Today’s investors must adjust to a global economy unlike any previously experienced. There is no historical precedent for the post-financial crisis economy, and one need look no further than the more than $12 trillion of government bonds currently carrying negative yields. The convergence of these unprecedented economic conditions with unconventional monetary policy, insufficient fiscal policy responses, and a changing market structure are challenging many investment strategies dependent on historical precedent. Volatility and uncertainty are two defining characteristics of a deflation-prone global economy marked by low growth and low interest rates. At the same time, growing economic divergences, populist politics and changing terms of global trade are contributing to significant shifts in investor sentiment, which in turn impact short-term security valuations. Bear in mind, the more negative the sentiment, the better the value for the buyer. Conversely, more positive sentiment can lead to greater overvaluation in individual stocks or the overall market. This is important because securities trade in an auction market that has inherent inefficiencies which lead to the mispricing of securities. These mispricings create opportunities for investors who have the ability to correctly define the macroeconomic conditions and the willingness to go against popular sentiment. The distinct economic, political and social dynamics of the current environment leads us to question whether investors can adapt to this new investment paradigm.

To remind our readers, the purpose of the ARS Outlooks is to define the forces affecting the global economy and to identify the beneficiaries of the key secular trends. The Outlook is the foundation of our investment philosophy and process. We employ a long-term, investment-oriented approach, and avoid short-term speculation. We do not attempt to make predictions with unwarranted precision, but rather work to determine those outcomes that should have the highest probability of success. Our focus is to define the secular beneficiaries of the global environment and then the outlook for the three fundamental elements of securities valuation — corporate earnings, interest rates and inflation rates. Once we determine the sectors and industries that should most benefit, our team conducts fundamental research to determine which U.S.-publicly listed companies represent the best values for client portfolios. We are seeking to buy the most assets, earnings and cash flows in the beneficiaries of the global economy. Our research focuses on those businesses that generate significant free cash flow as it represents what companies actually have left at the end of the day. Cash flow is what drives a business and its ability to invest in the future and to reward investors through dividends and share buybacks. We are less concerned about reported earnings which are a creation of accounting rules. The job of investment professionals is to make their best judgment on the future earnings power of the businesses they own.

In this piece, we will describe why investors cannot compare the current expansion to past cycles, why governments must become the spenders of last resort, the implications of changes to the structure of the market and where capital is likely to flow in the new investment paradigm. While the current environment is likely to remain volatile and uncertain, we expect the U.S. and global economies to improve in the coming quarters. Efforts by central banks to stimulate growth, including the recent rate cuts by the Federal Reserve and others, typically take 2-3 quarters to work through the system. Additionally, we remain positive on the secular trends that we have identified and highlighted in recent Outlooks. While policy missteps always remain a risk for the global system, we believe that the secular trends we have identified will continue to be the principle drivers of economic activity for the foreseeable future.

Why You Cannot Compare the Current Expansion to Past Cycles?

