society. The optimist invents the aeroplane, the pessimist the parachute.” -George Bernard Shaw

The U.S equity markets reached new highs driven by advances in technology, particularly in artificial intelligence and robotics which will revolutionize industries and drive significant economic growth. In a world of instability, the United States’ economy presents dynamic and promising opportunities for investors because this is a U.S. business cycle like no other. Therefore, investors should be more optimistic about the long-term prospects for the U.S. economy, the equity markets, and the specific business opportunities that have emerged. The current interest rate environment suggests a transition from a market driven by price/earnings multiple expansion to one that will be defined throughout the rest of the decade by strong earnings growth for a subset of the market. The prime beneficiaries should be businesses whose earnings are poised to grow because of their involvement in technological breakthroughs, reindustrialization, and electrification.

Dr. Ed Yardeni recently joined Arnold Schmeidler as a guest on our December webinar (A Special Year-End Call with Dr. Ed Yardeni and Arnold Schmeidler) and shared his base case for another strong year for U.S. equities, despite the risks present in the system. Dr. Yardeni forecasts double-digit returns for the S&P 500 both this year and next. After more than a decade of massive monetary and fiscal policy support for the global economy, the markets will rely more on earnings growth to differentiate returns as we do not expect the Federal Reserve to lower interest rates to the degree that the markets expect. In this Outlook, ARS makes the case for a continuation of U.S. exceptionalism, addresses the risks present in the system, and defines the investment opportunities for 2025.

In a messy world, the United States stands out as it possesses inherent strengths that position it for continued growth and prosperity. Corporate and government capital spending on the electrical grid, reshoring manufacturing, artificial intelligence, the rebuild from climate damage, and national security are creating significant increases in corporate earnings, cash flow growth, dividends and dividend increases, share buybacks, and merger and acquisition activity for the foreseeable future. The confluence of these factors will have a dynamic impact on the U.S. economic system for years to come and the combination of these factors does not exist in any other economy which only reinforces the reserve status of the U.S. dollar.

The U.S. economy will be driven by four primary forces: continued technological advancements, ongoing infrastructure investment, productivity growth, and continued spending from governments, corporations, and consumers. We expect increased capital spending on technology across various sectors indicating a strong commitment to innovation, productivity, and future growth. Furthermore, a renewed focus on infrastructure investment is catalyzing economic activity. Increased government spending on infrastructure projects is creating a ripple effect throughout the U.S. Reshoring manufacturing activities back to the United States is generating demand across various sectors, from raw materials (including steel, copper, and rare earths) and industrial equipment to energy production. This resurgence of domestic manufacturing is changing the terms of global trade while revitalizing key industries and creating new employment opportunities.

Innovation and Technology Capital Expenditures

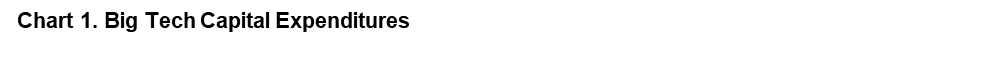

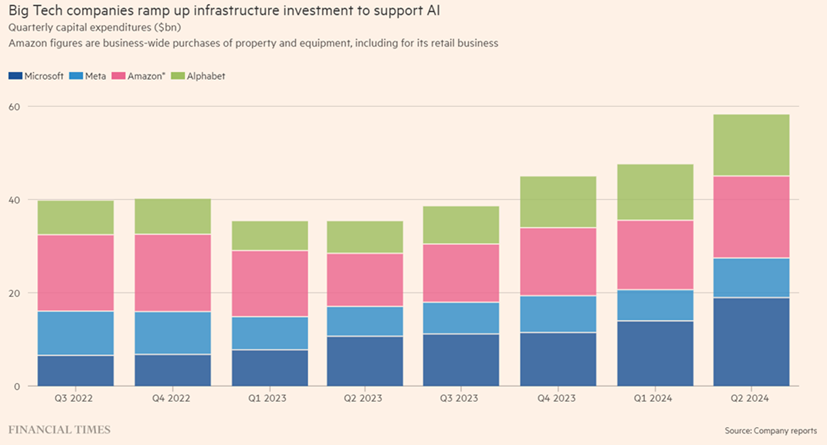

According to Axios, the big tech companies increased capital spending by more than 56% in the first three quarters of 2024 versus the prior year, and more companies will be increasing spending this year to compete in a changing world. In the fiscal year ending June 2024, Microsoft spent more than $50 billion on capex with the majority related to data center construction, fueled by demand for artificial intelligence services. This year, Microsoft plans to spend over $80 billion building out data centers with more than half of that spend in the U.S. Much of this spending is focused on cutting edge technologies whose full effects have yet to be felt.

