“In of world of change, the learners shall inherit the earth, while the learned shall find themselves perfectly suited for the world that no longer exists.” - Eric Hoffer, philosopher

In this issue:

In a February 22nd speech at the U.S. Monetary Policy Forum, Federal Reserve Vice Chair Richard Clarida said “the economy is constantly evolving, bringing with it new policy challenges. So it makes sense for us to remain open minded as we assess current practices and consider ideas that could potentially enhance our ability to deliver on the goals the Congress has assigned us.” The speech was timely as we were approaching the ten year anniversary of the start of one of the longest economic expansions in history. In March 2009, a group of global central bankers, led by the Federal Reserve, unleashed the most aggressive and coordinated monetary policy initiatives in history to set in motion the global recovery. At that time, many believed that these initiatives would result in a surge in inflation, but our readers know we did not share that point of view. Even the inflation models used by the Federal Reserve would have forecast a surge in inflation by now, but inflation has been running well below expectations. The assumption that monetary policy would promote inflation was not unreasonable based on historical precedent, but the unusual nature of the post-crisis global economy has confounded many of the so-called market experts. The presumption that the economy is more inflation prone ignores the powerful cyclical and secular deflationary forces present today. As our world continues to undergo rapid changes, we believe this time continues to be different, and reliance on past experience and historical precedent can lead to the wrong conclusions.

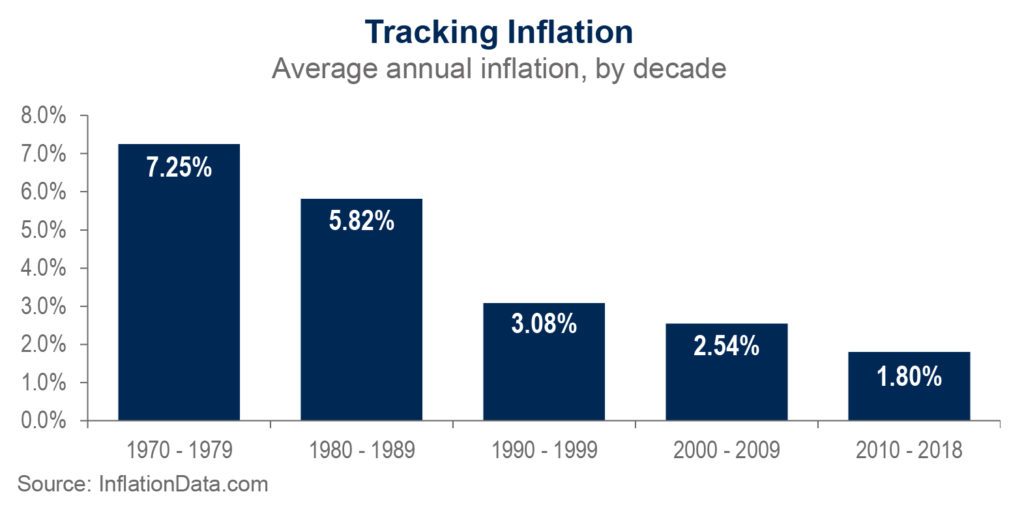

Most investment professionals have been in the business during the more recent decades in which they experienced only declining inflation coming off the high inflation years of the 1970s as seen in the chart on the previous page. Today the traditional playbook for forecasting inflation expectations is being called into question as the existing models employed by investors and central bankers appear to be out of sync with current economic conditions. In recent years, the terms ‘unprecedented’, ‘unconventional’ and ‘uncharted waters’ have been used to describe the economic conditions and policies adopted during the last ten years. Rarely do investment professionals or the media use the term ‘typical’ to describe the current investment environment. In times of rapidly changing social, political and economic conditions such as we have been experiencing since 2009, it is not surprising that the actual outcomes deviate from past experience. The difference between being in a deflation-prone versus an inflation-prone environment has important implications for investment portfolios because the winners will have different characteristics than those of past cycles. As John Maynard Keynes, influential economist, said, “When my facts change, I change my mind. What do you do, sir?”