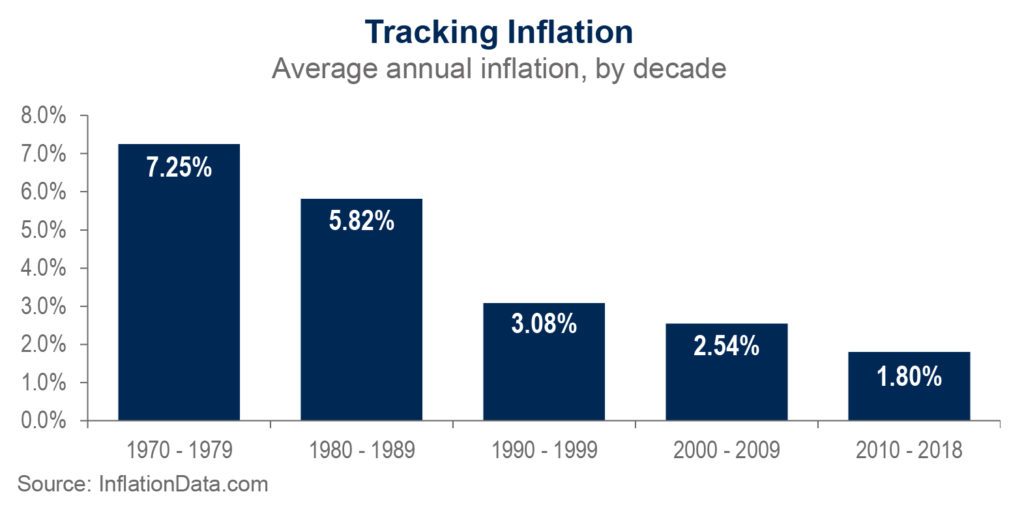

The current economic expansion, which is the longest in U.S. history, has many distinct characteristics when compared to past cycles. The post-WWII global economic system was defined by monetary controls, administered prices, fixed exchange rates, and cost-of-living wage adjustments in labor contracts with inflationary tendencies, among other forces. In 1973, President Nixon introduced floating exchange rates where currency rates are determined by the markets. Subsequently, governments moved to managed exchange rates, also called “dirty floats”, whereby a country’s central bank intervened to raise or lower the value of its currency. From a geopolitical perspective, two important multilateral governing institutions introduced between 1948 and 1949 were the North Atlantic Treaty Organization (NATO) for defense purposes and the General Agreement on Tariffs and Trade (GATT) which was introduced to help guide international trade in the post-war period. GATT was the predecessor to the World Trade Organization (WTO) which was officially launched in 1995. In the 1970s, cost-of-living wage adjustments combined with higher oil prices stemming from the 1973 oil embargo created extensive inflationary conditions. This led then Federal Reserve Chair Paul Volcker to use monetary policy to dramatically raise interest rates to curb the inflation which peaked at 14.8% in March of 1980.

The fed funds rate peaked at 20% in June of that year. In general, economic expansions end because the economy becomes overheated causing central banks to raise interest rates in response. At the same time, spikes in oil prices often accompanied rising economic activity which put even greater strains on the system.

Current conditions are very different from past expansions especially at this late stage of a business cycle because we are running a massive federal government deficit at the wrong time. Moreover, much has changed in the past decade to challenge the post-WWII norms that make comparisons with previous cycles questionable. In response to the 2008 global financial crisis, the world’s leading central banks embarked on accommodative monetary policy programs unlike any previously conducted. These actions have resulted in the lowest level of interest rates in most investors’ lifetimes. At no time in history has the Federal Reserve lowered interest rates at this late stage in an expansion with the economy at full employment, interest rates already near record lows and deficits legislated to exceed $1 trillion for many years. This move is without precedent. In the past, an attack on the Saudi oil fields, like the one experienced recently, would have led to a sharp increase in oil prices and created a significant strain on importing nations and consumers. However, this time prices rose for about two weeks before declining as U.S. oil production continues at record levels of over 12 million barrels a day. Perhaps the two most important differences in the economic and political conditions today are that the global economy is more deflation-prone than in past periods and that the United States has pulled back from its global leadership role. The latter policy change has important geopolitical implications as it has undermined a critical decades-old system. In addition, the Administration’s policies are leading to fundamental changes in global supply chains for corporations and strategic alliances among nations.

There are four secular deflationary forces present that have not been as characteristic in past expansions as they are today. These are technology-driven disruption, debt, demographics and deficits. The worst thing that can happen to an economy is a deflationary spiral, to which the aforementioned deflationary forces contribute, as those conditions are hard to reverse. Inflationary cycles are easier to manage since the central bank can raise interest rates as Mr. Volcker did in the 1980s. Most economists and quantitative investors use statistics of past cycles to compare to this one, but the past statistics are of little practical use because the same conditions are not present today. Decades ago, interest rates were 14-15%, now the 10-year treasury is yielding 1.9%. When yields are high, capitalization rates tend to be low, when yields are low, the reverse is true. A capitalization rate is the rate at which the market calculates the value of current earnings of a company. This has important implications for securities valuation and is a key reason why the stock markets are flirting with record highs even in the face of political and economic uncertainty.

