In this issue:

“No one in society remains untouched by a situation of high unemployment. For the unemployed themselves, it is often a tragedy which has lasting effects on their lifetime income. For those in work, it raises job insecurity and undermines social cohesion. For governments, it weighs on public finances and harms election prospects. And unemployment is at the heart of the macro dynamics that shape short- and medium-term inflation, meaning it also affects central banks. Indeed, even when there are no risks to price stability, but unemployment is high and social cohesion at threat, pressure on the central bank to respond invariably increases.”

Excerpt from Jackson Hole speech by Mario Draghi, President of the ECB, 8/22/14

The United States has the most positive economic outlook among the developed nations. Each quarter U.S. corporations continue to report strong and rising earnings in the face of tenuous and uneven global growth. U.S. corporations and consumers will continue to benefit from persistently low interest rates and declining commodity prices which are positives for the outlook and equity investments. For several months, Chair Janet Yellen and the Federal Reserve have been the primary focus of the markets, but in recent weeks the attention has shifted to Germany and the European Central Bank (ECB). Mr. Draghi’s above-referenced comment from his Jackson Hole speech captures the key challenge facing not only Europe, but the many leading nations as each struggles to get its economy on a sustainable growth trajectory. Developed nations are fighting high unemployment while deleveraging, and emerging market economies are adjusting to slowing growth and capital outflows in a rising dollar environment. The fears of Europe slipping into a recession are leading to broader concerns about deflation and a material slowing of global growth with the outbreak of Ebola also disquieting the markets. The weakness in the global economy has been evident in the decline of oil and natural gas prices, global bond yields and stock market indices.

The last Outlook (August 8, 2014) described an environment of mounting deflationary pressures in the global economy which were promoting lower inflation, lower commodity prices and foreign currency weakness. With interest rates already at historically low levels and the Federal Reserve moving gradually closer to a less accommodative policy, the pressure is building for government leaders, especially those in Europe, to quickly implement pro-growth initiatives while supporting the structural reform agendas required for sustainable, long-term growth. In order to avoid slipping into a global recession, raising current and future growth should remain the top priority for governments in the developed and developing world as high unemployment and indebtedness have led to a system beset by significant excess capacity, stagnant wages, and growing social stresses. Unfortunately, policy makers have been unable or unwilling to address the issues due to either political ideology or a lack of sufficient understanding of economics.

Global divergences and stresses are challenging the mindset of citizens who are becoming increasingly disillusioned with the status quo. From Scotland to Catalonia to Hong Kong to the Middle East, people are expressing dissatisfaction with government leaders as the world continues to struggle to recover from the “Great Recession” that began in 2008. Weighing heavily on the world’s population are ineffective political leadership, incorrect or insufficient fiscal policies, anemic growth, high unemployment, corruption and the general frustration with the lack of progress in dealing with the issues facing many countries. People are dissatisfied with the lack of government policies to address income inequality, create jobs and improve overall living standards. To date, much of the burden to address the economic challenges has fallen on central banks, particularly the ECB, the Federal Reserve, the Bank of England (BOE) and the Bank of Japan (BOJ). In the recently-released World Economic Report (October 2014), the International Monetary Fund (IMF) lowered its 2014 forecast for global growth by 0.4% to 3.3% and its 2015 forecast by 0.2% to 3.8% which reflects the downside risks to the global economy at this time. It has been clearly demonstrated that monetary stimulus alone is not enough and that thoughtful, pro-growth fiscal policy initiatives are essential.

This Outlook addresses key issues impacting investment decisions today including the global need for fiscal policy adjustments, global infrastructure investments, the strengthening dollar, thoughts on the oil market and the investment implications of the current environment. The recent market pullback notwithstanding, ARS believes that the United States continues to be one of the most solid growth opportunities globally, and that as the market adjusts to the concerns discussed in this Outlook, investors should take advantage of equity valuations which have become more attractive.

“The aggregate fiscal stance must be supportive of aggregate demand in the current cyclical position, this can and should be achieved within the existing rules… Simply put, I cannot see any way out of the crisis unless we create more confidence in the future potential of our economies. Reform and recovery are not to be weighed against each other. The combination of policies is complex, but it is not complicated. The issue now is not diagnosis, it is delivery. It is commitment. And it is timing.”

