In this issue:

This economic environment of the United States has never existed before. Current conditions are a manifestation of the distortions in the economy and the markets brought about by the pandemic and subsequent policy responses. Today’s challenge in building and protecting capital requires investors to view the world differently than in past cycles because current investment conditions are truly unique. The transformation of the economy is being reflected in the equity market’s shift to the industries and companies benefiting from a broad reopening and expansion of economic activity and away from the beneficiaries of the pandemic. The former concentration of capital came at the expense of a broad number of companies and industries which could not do well during a stay-at-home lifestyle and a remote-work environment. Subsequently, many previously neglected areas have taken on a new investment life, some of which we see as cyclical winners and some as secular winners. We continue to believe that many are underappreciating the magnitude of the rapid digitalization of the $22 trillion U.S. economy which will continue to occur over many years and have material societal benefits.

While there are critical social, political, and economic challenges that global leaders continue to struggle to address, the near-term headlines often serve as a distraction from what matters most from an investment perspective which is the outlook for corporate earnings, inflation, and interest rates that serve as the basis for equity valuations. Even with temporary, near-term inflationary pressures building, corporate earnings should continue to rise as the economy recovers, and interest rates and inflation rates remain historically low. These conditions are favorable for the companies that can raise prices to increase earnings as opposed to those companies whose earnings will be negatively impacted by their inability to absorb higher costs and pass on price increases. Some argue that innovation and productivity will continue to improve overall economic activity and suppress inflation pressures, while others argue that proposed tax increases, growing deficits, and rising inflationary pressures will slow economic activity and depress stock market valuations. From our perspective, the inflationary surge is a function of a short-term mismatch between consumer demand and production levels. The unprecedented monetary and fiscal policy responses to the virus are increasing the debate about how governments and markets should think about debt, deficits, and inflation. Lost in the debates is the fact that the U.S. economy and corporate earnings should remain strong for the next few years, notwithstanding episodes of volatility along the way.

Given this unique nature of the post-pandemic period, investors should remain focused on the businesses that are the primary beneficiaries of the secular transformations we have written about in recent Outlooks, especially those benefiting from the ongoing digital transformation which is still in the early innings. As this transformation further develops, it should drive the innovation and productivity growth needed to foster a more sustainable and balanced economy. Further augmenting these trends is the real concern to re-shore and rebalance supply chains away from geographic and politically challenged regions. As the cyclical inflationary pressures are absorbed by the global system, long-term inflation should remain muted allowing central banks to keep rates lower for longer, but not likely as low as currently projected by the Fed. This, in turn, should support some of the expansive fiscal policy initiatives needed to address climate, equality, health, and other long-term issues that are priorities for governments. In contrast to the post-WWII boom which was also characterized by pent-up demand and savings for products that had existed, the post-pandemic boom will also be characterized by products and services that had never existed and are creating new, large total addressable markets. This Outlook will lay out the case for near-term inflation rising and then moderating, will focus on the growth of the digital economy and how innovation and productivity will impact the overall economic prospects for the U.S. and global economies, and then focus on the investment opportunities that will be at the forefront for investors over the next 12 months and beyond.