Beyond the largest tech companies, businesses are expected to invest more in software to implement artificial intelligence more efficiently, boosting worker productivity. As robotics and AI agents become more accessible, companies will adopt them to help address ongoing challenges with labor skills and workforce availability.

Infrastructure Investment

In 2021 and 2022, after decades of neglect, Congress passed the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA), finally providing much needed funding for a system that has been underinvested for more than 20 years. In its 2021 report, the American Society of Civil Engineers projected that the United States would meet between 50-60% of its spending needs while still having a shortfall of $2.9-3.4 trillion. Chart 2 highlights the gap for five critical areas including energy, transportation, aviation, and water. Even with the new spending, the United States infrastructure still faces a shortfall as artificial intelligence is challenging the world’s ability to meet its power demands. The rebuild from climate damage will also require significant investments at all levels of government. At the same time, conflict zones such as Syria, Gaza and Ukraine will need to be rebuilt following the massive damage inflicted in recent years.

Here at home, Los Angeles is currently battling historic wildfires while the Southeast region needs to rebuild from the devastating effects from the hurricane season. The rebuild from these natural and man-made disasters will require significant investment dollars and will further increase demand for critical materials.

Productivity Growth

Productivity growth remains a crucial driver of economic success especially considering the demographic and labor force challenges facing many leading nations. Innovation has the potential to significantly enhance productivity across various sectors leading to positive outcomes such as lower inflation, higher wages, and improved living standards. By streamlining processes and automating tasks, technology can empower businesses to produce more with fewer resources boosting economic output. It is also one of the keys to addressing structural demographic issues as well as labor force availability and work skills issues. As shown in Chart 3 below, U.S. labor productivity was challenged in recent years but is now starting to show signs of improving.

While the outlook is generally positive, it is critical to acknowledge the many potential problems ahead for investors. Aside from the obvious geopolitical issues of expanding conflicts, there are other key risks that need to be considered.

The Trump Factor

The incoming administration’s unconventional approach to governing presents its own unique set of challenges for investors as the post-election period has demonstrated with the December drama around the continuing resolution to fund the government. Below are just a few of the questions on investors’ minds.

– When it comes to tariffs, what distinguishes actual policy from a negotiating tactic?

– What will tariffs mean for inflation and trade this year?

– What is China’s response to the policies of the new administration as it has had four years to prepare?

– What is the impact on relations with allies regarding trade and national security?

– What will happen with immigration policy and what will mass deportations mean for the labor force?

– What level of deficit will be acceptable to Congress and the markets?

– Will DOGE (Department of Government Efficiency) be able to identify meaningful savings to reduce the deficit?

Inflation and Rates

The global fight against inflation is far from over, with two key implications for investors. First, the Federal Reserve will likely be slower to cut the federal funds rate, meaning interest rates could remain higher for longer than many investors would prefer. Second, investors should prioritize companies with strong earnings growth rather than relying on the price/earnings multiple expansion supported by the Fed’s lower rates over the past 15 years.

While President Trump favors low interest rates and a strong stock market, bond market concerns about rising deficits could limit the Fed’s ability to continue easing monetary policy (keeping interest rates low). Some worry that the Fed may even need to raise the federal funds rate—either because the economy is performing too strongly or because buyers of U.S. Treasuries demand higher yields to compensate for the risks posed by record deficits. This could prompt pushback from conservative Republican members of Congress concerned about debt and deficits, potentially complicating parts of Trump’s agenda, especially given the slim Republican majorities in the House and Senate.

