Disruption: to break apart; to throw into disorder; to interrupt the normal course or unity of

Distraction: to draw or direct (something, such as someone’s attention) to a different object or in different directions at the same time; to stir up or confuse with conflicting emotions or motives

The world is in a state of flux, and the uncertainty caused by the rate and magnitude of change is unsettling for many people. This is especially the case for the middle class in developed economies who have been and are struggling to keep up. At the same time, the global economy continues to grow modestly, and the changes of the past decade have raised living standards for more than 2 billion people in the developing world. While it is easy to get distracted by news headlines, excessive focus on short-term concerns diverts investors from the opportunities presented by the disruption and ongoing changes as well as the rising living standards in the developing world. U.S. corporate profits should continue to improve, interest rates should rise modestly and inflation remain subdued. Current economic conditions suggest a positive backdrop for the second half of the year and into 2018. Notwithstanding the dysfunction in Washington DC, we remain positive on well-selected equities representing businesses whose earnings continue to rise.

In recent Outlooks we highlighted several powerful forces impacting the global economy today – namely, technological advances, globalization, demographic trends, central bank policy, debt burdens, immigration, terrorism and frustration with government institutions. These forces combined with the challenges of a low-growth developed world are causing a re-think of politics and business. In recent weeks, the surprising planned acquisition of Whole Foods Market by Amazon, the stunning results of the French election of Emmanuel Macron’s government and the elevation of 31-year old Mohammed bin Salman (MBS) as crown prince and successor in Saudi Arabia combine to highlight the disruption of traditional thinking with respect to global business and politics today. Recently, several central banks, including the Federal Reserve, have indicated their intentions to begin the long process of weaning their respective economies away from the excessively easy monetary policies to which we have grown accustomed. In this Outlook we discuss the challenges presented to policymakers, update our thoughts on the impact of technology on businesses and jobs, and address the investment implications as we head into the second half of the year.

A Look Back at the Past Decade

“There is growing polarization of labor-market opportunities between high- and low-skill jobs, unemployment and underemployment especially among young people, and stagnating incomes for a large proportion of households and income inequality. Migration and its effects on jobs has become a sensitive political issue in many advanced economies.”

– Technology, jobs and the future of work, McKinsey Global Institute May 2017

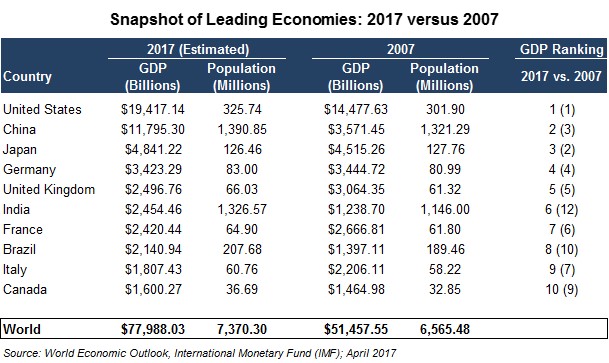

While much has changed in the past decade, we thought it would be worthwhile to share some of the big picture facts about the global economy and business to offer some perspective after having undergone one of the most severe financial crises in history. As shown in the chart below, global Gross Domestic Product (GDP in U.S. dollars) grew by 51.6% in the 10 years since 2007 with the United States having grown by over 30%. China, now the world’s second largest economy, has grown its GDP from $3.6 trillion to approximately $12 trillion. Today the United States and China account for over 40% of global GDP. From 2007-2017, the world’s population has expanded by an estimated 805 million to 7.37 billion people. According to the IMF, global GDP per capita grew roughly 22% from $8,651 to an estimated $10,560 in 2017. With the exception of the United States and Canada, there has been very little GDP or population growth in the developed economies. At the same time, China, India and Brazil have each experienced growth in both GDP and populations even with their own challenges during the past 10 years.

