In this issue:

“The COVID-19 pandemic has demonstrated that no institution or individual alone can address the economic, environment, social and technological challenges of our complex, interdependent world. The pandemic itself will not transform the world, but it has accelerated systemic changes that were apparent before its inception. The fault lines that have emerged in 2020 now appear as critical crossroads in 2021.”

– Excerpt from World Economic Forum website on the Davos 2021 agenda

Last year presented challenges that no one anticipated. While the battle against the COVID-19 virus is far from over, the rollout of vaccines has provided a light at the end of the tunnel. This is a welcome relief for consumers, businesses and governments after one of the most difficult and uncertain periods in history. Last year could not end quickly enough for most, and it will appropriately be remembered more for the devastation to lives and livelihoods stemming from the COVID-19 pandemic than the returns of the market or any individual stock. As policymakers continue to work to arrest this terrible virus and to heal the global system, there are five critical forces that should drive the recovery and, importantly for investors, help to determine those industries and companies that will be the primary beneficiaries of the resulting capital flows. The five forces involve pent-up demand, vaccine distribution, massive liquidity, low interest rates, and productivity improvements. The combined effect of these forces will lead to both strong economic growth and healthy returns for investors in well-selected equities.

To be sure, there are fundamental issues such as tackling a decaying infrastructure system, income inequality, civil unrest, fixing the education system, enhancing cyber security, and reducing the political divisiveness that need to be addressed immediately so that the country can then move onto important longer-term concerns such as deficits, debt levels, tax policy, entitlements, and demographic challenges. Under these circumstances, market participants should emphasize actively managing their portfolios as a narrow range of securities should benefit disproportionately from the complex dynamics of the global economy. That said, the acceleration of the systemic changes described by the World Economic Forum will create a relatively small number of well-defined opportunities for market participants. A January 4th article from McKinsey stated, “2021 will be the year of transition. Barring any unexpected catastrophes, individuals, businesses, and society can start to look forward to shaping their futures rather than just grinding through the present. The next normal is going to be different. It will not mean going back to the conditions that prevailed in 2019.” Given the many challenges facing the world, these times suggest investors should continue to be both cautious and opportunistic in 2021. However, better times are ahead for the economy, and market participants have already started to look past many of the near-term concerns and are focusing on opportunities developing for the post-COVID economy.

“The great comeback of 2021 is surely coming, at least according to the new picture I have in my head, and it will be led and fed by the idea of pent-upness. There’s so much pent-up desire for joy out there. Surely it will begin to explode in late spring, with vaccines more available and a spreading sense that things are easing off and be fully anarchic by summer. Growth will come back, people will burst out, it’s going to be exciting.”

– Peggy Noonan, The Wall Street Journal, December 31, 2020

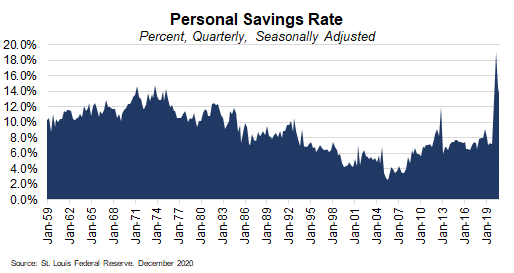

After being locked down and unable to take part in what were our normal activities prior to the pandemic, most people are eager to return to living without restrictions. As Peggy Noonan sums up quite well, there is so much pent-up demand not only from consumers, but also from governments and corporations that the effect may be similar to that of a coiled spring. As shown in the chart, the lockdowns forced savings rates to extreme levels and consumers have spending power that will be unleashed once economies reopen likely in the second half of the year. We have not seen this type of pent-up demand since the post-WWII period. Back then it was ending the war that ignited the resumption of spending, this year it will be the distribution of vaccines that will get things started.

The consumer is just one part of the pent-up demand; governments and corporations will also be increasing spending this year. President Biden has proposed a $1.9 trillion stimulus plan, and this would be in addition to the $3 trillion fiscal stimulus in 2020. For corporations, there is little choice but to increase capital spending in 2021 to acquire the most advanced technologies in order to effectively compete. Investors should anticipate that much of corporate spending in the manufacturing sector will be directed to increasing capacity and upgrading plants and equipment with the newest technologies to lower costs and meet increasing demand. While many market prognosticators are forecasting a rapid increase in inflation, that is not the base case for ARS. Our team believes that we might experience a modest rise in inflation this year but expect it to be transitory.

“In the aftermath of the presidential election, the US has its last best chance to reset the fight against the coronavirus. Such a reset will require restoring the working relationship between the national government and the states. And the first true test of this strengthened relationship will be the distribution of vaccines.”

