In this issue:

“The global COVID-19 pandemic shows few signs of relenting – in fact, in addition to its dual burden on lives and livelihoods, it is triggering civil unrest, new concerns about economic inequality, geopolitical tensions, and many other effects. The pandemic is more than an epidemiological event; it is a complex of profound disruptions.”

– McKinsey Global Institute

This rapidly changing world is presenting both interesting existing and new investment opportunities in the beneficiaries and profound challenges. In just a few months, the world has undergone critical transformations and, as highlighted in the McKinsey reference above, “a complex of profound disruptions”. Our lives continue to be reshaped in ways that were predictable prior to the COVID-19 virus and in ways that were not predictable. Many investors we speak with these days tend to be less aware of the dynamic opportunities available and more focused on the many uncertainties stemming from the resurgence of COVID-19 cases globally, rising geopolitical tensions, and the potential consequences of the upcoming U.S. election. It is important that serious, long-term investors not get sidetracked by the near-term uncertainties as we believe the six transformations described in this Outlook will provide a generational opportunity to protect and build capital in the beneficiaries even if future investment returns across the broad range of asset classes are lower than previously experienced.

As hopes for a 2020 resolution to the pandemic have faded, the economic consequences of business closures, high unemployment, lost incomes, and lower economic activity have become clearer. Investors should expect business closures and bankruptcies to continue or even accelerate in the coming months. The dramatic improvement in the unemployment rate experienced from May through August has begun to stall as companies announce new layoffs and furlough programs. Additionally, state and local government finances in the United States are being severely strained due to the virus, and this is accompanied by an increase in Federal spending needs placing even further pressures on the financial system. These developments have raised concerns with respect to the longer-term economic scarring that can occur whereby many of the long-term unemployed experience long-lasting damage to their individual economic situations as well as segments of the economy that may have become semi-permanently impacted.

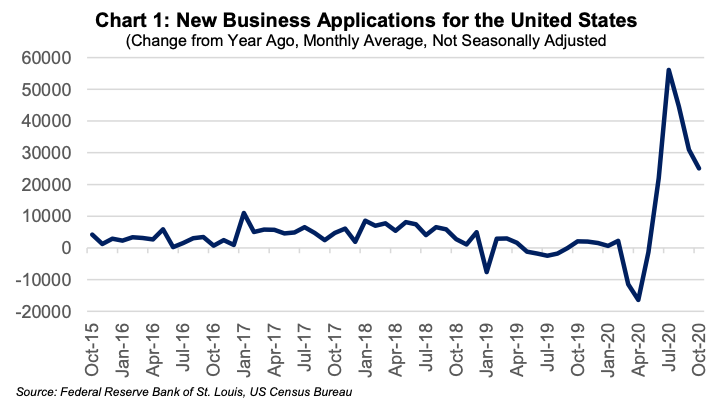

It is important to note that the United States has long been the most resilient, innovative and adaptive economy in the world. As seen in Chart 1, new business formations are up significantly this year over last year, one sign of entrepreneurs adapting to the evolving circumstances.

Despite the efforts by central banks and governments around the world to provide support to the global economy, more needs to be done. The next round(s) of fiscal initiatives should be structured to provide some immediate support and stimulus targeting productive investments to create sustainable, long-term growth. Smart support and stimulus can help the U.S. and other nations not only recover from the pandemic but also raise living standards. However, the pandemic recovery requires not just additional spending, but also a healthcare solution in the form of better testing, approved vaccines and treatments that are made widely available to allow a return to more normal activities on a global basis. This Outlook will frame the six critical transformations that are changing our world and their investment implications.

The Six Critical Transformations

“When we emerge from this corona crisis, we’re going to be greeted with one of the most profound eras of Schumpeterian creative destruction ever — which this pandemic is both accelerating and disguising… The reason the post-pandemic era will be so destructive, and creative is that never have more people had access to so many cheap tools of innovation, never have more people had access to high-powered, inexpensive computing, never have more people had access to such cheap credit — virtually free money — to invent new products and services, all as so many big health, social, environmental and economic problems need solving.”

