In times of considerable uncertainty, many investors make the mistake of overreacting to short-term conditions and market movements. The growing media attention towards trade wars, political divisiveness and immigration issues have been unsettling for many and serve as a distraction from the positive secular trends in the global economy.

In this issue:

The U.S. economy is in the midst of the second longest expansion in its history which is being supported by massive tax cuts, deficit spending, growing capital expenditures and some deregulation. The global economy is experiencing strains that it has not experienced in recent times making the United States economy the prime destination for capital flows resulting in a stronger U.S. dollar. This in turn is placing further strains on dollar debt held by foreigners as well as the earning power of multinational corporations. The United States’ economic advantage is such that some of Wall Street’s leading strategists are suggesting that the expansion could continue into the second half of 2021 or even beyond. At the start of the year, the world economy was experiencing synchronized growth. This is no longer the case. As trade tensions mount, investors should recognize that the United States will be less affected as it is a net importing nation. Notwithstanding today’s headlines, we remain constructive on a narrowing group of U.S. equities based on our positive outlook for their corporate profits. Those companies that are benefitting from the secular trends we have identified for several years should continue to generate higher earnings and cash flows allowing them to continue to invest to increase their competitive positions. Given the current economic outlook, investors should focus more closely on company-specific earnings and events. We expect the market to reassess company valuations, especially for those highly indebted companies that may need to issue additional debt or equity to finance their businesses.

In times of considerable uncertainty, many investors make the mistake of overreacting to short-term conditions and market movements. The growing media attention towards trade wars, political divisiveness and immigration issues have been unsettling for many and serve as a distraction from the positive secular trends driving the global economy. Since the market has not had a significant pullback in some time, it is always possible for the markets to experience one. When and if such a pullback occurs, we will use cash to add to our favorite names. The secular trends favoring technology, defense and health care companies remain intact and smaller capitalization companies should be attractive given their more domestically-oriented businesses. We continue to believe that many positive factors for U.S. corporations and U.S. economy continue to be underestimated.

In this Outlook, we discuss the three main challenges for the global economy, share some insights from some of the leading executives of various industries, address client concerns about inflation, and discuss the investment implications of the adjustments occurring in the global economy.

“The People’s Republic of China (China) has experienced rapid economic growth to become the world’s second largest economy while modernizing its industrial base and moving up the global value chain. However, much of the growth has been achieved in significant part through aggressive acts, policies, and practices that fall outside of global norms and rules (collectively, “economic aggression”). Given the size of China’s economy and the extent of its market-distorting policies, China’s economic aggression now threatens not only the U.S. economy, but also the global economy as a whole.”

Excerpt from the White House Office of Trade and Manufacturing Policy Report, June 2018 on China policies

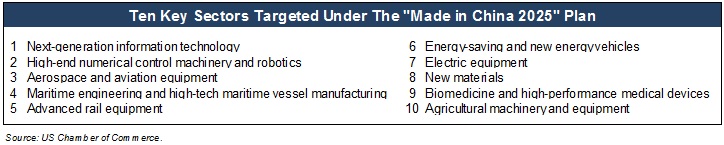

In our April Outlook, we wrote that President Trump was sending a strong message to the world that the U.S. was no longer willing to accept unfair trade practices from any nation. President Trump is following through on his campaign pledge to address unfair trade practices, particularly those of China, which have taken place in a global system to which the World Trade Organization, past U.S. Presidents and other nations have turned a blind eye for decades. In order to change current practices, our trading partners need to be convinced that the U.S. will go all the way in terms of enforcing fair trade. Therefore, suffice it to say that we have now entered into a trade war. The critical underlying issue regarding trade is the battle for future technology supremacy between the United States and China due to economic and security considerations. The concern of the United States is not about competing on the basis of legitimate competitive practices, but rather on China’s use of stolen intellectual property. President Trump’s comments have been directed at China’s “Made in China 2025” plan whereby the Chinese government is supporting what it deems to be strategically vital and important industries in ways that are considered outside of globally accepted practices. The chart on the top of the next page highlights the key sectors being targeted by China according to the US Chamber of Commerce. As we have written for years, data is the new global currency and those that own the intellectual property will have a significant competitive advantage.

