In this issue:

The market has reached record levels this year in the face of geopolitical events in Ukraine, the South China Sea and throughout the Middle East, which in other economic cycles would have likely led to a significant pullback. Clearly, the current market is being driven by other forces. Russia’s aggressiveness in Ukraine and conflict in the Middle East now pose major risks to political stability. While the term “complacency” has been used to describe the stock and bond markets this year, we believe that today’s market reflects a more complex set of dynamics resulting from the combination of a prolonged low-growth economic expansion, a lack of sensible alternatives available for investors (given the low and declining yields on fixed income) and the deflationary forces which exist in the global economy. The disequilibrium present in the global economy continues as the major economies struggle with muted growth due to excess capacity and debt in the system.

Against this backdrop, the United States remains the standout economy as these global forces are being countered by record and growing U.S. corporate earnings, cash balances and profit margins. The U.S., which was the first major economy to enter a recession during the financial crisis, has been among the first to recover due to the resilience of the economy and aggressive policy actions. U.S. corporations are using their strong balance sheets to invest heavily in technology to increase productivity and to maintain or reduce labor costs. The China-led emerging economies in contrast are dealing with the problems of slowing growth, rising debt levels, capital flows and ongoing concerns about social unrest. Europe is in the early stages of what appears will be a lengthy fight to implement the structural changes required to make the region competitive, while at the same time battling significant deflationary pressures and struggling to reduce debt burdens.

We are now at a point where the growing divergences in the global economy are complicating policy decisions as deflationary pressures appear to be mounting in some areas highlighting the need for a continued easy monetary policy. The size and duration of central bank policies have created uncertainty and made investment decisions more dependent on these policies than in previous periods.

Global deflationary pressures are being brought about by two primary forces: the mismatch in aggregate demand/supply and the impact of global deleveraging. Excess capacity in labor markets has become a structural problem and employment/wages have not recovered to acceptable levels. Wage increases have always been a major element in creating inflation where productivity improvements have not kept pace. The low cost of capital continues to encourage corporations to substitute technology for labor, which increases deflationary pressures and has the effect of muting wage gains and therefore growth. A technology-driven expansion has also made it difficult for many companies to increase prices. A prolonged low-growth expansion would allow employment and wage growth to return to an acceptable level, which in turn would allow for the necessary deleveraging to occur and utilize the excess capacity in the system.

Importantly, while investors and the media speculate as to when the Federal Reserve will begin to raise interest rates, we are more focused on the pace of the eventual increases rather than the timing. Based on the conditions that presently exist, it is our view that the pace of increase could well be slower than currently anticipated as slow economic growth is not supportive of either the speed or degree of increases witnessed in past rising-rate cycles. Due to the fragility of the U.S. and global economies, the deflationary pressures and debt burdens as well as the unemployment/wage problems mentioned above, it is difficult to envision a scenario in which central banks could raise rates significantly and have the system maintain a growth trajectory. Therefore the critical ingredient to address the current problems of the U.S. and Europe is to have an extended period of growth that is sufficient to avoid a Japan-like deflationary scenario but not so strong as to ignite inflation which would raise interest rates and stifle the expansion.

Due to the unique nature of the problems and solutions, many investors have been hesitant and confused about how to act to preserve and build capital as well as protect purchasing power. This Outlook addresses the most common questions being asked by our clients today, and offers a roadmap for investing in this uncharacteristic cycle.

Following the downing of Malaysian Flight 17 in Ukraine, Europe and the U.S. imposed new sanctions on Russia that are creating an additional headwind for the European economies and posing a risk to global growth. Germany is one of Russia’s largest trading partners, and Angela Merkel has chosen to accept near-term economic consequences in order to send Vladimir Putin the strongest message to date that Russia’s actions are not acceptable to the global community. This is important because Mr. Putin has given indications that he would like to see Russians living in reunited Russian republics, so his aggression may not stop with Crimea. The sanctions will result in some additional slowing of European growth, which can in turn weaken the Euro, suppress government bond yields, and further add to the structural challenges facing the European nations.

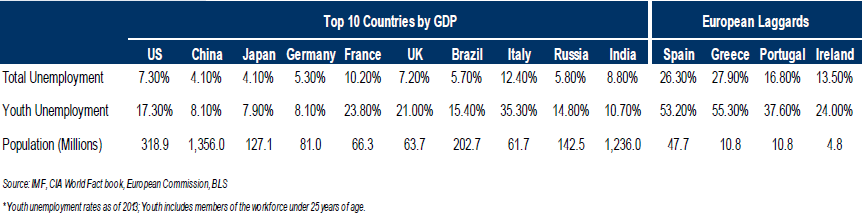

The sanctions come at a bad time for the European Union as it is struggling to form a common view for resolving the issues between the stronger and weaker members. The region has to undergo significant structural reform as the employment issues in the chart above illustrates. Overall unemployment remains a significant challenge. For example, Spain likely faces 4 more years of 20% or greater levels of unemployment with long-term unemployed estimated to be 3.5 million and youth unemployment still in excess of 50%. Based on the levels of youth unemployment in Spain, Italy, Portugal, Greece and Ireland as shown, Europe has a major unemployment problem across the broad population and also risks losing the productive capacity of a portion of the future generation as well. This situation will require a prolonged period of steady growth supported by lower than historically normal interest rates and inflation rates.