Except from Mario Draghi, Brookings Institution, 10/9/14

As concerns of the European economy slipping into recession rise, one of the biggest challenges facing governments is balancing policies to reduce deficits with those to stimulate growth. Monetary policy has been the primary tool for developed nations to stimulate economic growth following the financial crisis, but it alone has not been enough to achieve a sustainable recovery. This is particularly true in Europe where the lack of a unified institutional structure has made it difficult to implement the policies necessary to foster a sustainable recovery. This month’s German export numbers disappointed adding to recession and deflation fears as the effects of the sanctions against Russia and general slowing in Europe are reducing its growth potential. The German business confidence IFO Institute survey dropped for the sixth consecutive month providing further evidence that an adjustment process is underway. Germany has been one of the most productive economies in the world as well as the economic anchor for Europe. Angela Merkel stood tall politically in leading the European efforts to deal with the ongoing Russian aggressions in the Ukraine. Germany has also been a strong voice in favor of forcing strict adherence to structural reform targets for the European Union, and its finance minister has been at odds with the ECB with respect to the appropriateness and legality of quantitative easing.

Fiscal policy issues are a key topic for world leaders, but more so for those in Europe as philosophical and ideological differences in approach to solving the problems remain critical impediments to the European recovery. Because Europe does not have deep and liquid capital markets, it is more dependent on fiscal policy to promote the needed growth as the private sector cannot access capital as easily as can corporations in the United States. France, Italy and the ECB have very different views from Germany regarding their rigidity in adhering to budget targets based on current economic conditions as each nation has submitted budgets above European Union mandated targets. A policy of continuing austerity in Europe will guarantee more contraction for the federal governments. The insistence on a balanced budget in a contracting economy will result in lower living standards, decreased tax revenues, and greater deficits.

It remains to be seen whether a recession in Germany would lead it to change its views with respect to allowing greater flexibility in fiscal policy and be more supportive of the ECB’s efforts to adopt a more stimulative monetary policy (quantitative easing). France, Italy and the ECB have joined forces in insisting that Angela Merkel and Germany change course on fiscal policy to stimulate growth. Time is not on Europe’s side as the political and ideological standoff is taking a toll on its people and its economies and fracturing support for the euro.

“By failing to recognize the proper role of public investment, it has pushed governments to stop building infrastructure just when they should have built more. What is needed is not the flexibility to deviate from the rules, but rules that are economically and morally rigorous. The virtue of fiscal discipline is that it protects future generations from the abuses of current politicians… If that country decides to forgo such investment, as Germany is doing today, is it not acting against the interest of future generations?”

Mario Monti, former Prime Minister of Italy

It has been suggested by many that one of the best initiatives to move towards sustainable global growth would be to increase infrastructure spending. In a 2013 report, the McKinsey Global Institute (MGI) estimated that $57 trillion in infrastructure investment will be required to be spent by 2030 just to keep up with projected global GDP growth which is equivalent to an amount nearly 60% more than the $36 trillion spent globally on infrastructure over the past 18 years. Investments in roads, rails, ports, airports, power, water, and telecommunications infrastructure have averaged about 3.8% of global GDP or $2.6 trillion annually and would need to rise to about $3.35 trillion over the same period. MGI estimates that “the $57 trillion required investment is more than the estimated value of today’s worldwide infrastructure.” As we have written about for many years, the United States also has significant infrastructure issues that have been neglected for far too long with an estimated spending requirement of $3.6 trillion by 2020 to maintain the U.S. infrastructure. In its October World Economic Outlook, The International Monetary Fund (IMF) supported a substantial increase in well-designed, public infrastructure investment in much of the world. The IMF report cited that $1 of infrastructure spending increases output by nearly $5, puts many unemployed to work, creates tax revenues and increases productivity. The study suggested that infrastructure investment is especially effective when excess capacity exists so that the spending does not come at the expense of other initiatives.

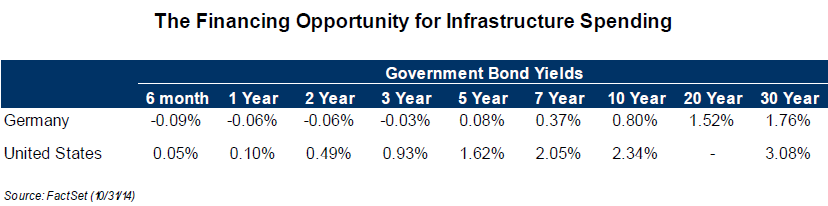

With growth opportunities so large and the cost of capital so low, it is regrettable that governments in partnership with the private sector are not taking advantage of the unique opportunity to reverse these trends. With interest rates at historic lows, the opportunity exists for countries like Germany and the United States to finance infrastructure spending with low-cost debt to foster economic expansion. The IMF report stated that Germany has the budgetary leeway to raise spending on items such as road and bridge maintenance by half a percentage point of its approximately $3.5 trillion GDP per year over 4 years which equates to more than $67 billion. Kurt Bodewig, a former German transportation minister, led a federal commission that recommended Germany must spend $9.7 billion a year more on infrastructure just to maintain its current network, while the budgeted plans were for less than $2 billion. Similar to the United States, about half of Germany’s bridges and one-fifth of its highways are considered to be in poor condition. This type of spending would increase productivity and raise living standards in Germany, while having a positive spillover effect on the slower-growing Eurozone nations.

