ARS Investment Partners would like to extend our thoughts and prayers to our friends and all those in the Houston Area, Florida, Puerto Rico and the Caribbean who have been affected by hurricanes Harvey, Irma, Maria and Nate as well as those affected by the earthquakes in Mexico. We wish you all the best during this difficult time as you work to recover.

In this issue:

From the escalation of tensions with North Korea (DPRK) to tragic hurricanes to continued dysfunction in Washington D.C., there are plenty of issues weighing on investors’ minds, and yet the U.S. and global economies continue to gradually improve. In times like these we are reminded that among the best characteristics of the United States and its people are the resiliency and the ability to pull together following crises to come back even stronger. The terrible damage of the recent hurricanes and earthquakes will have an impact on many lives for an extended period, while having economic, financial and political implications as well for the United States. The resolve of the American people will be tested further as the nation seeks the best solution for the troubling situation developing with North Korea’s nuclear capabilities. At the same time, Congress is struggling to enact the necessary fiscal policies required to achieve sustainable growth, while the Federal Reserve works towards a less accommodative monetary policy stance. While it is easy to get caught up emotionally in the negative issues, the outlook for U.S. equity investing remains positive in our view, as corporate profits should continue to improve, interest rates should rise only modestly and inflation remain stubbornly subdued. Given the current economic and geopolitical backdrop, we thought it appropriate to offer some perspective on four key questions on investors’ minds.

As we stand today, the three major stock market indices continue to make new highs. The global economy has been performing quite well led by a resurgence in North America, Europe and India as well as the strong performance of China heading into its important October leadership conference. In the United States, consumer net worth is approaching $97 trillion up from its low of approximately $51.5 trillion in Q4 2008. Employment at home and abroad has improved significantly since the financial crisis and continues to do so. Yet as of the time of this writing, there is a growing uneasiness among many investors. We would again advise investors against market calls on being in or out of the market. Historically, efforts to time the market have produced significantly worse outcomes than riding out the market fluctuations. Instead of reacting to the market, investors should focus on owning the businesses that are the beneficiaries of the economic outlook and that meet investors’ goals.

How should investors think about North Korea’s growing nuclear capabilities?

“The U.S. and South Korean warmongers are going reckless in their move to conduct war games against the DPRK at the time when U.S. President Trump made rubbish about the total destruction of the DPRK at the UN General Assembly, pushing the situation of the Korean Peninsula to a more uncontrollable catastrophe.”

– News as reported on the official webpage of the DPR of Korea

Today the world is a more risky place following Pyongyang’s latest, and most serious, nuclear provocation. As the quote above highlights, North Korea’s actions are now perhaps the most destabilizing force in the world, and follow several decades during which the leading nations had been working to reduce the size of nuclear arsenals through a series of bilateral arms control agreements. Currently nine countries have known nuclear capabilities including the U.S., Russia, China, U.K., France, India, Pakistan, Israel and North Korea. According to the Arms Control Association, the U.S., Russia, UK, France and China negotiated the nuclear Nonproliferation Treaty (NPT) in 1968 and the Comprehensive Nuclear Test Ban Treaty (CTBT) in 1996 in order to prevent more nations from gaining nuclear capabilities. Israel, India and Pakistan are viewed as Non-NPT Nuclear Weapons Possessors after having never signed the NPT. North Korea withdrew from the NPT in 2003, and has been testing since then. However, the recent actions and outright defiance of President Kim are forcing other countries to act. Ideally, the global community would like to see the DPRK stop its program. However, it is unlikely that North Korea will forego its nuclear capabilities. Therefore the most probable strategy, short of military conflict or regime change, will be to attempt to limit the program through a combination of more severe economic sanctions, diplomatic pressures, cyber countermeasures and continued show of military force. As things stand now, containment appears to be the most likely outcome.

