In this issue:

The recent strength of the US stock and bond markets has left many market participants as well as those watching on the sidelines questioning where we go from here. Against the backdrop of concerns about the European economies, the uncertainty surrounding US fiscal policy and a slowdown in China, the outlook for US corporations is positive. Many companies are increasing profits and cash flows and announcing record dividend payouts. The US industrial base is experiencing a renaissance supported by employment growth, technological advances, the decline in US natural gas prices and an improved competitive environment caused by rising overseas input costs for transportation, energy, taxes, labor and materials. This is encouraging US corporations to bring manufacturing back home and represents a sea change for US industry and corporate America.

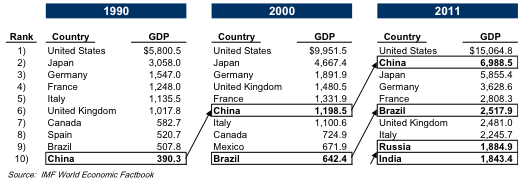

For the past two decades, the world has undergone a transformation with the massive transfer of wealth from developed to developing nations. This is best illustrated in the chart below by the changes in ranking and GDP of China.

Further highlighting this shift is the fact that in 1990 six of the world’s 10 largest corporations were Japanese and none were Chinese. Today, five of the worlds largest companies are US and three are Chinese, while none are Japanese. With potential leadership changes in major countries including the US, China, Russia, and France following last year’s changes in many South American, European, Middle Eastern and Asian nations, we can expect further shifts in the global economy.

As this is being written, the markets have retraced some of their recent gains giving buyers an opportunity to invest at more advantageous prices. The recent announcements by Brazil and India to lower interest rates to stimulate growth are in sharp contrast to last year when many developing countries were raising rates to fight inflationary pressures. With price pressures in China easing, it is anticipated that China will follow suit. These policy initiatives should begin to stimulate the respective economies within 6 months which should begin to be reflected in the equity markets. We expect the major forces which we have identified in this piece to lead to significant capital creation over the next two to three years through thoughtful security selection. Powerful forces continue to be at work favoring those equities benefitting from the current and future needs of the world’s population which is estimated to grow to 7.6 billion people by 2020. The nascent US manufacturing resurgence combined with the rapid advancements in technology highlights an important opportunity for the United States and corporate America.

Coming out of the financial crisis, the deleveraging (debt reduction) process for corporations targeted the key cost driver—employment. While consumers and governments have been slower to reduce their debt levels, US corporations have been able to build their cash balances to a record $1.7 trillion. They quickly changed their cost structures by lowering costs through layoffs, retiring high-cost debt, reorganizing business lines and through technological improvements. The trend in the retirement of high-cost corporate debt continues, adding to profit margins, earnings and cash flows.

The consequence of record amounts of corporate cash and the Federal Reserve’s Zero Interest Rate Policy (ZIRP) in combination with shareholder pressure on corporations’ dividend policies have resulted in S&P 500 companies collectively paying dividends of $241 billion in 2011 and an expected $280 billion in 2012. Nowhere was this trend more evident than when Apple declared an annual dividend policy of $10 billion plus a $10 billion share repurchase program over three years, making Apple the second largest dollar dividend payer in the S&P 500 after AT&T. Apple’s low payout ratio leaves room for additional dividend increases although none are likely for some time. Recently Cliffs Natural Resources, the leading North American producer of iron ore, increased its dividend to $2.50 from $1.12 putting a yield under the stock of approximately 4% while also maintaining a low payout ratio. These moves offer some insight into managements’ confidence in the future prospects for their respective businesses. Although we wrote about this trend early on, we believe this is far from over.

Another aspect aiding US corporations is the gradual return of the US consumer to a purchasing mode aided by lower levels of inflation, improvement in employment and a bottoming out of the housing market in select areas of the country. While these improvements are only on the margin, the halo effect has led to an improvement in consumer spending, including autos, in recent months. The US has also experienced a record warm winter reducing energy bills and driving consumers outdoors. As a consumer-driven economy, positive changes in consumer behavior can add materially to GDP and corporate earnings growth.

During the past year, Chinese officials have attempted to slow its too-rapid growth rate while effectively transitioning its economy from one driven by export-led growth to consumption-led growth to rebalance their economy and to foster a burgeoning middle class. This is not an easy task for any nation, but one made more challenging when China’s best customers for exports are developed nations that are on fiscal austerity programs and have historically high unemployment. The Chinese government recently announced its new GDP growth target of 7.5%. A closer look at China’s growth targets from its 5-year plan reveals that China had targeted an 8% average annual growth rate but achieved an 11% average from 2005-2011. China was able to achieve these tremendous growth rates in part due to unusually high levels of Fixed Asset Investment (FAI) which should be moderating and shifting in the coming years. With a planned leadership change scheduled for later this year and the ability to lower interest rates, China has room to reverse its formerly tight monetary policy to better control its growth. It is important to bear in mind that the government is determined to avoid social instability, and social instability is inextricably linked to employment and economic prosperity. This has been reflected in its recent policy of significantly raising wages and committing to annual wage increases.

