“I will argue that we are living through one of the greatest inflection points in history... The three largest forces on the planet – technology, globalization and climate change – are all accelerating at once. As a result, so many aspects of our societies, workplaces, and geopolitics are being reshaped and need to be reimagined. Where there is a change in the pace of change in so many realms at once, as we’re now experiencing, it is easy to get overwhelmed by it all.” – Thomas L. Friedman, excerpt from Thank You for Being Late

In this issue:

As noted author and journalist Thomas L. Friedman described in his latest book, societies are struggling to accept, absorb and adapt to the constant changes underway. While the evolving political situation in the United States and abroad remains a primary focus for many, this Outlook focuses on the opportunities beyond politics in areas with defined growth dynamics based on today’s secular trends. Several major technology trends are converging – cloud computing, big data, autonomous vehicles, the internet of things, artificial intelligence and augmented reality – and the development and commercialization of these technologies are creating the opportunity for investors. The confluence of these advances is changing the way we live and shifting supply and demand and pricing dynamics for goods and services. This is presenting a multi-year opportunity by extending the business cycle for many businesses in the technology food chain.

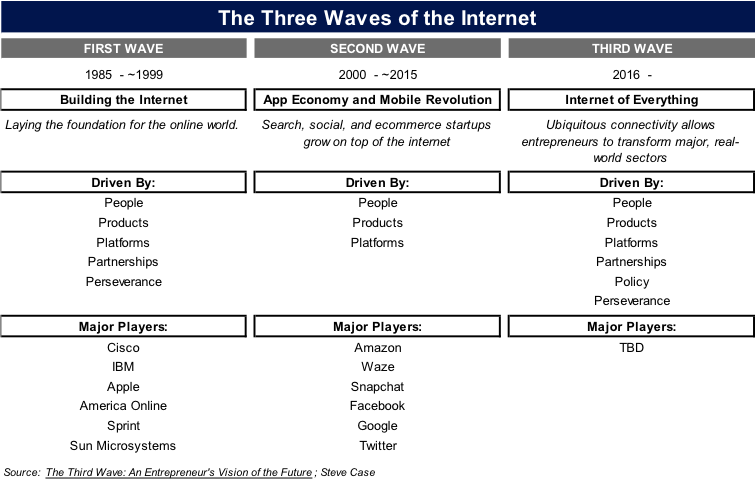

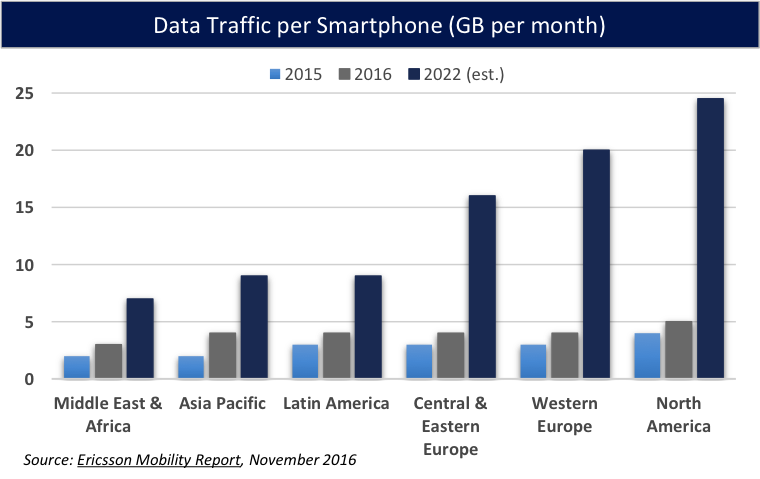

According to Steve Case, the founder of AOL, we are entering the third wave in the evolution of the internet, a phase where the internet becomes integrated into every part of our lives. The first phase laid the foundation with the building of the internet. The second phase gave us search, mobility and ecommerce. It is often hard to believe that it was just 10 years ago that Steve Jobs introduced the first iPhone and, after selling over a billion devices, changed the way we communicate. Five years ago, Facebook became a public company and now serves more than 1.8 billion monthly active users with 1.2 billion daily active users. It is estimated that last year Google processed on average more than 2.3 million search queries every second which translates to over 3.5 trillion searches per year. Because of technological advances, consumers and businesses are demanding faster download speeds. As more and more information is being downloaded and processed, the greater the volume of information that is available to be accessed, stored and managed at speed. The telecom industry is developing 5G, the next generation mobile technology, and we will experience download speeds unimaginable just a few years ago. As cited in the November 2016 Ericsson Mobility report, total mobile subscriptions will grow from 7.5 billion in 2016 to 8.9 billion in 2022 and that “total mobile data traffic is expected to rise at a compound annual growth rate of around 45% between 2016 and 2022. Smartphone traffic is expected to increase by 10 times and total traffic for all devices by 8 times.” As the chart below highlights, the exponential growth of data traffic per smartphone will fuel the demand for memory, storage, semiconductor chips, and these are only a few areas of opportunity.

Investing for an Extended Business Cycle

“Market growth was driven by macroeconomic factors, industry trends, and the ever-increasing amount of semiconductor technology in devices the world depends on for working, communicating, manufacturing, treating illness and countless other applications.”