China is a key player in resolving the problem as it is North Korea’s only global ally and its biggest trading partner. However China will be holding its leadership conference in late October and will take only limited action prior to that time. Furthermore, President Xi does not want to be perceived to be taking direction from the U.S. or any foreign body as China has been actively working to cement its position as a global power. North Korea has strategic value to China as it provides a border buffer between it and South Korea. China does not want to see North Korea destabilized as it would likely lead to a massive refugee exodus to its Northeast region which is already experiencing economic difficulties. As the major provider of energy to the DPRK, China could pressure President Kim by shutting off its supplies, but the pipeline infrastructure is so old and fragile that it may crumble in the restart making this option difficult.

“The international configuration and balance of power has undergone profound changes: the traditional and nontraditional threats have become more salient; global growth lacks robust driving forces; the trend of anti-globalization goes rampant; and the challenges for humankind to realize a lasting peace and orderly development are unprecedented.”

– Foreign Minister Wang Yi, China Daily

As a consequence of greater global conflict, global defense spending is increasing from the current levels of approximately $1.7 trillion. The United States accounts for 39% of global spending at roughly $670 billion annually. Bearing in mind that for several years the U.S. had a policy of budget sequestration, this resulted in under-investment in our defense capabilities. The armed services experienced a reduction in training initiatives that played a role in several recent naval accidents in the Pacific. The trend in spending is now reversing as evidenced by the increasing backlogs of our defense companies. U.S. defense companies are benefitting from the increases in defense spending from other nations as well. Most importantly, U.S. defense companies represent a small percentage weighting in the S&P 500 index, so institutional portfolios that are replicating the S&P weighting have been under represented with exposures of 2.5% or less. It is our view that these businesses continue to represent strong investments that generate significant cash, have robust orders, maintain high and/or growing backlogs, and are raising dividends and continue to repurchase stock. These businesses are not dependent on economic activity, but rather on national security issues and geopolitical conditions. Therefore, defense companies should continue to have higher representation in client portfolios than the S&P 500 index offers as the geopolitical situation remains unstable.

What is the impact of the storms on the investment Outlook?

“Hurricanes Harvey, Irma, and Maria have devastated many communities, inflicting severe hardship. Storm-related disruptions and rebuilding will affect economic activity in the near term, but past experience suggests that the storms are unlikely to materially alter the course of the national economy over the medium term.”

