Once again, the world’s fragile geopolitical situation has again taken center stage with the tragic and despicable use of chemical weapons by the Assad regime in Syria, ongoing nuclear provocations by North Korea and deadly terrorist attacks in Stockholm and Egypt. In a sharp reversal from his opposition to Syrian intervention during his campaign, President Trump ordered an attack on a strategic target in Syria in response to Assad’s use of Sarin gas on civilians including children. President Trump approved the strike on the evening that he hosted China’s President Xi for the initial meeting between the world’s two most powerful leaders. With a single move, President Trump sent a message to Assad, North Korea, President Xi and the rest of the world that the United States will act forcefully and unilaterally, if necessary. This statement was particularly important considering the role that China will likely need to play in helping restrain North Korea’s nuclear ambitions. Given the Chinese government’s long-standing anti-interventionist position, the prompt U.S. response caught many off-guard and was further evidence of the unconventional approach by the new Administration.

Importantly, for investors concerned about the geopolitical situation and its impact on the markets, current economic conditions suggest a positive backdrop heading into the second half of the year and into 2018. Notwithstanding soft patches in the economy that are likely on the horizon, we remain positive on equities even with a possible pullback in the coming months. We are also encouraged by the economic improvements in Europe and Asia as well as the market’s ability to shrug off negative news. While the meeting between President Trump and President Xi did not yield any major announcements, it should be viewed as a positive first step in the relationship between the two leaders as President Trump was respectful of the Chinese leader and avoided the anti-China rhetoric that was so much a part of his campaign. China’s Communist Party has a big leadership conference in the fall and President Xi needed to show his strength to his country and the rest of the world. According to Cabinet officials, one development coming out of the meeting was the agreement to work towards a 100-day plan to review the trade relationship with China and to better cooperate in addressing North Korea’s nuclear program as it had reached an urgent stage. In addition, both sides agreed to subsequent meetings to discuss economic cooperation and security issues including cyber threats. For those trying to make sense of the long-term relationship between the U.S. and China, the Chinese Foreign Ministry website provided some insight as it reported a statement from President Xi’s discussions with President Trump as follows: “We have a thousand reasons to get China-US relations right, and not one reason to spoil the China-US relationship.”

Deregulation: The Bridge to Other Pro-Growth Initiatives

“Business Roundtable is not proposing that all regulations on this list be repealed, although some are so deficient they cannot easily be fixed. Others can be improved, however, by providing additional compliance flexibility, which will help to reduce unnecessary costs and compliance burdens. While addressing existing regulations that are unduly burdensome is vitally important to help jump-start American business investment and job creation, Business Roundtable believes that fundamental regulatory process reforms are key to ensuring long-term success.”

– Business Roundtable February 22, 2017 letter to Gary Cohn, Director of National Economic Council

In the United States, one of the most critical elements driving the positive sentiment among business leaders is the emphasis by the new Administration on reducing or eliminating inappropriate and excessive regulations. At ARS, we believe that it is essential for our government to better thread the needle when it comes to regulating business by balancing the risk of overreach with failing to ensure the proper safeguards on the system. The Business Roundtable, an association of chief executive officers of leading U.S. companies working to promote sound public policy and a thriving U.S. economy, has suggested that “a smarter approach toward regulation is needed to strengthen economic growth and job creation.” Businesses large and small have cited deregulation as perhaps the most important pro-growth initiative to drive increases in spending and hiring. President Trump has already taken several steps including placing a freeze on new regulations, lifting restrictions on the energy industry and asking government agencies to prepare a list of unnecessary regulations currently on the books. According to President Trump’s legislative affairs director, Marc Short, the previous administration authored more than 600 major regulations with an estimated cost to the economy of about $740 billion. To reduce regulation, this Administration has also asked Congress to employ a little-used piece of legislation called the Congressional Review Act (CRA) to undo 11 pieces of regulation with two additional regulations under consideration. Government agencies can also choose to selectively enforce regulations, and their willingness to do so might provide an additional boost to the economy. At a time that Congress appears to be struggling to repeal and replace the Affordable Care Act and reduce or reform taxes, deregulation is a tool that can be a bridge to push the economy forward until those pro-growth initiatives can be passed.

