In this issue:

AR Schmeidler is pleased to announce the launch of our new website. The new website offers easy access to current and past editions of the Outlook, as well as information about our firm’s history, investment philosophy, process and investment professionals. Please visit our website at www.arsinvestmentpartners.com.

In our July Outlook, ARS expressed the view that many of the concerns of the global economy had been discounted to a meaningful degree by the markets, and that the pervasive focus on these issues was masking several positives in the US and global economy. The economy has in fact shown more resilience than many expected, and the equity markets went on to post strong returns for the third quarter. Significant challenges remain and will be with us for some time; however, at present, these challenges are balanced by several offsetting positive factors, including historically low interest rates, relatively low inflation, continuing monetary creation and the gradual improvement of several important US economic indicators, including housing and manufacturing indices. In addition to the cumulative effect of global monetary and fiscal stimulus, we also see important structural improvements in the US economy, which we discuss in further detail below. The Outlook calls for a low growth environment for both the US and global economy, and our research continues to target companies with the opportunity to increase earnings, assets and cash flows against this backdrop.

The magnitude and duration of the Federal Reserve’s policy in support of the economy is unprecedented in the monetary history of the United States. The actions resulting from the September Federal Open Market Committee (FOMC) meeting provide investors with yet another indication that US economic and employment growth may be muted for several more years. The Committee decided to keep short-term interest rates at near zero percent and stated that it anticipates that exceptionally low levels are likely to be warranted at least through the middle of 2015. The FOMC will then have committed the United States to a minimum of seven years of historically low short-term rates. When combined with the introduction of the third round of quantitative easing (QE), the Federal Reserve has made an open-ended pledge of its balance sheet to support its statutory mandate of maximum employment and price stability. In what has been perhaps its strongest statement yet, the Committee told the markets that a “highly accommodative stance will remain appropriate for a considerable time after the economic recovery strengthens.” This is a point reiterated on October 1st by Chairman Bernanke at the Economic Club of Indiana.

Several other central banks have also undertaken unconventional actions due to concerns about their respective economies. Mario Draghi of the European Central Bank (ECB) delivered a strong message to the markets that the ECB stood ready “to do whatever it takes” to support the Eurozone economy through an aggressive monetary policy. Furthermore, the Bank of Japan announced another $128 billion of quantitative easing bringing its total to over $1 trillion. The scale and scope of these actions seemed unimaginable just four years ago and speak volumes about the economic challenges facing the global economy.

These actions have potentially played a role in boosting confidence, enhancing liquidity and bringing down certain interest rates; however, they are not without critics. Ever-present with quantitative easing is the threat of inflation and competitive currency devaluation. This concern was summarized by the Finance Minister of Brazil in a recent speech stating that the US QE initiatives are creating significant problems in currency management and might spark a “currency war”. Aggressive monetary policy also takes pressure off the legislators and administrators to enact sound and responsible fiscal policy.

This Outlook addresses the impact of monetary and fiscal policy on interest rates, inflation and global growth prospects and the implications for investment portfolios. Also included is an update on some of the positive secular changes taking place in the US that are balancing some of the obvious challenges, including most notably the pending fiscal cliff.

“In order to restore confidence, policy makers in the euro area need to push ahead with great determination with fiscal consolidation, structural reforms to enhance competitiveness and European institution-building.”

– Mario Draghi, President of the European Central Bank“Monetary Policy, as I said many times, is not a panacea. We’re looking for policy makers in other areas to do their part. We will do our part, and we will try to make sure that unemployment moves in the right direction. But we can’t solve this problem by ourselves.”

– Ben Bernanke, Federal Reserve Chairman

In the absence of effective fiscal policy and economic restructuring efforts by the developed nations, the central banks’ responses have needed to be sufficiently reflationary and forceful on their own to offset the economic contraction. This is particularly true for Europe as many nations’ problems are growing worse each day. At present, social unrest is rising as a record high 11.4% unemployment rate in the Eurozone has fed increasing discontent with the additional sacrifices being demanded as the price for further financial aid. These deleveraging and restructuring efforts are

destined to fail if the policies employed promote further contraction. Additionally the politicians responsible for such policies will not be reelected. Central bankers have recognized the need to buy time while they wait for fiscal and economic policies to be implemented to address the many imbedded structural issues preventing a sustainable recovery.