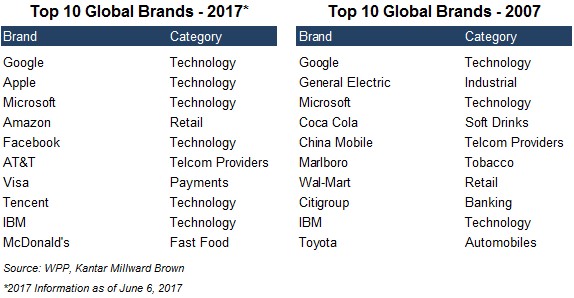

From a stock market perspective, the S&P 500 index peaked in October 2007 at 1565 with trailing twelve month earnings of $89.35 per share. Today, the S&P 500 index is trading at about 2430 with forward earnings projected to be $138. To help support the global economy following the financial crisis, central banks increased their total assets from a pre-crisis level of $6.4 trillion to an estimated $18.5 trillion today. According to the Council of Economic Advisors Economic Indicators report (May 2017), U.S. corporate profits before taxes have grown by 30% from $1.748 trillion in 2007 to an estimated $2.274 trillion today but were up 64% from its low in 2008. However the makeup of U.S. business has shifted considerably in the last decade as the financial crisis and technology innovation has changed market leadership in a material way. Our world has changed in so many ways since the first iPhone was introduced on June 29, 2007. There have been over 1.2 billion iPhones sold since its launch, and today we live in a more connected society. An example of how business leadership has been altered can be found in brand leadership. As shown in the chart below, 6 of the top 10 global brands today are technology companies as compared to 3 of the top 10 in 2007 and that is not counting Amazon one of the most disruptive companies of the past decade. We suspect that when we look at the top global brands in 2027, the list will be very different in company names but not in the leadership role of technology companies.

While technological advances have benefitted many, especially those in developing economies, these same advances have disrupted the labor markets in developed nations leading to greater inequality and political instability. Technological advances and the lack of wage growth and inflationary pressures in the developed economies are highly correlated. Their impact on the middle class, who are the key drivers of growth and rising living standards, is being reflected in the muted growth rates of these economies. The labor market issues in the United States have become increasingly complicated as there are over 6 million job openings available, yet the number of long-term unemployed remains stubbornly high as there is a substantial mismatch of the skills of the unemployed with those needed for the available jobs. One could argue that we don’t have a jobs problem but rather a skills problem as we have shifted to an ideas-based economy from a manufacturing-based economy. According to the McKinsey report one-third of the new jobs created in the United States in the past 25 years were types that did not exist previously. The study also highlighted the positive impact on employment. As stated in the report, “A 2011 study by McKinsey’s Paris office found that the Internet had destroyed 500,000 jobs in France in the previous 15 years — but at the same time had created 1.2 million others, a net addition of 700,000, or 2.4 jobs created for every job destroyed.” From a jobs perspective, global policy needs to focus on re-training the labor pool with the skills needed to be productive in the new economy. For the U.S., needed jobs will have to be filled through either rapid skills training or immigration, or else competitive wage increases for the existing pool of workers will increase inflation pressures.

The Lack of Inflation Challenging Policymakers Globally

“Weak productivity growth and uneven distributions of economic gains limit growth going forward, especially in advanced economies. The slow pace of economic reform and of private sector balance sheet repair continue to depress investment and productivity growth, reinforcing headwinds from longer-term trends such as aging populations, slowing innovation, and slow progress in raising female labor force participation. Combined with insufficient support for those who bear the burden of adjustment to technological change and global economic integration, these forces put a ceiling on future economic prospects as the current cyclical boost runs its course.”

– Excerpt from the IMF Briefing Note to G-20 Leaders

The fear of technological advances destroying employment opportunities and increasing income inequality has weighed heavily on the psyche of market participants and policymakers. At the same time, the limits of highly-accommodative monetary policies employed by central banks have been reached, and fiscal policy has not been employed as it should have been in recent years. During the month of June, central bankers from the Federal Reserve to the Bank of England (BOE) to the European Central Bank (ECB) expressed the desire to move to a less accommodative policy approach. While the global economy continues to experience improving but muted growth, the stated desire is partly out of necessity as the central banks worry about the lack of firepower to stimulate their respective economies if needed in the future. In our April 18th Outlook, we wrote about the need for the Federal Reserve to emphasize a gradualist approach in raising interest rates and reducing the size of its balance sheet. Based on our reading of the latest minutes, the committee members seem to agree with our view of the need for gradualism. We would suggest the same applies to the BOE and the ECB as there is a lack of inflation in the global system as wage growth remains anemic, commodity prices subdued, demographics worsening, and debt levels still high. With proper fiscal policy absent in the U.S., the U.K. and Europe, this is a sub-optimal time for central bankers to be too aggressive in tightening monetary policy.

