In this issue:

“The S&P 500 has risen dramatically, powered by America’s leading tech companies. Yes, this could be another bubble- and there are countless things to be worried about… That said, markets climb a wall of worry. America’s innovation in AI, growing creativity, and momentum in defense (focused on deterrence) combined with our democratic, entrepreneurial, and capitalist system could surprise us on the upside. For now, America remains the best house in an imperfect global neighborhood.” -Mary Meeker, called the “Queen of the ‘Net”, veteran tech investor

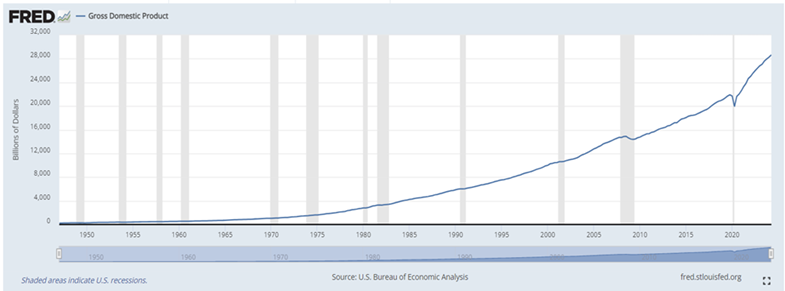

Despite important issues worrying investors today, the U.S. equity markets make new highs as corporate earnings continue to rise and the U.S. continues to attract capital. Notably, the U.S. GDP has grown by nearly 25% or $5.6 trillion (see Chart 1) in the past four years, and this growth was without the benefit of trillions of dollars of the legislated and required spending planned over the next several years. The economy will also be supported on a continuing basis by the ongoing efforts of U.S. companies to bring manufacturing back home, foreign companies shifting operations to the U.S., the massive future spending predicted for AI and data centers, and the new requirements to ensure a much stronger, more reliable, and expanded electrical grid. The United States will also need to increase and reorient defense spending in a perilous world. Breakthroughs in biotechnology and medical technology will likely have a significant effect on economic activity through greater productivity by lowering costs and improving health outcomes. It is the cumulative effect of the increased spending on each of these initiatives that should drive GDP growth through the decade.

Chart 1. United States Gross Domestic Product (GDP) Grew $5.6 Trillion Between 2021-2024

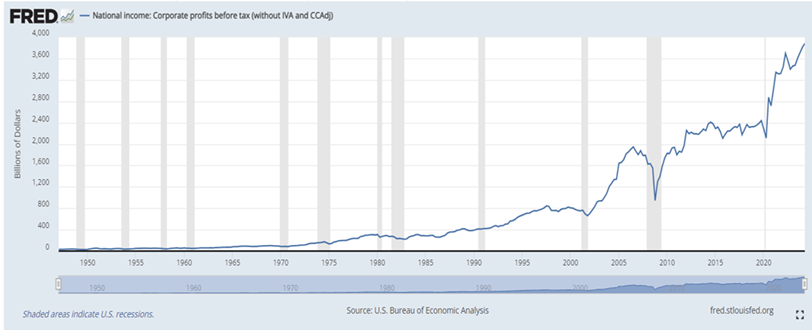

During the past three plus years, corporate profits have grown from $3.2 trillion to $3.8 trillion, as shown in Chart 2. We anticipate increasing corporate profits accompanied by greater productivity driven by technological advances. With lower interest rates, lower inflation rates and higher corporate profits, common stocks should continue to appreciate. As the Fed reduces interest rates, stock valuations tend to rise. If the aforementioned comes to pass, the United States will remain the strongest and most attractive economy in the world.

CHART 2. AT THE SAME TIME, CORPORATE PROFITS ROSE BY $600 BILLION

The recession that many investors are worried about is not our base case scenario, although we acknowledge the challenges for the U.S. and global economies. The United States economy remains remarkably resilient and corporate earnings continue to rise even in the face of higher living costs, changing terms of world trade, and the risks associated with national security and global conflicts. On recent earnings calls, the CEOs of companies represented in our portfolios highlighted multi-year growth opportunities supported by this relatively strong economic backdrop as well as by funding from the government’s fiscal programs and by state and local government funding.

