“This crisis will test our political system, our grit, our patriotism and our willingness to sacrifice for the common good. We will emerge stronger only if we are able to reshape our policies so that, while still retaining the magic dynamism of capitalism, they are responsive to dramatically different circumstances… Our nation will never be the same, but we can emerge stronger and retain our role as a global leader – if we are smart about the rebuilding to come.”

– Henry Paulson, former U.S. Treasury Secretary, Chairman of the Paulson Institute and Co-Chairman of the Aspen Economic Strategy Group

In our January 24th Outlook, we wrote that “As a new decade dawns, the rate and magnitude of the coming changes will require investors to identify and embrace the most investable themes in a world that may at times feel un-investable. To protect and build capital in this type of environment, investors should focus on the primary beneficiaries of a few critical secular themes in the new decade of disruption and avoid the companies that are being disrupted that are being disrupted… Successful investing in the coming year will require a high level of conviction at a time when many aspects of our lives could be experiencing significant change.” When we wrote that Outlook, we did not anticipate the COVID-19 pandemic or the political, economic, and social challenges that the virus has presented. Today the United States is faced with a crisis the likes of which we have not previously experienced, with historic levels of unemployment, rising debts and deficits, a record number of small businesses at risk of closures and bankruptcy which potentially adds to growing inequality. Many are trying to envision how we can safely restart, recover, and then rebuild a better and more balanced economy, particularly considering the political dysfunction that exists today.

The COVID-19 pandemic is testing the world in ways it has not been tested previously. This crisis has accelerated and augmented many of the positive and negative trends which were in place prior to the pandemic and that continue to impact so many aspects of our lives. A positive resolution will require both a short-term solution to achieve a successful restart and then a longer-term one to address the problems that are either being created or worsened by the pandemic. A successful restart will require a medical solution – testing, treatment and vaccination – to arrest the disease, a financial solution to provide a bridge from lockdown through the restart to the next normal, and an economic solution to prevent a global depression. Once a successful restart is underway, we will need a multi-pronged approach to address the three most significant longer-term issues involving debt and deficits, inequality and shifting geopolitical alliances. For far too many, the economic and emotional damage that will result from the pandemic will be felt for decades if past pandemics can serve as a guide. In this Outlook, we will address the most frequently asked questions we are receiving from investors and ones we are asking ourselves as an investment team.

How do you reconcile the difference between the terrible unemployment and other economic numbers with the stock market rebound?

Given the unprecedented nature of the COVID-19 virus and the resulting actions to shut down economic activity, it is no surprise that the United States and global economic activity has ground to a halt this quarter and that the stock market experienced a sudden and severe decline in March. What has surprised many on Main Street and Wall Street has been the dramatic rebound in stocks given the uncertainty still present in the system, leaving many to wonder what to make of the disconnect. A key element of support for the economy and the markets has been the massive monetary and fiscal response from central banks and governments in the United States and globally. On May 25th, Japan announced an additional fiscal stimulus of over $1 trillion and is now targeting aggregate stimulus of 40% of its Gross Domestic Product (GDP). This has had the short-term effect of replacing some lost income for workers and revenues for businesses, while offsetting some of the decline in GDP lost due to the virus. This much global stimulus will result in further increasing asset values. It is important for investors to bear in mind that the stock market is a discounting mechanism based on future expectations of better times. The market is anticipating the resumption of economic activity; the development of effective testing, treatment, and a vaccine; and the intermediate-term benefits of the massive monetary and fiscal policy initiatives being introduced. The economic effects of fiscal and monetary policy initiatives usually take between 12-24 months to work through the system, while the financial impacts are immediate. It is also appropriate to mention that the reopening of the economy should gradually bring the unemployment numbers back down from the current 20% level. We anticipate continued market volatility as most pandemics do not get resolved quickly. Based on studies of past pandemics and other crises, investors should expect that the economic and social impact will be felt for years or even decades.

What are the implications of rising debt and deficits?

Rising debt and deficits matter for the economy and investors, but these need to be kept in context of the unique dynamics present in the system. Typically, rising deficits are inflationary, but conditions today clearly are without precedent. Before the pandemic hit, for example, the United States had an economy that was ripe for inflation with full employment at 3.5%, while the U.S. was running a fiscal deficit of more than $1 trillion and growing, and yet the economy was more deflation prone than inflation prone which is why we never got the inflation that many anticipated. The present level of deficit spending has been a replacement for lost wages and revenues, while past deficit spending had been additive to economic activity. Additionally, quite a few investors also misunderstood that the pre-COVID corporate spending that was taking place was to increase productivity to gain market share and lower costs which is the antidote to inflation.

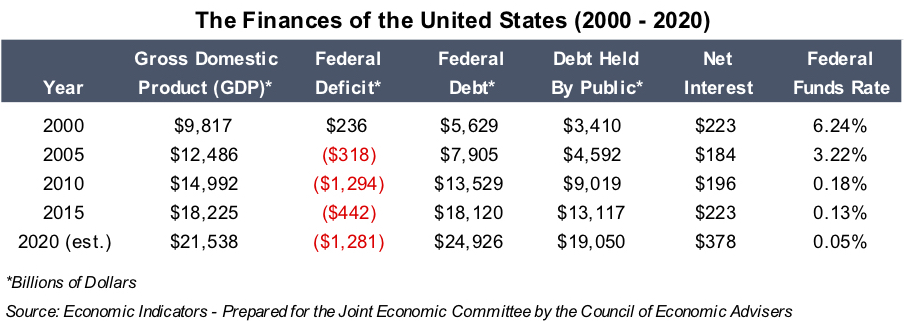

When it comes to the level of debt, what matters more than the total amount is the cost of servicing the debt which given today’s interest rate environment is near zero. As shown in the chart, the federal debt in 2000 was $3.4 trillion with servicing costs of $223 billion. Today, we have over 7x the amount of debt but only 1.7x the interest costs. Investors should also be aware that as existing debt (carrying a higher interest rate) matures, the reissuance is being financed at significantly lower cost. There are three major implications of the levels of debt and deficits for the United States. The first is that the Federal Reserve is able to work to keep interest rates low for a very long time as long as inflationary pressures are not an issue. The second is that it will be very difficult to raise taxes in a meaningful way anytime soon without slowing growth and risking another downturn. The third is that if the current deflationary pressures persist, the market will not force interest rates higher, and that will keep debt servicing costs relatively low and manageable, giving government the latitude for further deficit spending including pro-growth infrastructure programs.