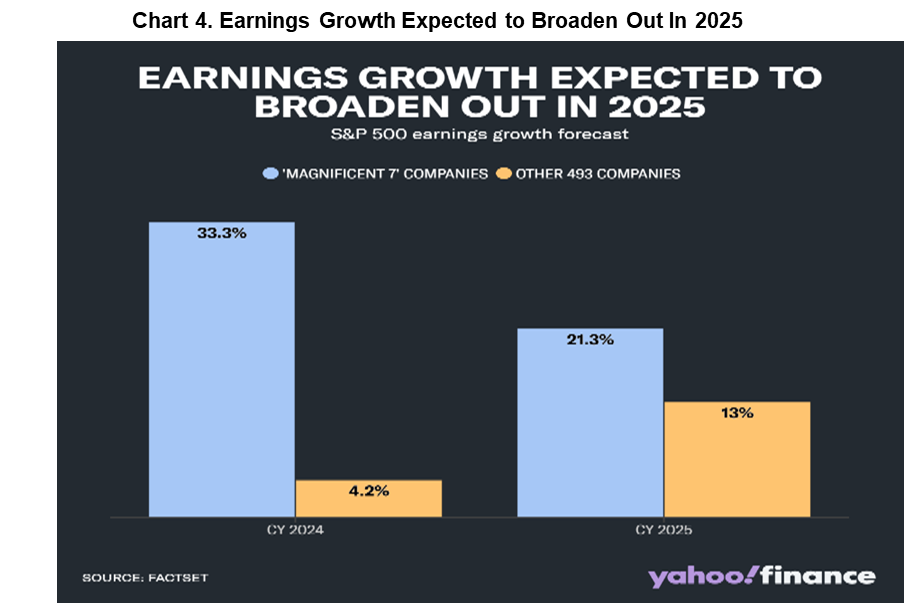

Markets

In recent years, the market has heavily favored a narrow group of companies, specifically the leading tech giants collectively known as the Magnificent 7. As illustrated in Chart 4, this group has experienced significantly higher growth compared to the rest of the market. However, projections for 2025 suggest that the remaining 493 companies will achieve growth rates three times higher than what they had been, indicating a potential broadening of investment opportunities.

The importance of the second derivative—accelerating or decelerating earnings growth rates—comes into play here. If the broader market’s earnings growth exceeds expectations, it could lead to multiple expansion and higher stock prices for these companies, reinforcing the narrative of broadening opportunities. Conversely, if the Magnificent 7 fail to sustain their elevated growth rates or fail to deliver returns on AI spending, their valuations could compress, leading to declining stock prices. Similarly, if the remaining 493 companies fail to meet growth expectations, stock prices could deteriorate, especially in the face of tighter financial conditions. There has been a great deal of discussion about a broadening out of the S&P 500 from the Magnificent 7 to those remaining 493, but the degree of broadenings will be directly impacted by the level of interest rates as seen in chart 5.

From an investment perspective, the United States economy and equity markets offer compelling opportunities. Given the absolute and relative strength of the U.S. economy and the attractive investment opportunities within the domestic market, overweighting U.S. equities should be considered. As is typical in times of heightened disruption, the inherent strengths of the U.S. come to the fore – its robust enterprising spirit fosters innovation and drives economic dynamism. Furthermore, the leading U.S. corporations should benefit from deregulation, while baby boomers are spending, donating, or passing to their heirs a portion of an estimated $80 trillion of the $175 trillion U.S. household net worth. Our financial system is the world’s deepest and most mature, providing a solid foundation for sustained economic growth, and the U.S. dollar remains the world’s reserve currency. Investors should prioritize the companies positioned to benefit from key trends, including infrastructure development, reshoring, and technology advancements. This may include sectors such as industrials, including defense and electrification companies, energy, technology and select financial and healthcare companies. While China and Europe remain home to some of the world’s best companies and offer interesting prospects in some critical areas such as renewables and electric vehicles, ongoing issues suggest there are more attractive places in which to invest.

A long-term investment horizon with a focus on companies with strong fundamentals remains crucial for navigating the evolving environment. Investors should prioritize companies with sustainable business models, strong financial positions, and the ability to adapt to changing market conditions. This will be a particularly challenging period for companies with weak balance sheets as they have limited access to affordable capital making it extremely difficult for them to invest in order to compete with well-financed or self-financed rivals. A key difference between last year and this year will be expectations for inflation and interest rates which are likely to be higher than what market participants prefer. These conditions will make companies with strong earnings growth more likely to reward investors, as opposed to those relying on price/earnings multiple expansion.

