In this issue:

During the past quarter, leading economic indicators around the world began to soften as a result of fiscal tightening in the developing world in combination with disruptions from the nuclear tragedy in Japan and record flooding in Australia, uprisings in the Middle East and rising food and oil prices. While there are always shorter-term ebbs and flows within the context of important secular trends, it is important to remain focused on the companies benefitting from enduring themes. As we start the second half, some of the same factors that were weighing on growth are in the process of reversing themselves. Manufacturing activity has been increasing and China is in the later stages of its monetary tightening policy. Furthermore Japan and Australia are beginning their re-building process, creating renewed demand for materials and loosening supply-chain bottlenecks. For ARS, our research process is presenting a number of compelling investment opportunities resulting from both the cyclical and secular trends. This Outlook focuses on the structural challenges of deleveraging facing the developed world and why we believe the Central Banks of the US and europe will be compelled to keep interest rates low well into the future. Both are likely to continue policies of currency devaluation through the purchase of government debt with newly-created money (a process referred to as “monetization”) in an effort to ease debt burdens. In his press comments following the recent FOMC meeting, Federal Reserve Chairman Ben bernanke lowered his forecast for US growth, inflation, employment growth and interest rates. In this sustained low-rate environment where trillions of dollars are earning virtually no interest, we expect money market and fixed income investors to seek the higher rates of return offered by high-quality healthcare, consumer staples, utilities and defense companies with secure and growing dividend yields well in excess of money market and shorter-term bond rates. The difficult sovereign debt situation of the developed nations reinforces our view of the risks of owning paper assets, particularly of financial institutions during a prolonged period of deleveraging, and also highlights the continued importance of gold investments in portfolios. investment portfolios should also continue to prioritize companies catering to essential needs that the world’s population cannot do without, including inputs needed for food, power, infrastructure and rising living standards. given their exposure to the economic cycle, these investments should be focused on companies with the strongest franchises, management teams and balance sheets with the best prospects for profitable growth and the greatest