MEGATRENDS DEFINING GENERATIONAL OPPORTUNITIES

“The megatrends that we talk about of energy transition, electrification, digitalization, all of those trends are just as relevant in Europe as they are in the North America market. I will say, though, if you think about some of the big differences in what’s driving perhaps this outperformance in the US is really a lot of reindustrialization, a lot of investments in manufacturing and LNG and other sectors, data center, where you have manufacturing that is historically taking place in other regions of the world. Now, those investments are being made in the US. Obviously, these investments are also being helped and supported by a number of these stimulus programs as well.” -Eaton Corp. CEO Craig Arnold

The recent surge in equity market returns has been largely driven by enthusiasm for artificial intelligence, with investors viewing it as potentially transformative as the printing press, steam engine, railroad, and the internet. However, it’s important for investors to remember that while these past technological revolutions changed the world, early investors had mixed outcomes, with some early leaders failing. Investors must not only identify promising technologies, but also the companies best positioned to execute, innovate, and sustain growth over the long-term. As history has shown, being an early mover in an emerging industry doesn’t guarantee success, making informed stock selection a key component of long-term investment success.

We see generative AI, climate change initiatives, and national security-related investments as key factors shaping a generational opportunity for investors. As we’ve discussed before, U.S. fiscal policies—such as the Inflation Reduction Act, the CHIPS and Science Act, and the National Defense Authorization Act—are attracting capital, including from other nations, and are setting apart the companies most likely to benefit.

The required infrastructure spending includes substantial funds allocated by state governments, in addition to federal and corporate contributions. New investments in data centers could eventually total $1 trillion, with much of this spending directed towards the industrial sector—an area that has only recently gained attention from investors.

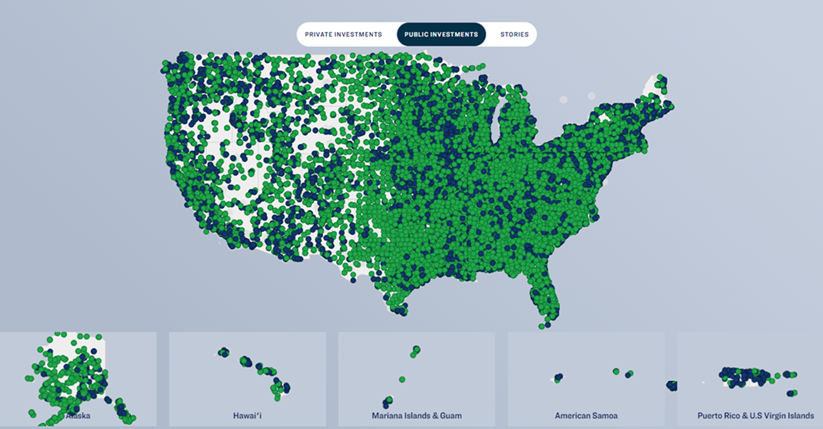

Chart 3. Public Investment Helping to Define the Opportunities

Source: https://www.whitehouse.gov/invest/

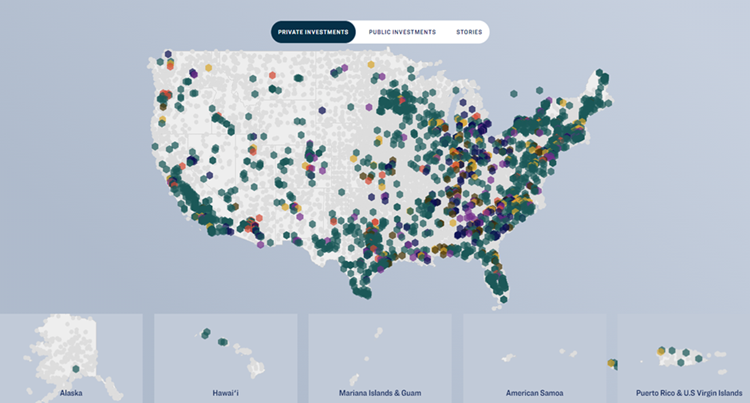

As illustrated in Chart 3, there has been a significant increase in the volume of projects initiated by federal, state, and local governments and supported by private investments from corporations. Chart 4 highlights private sector support in the areas of semiconductors, electric vehicles, clean energy, batteries, power, biomanufacturing and heavy industry. In the North American market in 2022, there were 31 mega projects totaling $103 billion. According to Eaton Corp. (a leading electrical and industrial products manufacturer), there are currently 444 mega-projects with a combined value of $1.4 trillion, double the number from the previous year. Despite recent reports of delays, corporate executives are not anticipating a slowdown in projects and believe there are opportunities that will last for several years. Notably, only 15% of these mega-projects have begun, and Eaton has secured over $1.4 billion in orders, with another $1.3 billion in negotiations.