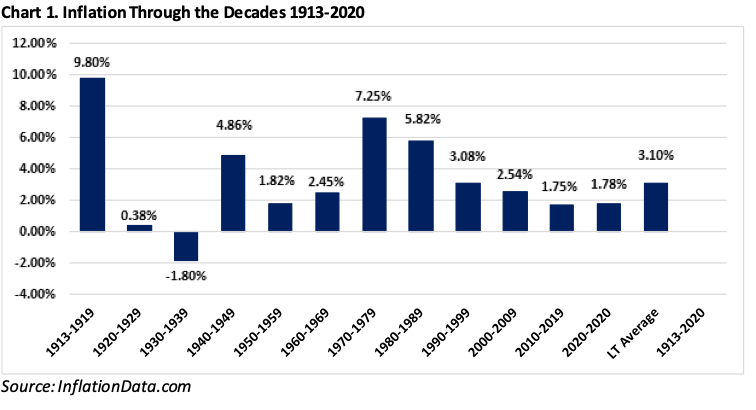

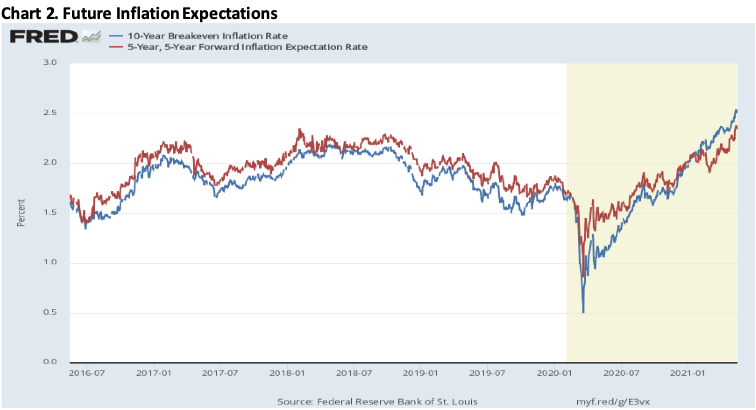

One of the most widely debated topics among investors involves the outlook for inflation as the battle lines are being drawn between a growing number of market participants and the Federal Reserve on whether the recent rise in inflation is becoming more permanently embedded in the system or is transitory in nature. As shown in Chart 1, inflation has averaged 3.10% from 1913 to 2020, but has been in a downward trend since the 1970s and was crushed by then Fed Chair Paul Volker beginning in 1981. For some time, the ARS team has held the view that four secular forces – technology advances, globalization, debt levels, and demographics – were creating a more deflation-prone economy. Three of the four forces are still intact with trade tensions and the resulting supply-chain disruptions having reversed some of the positive, deflationary tendencies stemming from globalization. However, as indicated in Chart 2, the market expects inflation to rise from last year’s depressed levels, but forecasts inflation rates rising to around 2.4% in five years. We continue to side with Treasury Secretary Janet Yellen and Federal Reserve Chair Jay Powell in their beliefs that recent upward pressure on inflation rates will be transitory in nature. The basis for our view is that pent-up consumer demand and severely drawn down inventories, which are causing price hikes, will be satisfied and short-term production shortfalls due to the pandemic are in the process of being corrected. Because the substantial level of shortfalls is so large, it could take longer to be corrected but nevertheless equilibrium will be restored, and inflationary pressures will abate.

The cyclical forces pushing up inflation involve supply-chain disruptions, labor shortages, skills mismatches between job openings and available talent, commodity price pressures, and pent-up demand alongside monetary and fiscal stimulus. Unlike the 1970s inflationary period where cost-of-living wage increases were contractual and administered prices were more the norm, the current period is very different as companies can more easily substitute capital for labor to manage the rise in compensation costs, while new and non-traditional competitors make passing on price increases far more difficult for many companies. One of the key factors that will determine whether wage inflation will be more permanent or transitory is the wage bill. The wage bill is the total amount of wage a company or industry pays annually while the wage rate is the unit cost of an hour of work. There has been a great deal of debate on raising the minimum wage rate, but wage rates matter less to companies than their total costs of labor which is their wage bill. If wage rates rise, but the wage bill does not rise proportionately then the inflation concerns will prove to be misplaced. The companies that thrive in the upcoming period will be the ones that are able to grow their revenues and earnings using innovation and productivity improvements to keep the wage bill from impacting profitability.

Investors should keep in mind that the Federal Reserve has been trying to stimulate the economy since the Great Financial Crisis in 2008 using quantitative easing (QE or the printing of money) and low interest rates to support its dual mandate of price stability and maximum employment levels. To date, the economy has struggled to reach the 2% inflation target set out by the Fed but was on track for its maximum employment goals prior to the pandemic which has introduced renewed concerns about the impact of longer-term economic scarring for segments of the economy. Chart 2 presents two measures of expected inflation followed by the Federal Reserve which are 10-year breakeven inflation rate and the 5-year, 5-year forward inflation expectation rate. While each indicates that inflation pressures are on the rise, they are not inconsistent with the Federal Reserve’s stated goal of letting inflation run higher to allow the economy to return to more appropriate levels of price stability and employment. It is understandable for market participants to react to headlines about inflation pressures rising as the cost for items like lumber, homes, used cars, and commodities rise sharply on the re-opening of the economy. However, investors should expect some of these pressures to dissipate after the initial wave of pent-up demand is met. Importantly from a market perspective, the digital transformation should re-emerge as the more dominant theme after the economy adjusts to the distortions in inflation measures stemming from the collapse in prices experienced in the early stages of the pandemic in the second quarter of 2020.