– Thomas Friedman, NY Times, October 20, 2020

Since the financial crisis in 2008, societies have seemed to be struggling to accept, absorb and adapt to the pace and magnitude of the constant changes occurring all around. As Thomas Friedman points out, the COVID-19 pandemic has acted as another accelerant for change bringing forward by years the adoption of new ways of doing things, while affecting all aspects of our lives. Importantly, the transformations are also accelerating the greater adoption of technology which in turn drives the adoption of future innovations. The virus is forcing consumers, businesses and governments to embrace change as there is simply no other choice. There are six critical transformations occurring that are changing our world and will have an outsized impact on achieving more sustainable economic growth, increasing corporate profits and raising living standards. These transformations are the monetary and fiscal, the geopolitical and political, the digital, the social and societal, the climate and the educational. These transformations are highly interdependent, and therefore their proper management by policymakers as well as the private sector is essential to a successful transition. If done correctly, this would lead to a profoundly positive outcome for the United States as a country.

The Monetary and Fiscal Transformation

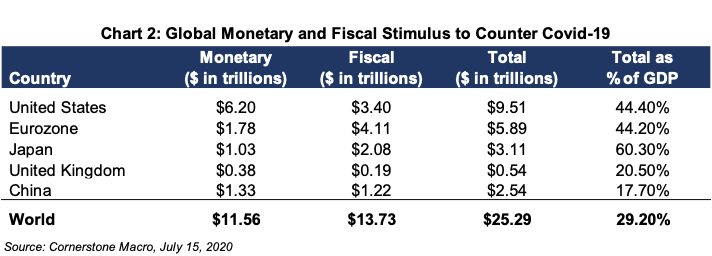

The global central banks have been working overtime this year in response to COVID-19. When the Federal Reserve announced new interest rate cuts and monetary easing in March as the virus was accelerating, investors initially viewed it as a temporary stimulus move. The Federal Reserve and other central banks have taken monetary accommodation to levels that were once unimaginable. With the Fed’s recent forecast that rates will remain low at least until 2023, more market participants are starting to believe we are in a period of semi-permanent near-zero interest rates perhaps like Japan has experienced since the 1990s. Most advanced economies cannot tolerate a return to a normal interest rate policy due to the current political and social dynamics, deflationary forces, debt levels, government spending needs and lack of sustainable growth. A premature return to a normal interest rate policy would immediately weaken economic activity and promote an unwanted downturn, a lesson learned by central bankers from the aftermath of the Great Depression. Therefore investors should anticipate that monetary policy will remain highly accommodative and understand that central banks have more tools, such as interest-rate caps, to bring to bear if necessary.

One of the most essential transformations involves the shift in attitude toward fiscal policy. During the period following the financial crisis, the prevailing view was to lean toward austerity rather than deficit spending as an answer to the debt and deficit problems present in the system. This was particularly true in Europe. Central banks have set the stage for a new era of fiscal policy by giving policymakers the ability to finance deficit spending with historically low interest rates. Governments have abandoned the policies of austerity and are replacing them with spending programs to address major needs such as infrastructure, clean energy, education, skills re-training programs, and healthcare. In the United States, the pandemic crisis has also led to a change in attitude among politicians in both parties with Republicans now supporting even greater deficit spending as our federal deficit as has reached $3.1 trillion and appears likely to increase further regardless of who wins the upcoming election. Investors should expect higher deficits in most advanced economies, new spending programs and possibly more public-private partnerships to address the most pressing social and economic issues.

