“In all history, there is no instance of a country having benefited from prolonged warfare. Only one who knows the disastrous effects of a long war can realize the supreme importance of rapidity in bringing it to a close.” – Sun Tzu, Chinese general, military strategist and philosopher

In this issue:

Nobody wins a long trade war, particularly when it involves the world’s two leading economies, and it appears we may be moving towards a prolonged trade problem with China. After a positive start to the year which saw the markets rebound off the fourth quarter lows to rally back to near-record levels, the U.S. equity markets took a turn for the worse in early May as trade discussions between the United States and China suffered a major setback. On May 9th, President Trump accused China of reneging on previously agreed to settlement terms. Not surprisingly, the Chinese government subsequently denied those claims saying that is “common practice” to make adjustments and new proposals as talks progress. It is possible that both sides are using harsh rhetoric as a negotiating tactic, but it is also possible that both sides are positioning for a more drawn out negotiation that would have significant implications for the global economy and for investing. The importance of the U.S. and China trade negotiations should not be underestimated as the recent events are having a negative impact on the markets as well as business and investor sentiment. In addition, the delay in a resolution limits the ability of corporations to adjust their global supply chains to reflect new terms of trade, and that could cause a slowing of the global economy. As if the problems with China were not enough, President Trump subsequently announced his decision to remove India’s favored-nation trade status and his intention to impose tariffs on Mexico to pressure that nation to more pro-actively address the immigration issue. Subsequently, the U.S. and Mexico have reached an agreement to address the border issues and avoid the tariffs for now.

In anticipation of a more prolonged trade dispute, we had embarked on a policy to be appropriately cautious, which also would give us the opportunity to take advantage of the mispricings of quality businesses that naturally occur in periods of heightened uncertainty. At the same time, there are two factors working in favor of an eventual resolution. President Trump wants to be re-elected and President Xi has near-term social and economic challenges to consider. As a result, we anticipate a deal will eventually be reached, but the timing remains uncertain. Since the beginning of the year, we made a decision to de-risk portfolios by selectively raising cash levels as the market recovered from the fourth quarter downturn. Based on the changes we have been making, we are in a position to take advantage of opportunities in the beneficiaries of the secular trends due to the higher than normal levels of cash in client accounts. Notwithstanding the messy global economic and political situation, we remain focused on identifying those leading businesses that stand to benefit from the dramatic technological advances coming in the next 24 – 36 months, and we believe that many of the leading companies may be available for purchase at lower prices. While we cannot ignore the importance of concerns driving the uncertainty, we believe that “select” U.S. corporations with above-market revenue growth, strong balance sheets and rising dividends as well as special situation investments will provide positive returns for investors over the coming quarters.

What Some of America’s Leading CEOs are Saying About the Major Technology Opportunities

In this Outlook, we offer some insights shared by corporate executives who are members of the Business Roundtable as it relates to the critical technological challenges facing the United States. The stated objective of the Business Roundtable, an association of chief executive officers of America’s leading companies, is “to promote a thriving U.S. economy and expanded opportunity for all Americans through sound public policy.” On May 6th, the group released a report entitled “Innovation Nation: An American Innovation Agenda for 2020” in which it provided its recommendations to bolster American leadership in key technologies. The report focuses on six policy proposals addressing cybersecurity, 5G, space, artificial intelligence, autonomous vehicles and quantum computing to ensure future American leadership in these key technologies. Importantly, the areas of focus are aligned with key secular themes we have highlighted in recent Outlooks. Industries and companies are being transformed and redefined, and what the Roundtable CEOs are saying about technology is particularly noteworthy as they employ more than 15 million people and invest nearly $147 billion annually in research and development. We believe the technological advances coming in the next few years will be unlike anything we have previously experienced, and that the U.S. is in a battle for technological supremacy with China that will have critical implications for our nation and its businesses. We remain convinced that market participants continue to underestimate the pace and magnitude of the changes that lie ahead in the coming years as things that were once unimaginable become reality. While these companies may or may not be currently owned in client accounts, we have chosen these quotes from the Business Roundtable press release as they highlight some of the key secular themes that will impact business, consumers and investors in the coming years.