From the time he assumed responsibilities as President of the ECB from Jean Claude Trichet, Mario Draghi has consistently utilized unconventional monetary policy which reflects both the degree of the challenge and his MIT-orientation towards solving problems proactively. From the introduction of the LTRO (Long-Term Refinancing Operations) last year to his bold statement this past August about keeping the Euro intact through QE and other initiatives, he has managed the political and economic issues deftly, but the coming months will test his skills as he attempts to promote a fiscal union. Mr. Draghi’s actions along with signs of economic stability have bought time, but now Europe needs policy makers to become action-takers to resolve the crisis. We believe that we have reached an important inflection point because policy makers are running out of time to address pressing needs. This position was recently supported by IMF’s Christine Lagarde who warned against the possible excesses of austerity and suggested stimulative initiatives also be enacted.

While many may view the recent announcement of additional QE from the Federal Reserve as more of the same, the open-ended nature of this program makes it quite different. As a student of the Great Depression and of the Japanese economy in the 1990’s, Mr. Bernanke is of the belief that central bank response in each case was neither sufficient in amount nor duration. The announcement of QE3 indicates that the Federal Reserve recognizes that its first two QE programs were not sufficient to move the needle on unemployment. Many US politicians and some economists have criticized the use and the value of QE3 as well as expressed considerable concern about the inflation that could result. The Federal Reserve is willing to accept higher inflation if it would be accompanied by rising employment and a strengthening of the housing market. The Committee views food and energy inflation as transitory. Mr. Bernanke is focusing on increasing employment which would reduce the federal deficit by increasing tax revenues and lowering unemployment insurance costs.

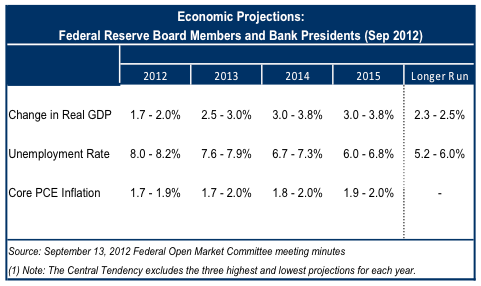

The chart below provides the Federal Reserve’s assumptions for interest rates, inflation rates and unemployment rates extending several years and highlights the challenges facing the United States economy. It is this data and these projections that influence the Committee’s policy decisions.

One of the unfortunate consequences of the actions of the Fed is that they allow politicians to delay making the difficult fiscal policy decisions needed to address the structural problems of the US. According to a recent Gallup poll, the approval rating for Congress hit a 38-year low with only 10% of Americans approving of the job Congress is doing. Without stimulus from the Federal Reserve, the US might still be mired in a recession, and every politician’s job would be at risk, which sadly seems to be the prerequisite condition for action. With the pending fiscal cliff almost upon us, policy makers cannot ignore the problem any longer. The business community has been emphatic with congressional representatives about removing obstacles hindering growth. Immediately after the election, the winner will need to work with Congress to reach a compromise, something it has not been willing to do up to now. A failure to orchestrate a compromise would result in higher taxes and lower government spending, leading to slower economic growth and an even greater burden on the Federal Reserve.

Over 270 stimulative policy initiatives have been implemented around the globe during the past 12 months including interest rate reductions, tax cuts, lower reserve rate requirements and quantitative easing initiatives. The two key issues that have driven our investment thinking over the past several months have been the anticipated improvement of leading economic indicators (driven by these stimulus initiatives and lower inflation) and the massive monetization by central banks. It has been our belief that the combination of these two forces has been underestimated by the markets as the focus of the media continues to be on the negative headline issues of Europe, China and the US.