As a net importing nation, the U.S. should be hurt less by a trade war than other nations, but there is great uncertainty about the impact of tariffs on global growth. Consumers should expect higher prices on certain goods as many companies will not be able to absorb the costs of tariffs. After a period of strong earnings growth of the S&P 500 companies, we anticipate many companies will be lowering earnings expectations until they have clarity on the impact of changes on their costs and revenues. A trade war at this stage of the global expansion will have repercussions for global growth with Europe and a number of emerging market economies likely being the hardest hit. If this ultimately results in fairer trade and better global security, then everybody wins.

The U.S. tax cuts and higher deficit spending initiatives are requiring the U.S. Treasury to substantially increase the issuance of Treasury securities. Concurrently, the Federal Reserve is attempting to normalize interest rates and reduce its balance sheet. The combination of the clash of the expansion of the federal debt and the contraction of the Federal Reserve’s balance sheet has led to a shortage of U.S. dollar funding which impacts sovereign debt markets and has created a reversal of capital flows. This in turn has reduced the value of emerging market bonds and currencies, and accordingly raised the cost of global commodities traded in dollars. The United States is the world’s largest economy at $19.97 trillion and largest debtor nation at $21.04 trillion with fiscal deficits to be $828 billion estimated for 2018. The U.S. has been running annual trade deficits ranging from $395 billion to $723 billion or roughly 3% of GDP. That our trade deficits are high is well known, but the fact that the trade and fiscal deficits cause the United States to be overly dependent on foreigners to finance fiscal deficits perhaps is not as well understood. The efforts to eliminate unfair trade practices would help reduce our dependence on China and other nations to purchase our Treasuries. While this would have limited impact in the short term, the longer-term benefits would be tangible.

We are monitoring the pace of the rise in U.S. interest rates relative to those of other countries to anticipate future adjustments in currencies and capital flows as well as any debt problems that might arise. We are keeping a close eye on policy changes around the globe to assess their impacts as well. For example, China is in the process of adjusting its monetary and fiscal policies to address its growing debt problems, manage capital flows and its exchange rate, in part to respond to trade issues, and is also considering a proposal to lower taxes to stimulate domestic consumption. Reuters recently reported that the European Central Bank is considering its own version of “operation twist” whereby the ECB will be buying more long-dated bonds next year to keep Eurozone borrowing costs in check even after it stops pumping fresh money into the economy.

So even though it has been 10 years since the debt-induced financial crisis, governments still need to keep borrowing costs down because the recovery needs more time. Perhaps the biggest takeaway regarding interest rates is that investors should expect central banks to feel the need to keep interest rates historically low well into the future. As the economic expansion has progressed, it has not shown itself to be strong enough to withstand higher rates based on the debt burdens facing the global system. Importantly, central banks lack the firepower to respond to the next recession with the traditional tool of significant interest rate cuts. We anticipate this will force bankers to extend the low-interest-rate cycle even beyond current expectations, while on the margin trying to push short rates somewhat higher.

“This is an important time in the history of China and the United States as we work our relationship forward … The China-U.S. relationship is one of the most important in the world, [and] must be treasured.”

U.S. Secretary of Defense James Mattis at a 6/26 meeting with President Xi

Three fundamental geopolitical changes we are monitoring are the rise of populism and autocratic regimes in the developed world, the massive migration problem, and the apparent reduction of the United States’ role as the global leader. The United States’ withdrawal from its global leadership role is giving China an opportunity to step up and exert greater influence from an economic and military perspective. At the same time, China’s rise is being augmented by the United States challenging traditional alliances, trading relationships and many of the international institutions that have been in place for over 70 years. China is planning to invest an estimated $1.5 trillion in 80 countries as part of its “One Belt, One Road” initiative that it is using strategically to expand its sphere of influence although the original commitments may be tempered due to concerns about overreach and risks associated with the financing of these initiatives. The geopolitical situation is resulting in an increase in military spending.

