In this issue:

“Both optimists and pessimists contribute to society. The optimist invents the aeroplane, the pessimist the parachute.” -George Bernard Shaw

The U.S equity markets reached new highs driven by advances in technology, particularly in artificial intelligence and robotics which will revolutionize industries and drive significant economic growth. In a world of instability, the United States’ economy presents dynamic and promising opportunities for investors because this is a U.S. business cycle like no other. Therefore, investors should be more optimistic about the long-term prospects for the U.S. economy, the equity markets, and the specific business opportunities that have emerged. The current interest rate environment suggests a transition from a market driven by price/earnings multiple expansion to one that will be defined throughout the rest of the decade by strong earnings growth for a subset of the market. The prime beneficiaries should be businesses whose earnings are poised to grow because of their involvement in technological breakthroughs, reindustrialization, and electrification.

Dr. Ed Yardeni recently joined Arnold Schmeidler as a guest on our December webinar (A Special Year-End Call with Dr. Ed Yardeni and Arnold Schmeidler) and shared his base case for another strong year for U.S. equities, despite the risks present in the system. Dr. Yardeni forecasts double-digit returns for the S&P 500 both this year and next. After more than a decade of massive monetary and fiscal policy support for the global economy, the markets will rely more on earnings growth to differentiate returns as we do not expect the Federal Reserve to lower interest rates to the degree that the markets expect. In this Outlook, ARS makes the case for a continuation of U.S. exceptionalism, addresses the risks present in the system, and defines the investment opportunities for 2025.

In a messy world, the United States stands out as it possesses inherent strengths that position it for continued growth and prosperity. Corporate and government capital spending on the electrical grid, reshoring manufacturing, artificial intelligence, the rebuild from climate damage, and national security are creating significant increases in corporate earnings, cash flow growth, dividends and dividend increases, share buybacks, and merger and acquisition activity for the foreseeable future. The confluence of these factors will have a dynamic impact on the U.S. economic system for years to come and the combination of these factors does not exist in any other economy which only reinforces the reserve status of the U.S. dollar.

The U.S. economy will be driven by four primary forces: continued technological advancements, ongoing infrastructure investment, productivity growth, and continued spending from governments, corporations, and consumers. We expect increased capital spending on technology across various sectors indicating a strong commitment to innovation, productivity, and future growth. Furthermore, a renewed focus on infrastructure investment is catalyzing economic activity. Increased government spending on infrastructure projects is creating a ripple effect throughout the U.S. Reshoring manufacturing activities back to the United States is generating demand across various sectors, from raw materials (including steel, copper, and rare earths) and industrial equipment to energy production. This resurgence of domestic manufacturing is changing the terms of global trade while revitalizing key industries and creating new employment opportunities.

Innovation and Technology Capital Expenditures

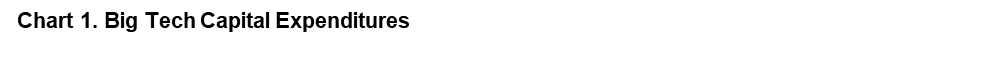

According to Axios, the big tech companies increased capital spending by more than 56% in the first three quarters of 2024 versus the prior year, and more companies will be increasing spending this year to compete in a changing world. In the fiscal year ending June 2024, Microsoft spent more than $50 billion on capex with the majority related to data center construction, fueled by demand for artificial intelligence services. This year, Microsoft plans to spend over $80 billion building out data centers with more than half of that spend in the U.S. Much of this spending is focused on cutting edge technologies whose full effects have yet to be felt.

Beyond the largest tech companies, businesses are expected to invest more in software to implement artificial intelligence more efficiently, boosting worker productivity. As robotics and AI agents become more accessible, companies will adopt them to help address ongoing challenges with labor skills and workforce availability.