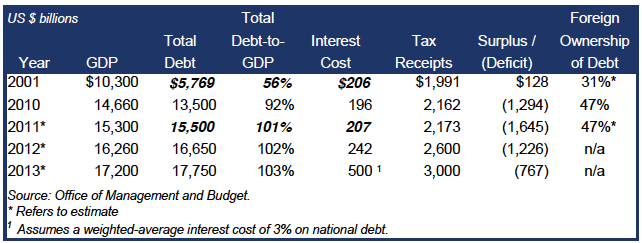

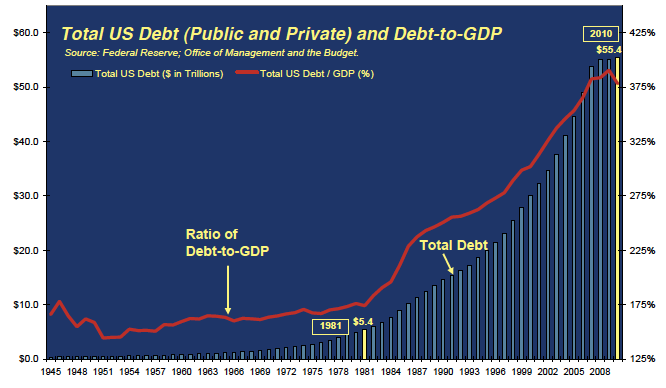

aRS notes that in 2001 the federal debt stood at $5.8 trillion with interest costs of $206 billion. By year-end 2011 the national debt is estimated to have nearly tripled to $15.5 trillion but with virtually the same interest costs as in 2001 ($207 billion) due to significantly lower interest rates. Just for perspective, three-month treasury bills in 2001 yielded 3.44% versus today’s rate of 0.1%. Today’s lower rates are the end result of a multi-decade disinflation trend punctuated by the Federal Reserve’s initiative coming out of the financial crisis to hold short-rates near 0%. With the average maturity of the national debt at approximately 53 months, any increase in interest rates would rapidly filter through the government’s average debt balance resulting in higher interest expense. If the current blended rate of 1.5% were to rise to approximately 4% (still well below 50-year average rate of approximately 6%), total annual interest expense would increase to more than $600 billion. this would offset much of the benefit of deficit reduction currently being contemplated in Washington. One can effectively argue that many of the assumptions that exist in the budget projections are optimistic at best, suggesting actual deficits could be greater than those estimated in the preceding chart. Moreover with national debt exceeding 100% of GDP, a 4% cost of debt would mean that GDP would need to grow at an even higher rate than 4% (assuming the deficits are eliminated) just to keep the debt-to-GDP level constant. Achieving this rate of growth on a sustained basis is quite difficult for any developed economy, especially at a time of deleveraging. the challenge of addressing the debt burden in a politically acceptable manner will keep pressure on the Federal Reserve to continue its easy money policy. the following chart highlights the 30-year debt cycle in the US in which GDP growth was augmented by an ever-increasing ratio of total debt-to-GDP:As the chart illustrates, over the past two years, debt-to-GDP (the red line) has stabilized and begun to decline as debt capacity and appetite in the private sector has subsided. This is starting the healing process but also impeding growth as capital is diverted from consumption and investment to debt reduction. To further break the 30-year debt cycle, the economy must be reoriented to grow faster than debt, and must be led by the private sector. structural areas in which the government can help include: targeted reinvestment in infrastructure, refined immigration and education policies to match labor skills with job demand, tax code revisions to reduce disincentives for investment in the US and an overlay to regulatory policy that makes new investment and private-sector job creation paramount in the cost-benefit analysis of new and existing regulations. Recognizing that many of these are “third rail” issues, to effect the necessary change will require bold leadership from political representatives and support from business and voters and will still take some years to accomplish. One additional, and very overdue, initiative is the need to implement a strategic national energy policy which could create significant increases in employment, improve the US trade deficit and potentially be a net benefit to environmental and military priorities.

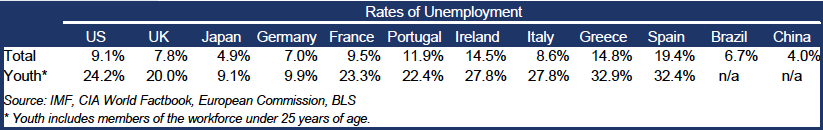

the foremost concern of government leaders around the world is to stay in power. Given the social and economic stresses being experienced today, the biggest concern for leaders should be job creation. At the root of the Arab Spring was broad-based discontentment in society caused in large part by high levels of unemployment, food inflation and government corruption. In the US, reported unemployment remains around 9%, and a study of the demographic segments highlights the particular challenges for women who maintain families (over 12%) and various minority groups (11% to 15%). adjusting for workers who have given up looking for work or who work parttime but would prefer full-time employment, the total unemployment rate is estimated to be closer to 16%. Importantly for President Obama, no president has been re-elected in recent decades with an unemployment rate above 7.5%. In Europe, the peripheral countries also have significant unemployment problems as indicated on the following chart:Particularly troubling are the unemployment figures for the younger demographic with Greece at 33%, Spain at 32% and Ireland at 28%. Japan has a very different problem of a rapidly aging workforce with too few new entrants to the labor pool. Finally, China faces perhaps the greatest challenge which is to create well over 10 million jobs per year to meet the growing expectations of 1.3 billion people seeking a higher living standard. the critical point missing from the current discussions in Washington is that the economy cannot recover without increasing aggregate demand. For the past several weeks we have been reviewing the “Fiscal Year 2012 Budget of the US Government” published by the Office of Management and Budget (OMB) and “Economic Indicators” prepared for the Joint Economic committee by the Council of Economic Advisors. After consideration of the numbers and assumptions, it is painfully obvious that the fiscal imbalances of the US will remain for an extended period. While politicians debate the merits of cutting spending and/or raising taxes, the idea that our nation can achieve the required GDP growth through either approach alone is seriously flawed. until the US is clearly on a path of sustainable growth, Chairman Bernanke has strongly cautioned Congress to delay any policy that would be contractionary. Unlike past recessions when interest rate reductions were aggressively pursued by the Federal Reserve and successfully stimulated economic activity, this time the rate cuts only served to halt the decline and create subpar growth. With the US unemployment rate at approximately 9%, growth must be the first priority, with deficit reduction following as part of a credible, concrete and longer-term plan.