Today, China presents a dilemma for many who are focused on the question of how much slowing will actually occur. However, the central theme for longer-term investors must be how and where China will invest its vast reserves to position itself as a greater economic and political force in the world and secure its long-term strategic needs. Recently, the government has made significant investments in Latin America, Europe, the Caribbean and Africa as well as in projects partnering with companies such as Devon Energy and Chesapeake Energy. It is worth noting that in absolute dollars a $7 trillion Chinese economy slowing to 7.5% growth would produce over $500 billion of incremental GDP in 2012. This compares to only $200 billion generated when China grew by 10% in 2000. It is important to focus on the absolute level of growth rather than on the percentage change.

The economies of the developed world are too small for their debts especially in the face of austerity programs designed to address their deficits. With debt costs rising faster than GDP, deficit countries are losing more money each day and austerity is having the affect of worsening the relationship of rising debt to a contracting economy (Debt/GDP ratio). These countries need three policy conditions to be met to reverse this trend – accommodative monetary policy, policies to reduce the value of the debt and productive/growth-oriented fiscal policies. It is essential for developed nations to stop the bleeding, but it should be apparent that austerity alone will not solve their debt problems. After the most recent Greek bailout, attention has shifted to Spain which represents an economy approximately five times larger than Greece. Spain has reported unemployment of around 24%, youth unemployment at a staggering 50%, rising sovereign bond yields and private debt at 227% of GDP. The current forecasts for the 2012 budget show a 1.7% contraction in the economy. Spain will not be able to meet its deficit target of 4.4% of GDP. With high unemployment throughout most of the developed world, these countries need to address the structural challenges while increasing the investment component of GDP to reverse this trend. With leadership changes in so many nations in 2011 and 2012, it has become very difficult to put in place effective programs to address their economic challenges.

Against this backdrop, ARS expects central bank monetary policy of the developed nations to remain accommodative, and we also expect a return to accommodative policies in the developing nations this year after a period of tightening in 2011. This combination will continue to be supportive of corporate earnings, profits and equity returns in general as it will be very difficult for the Central Banks to withdraw funds that have been injected into the banking system during the past three years. For all the money injected, most of it is still sitting on bank balance sheets or used to purchase sovereign debt and not being lent to the private sectors to more efficiently stimulate the economies. As a consequence, the equity markets received a critical boost to investor confidence with the decisive actions of the European Central Bank’s (ECB) Chairman Mario Draghi to support the banking system through its Long Term Refinancing Operation (LTRO) of about $1.3 trillion. Mr. Draghi replaced Mr. Trichet as head of the ECB and dramatically shifted the European policy emphasis from price stability to recovery and growth starting in the fourth quarter of 2011.

Since 2008, the ECB balance sheet has expanded by over $1.4 trillion, the US has added approximately $2 trillion, the Bank of England $200 billion, the Bank of Japan $800 billion, the Bank of China $2.5 trillion, the Swiss National Bank $300 billion, French Central Bank $430 billion and German Bundesbank $700 billion. It is worth noting the role of Massachusetts Institute of Technology (MIT), which favors the use of aggressive and active

monetary policy to solve problems. Among those influenced by their time at MIT are Federal Reserve Chairman Bernanke and President of the NY Federal Reserve Dudley, Mr. Draghi (ECB), Mr. King (UK), Mr. Monti (Italy) and Mr. Fischer (Israel) as well as the Greek Prime Minister Papademos and Mr. Blanchard, a chief economist of the IMF. It would not take a leap of faith to conclude that it will be a significant period before central banks begin to pull liquidity from the system, nor should one expect a dramatic increase in interest rates in the foreseeable future.

Chairman Bernanke supported by two of the most important policy makers, Vice Chair of the Board of Governors Janet Yellen and William Dudley, remains concerned about repeating the key policy mistakes of the 1930’s. Supporting continued accommodative policy in the US are the fears about sustainability of the recovery in jobs and housing which officials believe may remain challenged through 2014. The FOMC is also painfully aware of the impact of rising interest rates on the deficit and interest costs on the national debt. With interest costs now approximately $211 billion, a significant rise in rates would have a material impact on deficit savings and future fiscal policy decisions. The Fed is mindful of the inflationary pressures brought about by rising gasoline prices for consumers as well as other inflationary issues but believes that the greater challenges to economic growth remain jobs and housing. Federal Reserve policies may assist in addressing the cyclical challenges to employment, but the structural employment issues of the mismatch between the required skills for available and future jobs and the skills of the existing unemployed labor pool will require time, investment and significant fiscal policy change. Recognizing that risks and headwinds will continue to be present in the global economy, we continue to anticipate that the Central Banks of the developed world will maintain aggressive monetary policies to support growth in the face of austerity budgets. This has profound implications for investment security selection.