– Excerpt from the FOMC statement dated 9/20/17

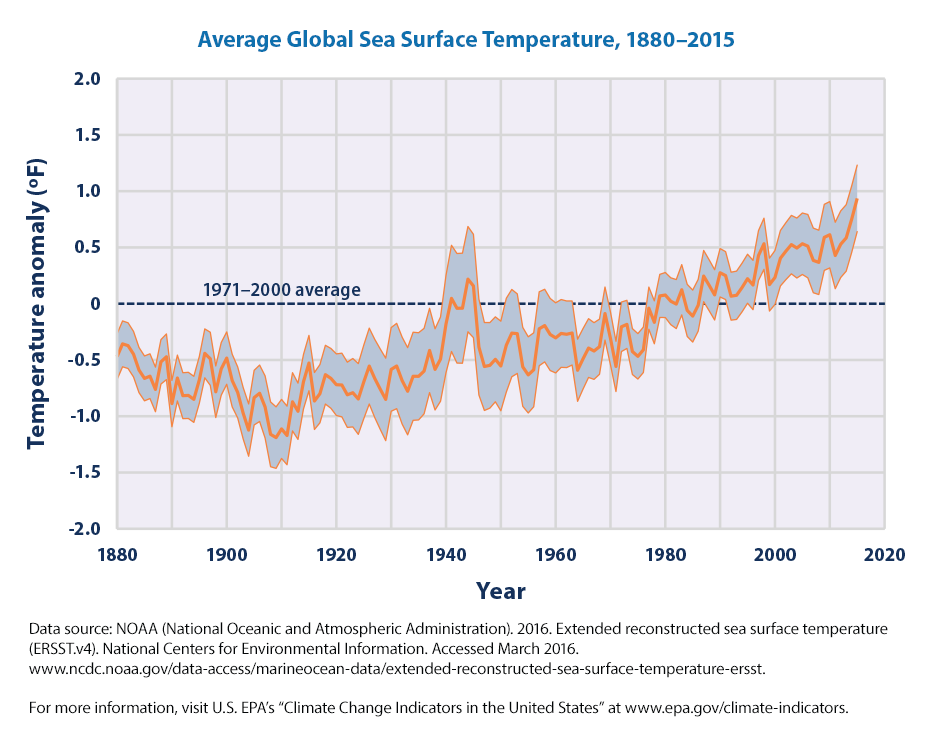

Regardless of one’s views on climate change, measured temperatures have been rising globally and the implications may be far-reaching for consumers and investors. While the FOMC could be correct in its view that the storms are unlikely to materially alter the course of the economy, we believe that it will change its character as the reconstruction and infrastructure needs can alter the supply and demand of the factors of production. As shown in the chart from the Environmental Protection Agency (EPA), water temperatures have been rising in recent decades. In fact, the higher than average water temperatures off the coast of Florida allowed Hurricane Irma to increase its speed and inflict even greater damage across the state. According to reports, Irma had sustained winds of 180 miles per hour for a record 37 hours besting the previous record of 24 hours. The National Weather Service reported that Harvey set the record for rainfall in the continental U.S. as the storm poured 51.88 inches of rain into Texas, while the earthquake in Mexico was one of the worst in the last 100 years. Investors should expect that future storms will be more powerful than those of the past. Rather than argue about the science of climate change, investors should focus on the investment implications such as the future values of coastal real estate, the cost of insuring against more violent storms, the need to replace all the damaged and destroyed goods, and the required spending to rebuild homes and infrastructure in those hard-hit areas. Additionally, the storms must have an impact on monetary and fiscal policy going forward.

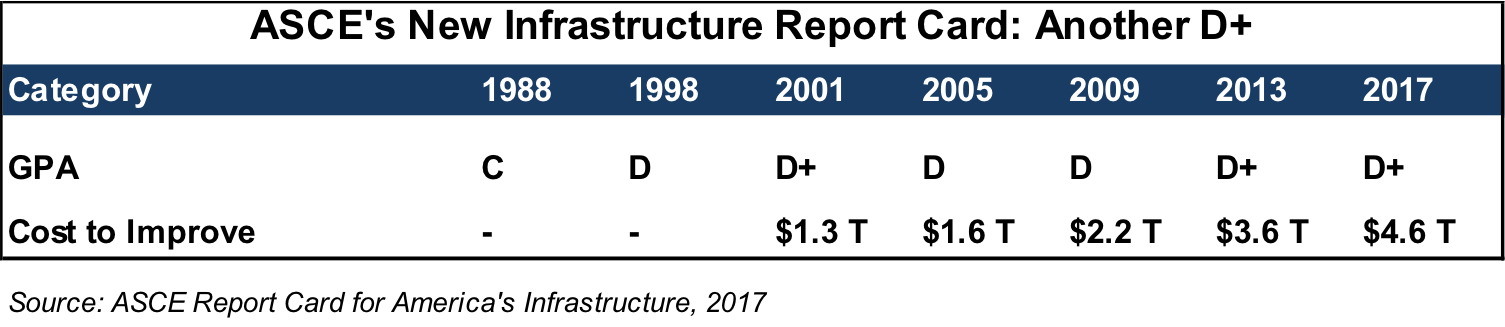

The storms further highlight the fact that the United States must address its chronic underinvestment in its infrastructure as the needs can no longer be postponed. The American Society of Civil Engineers (ASCE) has issued several reports grading the system, the spending required and the shortfall going back to 2001. At that time, the required investment to keep the infrastructure in a state of good repair was $1.3 trillion, but due to political neglect the pre-storm figure had risen to an estimated $4.6 trillion in 2017. Already technically in bankruptcy, Puerto Rico has been devastated by Hurricane Maria, and the U.S. must find the dollars needed to aid in the rebuild of this island nation as well as deal with its chronic debt issues. Three key factors working against the near-term recovery of Puerto Rico are the impact on tourism and pharma manufacturing as well as the ongoing population drain. Puerto Rico’s pharmaceutical industry represents roughly 25% of the island’s Gross Domestic Product (GDP). Tourism accounts for nearly 7% of Puerto Rico’s GDP. These two industries have been particularly hard hit and the timing makes the economic challenge even worse as we are heading into the prime months for tourism.