What has been noteworthy in recent weeks have been the numerous calls for increased fiscal spending from Christine LaGarde, President of the European Central Bank, Federal Reserve Chair Jay Powell and several Federal Reserve Bank members including Lael Brainard, Neel Kashkari, and Charles Evans. One of the strongest messages about providing more fiscal stimulus came from IMF Managing Director Kristalina Georgieva, who said recently, “Public investment—especially in green projects and digital infrastructure—can be a game-changer. It has the potential to create millions of new jobs, while boosting productivity and incomes.” In a recent release, the IMF also stated that “policymakers have to address complex challenges to place economies on a path of higher productivity growth while ensuring that gains are shared evenly, and debt remains sustainable. Many countries already face difficult trade-offs between implementing measures to support near-term growth and avoiding a further buildup of debt that will be hard to service down the road.” The challenges are complex, and the problems can no longer be postponed, but the opportunity remains the best one to reverse the damage done by the pandemic and flawed policy responses of the past.

To meet the challenge from the IMF to invest, policymakers should consider splitting government spending plans into two categories – an operating budget and an investment budget. For the operating budget, the recommendation would be that all existing programs be reviewed to ensure that each expense is still necessary, the spend is being done effectively, and whether there are any opportunities to combine some operating expenses with investment expenses to maximize spending. For the investment budget, the recommendation would be evaluated in a manner similar to corporate capital programs with a return-on-investment approach over multiple years. This approach would avoid some of the waste that exists in government programs and allow for more efficient capital allocation.

The Geopolitical and Political Transformation

There has been a significant geopolitical transformation occurring for some time driven primarily by a few key factors – the pandemic, the shifting geopolitical landscape and each nation’s specific internal challenges. The COVID crisis restart has provided governments with a complex set of challenges as each works to protect the public, to manage the economic and social consequences of the pandemic, and to put the global economy on a sustainable growth trajectory. Top of mind is how to create a framework to think about managing the new stages of the pandemic and still address the ongoing and future needs of each nation. A recent report from the Boston Consulting Group discussed a framework employed by one government to make decisions to assess the varied interests that needed to be balanced. The report discussed an Australian state government that is “assessing each step in its reopening process against three dimensions: its potential economic benefits in terms of jobs and economic value creation, its potential social benefits in terms of improved mental health and social equity, and the degree of increased health risk from the kind of social interactions that are likely to occur.”

Other major factors to be considered are the implications of the apparent withdrawal of the U.S. as the global leader and the aspirations of China to play a leading role in the world. This is resulting in perhaps the most significant shift since the end of the Cold War with the former USSR and will have important implications for the global order for decades. We are moving to a bifurcated world with nations being forced to choose sides. This is evidenced by the measures taken by the United States to redefine its trade relationship with China, the actions surrounding technology leadership and the rising tensions in multiple parts of the globe. The changing geopolitical dynamics are forcing some nations to choose sides and allowing autocratic leaders like those in Russia and Turkey to take advantage of the global leadership void.

In addition to the geopolitical challenges, politicians are fighting battles on multiple fronts as they attempt to arrest the pandemic and manage the disruptions while attempting to navigate these six transformations. Countries are experiencing swings in national politics between the far left and the far right, and as with most things the pendulum tends to swing back from one extreme to the other after a period as the majority is typically underserved by the politics of either the far right or left. These swings are not ideal from an economic perspective as they lead to waste and suboptimal outcomes. At the same time, politicians in the U.S. and in other nations are dealing with near-term issues such as social unrest, weak national, state and local finances, significant spending requirements to address near and long-term issues, and highly divisive politics.

The Digital Transformation

Technology allows us to accomplish some of the most complicated and challenging endeavors faster, more effectively and less expensively. However, creative destruction comes at a cost with some old industries being carved out and those jobs lost, while new industries, companies and jobs are created. Some industries will see even more jobs created than are lost by obsolescence. Today technology adoption is occurring faster than ever due to ongoing innovation and the willingness and/or needs of governments, businesses and consumers to change. Corporations are embracing productivity-improvement technologies in response to the economic realities of the new business environment. With an estimated near $1 trillion investment for global deployment, 5G is a key enabler of the new technologies being pioneered including AI (artificial intelligence), cybersecurity, blockchain/bitcoin, advanced robotics, autonomous vehicles and drone delivery systems to name just a few. While much has been written about the pull forward of future demand due to the pandemic, one major aspect of the shift underway is accelerating the adoption of the next generation of technologies across a broad array of applications. In the United States, the government should play a critical role in ensuring that the right balance is struck between public and private sector roles in championing infrastructure and the US role as the global tech leader. Technology is so important to economic, political and military leadership that it is the focal point of continuing tensions between the U.S. and China. (Note: We invite readers to visit our website to hear our recent conference call on 5G).