Chart 4. Private Investments Supporting Government Initiatives

Source: https://www.whitehouse.gov/invest/

We anticipate these megatrends to persist, as noted by CEO C. Howard Nye of Martin Marietta Materials Inc., a company specializing in aggregates and concrete. During a recent earnings call, he stated, “Beyond 2024, we expect generational highway and streets investment as the nascent reshoring and artificial intelligence infrastructure build-outs are very much expected to provide an extended multiyear construction cycle in these aggregates-intensive end markets. Equally, when the affordability headwinds recede, we fully expect an accelerated housing construction recovery, specifically in single family, which will be required to address the structural deficit of homes in many of Martin Marietta’s key markets.”

THE GREAT DEBATE – WILL BIG TECH GET A RETURN ON AI INVESTMENT

“I think the natural comparable that jumps to mind for many investors is the tech bubble of the late 1990s and early 2000s, most of the companies involved in the buildout went bust. This buildout is similar in some ways…The main difference, though, is that the firms doing most of the building have massively profitable existing businesses and fortress-like balance sheets.” -Morningstar Equity Analyst Hodel

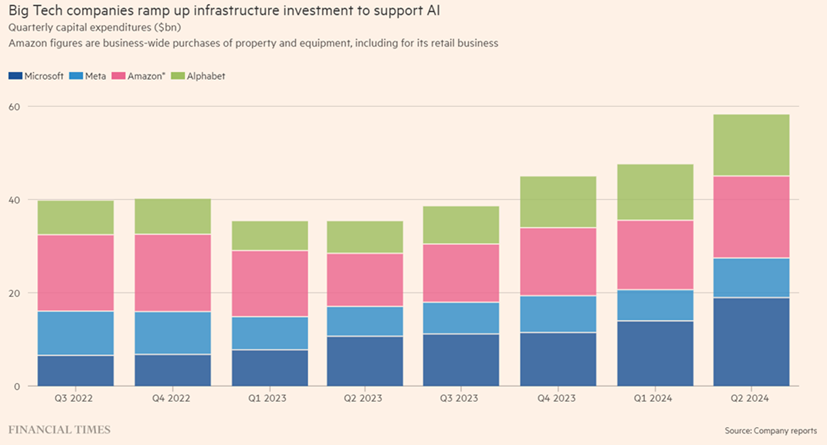

Market participants are debating two key issues regarding big tech: valuations and the returns on significant investments by industry leaders. Chart 5 shows the quarterly AI infrastructure spending by Microsoft, Meta, Amazon, and Alphabet from Q3 2023 through Q2 2024. While investors often look to past trends for insight into the current market, Morningstar’s Hodel emphasizes two crucial factors: the massive profitability of these companies and the strength of their balance sheets. With combined quarterly spending exceeding $50 billion, it will be extremely difficult to compete with these market leaders, especially for highly leveraged, low-growth companies. Larry Ellison of Oracle described the ongoing battle for technological supremacy as one that “will be fought by a handful of companies and maybe one nation-state over the next five years at least, but probably more like 10. So, this business is just growing larger and larger and larger. There is no slowdown or shift coming.” Why? Ellison estimates that the cost of building gigawatt or multi-gigawatt data centers starts at around $100 billion of corporate spending over the next 4-5 years.