Why Do Governments Need to Become the Spenders of Last Resort?

“We all know what to do, we just don’t know how to get reelected after we do it.”

– Jean-Claude Juncker, the outgoing president of the European Commission

Why are most advanced economies growing at near stall speeds despite central banks pulling all the levers at their disposal? The answer is that the current problems cannot be solved by monetary policy alone, and that the fiscal policy responses of advanced nations has been woefully inadequate. As Mr. Juncker states clearly, politics are holding back the economy. Additionally, the trade war is retarding capital expenditures, debt and uncertainty are weighing on consumer spending, and monetary accommodation is showing diminishing effectiveness in generating economic activity. The post-crisis goal of monetary policy was to increase asset values to stimulate economic growth and make the debt problems more manageable. However, there were unintended consequences including growing income inequality that resulted from the failure of politicians to introduce the fiscal stimulus required to address the many needs of a rapidly changing world. The growing frustration with governments is evidenced by the street protests in Hong Kong, Chile, Spain, Lebanon, Bolivia, Iraq, and Russia to name just a few. This failure of elected officials to act responsibility is also a major reason for the political divisiveness in the U.S., U.K. and Europe. The outgoing European Central Bank President Mario Draghi summed up the problem succinctly with his recent comment, “If fiscal policy had been in place, or would be put in place, the side-effects of our monetary policy would be much less, the actions of our decisions today would be much faster and therefore the need to keep in place some of these measures would be much less.”

What should happen now? There are three sources of spending in an economy – consumers, corporations and governments. Today, governments need to act to become the spender of last resort in order to counter the deflationary pressures and stimulate growth. The good news is that there are several important initiatives that could be implemented immediately, and these are in areas of greatest need in most advanced nations. To start, governments should make significant investments in our physical, digital and educational infrastructures. As the former head of the International Monetary Fund and incoming ECB President Christine LaGarde said recently, “Those that have the room to maneuver, that’s to say Germany, the Netherlands, why not use that budget surplus and invest in infrastructure? Why not invest in education? Why not invest in innovation, to allow for a better rebalancing?” Advanced nations share the same challenges, but few politicians have the courage to risk reelection in order to do the right thing. France’s President Macron is one who has gone against the grain by attempting significant reforms, and his efforts are starting to bear fruit. Maybe this will encourage others to follow suit.

In the United States, there are an estimated 7.1 million job openings which highlights the significant mismatch between available workers and the skills required for the jobs of the new economy. A recent survey from the National Federation of Independent Businesses reveals that 88% of small business owners hiring, or trying to hire, reported few or no “qualified” applicants. In response, the U.S. government should partner with leading businesses to create apprenticeship programs to help address the skills gap. Governments should work with our public universities to revamp the curriculums to better prepare graduates for the jobs of the future and not those of the past. Free tuition, as it has been proposed by some Presidential candidates, will not be useful without some changes as many recent graduates feel they are not properly prepared to enter the workforce and are saddled with an average of $28,000 or more in debt. In our May 6, 2019 Outlook, we discussed in some detail initiatives that should be considered by our elected officials to foster a higher and more sustainable rate of growth.

How Do the Changes in the Structure of the Markets Impact Investment Thinking?

In our September 18, 2018 Outlook, we addressed the key changes that are impacting the structure of the equity market in the United States. The most significant changes include the significant drop in the number of publicly traded companies, the concentration of power of leading corporations, the explosive growth in the number of investment vehicles available, the growing influence of private equity and the technological advances such as artificial intelligence, machine learning and high speed trading that are redefining the market’s mechanics and investment approaches. Many businesses which would have become public in the past now have much greater access to private capital from either venture capital or private equity investors. This means that a business can remain private and avoid the regulatory burdens of being a publicly listed company. Bear in mind that private equity firms are sitting with an estimated $1.7 trillion of uninvested capital and continue to raise record amounts of cash. Another factor impacting the structure of the market is the growing influence of passive investments in index funds and exchange traded funds (ETFs).