The Social and Societal Transformation

While the economic and political changes tend to be the focus of our Outlooks, the social and societal ones are equally important for investors, and the pandemic has brought about some of the more critical forces for investors to consider. The COVID-19 virus has changed many aspects of how we live, learn, work and govern. All around the world, people’s daily lives have been changed in ways many could not have contemplated prior to the virus. This is evidenced by the shift from cities to the suburbs, from work in the office to working remotely, from in-person meeting to Zoom meetings and from mass transit to driving oneself. Some changes will be temporary, but others will be semi-permanent and still others permanent. This is impacting commercial and residential real estate values surrounding major cities, where, when and how we work, and how we educate our children. The virus has also forced companies to adopt technology more quickly to replace jobs completely or reduce tasks of workers.

The pandemic has also highlighted the need for societies to address essential services in which most developed nations have underinvested due to either the austerity bias discussed above or the lack of political will. In the United States, it has led to a shift in attitudes toward healthcare, educational costs and inequality, but it has also led to increased social unrest as evidenced by violent demonstrations in many cities. Governments’ roles in all aspects of our lives has increased because of the pandemic along with the many underlying problems that were below the surface and had been bubbling up for years.

The Climate Transformation

“The 21st-century energy system promises to be better than the oil age—better for human health, more politically stable and less economically volatile. The shift involves big risks. If disorderly, it could add to political and economic instability in petrostates and concentrate control of the green-supply chain in China. Even more dangerous, it could happen too slowly.”

– The Economist, September 17, 2020

One of the most controversial transformations involves climate change. From the melting of the permafrost to the wildfires in California to the rising water temperatures, climate transformation is clearly underway. The world has also seen rising air temperatures, changes in migration patterns and more violent storms. With the onset of the COVID-19 virus, oil demand dropped by 20% and prices collapsed. This has placed strains on oil-producing nations and the oil sector. Unlike past periods of oil price declines, this one has opened the door for clean energy transformation as governments, businesses and the public are now more focused on climate change than ever before. Supported by the current zero-interest-rate policies of central banks in the developed markets, governments are more aggressively pursuing green-infrastructure plans with the EU committing nearly $880 billion for clean energy initiatives and American Presidential candidate Joe Biden proposing a $2 trillion program to decarbonize the U.S. economy. China is also shifting to cleaner energy as its moves to reduce its carbon footprint and reliance on oil imports, while strengthening its global economic, military and political position. It is also about China playing to its other strengths. China has a dominant position in several aspects of the clean energy supply chain as it produces an estimated 72% of the world’s solar modules, 69% of its lithium-ion batteries and 45% of its wind turbines. The fact that it also has the leading position in the rare-earth materials necessary for the production and distribution of clean energy is another reason for its interest in green initiatives. China is positioned to be as dominant a player in clean energy as the Saudi’s have been in oil for decades.

The Economist also points out that “Today fossil fuels are the ultimate source of 85% of energy … A picture of the new energy system is emerging. With bold action, renewable electricity such as solar and wind power could rise from 5% of supply today to 25% in 2035, and nearly 50% by 2050.” For the transformation to take place, it will likely take a higher commitment from governments including changes to regulations, continued advances in technology to lower the costs of the transition, public-private partnerships to finance and support the required infrastructure spending, and a higher commitment from the public to support the transformation with their actions. There are potential negatives for investors as the transition may increase costs in the nearer term and lower earnings for some companies, but those companies with the balance sheets and foresight to embrace the transformation should separate themselves from their competition and increase their valuations.