The diverse needs of the global nations and economies will favor those companies that (i) can lower costs and increase productivity, (ii) have strong global franchises with meaningful barriers to entry, (iii) benefit from resource scarcity, rising demand and have low-cost producer status. Looking ahead for 2012 and 2013 and absent a global recession, which we do not foresee at this time, ARS is placing increased emphasis on the following areas:

I.Beneficiaries of the Revitalization of Industrial America

A sea change for US industry and corporate America is underway as wage increases from overseas competitors and low natural gas prices in the United States are contributing to a resurgence in US manufacturing

competitiveness. Moreover state-of-the-art US technology gives our manufacturers a distinct global advantage which can be a real benefit to our balance of trade, trade deficits and helps those states narrow their budget deficits. This highlights the structural employment mismatch between companies’ needs for highly skilled labor and the availability of those with the technical skills to fill these positions. Many companies in our portfolio are generally selling for single digit multiples of cash flow. Projecting out a few years, these companies are selling for single digit multiples of earnings. The current ZIRP policy described earlier gives those companies access to historically low-cost capital to finance expansion and reduces the cost of bringing business back to the US. Business leaders who have proposed a tax holiday to bring back overseas cash have a choice of bringing cash back and paying taxes on the cash or not repatriating the cash and instead borrowing the funds whose interest costs are tax-deductable thereby reducing the revenues to the treasury. Also, keeping the cash abroad favors foreign investment, acquisitions, and job growth over domestic alternatives.

II. Select Technology Companies

ARS is focusing on the leading companies that are poised to benefit from the mega-trends in technology that will help shape the world over the next decade. One of these secular trends is the growth in mobility and the proliferation of smart devices. This opportunity has led to 2015 forecasts for smart phone sales to be 1 billion units with laptop and tablet sales of 600 million units. The mobility trend is being supported by two complementary forces – rising global incomes and falling technology costs – which are making these devices more accessible and affordable. One important measure of affordability is the average weeks worked to purchase a computer. In India for example, the average weeks worked to purchase a device in 2000 was 279 and is forecast to decline to less than 9 weeks in 2015. Nowhere was the power of mobility more evident than during the Arab Spring as protestors relied on mobile technology and social networking to communicate, organize and mobilize. The mobility trend will also augment demand for managing, storing and analyzing data. Separately, we believe that technological changes are raising the value of businesses that provide various forms of content including entertainment media and information services. The internet is providing content companies with an additional distribution platform for existing assets. Valuations for many technology companies are at historically low levels when looking at cash flow, earnings, return on capital, gross margins and cash on the balance sheet given their growth profiles. Moreover many have committed to dividend payouts which they had not done previously.

III. Energy and Strategic Resource Opportunities

The international price of energy will continue to reflect rising global demand. Because the United States has been so successful at increasing oil and gas production, the country has put itself in the position of being less dependent on imported oil if it so chooses. At the present time, there is an increase in pipeline construction and infrastructure spending in general as the major producers have announced significant discoveries both on-shore and off-shore. This has resulted in capital flows into the oil and natural gas sector by foreign entities including state-owned-enterprises which is also leading to additional capital to develop newly discovered reserves and to process and transport these reserves throughout the United States. To put the US energy cost advantage to a US manufacturer of $2 per mcf (one thousand cubic feet) natural gas in proper perspective, this price equates to $12 per barrel of oil on an energy content basis, versus in excess of $100 per barrel of oil or $13-16 per mcf of liquefied natural gas outside the US. The gives the US a large economic advantage to export its surplus natural gas.

Governments have been building strategic reserves of scarce resources including oil, coal, grains and rare earth metals to satisfy their long-term growth requirements and not be dependent on the vagaries of global supply. This is an ongoing discussion in many governments around the world. Our research shows that many resource producers are selling for 4-6x cash flow from operations and significant discounts from asset values. Under these circumstances, any companies that would be acquired would have to attract a significantly higher price in the market, since the real-world value of their reserves and assets are significantly greater than their current stock market valuations.