Cybersecurity

“Strong cybersecurity is vital to protect U.S. national and economic security and promote U.S. innovation. Securing a prosperous future in the United States depends on business and government working together to protect networks, safeguard data and matching the sophistication and relentlessness of our adversaries.”

– Jamie Dimon, CEO of JPMorgan Chase and Chairman of the Business Roundtable

5G

“Within 5 years, 5G will change our world and society in ways we can’t imagine now. 5G isn’t just “the next G,” it’s truly a new generation. 5G will be up to 10 times faster than 4G, operating in near-real time, with a nearly imperceptible lag between action and response. But beyond its faster speeds and quicker response times, 5G will connect and control vast amounts of infrastructure?—?defense, transportation, manufacturing, utilities, healthcare, banking, autonomous cars … you name it. 5G enables a world of hyper-connectivity. Wi-Fi allows hundreds of devices to be connected, 4G allows thousands of devices, 5G will connect millions of devices and sensors per square mile. And it will enable you to isolate and locate a device on a 5G network within centimeters.”

– Randall Stephenson, AT&T Chairman and CEO

Space

“Continued U.S. leadership in space will require two things: robust investment in civil and national security space technologies and a commitment to developing and maintaining a best-in-class workforce. The criticality that space plays in maintaining our military and commercial technologies advantage is clear and our leadership is being challenged. We are at a very important moment in our history, and it is critical that we focus on inspiring the next generation to join us in pushing the bounds of human discovery in space. Space technologies and capabilities have transformed the way we live and work. A clear example is the GPS service we use from our vehicle or mobile device daily. GPS was a technology developed for national security applications and then was expanded to commercial use. Much of our day-to-day lives are impacted by the technology we have deployed into space and this is yet another reason why we must maintain our technological leadership.”

– Kathy Warden, CEO and President of Northrop Grumman

Artificial Intelligence

“The United States needs a coordinated national effort on AI that combines greater funding from the federal government, involvement from the business community and collaboration with leading research universities. If we are to shape how these emerging technologies impact our country and people, we must be leaders in their development and ethical introduction.”

– Stephen A. Schwarzman, Chairman, Chief Executive Officer and Co-Founder of Blackstone

Autonomous Vehicles

“Delivering safe, autonomous technology at scale is the greatest engineering challenge of our lifetime. Solving this will unlock profound societal benefits and a multi-trillion-dollar market potential – and I wouldn’t trade our position with anyone… many of the building blocks of the autonomous future are already in today’s cars and help to keep families safe, but there’s enormous opportunity to eliminate the human error that causes more than 90% of all fatalities in the U.S. We’ve laid out a vision of a world with zero crashes, zero emissions and zero congestion?—?and autonomous technology will be key to delivering that future.”

– Mary T. Barra, Chairman and Chief Executive Officer of General Motors Company

Quantum Computing

“Quantum computing will allow us to answer questions and tackle challenges that are beyond the reach of today’s classical computers. Investing now in systems and research and building a quantum-ready workforce will help ensure the United States leads on this pivotal technology and enjoys its economic benefits for years to come.”

– IBM CEO Ginni Rometty, Chair of the Business Roundtable Education and Workforce Committee.

Why We Remain Positive on the Leading U.S. Corporations for the Longer-term

“America is still the most prosperous nation the world has ever seen. We are blessed with the natural gifts of land; all the food, water and energy we need; the Atlantic and Pacific oceans as natural borders; and wonderful neighbors in Canada and Mexico. And we are blessed with the extraordinary gifts from our Founding Fathers, which are still unequaled: freedom of speech, freedom of religion, freedom of enterprise, and the promise of equality and opportunity. These gifts have led to the most dynamic economy the world has ever seen, nurturing vibrant businesses large and small, exceptional universities, and a welcoming environment for innovation, science and technology. America was an idea borne on principles, not based upon historical relationships and tribal politics. It has and will continue to be a beacon of hope for the world and a magnet for the world’s best and brightest.”