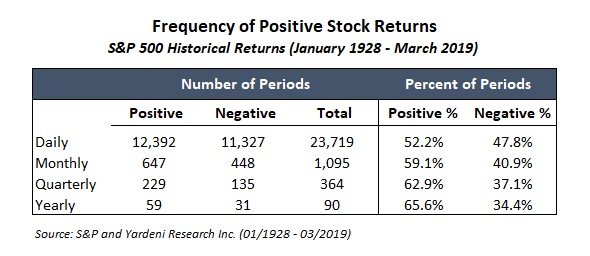

Passive investment strategies influence sentiment and encourage a “follow the herd mentality.” This is evidenced by the significant movement of capital out of equities (even as the indices have reached record levels) and into bonds which currently offer only modest yields at best. Investors seem

to have forgotten that the bull market in bonds has been going on since 1981, while the bull market in stocks has been going on since 2009. This would indicate to us that the risks of bonds may be underestimated by market participants while the risks of equity investing may be overestimated. In a recent survey of Barron’s Big Money poll of institutional investors, bullish sentiment was at or near a record low. If this sentiment changes and there is a reversal in flows back into equities, then the market in 2020 may provide even higher returns than anticipated for those who act ahead of the crowd. The prevalence of short-term thinking is another factor that investors must consider as capital is built over time through the ownership of businesses, not through quick return schemes. While more and more market participants are making decisions based primarily on price and popularity, our decisions continue to be business-driven, based on our judgment of the outlook for cash flow and earnings growth. While our core principles for investing will not change, the application of those principles must always take into account changes in the environment. We believe it is prudent to assess the current environment with a clear eye and without preconceived notions about the present based on past experiences. As Warren Buffet once said, “The stock market is a device for transferring money from the impatient to the patient.”

Where is Capital Likely to Flow in this New Paradigm?

“It is impossible to produce superior performance unless you do something different from the majority.”

– John Templeton

Capital will flow to the problem solvers of a low-growth and low-interest-rate world. The social, economic and political forces shaping the new investment paradigm described in this Outlook will require investors to adjust in at least three ways – asset allocation, return expectations across asset classes, and their views of liquidity. Asset allocation is determined by the relative risk/reward of cash, bonds and stocks. Low interest rates have been punishing savers and pension funds encouraging each to assume higher risk to achieve required rates of return. Pension plan managers, especially of public funds, have been forced to lower their return expectations, and the plans will require greater annual contributions going forward. This comes at a time when U.S. public pension funds are already facing an estimated $4.4 trillion funding shortfall. In our view, the search for higher yields has pushed investors to assume higher risks than may be suitable for many. When interest rates were higher, pension plan sponsors could achieve a significant portion of the required returns from bond yields that are no longer available. This makes quality dividend growers an attractive alternative.

Given the growth in private equity assets to over $4 trillion, it seems appropriate to share some thoughts in this area. Private equity plays an important role in the markets as it provides capital to businesses that might not be developed sufficiently for the public markets. When less capital was available for private equity deals, there were better opportunities to achieve outsized returns. However, several major public pension funds recently lowered their excess return expectations for private equity over public equities from 3% down to 1.5%. For those focused on private equity, this year’s failed IPOs and the Softbank investment in WeWork provided an excellent reminder that private valuations are also driven by sentiment. Softbank saw the value of its investment go from $47 billion a few months ago down to $7 billion. Many investors consider private equity to be a less volatile investment, but this false sense of security is due to the lack of daily pricing. Investors in WeWork might not agree given the swift change in valuation. Finally, we would remind investors that liquidity matters most when it is needed, and it is often needed when least expected. Private equity can play an important role in investors’ portfolios, but one should make sure the characteristics of the investment match the investor’s risk appetite and liquidity needs.

