In this issue:

As we wrote in our last Outlook, the rapid pace of change is leaving many feeling unsettled, but also angry and frustrated with the government institutions they feel have failed them. This anti-establishment sentiment helped propel President Trump into office. Since the election, politics have become the focus for many investors as President Trump is now experiencing the difference between being the anti-establishment candidate and being the President who is trying to work with both Republicans and Democrats to make good on campaign promises. The President is finding out how hard it is to affect change inside the Beltway. To be sure the election of President Trump has raised expectations for a pro-growth agenda highlighted by deregulation, tax reform, fairer trade practices, infrastructure and defense spending. Those expectations have been built into stock market valuations to some extent. The market has been quite strong since the election as the three major U.S. stock indices have hit new highs. However the market itself had been improving since last June, and the positive momentum should continue as first quarter revenue growth is expected to be strong with earnings estimated to be up 10%. This has less to do with the new Administration and more to do with an economy that has continued to expand as employment growth continues to be accompanied by low inflation and slightly higher interest rates. The conclusion is that additional delays of key elements of the Trump agenda could result in a market pullback and investors should use the market dips as an opportunity to buy.

To be clear, we remain positive on the opportunities for well-selected equity investments in the areas we have highlighted in recent quarters. The outlook for corporate profits remains positive while interest rates and inflation rates have been rising only modestly and proportionally to the current rate of growth. The yield differentials between non-U.S. government bonds and treasuries may also serve to limit any disproportional rise in U.S. interest rates which would otherwise be a negative for economic expansion and for equities. Furthermore, the Federal Reserve’s measured approach to increasing interest rates, expected delays in implementing pro-growth initiatives in the U.S. and improving economic numbers out of Europe and Asia are working to keep the U.S. dollar in check. Many investors have been on the sidelines and missed out on the strong move in the markets and appear to be hoping for a pullback to get their money to work. These same investors may end up disappointed and forced to buy in at higher prices.

In this Outlook our focus continues to be on the crisis facing the United States with respect to our nation’s crumbling infrastructure. The problem is so severe in our view that the necessary spending can no longer be postponed.

Aside from the economic costs of American jobs and lost sales for U.S. companies, we are putting people’s lives at risk. For more than a decade we have written about the findings of the American Society of Civil Engineers (ASCE) as it has issued reports every few years projecting the spending required to maintain our infrastructure in a state of good repair. In the past this report has fallen on deaf ears in Washington D.C. as the federal government has failed to make the commitments to secure our future and invest meaningfully in shoring up our infrastructure. We are encouraged that Transportation Secretary Elaine Chao recently announced that the White House is targeting late May to introduce a $1 trillion infrastructure plan to be spent over 10 years.

A Positive First Step – FirstNet/AT&T Announcement

“Today is a landmark day for public safety across the Nation and shows the incredible progress we can make through public-private partnerships. FirstNet is a critical infrastructure project that will give our first responders the communication tools they need to keep America safe and secure. This public-private partnership will also spur innovation and create over ten thousand new jobs in this cutting-edge sector.”

U.S. Commerce Secretary Wilbur Ross, 3/31/17

An encouraging sign of Washington’s resolve to address our future infrastructure needs came with the recently announced contract between FirstNet, an independent arm of the U.S. Commerce Department, and AT&T to build and manage the first broadband network dedicated to America’s police, firefighters and emergency medical services (EMS). Today our nation’s first responders use the same networks as consumers and businesses which has been a severe problem in times of crisis when communication networks have been overloaded. As highlighted in the press release, “In addition to creating a nationwide seamless, IP-based, high-speed mobile communications network that will give first responders priority access, the network will help:

As 5G technologies develop over the next few years, AT&T and FirstNet will work together to provide significant increases in the speed which data and video travel across the FirstNet network. AT&T will work with several leading technology, data, communications and defense companies, including General Dynamics, to make this project a reality. Under the terms of the deal, AT&T will receive $6.5 billion in funding as well as important spectrum for data and wireless transmission. In turn, AT&T will spend $40 billion over 25 years on the project. It is also significant that this project will create 10,000 jobs over the next two years. FirstNet’s funding was raised from previous spectrum auctions, and is a reminder that the government has assets which may be used to help finance future projects. This represents a possible public-private partnership model for future infrastructure investment in air-traffic control, roads, bridges and other infrastructure needs.

2017 Infrastructure Report Card Update

“Our nation is at a crossroads. Deteriorating infrastructure is impeding our ability to compete in the thriving global economy, and improvements are necessary to ensure our country is built for the future… Even though the U.S. Congress and some states have recently made efforts to invest in more infrastructure, these efforts do not come close to the $2 trillion in needs. The good news is that closing America’s infrastructure gap is possible if Congress, states, infrastructure owners, and voters commit to increasing our investment. To raise the overall infrastructure grade and maintain our global competitiveness, Congress and the states must invest an additional $206 billion each year.”