Banking remains one of the most regulated sectors and appropriately so. Some experts have blamed the 2008 financial crisis on the repeal of the Glass-Stegall Act which was originally designed to protect the system through the separation of investment and commercial banking. Gary Cohn, the former President of Goldman Sachs and a key member of the Trump Administration, has recently suggested that Glass-Stegall be reconsidered. The main regulation put in place to address many of the issues believed to have contributed to the financial crisis was the introduction of Dodd-Frank legislation which includes the Volker Rule. While well-intended, Dodd-Frank was complex, costly and burdensome both on the banks as well as on their regulators. This has been a complaint of bankers for years including in the recent annual shareholder letter by Jamie Dimon, CEO of JPMorgan Chase. The point was further driven home by outgoing Federal Reserve Governor Tarullo who served as the primary regulator for the major banks. In his final speech, Governor Tarullo said, “Several years of experience have convinced me that there is merit in the contention of many firms that, as it has been drafted and implemented, the Volcker rule is too complicated. Achieving compliance under the current approach would consume too many supervisory, as well as bank, resources relative to the implementation and oversight of other prudential standards.” It is estimated that only two-thirds of the Dodd-Frank regulations have been implemented. Designing the regulatory framework that allows the system to function properly and provide the necessary protections for consumers is critical.

Gradualism is Required for an Extended Business Cycle

“The Committee expects that economic conditions will evolve in a manner that will warrant gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run… This policy, by keeping the Committee’s holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.”

– Federal Open Market Committee statement released March 15, 2017

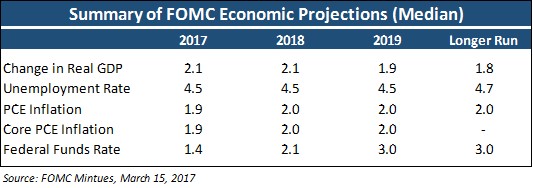

In response to the 2008 financial crisis, the Federal Reserve under Chair Ben Bernanke announced in March 2009 that it would introduce the most unconventional and highly accommodative monetary policy initiative in history to stave off deflation and stimulate the U.S. economy. Since that time, market participants have been eagerly awaiting a return to normalcy. This year on March 15th, the Federal Open Market Committee (FOMC) took another step toward normalization by raising the federal funds rate for the third time in three years by 0.25%, while suggesting further increases of 0.50% by the end of the year. Based on the Committee’s projections below, real interest rates should remain at or below 1% for several years which means that even though interest rates will rise in coming quarters, the Federal Reserve’s monetary policy will remain supportive of the economy. The FOMC recently announced that it will consider starting to reduce its $4.5 trillion balance sheet later this year which would be a form of monetary tightening. The stock and bond markets initially sold off on that news in what has become a typical short-term overreaction to a Fed statement. It is notable that while the balance sheet has expanded from around $900 billion in 2008 to its current level, a significant portion of the money created remains parked in the Fed in the form excess reserves and it has not been lent out. As it is not circulating in the economy, a measured reduction in the Federal Reserve balance sheet should not create economic headwinds.

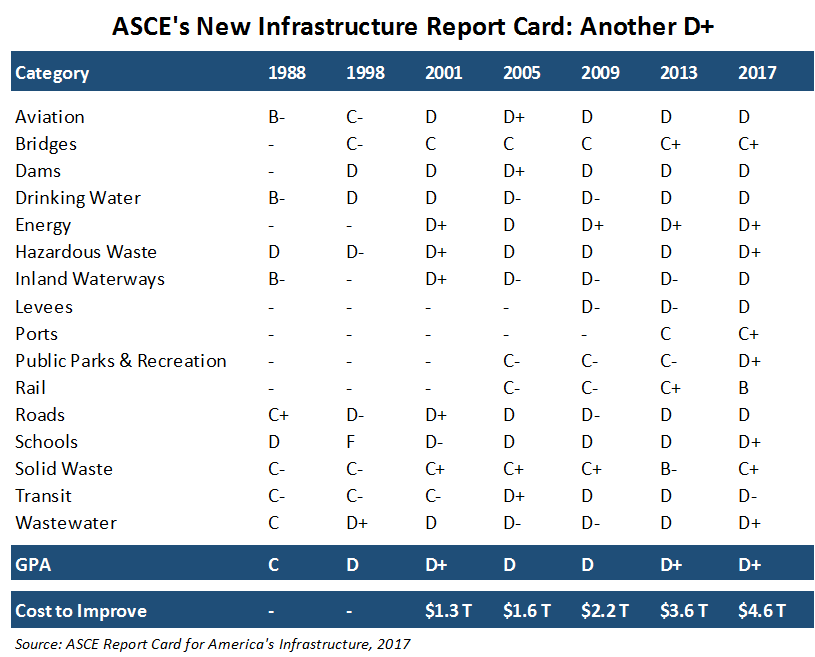

The Federal Reserve is emphasizing a balanced approach to stimulating the economy without overdoing it. It is critical to the Committee that its plan to hike rates and reduce its balance sheet does not create an economic slowdown and force it to backtrack. During the Presidential campaign, the Federal Reserve was criticized by President Trump, but the Fed is doing its part to support the Administration’s pro-growth initiatives with its measured approach to raising rates. The Fed’s current path will aid the much-needed spending required for the United States to maintain and update the nation’s infrastructure by keeping borrowing costs relatively low.