ARS portfolios have benefited in recent months from the gradually improving economic trends, as well as particular portfolio initiatives. We have been transitioning our China growth exposure from steel-related infrastructure investments to power and energy investments which are reflective of an economy entering a more advanced phase of industrialization. We have also added investments in companies with rather unique competitive positions whose business activities are dependent on the global economy. A third initiative has been to add to high-conviction holdings that the market had temporarily mispriced, including select financials, gold and energy securities. Finally, we continue to find opportunities in special situations such as spinoffs. As we wrote in recent investment outlooks, ARS continues to favor the following areas:

Beneficiaries of the Revitalization of Industrial America: A sea change for US industry and corporate America is underway. Wage increases from overseas competitors, low natural gas prices and for the first time in many years increasing oil and natural gas production in the United States are contributing to a resurgence in US manufacturing and its competitiveness. A recent Boston Consulting Group report suggests that the US now has a competitive cost advantage over the UK, Japan and Germany, and that its disadvantage versus China is narrowing. Key beneficiaries include energy-intensive manufacturers, users of energy feedstocks (such as chemical, fertilizer and manufacturing companies), pipeline companies and transportation companies, among others. The current low interest rate environment also gives companies access to historically low-cost capital to finance expansion and pursue shareholder-friendly policies such as return of cash through dividends and share buybacks.

Select Media and Technology Companies: Internet traffic continues to swell and is expected to grow by a factor of four in as many years. Mobility, cloud computing, machine-generated information and internet video are among the underlying drivers of internet use. Data center companies and owners of wireless spectrum will be key beneficiaries as businesses and consumers demand access to data anytime and anywhere.

We also see opportunities in the media industry, which we believe is approaching an important inflection point as content companies (producers of original programming), are set to benefit from the emergence of novel distribution outlets. High-quality content owners will benefit from an expanding customer base that can be serviced at negligible incremental costs, positioning them to benefit from the disruptive era in video distribution that is occurring.

Energy and Strategic Resource Opportunities: Equities in this sector rebounded in the third quarter after being hurt by several compounding factors over the past 12 months. ARS believes that many of these factors are temporary in nature, but together they conspired to drive energy company valuations to the lowest levels in a decade when measured by valuations of cash flow and/or reserves, with several companies in ARS’ portfolios trading for less than 4x cash flow from operations. These companies are well-positioned to benefit from a cyclical recovery in the US and the developing world, as well as growing secular demand for energy in the developing world and expected increasing US reliance on natural gas in the coming decade. The attractive valuations also make the mid-sized exploration and production companies appealing acquisition candidates to strategic buyers. Importantly, some companies have shifted the emphasis of their capital deployment from purely long-term growth projects to a balance of growth and return of free cash flow to shareholders which we expect to be well received in the coming quarters.

Dividend Payers: With interest rates at historic lows and quite possibly set to stay there for longer than many anticipate, investors should look to benefit from the attractive dividends currently available from select US corporations with strong balance sheets and their policies of raising payouts over time. Moreover, we expect companies to consider special dividend distributions before year-end.

Beneficiaries of Currency Devaluation:Currency devaluation or debasement occurs when governments manage debt service and other obligations through monetizing or printing currency. During such periods, as the purchasing power of fiat (paper) currency declines, tangible assets and productive businesses tend to maintain their relative values to society and appreciate in currency terms. For this reason, gold has tended to be a standout performer during times of currency debasement. We believe that gold and undervalued mining companies with growth potential, low production costs and strong cash flows should have continued representation in ARS client portfolios.

Financials: Several forces have combined to lead us to selectively add financials to portfolios. While US and European banks continue to make headlines with trading losses, fines and regulatory issues, the news flow and negative sentiment towards the industry is offering potential opportunities to buy quality businesses at unusually attractive valuations of earnings and tangible book value. Several of these investments are particularly well positioned to benefit from a recovery in the US housing sector and a cyclical improvement in the US economy overall.

Opportunistic use of Cash: Because the business cycles have tended to be shorter in duration in the current environment of near-zero interest rates and fluctuating inflation, it can be prudent to periodically hold higher cash balances in accounts, particularly during times of greater market complacency and lower margins-of-safety in company valuations. As importantly, it provides the buying power to be opportunistic to purchase shares of attractive companies at compelling valuations.