In closing, the U.S. presents a dynamic and promising economic landscape with significant growth potential. The United States culture of innovation, recent massive investments in infrastructure, and productivity growth are driving economic expansion. While challenges exist, the U.S. economy possesses inherent strengths that position it for continued growth. A long-term investment perspective, coupled with a focus on high-quality companies, can help investors navigate the markets and capitalize on the exciting opportunities that lie ahead. While it is easy to be a pessimist, long-term investors have been well-served by taking a more optimistic view and should continue to do so in the coming period.

Published by the ARS Investment Policy Committee:

Stephen Burke, Sean Lawless, Nitin Sacheti, Greg Kops, Andrew Schmeidler, Arnold Schmeidler, P. Ross Taylor, Tom Winnick.

The information and opinions in this report were prepared by ARS Investment Partners, LLC (“ARS”). Information, opinions and estimates contained in this report reflect a judgment at its original date and are subject to change. This report may contain forward-looking statements and projections that are based on our current beliefs and assumptions and on information currently available that we believe to be reasonable. However, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements.

ARS and its employees shall have no obligation to update or amend any information contained herein. The contents of this report do not constitute an offer or solicitation of any transaction in any securities referred to herein or investment advice to any person and ARS will not treat recipients as its customers by virtue of their receiving this report. ARS or its employees have or may have a long or short position or holding in the securities, options on securities, or other related investments mentioned herein.

This publication is being furnished to you for informational purposes and only on condition that it will not form a primary basis for any investment decision. These materials are based upon information generally available to the public from sources believed to be reliable. No representation is given with respect to their accuracy or completeness, and they may change without notice. ARS on its own behalf disclaims any and all liability relating to these materials, including, without limitation, any express or implied recommendations or warranties for statements or errors contained in, or omission from, these materials. The information and analyses contained herein are not intended as tax, legal or investment advice and may not be suitable for your specific circumstances. This report may not be sold or redistributed in whole or part without the prior written consent of ARS Investment Partners, LLC

“The S&P 500 has risen dramatically, powered by America’s leading tech companies. Yes, this could be another bubble- and there are countless things to be worried about… That said, markets climb a wall of worry. America’s innovation in AI, growing creativity, and momentum in defense (focused on deterrence) combined with our democratic, entrepreneurial, and capitalist system could surprise us on the upside. For now, America remains the best house in an imperfect global neighborhood.” -Mary Meeker, called the “Queen of the ‘Net”, veteran tech investor

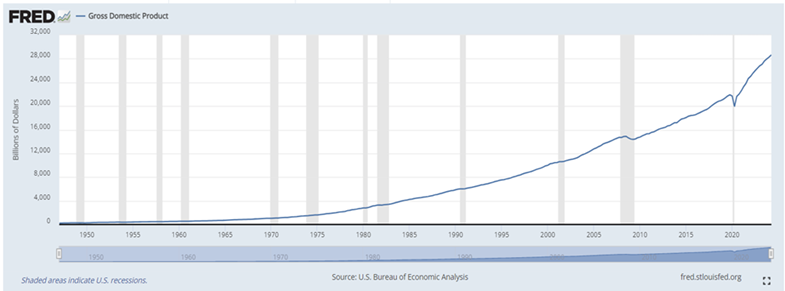

Despite important issues worrying investors today, the U.S. equity markets make new highs as corporate earnings continue to rise and the U.S. continues to attract capital. Notably, the U.S. GDP has grown by nearly 25% or $5.6 trillion (see Chart 1) in the past four years, and this growth was without the benefit of trillions of dollars of the legislated and required spending planned over the next several years. The economy will also be supported on a continuing basis by the ongoing efforts of U.S. companies to bring manufacturing back home, foreign companies shifting operations to the U.S., the massive future spending predicted for AI and data centers, and the new requirements to ensure a much stronger, more reliable, and expanded electrical grid. The United States will also need to increase and reorient defense spending in a perilous world. Breakthroughs in biotechnology and medical technology will likely have a significant effect on economic activity through greater productivity by lowering costs and improving health outcomes. It is the cumulative effect of the increased spending on each of these initiatives that should drive GDP growth through the decade.