Lawrence Summers, the former U.S. Treasury Secretary, wrote in a recent article in the Financial Times that, “If we are entering a period of secular stagnation, unemployed resources could be available in much of the industrial world for quite some time. While the case for investment applies almost everywhere – possibly excepting China – … the appropriate strategy for doing more differs around the world.” Emerging economies need more spending, but the key is choosing the right projects that will be productive. The same holds true at home in the United States. New York City is one example of the challenges facing the U.S. as damage caused by Hurricane Sandy to the four century-old rail tunnels will disrupt travel for commuters for at a few years between Manhattan and Long Island. Additionally, the two tunnels under the Hudson River were also damaged and the repairs could reduce capacity by 75% for several years. The total costs of repairs are estimated at $689 million for these projects. Elsewhere China and 20 other nations recently agreed to create an infrastructure development bank to offer financing for infrastructure projects in underdeveloped countries across Asia. China has promised to contribute $50 billion in capital as part of a much larger fund. In 2009 the Asian Development Bank estimated that the region would need $8 trillion in infrastructure investment by 2020. ARS has written extensively about the need for infrastructure spending that is critical to ensuring a more productive society while reducing political and social instability.

Globalization and technology have many implications for the world economy with the primary characteristics of making the world smaller, more interconnected and interdependent. Global trade and capital flows cross borders at far greater speeds than previously experienced. The disequilibrium in foreign exchange rates, oil prices, interest rates and the deflationary pressures are being reflected in greater market volatility. In the short term, market participants are adjusting to these shifts, and the world works in such a fashion that each action causes a reaction in the areas we have identified above. While some had predicted the recent decline in oil prices and interest rates, few had anticipated the rapidity of the decline and reversal of the U.S. 10-year Treasury yield. Moreover the rise of the U.S. dollar versus the euro occurred as a consequence of the European Central Bank working to reduce the Eurozone’s labor costs by devaluing the euro to stimulate its economy. This was accompanied by the view that the Federal Reserve will raise interest rates sooner than later. There have been concerns about the effect of an increase in U.S. interest rates on the global economy because a rise in U.S. interest rates would draw capital to the United States strengthening the dollar further and increasing deflationary pressures on the European economies and other nations. This is a particular fear of the emerging and commodity-producing economies as they are already dealing with the economic impact of China’s slowing growth.

Another example of the disequilibrium relates to Russia which has experienced approximately $75 billion of capital outflows for the first 6 months of 2014 and will need to continue to draw on its currency reserves to fund its government spending and support its currency, the ruble. In order for Russia to preserve its currency reserves, it may be forced to stop supporting its currency which would lead to further devaluation of the ruble and increase inflationary pressures. Moreover in response to the sanctions, the Russian government has reacted by taking an aggressive stance against dozens of Fortune 500 companies. The imposition of sanctions on Russia has slowed trade for Europe and Germany in particular. In response to the sanctions, Russia has negotiated new trade agreements with China to help fill the void.

Against this backdrop, the United States remains the standout economy as evidenced by the strengthening of the U.S. dollar and the record levels of profits of U.S. corporations, but it is not completely insulated from a further decline in global economic activity. It is important to emphasize that the United States remains the best positioned major economy, and a U.S. recession is hard to envision given the industrial activity that is currently occurring and the future spending that is required to accommodate the move towards energy independence. The dollar’s strength can be attributed to the following factors:

In the past three months, the price of Brent has declined from around $110 to around $85, while the price of WTI has declined from around $100 and is currently just above $80. This decline can be attributed to several primary factors including slowing global demand, increasing supply driven primarily by the energy revolution in the U.S. and growing Organization of the Petroleum Exporting Countries (OPEC) member discord. OPEC produces about a third of world oil supplies and historically has acted to stabilize prices during supply disruptions. Recently Saudi Arabia, the world’s leading oil producer, implemented a unilateral price decrease for crude deliveries without consulting other members of OPEC in an effort to maintain market share in the face of increased production from the U.S. Historically, the Saudis would adjust output to keep prices stable, but this present move sent prices lower. From an economic perspective, a handful of OPEC members such as Saudi Arabia and Kuwait can afford lower prices, but many OPEC and non-OPEC producers cannot. The drop in oil prices is particularly worrying for OPEC producers in Latin America and Africa that depend on oil revenues to support their budgets. It also has the effect of extending the long-term value of Saudi Arabia’s reserves while reducing the economic viability of high-cost exploration and production. Two of the biggest beneficiaries of lower oil prices are the U.S. consumer and energy-starved China. An added benefit of the Saudi price decrease is that it gives them an opportunity to grab greater market share of Chinese energy demand as the lower prices discourage the Chinese from pursuing alternative sources to meet their energy needs. While China is reducing its reliance on coal as a primary source of energy, the European sanctions on Russia combined with lower Brent crude prices come at an opportune time as China is taking advantage of the price decline to add to its Strategic Petroleum Reserves and has formalized a long-term energy deal with Russia likely at very favorable terms.