According to the Washington Post, “Senate Democrats, emboldened by the GOP’s failure to unilaterally pass a health-care bill, are launching an effort to win bipartisan support for the investment of $500 billion in taxpayer dollars in infrastructure improvements.” The Senate Democrats and Republicans generally agree on the need for infrastructure spending, but do not agree on how to fund it. There is a growing conflict between the needs of the U.S. and deficit spending. The big question that remains is whether the challenges facing the nation today force politicians from both parties to act based on practical realities rather than ideological considerations. For Congress, that means increasing deficit spending and reaching across the aisle to achieve its pro-growth agenda.

What does the recent announcement of the Fed to reduce its balance sheet mean?

“Meanwhile, Ms. Yellen reminded us that the Fed – indeed, several central banks – are yet to solve the “mystery” of low inflation; and this at a time when productivity is generally subdued and the relationship between unemployment and wages is behaving in a historically peculiar manner. All of which serves also to highlight structural uncertainties, including those associated with technological and demographic change, distrust of institutions and experts, and Brexit implementation.”

– Mohamed El-Erian

The Federal Reserve announced it will begin the process of reducing its balance sheet which has grown from a pre-crisis level of approximately $750 billion to $4.5 trillion. It is the start of a process to return to a more normal monetary policy stance, but we must bear in mind that it is a process that will take several years. The persistently low level of inflation has confounded the FOMC, economists and professional investors to the point where Federal Reserve Chair Yellen admitted in a recent press conference that she “cannot say that the Committee clearly understands what the causes are.” There are different explanations for the lack of inflationary pressure. One view is that the changes are structural in nature and have been fostered by rapid technological advances and globalization. With the easy monetary policy financing aggressive investment, technology is creating greater deflationary forces in many industries than would typically be experienced at this stage of the economic recovery, suggesting that the changes might be structural. The counter view is that the factors suppressing inflation are transitory, and that inflation will pick up in the coming quarters.

From our perspective, the initial stages of the balance sheet reduction program should not have a material impact on interest rates, inflation rates or the markets since much of the money created through quantitative easing remains on the balance sheets of banks and has not been lent out. Therefore, the pace suggested by the Fed should have little actual impact, but may be misinterpreted by market participants causing some added volatility in the equity and bond markets. Furthermore, investors should anticipate that the economic setting will force the Federal Reserve to continue its measured approach. Without substantive fiscal initiatives, economic growth should remain in the 2-3% range, interest rates should rise slowly and inflation will remain muted. Until the full impact of the damage from the hurricanes is known, monetary policy moves will be cautious and gradual, and this should be positive for equity investing as it should extend the business cycle.

Where can investors find opportunities given the current environment?

“Whenever I hear people talk pessimistically about this country, I think they’re out of their mind… It has been 241 years since Thomas Jefferson wrote the Declaration of Independence. Being short America has been a loser’s game. I predict to you it will continue to be a loser’s game.”

