“Don’t forget about the huge difference between expecting something and experiencing it.” — Attributed to Angela Merkel

In this issue:

In our Outlook (October 13th) published before the Presidential election, we described a world at an inflection point. Monetary policy, which had succeeded in stabilizing economies and markets after the financial crisis, appeared to be reaching its limits. We wrote that “without proper fiscal policy, investors should expect more of the same low growth, low interest rates and low inflation … we have experienced for some time.” The election result in the U.S. is being interpreted as a call for change, and some of the initiatives being proposed echo the policies that we have called for in this Outlook for years. These include investing in U.S. infrastructure, making corporate tax policy globally competitive, repatriating cash held overseas by U.S. corporations and reducing the regulatory burden on businesses. Importantly for investors, there is a renewed sense of confidence and optimism developing from U.S. businesses and consumers as the long-awaited fiscal policy initiatives appear to be on the way to complement the accommodative monetary policy stance of the Federal Reserve. The outlook for corporate earnings (higher), inflation rates (slightly higher) and interest rates (trending higher, but continuing to be well below historical norms) remains supportive of equity investments.

The current optimism for future policy changes should be balanced against the market conditions present today. Whenever rapid changes occur in the markets as we have seen in the post-election period, it often gives us pause as the global economy needs time to adjust. We cannot help but notice that markets are already giving significant credit for legislation that could take many months to pass, and possibly then only after considerable debate and compromise. Furthermore, the confirmation process for Cabinet positions may be contentious and drawn out. Even as new laws are passed, they often require several months for their benefits to flow through the economy. While we are awaiting those benefits, what economic impact will rising interest rates, and oil and gas prices have in the meantime? And what impact will a sharply rising dollar have on developing economies whose depreciating currencies make it more difficult for them to service their dollar-denominated debts? We also wonder whether investors are postponing making security sales until January in anticipation of lower tax rates in the New Year?

These are some of the questions we are asking as we witness a growing chorus of optimists, many of whom were so cautious just six weeks ago.

In balancing the opportunities presented by the transition from an economy supported primarily by monetary policy to one which also has added fiscal policy initiatives, investors should consider an investment strategy with three elements – owning quality growth companies, owning quality companies with strong balance sheets and reasonable dividend growth prospects, and owning opportunistic investments with specific catalysts. An added challenge for market participants, many of whom were over-allocated to fixed income, will involve the timing of getting back into the equity market given the uncertainty as to the timing of policy implementation and anticipated market volatility in 2017. Near-term uncertainties aside, equity investors with a longer-term view should continue to be rewarded in the coming years as the recovery continues.

“The projections in this Economic Outlook offer the prospect that fiscal initiatives could catalyse private economic activity and push the global economy to the modestly higher growth rate of around 3.5% by 2018. Durable exit from the low-growth trap depends on policy choices beyond those of the monetary authorities – that is, of fiscal and structural, including trade policies – as well as on concerted and effective implementation.”

“Escaping the Low-Growth Trap”, OECD, Economic Outlook No. 100, 10/28/16

The challenges in the world cannot be erased by one election as economic headwinds such as excessive indebtedness, aging demographics, underfunded pensions, excess capacity and declining productivity (not to mention environmental) are structural in nature and will take years to address. Of more immediate concern is the adjustment process the global economy must undergo due to the rapid strengthening of the U.S. dollar and nearly 1% rise in Treasury bond yields. The suddenness of these moves is driving capital outflows from China, Europe and developing nations into the United States. As many European and developing nations have already been experiencing anemic growth, the challenges posed by a stronger U.S. dollar and rising interest rates come at an inopportune time. China’s currency reserves have declined by over $1 trillion in recent years and are approaching the $3 trillion level. Recently the Euro has reached a multi-year low, Italy is dealing with the need to form another new government and to strengthen a weak banking system, the region is struggling with immigration issues, and austerity programs have fueled anger and anti-establishment sentiment in many nations.