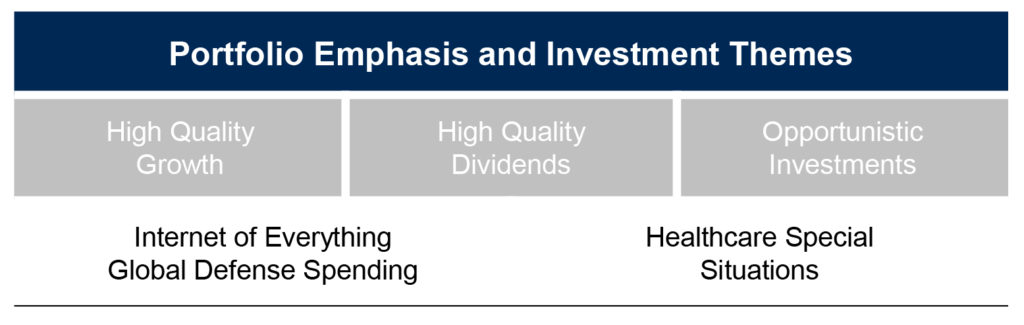

The three primary beneficiaries of the Outlook are companies with above-average revenue growth in a low-growth world, companies with stable, above-market dividend yields in a low-interest-rate environment and special situation companies including publicly traded small capitalization companies. While the economic outlook remains both volatile and uncertain, the secular drivers about which we have written for several quarters remain intact with the beneficiaries continuing to attract capital. The major areas of emphasis for portfolio holdings include:

Quality dividend growers – We have identified a portfolio of high-quality companies with strong balance sheets, good growth and which pay dividends at above market rates. The dividend yields are nearly 1% higher than the 1.95% yield of S&P 500 and the 1.9% yield on the 10-year U.S. treasury bond.

Quality growth companies – One of the key implications for investors is that companies with above average revenue growth can command premium valuations as they are less reliant on a strong economy. This opportunity includes technology companies that are benefiting from unprecedented innovation which we see accelerating in the next 36 months. ARS is focused on cloud, 5G, cyber security, software services, semiconductors and capital equipment, display, telecommunications, mobile communications, network infrastructure, connectivity solutions providers, and beneficiaries of autonomous driving. We also favor select defense and materials companies as well as specially defined healthcare investments due to favorable demographic trends and technological advances.

Company-specific stories – (including some smaller capitalization investments) with compelling valuations and strong company-specific catalysts or growth drivers. Furthermore, in this environment, companies with strong balance sheets should continue to prosper as cash allows these businesses to invest in increased productivity, new growth initiatives as well as to return capital to shareholders. Please refer to our recent Outlooks for more specifics on these themes.

Our Outlook describes an environment unlike any investors have ever experienced. The U.S. and global economies should experience higher growth into 2020 and the expansion should continue for some time. Any tariff relief will release the pressure on the global economy allowing capital expenditures to increase and the outlook for corporate profit growth to improve. In turn, this could result in interest rates rising somewhat as many investors shift from bonds back into equities at a seasonally strong time for equity investing. Those equity investors who have been on the sidelines will be under pressure to invest cash. This could result in stronger equity returns than many currently anticipate in coming quarters. One can be 100 percent invested in any environment if one can correctly define it. However, the dynamics present today are very fluid and volatile, making being fully invested somewhat less appropriate in our view. Today, it pays to have some cash reserves, not as a market call, but to take advantage of the opportunities presented by market volatility. We remain optimistic about the prospects of building capital in the coming quarters but believe investors should focus on striking the appropriate balance between risk, reward, and liquidity. As legendary investor, Seth Klarman reminds us, “Investors should always keep in mind that the most important metric is not the returns achieved but the returns weighed against the risks incurred. Ultimately, nothing should be more important to investors than the ability to sleep soundly at night.”