– Boston Consulting Group, November 30, 2020, “Only a Reset Can Defeat the Virus”

The COVID-19 pandemic has been a human and economic catastrophe, and the battle is far from over as new mutations are creating additional concerns. But with the vaccine roll out underway, it’s possible to be cautiously optimistic that we will be shifting away from the lockdowns and restrictions so prevalent today to the next normal which should begin in earnest later this year. The Biden Administration has taken a fresh approach to fight the virus and it started with designing a strategy that plays to the distinct strengths of the federal and state/local governments. As the BCG highlights, “Federal and state governments have different strengths. By virtue of its borrowing and purchasing power, the federal government excels at funding and procurement. Its expertise and broad perspective also position the federal government to establish evidence-based national standards and offer tailored regulatory relief. The states’ strength derives from local knowledge and service delivery. They clearly see the reality in the field that can be fuzzy to federal officials.” It is safe to say that the lack of proper coordination and communication between federal and state officials as well as with the drug manufacturers had prevented a more effective response to the distribution process.

The ability of biotechnology and pharmaceutical companies to produce not one, but several effective vaccines in just a few months has put the United States and global economies on track for potentially a strong recovery in the second half of the year. However, there are many manufacturing and logistical problems to be addressed which would suggest that not only does the United States need better coordination on all levels of government, but that corporations need to pitch in to assist in helping solve these complex challenges. This would not only provide a public service but also accelerate the time to get their businesses closer to the post-COVID environment. The world continues to experience episodes of heightened uncertainty which are likely to persist at least until the virus is contained and people feel more confident that it is safe to return to many of the activities that are currently being prohibited, restricted, or avoided. As we said in our August Outlook, “While we believe that innovation and science will win in the end, the road to recovery will be bumpy with unsettling news headlines adding to the already high level of uncertainty and unease.” That has been the case the past few months and may continue to be until the current supply and logistical difficulties are resolved and herd immunity is achieved.

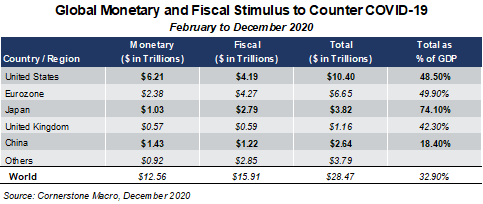

One of the most fascinating aspects of 2020 was the speed and magnitude of the policy response from governments around the world, not just in lowering benchmark interest rates, but also by pumping an unprecedented amount of liquidity into the global system. Nowhere was this more evident than in the U.S. as shown in the following chart. As one can see, the United States’ combined monetary and fiscal policy responses last year was equivalent to over 48% of gross domestic product (GDP). And that does not take into account this year’s initial stimulus proposal which would bring total stimulus in the U.S. to over 50% of gross domestic product. Globally, governments and central banks have provided stimulus equal to more than 33% of global GDP and this figure continues to rise.

Why is this important? The liquidity injected into the system has allowed the global economy to absorb the shock of the pandemic and rebound from the brink of a severe recession, if not, a depression. It also allowed employment, consumer net worth, and corporate profits to rebound strongly since the March lows. All this liquidity sloshing around the global system has forced investors to seek opportunities to get a higher return on their money and has encouraged added risk-taking. This was clearly evidenced in the markets the last week in January as retail investors, using social media, turned the tables on a few hedge funds by executing a coordinated attack on the extreme short positions in GameStop shares which led to a “short-squeeze” that drove up the price of the company’s shares beyond reason. The implications of this and the unusual trading activity of other stocks have yet to be determined, but it is safe to say that we have not heard the last of this yet as investors can expect regulatory and other changes in the not-too-distant future.

“When the time comes to raise interest rates, we’ll certainly do that, and that time, by the way, is no time soon,”

– Jay Powell, Federal Reserve Chair, in comments on January 14, 2021

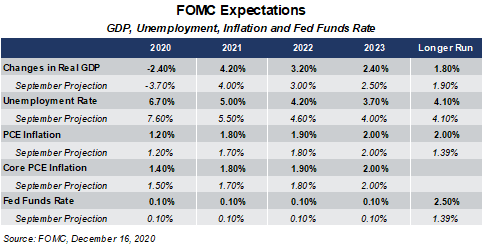

For investors, the outlook for interest rates, inflation rates and corporate profits are the critical determinants of equity valuations. Low interest rates are to the economy what blood is to the body as it promotes the flow of capital throughout the economy. Interest rate levels either retard or augment capital flows, and today’s historically low rates maximize the ability of capital to be deployed. Low interest rates allow for economies to heal and to grow by promoting consumption and capital expenditures by businesses. High interest rates slow economic activity by restricting investment, borrowing and risk taking. As Chair Powell and the rest of the Federal Reserve officials regularly remind us, they do not intend to raise rates any time soon. As shown in the following chart, Fed officials do not forecast federal funds rate increases before 2023. By anchoring rates near zero, the Federal Reserve is attempting to bring down other rates such as those for corporate debt as BAA yields have fallen to record low levels and mortgage rates have also come down to near-record low levels of 2.86% as of the time of this writing. The Federal Reserve is maintaining its laser-like focus on returning the economy to full employment even if inflation runs above its target in the near term. With the recent confirmation of Janet Yellen as Treasury Secretary, Chair Powell has a close ally to coordinate policy between the Federal Reserve and the Treasury Department. Secretary Yellen’s knowledge of the challenges of U.S. economy and the Federal Reserve’s policy intentions are unique. For market participants, the Yellen-Powell combination should provide a supportive backdrop for equity valuations.