Investors are focusing significant attention to the timing and pace of the policy changes of the major central banks with the greatest focus on when the Federal Reserve will begin to raise interest rates. Investors are attempting to anticipate the impact on the stock and bond markets. Since 2009, the major central banks including the Federal Reserve, the European Central Bank (ECB) and the Bank of Japan (BOJ) have employed unconventional policies in an effort to stimulate their respective economies. These have included the use of two primary tools – monetary creation through quantitative easing (QE) and historically low interest rate policies. Today, central banks have increased their assets by nearly $6 trillion in the past six years which would not have been possible in the past as the market would have feared inflation and interest rates would have increased sharply.

The current divergences in monetary policy represent an important consideration for investors as the Federal Reserve is on pace to end its QE program in the fall and will raise rates before the ECB and BOJ. Conversely the ECB may launch a formal QE program in the coming months. One could argue that the ECB has been implementing a back-door QE program by using its negative interest rate policy to encourage banks to increase lending and to incentivize the banks to purchase European sovereign debt resulting in lowering bond yields and allowing member governments to borrow at lower costs. Japan is attempting to reverse a 25-year deflationary cycle through yet another, although far more aggressive, QE program after the earlier efforts were too timid to work. It is likely that the ECB and BOJ will be considerably behind the U.S. in becoming less accommodative.

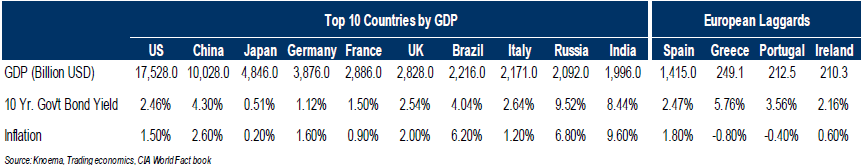

Notwithstanding the inevitable increase in benchmark interest rates by the Federal Reserve, the likely outcome of the policy change will be a rate well below historical norms as the U.S. economy cannot support anywhere near a 5% nominal rate. There are three primary reasons why U.S. interest rates should remain low for some time including: 1) the lackluster employment and wage recovery, 2) the debt overhang, and 3) global yield differentials. The chart below shows the yield differentials of some of the major economies which highlights the divergences. It is notable that the U.S. 10-year treasury is approximately 1.30% higher than German yields and 1.00% higher than yields on French debt. The yields for many European nations now stand at levels not seen in more than 100 years.

At the June meeting of the Federal Open Market Committee (FOMC), the Committee highlighted that both labor market conditions and inflation expectations moved closer to their longer-term objectives, and that economic activity will expand at a moderate pace. One important consideration for the Federal Reserve or any other central bank as to timing the shift to increase interest rates is that central banks would rather be somewhat late to raise rates and be forced to address inflation, than to be forced to backtrack to lower interest rates again because the economy was not healthy enough to maintain its growth trajectory or worse face deflation which would undo all the previous efforts. Given the nature of this low-growth expansion, investors should think about the pace of rate increases rather than the inevitable first rate increase itself. Investors should anticipate that the pace will be slower than in the past with the end point likely to be lower. Equity investors should be aware of the fact that in the past five tightening periods, the commencement of rate increases hurt the equity and bond markets but after this temporary negative initial reaction, equities then went on to rise meaningfully as increases in rates signified an improving economy.