Elections bring to light many of the differences in beliefs about social and economic issues, and this election is being described as a choice between two different views for America. Rather than focus on the choice and the differences, this is meant to provide a balanced view of the short and long-term concerns and opportunities that exist today and why, in the face of the many challenges, the US remains uniquely positioned for the future. Elections are often divisive and this one certainly seems to be. While many politicians are focused on getting re-elected, unemployment remains stubbornly high and a growing number of unemployed are giving up and leaving the work force. What should be the top priority, creating jobs, is being put on hold. The looming fiscal cliff is not being addressed and likely will not be until after the election. Finally, businesses are putting hiring and spending on hold until they have greater clarity regarding taxes and regulations.

Against this backdrop, there are several near-term positives as well. One of the least discussed and appreciated advantages of the low interest rate environment is that it is allowing the system to finance its current and longer-term needs at record low costs. The three biggest beneficiaries are housing, financial institutions and corporations which are critical drivers of the economy. Housing has been gradually improving, the financial institutions are in much better financial shape than just a few years ago, consumers have been reducing their debt burdens and industrial America is experiencing a resurgence. The US is taking advantage of its tremendous energy resources, our technology industry remains one of the most innovative in the world, and manufacturing is regaining its competitiveness as cost differentials close with developing nations.

The long-awaited recovery in the housing sector has been understated by many but is critical to our economy. Home building has traditionally played a key role in helping to lift economies out of recessions as slowing growth leads to falling mortgage rates, in turn making homes more affordable and leading to greater demand and ultimately an increase in construction jobs. The recession following the financial crises of 2008 was a key exception. Heavy excess supply including “shadow inventory” of repossessed homes held by the banks was a significant overhang on the market making new homes less competitive. This led to a decline in housing starts from over two million prior to the financial crises to a 65-year low of fewer than 500 thousand units in 2009. According to the Census Bureau and JP Morgan, housing starts have averaged approximately 1.5 million per year since 1947, driven by growth in population, household formation and GDP per capita. From 2009 through 2011, housing starts remained below 600 thousand, more than two standard deviations below the long-term average.

This period of below-trend building while the population and number of households have continued to grow has slowly brought supply and demand back into balance. Vacancy rates and new and existing home inventories are down and the cost of owning a home relative to renting is approaching a 40-year low as rents continue to rise while mortgage rates continue to drop. As a result of these factors, the Case Shiller Home Price Index recently turned positive, and housing starts have climbed back to 872 thousand on an annualized basis. Importantly, each incremental 250 thousand housing starts is estimated to generate up to one million jobs, which would provide a significant boon to consumer confidence and spending and which is not currently anticipated by the financial markets. An additional benefit of home price appreciation should be to strengthen the collateral values and hence the balance sheets of the banking system, potentially contributing to a virtuous circle in the economy. Moreover, the US housing recovery is somewhat insulated from factors impacting the international economy, and is providing an important offset to weakness in other parts of the globe for the benefit of the US.

Longer term, the US is well positioned relative to other nations even with our debt, deficit and employment problems. It remains the leading country in innovation, and through innovation companies are able to transform industries from secondary to leadership positions. Five key US advantages should give people cause for optimism:

Demographics: A significantly better demographic profile over most developed nations and in a few years over China as well

Natural Resource: Abundant food, energy and water resources relative to other nations

Culture of Innovation: Arguably the most innovative and entrepreneurial culture in the world

Capital Market System: A capital market system that is one of the world’s most advanced and liquid as the US dollar remains the world’s reserve currency

Worker Productivity: A workforce that remains one of the most productive in the world

These are all key ingredients which foster growth. It is easy to focus on the many challenges, but there is a reason the US remains home to many of the best and strongest corporations in the world. It also remains the country of choice for foreign students to come for their education. Finally, the US is the nation that many people will risk their lives to come to for a chance at a better life. This is not to suggest that the United States does not have its flaws, but rather it enjoys many advantages that are frequently overlooked. The United States can mobilize faster than virtually any other nation to resolve any difficulty it confronts when it acts with a sense of urgency and common purpose.

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.