In this issue:

The past few years have seen a significant shift in the trajectories of the major global economies. After coordinated efforts to reflate the global economy following the 2008 crisis, the cumulative effects of monetary and fiscal policy have put the US at the forefront of a successful emergence from the financial crisis relative to Europe and Japan. At the same time, China and the commodity-driven economies are struggling to rebalance their economies while maintaining acceptable growth rates. The US is undergoing a robust recovery in the housing, automotive and industrial sectors, making it an attractive market in which to invest. Among the key factors driving US industry is the energy sector’s ability to dramatically reverse decades of production declines which is resulting in lower energy prices and giving domestic manufacturers a significant production cost advantage. US corporate profits are also benefitting from lower capital costs and limited labor inflation, which are the same factors that are allowing the Federal Reserve to maintain its near-zero interest rate policy and creating the conditions for a potentially extended business cycle. The current combination of benign inflation, low interest rates and rising corporate profits is conducive to valuation multiple expansion and is favorable for equity investing.

The divergences in global monetary and fiscal policies in recent years have impacted the respective recovery rates of the major economies, and in turn, the relative prices of currencies, equities and fixed income securities. Although we continue to believe that interest rates will remain below historical norms for several years, it is notable that the Federal Reserve is now in the position to discuss the tapering of monetary stimulus as a result of a still fragile but improving economy. In contrast, Europe continues to require a highly accommodative monetary policy to reduce unemployment, deficits and debt loads. Japan recently implemented aggressive monetary and fiscal policies designed to reverse its decades-old deflationary economy. China, now the world’s second largest economy, is attempting to stabilize growth at or above 7% while introducing much needed reforms, de-emphasizing fixed asset investment and rebalancing its economy between investment spending and consumption.

Despite a recovery that has been slower than those experienced in past cycles, the US is better positioned relative to other major economies with which it competes for capital. Besides having the world’s largest economy, the US has many distinguishing characteristics, including the world’s most advanced and deepest capital market system, the most entrepreneurial and adaptive society, positive demographic trends, a good resource base (food, energy and water), a well-established legal system with respect for contract law and, for all its challenges, one of the most stable political systems. Additionally, and somewhat counter-intuitively, the US is also a beneficiary of many of the challenges currently confronting other economies. In the US, consumer spending accounts for over 70% of GDP, whereas exports account for less than 15%. Therefore, the US benefits disproportionately from having a stronger currency that increases the purchasing power of consumers. The relatively stronger recovery of the US economy has helped to strengthen the US dollar. A stronger dollar combined with slower growth in infrastructure spending in China is helping to suppress the price of commodities, which represent the most volatile component of inflation. Lower commodity inflation in turn is helping consumers and allowing the Federal Reserve to maintain an easy monetary policy. Historically, divergences such as the one we are seeing today between the US and other major global economies have created some of the best investment opportunities for active investors.

In the period following the 2008 financial crisis, fears of a global depression caused governments and central banks around the world to develop a coordinated response. The result was arguably the most extensive policy response in history with over 600 monetary and fiscal stimulus programs implemented. Central banks created trillions of dollars in new currency and liquidity and these efforts were further supported by aggressive fiscal stimulus programs. Five years later, the global economy is in a very different place and governments are even more focused on protecting their respective self-interests. The following provides a brief perspective on the impact of the policy actions taken by the US, Europe, China and Japan in response to the unique situation in each economy.

The United States

“The economic recovery has continued at a moderate pace in recent quarters, despite the strong headwinds created by federal fiscal policy. Housing has contributed to recent gains in economic activity. Conditions in the labor market are improving gradually. CPI has been running below the Committee’s longer-run expectations.”

– Federal Reserve Chairman Ben Bernanke, 7/17/13

In recent decades, increasing credit levels helped to fuel spending and support economic growth. Going forward, the US will likely experience a more muted growth rate as a consequence of little or no wage growth for most workers, structurally high unemployment and private and public-sector deleveraging. Due to the fragility of the economic recovery, some Federal Reserve officials worry that a premature withdrawal of stimulus from the system could be more damaging than an extended easy-money policy. Because the US faces considerable structural headwinds which will prevent the economy from easily returning to its former growth rates (3-4%), ARS continues to believe that interest rates will likely remain historically low for a considerable period of time.

Even with the challenges described above, the US is further along in its recovery than much of the developed world. Reflecting this divergence, the Federal Reserve has discussed beginning to taper its bond purchases over time while other central banks continue to see the need for aggressive stimulus. Consequently, capital is flowing into US dollars which is helping to strengthen the dollar relative to other currencies. The recovering economy is also lifting tax receipts and lowering the budget deficit, which is further supporting the dollar. These trends are self-reinforcing, as a stronger dollar in turn benefits the US consumer-driven economy. The highly accommodative monetary policies in other markets combined with the resilience of the US economy, low inflation and improving economic conditions should continue to attract capital in the coming quarters.