“What we are witnessing is the dawn of a second wave of digital transformation sweeping every company and every industry. Digital capability is key to both resilience and growth. It’s no longer enough to adopt technology to compete and grow.”

– Satyta Nardella, Chief Executive Officer, Microsoft Corporation

Productivity reflects the efficiency of an economy as well as serving as the determinant of the foreign exchange value of its currency. Productivity growth has been lackluster in the United States over the past few decades. The productivity improvements from technological advances have been most evident in the ability of the pharmaceutical industry to develop and bring to market multiple vaccines for COVID in record time. In addition, U.S. manufacturers have made their production lines so much more efficient that they can run shifts with a fraction of the workers required 20 years ago. This enables companies to bring back jobs and more effectively compete with foreign workers who are earning a fraction of the wages of U.S. workers. Furthermore, the scale of the shift to remote work due to the pandemic would not have been possible without advances in cloud computing, artificial intelligence, software and 5G. Productivity improvements are creating new large addressable markets in several areas such as green energy by lowering costs for electric vehicles, solar and wind power.

The digitalization of the economy is enabling companies, large and small, to do more with less time and expense. The growth of the digital economy is important for society as it aids nations in closing the gap between the actual and potential GDP of their economies by driving productivity growth, keeping inflation low and raising living standards. While much has been written about the loss of jobs due to technology, many studies have shown the longer-term benefits offset the negatives. However, in the nearer term it does put a greater burden on governments and companies to help those workers impacted to learn new skills to compete in the new workplace. Additionally, technological advances help create new industries, jobs and functions which can result in new and more efficient markets. The productive capacity of a nation is closely connected with its education system as it needs to prepare workers for multiple careers they will likely experience. Investors should anticipate that the expected increases in capital expenditures will lead to significant improvements in productivity while resulting in a strong growth, low inflation environment. The rapid adoption of new technologies creates a positive feedback loop with future technologies being brought to market at an accelerated pace. While certain types of jobs will disappear or see significant reductions in demand, the technological advances we see occurring at this time will create many new jobs which could well be better paying such as those being created in emerging industries like clean energy.

As the economic recovery remains both fragile and fluid, we continue to be both opportunistic and cautious in our investment approach. As we have written throughout this piece, the powerful shifts in the global economy are creating large investment opportunities, and well-selected equities should reward investors over the next several years. There are investable ideas present in virtually all market environments, and investors should be able to achieve attractive absolute and relative returns over time by owning the businesses that are the beneficiaries of the secular trends. One issue that has been hard for many investors to grasp is the fact that a relatively small number of companies are prospering, while many others are struggling. Why has this been occurring? Because these successful companies have significant embedded advantages including scale, stronger balance sheets and better access to talent and capital. This enables them to commit more funds to increasing productivity by investing in innovation and technology advances. Last year, Amazon, Apple, Alphabet and Microsoft together increased their capital expenditures at a nearly 25% rate. This, in turn, led to higher earnings, better pay for employees, stronger market share, and ultimately greater shareholder value, while at the same time increasing their competitive positions. Investors should focus on companies with “embedded advantages” over their peers. It is for this reason that we feel the investment environment should favor active investment management over passive management and high conviction strategies over more diversified strategies. Additionally, this low-interest-rate environment favors companies with strong balance sheets, resilient business models, and the ability to raise their dividends. These conditions have led to a broadening of the market to include small capitalization companies that are drivers of some of the most important new innovations. We continue to identify a number of companies that are uniquely positioned to benefit and are strategically vital to enable the ongoing global transformation.

There are always risks to the economic outlook and that is certainly the case today. Among the key risks that would shift our positive views from our current position would be a sharp rise in inflation and the exchange rate for the U.S. dollar. Other risks include how we manage the expanding federal deficits, asset valuations, tax and regulatory increases, extreme weather, geopolitical uncertainties and, of course, the resolution to the current health crisis. The focus for client portfolios remains consistent with our recent Outlooks as we continue to favor the beneficiaries of the digital transformation involving cloud, cybersecurity, 5G and semiconductor chips as well as healthcare companies helping to lower healthcare costs in the U.S. In the past quarter, we have increased our emphasis on the clean energy transition and climate change but continue to be vigilant to avoid over-hyped areas of the market. Regardless, a number of leading companies, large and small, will continue to innovate, disrupt and evolve their business models to thrive in the coming years. As such, investors should be focused on benefiting from the powerful secular trends and not on speculating in shares of companies whose futures are behind them as they have either lost their way or will be unable to transition in their current forms to benefit in the post-pandemic world.

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.