What Might the Models be Missing?

“Going forward, we need, I believe, to be cognizant of the balance we must strike between (1) being forward looking and (2) maximizing the odds of being right given the reality that the models that we consult are not infallible.”

– Fed Vice Chair Richard Clarida, February 28, 2019

The recent speeches by Mr. Clarida and other Federal Reserve voting members reflect their awareness of the need to question the accuracy of the Federal Reserve’s forecasting models. This may be the first time that the voting members of the Fed have publicly questioned the accuracy of their forecasting models. One of the problems is that the historic models have been based on an inflation-prone system as the concept of deflation has not been embodied in investment thinking. The models were typically based on previous depressions, post-inflation periods and times of administered prices, where companies cut production instead of lowering prices. The post-financial crisis economy has different characteristics than previous periods, and adjustments to models need be made to reflect those differences. Of the developed economies, only Japan has recently experienced a prolonged period of continuing deflationary pressures, although its economy differs significantly from that of the United States. As market participants struggled to explain the lack of inflationary pressures in recent years, the view was that the factors suppressing inflation were transitory, and that inflation would accelerate in the nearer term. Yet for years inflation has remained below expectations, challenging that view. In 2017, Federal Reserve Chair Janet Yellen reminded the markets that the Fed, and several other central banks, had yet to solve the “mystery” of low inflation, despite healthy employment growth that was not accompanied by expected growth in wages.

There are several significant forces at work in the global economy which contribute to a more deflation prone environment. Ironically, the deflationary pressures present in the system today can, in part, be attributed to the same monetary policies that many thought would feed inflation. This is due to the fact that the additional liquidity in the system was invested in areas that increased productivity resulting in lower production costs and prices. These deflationary pressures have been and continue to be fostered by the following:

As a result of these factors, investors should not anticipate dramatic changes in the trajectory of inflation. Globalization and technological advances are secular in nature and should continue to weigh on inflation expectations. Despite the desire of central banks to “normalize” policy, the current accommodative approach is required to offset the deflationary tendencies of the global economy. Given these factors one can see why this period is different from past periods, and why the economy could remain deflation prone for an extended period.

What are the Investment Implications of the Deflationary Forces on Securities Valuation and Portfolio Strategy?

Contrary to conventional thinking, the current economic backdrop has the ingredients for an extended economic expansion, namely deflationary tendencies and slow growth. Historically, economic expansions come to an end when the economy begins to “overheat” and the Fed is required to raise interest rates to control inflation. A positive side effect of deflationary forces is that the economy has been able to expand for a longer period of time without driving up prices. This has had the effect of elongating the economic cycle. However, not every type of business is equally suited for thriving in an environment of slow growth.