The implications of the shifting alliances and anti-immigration sentiment have important ramifications for the future of the European Union and the economic expansion in Europe both of which are quite fragile right now. On the need for European reform, Angela Merkel, Chancellor of Germany, summed up the European challenge with her statement, “if we stand still, we will be pulverized.” On June 28th, European leaders agreed to the framework for an important agreement regarding the migration crisis that has plagued incumbent political parties throughout Europe and threatened to topple Angela Merkel’s coalition government. Given that the deal was put together in an overnight session, many details need to be worked out or this issue will remain politically divisive. Europe still needs to pull together to address the structural issues of the original design of the EU as its governing institutions did not foresee many of today’s key issues. The lack of a common vision is undermining efforts from leaders like France’s Macron to not only increase competitiveness, but to create a compelling and sustainable future for the upcoming generation. Importantly, the majority of people in Europe want to remain in the European Union and we do not anticipate a break up, but the status quo is not sustainable.

We wanted to share some insights from political, business and industry thought leaders to understand their views on the economy, and the secular drivers of growth. The unique perspectives that these leaders bring to the table is invaluable to understand where the world is headed as political and corporate leaders are making decisions for future growth.

On the Economy

Jamie Dimon, CEO of JPMorgan Chase discussing the length of the economic expansion

“I would look at it a little bit more like we’re probably in the sixth inning or something like that … Bad tax policy, bad regulatory policy, bad policies some of which are being fixed and stuff like that. So I think it’s very possible you’re going to see stronger growth in the United States of America and that is picking up a little bit. You see capital expenditures going up a little bit. Consumer and business confidence are close to all-time highs. There are no potholes. I’ve heard [some people] say, well, it’s looking like 2007, completely untrue. There’s much less leverage in the system. The banks are much better capitalized. I can go on and on about the safer system. So, yeah, I think it can easily continue.”

On Trade

U.S.-China Economic and Security Review Commission, 2017 Annual Report, 11/15/17

“The Chinese government is implementing a comprehensive, long-term industrial strategy to ensure its global dominance … Beijing’s ultimate goal is for domestic companies to replace foreign companies as designers and manufacturers of key technology and products first at home, then abroad.”

Brian Coulton, chief economist at Fitch

“A major global tariff shock would have adverse supply side impacts, raising costs for importers and disrupting supply-chains, while reducing consumers’ real wages. The global multiplier effect of lower U.S. imports could be significant. U.S. outward foreign direct investment — the largest source of FDI (foreign direct investment) globally — would probably fall. Along with weaker confidence and lower investment, a global tariff shock would also hit job creation.”

On Technology

George Schultz, a former Secretary of the Treasury, in an Op-Ed in the Wall Street Journal on 6/27/18 on politics and technology

“The world is experiencing change of unprecedented velocity and scope. Governments everywhere must develop strategies to deal with this emerging new world. They should start by studying the forces of technology and demography that are creating it.”

Sanjay Mehrota, President, CEO & Director, Micron Technology from 5/21/18 earnings transcript on the growth of the cloud, data and storage business, and why this technology cycle is different

“One point I would like to make sure that I get across to you is that the cloud, the data center and the intelligent devices on the edge are really forming a virtuous cycle. The intelligent devices rely on more data to provide useful experience but they also create more data that gets stored in the cloud, which makes the cloud bigger, more pools of data created and stored on the cloud and processed in the cloud, that enables cloud to provide even greater value to the edge devices. It unleashes even more innovation and creation of new intelligent devices, more powerful intelligent devices, which then, in turn, guess what, create more data. And so, this is a virtuous cycle between cloud and billions of edge devices really leveraging this data economy to bring great value to the consumers as well as businesses across the globe, and at the heart of this is memory and storage industry and DRAM and flash.”

On Defense

Eric DeMarco, President, Chief Executive Officer & Director, Kratos Defense & Security Solutions, Inc.

“We are seeing significant demand for Kratos‘ target drones in the United States and also globally as a recapitalization of strategic weapon systems to address nation-state adversaries underway. With not only the United States DoD, but every NATO ally increasing its defense spending this year with 15 NATO countries increasing their defense budgets as a percent of their GDP. These strategic systems being deployed need to be exercised against the highest performance and most realistic threat surrogates of the world, which are Kratos‘ targets, and where Kratos is the undisputed an industry leader.”

