“We live in an era of disruption in which powerful global forces are changing how we live and work. The rise of China, India, and other emerging economies; the rapid spread of digital technologies; the growing challenges to globalization; and, in some countries, the splintering of long-held social contracts are all roiling business, the economy, and society. These and other global trends offer considerable new opportunities to companies, sectors, countries, and individuals that embrace them successfully—but the downside for those who cannot keep up has also grown disproportionately.”

– McKinsey Global Institute Report, January 2019

As a new decade dawns, the rate and magnitude of the coming changes will require investors to identify and embrace the most investable themes in a world that may at times feel un-investable. To protect and build capital in this type of environment, investors should focus on the primary beneficiaries of a few critical secular themes in the new decade of disruption and avoid the companies that are being disrupted. These secular themes are continuing technological advances and the powerful demographic shifts involving aging, automation and inequality. Climate change is becoming a more actionable investment theme across all equity strategies, and investment professionals may have to play catch up. These three themes will have profound implications for investment strategy and are closely linked to other important factors including the adjustments in monetary policy, fiscal policy, debt burdens, political disequilibrium, geopolitical conflicts and deflationary global forces. Successful investing in the coming year will require a high level of conviction at a time when many aspects of our lives could be experiencing significant change.

While impeachment proceedings, the Phase I deal with China, and the Iran situation have dominated the news flow so far this year, the market has instead continued to react favorably to the outlook for improving corporate earnings and lower-for-longer low interest rates. Notwithstanding negative headlines, we continue to view the United States as the standout economy due to the underlying strength of consumer spending, the efforts of state and local governments to invest in infrastructure and other critical programs, and the potential for corporations to significantly increase capital spending. Consequently, we continue to view the U.S. equity market as superior to foreign markets on a risk/reward basis. In the current environment, client portfolios should continue to emphasize many of the leading companies including healthcare companies, large cloud-service providers, display, telecommunications, mobile communications companies, semiconductor

capital equipment companies and chip manufacturers, as well as cyber, software, and defense companies. In this Outlook, we will discuss the investment implications of three of the most powerful forces that are reshaping our world. We believe the rate of change is in an accelerating state, and that this will force investors, policymakers and business leaders to come to grips with the implications of these changes so that they will not be left behind. Legacy companies must transition to adjust to the changing environment, and their success or failure will result in a revaluation of the businesses, which sets the stage for potential shifts in market leadership. To the degree that this environment fosters original thinking, active management should become more important than passive management.

The Third Wave of Technology: The Start of the Transformational Phase

“Technological change is not additive; it is ecological. A new technology does not merely add something; it changes everything.”

– Neil Postman, American educator

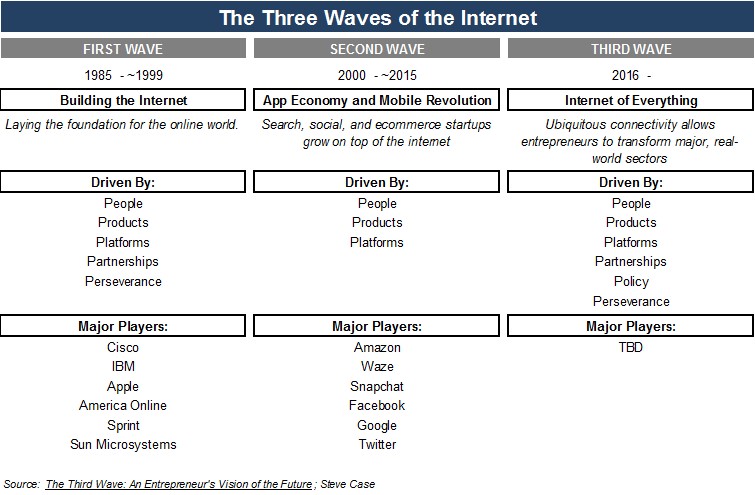

In the past, we have written extensively about the Third Wave (see Chart 1) and the coming transformative opportunity that 5G would deliver for consumers and businesses. 5G is moving from pilot programs to becoming a reality as it moves to full deployment over time. This is a game changer in our view as the way we live and work is about to undergo unprecedented change. By solving complex data and storage problems and the latency issue, 5G facilitates breakthrough technologies and their applications that were once unimaginable. Many of the benefits of this transformation will be less transparent than the obvious download speeds of data and videos on our devices. But no less important, it will help drive down production costs for the products and services in daily use. This in turn fosters more innovation.