– Warren Buffett

Excessive focus on the concerns described in this Outlook diverts the attention of investors away from the opportunities to protect wealth and build capital. As Warren Buffett says so eloquently, those with a longer-term perspective will do just fine as there are many positives that do not garner the same headlines. These include rising U.S. consumer net worth, a global economy that is experiencing synchronized growth with improving employment figures, and most importantly, corporate earnings that continue to rise not just in the United States but globally. Over the next year, investors should continue to benefit from the ownership of leading technology companies including semi-conductors and semi-conductor equipment companies, defense companies, healthcare companies and select consumer businesses. Small capitalization stocks should benefit from tax reform or tax cuts which we might see passed in 2018. If Congress is able to enact tax reform, high taxpaying businesses could see an increase in earnings of over 10%. Additionally, the Administration has moved to reduce regulation of several industries and that should continue to have a positive effect on corporate earnings for those companies as well. Small cap companies should also benefit from increased merger and acquisition activity in a market flush with cash. Additionally, the market continues to misprice many of these businesses as they often fall through the cracks due to the fact that they are less followed than large companies.

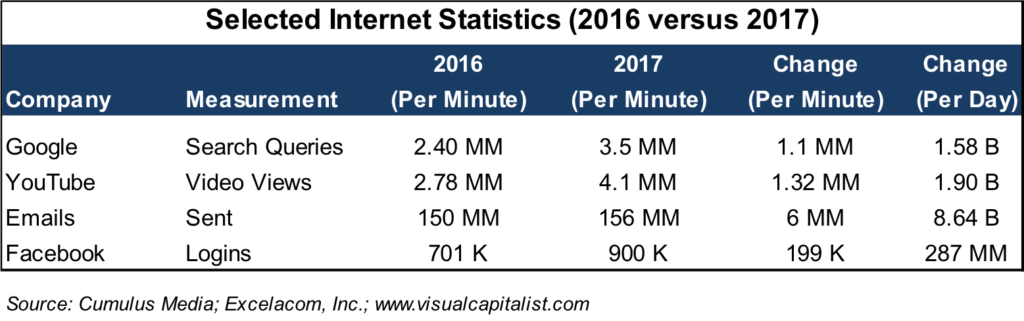

As a leader in technological innovation, U.S. companies are maintaining an exceptional pace of innovation. No one should assume that technologies have reached a level of maximum utilization. For example, Google search queries experienced an estimated 46% increase from 2016 to 2017 growing by 1.58 billion searches per day. YouTube video views grew by nearly 1.9 billion per day for a 48% increase. As internet speeds increase with the introduction of 5G technologies, the internet of things and artificial intelligence, the ability to access, process and store yet greater volumes of information will lead to even greater changes for the way we live and work. In the emerging economies of India and China, the introduction of new technologies is paving the way for the next stage of growth as these nations are rapidly transforming their economies and raising living standards for over 2.5 billion people. As positive as is the outlook for many in the technology industry, as so often happens the success and disruptive nature of a few leading companies is making them the target of increased regulatory oversight and taxation in the not-to-distant future. As such some of these leaders may be facing new headwinds after a period of unusual success.

In a recent post in Forbes, Bill Gates put the outlook in perspective, “The next 100 years will create even more opportunities like that. Because it’s so easy for someone with a great idea to share it with the world in an instant, the pace of innovation is accelerating–and that opens up more areas than ever for exploration. We’ve just begun to tap artificial intelligence’s ability to help people be more productive and creative. The biosciences are filled with prospects for helping people live longer, healthier lives. Big advances in clean energy will make it more affordable and available, which will fight poverty and help us avoid the worst effects of climate change. The potential for these advances is thrilling–they could save and improve the lives of millions–but they’re not inevitable. They will happen only if people are willing to bet on a lot of crazy notions, knowing that while some won’t work out, one breakthrough can change the world. Over the next 100 years, we need people to keep believing in the power of innovation and to take a risk on a few revolutionary ideas.”

We share Mr. Buffett’s and Mr. Gates’ views that the United States should remain one of the world’s leading nations from both a geopolitical and economic perspective. We also believe that the technological changes that lie ahead will be as exciting and disruptive as any experienced in the last 100 years. We would strongly recommend against being on the sidelines as winning businesses continue to change the world. The conviction as to the views expressed in the Outlook are reflected in our heightened exposure in client portfolios to the companies that are the primary beneficiaries.

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.