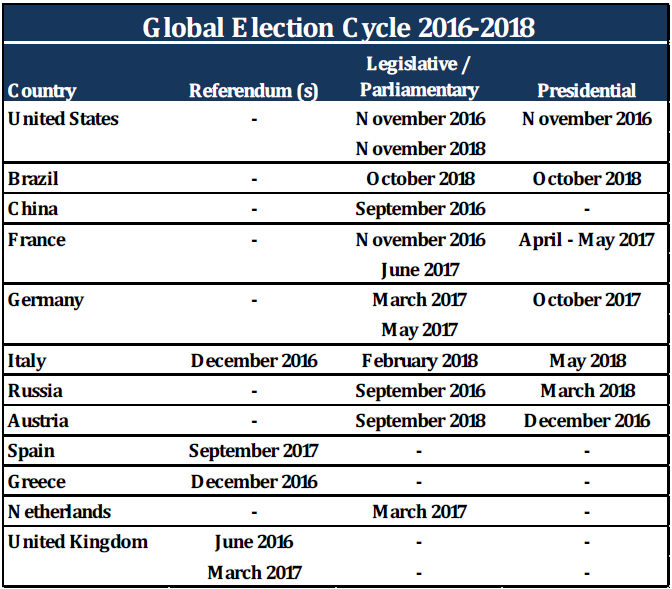

We continue to believe that the global economy could be at an important inflection point in which fiscal policy initiatives, encouraged by the OECD and other leading institutions, begin to be implemented and become supportive of monetary policy. In recent months the economic data out of Europe has improved, and its sustainability may accelerate the introduction of more pro-growth initiatives. As the chart highlights, there are several important elections coming up in 2017 and 2018, and the pressure is growing for Europe to replace its austerity orientation with pro-growth fiscal policy initiatives. The European Central Bank (ECB) President Mario Draghi has repeatedly called upon governments to implement fiscal policy to support the ECB’s highly aggressive monetary policy initiatives. Until these countries adopt more pro-growth policies, the U.S. will remain a magnet for capital flows and among the strongest economies in the world.

For several years, we have discussed the United States being the standout economy among developed nations. While the post-financial crisis recovery has been muted, the U.S. has continued to be a global leader due to its adaptability, innovation and resilience. Prior to the November election, the U.S. economy was slowly but steadily improving. The Federal Reserverecently announced that based on the improvements in economic data and its projections for 2017, the FOMC anticipates three rate hikes next year. Per the Council of Economic Advisors November 2016 Economic Indicators report, U.S. corporate pre-tax earnings were projected to exceed $2.26 trillion with an increase of $78.3 billion for 2016 alone. After-tax earnings for U.S. companies were estimated to be $1.69 trillion with an increase of $57 billion. Personal income rose at an annual rate of $98.7 billion and is forecast to be over $16.3 trillion, while wages and salaries rose $45.2 billion in October. U.S. consumer net worth rose to an estimated $92.8 trillion in the third quarter, and unemployment declined to 4.6% in the most recent report.

The Trump campaign platform identified four major economic policies which have created excitement about the future – infrastructure spending, corporate and individual tax reductions, lowering regulatory burdens and the repatriation of corporate cash held overseas. In 2016, taxes on corporate income were forecast to be $565 billion which represents a 25% rate as many large corporations were paying well below the 35% statutory rate. The President-elect has proposed lowering the rate to 15%, while the House plan targeted a 20% rate. Even a 10% reduction in corporate taxes would improve after-tax profits by over $56 billion with small and medium sized businesses benefiting significantly. For consumers, any reduction in personal income taxes would be welcome. Personal income taxes are estimated to be $1.99 trillion in 2016, and much of the benefit of lower taxes would likely be spent. Additionally, if the new Administration is effective in its commitment to reduce unnecessary regulatory burdens, small and mid-sized companies would again benefit significantly as would large corporations. In speaking with small-business owners, lowering regulatory requirements for them may be the most important element of the Trump platform as it would make doing business less complex and costly. Estimates vary for the total amount of U.S. corporate cash held overseas ranging from $2-3 trillion dollars. If corporations are incented to bring home some portion of this cash, there could be a significant ripple effect throughout the economy. If $1.5 trillion were to be repatriated at a 10% tax rate, the government would receive $150 billion and corporations would have $1.35 trillion for increased capital expenditures, dividends and/or share buybacks.