– Jamie Dimon, CEO of JPMorgan Chase, in a recent annual shareholder letter

For some time, we have written that the United States has been and remains the standout global economy because of its many strategic competitive advantages over all other major economies, as Mr. Dimon points out above. While not without its flaws, the United States is both a remarkable country and economy because of its resilience, adaptability and its system of government. We have the deepest and most mature capital markets system in the world, and our financial institutions rank among the strongest and best capitalized. The strength of an economy is reflected in its currency, and the U.S. dollar’s position as the world’s leading reserve currency has been highlighted recently as a result of the flaws of the other reserve currencies, the Euro and the Yen. At the same time, China’s aspirations for the Renminbi need to be tempered as the government’s attempts at currency management or manipulation have raised questions about whether the rest of the world is ready to accept it as a reserve currency. Additionally, the world will not accept a currency as a reserve currency as long as that nation is run as a dictatorship.

Another significant competitive advantage is that our system of capitalism has fostered the creation of some of the world’s most dynamic and innovative businesses. The U.S. has developed a culture that encourages those willing to take risks and work hard to innovate and change the way we live. This has enabled companies such as Apple, Google and Amazon to rank among the largest companies in the world. The current system of capitalism and the role of big corporations in society is now being questioned. Some politicians are proposing more government involvement in how businesses are managed which is ironic given the respective track records of business and government leaders. Although we know that there are some companies that have not always served the public’s best interests, overall corporate America has done an outstanding job, which is why so many U.S. companies are among the world’s most valuable and respected. However, it is not just big corporations that set the United States apart from other countries, the U.S. is home to approximately 30 million small businesses. As a nation, we should be proud of these successes and encourage them.

Why Taking a Longer-term View Matters for Investors

“Successful investing takes time, discipline and patience. No matter how great the talent or effort, some things just take time.”

– Warren Buffett

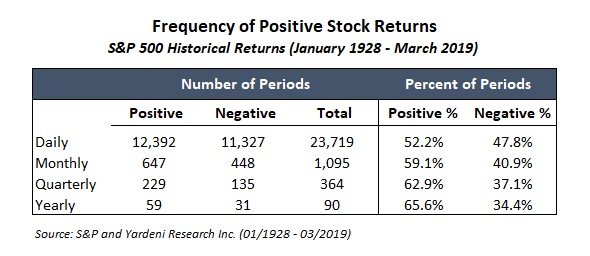

The U.S. stock markets have rebounded strongly this year before giving back some returns in May, leaving many investors wondering what to do now, so we thought a little perspective would be helpful. Recently, money market balances have been moving back to post-financial crisis highs and some investors have been pulling money out of U.S. equities. No one can know what the markets will do from one day to the next, but the numbers here speak for themselves. As the chart going back to 1928 indicates, the stock market has risen between 52.2%-65.6% of the time depending on whether one is measuring days, months, quarters or years. That is statistically significant. Therefore, we would suggest that investors continue to take a longer-term view and to use volatility to their advantage by holding somewhat higher levels of cash to buy shares of attractive businesses when they go on sale.

At ARS, we view the stock market as a medium of exchange, trading dollars for ownership of shares of businesses. Too much attention is being paid to news headlines and short-term price movements which do not typically reflect the earnings, cash flows and assets of listed businesses. Securities trade in an auction market that has inherent inefficiencies, and there is often an inverse relationship between the popularity of a security and its intrinsic value. However, investors often get caught up in the emotion of the moment and allow their emotions to get the best of them which then leads to bad decisions. As legendary investor Benjamin Graham reminds us, “Investing isn’t about beating others at their game. It’s about controlling yourself at your own game”.

What Should Investors Do Now?