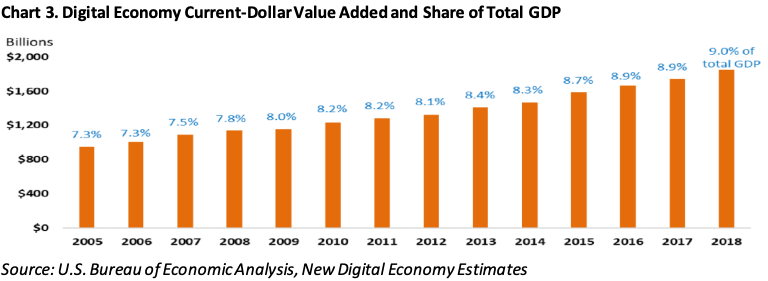

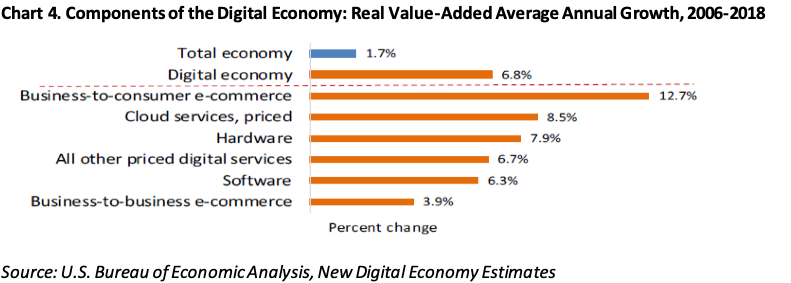

If the politicians in Washington are to effectively manage the nation through its social, economic, and political challenges, they will need to combine smart bi-partisan leadership and clear priorities with a commitment to supporting the continued growth of the digital economy. Since the Great Financial Crisis, the U.S. digital economy’s share of gross domestic product (GDP) has been on the rise and is reshaping business and daily lives in America as shown Chart 3. The COVID-19 pandemic has accelerated the digital economy’s growth rates and increased its share of GDP. From 2006-2018, the overall economy grew 1.7% annually, while the digital economy grew 6.8% annually as shown in Chart 4. The digital economy grew at an average annual rate of more than 3 times that of the overall economy. For that same period, business-to-consumer e-commerce grew over 12% a year on average and cloud services also grew very strongly at 8.5%. Bear in mind that these were pre-pandemic figures, and these growth rates have been exceeded in the past twelve months.

As Microsoft’s CEO Satya Nadella recently stated, “The next decade of economic performance for every business will be defined by the speed of their digital transformation.” This means that a greater share of capital expenditures will be dedicated to the rapid advancement of technological breakthroughs to create new products, new markets, new ways of solving health issues, lower costs, increase competitiveness, and gain market share. But not all companies and industries will benefit equally. The healthcare, manufacturing, and financial services sectors stand to be among the primary beneficiaries. The enormity of this century’s transformation is exemplified by the rapidity of the COVID-19 vaccine development which took a matter of days to analyze the code necessary to create the vaccines. The use of A.I. (artificial intelligence) to successfully handle the exponential growth of data generation has led to a digital transformation to create value from the enormous volumes of data. This is leading to an explosion of new drugs, therapies, and the prospect of revolutionizing medicine. In turn, the prospect of improving healthcare outcomes enabling longer and better lives leading to greater productivity and cost savings with big implications for government finance as healthcare cost represents approximately 17% of GDP. As the digital economy continues to become a larger part of the overall economy, it will bring with it both significant opportunities and challenges for policymakers, populations, business leaders, and investors.