These policies are forecast to widen the deficit by anywhere from $3-6 trillion over the next decade, but those numbers could vary significantly depending on the ability of these fiscal policies to raise GDP growth and tax receipts. It remains to be seen whether the President-elect’s campaign anti-trade rhetoric becomes a reality, but this would likely offset the positives of the fiscal policy initiatives described above. Given the selection of Rex Tillerson, the CEO of Exxon Mobile, as Secretary of State as well as other Cabinet appointments, we anticipate that the Trump Administration trade policies will be more pragmatic than the campaign rhetoric would suggest.

This Outlook highlights the positive potential for change in key areas over the medium term. With investor sentiment potentially getting ahead of itself in recent weeks, we approach the New Year a little guarded but with an opportunistic bent. Over the medium term, however, we see investment opportunities in many of the areas we have emphasized over the past year, including companies with strong secular growth characteristics, high quality companies with attractive and growing dividend payouts, opportunistic investments in out-of-favor areas in the market, industries with special catalysts, and U.S. domestically-oriented businesses (especially small capitalization companies). Recently we have also increased exposure to companies that will be direct beneficiaries of new administration priorities, such as infrastructure investment and defense spending. We are also focused on defensive, divided-paying stocks that have been discarded by the market and have become more attractive since the election. With the U.S. economy and consumer confidence improving, the outlook for small capitalization stocks has also improved. As previously mentioned, the more domestically-oriented, smaller market capitalization companies should be major beneficiaries of the proposed tax cuts, the stronger U.S. dollar, infrastructure spending, lower regulatory burdens, repatriation of overseas cash from larger corporations and increased merger and acquisition activity. The combination of these forces should increase after-tax earnings for these companies. In the New Year, we will take advantage of any market dislocations to build positions in the beneficiaries of our Outlook.

We are also pleased to announce that effective December 20, 2016, the firms of Somerset Capital Advisers, LLC led by Michael Schaenen and Ross Taylor and Artemis Wealth LLC and PS Management, Inc. led by Sean Lawless, have formally merged with A.R. Schmeidler & Co., Inc. The firm has been renamed ARS Investment Partners, LLC. The combination of our firms will allow us to better service our clients’ evolving needs in the coming years. In January 2017, we will be introducing two new investment strategies which leverage the collective capabilities of our expanded team – the ARS Focused Small Cap Strategy and the ARS Focused ETF Strategy. The ARS Focused Small Cap Strategy intends to invest in companies with market capitalizations ranging from $100 million to $2.5 billion. The strategy employs a high-conviction approach resulting in a portfolio of 15-20 small-cap companies. The portfolio is long biased, while attempting to mitigate risk via cash levels, prudent short sales, inverse ETF’s (Exchange Traded Funds) and option strategies.

The ARS Focused ETF Strategy is designed to concentrate investments in ETFs that provide the greatest exposure to ARS’ highest-conviction themes. This may lead to investments in “narrow” industry ETFs. Typically, the portfolio will focus on 5-10 themes that will result in 10-20 ETF investments. These new offerings are just one example of the benefits of our firms coming together. We are delighted to expand our investment and service capabilities with these talented and experienced managers whom we have known for several years. We look forward to introducing you to our new colleagues at the earliest opportunity.

We want to wish all of our clients and readers Happy Holidays and a healthy, joyful and prosperous New Year!

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.