As the fourth quarter began, we noted a few troubling signs for the U.S. economy, but we didn’t expect that these would contribute to one of the worst quarters for equity investors in history and the worst December since 1931. While it would be easy to try to point to one thing that was the cause of the pullback, this would be understating the complexity of the relationship between today’s chaotic political environment, conflicting monetary and fiscal policy, the slowing global economy, a strong U.S. dollar, plunging oil prices and the markets. We believe that a healthy amount of concern moving forward is certainly appropriate, but it is important that investors do not lose sight of the attractive valuations being created in some the world’s finest businesses as a result of the recent market retracement. Looking at 2019, we see many challenges for the United States and global economies, but believe there are three key factors that investors should strongly consider. First, it is in everyone’s best interest that we avoid a recession; this is especially true for governments and central banks in the developed world and China. Today’s high levels of global debt, trade frictions and slowing global growth make extending the business cycle the top priority for world leaders. Second, the S&P 500 is currently valued at just 14x earnings according to consensus earnings estimates and earnings are still expected to grow in 2019. This is the lowest valuation level in more than five years. Third, greater volatility will be a fundamental characteristic of the markets for the foreseeable future. As the market digests economic and political headwinds, we believe the market has already fallen to attractive levels for investors. We have been taking advantage of this recent weakness to selectively add to favorite positions, or to swap into high-quality investments that are better positioned for a slowing growth environment.

What’s behind the market correction?

Coming into 2018, the United States was the standout economy. U.S. growth was strong with corporate earnings growing at 24% helping to drive positive U.S. equity returns through September. Even though the headline numbers for the United States were positive, the economy was beginning to show signs of deceleration, monetary policy was less accommodative, oil prices were plunging and price to earnings (P/E) multiples were contracting. The indexation of the market and high frequency trading may have further added to the severity of the decline in stock prices. While global economic activity was fairly resilient, it was becoming more uneven and global growth was decelerating as China was attempting a controlled slowing to better manage its economic risks. As the European Central Bank highlighted in its December 13th Bulletin, “the maturing global economic cycle, waning policy support across advanced economies and the impact of tariffs between the United States and China are weighing on global activity.” In addition to slower growth and trade concerns, arguably the biggest concerns for the U.S. equity markets stem from the economic and trade outlook for China, the uncertainty and instability in the Trump Administration, and the inconsistent and confusing messaging from the Federal Reserve regarding future monetary policy.

China – Slowing and stimulating

“The practices of reform and opening up in the past 40 years have shown us that the Chinese Communist Party leadership is the fundamental character of socialism with Chinese characteristics … east, west, south, north, and the middle, the party leads everything. Every step in reform and opening up will not be easy, and we will face all kinds of risks and challenges in the future and we may even encounter unimaginable terrifying tidal waves and horrifying storms.”

– Chinese President Xi

China has grown gross domestic product (GDP) from $306 billion in 1980 to over $12.2 trillion in 2017 becoming the world’s second leading economy during that time. Its economic growth has been remarkable, and China has offered its economic model to other developing nations as an alternative to the economic model of the U.S. However, China’s growth has not been without risks as the drivers of its growth – ultra-high infrastructure investment and rapid debt accumulation – now make its economy more fragile and prone to deceleration. As China was attempting a controlled slowdown, which was in and of itself a challenge, the subsequent trade war with the United States made a difficult economic situation even worse. The Chinese stock market lost $2.3 trillion in value this year further adding to China’s woes. The combination of a slowing Chinese economy, a trade war and the rout in its stock market are causing significant political, economic and social issues for the government. So much so that several Chinese economists are publicly questioning the country’s economic model, and students are protesting more frequently.

[Update January 8, 2019: China announced two moves to support the economy. It added liquidity into its system to stimulate lending activity by lowering the rate for reserve requirements for banks by 1%, and also announced a $125 billion infrastructure initiative for the buildout of its railway system. Both moves are supportive of China’s attempt to prop up its economy to address the economic slowdown and prepare for a difficult outcome of its trade negotiations.]