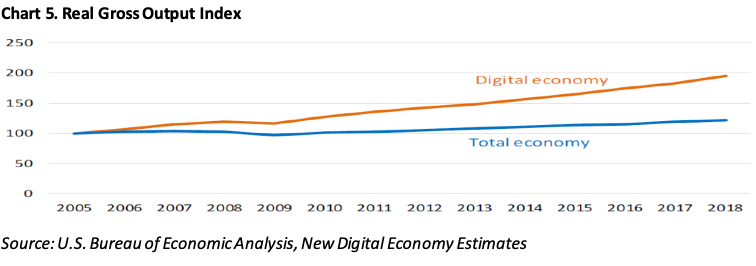

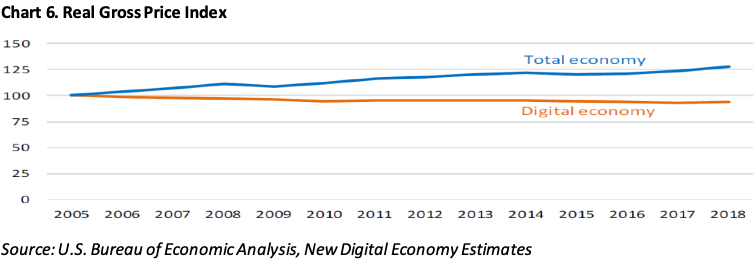

The expansion of the digital economy comes at a perfect time for the United States and other nations that are struggling to deal with the aftermath of two of the most disruptive economic events in recent history – the Great Financial Crisis and the COVID-19 pandemic, which occurred less than 15 years apart. Economies around the world are battling a lack of sustainable growth, rising deficits, high debt levels, growing frustration, and a lack of trust between populations and their governments. Technological advances will allow economies to be more efficient by increasing productive capacity. As shown in Charts 5 and 6, the digital economy has grown at a much higher rate than the overall economy, while at the same time technology is lowering prices. Chart 5 compares real gross output, which is the annual measure of total economic activity in the production of goods and services between the digital and overall economy. Chart 6 compares the real gross price index of the digital to the overall economy. Real gross price index measures inflation in the prices of goods and services in the U.S. In summary, these two charts show that the digital economy is becoming a larger percent of the economy and lowering prices in the process. As stated in past Outlooks, productivity is the antidote to inflation, and these charts illustrate this concept clearly.

For the United States’ economy to realize its potential, the government and corporations must commit to investing in the digital transformation at higher levels than ever before as aggressive global competition for technology leadership grows in importance. In 2020, China’s digital economy was estimated to be 7.8% of its GDP with a target of reaching 10% of GDP by 2025. China is also becoming a leader in patents issued across the key areas of technology including artificial intelligence, drones, cybersecurity, and quantum computing. For the United States to continue to be a technology leader, it needs to invest in infrastructure for 5G, research and development for innovation, up-skilling and re-skilling existing workers, and better educating our youth for the digital age. As many leading nations are experiencing record low fertility rates and rapidly aging populations, the digital transformation can partially offset the demographic challenges these countries are facing.

It is in a time like this that the best investment opportunities are often missed because of excessive focus on the heightened uncertainty stemming from the multitude of problems present in the system, and the fact that there is no historical precedent for the world we are living in today. The global system is undergoing massive transformations due the unusual political, social, economic and climate conditions, and the magnitude of the problems has required the use of unconventional monetary and fiscal policies by governments. The fallout from global trade tensions, population displacements from failed states, and the COVID-19 pandemic has forced governments and businesses to adapt to changing conditions and societal tensions. For the United States government, it forces the need to promote changes in infrastructure, immigration, and education policies. It is also forcing businesses to come to grips with conditions that they have not previously had to prioritize or even consider including equality, diversity, and opportunity. At the same time, it is requiring all businesses to accelerate the pace of innovation to improve their productivity to protect and grow market share and transition to this new post-pandemic world. Fortunately, from a purely financial point of view, the wherewithal to deal with the many needs and opportunities is available. As one need leads to another, and to keep up with the emerging requirements, significant structural changes to the educational system and immigration policies are required to produce the necessary labor force to deal with the 21st century needs. New and dangerous competitive challenges for democratic states from autocracies, which also possess advanced technologies, is now manifest in the area of cybersecurity. When one connects the dots, new investment opportunities present themselves to reveal the potential for large addressable markets.

This area has come to the forefront of concerns as the recent Colonial Pipeline ransomware attack has now raised additional national security concerns across the entire United States infrastructure. To protect the United States, national security has become the principal concern as ransomware is exacting an intolerable and dangerous toll on the national well-being. Correcting this problem will also require major upgrades and overhauls of both the national grid and our communications networks including GPS systems – long a need and now no longer postponable. Microsoft also recently announced that the Russian hacking group behind last year’s SolarWinds cyber-attack is at it again as it is targeting government agencies, think tanks, consultants, and non-governmental organizations. This also involves a shift and an increase in our national defense budget and goes beyond political posturing.

A new level of increased demand for essential and basic raw materials has emerged. Many materials are critical for addressing the United States’ and the world’s climate transformation, particularly for wind, solar, and the efficient transition from fossil fuels. And because we are competing with Europe and other regions for these resources, this creates even greater demand which will require additional investment spending to bring supply into better balance. Steel, copper, and rare earth materials are among the areas on which we are focusing. The trade tensions between the United States and China are forcing companies to consider reshoring and onshoring to ensure dependable supplies of the inputs needed to compete, particularly in areas where future demand is certain to outstrip the previous supply capabilities of the global system.