Noted investment strategist Ed Yardeni has, for some time, stated that the easy monetary policies of the central banks had the effect of creating deflationary conditions rather than the inflationary ones that many had anticipated by providing low-cost capital for businesses to heavily invest in productive technologies to reduce labor costs and the prices of goods. Unfortunately, governments in the developed economies were not pro-active in taking advantage of these low interest rates to finance critical spending needs in infrastructure and re-training the labor force. The combination of these secular forces is suppressing inflation and should prevent central banks from tightening excessively which is helping to create a positive environment for equity valuations, and they should act to extend the business cycle. Investors should be watching the central banks’ actions to make sure that the policy shift does not choke off growth and tilt the economies into recession. So far, the Fed’s Janet Yellen, the BOE’s Mark Carney and the ECB’s Mario Draghi have done an exceptional job in supporting the economic recovery.

Revisiting the Third Wave

“The Internet of Things (IoT), sometimes referred to as the Internet of Objects, will change everything—including ourselves. This may seem like a bold statement, but consider the impact the Internet already has had on education, communication, business, science, government, and humanity. Clearly, the Internet is one of the most important and powerful creations in all of human history. Now consider that IoT represents the next evolution of the Internet, taking a huge leap in its ability to gather, analyze, and distribute data that we can turn into information, knowledge, and ultimately wisdom. In this context, IoT becomes immensely important.”

– Dave Evans of Cisco’s Internet Business Solutions Group (IBSG)

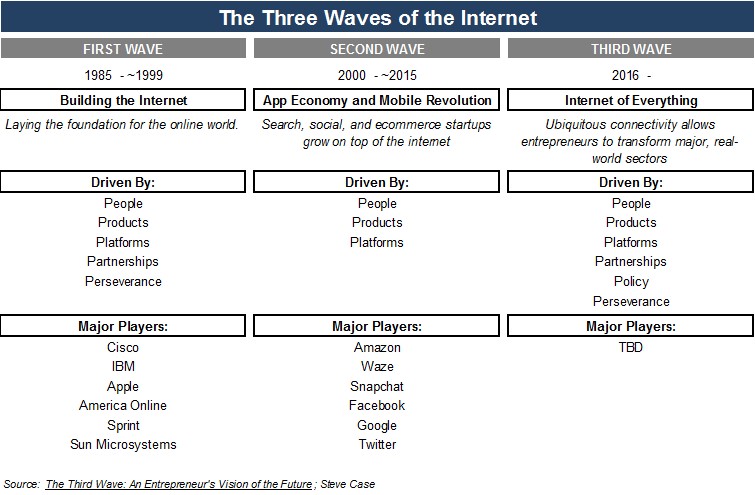

Regular readers of the Outlook are well aware of our positive view of technological advances continuing to drive one of the most critical investment opportunities for the next several years. Several major technology trends are converging – cloud computing, big data, autonomous vehicles, the internet of things, artificial intelligence and augmented reality – and the development and commercialization of these technologies are creating opportunity for investors. The confluence of these advances is changing the way we live and shifting supply and demand and pricing dynamics for goods and services. This is presenting a multi-year opportunity by extending the business cycle for many businesses in the technology food chain. In our February Outlook, we introduced Steve Case’s concept of the Third Wave in the evolution of the internet, a phase where the internet becomes integrated into every part of our lives. The first phase laid the foundation with the building of the internet. The second phase, gave us search, mobility and e-commerce.

In recent years improvements in wireless technology have driven a surge in demand for products that can take advantage of faster mobile download speeds. In 2009, wireless carriers introduced “4th-generation” wireless technology (or “4G”), offering data transfer speeds approximately 10 times faster than those available on 3G technology. This same wireless technology is driving a growing industry of products that can “talk” or interact with one another over wireless, helping them become “smart” devices. One example would be a home security monitoring system that can turn on when triggered by motion and then send images to a central monitor or a customer’s smart phone. Another would be the integration of semiconductor chips into automobile dashboards, delivering information on traffic or weather patterns. These chips require new technology allowing rapid processing speeds but with low power utilization and easy integration with Wi-Fi / Bluetooth and user-friendly software programs. Today’s higher-end car models have approximately $1,000 of semiconductor content compared with just $300 for introductory models according to Cypress Semiconductor Corporation. As today’s luxury devices become tomorrow’s standards, demand for processing chips for the auto sector are expected to grow at high-single-digit to low-double-digit rates between 2016 and 2021. Additionally, connectivity for the home is expected to drive double-digit demand growth through 2021. These demand drivers are presenting multi-year opportunities for the leading companies positioned to service this growth. Furthermore, a new 5G wireless infrastructure is expected to be introduced over the next few years allowing us to access, process and store data at speeds and in volumes at multiples of what is available today.