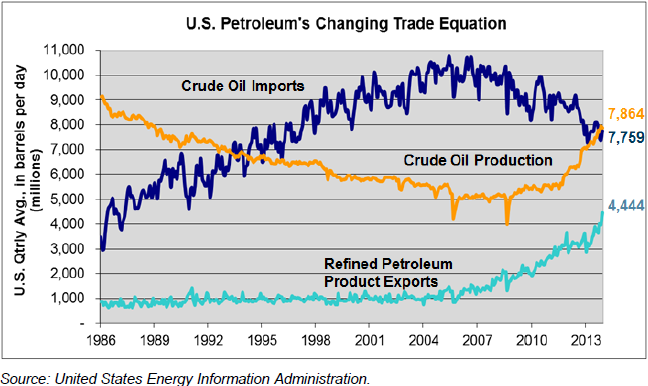

In recent outlooks, we have written extensively about the energy and industrial transformation which is taking place in the U.S. Its importance cannot be understated, for without the improvement in energy production which has reduced our import needs, the price of oil would likely be much higher. Energy prices are likely to be volatile but should remain relatively elevated with an upward bias due to a variety of factors. Geopolitical stresses in the key producing nations in the Middle East and Africa continue to add uncertainty to supplies from these regions as evidenced by the swings in output for Libya, Iran, Iraq and Nigeria. At the same time, reserve replacement from most of the world’s major oil companies remains challenged and production costs are anticipated to remain high as much of the lower-cost and easier-to-access oil has been produced. With approximately 35% of world supply coming from increasingly aging fields, and much of the new supply coming from the more expensive deep water fields, production costs will be challenged in the years to come. Labor force issues also remain a problem for the industry and skilled labor shortages are further increasing the costs as wages are rising for workers in this sector. Additionally, the continued growth in global Gross Domestic Product means increased demand for oil which is now at 92.4 million barrels per day and is up 1.4 million barrels per day this year over last. In the past year, demand has exceeded supply by around 500,000 barrels per day.

Without the dramatic changes of the past few years in U.S. energy production, we believe that the current price would be significantly higher. This is especially important against the backdrop of growing geopolitical stresses including Russia’s annexation of Crimea, China’s aggressive tactics for oil and other resources in the South China Sea, and the multitude of issues in the Middle East ranging from the Israel/Hamas conflict to ISIS actions in Iraq. Without the dramatically improving U.S. domestic energy position there would be a greater impact on energy prices and there would be increased equity market volatility. To put this in perspective, U.S. production has grown in recent years by nearly 3.3 million barrels per day which is an increase equivalent to the production output of Iraq, one of the world’s largest producers. According to the Energy Industry Association, U.S. crude oil production in 2015 will increase to 9.3 million barrels per day, a level not seen since 1972. That is up from 8.4 million barrels per day in 2014. As European nations come to grips with the harsh reality that they must reduce their reliance on Russia as the primary source of their natural gas, there have been calls for Europe and the U.S. to form a long-term energy-trade relationship. While it would take time for exported energy to make a large impact on Europe, formalizing such a relationship is hard to reverse and sends an important message to Russia.

The United States is reasserting its economic leadership after a nearly decade-long period of rapid Chinese growth. The U.S. has been the largest economy for decades, and the country’s key competitive advantages – the world’s most liquid and mature capital markets system, positive demographic dynamics, democratic institutions, a culture of innovation and enterprise, high worker productivity and availability of critical resources (food, energy and water) – are coming to the fore. The United States is in the midst of a multi-year economic and industrial expansion which we believe is not fully recognized as of yet. The economic growth going on in the central part of the United States has been spectacular and has some economists calling parts of that region the “best emerging market” in the world. United States corporations, many of whom have been the biggest beneficiaries of the low interest rate polices, are reporting record corporate earnings, cash balances and profit margins. U.S. corporations are using their strong balance sheets to invest heavily in technology to increase productivity. At this time, the U.S. should continue to attract capital to many areas of the economy especially the areas where critical investments can no longer be postponed.

After the strong returns in the stock and bond markets in recent years, we believe today’s investment opportunities will require greater selectivity, with bond investing an area of greater risk given the likelihood of higher rates in the coming years and little in the way of current compensation due to the low level of today’s yields. At the same time equities are more likely to represent a better opportunity to preserve and build capital under present circumstances. In addition, rising shareholder activism is a strong indication that many corporations have the ability to unlock hidden value, and if that were not the case the managements would not be responding in the fashion that they are. This year there have been over $1.7 trillion in deals announced and investors should anticipate a continuation of merger and acquisition activity as the current interest rate environment makes most transactions immediately accretive.

From a portfolio positioning perspective, we remain constructive on investments in the industrial, technology and energy sectors in addition to other select areas as our slow but relatively steady economic expansion is likely to continue for some time. We have also increased our emphasis on companies that have particular internal dynamics that make them less dependent on the level of growth in the economy to generate increasing earnings and to realize higher values. In addition, many of the holdings in the portfolio have the ability to unlock value by selling assets and redirecting the capital to the most economic and immediate projects. Finally, many companies have been increasing dividends and stock buybacks creating additional value for shareholders.

One of the primary considerations for equity investors today is that capital must flow to the areas of the U.S. economy where the needs can no longer be postponed. One of the key opportunities for the U.S. economy to continue its growth trajectory through the end of the decade is where three fundamental investment dynamics overlap: the energy renaissance, growing corporate profits, and large infrastructure needs which must be addressed. U.S. growth is further supported by a unique combination of factors that exists today including:

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.