In this issue:

Investors are appropriately concerned about several factors today, including the European crisis, a soft patch in the US economic data, the pending US fiscal cliff and a cyclical slow-down in China and other developing markets. These concerns are significant but have already been discounted by the markets to a meaningful degree, and we believe that the pervasive focus on these issues is masking several positives in the US and global economy.

In the United States, the decline in oil prices has led to lower gasoline prices, which is a significant stimulus (non-taxpayer funded) for a consumer-driven economy and is being augmented by lower electric utility bills resulting from the decline in natural gas prices. In recent years, we have repeatedly seen that approximately two quarters after a peak in oil prices, the US economy has begun to improve. Most recently, oil prices peaked in February and have since fallen by more than 20%—a benefit that is filtering through the US economy as we speak. Moreover there has been a fundamental change in the US energy sector which is having a major impact on the competitiveness of the US industrial base.

In Asia and other developing markets, energy and other commodity prices have come down considerably, providing stimulus to its economy. Importantly, lower inflation has given China the policy room to once again prioritize growing employment over fighting inflation, and China has already implemented multiple reductions in bank reserve ratio requirements and interest rates. Other developing nations are also benefitting from the lower inflation pressures and are acting to stimulate their economies as well. These monetary and fiscal stimulus measures began a few quarters ago and should start to have a positive influence on the global economy in the second half of this year.

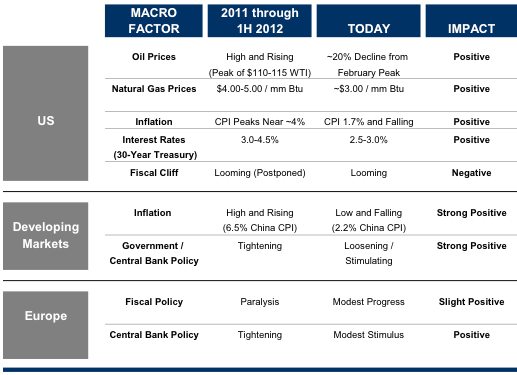

In other words, falling inflation and stimulative fiscal and monetary policy represent a material change from the rising inflation and tighter fiscal and monetary policy that we saw last year. A comparison of these important macro factors impacting the global economy today versus late 2011 through early 2012 is presented on the following page:

We remain sensitive to the structural problems that exist in the global economy which we address in this Outlook. However as a result of the negativity in the media, longer-term investors now have the opportunity to purchase world class companies which we refer to as the crown jewels of the global economy at particularly attractive prices. While we expect modest support from fiscal policy outside of the US, central banks will feel compelled to take the lead in addressing the unemployment, debt and deficit problems, albeit reluctantly, with aggressive action with respect to still lower interest rates and ultimately currency devaluation. Attractive valuations combined with a resilient economy in the US and a cyclical pick-up in the developing world should create a more constructive investment outlook in the coming quarters.

In addition, our bottom-up research has been focused on new opportunities consistent with the six focus areas identified in our April Outlook— America’s industrial resurgence; the mega-trends of mobility, data and content; high dividend payers; the beneficiaries of currency devaluation; financials; as well as energy and strategic resource companies. During the quarter, ARS implemented changes in portfolios to reflect ideas our research team identified with new positions initiated in mobility, data, content and high dividend payers, while reducing exposure to selected materials companies in the supply chain for steel production. The following pages provide detail on the impact of policy paralysis in Europe and the US, the changes occurring in China’s economic program, followed by a discussion of the potential for a second half cyclical improvement and the investment implications for investors.