Clients have been expressing concerns about rising inflation. While we acknowledge the near-term inflationary pressures from rising oil prices and tariffs, we believe that longer-term inflation remains constrained by the highly deflationary secular forces of technology, globalization, demographics and debt present in the system. While conditions are right for a modest increase in inflation rates, we do not feel that these concerns are warranted. In fact, the Dallas and Atlanta Federal Reserve Banks held a meeting in May to address this topic and the views are summarized in the quote below from the Dallas Fed. We are focused on the rate of change and will make necessary portfolio adjustments accordingly if inflation rates diverge from our expectations.

“Technology-enabled disruption means workers are increasingly being replaced by technology. It also means that existing business models are being supplanted by new models, often technology-enabled, for more efficiently selling or distributing goods and services. In addition, consumers are increasingly able to use technology to shop for goods and services at lower prices with greater convenience—having the impact of reducing the pricing power of businesses which has, in turn, caused them to further intensify their focus on creating greater operational efficiencies. These trends appear to be accelerating… To deal with disruptive changes and lack of pricing power, many companies are seeking to achieve greater scale economies in order to maintain or improve profit margins. This may help explain the record level of merger and acquisition activity globally over the past few years.”

In our last Outlook, we advised readers that the two quarters preceding mid-term elections have historically proven to be challenging for the markets. The changes in monetary policy, global politics and trade are creating challenging conditions for stock and bond investors. As tempting as it is for investors to be distracted by short-term considerations, we would strongly encourage investors to focus on the secular forces to drive investment decisions. We cannot overemphasize the need to take advantage of the opportunities presented by market pullbacks. The United States should continue to attract capital from the rest of the world which should strengthen the U.S. dollar and constrain interest rate increases. The economic expansion could continue for a few more years and create an opportunity for companies to see even stronger earnings. Central banks will likely conclude that while normalizing policy is a desirable goal, it is secondary to extending the economic cycle for as long as practical in order to delay the next recession for which they do not currently have the tools to effectively address. This means that global interest rates should remain lower for longer than most anticipate. U.S. companies, should continue to enjoy the benefits of massive tax cuts, deficit spending, growing capital expenditures, and some deregulation. However, fewer companies will benefit in the current environment as some could experience supply chain disruptions and higher input costs from tariffs which they may not be able to pass on to consumers. Additionally, the stronger U.S. dollar will reduce earnings for some multi-national companies. As the beneficiaries continue to narrow, the market should react to support the winners at the expense of the rest of the broader market which is highly supportive of active management. Those that benefit from the conditions highlighted above should be well rewarded.

Share prices of some of the leading companies came under pressure in June as profit taking as well as concerns about a trade war had investors selling winners to lock in profits. However, we believe that capital will again flow to companies with above average growth characteristics, strong balance sheets, and high free cash flow to drive investments in future growth. In addition to being big beneficiaries of tax reform and deregulation, small capitalization companies whose earnings are better insulated from tariffs and currency fluctuations offer investors attractive opportunities. We continue to prefer to invest in the areas that are attracting increased capital spending, and those include disruptive technology, defense, healthcare and financial companies. We also favor energy companies in the exploration and production area that have demonstrated greater financial discipline and have become more attuned to purchasing reserves at a discount to market value by using their free cash flows to buy back shares, while benefiting from higher prices. As a result, we have increased our energy exposure this year. We continue to remain cautious on fixed income investments given the risk/reward dynamics and would suggest that investors consider reducing their allocations and shortening their maturities to reduce the risk of capital losses. We recognize that important shifts in the global economy are occurring, and therefore it is a time to be more selective and opportunistic in portfolio construction and asset allocation.

Published by the ARS Investment Policy Committee:

Brian Barry, Stephen Burke, Sean Lawless, Jared Levin, Michael Schaenen, Andrew Schmeidler, Arnold Schmeidler, P. Ross Taylor.

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.