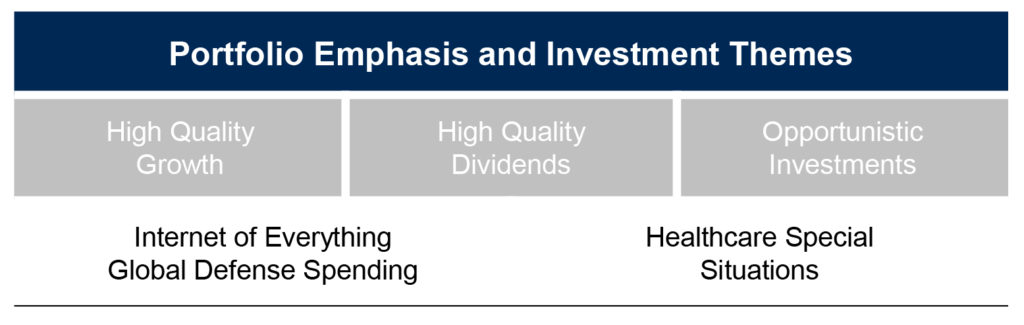

One of the key implications for investors is that companies with above-average revenue growth will command premium valuations as they are less reliant on a strong economy. At the start of the year, we felt that the U.S. equity markets were undervalued and there was a high probability of a recovery of stock prices from the fourth quarter lows. Our view was supported by the five-year low valuation placed on the market while the outlook for corporate earnings continued to be positive, inflation subdued, and interest rates stable. The U.S. stock markets have rebounded strongly since then supported by better communication from Fed Chair Powell who lowered interest rate expectations. In addition, the avoidance of a second government shutdown and greater optimism for a positive resolution of the trade negotiations with China further improved investor sentiment. Because the basis for securities valuation begins with the outlook for corporate profits, inflation and interest rates, inflation expectations have important implications for investment strategy and portfolio positioning. Against this unusual setting, the separation between the winners and losers in each industry becomes more exaggerated making security selection even more important. In a more volatile and deflation-prone environment, investment strategy should focus on high-quality growth, high-quality balance sheets, strong dividend payers and special situation investments. The companies that should command higher valuations will be those that deliver above-market revenue growth through consistent execution.

Our research has identified select opportunities for above-market revenue growth. There are four major areas of particular emphasis – technology involving 5G (the new fifth-generation cellular networks), robotics and related beneficiaries; healthcare; defense; and special situations – on which we remain focused as their growth characteristics make them among the most attractive areas in this environment. Importantly we are witnessing a significant technological inflection point whereby new technologies are upgrading existing technologies and accelerating the rate of change. This inflection point has been brought about by advances in three key areas: the introduction of 5G wireless technology, major advances in semiconductor development, and lastly, emerging innovations in the world of display. The result of these advances is that existing systems used by governments, businesses and consumers, some of which are already outdated, are falling by the wayside and require a dramatic upgrade cycle.

While 5G is just being introduced in select markets across the U.S., it will allow for the better integration of technology into everyday job functions across a range of industries including banking, healthcare, defense, and manufacturing. 5G combines a revolutionary speed change with better network responsiveness and will be the enabling technology for future applications. As we wrote in our January Outlook, Cisco Systems, Inc., projects the number of connected devices to grow by 10.5 billion between 2017 and 2022, while internet traffic will grow 3-fold during that period. The faster download speeds and reduced latency will make the next generation of chips more important. At the same time, we are seeing continued improvements in the semiconductor chips with the introduction of 7 nanometer chips coming this year. This will lead to increased processing power, higher data traffic, longer battery life and the need for more storage. This will also lead to the obsolescence of many devices in the market today as well as to the introduction of billions of new devices.

Accompanying the major innovations and advances in technology is the need for governments, businesses and individuals to increase investments in cybersecurity. The Internet of Things, self-driving cars, military equipment, drones, medical devices and critical infrastructure such as the electrical grid, water supply, public transportation are all vulnerable and in need of greater cybersecurity. As technology gets even more integrated into our society, governments, businesses and consumers need to upgrade their defenses against cyber-attacks. In the United States, the Department of Defense has been a leader in the development of new technology and many of the largest defense companies are at the forefront of cybersecurity. In addition, the big tech companies and cloud providers are also leading the way in developing the services to protect customers against attacks. This is an area in which we have invested for clients for some time. As governments, businesses and consumers spend more to protect themselves, related cyber companies with strong growth profiles will continue to be the beneficiaries.

In the coming quarters, investors should also focus on high-quality companies that pay dividends at levels above market as investors will continue to be attracted to higher rates of return. We anticipate a continuation of the low interest rate environment for some time. In addition, we would caution bond investors to make sure their portfolios have a bias towards strong balance sheet companies as we expect a large number of issues to be downgraded in the coming quarters.

In summary, we believe that there will be significant differentiation between the winners and losers in this deflation-prone economy. Under these conditions, it would not be surprising to see continued market volatility including in some of biggest beneficiaries of this outlook. Successful investing during this period will require the discipline to profit from the volatility in these same strong-revenue growth companies. Furthermore, we believe that investors should not be fixated on historical thinking to drive decisions in the coming period as the dynamics of a changing world will require adjustments to investing thinking.

“Wisdom is not a product of schooling but of the lifelong attempt to acquire it.”

–Albert Einstein, physicist

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.