Uncertainty and instability in the Trump Administration

The “unconventional” approach of the current administration towards governing has created a great deal of uncertainty at home and abroad. One of the key goals of the Trump Administration was a reduction of the United States’ role as a global leader. Recent actions, such as the announced troop withdrawal from Syria, are changing the geopolitical dynamics in many regions. For market participants there were two major issues this quarter which have added to market volatility. The first issue relates to the high rate of turnover of key members of the administration. With the departures of Chief-of-Staff John Kelly and the resignation (and subsequent firing) of Secretary of Defense James Mattis, the Administration is losing two highly respected and experienced leaders who were regarded as important voices of reason. The second major issue was President Trump publicly questioning the policy decisions of the Federal Reserve. This was followed by rumors that Fed Chair Powell might be fired. This was disquieting for the markets as independence and stability at the Fed are paramount to the effective functioning of this agency. As we head into 2019, President Trump will be faced with an unfriendly, Democrat-led House of Representatives whose agenda is at odds with his, waning support from within his own party, and the partial government shutdown. This is likely to be just the beginning of two challenging years. The House Oversight and Governmental Committee and the Mueller investigation will further complicate matters and serve as a distraction from needed initiatives such as immigration reform and increased infrastructure spending.

Communication gaffes by Fed Chair Powell and Secretary of Treasury Mnuchin

“The really extremely accommodative low interest rates that we needed when the economy was quite weak, we don’t need those anymore. They’re not appropriate anymore. Interest rates are still accommodative, but we’re gradually moving to a place where they will be neutral. We may go past neutral, but we’re a long way from neutral at this point, probably.”

– Federal Reserve Chairman Jay Powell, October 3, 2018

In a late September speech, Fed Chair Jay Powell signaled a much more aggressive approach to tightening monetary policy than the markets expected when he indicated that the then current Fed Funds interest rate was below the desired neutral rate (the rate that neither stimulates nor contracts the economy) and that the Federal Open Market Committee (FOMC) believed it appropriate to raise rates beyond neutral. At the December meeting, the Federal Reserve announced it would raise interest rates by a quarter of a point but would likely raise interest rates twice next year and that the process of shrinking its balance sheet was on “auto-pilot”. Immediately following this statement, the market began a sharp decline. The FOMC felt the strength of the economy was such that it could be more aggressive with its normalization of monetary policy in order to provide it with the tools to address the next recession whenever that might be. This was despite the fact that the economy was already showing signs of deceleration. In light of that we feel it would have been prudent for the Fed to take more time to observe how the economy is digesting the previous hikes of the past few years before hiking further. In our view, the messaging by Chair Powell missed the mark. We believe it was a mistake for the Fed to telegraph its future policy with such a degree of certainty and inflexibility when the data supporting those decisions did not exist.

[Update January 8, 2019: Chairman Powell, on January 4th spoke to economists at the American Economics Association’s annual meeting with two former Fed Chairs, Ben Bernanke and Janet Yellen. In a wide-ranging discussion, Mr. Powell went a long way to calm the primary concern of market participants regarding monetary policy, namely, that the fed would not tighten monetary policy too much if economic conditions are not supportive of such actions. Mr. Powell said, “we will be prepared to adjust policy quickly and flexibly, and to use all of our tools to support the economy should that be appropriate to keep the expansion on track, to keep the labor market strong, and to keep inflation near 2 percent… So if we ever came to the conclusion that any aspect of our normalization plans was somehow interfering with our achievement of our statutory goals we wouldn’t hesitate to change it, and that would include the balance sheet, certainly.”]

Shortly after the FOMC press conference, Secretary of the Treasury Steven Mnuchin held a conference call with top bankers to make sure the financial system had proper liquidity which is part of the Treasury department’s role to ensure orderly functioning of the capital markets. The problem was not that he spoke to the bankers who assured him that there was ample liquidity and everything was fine, but rather that in an effort to reassure the markets Mr. Mnuchin announced to the world that the call was held. Since most already presumed that there was ample liquidity in the system, the announcement only served to frighten the markets and led to renewed selling pressures. While demonstrating their inexperience in their roles, Chair Powell and Secretary Mnuchin hopefully were reminded that what they say matters and every statement must be carefully worded.

Where do we go from here?

As we described above, it is our view that key stakeholders in the global economy, namely Presidents Trump and Xi, European leaders and central bankers around the world, will view avoiding a recession and extending the business cycle to be the top priorities for 2019. Given the challenges facing President Trump, he will likely be looking for wins in the next few months which will mean taking steps to help the economy. Mr. Xi and the Chinese government have already been implementing aggressive fiscal and monetary policy initiatives to stimulate the economy. While China has a more long-term orientation than most developed nations, its concern with the short-term is evident in its willingness to repeatedly use stimulus initiatives to manage its economy. These factors are raising the probability that both presidents will reach a resolution of the trade conflict between the U.S. and China even if it falls short of the Administration’s stated objectives. A failure to reach an agreement would place strains on each nation and the global economy as well. At the same time, Europe is wrestling with at least three major issues – uncertainty surrounding Brexit negotiations, its most prominent leaders (Germany’s Merkel and France’s Macron) losing support at home and the ongoing fallout from the rise in populism. As a result, the European Central Bank will likely be forced to continue its accommodative monetary policy for some time. Either continued slowing global growth or the lack of a resolution to the U.S.-China trade negotiations, should force the Federal Reserve to moderate its interest rate policy and modify or delay its current plans for reducing its balance sheet. Furthermore, the FOMC may even deem it appropriate to ease monetary policy at some point in the next 6-12 months.