There is another critical issue driving the Saudis to promote a lower price. The United States and Saudi Arabia are in effect waging an economic war on “bad actor” nations. Russia’s Putin, the leadership in Iran and the terrorist group ISIS, each use oil revenues to fund aggressive actions and each requires high prices to fund their budgets and initiatives. It is believed that Russia’s budget for 2014 is based on oil prices of $117 per barrel (oil revenues are approximately 50% of the budget) and its economy is already suffering from the sanctions imposed by Europe and the U.S. Iran’s supreme leader, Ayatollah Ali Khamenei, also relies heavily on oil revenues to fund the economy, and Iran is in talks with the West to have its sanctions reduced as part of nuclear negotiations. So declining oil prices only add to the economic and social problems facing these nations. Geopolitical stresses in the key producing nations in the Middle East and Africa continue to add uncertainty to supplies from these regions as evidenced by the swings in output from Libya, Iran, Iraq and Nigeria. Brazil and Venezuela are also struggling with high-cost projects and political disharmony.

The energy revolution in the United States has been a key factor for oil prices as the country continues to increase its production and reduce its imports of oil. To put this in perspective, U.S. production has grown in recent years by nearly 3.3 million barrels per day which is an increase equivalent to the production output of Iraq, one of the world’s largest producers. It is anticipated that the U.S. will add an additional 1 million barrels of oil next year which must be absorbed by the markets tending to put downward pressure on prices. Absent a major supply disruption, such as an attack on a major production facility in Saudi Arabia or Kuwait or a decision to dramatically cut production by a leading nation or a significant reversal in global growth trends, we anticipate an increased probability of downward pressure on global oil prices.

After several months of below average volatility, the markets are adjusting to the global disequilibrium discussed in this Outlook. From a portfolio perspective, rising deflationary pressures argue for a broadening out of portfolios targeting the drivers and beneficiaries of those pressures. We have harvested some tax losses and raised some cash in accounts in the past month. We have been lightening our weighting in energy holdings while continuing to focus on those companies with strong reserve replacement and high growth projects which are, by the nature of their business characteristics, attractive merger and acquisition candidates. Also technology remains a disruptive and deflationary business as it increases productivity often at the cost of jobs, and as such will remain an overweight in the portfolio as will industrial companies. As corporate profits continue to improve and companies take advantage of low rates to finance debt, investors can expect increasing capital expenditures with technology and industrial companies to be among the primary beneficiaries. The decline in commodity prices brought about by the end of the China-driven commodity boom has shifted the focus from commodity producers to commodity consumers. U.S. industry and the consumer are big beneficiaries of lower interest rates and lower energy prices. Other common themes for businesses are their focus on improving safety, productivity, efficiency and increasing environmental awareness. Our research continues to identify leading businesses that stand to benefit from these trends.

During times of higher volatility, it is important to bear in mind that quality securities can have large price movements that reflect the structure of today’s markets which involve fast money and leveraged speculation as hedge funds with total assets of $2.8 trillion and Exchange Traded Funds (ETFs) are focused on taking advantage of short-term market moves. Great businesses can then become temporarily mispriced distracting investors from the true underlying value of these assets while creating great buying opportunities.

From an economic perspective, we expect the current low growth, low inflation and low interest rate environment to persist for a considerable period of time – perhaps even through the rest of the decade. While the United States will be among the standout economies with growth rates at or above the global average, the Federal Reserve will be hard pressed to raise rates meaningfully unless the U.S. economy becomes much stronger and global growth accelerates. Under these conditions the Federal Reserve will be hesitant to increase interest rates much next year if at all. We see positive dynamics driving corporate profits over the next 12 months.

The U.S. remains the best major economy with many significant drivers which will continue to propel corporate profits and the economy in the later part of this year and next as long as the country remains in a low growth, low interest rate and low inflation environment. Based on current forecasts for the mid-term elections which call for a Republican congress, it is conceivable that positive changes could occur in the areas of trade, some tax reform and regulation. Even with the challenges described in this Outlook, we are positive on the U.S. continuing to demonstrate its economic leadership as it benefits from the most innovative, entrepreneurial society in the world, the most liquid capital markets and positive demographic characteristics. Investing in U.S. equities should continue to be rewarding for those who approach security selection as the purchase of businesses and who take advantage of opportunities presented by today’s volatile markets.

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.