Chart 1. United States Gross Domestic Product (GDP) Grew $5.6 Trillion Between 2021-2024

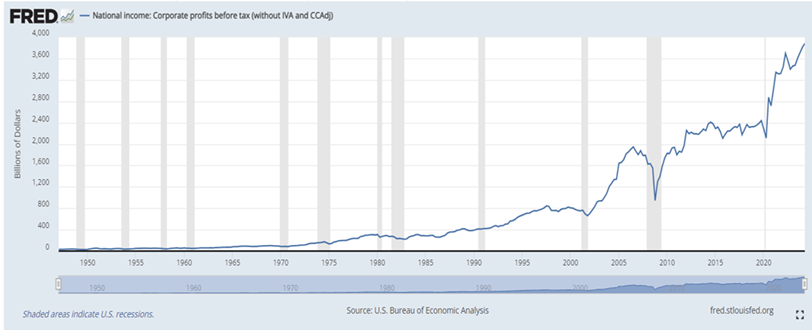

During the past three plus years, corporate profits have grown from $3.2 trillion to $3.8 trillion, as shown in Chart 2. We anticipate increasing corporate profits accompanied by greater productivity driven by technological advances. With lower interest rates, lower inflation rates and higher corporate profits, common stocks should continue to appreciate. As the Fed reduces interest rates, stock valuations tend to rise. If the aforementioned comes to pass, the United States will remain the strongest and most attractive economy in the world.

CHART 2. AT THE SAME TIME, CORPORATE PROFITS ROSE BY $600 BILLION

The recession that many investors are worried about is not our base case scenario, although we acknowledge the challenges for the U.S. and global economies. The United States economy remains remarkably resilient and corporate earnings continue to rise even in the face of higher living costs, changing terms of world trade, and the risks associated with national security and global conflicts. On recent earnings calls, the CEOs of companies represented in our portfolios highlighted multi-year growth opportunities supported by this relatively strong economic backdrop as well as by funding from the government’s fiscal programs and by state and local government funding.

MEGATRENDS DEFINING GENERATIONAL OPPORTUNITIES

“The megatrends that we talk about of energy transition, electrification, digitalization, all of those trends are just as relevant in Europe as they are in the North America market. I will say, though, if you think about some of the big differences in what’s driving perhaps this outperformance in the US is really a lot of reindustrialization, a lot of investments in manufacturing and LNG and other sectors, data center, where you have manufacturing that is historically taking place in other regions of the world. Now, those investments are being made in the US. Obviously, these investments are also being helped and supported by a number of these stimulus programs as well.” -Eaton Corp. CEO Craig Arnold

The recent surge in equity market returns has been largely driven by enthusiasm for artificial intelligence, with investors viewing it as potentially transformative as the printing press, steam engine, railroad, and the internet. However, it’s important for investors to remember that while these past technological revolutions changed the world, early investors had mixed outcomes, with some early leaders failing. Investors must not only identify promising technologies, but also the companies best positioned to execute, innovate, and sustain growth over the long-term. As history has shown, being an early mover in an emerging industry doesn’t guarantee success, making informed stock selection a key component of long-term investment success.

We see generative AI, climate change initiatives, and national security-related investments as key factors shaping a generational opportunity for investors. As we’ve discussed before, U.S. fiscal policies—such as the Inflation Reduction Act, the CHIPS and Science Act, and the National Defense Authorization Act—are attracting capital, including from other nations, and are setting apart the companies most likely to benefit.

The required infrastructure spending includes substantial funds allocated by state governments, in addition to federal and corporate contributions. New investments in data centers could eventually total $1 trillion, with much of this spending directed towards the industrial sector—an area that has only recently gained attention from investors.