What are the investment implications?

“I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.”

-Warren Buffett

When markets decline with the rapidity we witnessed in December, it is easy to fear the worst. In addition to the political and economic factors driving the market pullback in December, significant selling was occurring as a result of hedge fund liquidations and investors harvesting tax-losses. These factors placed added pressure on prices as buyers were reluctant to step into the market in the face of heavy selling which created significant buying opportunities that we have been selectively taking advantage of in client accounts. No one knows exactly what 2019 will bring for equity investors, and it is impossible to predict exactly when markets will bottom. However, it is clear that as a result of the pullback many leading businesses are now selling at compelling valuations, which should provide for attractive returns from these levels. Those companies that are benefitting from the secular trends driving economic activity, which we have identified for several years, should continue to generate higher cash flows and earnings allowing them to continue to increase their competitive positions. Our research efforts are concentrated on companies with strong balance sheets, growing market share, increasing dividends, and repurchasing shares.

Frequent readers of the Outlook know that technology has been an area of focus for client portfolios for several years with our emphasis on mobility, cloud, storage, the Internet of Things (IoT) and autonomous vehicles. Companies in the technology sector, including some of our favorite names, saw prices decline even more than the market during the pullback. These companies are at the forefront of the technology revolution which continues to change the way we live and businesses operate. There are four major areas of emphasis – technology involving 5G (the new fifth-generation cellular networks) and the related beneficiaries; health care; defense; and special situations – on which we remained focused as the values created by the retracement helped make several leading businesses compelling investment opportunities.

Technology – 5G and related beneficiaries

“A quick explainer: 5G combines fast speeds with low “latency” or network responsiveness, which will be critical to the technology’s long-time impact on everything from self-driving cars to remote surgery.”

– USA Today, December 12, 2018

In 2019, the much-awaited commercial rollout of 5G wireless technology will begin in earnest in the U.S., China and Europe. We will not experience the full benefits of 5G for some time, but global investment in 5G is estimated by Morgan Stanley to be in excess of $850 billion, with China’s capital expenditures of over $420 billion and the United States’ capital spending estimated to be $265 billion. These investments will be made over the next decade, and will include investments in spectrum, cell towers, small cells, fiber, datacenters, and other companies involved in the build-out of the 5G infrastructure. The leading telecom companies, Verizon, AT&T and T-Mobile, will be at the forefront of the build out in the U.S., and are investing heavily in this area. 5G is important as it will enable greatly improved efficiencies for businesses, governments and consumers and help to realize the full benefits of the internet of things, artificial intelligence and autonomous vehicles.

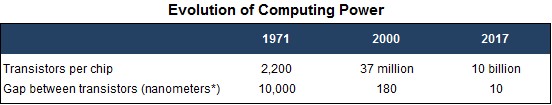

The evolution of the science of computing power has been quite spectacular as shown in the chart on the Evolution of Computing Power and continues unabated. Cisco recently projected that worldwide there will be 28.5 billion networked devices by 2022, up from 18.0 billion in 2017. Cisco also estimates that internet traffic will grow 3-fold from 2017 to 2022, and will reach 396.0 exabytes per month by 2022, up from 122.4 per month in 2017. For perspective, one exabyte is equivalent to 250 million DVDs of data. In 2019, 7 nanometer chips are being introduced, a significant change in computing power from the 10 nanometer shown above. The faster download speeds and reduced latency will make the next generation of chips more important. This will lead to increased processing power, higher data traffic, longer battery life and the need for more storage. This will also lead to the obsolescence of many devices in the market today as well as to the introduction of billions of new devices. As 5G is rolled out and computing power continues to evolve, investors should not underestimate the impact of the powerful technological advances coming over the next 18-36 months which will affect every industry. These are revolutionary changes.

Health Care

“According to the United Nations, the number of those over 60 worldwide is expected to double by 2050 to 2.1 billion. In the 1950’s, that segment of the world’s population was around 205 million.”