Conventional thinking is that the economic cycle must end soon; however, the current backdrop has the ingredients for an extended economic expansion. The current slow-growth, deflation-prone environment will have the effect of elongating the economic cycle rather than shortening it, and therefore we do not see a recession coming anytime soon. The United States should continue to attract money flows to our capital markets. Federal Reserve policy has helped fuel the rebound in equities in 2019 and barring a policy misstep should continue to be supportive of equity investing.

Furthermore, over 70% of corporations reporting earnings this quarter have beaten estimates. This combined with little to no inflation and our view that interest rates will continue to be well below historical levels are all highly constructive for equity investing. On June 4th, Federal Reserve Chair Powell in response to trade concerns said in a speech, “We do not know how or when these issues will be resolved. We are closely monitoring the implications of these developments for the U.S. economic outlook and, as always, we will act as appropriate to sustain the expansion, with a strong labor market and inflation near our symmetric 2 percent objective.” The equity and bond markets rallied as investors interpreted these comments as a willingness of the Federal Reserve to act to support the economy, even if it means reversing itself and cutting interest rates to offset the challenges of a prolonged trade war. If the Fed cuts rates at some point, we believe it will not likely be a preemptive move, but rather a reactive one based on evidence of a slowdown in economic activity.

While the economic outlook has become more uncertain, the secular drivers remain intact and should continue to attract capital. The major areas of emphasis for portfolio holdings include:

–Technology companies that are benefiting from unprecedented innovation and especially those that are integral to the introduction of 5G. The evolution of 5G technology borders on revolutionary change. ARS is focused on the beneficiaries including telecommunications, cloud, semiconductor and equipment, mobile communication, network infrastructure, software services, cyber, connectivity solutions providers, autonomous driving and display companies;

Update on the 5G rollout – Jon Swartz, a writer at Barron’s, was recently given an exclusive to test AT&T’s new 5G network in Dallas. The test was not run on a “fully mobile 5G” but the results were still impressive. In one test using an older iPhone 6, he experienced “speeds of 128 megabits per second, up from 23 megabits on his 4G connection.” In another test at the Dallas Cowboys stadium, a “laptop using a 5G antenna reached speeds of 923 megabits per second to 1.114 gigabits per second.” While this was only a test, it indicates the potential for 5G to change the way we live and businesses to operate over the next few years. Additionally, President Trump and the head of the Federal Communications Commission (FCC) recently announced a plan to support U.S. companies in the development of 5G by making available additional wireless spectrum and allowing companies to have access to some of the spectrum used by the Department of Defense.

–Industrial and material investments in areas of need such as defense companies that are benefiting from increases in global spending and infrastructure companies that are benefiting from programs supported by state and local governments;

Thoughts on changing U.S. weather patterns – flooding and severe weather throughout the United States have created the immediate need to spend billions of dollars on infrastructure and housing as many Midwestern towns will need to be completely rebuilt, and in some cases, relocated entirely. Higher than normal rainfall in the United States is creating a significant dilemma for farmers as the overly saturated farmland makes the decision to plant crops this year a difficult one.

–Healthcare investment remains a strong secular theme due to the favorable demographic trends, but the sector has been under considerable political pressure recently and could very well remain that way until there is greater clarity. At some point the tension between the secular opportunity and near-term political pressures could create a strong buying opportunity, especially for those companies with critical technology-enabled breakthroughs as well as those with strong product pipelines;

Dividend growers with strong balance sheets that will continue to attract capital in a low-interest rate world;

Consumer companies with pricing power that can increase profit margins, improve overall profitability and benefit from lower input costs and stronger consumer spending; and

Company-specific stories (including some smaller capitalization names) with compelling valuations and strong company-specific catalysts or growth drivers.

We continue to identify many above-average revenue-growth opportunities, including several smaller capitalization companies that have market-leading positions in the themes listed above. Investors should stay committed to their long-term plans to build capital through the ownership of the world’s most dynamic growth businesses. Under current conditions, one should expect to see continued price volatility including some of the biggest beneficiaries of this outlook. Successful investing during this period will require the patience and discipline to profit from market volatility. This is the time to be appropriately cautious but also opportunistic.

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.