Infrastructure Investment

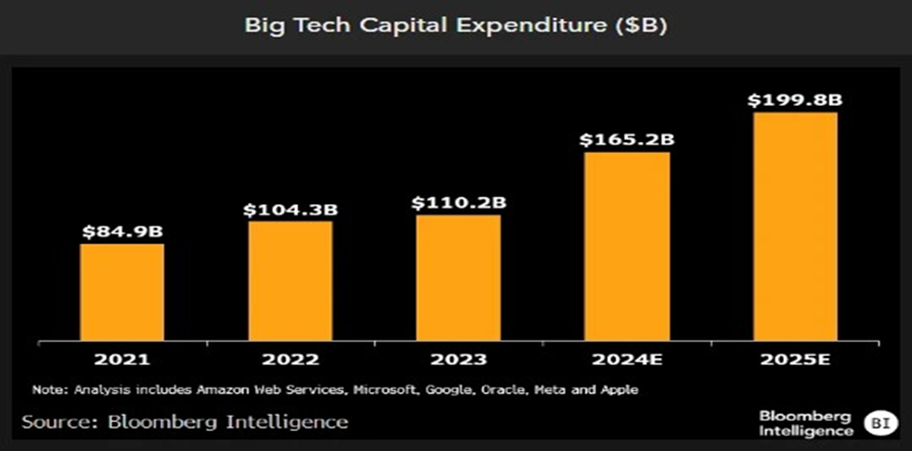

In 2021 and 2022, after decades of neglect, Congress passed the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA), finally providing much needed funding for a system that has been underinvested for more than 20 years. In its 2021 report, the American Society of Civil Engineers projected that the United States would meet between 50-60% of its spending needs while still having a shortfall of $2.9-3.4 trillion. Chart 2 highlights the gap for five critical areas including energy, transportation, aviation, and water. Even with the new spending, the United States infrastructure still faces a shortfall as artificial intelligence is challenging the world’s ability to meet its power demands. The rebuild from climate damage will also require significant investments at all levels of government. At the same time, conflict zones such as Syria, Gaza and Ukraine will need to be rebuilt following the massive damage inflicted in recent years.

Here at home, Los Angeles is currently battling historic wildfires while the Southeast region needs to rebuild from the devastating effects from the hurricane season. The rebuild from these natural and man-made disasters will require significant investment dollars and will further increase demand for critical materials.

Productivity Growth

Productivity growth remains a crucial driver of economic success especially considering the demographic and labor force challenges facing many leading nations. Innovation has the potential to significantly enhance productivity across various sectors leading to positive outcomes such as lower inflation, higher wages, and improved living standards. By streamlining processes and automating tasks, technology can empower businesses to produce more with fewer resources boosting economic output. It is also one of the keys to addressing structural demographic issues as well as labor force availability and work skills issues. As shown in Chart 3 below, U.S. labor productivity was challenged in recent years but is now starting to show signs of improving.

While the outlook is generally positive, it is critical to acknowledge the many potential problems ahead for investors. Aside from the obvious geopolitical issues of expanding conflicts, there are other key risks that need to be considered.

The Trump Factor

The incoming administration’s unconventional approach to governing presents its own unique set of challenges for investors as the post-election period has demonstrated with the December drama around the continuing resolution to fund the government. Below are just a few of the questions on investors’ minds.

– When it comes to tariffs, what distinguishes actual policy from a negotiating tactic?

– What will tariffs mean for inflation and trade this year?

– What is China’s response to the policies of the new administration as it has had four years to prepare?

– What is the impact on relations with allies regarding trade and national security?

– What will happen with immigration policy and what will mass deportations mean for the labor force?

– What level of deficit will be acceptable to Congress and the markets?

– Will DOGE (Department of Government Efficiency) be able to identify meaningful savings to reduce the deficit?

Inflation and Rates

The global fight against inflation is far from over, with two key implications for investors. First, the Federal Reserve will likely be slower to cut the federal funds rate, meaning interest rates could remain higher for longer than many investors would prefer. Second, investors should prioritize companies with strong earnings growth rather than relying on the price/earnings multiple expansion supported by the Fed’s lower rates over the past 15 years.

While President Trump favors low interest rates and a strong stock market, bond market concerns about rising deficits could limit the Fed’s ability to continue easing monetary policy (keeping interest rates low). Some worry that the Fed may even need to raise the federal funds rate—either because the economy is performing too strongly or because buyers of U.S. Treasuries demand higher yields to compensate for the risks posed by record deficits. This could prompt pushback from conservative Republican members of Congress concerned about debt and deficits, potentially complicating parts of Trump’s agenda, especially given the slim Republican majorities in the House and Senate.

Markets

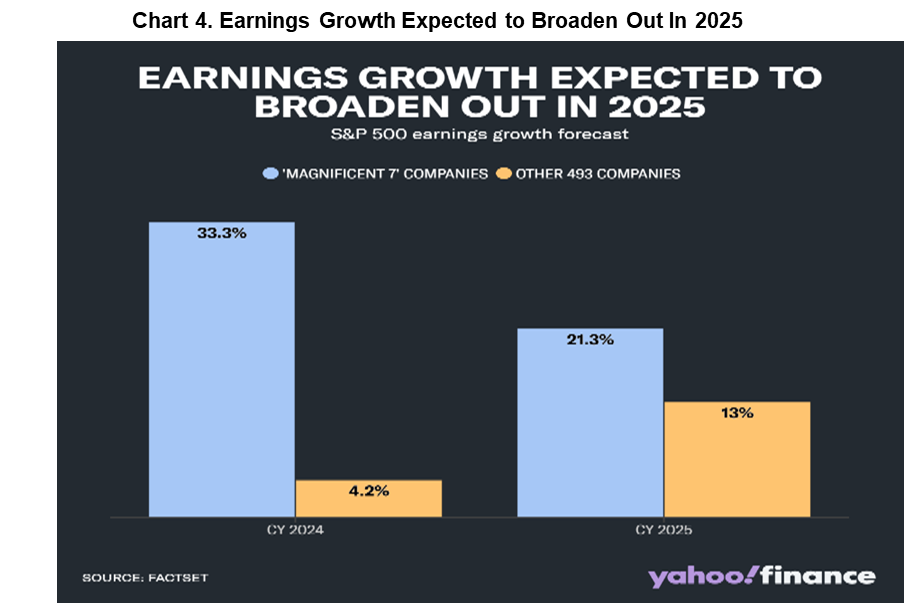

In recent years, the market has heavily favored a narrow group of companies, specifically the leading tech giants collectively known as the Magnificent 7. As illustrated in Chart 4, this group has experienced significantly higher growth compared to the rest of the market. However, projections for 2025 suggest that the remaining 493 companies will achieve growth rates three times higher than what they had been, indicating a potential broadening of investment opportunities.