– Excerpt from the New York Times, December 30, 2018

The health care sector also aligns closely with our Outlook as an aging global population provides a strong secular tailwind for healthcare demand.

According to the World Health Organization (WHO), in most countries the proportion of people age 60 or older is growing faster than any other age group due to longer life expectancy and declining fertility rates. This is expected to drive demand for healthcare services, including medicines and medical devices as well as the companies that provide these services. An aging population will also drive healthcare demand in large developing countries such as China and India. Moreover, demand in these markets will also benefit from increased per capita spending as their populations insist on better quality care. Greater spending suggests greater volumes of healthcare consumption, but there will also be a “trade up” from medicines and devices that are locally-sourced or generic to best-in-class patented drugs and devices sold by the leading global pharmaceutical and device companies. We expect a select group of pharmaceutical, biotech and medical device companies to be beneficiaries of these spending trends. We are focusing on those health care companies whose relatively strong balance sheets and diverse product portfolios offer the ability to use divestitures and mergers/acquisitions to increase the value of their companies. These companies are also supported by powerful demographic trends which make them less economically sensitive as many treatments cannot be postponed.

Defense

One of the few certainties in the world today is that the geopolitical environment remains decidedly unstable as the United States’ withdrawal from global leadership is causing a shift in regional alliances and calls into question the multi-lateral arrangements that helped govern the world following WWII. At the same time, there has been a troubling rise in the number of autocratic regimes which is adding to geopolitical instability. In addition to the changes brought about in the United States, China continues to exert its economic and military influence globally, and in particular, in the South China Sea. The Middle East is seeing progressively more complex dynamics as OPEC’s influence is waning, traditional relationships are becoming increasingly strained, and many historic conflicts show no signs of positive resolution. In short, the global geopolitical situation has grown increasingly more unsettled at this time.

In recent years, the United States had slowed defense spending as a result of the financial crisis and the federal budget sequestration. That trend is in the process of being reversed, not only in the U.S. but also globally. In 2019, U.S. military spending is projected to be between 4% and 5% of GDP or nearly $890 billion. China is projected to spend between 3% and 4% of GDP or between $240 billion and $360 billion although that figure may be even higher. Saudi Arabia and Russia are projected to spend between $50 billion and $90 billion. Furthermore, NATO nations are under pressure from the United States to increase spending to the agreed target of 2% of GDP. Technological advances in drones, advanced weapons systems, cyber-security and space are now bigger drivers of spending. With market capitalizations of roughly $350 billion, the top U.S. defense companies represent a relatively small percentage weighting of the S&P 500, so most institutional portfolios have a representation to defense of approximately 2% or less. In our view, these businesses represent strong investment opportunities and should continue to generate significant cash, have robust orders, maintain high and/or growing backlogs, raise their dividends, and maintain share repurchase programs. Therefore defense companies should have a more meaningful representation in client portfolios than their representation in the S&P 500.

Special Situations

As industry after industry is being disrupted, CEOs are being faced with difficult choices in order to be competitive and, in some cases, just survive. This will lead to companies making interesting strategic decisions that may, in the case of divestitures, create values either for the seller or the buyer of assets. With private equity firms holding over $1.7 trillion in cash still to be invested, investors should expect an increase in merger and acquisition activity as businesses seek to divest underperforming assets to compete more effectively. We have identified a few companies that are executing strategies to unlock hidden value by selling low-growth businesses and taking the proceeds from the sales to pay down debt, re-invest in higher-growth opportunities, increase dividends or repurchase shares. Companies have many tools to unlock value, and those with strong balance sheets are using this opportunity to take advantage of the attractive valuations.

After a market retracement, clients often ask “should I be invested in stocks or should I reduce my exposure”, so we thought it would be helpful to offer some perspective. The U.S. stock market generated positive returns in 71.5% of the past 193 years according to Carter Worth of Cornerstone Macro. History has demonstrated that the ownership of businesses is the best way to build capital and protect purchasing power. Market declines are never fun to experience, but keeping perspective and focusing on goals are critical to successful investing. This in no way minimizes the declines in account balances resulting from the recent pullback, but serves as a reminder that successful investing requires taking a longer-term view and the courage to use volatility to one’s advantage.

“Those who keep their heads while others are panicking do well.”

–David Tepper, legendary hedge fund investor

Wishing our clients and friends a happy, healthy and prosperous New Year,

– ARS Investment Partners, LLC