–John Neuffer, CEO of the SIA; on record 2016 semiconductor revenues

The International Monetary Fund (IMF) forecasts that the world’s Gross Domestic Product (GDP) in U.S. Dollars to reach $79.5 trillion in 2017, and Gartner, a respected technology research firm, estimates that worldwide information technology spending will total $3.5 trillion which is 4.4% of world GDP. Gartner also projects that 8.4 billion connected things will be in use worldwide in 2017 up 31 percent from 2016, and will reach 20.4 billion by 2020. Consumers will use 5.2 billion devices and businesses will use 3.1 billion. We see significant multi-year opportunities in companies involved in devices, the shift to the cloud, storage and memory, production of the chips that power the industry, and service providers. We anticipate some companies will benefit from secular changes and some from an extended business cycle.

One of the most striking opportunities is in the semiconductor industry which recorded nearly $340 billion in revenues in 2016 and was the industry’s highest-ever total according to the Semiconductor Industry Association (SIA). Gartner expects semiconductor capital spending to grow 5.3 percent in 2018 and 6.4 percent in 2019. Designing, manufacturing, and testing semiconductor chips is an expensive, highly technical and complicated process which requires the expertise of many companies. One factory alone can cost anywhere from $7-14 billion to build and stock with equipment. There are 8-10 factories scheduled to be built over the next two years at a estimated total cost of $100 billion. Intel recently announced plans to build a fab in Arizona at a cost of $7 billion, take two to three years to complete, and employ 3,000 workers. Due to the increasing complexity and capacity of mobile devices, the advances in download speeds, and growth of data centers, we anticipate an extended business cycle for the industry.

The Positive Outlook for Securities Valuation

The market has been quite strong since the election with the three major U.S. stock indices hitting new highs. Importantly, governments around the world are reporting improving economic numbers. ARS uses the outlook for corporate profits, interest rates and inflation rates as the standard for securities’ valuation, and based on this outlook we remain positive on equities notwithstanding a likely pullback in coming months. The outlook for corporate profits remains positive and improving, while interest rates and inflation rates are moving up modestly and proportionally to the current rate of growth. The yield differentials between non-U.S. government bonds and treasuries may also serve to limit any disproportional rise in U.S. interest rates which would otherwise be a negative for economic expansion and for equities. Further support for the positive view on equities was provided by Norway’s $900 billion sovereign wealth fund, the world’s largest, which recently announced it was increasing its commitment to equities by 10% because of the anticipated return opportunities relative to other investments. This is significant as the fund already owns an estimated 1.3% of all listed securities globally.

The unconventional approach of the Trump Administration has many off balance and uncertain. The geopolitical situation is unstable as Russia, China and North Korea remain aggressive, the future of the European Union is in question, the United Kingdom wrestles with Brexit, debt levels are still elevated and demographics continue to work against growth. Global politics also will factor heavily in the markets as France and Germany will have major elections in the coming months. Yet we remain cautiously optimistic about the prospects for the United States and the global economy particularly in the second half of 2017 and for 2018. The Trump campaign platform identified four major economic policies which have created excitement about the future – infrastructure spending, corporate and individual tax reductions, lower regulatory burdens and the repatriation of corporate cash held overseas. We believe in the need for corporate and individual tax reform, and that corporations should be encouraged to bring a portion of their roughly $2.6 trillion in cash held overseas back to the U.S. to be invested here. We have long believed in the need for the United States to increase its investment in the nation’s infrastructure, and that these needs can no longer be postponed as we were recently reminded by the problems with the Oroville Dam in Northern California.

Investment Implications

In addition to the technology beneficiaries highlighted above, we see investment opportunities in many of the areas we have emphasized over the past year including companies with strong secular growth characteristics, high quality companies with attractive and growing dividend payouts, opportunistic investments in out-of-favor areas in the market, industries with special catalysts, and U.S. domestically-oriented businesses, especially small capitalization companies. With the U.S. economy and consumer confidence improving, the outlook for small capitalization stocks has also improved. There is also renewed sense of optimism among business leaders in the United States which is raising confidence in investment spending and hiring. If corporate and personal tax cuts are enacted, repatriation occurs and infrastructure spending occurs, U.S. companies will be major beneficiaries.

The combination of these forces should increase after-tax earnings for these companies. Irrespective of the specifics of these policies, the direction of change is quite positive for the economic outlook and therefore for equities.

Important Reminder

The firm has recently been renamed ARS Investment Partners, LLC. following the consolidation of A.R. Schmeidler & Co., Inc. with Somerset Capital Advisers, LLC, Artemis Wealth LLC and PS Management LLC. The combination of our firms will allow us to better service our clients’ evolving needs in the coming years. We are introducing two new investment strategies which leverage the collective capabilities of our expanded team – the Focused Small Cap Strategy and the Focused ETF Strategy. The ARS Focused Small Cap Strategy invests in companies with market capitalizations ranging from $100 million to $2.5 billion. The strategy employs a high-conviction approach resulting in a portfolio of 15-20 small-cap companies. The portfolio is long-biased while mitigating risk via cash levels, prudent short sales, inverse ETFs (Exchange Traded Funds) and option strategies. The ARS Focused ETF Strategy involves our team constructing a portfolio that utilizes ETFs to express the views put forth in our Outlooks. The strategy is designed to concentrate our investments in ETFs that provide the greatest exposure to our highest-conviction themes. This may lead to investments in “narrow” industry ETFs. Typically, the portfolio will focus on 5-10 themes that will result in 10-20 ETF investments. These new offerings are just one example of the benefits of our firms’ coming together. We are delighted to expand our investment and service capabilities with the talented and experienced investors whom we have known for several years.

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.