The Federal Reserve is highlighting its gradual approach to normalization because it sees an improving economy but also one with ongoing challenges. Unemployment has improved considerably in recent years, wages are slowly rising, housing is improving and consumer net worth has reached new highs. While monetary policy has helped arrest the deflationary effects of the financial crisis, there are secular forces which will continue to suppress inflation and which should work to keep interest rates below normal levels for longer than many market participants may be anticipating. These secular forces are technological advances, globalization, aging demographics in much of the developed world and excessive debt levels. Each of these presents a distinct challenge for monetary and fiscal policy makers who are struggling to put the United States economy on a sustainable growth trajectory. Because these are longer-term challenges, investors tend to acknowledge them but then promptly revert their focus back to shorter-term issues such as the policy agenda of the Trump administration or the upcoming elections in Europe. Investors with a longer-term focus should bear in mind that secular forces are helping to create a positive environment for equity investments as they will extend the business cycle.

Technology Leadership Continues

In recent quarters, we have written about technological advances and how they are changing the way we live. These advances are being driven by research and development spending. The Wall Street Journal recently reported that the top three companies in cloud computing – Amazon, Alphabet’s Google and Microsoft – collectively spent $31.5 billion in 2016 for an increase of 22% over 2015. Adding in Apple, AT&T, Verizon and other technology and telecom companies and the amount of spending rises significantly. As the capital requirements to maintain leadership continue to rise, the big are getting bigger. And that is even before data requirements grow with the introduction of 5G and continuous growth of the Internet of Things (IoT). In the February 28, 2017 Outlook, we wrote about the increase in download speeds that 5G will have on information available to be accessed and its required data storage. One area where the impact of technological advances will be seen is in autonomous cars. According to Intel, the average autonomous car will soon create 4,000 gigabytes of data per day based on just one hour of driving. The new cars will have hundreds of on-vehicle sensors to record data with cameras, sonar, GPS and radar being big drivers of data creation. Intel’s CEO Brian Krzanich, in a speech to the auto industry, estimated that “one million autonomous cars will generate 3 billion people’s worth of data.” This does not even begin to address the additional information that will be generated by devices designed for residences. Government spending on technology also continues to grow rapidly, and one area of significant spending will continue to be by the military’s growing need to improve cyber defense. These are just a few examples as to why we believe that we are in a unique, multi-year cycle for technology.

Investment Implications

Investors should expect to see continued volatility in the markets. Our ongoing portfolio strategy focuses on three things – high-quality growth, high-quality dividends and opportunistic investments. Our emphasis remains on selecting companies benefitting from positive trends in cloud computing and mobility, rising defense spending, changes in the financial and healthcare industries, increasing U.S. consumer spending and the shift to a more service-oriented global economy led by China and India. We especially favor leading technology companies with strong growth characteristics that are driving changes in cloud computing, big data, autonomous vehicles, the internet of things, artificial intelligence and augmented reality. ARS has spent substantial time researching the beneficiaries of greater infrastructure spending and will look to increase our investments in this area as our conviction grows that Washington is taking steps to make the investments our nation requires. We continue to target companies that are gaining market share, maintaining or improving profit margins, increasing free cash flow, restructuring to gain more efficiency, increasing pricing power and/or growing dividends.

Companies that are able to more aggressively invest in the future growth of their businesses should be more highly rewarded as there is a growing view that many corporations have been able to only financially engineer their performance improvements in recent years.

At the same time, global developments will impact investor sentiment and short-term behavior. The United Kingdom has begun the process of negotiating its exit from the EU, and several European nations, particularly in France, Italy and Germany, have major elections this year. North Korea and Russia remain aggressors and the focus of geopolitical discussions between the U.S., China and other leading nations. It is easy to be distracted by the headline news. Importantly for investors, the Outlook is that the Fed will remain accommodative, the business cycle is likely to be extended and the backdrop for equities should remain positive.

Rather than focus on the short-term market moves, investors should focus on targeted investment opportunities in the many areas we have emphasized over the past year. With the U.S. economy and consumer confidence improving, the outlook for small capitalization stocks has also improved and yet these companies have not participated in the strong returns so far this year. Small cap companies represent an area of undervaluation that may present some interesting opportunities for investors. When and if corporate and personal tax cuts are enacted, overseas cash is repatriated, and infrastructure spending occurs, U.S. companies and consumers will be major beneficiaries. The combination of these forces should increase after-tax earnings for companies whether it should occur in 2017 or 2018. Irrespective of the specifics and timing of these policies, the direction of change is positive for the economic outlook and therefore for equities.