The Educational Transformation

“The main hope of a nation lies in the proper education of its youth.”

– Erasmus

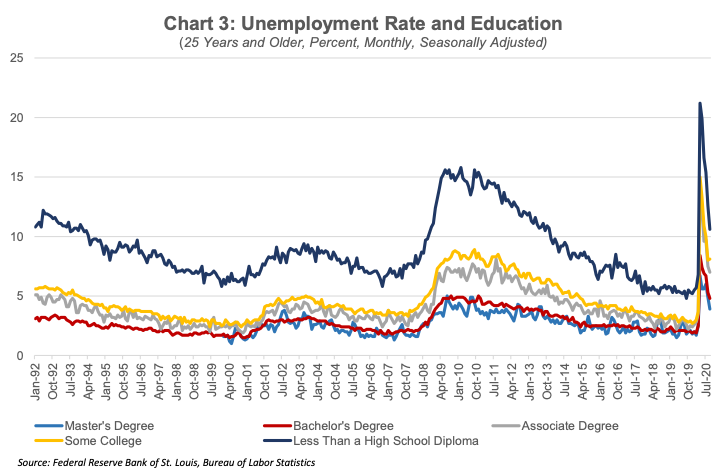

For all the progress made in society in the last hundred years, one area that has been slower to advance has been the nurturing of its most important asset – its children. Too many students today learn in a similar fashion as their parents and grandparents, and yet math and reading scores continue to decline. This is true in too many countries. As Alibaba founder Jack Ma has said, “If we do not change the way we teach, 30 years from now, we’re going to be in trouble.” If for no other reason, the rapid changes in technology require a new approach to education to provide the skills that are necessary for individuals to reach their potentials with the alternative of falling by the wayside. As shown in Chart 3, educational attainment plays a significant role in unemployment. The educational system needs to shift the focus from standard test scores as the basis for evaluating success to preparing students for a life of continuous learning. A recent World Economic Forum piece titled the Future of Jobs 2020 reported that the top 5 skills for 2025 are active learning and learning strategies, complex problem solving, critical thinking and analysis, creativity, originality and initiative, and analytical thinking and innovation as well as core social skills and emotional capabilities.

The educational system needs an immediate overhaul as it is at the core of many of societies’ challenges such as inequality, economic scarring and political divisiveness. Education is about much more than getting a good job. Without fixing the problems, the status quo opens the door for more populist politics as populations react aggressively to failed institutions, a lesson learned by several nations in the last decade. However, if done right, it can break cycles of poverty and oppression while lifting nations up. The stakes are high as democracies require a strong and growing middle class which results from an effective educational system.

Investment Implications – Looking Past the Near-Term Uncertainties

The global pandemic is now entering its next critical stage as the seasons change, new cases surge in parts of Europe, the United States, and the rest of the world. Meanwhile, the prospects for quality vaccines and therapeutics to be available in the quantity required for broad distribution to arrest the disease to allow for a return to normal activity remain, conservatively speaking, quarters away. As fall turns to winter in the northern hemisphere, we are beginning to see some troubling signs as recent announcements of severe new restrictions emerge. Politicians around the world are struggling to balance the health considerations with the social, political, and economic ones as a pandemic of this magnitude was something that few have ever experienced and something, we all hope we will not experience soon again.