the tension over political and religious differences between Saudi Arabia and Iran carried into the recent OPEC meeting, highlighting conflicting priorities. saudi Arabia argued for OPEC to increase production in order to promote lower prices and support global growth. A quota increase plays to Saudi arabia’s advantage because they are one of the few OPEC members with excess capacity, and the additional revenues from higher sales volumes would be useful at a time when they are spending heavily to keep their population content. Iran, in contrast, is already producing oil near full capacity and hence any decrease in price would result in a net loss of revenues. The excess capacity of OPEC being concentrated in just a few member countries, calls into question the longer-term role of OPEC in oil price stability. Following the conflicted OPEC meeting the International Energy Agency (IEA) orchestrated the release of 60 million barrels of oil from member nations’ Strategic Petroleum Reserves (SPR). The IEA also would not rule out an additional release once the drawdown is complete. These actions would appear to shift the purpose of the SPR from a national security role to a political/economic one. The political motivation could involve portraying the IEA as the responsible party for any oil price weakness dampening Iranian hostility towards the Saudis. The second political consideration relates to the desire by the Administration to reduce the price of gasoline to help American consumers during the summer driving season. The logic that this infusion will offset the loss of Libya’s oil production is questionable due the fact that it is attempting to replace a consistent flow of high-quality crude with a one-time infusion that will eventually need to be replaced. Moreover, the 60 million barrels will only replace a little over thirty-seven days of Libya’s production, and some of the oil is coming from the reserves of Japan which is a nonproducing nation struggling to offset the loss of its nuclear power. It would also not be a surprise to see China take advantage of temporarily lower prices to continue to build its own SPR.

the global imbalances built up over decades will take several years to resolve. Our recent Outlooks have highlighted the secular growth prospects in the developing world, where the industrialization of a majority of the world’s population is creating demand for critical materials and services and benefiting leading companies that are well-positioned to fulfill these needs. We have also discussed the need for deleveraging in the developed economies, including the US and Europe, which will continue to restrain economic growth. These competing forces are likely to be felt for some years. Following the recent slowdown, it is easy to forget that the global economy continues to expand with GDP growth projected to be approximately 2% in the developed world and 5% in the developing world in 2011. Based on 2010 global GDP of approximately $65 trillion, those growth levels would produce approximately $2 trillion in additional global GDP in 2011 directly benefitting the earnings of well-positioned companies. As we have written about regularly since the financial crisis, it is important to keep perspective and to take advantage of market volatility where appropriate. equity investors should continue to emphasize the ownership of leading US companies with attractive valuations offering a margin-of-safety which cater to the world’s essential needs. In our research, we continue to find several compelling investment opportunities, including high-quality franchises with defensive businesses and appealing dividend yields. These dividend yields, that are well-in-excess of money market and short-term bond rates, are taking on increased importance in this low interest rate environment. We expect capital to flow to higher yielding equity securities as the United States enters its third year with negative real short-term interest rates. For fixed income, we favor high-quality investment-grade securities of intermediate duration. Lastly, given the political practice of “kicking the can down the road” rather than addressing problems of excessive leverage in the developed world, the prospects exist for further central bank monetization and currency devaluation in order to make debts easier to handle. In this environment, precious metals will continue to play an important role for preservation and growth of longer-term purchasing power in equity portfolios.

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.