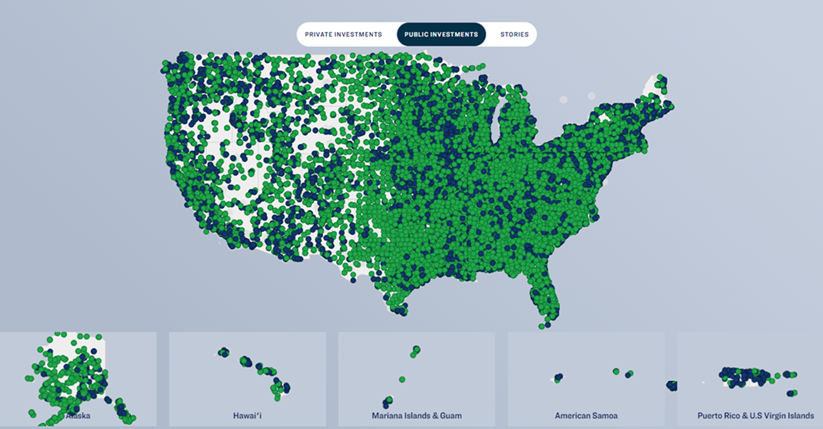

Chart 3. Public Investment Helping to Define the Opportunities

Source: https://www.whitehouse.gov/invest/

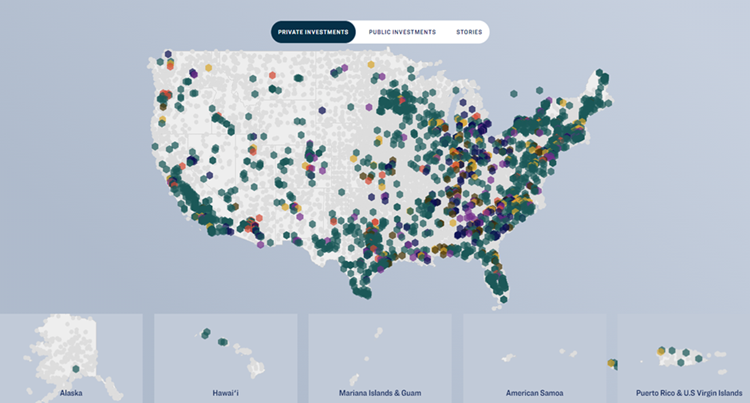

As illustrated in Chart 3, there has been a significant increase in the volume of projects initiated by federal, state, and local governments and supported by private investments from corporations. Chart 4 highlights private sector support in the areas of semiconductors, electric vehicles, clean energy, batteries, power, biomanufacturing and heavy industry. In the North American market in 2022, there were 31 mega projects totaling $103 billion. According to Eaton Corp. (a leading electrical and industrial products manufacturer), there are currently 444 mega-projects with a combined value of $1.4 trillion, double the number from the previous year. Despite recent reports of delays, corporate executives are not anticipating a slowdown in projects and believe there are opportunities that will last for several years. Notably, only 15% of these mega-projects have begun, and Eaton has secured over $1.4 billion in orders, with another $1.3 billion in negotiations.

Chart 4. Private Investments Supporting Government Initiatives

Source: https://www.whitehouse.gov/invest/

We anticipate these megatrends to persist, as noted by CEO C. Howard Nye of Martin Marietta Materials Inc., a company specializing in aggregates and concrete. During a recent earnings call, he stated, “Beyond 2024, we expect generational highway and streets investment as the nascent reshoring and artificial intelligence infrastructure build-outs are very much expected to provide an extended multiyear construction cycle in these aggregates-intensive end markets. Equally, when the affordability headwinds recede, we fully expect an accelerated housing construction recovery, specifically in single family, which will be required to address the structural deficit of homes in many of Martin Marietta’s key markets.”

THE GREAT DEBATE – WILL BIG TECH GET A RETURN ON AI INVESTMENT

“I think the natural comparable that jumps to mind for many investors is the tech bubble of the late 1990s and early 2000s, most of the companies involved in the buildout went bust. This buildout is similar in some ways…The main difference, though, is that the firms doing most of the building have massively profitable existing businesses and fortress-like balance sheets.” -Morningstar Equity Analyst Hodel

Market participants are debating two key issues regarding big tech: valuations and the returns on significant investments by industry leaders. Chart 5 shows the quarterly AI infrastructure spending by Microsoft, Meta, Amazon, and Alphabet from Q3 2023 through Q2 2024. While investors often look to past trends for insight into the current market, Morningstar’s Hodel emphasizes two crucial factors: the massive profitability of these companies and the strength of their balance sheets. With combined quarterly spending exceeding $50 billion, it will be extremely difficult to compete with these market leaders, especially for highly leveraged, low-growth companies. Larry Ellison of Oracle described the ongoing battle for technological supremacy as one that “will be fought by a handful of companies and maybe one nation-state over the next five years at least, but probably more like 10. So, this business is just growing larger and larger and larger. There is no slowdown or shift coming.” Why? Ellison estimates that the cost of building gigawatt or multi-gigawatt data centers starts at around $100 billion of corporate spending over the next 4-5 years.