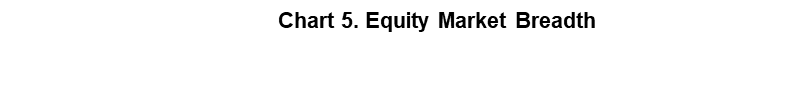

The importance of the second derivative—accelerating or decelerating earnings growth rates—comes into play here. If the broader market’s earnings growth exceeds expectations, it could lead to multiple expansion and higher stock prices for these companies, reinforcing the narrative of broadening opportunities. Conversely, if the Magnificent 7 fail to sustain their elevated growth rates or fail to deliver returns on AI spending, their valuations could compress, leading to declining stock prices. Similarly, if the remaining 493 companies fail to meet growth expectations, stock prices could deteriorate, especially in the face of tighter financial conditions. There has been a great deal of discussion about a broadening out of the S&P 500 from the Magnificent 7 to those remaining 493, but the degree of broadenings will be directly impacted by the level of interest rates as seen in chart 5.

From an investment perspective, the United States economy and equity markets offer compelling opportunities. Given the absolute and relative strength of the U.S. economy and the attractive investment opportunities within the domestic market, overweighting U.S. equities should be considered. As is typical in times of heightened disruption, the inherent strengths of the U.S. come to the fore – its robust enterprising spirit fosters innovation and drives economic dynamism. Furthermore, the leading U.S. corporations should benefit from deregulation, while baby boomers are spending, donating, or passing to their heirs a portion of an estimated $80 trillion of the $175 trillion U.S. household net worth. Our financial system is the world’s deepest and most mature, providing a solid foundation for sustained economic growth, and the U.S. dollar remains the world’s reserve currency. Investors should prioritize the companies positioned to benefit from key trends, including infrastructure development, reshoring, and technology advancements. This may include sectors such as industrials, including defense and electrification companies, energy, technology and select financial and healthcare companies. While China and Europe remain home to some of the world’s best companies and offer interesting prospects in some critical areas such as renewables and electric vehicles, ongoing issues suggest there are more attractive places in which to invest.

A long-term investment horizon with a focus on companies with strong fundamentals remains crucial for navigating the evolving environment. Investors should prioritize companies with sustainable business models, strong financial positions, and the ability to adapt to changing market conditions. This will be a particularly challenging period for companies with weak balance sheets as they have limited access to affordable capital making it extremely difficult for them to invest in order to compete with well-financed or self-financed rivals. A key difference between last year and this year will be expectations for inflation and interest rates which are likely to be higher than what market participants prefer. These conditions will make companies with strong earnings growth more likely to reward investors, as opposed to those relying on price/earnings multiple expansion.

In closing, the U.S. presents a dynamic and promising economic landscape with significant growth potential. The United States culture of innovation, recent massive investments in infrastructure, and productivity growth are driving economic expansion. While challenges exist, the U.S. economy possesses inherent strengths that position it for continued growth. A long-term investment perspective, coupled with a focus on high-quality companies, can help investors navigate the markets and capitalize on the exciting opportunities that lie ahead. While it is easy to be a pessimist, long-term investors have been well-served by taking a more optimistic view and should continue to do so in the coming period.

Published by the ARS Investment Policy Committee:

Stephen Burke, Sean Lawless, Nitin Sacheti, Greg Kops, Andrew Schmeidler, Arnold Schmeidler, P. Ross Taylor, Tom Winnick.

The information and opinions in this report were prepared by ARS Investment Partners, LLC (“ARS”). Information, opinions and estimates contained in this report reflect a judgment at its original date and are subject to change. This report may contain forward-looking statements and projections that are based on our current beliefs and assumptions and on information currently available that we believe to be reasonable. However, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements.

ARS and its employees shall have no obligation to update or amend any information contained herein. The contents of this report do not constitute an offer or solicitation of any transaction in any securities referred to herein or investment advice to any person and ARS will not treat recipients as its customers by virtue of their receiving this report. ARS or its employees have or may have a long or short position or holding in the securities, options on securities, or other related investments mentioned herein.

This publication is being furnished to you for informational purposes and only on condition that it will not form a primary basis for any investment decision. These materials are based upon information generally available to the public from sources believed to be reliable. No representation is given with respect to their accuracy or completeness, and they may change without notice. ARS on its own behalf disclaims any and all liability relating to these materials, including, without limitation, any express or implied recommendations or warranties for statements or errors contained in, or omission from, these materials. The information and analyses contained herein are not intended as tax, legal or investment advice and may not be suitable for your specific circumstances. This report may not be sold or redistributed in whole or part without the prior written consent of ARS Investment Partners, LLC

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.