Semiconductor technology is the lifeblood of technological advancement for everything from smartphones, electric vehicles, robotics, medical research, wireless spectrum, and broadband to datacenters and gaming. However, the combination of the pandemic and trade tensions has created supply shortages that will persist for some time. Few countries will be able to compete effectively on the world stage without a dependable and resilient domestic supply of the chips to support their digital transformations. It is important to note that bringing supply and demand into balance can take 2-3 years to build additional manufacturing capacity. To that end, the Senate is considering a bi-partisan bill that would authorize over $500 billion to compete with China in the race for technology supremacy. The bill includes over $50 billion for domestic semiconductor production and $100 billion for research into artificial intelligence and machine learning, robotics, high-performance computing, and other advanced technologies. This follows previous announcements by Taiwan Semiconductor and Samsung to build facilities to produce state-of-the-art facilities in Texas and Arizona with each facility costing upwards of $10-15 billion dollars. China is a formidable competitor in this area as it has become the leading nation in terms of patents in the most important areas supporting advanced technologies.

The use of A.I. to successfully handle the exponential growth of data generation has led to a digital transformation to create value from enormous volumes of data. This is leading to an explosion of new drugs, therapies, and the prospect of revolutionizing medicine. The benefits of digitalization are being realized in healthcare, and the pandemic illustrated this in two key areas – the dramatic growth of telemedicine and the research and development of new vaccines and medicines. Similar to the ability of companies to transition their employees to remote work, doctors were able to transition many patients to telemedicine visits instead of office visits. In the pre-pandemic period, it took approximately 10 years to bring a new drug to market, and the industry was able to bring 2-4 vaccines to the market in less than 1 year. These are just two examples of opportunities to improve the quality of healthcare and to lower costs which will be even more important given the demographic challenges associated with the longer lifespans of a rapidly aging global population. The prospect of better healthcare enabling longer and better lives should lead to greater productivity with big implications for U.S. government finance.

High quality companies with defined dividend policies represent superior opportunities for investors who focus on income. For investors, the bond market will represent a poor asset class in a rising rate environment. Investors holding U.S. Treasury bonds with a 10-year maturity yielding 1.6% could lose nearly 8% of their principal value in the event of a 1% increase in rates. Conversely, equity investors can find many high-quality companies with dividend yields well in excess of Treasury rates and with both the reality and the prospect of increasing dividends.

The conditions for capital appreciation are noteworthy in stocks of all market capitalizations and in particular in smaller capitalization companies. We continue to focus on the investment opportunities which grow out these and our other observations of what changes and opportunities are presenting themselves in the markets. We anticipate companies will redefine themselves to improve productivity and better compete in the coming period through merger and acquisition activity and spinoffs. Notwithstanding the significant advancements of many of the leading beneficiaries of this Outlook over the past two years, periods of market volatility should be viewed both as the pause that refreshes and an opportunity to add to investments at more attractive prices. This is particularly true for companies which have significantly increased their revenues and earnings and continue to have bright prospects for significant growth over the intermediate term. Because the economy is progressing so rapidly, the companies with embedded advantages will continue to fetch the best market valuations as a result of great investor interest. To do so, they must innovate and embrace the latest technologies, while assuring themselves of the needed elements to remain at the forefront of competition.

Published by the ARS Investment Policy Committee:

Brian Barry, Stephen Burke, Sean Lawless, Nitin Sacheti, Michael Schaenen, Andrew Schmeidler, Arnold Schmeidler, P. Ross Taylor.

The information and opinions in this report were prepared by ARS Investment Partners, LLC (“ARS”). Information, opinions and estimates contained in this report reflect a judgment at its original date and are subject to change. This report may contain forward-looking statements and projections that are based on our current beliefs and assumptions and on information currently available that we believe to be reasonable. However, such statements necessarily involve risks, uncertainties and assumptions, and prospective investors may not put undue reliance on any of these statements.

ARS and its employees shall have no obligation to update or amend any information contained herein. The contents of this report do not constitute an offer or solicitation of any transaction in any securities referred to herein or investment advice to any person and ARS will not treat recipients as its customers by virtue of their receiving this report. ARS or its employees have or may have a long or short position or holding in the securities, options on securities, or other related investments mentioned herein.

This publication is being furnished to you for informational purposes and only on condition that it will not form a primary basis for any investment decision. These materials are based upon information generally available to the public from sources believed to be reliable. No representation is given with respect to their accuracy or completeness, and they may change without notice. ARS on its own behalf disclaims any and all liability relating to these materials, including, without limitation, any express or implied recommendations or warranties for statements or errors contained in, or omission from, these materials. The information and analyses contained herein are not intended as tax, legal or investment advice and may not be suitable for your specific circumstances. This report may not be sold or redistributed in whole or part without the prior written consent of ARS Investment Partners, LLC.

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.