IV. Dividend Payers

Last October, the FOMC committee released its 2014 year-end forecast for an unemployment rate of 6.8% to 7.7% with inflation at or below its target rate of 2.0%. As we wrote in our November 2011 Outlook, this suggested to us that the committee may not believe it appropriate to raise interest rates until at least the end of 2014 instead of the middle of 2013. Our view was confirmed in a statement by the Federal Reserve made in mid-January of this year. Last week, Janet Yellen suggested that unemployment and housing market conditions might warrant the low rate policy extending through 2015. With interest rates at historic lows and likely to stay there for some years, investors should look to benefit from the attractive dividends currently available from select US corporations with strong balance sheets and the ability to raise dividends over time.

With people living in retirement for longer and with traditional income investments producing far lower returns than often needed, the demographics of the US are leading income-oriented investors to consider increasing exposure to equity investments for income replacement. In addition, the return assumptions of institutional investors are making asset allocation decisions more difficult given the anticipated future returns of fixed income investments. After posting strong returns in 2011, many of these companies have lagged the benchmarks in the first part of 2012. However, ARS has identified high-quality equities with dividend yields of between 2.5% and 4.5% (compared with market average yields of closer to 2%) and Price/Earnings ratios, in many cases, ranging between 8-14 times. These companies appear undervalued in the absolute and look particularly compelling relative to fixed income offerings currently available in the market. A further benefit is that many of these companies are in defensive sectors such as healthcare, consumer staples, telecom and utilities, with strong, defensible franchises that tend to outperform at times when market fears over deleveraging risks are at their greatest.

V. Beneficiaries of Currency Devaluation

Currency devaluation or debasement occurs when governments manage their nations’ debt service and other obligations through monetizing or printing currency, which eventually can lead to rapid inflation. During such periods, as the purchasing power of fiat (paper) currency declines, tangible assets and productive businesses tend to maintain their relative values to society and appreciate in fiat currency terms. For this reason, gold has tended to be a standout performer during times of currency debasement. As governments continue to run deficits and increase their national debts, the choices for governments become limited. They can go into the open market to borrow which often forces rates higher or they can rely on the central banks to become the lenders of last resort. This process must occur absent sensible fiscal policies which must involve a combination of pro-growth investments, tax increases/reforms and spending reductions or efficiencies. Despite this risk, we are continually surprised by how little exposure the average investor has to precious metal investments. For these reasons, we believe that gold and/or undervalued mining companies should continue to comprise some portion of ARS client portfolios.

VI. Financials

In late 2006, our research identified growing stresses in the housing market which led to concerns about US financial institutions. For several years, ARS has avoided investing in financial companies. The concern since the financial crisis was in part a reflection of our concerns about the deleveraging process for consumers and the recovery in employment and housing. In addition, the uncertainty regarding the regulatory environment

including the impact of Dodd-Frank on the business models of financial institutions and their future profits, as well as the uncertainty of the value of their assets and extent of their liabilities worked against one’s ability to effectively value the businesses and disqualified these investments from our selection process.

We believe that several forces are combining to lead us to gradually and selectively add banks into portfolios. The recent stress tests conducted by the Federal Reserve, who as the banks’ regulator has unique access and insight into the assets and liabilities of banks, identified the institutions that were in the strongest financial position and provided a basis for security selection that had not been present before. Research is identifying interesting opportunities to purchase banks that are selling for significantly less than 1x tangible book value, which has historically represented undervaluation. Another positive factor is the improving economy which has strengthened the jobs and housing markets. While we believe that there remain many challenges in the recovery, the improvement in housing and consumer balance sheets has provided relief to the banks which will tend to lead to improvement in their loan portfolios.

The challenges of Europe and its banks stemming from the sovereign debt crisis are offering the stronger US banks an opportunity to gain a competitive advantage at a critical time to acquire loans and assets at deep discounts and to serve as an important source of capital market expertise at a time of need for the emerging economies. Although financials have been one of the best performing sectors in the market this year, we believe that investors should continue to be selective, and we urge caution as the problems of the past are not fully behind us.

VII. Opportunistic use of Cash

As discussed in recent Outlooks, it can be prudent to periodically hold higher cash balances in accounts, particularly during times of greater market complacency and lower margins-of-safety in company valuations. Having higher cash balances can make it easier to ride out periods of heightened volatility. More importantly, it also provides the buying power to be opportunistic and purchase shares of well-positioned companies at very attractive valuations, such as we saw in September and are currently seeing now for selected companies.

The Focus on Long-Term Capital Appreciation

In order to compound rates of return to build capital over time, the minimization of business risk is at the forefront of our security selection. Therefore, security selection should emphasize clarity, qualitative and quantitative appeal. There will be periods such as the internet boom where the speculative nature of the markets drove the averages pushing prices up without regard to value, but over the intermediate to long term, investors should expect value will be awarded.

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.