To help our readers understand the power of 5G and the related technological advances we focus on the healthcare industry which will be one of the biggest and most immediate beneficiaries. As many are aware, the $3.3 trillion of annual healthcare costs in the United States represent an estimated 16% of GDP, which is double most other developed nations. Technological advances should enable the U.S. to reduce costs and improve the delivery of health services, while extending average life expectancy. There are three major benefits that technology brings to the industry—more accessible and better treatment, improved care and efficiency, and software-specific programs to improve overall care and disease control. In the coming years, we will see new applications of predictive healthcare and the introduction of more personalized prevention and treatments to ensure better outcomes for individual patients.

Big Data Capabilities and Storage: One of the key inefficiencies in the healthcare system is the management, access and retrieval of medical records. Moving to an electronic health record system will address some inefficiencies as data entry into a computerized system is much less time-consuming than are paper-based systems. One study from the University of Michigan estimates that this switch alone could reduce the cost of outpatient care by 3%. Cloud storage of data helps improve efficiency and accessibility while reducing wastage. This also facilitates the research and development of new treatment protocols and lifesaving pharmaceutical formulations. As patient data is highly valuable, the critical weaknesses of electronic health record systems are being addressed such as security and data protection. According to some estimates, stolen health credentials have 10–20 times the value of credit card data.

Artificial Intelligence: A recent study published in Nature Medicine highlighted how doctors are using artificial intelligence (AI) during brain surgery to diagnose tumors with slightly greater accuracy, but in less than two and half minutes compared to 20 to 30 minutes by a pathologist. The greater speed and accuracy offered by AI means the patient will spend less time under anesthesia, while allowing surgeons to detect and remove otherwise undetectable tumor tissue according to the study.

Genomic Research and Personalized Services: According to the National Human Genome Research Institute, technological advances are lowering the cost of sequencing a human genome which fell from $14 million in 2006 to about $1000 in 2016, and costs continue to decline. Genomics is the study of a person’s genes (the genome) including interactions of those genes with each other and with the person’s environment. A genome is an organism’s complete set of DNA. As the costs of genomic sequencing continue to decline, it opens the way for personalized treatment and medical programs designed for an individual’s specific genetic makeup. While there are many ethical issues surrounding genetic research, the potential to lower costs, improve outcomes and extend lives is significant.

Wearable Technology: Continued advances in wearable technology will help transform healthcare by allowing doctors to more quickly and accurately diagnose, treat, and prevent debilitating health conditions, while increasing patients’ access to care. Healthcare is a major point of emphasis for research by Apple and Alphabet (Google) among others, and wearable devices are a significant potential revenue opportunity for many companies. Wearable devices are being designed to target the most common chronic diseases including heart disease, diabetes, hypertension, and respiratory diseases. Other types of wearable technology being introduced include: wireless headsets for EEG (electroencephalogram) tests which are less invasive; eye lens implants to help restore or improve eyesight; bionic suits to help workers lifting heavy weights in repetitive movements or the elderly being more ambulatory; and for robotics to assist doctors and nurses treat life-threatening health issues. Also being tested are smart scanners that can check someone’s vital signs with a simple touch of the forehead, and at some point in this decade, ingestible nanochips could help doctors monitor the body’s internal systems.

These are just a few of the many ways the healthcare industry will be reinvented in the future, and there will be many more advances involving the use of artificial intelligence, machine learning and blockchain technologies that will improve and extend our lives.

How Demographic Shifts Are Reshaping Our World

“Demographics, automation and inequality have the potential to dramatically reshape our world in the 2020s and beyond… In the next decade, they will combine to create an economic climate of increasing extremes but may also trigger a decade-plus investment boom. In the U.S., a new wave of investment in automation could stimulate as much as $8 trillion in incremental investments.”

– Excerpt from the Bain Consulting report, “Labor 2030: The Collison of Demographics, Automation and Inequality”

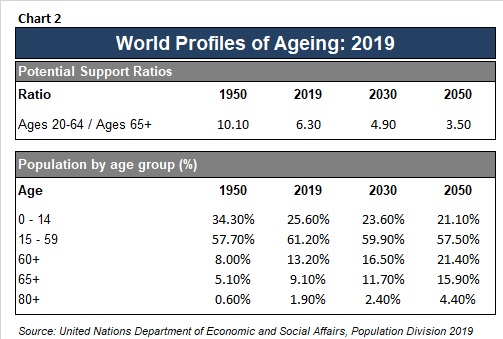

The unusual combination of rapidly aging populations, increasing workplace automation, and worsening income inequality will provide complex and interconnected challenges for policymakers for years to come. Changes in the demographic characteristics of a society have important implications for the structure of the workforce, government policy, and the overall economic outlook as most of the world’s leading economies are facing major headwinds from the demographic decline. According to data from World Population Prospects: the 2019 Revision, “by 2050, one in six people in the world will be over age 65 (16%), up from one in 11 in 2019 (9%)… In 2018, for the first time in history, persons aged 65 or above outnumbered children under five years of age globally. The number of persons aged 80 years or over is projected to triple, from 143 million in 2019 to 426 million in 2050.” This is the result of three factors – increases in life expectancy, declining fertility rates and unusual emigration patterns. Chart 2 highlights the projected trends toward an aging society as published in the United Nations report, World Population Prospects 2019.