Europe

“The euro area still faces considerable challenges. The economy is still weak. The Governing Council stressed that the monetary policy stance will remain accommodative for as long as needed.”

– ECB President Mario Draghi, 7/8/13

“As long as inflation remains subdued, [our] forecast for low interest rates will remain in place; this was unanimous; all interest rates are part of the statement; liquidity will remain abundant and stay ample as long as needed.”

– ECB President Mario Draghi, 8/1/13

Since taking over as ECB President in 2011, Mario Draghi has introduced monetary policies similar to those previously initiated by the Federal Reserve in an attempt to stimulate the European economy and offset the aggressive austerity initiatives that were being implemented by several European nations. The Federal Reserve began its easing program nearly 2.5 years earlier, which explains in part why the US is ahead in its recovery. It was only 12 months ago that Mr. Draghi issued his now famous “whatever it takes” statement to support the Euro and reduce fears of a break up. While some progress has been made by European nations to spur a recovery, political and structural challenges remain and several more years will be required to sufficiently reduce debt, lower unemployment and restructure individual economies. Unfortunately for Europe, the relative attractiveness of the US economy is drawing capital to the US markets. This is a form of monetary tightening on those nations experiencing capital outflows. So it was not a surprise to hear Mario Draghi indicate that he was going to maintain a low interest rate environment for the indeterminate future to make the European economies stronger and to relieve pressure on the over-indebted southern-tier economies as Europe continues to play catch-up to the US.

Despite ongoing challenges, there is some evidence of a nascent recovery in the European economy, such as the recently improved purchasing managers index (PMI) readings that suggested a shift from contraction to expansion. This may present an opportunity for select European-related investments as well as for US companies with significant exposure to Europe, although we will need to monitor closely for signs that improvement will be sustainable.

China

“China is in a phase when it must rely on economic transformation and upgrading to maintain continuous and healthy development. Through stabilizing growth, we can create room and conditions for restructuring and advanced reform.” – Premier Li Keqiang, 7/9/13

Since 1990, China’s GDP has grown from $390 billion to $8.2 trillion reflecting one of the great industrializations in history as over 300 million people migrated from farms to cities. However, a disproportionate amount of China’s GDP growth has come from government-led infrastructure outlays driving investment spending to nearly 50% of GDP—an unprecedented level for a major economy. China’s government-led expansion fueled a major boom in commodity prices, and as China became the price-setter for commodities, it exported inflation to the global economy. China’s rapid growth also brought challenges in the form of income inequality, corruption, environmental degradation and impairment of basic social needs. The government now faces the difficult challenge of transitioning the economy from one which relied on exports and government spending, often debt-driven, to a more consumption-oriented one. According to Premier Li Kegiang, China will focus on GDP, jobs and inflation. It is taking some small-scale steps to stimulate and stabilize its economy including pumping $2.5 billion of cash into its banking system and announcing a review of the risks of local government debt. Some of the top priorities for the government are preventing social unrest and fostering sufficient employment during this transition.

As part of the government’s 5-year plan, it mandated significant multi-year wage increases for workers, but as a consequence is reducing its low-cost competitive labor advantage versus other nations. China’s environmental issues are increasingly at the forefront of both media headlines and leaders’ concerns, and the resulting regulation is leveling the playing field for developed-market companies that compete with Chinese manufacturers. In short, China is willing to tolerate slower growth to achieve a more balanced set of policy goals. If China’s growth can stabilize near its current target of 7%, it will still be a material contributor to global growth. At China’s current size, 7% growth in dollar terms (estimated in excess of $500 billion) would contribute significantly more than a decade ago when China was growing in the double digits but from a smaller base. Moving forward, the beneficiaries of China’s GDP growth will be quite different from those of the past decade.

Japan

“Japan faces structural issues – firstly, to extricate itself from deflation; secondly, to improve labor productivity; and thirdly, to maintain fiscal discipline. These threefold structural issues must be resolved simultaneously, and growth is a necessary condition for success.”

Reflecting on the challenges and recovery progress of the important global economies highlights the relative strength of the US today. This is leading to a return of the US as arguably the most attractive opportunity for equity investment—a condition that we believe has the potential to sustain itself for a significant period of time.