Chart 5. It’s Hard To Compete With Capex On This Scale

This is a critical time for executives at technology companies around the world as the U.S. and China are engaged in a battle for technological supremacy, the EU is active in trying to regulate big tech, and both public and private market investors are working to determine who will be the winners and who will earn a return on the capital investment. As an Alphabet executive recently said, “the risk of underinvesting is far greater than overinvesting when you are going through a major transition.” Fortunately, most big tech companies have other spending programs from which they can redirect capital to pursue higher returns. ARS has adjusted its weightings of the big tech companies throughout the year. In another example, Meta’s Mark Zuckerberg doubled down on spending on AI when he said recently, “At this point, I’d rather risk building capacity before it’s needed, rather than too late… The downside of being behind is that you are out of position for, like, the most important technology for the next 10-15 years.”

Investment Implications

“In the real world, things fluctuate between ‘pretty good’ and ‘not so hot,’ but in investing, perception often swings from ‘flawless’ to hopeless.” – Oaktree Capital’s Howard Marks

Given the elevated market volatility experienced since August 1st and September being typically the worst month of the year for the markets, it is easy for investors to get caught up in the short-term dynamics of the markets and lose sight of the fact that recent market volatility is more a reflection of investor perceptions and not a reflection of the underlying business fundamentals. As we have experienced this quarter, short-term investor perceptions can move significantly, especially when we are dealing with the current state of world politics, multiple geopolitical conflicts, and worsening economic and social challenges in Japan, Europe, China, and the UK. In a world where the other leading economies are struggling, the United States remains the best economy and most attractive market on a risk-reward basis. Client portfolios are focused on U.S.-listed companies with strong balance sheets involved in upgrading infrastructure, the energy transition, improving productivity and national security with leading market positions, secular growth prospects, and pricing power. Another area of focus is the healthcare sector which stands to be both an immediate and long-term beneficiary of the application of technology, including artificial intelligence, to lower costs and improve patient outcomes. It couldn’t come at a better time as the population ages.

The U.S. economy should continue to benefit from domestic spending by all levels of government, supported by the reshoring and onshoring of manufacturing, rising corporate earnings and the surprising strength of its consumers. While we are troubled by the lack of fiscal discipline in the loosely defined economic proposals of the Harris and Trump campaigns, we would not advise shifting client portfolios until one knows the composition of the next government as many policies as proposed would not likely pass in a divided or near-divided government. On that note, ARS recently hosted a Zoom with Andy LaPerriere of Piper Sandler Macro discussing the odds of potential election outcomes, what a Harris or Trump portfolio might look like, and what to expect in the months ahead (https://arsinvestmentpartners.com/what-matters-now-democracy-2024-candidate-policies-election-odds-and-portfolio-implications/).

During periods of heightened uncertainty, ARS relies on its focus on the secular themes that drive capital flows and its proprietary fundamental research to drive investment decisions and capitalize on the mispricings of securities created by market perceptions. It is often in times of the greatest uncertainty that opportunities arise, and we view this environment as one of those times.

Published by the ARS Investment Policy Committee:

Stephen Burke, Sean Lawless, Nitin Sacheti, Greg Kops, Andrew Schmeidler, Arnold Schmeidler, P. Ross Taylor, Tom Winnick.

The information and opinions in this report were prepared by ARS Investment Partners, LLC (“ARS”). Information, opinions and estimates contained in this report reflect a judgment at its original date and are subject to change. This report may contain forward-looking statements and projections that are based on our current beliefs and assumptions and on information currently available that we believe to be reasonable. However, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements.

ARS and its employees shall have no obligation to update or amend any information contained herein. The contents of this report do not constitute an offer or solicitation of any transaction in any securities referred to herein or investment advice to any person and ARS will not treat recipients as its customers by virtue of their receiving this report. ARS or its employees have or may have a long or short position or holding in the securities, options on securities, or other related investments mentioned herein.

This publication is being furnished to you for informational purposes and only on condition that it will not form a primary basis for any investment decision. These materials are based upon information generally available to the public from sources believed to be reliable. No representation is given with respect to their accuracy or completeness, and they may change without notice. ARS on its own behalf disclaims any and all liability relating to these materials, including, without limitation, any express or implied recommendations or warranties for statements or errors contained in, or omission from, these materials. The information and analyses contained herein are not intended as tax, legal or investment advice and may not be suitable for your specific circumstances. This report may not be sold or redistributed in whole or part without the prior written consent of ARS Investment Partners, LLC.

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.