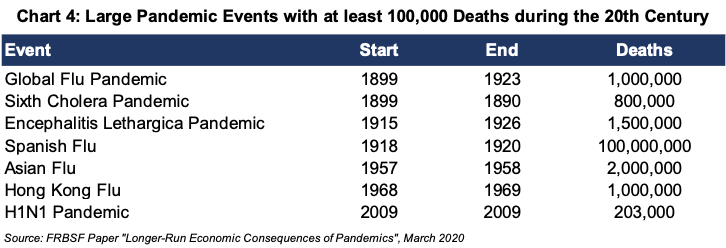

Given the unique issues associated with a major pandemic, many policymakers, central bankers and professional investors were forced to research past pandemics to better understand both nearer-term and longer-term implications. Our research has led us to an April 2020 working paper released by the San Francisco Federal Reserve Bank that studied the 15 largest pandemics with at least 100,000 deaths to determine the longer-term consequences (see Chart 4 for 20th Century pandemics). The Fed working paper concluded that past pandemics generally result in lower returns on assets and in lower interest rates. Additionally, labor shortages also developed due to the higher mortality rates at the time and therefore relatively better wage growth in the following decades. As it relates to the COVID-19 pandemic, we anticipate that the longer-term consequences can be similar to the findings of the San Francisco Fed working paper with one key exception: that we could anticipate better wages with the absence of inflationary wage pressures due to the use of technological advances, including robotics. The Spanish Flu, which lasted from February 1918 to April 1920, had four waves infecting about one-third of the world’s 1.5 billion people and killed an estimated 100 million as shown in the chart below, although some estimates of the number of deaths ranged from 40-75 million. The highest number of cases occurred in the second and third waves of the pandemic with the second wave starting in September 1918 and the third wave in early 1919 with the fourth wave ending in early 1920. We conclude that the economic effects of this pandemic will be felt for some time to come.

Periods of broad transformations are characterized by the elimination and creation of particular industries, companies and jobs. This process of creative destruction is one that the world has experienced many times in the past, is occurring now and will again in the future. Obviously for example, the leisure and travel industries, brick and mortar retail, specific areas of commercial real estate, restaurants and parts of the sharing economy have been severely damaged. If the 2008 financial crisis is any guide, then it could be 3-5 years before some of these businesses recover. On the other hand, the housing industry, the remote work beneficiaries, education and entertainment content providers, the auto market, and the technology enablers that allow companies and consumers to transition during this virus have been and are likely to continue to be among the primary beneficiaries. From a market perspective, the sudden decline in February and March as well as the subsequent rebound in the markets has been astounding to say the least, but the popularity and the success of the winners has had the effect of distorting company valuations just as the valuations of some of the 2020 laggards have as well. The valuation gaps and the uncertainties about the possible post-election policy changes are leaving investors wondering, “Where do we go from here?”

After lowering interest rates to near zero, the Federal Reserve has indicated that rates are likely to remain at or near zero until at least 2023. It is also our view that the world remains more deflation prone, and that any inflationary pressures are likely to be transitory in nature. Overall corporate earnings should continue to rebound off the lows and are likely return to 2019 levels sometime in 2021. The earning power of the winners will continue to distinguish and separate themselves from the broader market. Many of the 2020 COVID winners should continue to attract capital as their earning power expands giving these companies the resources to finance further innovation and expansion. With respect to 2020 laggards, some can reverse their performance in 2021 given that corporate earnings are poised to rebound. Mergers, acquisitions and restructurings are also playing an important role in redefining the business models for many companies. Therefore, we would caution investors not to follow the much-discussed rotation from so called “growth to value” as any market shifts can be more subtle. The one area where investors may realize better returns in 2021 is with companies that have solid balance sheets, reasonable growth and quality dividends. These companies have been underperformers this year as the market lost confidence in their ability to maintain dividend payments due to revenue disruptions, and now there is better clarity around their prospects.

The uncertainty of the impact of the upcoming election on markets has weighed on investors’ minds for several weeks. Interestingly for investors, there have been 6 Democratic administrations for a total of 48 years and 7 Republican administrations for a total of 39 years. The common perception is that Republican administrations would be more favorable for the markets, but the reality is that the average annual returns for Democratic administrations is 10.50% and for Republican ones is 6.90%. Regardless, we would advise market participants to look past the nearer-term issues and focus on the beneficiaries of the six critical transformations and the generational opportunity to build and protect capital.

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.