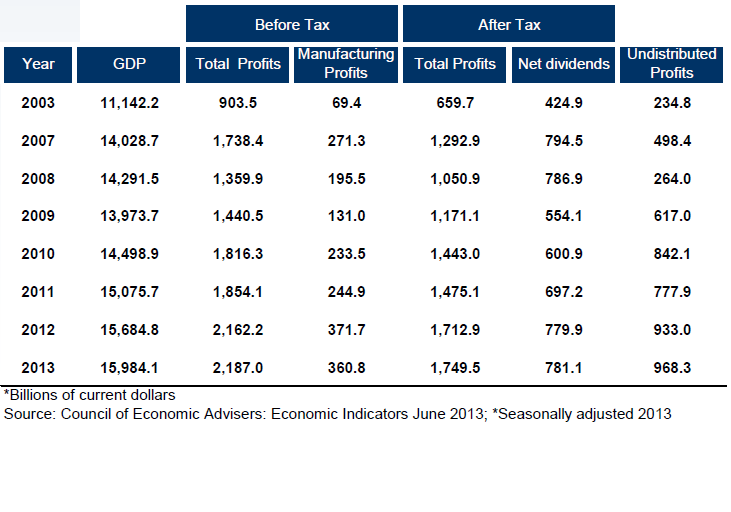

We expect that US corporate profits will continue to increase over the next several years. As highlighted in the chart below, US corporate pre-tax profits have risen from $903.5 billion in 2003 to $1.36 trillion in 2008 to almost $2.2 trillion today. In past Outlooks, we have discussed the manufacturing renaissance that is taking place as evidenced by manufacturing pre-tax profits having grown from $131 billion in 2009 to $360.8 billion as of the first quarter of 2013. With interest rates remaining at low levels US corporations have also been able to refinance debt at cheaper costs allowing managers to repurchase stock, reinvest in their businesses and drop remaining savings to the bottom line. Although profit growth slowed in the second quarter, we expect that a gradual and non-inflationary expansion of the US economy combined with recoveries in other major markets will be supportive of profit growth over the intermediate term. Importantly, low interest rates are making equities more attractive relative to fixed income, and so long as inflation remains contained, a persistent low-rate environment should be favorable for equity valuation multiples.

In our April Outlook, ARS discussed in detail the energy boom and its impact on the US economy. We note the recent passing of George Mitchell, who was a pioneer in US natural gas fracking, exploration and development. Mr. Mitchell, the founder of Mitchell Energy (later sold to Devon Energy), was an important voice for sensible and environmentally responsible growth of US energy resources. It was through the efforts of entrepreneurs such as George Mitchell combined with the increasing use of new fracking technologies that have allowed the US to reverse nearly four decades of energy production declines. According to the NY Times, “fracking and other unconventional techniques have doubled North American natural gas reserves to three quadrillion cubic feet … These same techniques have been applied to oil and a well that would have produced 70 barrels a day using conventional drilling can produce 700 with fracking.”

Investors should not dismiss the intermediate and long-term impact of the energy revolution on the US economy. In 2008, the US produced about 5 million barrels of oil per day but thanks to new technology, production has increased 50% to 7.5 million barrels per day, growing by 1 million barrels per day in just this past year. This means that the US will be importing a million fewer barrels per day this year than last, reducing import costs by approximately $35 billion dollars and allowing those dollars to be repurposed toward more productive uses. As oil and gas production has increased, the US industry has embarked on a massive, multi-year investment program to move oil and gas from where it is now being produced to where it is needed and the US reserve base has risen dramatically.

Because the US has become a low-cost energy producer, the country has a decided advantage in manufacturing for those businesses that have a high energy cost component. The consequence is that US manufacturing is expanding. By way of example, over the past few years more than $100 billion in new plant investments have been announced in the US chemical industry alone.

One of the defining characteristics of the lost decade in US equities was the industrialization of the developing economies and rapid pace of globalization which drove capital out of US stocks and into emerging markets. It was the ability to recognize this shift that allowed some investors to outperform the US stock market from 2000-2010. As described above, China is experiencing difficulties after this period of rapid growth, and the pendulum has swung back in favor of the US. This transition is further enabled by the end of the commodity boom this past year as the US now imports less inflation. We have been asked how US companies will perform when China is slowing and Europe is struggling. Our view is that the US economy is more than 70% consumer-driven and in many ways is benefitting from the lower inflation caused by current conditions in those economies. Further, many US companies, especially small and mid-capitalization businesses that tend to rely more on domestic consumption than global sales, stand to be important beneficiaries. In the context of a slowly improving economy, fixed income is less attractive relative to equities on a risk/reward basis. Fixed income investor sentiment turned decidedly negative in June as evidenced by the $76.5 billion outflow from bond funds during that month.

The combination of factors described above leads us to a positive view of the opportunity for investors to benefit by investing in US equities which offer growth, rising dividend income or both. As we head into the second half of the year, it is possible that we will see renewed focus on the significant political dysfunction in Washington; however, we expect any short-term disruption to be viewed as an additional opportunity for capital sitting in cash to be invested into equities. We believe long-term investors should be well rewarded by owning companies benefitting from this outlook.

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.