Chart 5. It’s Hard To Compete With Capex On This Scale

This is a critical time for executives at technology companies around the world as the U.S. and China are engaged in a battle for technological supremacy, the EU is active in trying to regulate big tech, and both public and private market investors are working to determine who will be the winners and who will earn a return on the capital investment. As an Alphabet executive recently said, “the risk of underinvesting is far greater than overinvesting when you are going through a major transition.” Fortunately, most big tech companies have other spending programs from which they can redirect capital to pursue higher returns. ARS has adjusted its weightings of the big tech companies throughout the year. In another example, Meta’s Mark Zuckerberg doubled down on spending on AI when he said recently, “At this point, I’d rather risk building capacity before it’s needed, rather than too late… The downside of being behind is that you are out of position for, like, the most important technology for the next 10-15 years.”

Investment Implications

“In the real world, things fluctuate between ‘pretty good’ and ‘not so hot,’ but in investing, perception often swings from ‘flawless’ to hopeless.” – Oaktree Capital’s Howard Marks

Given the elevated market volatility experienced since August 1st and September being typically the worst month of the year for the markets, it is easy for investors to get caught up in the short-term dynamics of the markets and lose sight of the fact that recent market volatility is more a reflection of investor perceptions and not a reflection of the underlying business fundamentals. As we have experienced this quarter, short-term investor perceptions can move significantly, especially when we are dealing with the current state of world politics, multiple geopolitical conflicts, and worsening economic and social challenges in Japan, Europe, China, and the UK. In a world where the other leading economies are struggling, the United States remains the best economy and most attractive market on a risk-reward basis. Client portfolios are focused on U.S.-listed companies with strong balance sheets involved in upgrading infrastructure, the energy transition, improving productivity and national security with leading market positions, secular growth prospects, and pricing power. Another area of focus is the healthcare sector which stands to be both an immediate and long-term beneficiary of the application of technology, including artificial intelligence, to lower costs and improve patient outcomes. It couldn’t come at a better time as the population ages.

The U.S. economy should continue to benefit from domestic spending by all levels of government, supported by the reshoring and onshoring of manufacturing, rising corporate earnings and the surprising strength of its consumers. While we are troubled by the lack of fiscal discipline in the loosely defined economic proposals of the Harris and Trump campaigns, we would not advise shifting client portfolios until one knows the composition of the next government as many policies as proposed would not likely pass in a divided or near-divided government. On that note, ARS recently hosted a Zoom with Andy LaPerriere of Piper Sandler Macro discussing the odds of potential election outcomes, what a Harris or Trump portfolio might look like, and what to expect in the months ahead (https://arsinvestmentpartners.com/what-matters-now-democracy-2024-candidate-policies-election-odds-and-portfolio-implications/).

During periods of heightened uncertainty, ARS relies on its focus on the secular themes that drive capital flows and its proprietary fundamental research to drive investment decisions and capitalize on the mispricings of securities created by market perceptions. It is often in times of the greatest uncertainty that opportunities arise, and we view this environment as one of those times.

Published by the ARS Investment Policy Committee:

Stephen Burke, Sean Lawless, Nitin Sacheti, Greg Kops, Andrew Schmeidler, Arnold Schmeidler, P. Ross Taylor, Tom Winnick.

The information and opinions in this report were prepared by ARS Investment Partners, LLC (“ARS”). Information, opinions and estimates contained in this report reflect a judgment at its original date and are subject to change. This report may contain forward-looking statements and projections that are based on our current beliefs and assumptions and on information currently available that we believe to be reasonable. However, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements.

ARS and its employees shall have no obligation to update or amend any information contained herein. The contents of this report do not constitute an offer or solicitation of any transaction in any securities referred to herein or investment advice to any person and ARS will not treat recipients as its customers by virtue of their receiving this report. ARS or its employees have or may have a long or short position or holding in the securities, options on securities, or other related investments mentioned herein.

This publication is being furnished to you for informational purposes and only on condition that it will not form a primary basis for any investment decision. These materials are based upon information generally available to the public from sources believed to be reliable. No representation is given with respect to their accuracy or completeness, and they may change without notice. ARS on its own behalf disclaims any and all liability relating to these materials, including, without limitation, any express or implied recommendations or warranties for statements or errors contained in, or omission from, these materials. The information and analyses contained herein are not intended as tax, legal or investment advice and may not be suitable for your specific circumstances. This report may not be sold or redistributed in whole or part without the prior written consent of ARS Investment Partners, LLC.