As the world population ages, the Potential Support Ratio (PSR), or the ratio of the working-age population, 15 to 64, per one person 65 and older will become more important for investors. In 1950, the global PSR was 10.1 and it has dropped to 6.3 in 2019. By 2050 the PSRs are projected to be substantially lower at 3.5. The problem is most acute in Eastern and South-Eastern Asia with 261 million people aged 65 and over in 2019, Europe and North America (200 million), and Central and Southern Asia (119 million). By 2050, the United Nations forecasts the number of older persons doubling from 703 million to 1.5 billion. Concurrently, the birth rates in most developed nations are declining. According to a recent United Nations report, “The unprecedented shift towards a larger proportion of older persons and concomitant declines in workers is gradually and inexorably necessitating redesign of national economies.”

As a result of the demographic shifts, we anticipate greater social strains as governments are forced to address rising and, in many cases, unsustainable pension and healthcare obligations. As the yellow vest demonstrations in France have shown, the demonstrators do not want any adverse changes to their pension benefits, and one proposed change that was heavily criticized was raising the retirement age by only 2 years. The fact is that many of the future pension and healthcare obligations will not be able to be met without either lowering future benefits and/or raising taxes considerably due to fiscal constraints on governments in most developed nations. In addition, the aging issue will require a massive adjustment in the labor force that will necessitate greater use of automation, artificial intelligence solutions, and robotics in a variety of job functions in both the manufacturing and service sectors. New jobs will be created, jobs will be lost, and industries transformed in the process. This adjustment will create supply and demand imbalances in the work force for specific jobs, sometimes creating wage inflation for jobs in tight labor markets and sometimes leading to significant job elimination. There will be both inflationary and deflationary aspects of this shift that will pose additional challenges for monetary and fiscal policy.

Ironically, many nations may need to attract immigrants in order to have enough labor and consumption to drive economic growth and help meet future obligations, which for some countries would require a reversal of recent anti-immigration policies. Initially income inequality will likely be exacerbated as a result of the shift in the workplace as low-skilled, less-educated workers as well as older workers may not be as able to develop the skills required to compete for the better paying jobs. This low-interest rate environment enables businesses to be able to continue to invest in automation and lower labor costs through additional headcount reductions. This may push governments to consider skills-retraining and apprentice programs in conjunction with the private sector, a revamp of the educational system and ultimately to consider implementing some type of universal guaranteed income program.

Climate Change – We’re on the Eve of Destruction

“Climate crises in the next 30 years might resemble financial crises of recent decades: potentially quite destructive, largely unpredictable, and given the powerful underlying causes, inevitable.”

– Greg Ip, Wall Street Journal, January 17, 2020

From shifting weather patterns that threaten food production, to the terrible fires in Australia, to rising sea levels that increase the risk of flooding, among other problems, the impacts of climate change are being felt on every continent on an unprecedented scale. The problem is both man-made and due to natural causes and will require a multi-decade transition to address it. Attempts by governments to moderate the effects of climate change by controlling human activity are being undercut by the melting of the Arctic ice shield—250 billion tons of ice in 2019 alone—and the melting of the permafrost which is adding carbon dioxide and methane back into the atmosphere. There was a record melting of the permafrost in 2019, and this is critical as the melting causes erosion, the disappearance of lakes, landslides and ground subsidence. Whether you agree with the scientists or not, what is clear to the investment community is that changes in climate are having an immediate impact on supply chains, industries, living standards, water systems, food sourcing, global finance, and where people will live.

From an investment perspective, climate change is forcing immediate planning and spending that had previously been postponed. Capital spending related to climate change is going to be a much more important factor in economic activity this decade and beyond. This is forcing state, local, and federal governments as well as the private sector to respond with smart investment strategies. In many cases, it will require the continuation of low interest rates for an even longer period and greater investment spending which has repercussions for monetary and fiscal policy in a world already heavily indebted. Critically, the spending will be coming at a time when the global interest rate structure (the cost of capital) has never been lower, providing governments an ideal borrowing opportunity.