Given the political divide and the problems you are describing, how can we govern effectively?

“When times are tough and people are frustrated and angry and uncertain, the politics of constant conflict may be good, but what is good politics does not necessarily work in the real world. What works in the real world is cooperation.”

– William J. Clinton, 42nd President of the United States of America

The pandemic and its aftereffects will add an additional level of complexity for both the Republican and the Democratic party leaders as the traditional platforms will not work to address the multitude of long-term problems we are facing today. Crises are the times to put partisan politics aside and focus on our nation’s most critical needs. These include developing a plan to provide additional relief for those in need right now, creating an effective path to reopening and laying the foundation to rebuild a better, more resilient economy that is more inclusive for our entire society and essential for our future. Just as increasing productivity is the antidote to inflation, societal inclusivity is the antidote to confrontational partisan politics. Regardless of who wins the election, the traditional approaches of either party simply won’t work given the pandemic-related economic and social damage that is being done, the growing inequality, the geopolitical instability that exists today and could grow, and the rising levels of debt and deficits. The United States needs a long-term plan to which our nation can commit to regardless of which party is leading as policies based on two-year election cycles have contributed to putting our nation in this mess to begin with. As Jean Claude Juncker of the European Commission once said, “We all know what to do, we don’t know how to get re-elected once we do it.”

So, what needs to be done? First, Congress needs to draft a bipartisan plan to provide a path to achieving a more steady and fair economy, not solely for the next election cycle but for future generations. This plan should have mission-critical initiatives that should be implemented regardless of which party is in office. Second, as we suggested in a recent Outlook, the federal budget should be separated into an operating budget and an investment budget to allow for smart, strategic investments in our areas of most critical need as highlighted in the new plan. Third, the U.S. needs to develop and fund a massive multi-year infrastructure initiative focusing on our healthcare, education, digital and physical infrastructure. This is a need that can no longer be postponed and would go a long way to creating a more inclusive, stronger, and therefore, more resilient economy. It would accomplish two important long-term goals. It would address the inequality problem which otherwise will be intensified by the policies being implemented. The resulting growth will lay the foundation our country’s needs to eventually bring the deficits and debt down in relation to the size of the growing economy. Fourth, we need to rework our tax system to make it fairer, and also need realize that the current backdrop makes raising taxes inappropriate at this time, beyond closing some loopholes, given the financial challenges facing so many individuals and businesses.

There is too much of a singular focus on taxes for big corporations, given that tax policies targeting one segment often have significant unintended consequences for other parts of the economy. Fifth, we need to champion corporations that are strategically vital to our future prosperity, but to do so in a way that ensures that they are acting in an appropriate manner. It is our businesses, both large and small, and innovation that have allowed the U.S. to prosper. To that end, we would encourage a more collaborative and a less punitive approach from some in Washington, while encouraging more public-private partnerships to address the many complex issues facing the nation. Finally, we need our young adults to step forward to become the next “greatest generation” and lead us with new ideas and a renewed spirit of cooperation placing practical solutions ahead of ideology.

With the current level of uncertainty, what should investors do now?

“Out of intense complexities, intense simplicities emerge.”

– Sir Winston Churchill, former Prime Minster of the United Kingdom

As a result of the extraordinary nature of the COVID-19 world, many market participants are struggling to make sense of the markets given the level of uncertainty, complexity and growing geopolitical risks, particularly with China as well as the need to better address climate change. During times like this it helps to take a step back to assess the bigger picture and not get caught up in the news cycles about the crisis. Investors should recognize that the virus is creating a two-tiered market between those that are providing solutions during this difficult time and those that are being more negatively impacted. Obviously some e-commerce companies are doing well right now, but in every crisis we see new businesses emerge and old ones disappear. It has been this way throughout history and will be this time as well.

A relatively small number of companies are prospering, and many others are struggling. Why? Because these companies have embedded advantages including scale, stronger balance sheets and better access to capital enabling them to invest more heavily to increase productivity through investments in innovation and technology advances. This, in turn, leads to higher earnings, better pay for employees, stronger market share, and ultimately greater shareholder value. Investors should focus on companies with “embedded advantages” over their peers. It is for this reason that we feel the investment environment is set to favor active investment management over passive management, and high conviction strategies over more diversified strategies. Additionally, the low-interest rate environment favors companies with strong balance sheets, good business models, and the ability to raise their dividends.

There are always risks to the economic outlook and that is certainly the case today. Among the key risks that would change our positive views would be a sharp rise in inflation and the exchange rate for U.S. dollar. As the world economy remains both fragile and fluid, we continue to be both opportunistic and cautious in our investment approach. As we said at the start of this piece, the powerful shifts in the global economy are creating large opportunities, and well-selected equities should reward investors over the next several years. There are investable ideas present in virtually all market environments, and investors should be able to achieve both absolute and relative returns over time by owning the businesses that are the beneficiaries of the secular trends.