Currently gaining a great deal of attention and capital investment is artificial intelligence (AI) which has the potential to disrupt the competitive landscape for industries and companies. Businesses that are quick to adapt can create value in the following ways – smarter research and development as well as business forecasting, more efficient production and maintenance, more targeted sales and marketing and enhanced customer experience. Industries that are employing AI include telecommunications, auto, financial services, utilities, transportation and logistics, retail, education, healthcare, travel and tourism to name a few. We previously touched on the increase in download speeds that 5G will have on information available to be accessed and its required data storage. German car-maker BMW has partnered with Intel, Delphi and Mobileye to develop its capabilities in-house. The NY Times recently reported that BMW had hired more information technology specialists last year than mechanical engineers as it needs huge data processing and analytic capabilities. According to the article, “the company has a fleet of 40 prototype autonomous cars it is testing in cooperation with its partners. BMW uses artificial intelligence to analyze the enormous amounts of data compiled from test drives, part of a quest to build cars that can learn from experience and eventually drive themselves without human intervention. After test sessions, hard disks in the cars are physically removed and connected to racks of computers at BMW’s research center near Munich. The data collected would fill the equivalent of a stack of DVDs 60 miles high.” These cars are producing so much data that it has to be stored in a data-center on site because it is too much to be transmitted to remote data centers via the cloud. Now multiply this type of application by thousands of other applications by thousands of companies in various industries in each country around the globe and one gets a sense of why data is the new currency for businesses. This puts companies like Amazon, Google, Apple, Facebook and other of the top global brands at the forefront of data ownership.

Investment Implications

There are many important issues that will create greater volatility in the markets including the nuclear provocations of North Korea, the Brexit negotiations, ongoing cyber and terror attacks just to name just a few. Based on the current conditions, our ongoing portfolio strategy continues to focus on three things – high-quality growth, high-quality dividends and opportunistic investments. The two biggest themes represented in our portfolios continue to be technology and defense which we believe are experiencing extended cycles. In addition, we expect financial and healthcare companies to benefit from a variety of catalysts including deregulation, while we also favor companies benefiting from increasing U.S. consumer spending and the shift to a more service-oriented global economy led by China and India. Like many, our team is disappointed that Congress in Washington has not enacted any of the fiscal policy initiatives we have written about in past Outlooks. To achieve growth rates in the U.S. beyond 2.0 – 2.5%, we believe that tax reform, infrastructure spending and repatriation of overseas corporate cash are necessary and should be done now to take advantage of current low interest rates.

Companies that are able to aggressively invest in the future growth of their businesses should be more highly rewarded. In recent years, many corporations have only been able to improve their stock performance through financial engineering. As interest rates begin to rise, companies with good growth rates and strong cash balances should be well rewarded.

The combination of easy money and technology which led to greatly- increased U.S. production have altered the global oil markets leading to lower prices. Over the past several years, U.S. oil production has risen from 5.5 million barrels per day (bpd) to approximately 10 million bpd. The U.S. is in the position to export light crude (easy to refine) and import heavy crude which our refineries are uniquely able to process as opposed to those overseas refineries which require light crude. We expect the result will be sustained pressure on oil prices globally, greater strains on oil-producing nations dependent on oil revenues and the chance of additional instability and social unrest in those nations. Our views on the supply and demand dynamics impacting oil prices are underscored by the decision of three OPEC nations to plan initial public offerings to monetize their oil assets to diversify their economies. Moreover, we anticipate that industry consolidation will accelerate in coming quarters as the high-cost projects are draining the earnings and cash flows of the major oil companies. This will likely force them to seek out lower-cost production and reserves through acquisition to replace existing reserves.

At the same time, global developments will impact investor sentiment and short-term behavior. The United Kingdom has begun the process of negotiating its exit from the EU, and several European nations, particularly in France, Italy and Germany, have major elections this year. North Korea and Russia remain aggressors and the focus of geopolitical discussions between the U.S., China and other leading nations. Importantly for investors, the Outlook calls for the Fed to remain accommodative, the business cycle to be extended and the backdrop for equities to remain positive.

Rather than focus on short-term market moves, investors should remain focused on targeted investment opportunities in the areas we have emphasized over the past year. With the U.S. economy and consumer confidence improving, the outlook for small capitalization stocks has also improved. Small cap companies represent an area of undervaluation that may present some interesting opportunities for investors. When and if corporate and personal tax cuts are enacted, infrastructure spending occurs and overseas cash is repatriated, U.S. companies and consumers will be major beneficiaries. Whether these initiatives occur in late 2017 or 2018, the expected direction of change is positive for the economic outlook and common stock valuations.