Our research efforts are focusing on the United States electrical grid and infrastructure systems as one of the most critical and immediate areas of need. The Fourth National Climate Assessment, released in 2018, noted, “Infrastructure currently designed for historical climate conditions is more vulnerable to future weather extremes and climate change.” Failure to address the nation’s grid will result in more problems like those experienced in California in the past year with rolling blackouts and wildfires. The current grid system in the U.S. is made up of three grids that are not well integrated. And one of the key issues will be transmitting energy between regions efficiently, particularly from the Southwest to the Northeast as well as from sparsely populated areas with energy supply surplus to more densely populated areas in supply deficit. The aging electrical grid system requires downtime to cool its transformers, and the shift to electric vehicles combined with rapid growth of the cloud and 5G would overwhelm the system as it stands today. The utilities are aware of the need to upgrade the electrical grid system, and four of them have announced capital expenditure plans in aggregate of more than $100 billion over the next three years. Our research continues to identify the companies benefiting from climate-related expenditures, especially those companies providing infrastructure solutions for the utility, pipeline, energy and communications industries.

As government and business leaders gather at the World Economic Forum Annual Meeting in Davos, the calls for action on climate are growing as evidenced by the theme for the event which is Stakeholders for a Cohesive and Sustainable World. Business leaders are paying attention as demonstrated by the recent pledge by Microsoft to become carbon negative in its emissions by 2030 and remove the amount of carbon it has emitted over the decades by 2050. This is a recognition of its role as a corporate leader in addressing the problem. Importantly for investors, the steps taken to address climate change will factor heavily into the valuations of companies going forward with some being helped and others being negatively impacted.

Investment Implications – Be Cautious and Opportunistic

“The future depends on what you do today.”

– Mahatma Gandhi

On the surface, the conditions described above might lead investors to be pessimistic about the prospects for the U.S. and global economies, and therefore the markets. However, it is these conditions that may very well set the stage for an extension of the current economic expansion, and perhaps an even longer run for this bull market notwithstanding the possibility of a near-term pullback. The reason for the more positive view is a continuation of the present low-growth, low-interest rate and deflation-prone environment which will enable the Federal Reserve and other central banks to continue their accommodative interest rate policies and avoid impeding capital flows. Barring a significant shift in the outlook for inflation, which we do not anticipate at this time, the Federal Reserve must work to keep interest rates low for the foreseeable future, and that would continue to provide a favorable backdrop for equity investing.

While much has been made of the income and wealth inequality experienced around the world, there is a similar dynamic playing out with corporations. The leading companies are prospering, and the rest are less so. Why? Because these companies are more productive, and the resulting productivity leads to higher earnings and better pay for employees. These companies tend to have better balance sheets and access to capital, enabling them to invest more heavily, and therefore enhance their productivity, grow market share, and ultimately increase shareholder value. Investors should focus on companies with “embedded advantages” over their peers. The leading technology companies offer excellent examples of businesses with embedded advantages. Alphabet, the parent of Google, dominates the worldwide search market ex-China. While there is talk of increased regulatory scrutiny and higher taxes for companies like Google, this would likely reduce the ability of others to compete by raising the cost of doing business and increasing the barriers to entry. There are companies with these embedded advantages in several industries that are benefiting from the secular themes described in this Outlook, and that is where investors should focus their dollars. It is for this reason that we feel the investment environment is set to favor active management over passive management, and high conviction strategies over more diversified strategies. Additionally, the low-interest rate environment favors companies with strong balance sheets, good business models, and the ability to raise their dividends. Companies with solid, above-market dividend yields should continue to be rewarded under these conditions.

There are always risks to the economic outlook and that is certainly the case today. Aside from the ever-present geopolitical risks, the risk of a massive cyber-attack on the U.S. infrastructure, government institutions or the financial system, or the risk of policy missteps, among the key risks that would change our positive views would be a sharp rise in inflation and in the U.S. dollar. As the world economy remains both fragile and fluid as highlighted by the coronavirus epidemic, we continue to be opportunistic and cautious in our investment approach. Climate change has now come to the fore as a secular trend. It now represents an immediate, multi-year investment opportunity. As we said at the start of this piece, the powerful shifts in the global economy are creating large opportunities, and well-selected equities should reward investors over the next several years. There are investable ideas present in virtually all market environments, and investors should be able to achieve both absolute and relative returns over time by owning the businesses that are the beneficiaries of the secular trends.