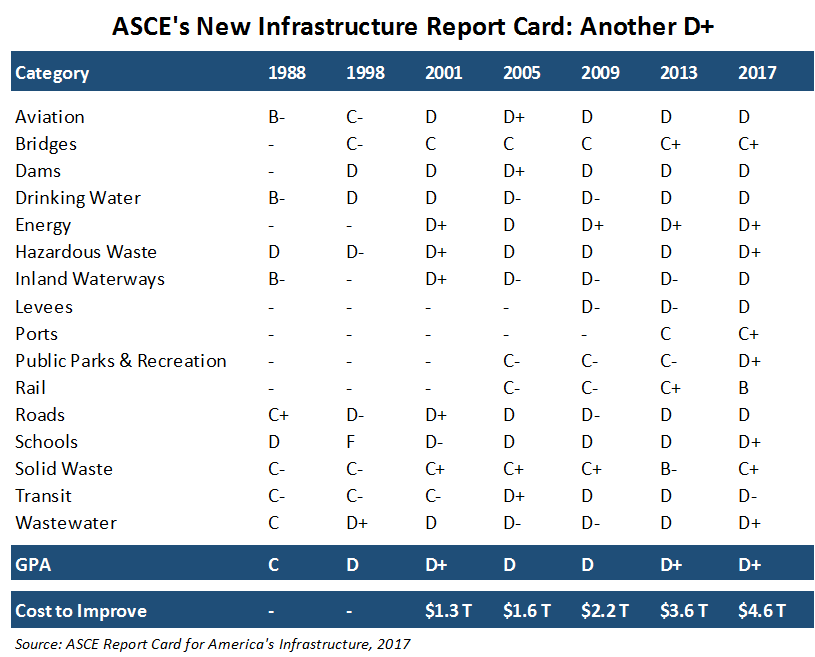

The ASCE’s recent assessment of our infrastructure yielded a D+ which is the same grade as in 2013. For the period of 2016-2025, the total U.S. infrastructure needs are estimated to be $4.59 trillion with $2.53 trillion funded and a shortfall of $2.06 trillion. As highlighted in the chart that follows, the United States can no longer postpone the required investment as the cost to improve our infrastructure has grown from $1.3 trillion in 2001 to an estimated $4.6 trillion today. In a 2016 study, the ASCE determined that failing to close the investment gap has serious economic consequences for the U.S. with an estimated $3.9 trillion in losses to U.S. GDP, $7 trillion in lost business sales, and 2.5 million in lost American jobs by 2025. The ASCE has called for the United States to increase infrastructure investment from the current level of about 2.5% of GDP to 3.5% by 2025.

The ASCE further estimates that if the infrastructure gaps are not addressed, the U.S. economy is expected to lose $18 trillion in Gross Domestic Product (GDP) over the 25-year period of 2016 to 2040 with each household losing nearly $4,400 in disposable income. To provide some context, Americans spend approximately 6.9 billion hours a year delayed in traffic. In 2014, these delays costs the economy an estimated $160 billion in wasted time and fuel.

Airport congestion is a growing problem as well, and it is expected that 24 of the top 30 major airports may soon experience “Thanksgiving-peak traffic volume” at least one day every week. The average age of the 94,580 dams in the United States is 56 years. While 4 out of 10 bridges are over 50 years old, 9.1% of the 614,387 were deemed structurally deficient in 2016. Our drinking water is delivered via one million miles of pipes, many of which were laid in the early to mid-20th century with an expected lifespan of 75-100 years. There are an estimated 240,000 water main breaks each year wasting over two trillion gallons of treated drinking water.

While the United States is the global leader driving technological advances, it has underinvested in the infrastructure to support the growing needs to support these advances. According to The State of the Internet report from Akamai Technologies, the United States ranked 16th in average connection speed of 17.2 Mbps in Q4 2016 among nations. Megabits per second (Mbps) are a unit of measurement for bandwidth and throughput on a network. The result was well above the global average of 7.0 Mbps, but considerably behind top-ranked South Korea with speeds of 26.1 Mbps.

The neglect of our infrastructure spending requirements has been a source of frustration for our team as we have shared the ASCE report with readers for nearly a decade. Politicians have been sitting and watching the costs escalate and the risks of further tragedy increase. President Trump has made infrastructure spending one of his key priorities, it remains to be seen whether Congress will act and if so whether they will respond with the appropriate commitment of dollars. However, we are excited by the possibility of further public-private partnerships along the lines of FirstNet/AT&T as these types of arrangements leverage the strengths of our government agencies and businesses to attack specific problems. Since it is politically a challenge for Congress to find a way to finance the cost, a portion of the burden will likely fall on state and local governments to fund these projects. Given the fact that many states are already struggling, it will possibly mean consumers will bear some of the burden in the form of higher state and local taxes or consumption taxes.

Investment Implications

Given the combination of political, economic and social forces at work in the U.S. and global economies, it is easy for investors to be unsure of their investment strategies at this time. We would emphasize that there are important beneficiaries of the Outlook that we have described in recent quarters, and see opportunities for well-selected equity investments in technology, defense, health care, infrastructure, and high-quality dividend payers. It is notable that small capitalization stocks have not participated in the strength of the equity markets so far this year creating interesting valuation prospects for investors. ARS has spent substantial time researching the beneficiaries of greater infrastructure spending and will look to increase our investments in this area as our conviction grows that Washington is taking steps to make the investments our nation requires. The outlook for corporate profits remains positive, while interest rates and inflation rates have been rising modestly and proportionally to the current rate of growth. As a direct result of the improvement in U.S. economic conditions and its outlook for a continuation in the coming quarters, the Federal Reserve is now able to take a measured approach to increasing rates and possibly begin to reduce its balance sheet later this year. The Federal Reserve’s positive outlook is further supported by improving economic numbers out of Europe and the Emerging Markets.

Our next Outlook will discuss the ability of the Administration to continue to use deregulation as a bridge to buy time to negotiate other pro-growth initiatives. We will also address the short term and secular forces arguing against much high interest rates and inflationary pressures. In addition we plan to share our thoughts on the important meeting between President Trump and China’s Premier Xi. Please call us with any questions or comments.

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.