The failure of governments in the developed nations to provide the fiscal policies necessary to adequately support growth in the face of a synchronized global slowdown has forced central bankers to step up monetary policy initiatives. Although there have been over 200 fiscal and monetary stimulus initiatives implemented globally in the past ten months, the most significant have come from the central banks. Last month, the Federal Reserve announced it would expand Operation Twist, its program of purchasing long-term bonds by selling short-term bonds in order to lower longer-term interest rates. At the time of the announcement, Ben Bernanke, the Chairman of the Federal Reserve, indicated that he was ready to take additional action if needed. On July 5th, global central banks again took aggressive and decisive action. The European Central Bank (ECB) and the People’s Bank of China (PBoC) moved to counter the economic slowdown by cutting interest rates, and the Bank of England (BOE) expanded its asset-purchase program (“quantitative easing” or printing of currency). These announcements took place within an hour of one another. One reason for these actions is to encourage the banks to increase their lending to stimulate growth. As many investors hope for some form of coordinated central bank action to jumpstart the global economy, the more likely course of action is a series of reactive policy initiatives, whereby nations respond with policies that are in their own best economic interests, particularly to expand exports to counteract their slowing domestic economies. As we have previously written, such actions by one country to improve its competitiveness will cause other nations to respond with a counter action to regain any lost ground which will lead to further competitive currency devaluations.

Complicating matters for central banks is the massive monetary disequilibrium that is evidenced by capital flight from the periphery of Europe to Germany, the UK and the US, which has created record low interest rates for the 10-year bonds of the US and Germany. During the second quarter, Greece and Spain saw record capital outflows into safe-haven assets such as German bunds, the Swiss franc and the US dollar and treasuries. Investor sentiment has been so negative that the German 10-year bund reached a record low yield of below 1.2% this month. With Spanish 10-year bond yields approaching the 7.5% level, the large yield differential between the Spanish and German debt is a symptom of the real and perceived differences between the German economy and many of the other nations in the eurozone. This monetary disequilibrium is forcing countries with large foreign reserves to reconsider their choices for how those reserves are deployed, as further discussed later in this Outlook.

The political dysfunction of Europe has prevented governments from effectively addressing the debt and deficit challenges with suitable immediate and longer-term solutions. Last month, the European leaders met for the 20th European Union (EU) Summit since the start of the financial crisis. While this meeting was more productive than others and some progress was made in temporarily lowering borrowing costs for Spain and Italy, in strengthening the banking system and generally improving confidence that the problems are being understood, there is much that remains to be done. Each meeting of the EU highlights the need for not only a monetary union, but also a more fully integrated banking, fiscal and political union as well. However, the major historical and cultural differences among the European nations do not auger well for meaningful structural solutions in the short-term.

Today the periphery member countries require a dramatic restructuring of their economies to remain economically viable within the union. Realistically, a restructuring will require the wealthier EU nations, who have been the primary beneficiaries of the euro, to bear much of the costs. To date however, the more fiscally-sound EU nations, led by Germany, have continued to benefit from the ability to export goods to the periphery in exchange for euros, but have not addressed the impact that the single currency and forced austerity is having on the weaker members.

Unemployment in Europe was recently reported at over 11%, and this poor employment data highlights the slowing global growth currently taking place. Slower growth has been a catalyst in the recent market pullback although some retracement was to be expected after several months of gains earlier in the year. The unemployment problem is made worse by the austerity programs being forced on the peripheral nations causing social and political stresses. This has placed tremendous pressure on the incumbent political leaders making the implementation of the needed reforms increasingly difficult. In France, François Hollande won the recent election on a platform of growth reforms and anti-austerity which was a message that was welcomed by many in the indebted nations. Hollande’s win changed the working dynamics among European leaders as his predecessor had aligned with Germany’s Angela Merkel to push an austerity platform to address the deficit problems. He will be a significant force in shaping the solutions to the European crisis going forward.

It is quite possible that it will require a meaningful slowdown or even a recession in Germany itself driven by faltering exports before the German people come to appreciate that weakness in the peripheral nations has negative repercussions for their own economy. For now, the actions needed to be taken by the political leadership will most likely result in the presiding party losing in the next elections. Fixing the problems of Europe and the US without growth initiatives will not work in our opinion, but only

lead to lower living standards and increasing social stress, which is not a recipe for re-election. It is clear to all the parties involved in the European crisis that a major restructuring is required in the peripheral countries. It is also becoming increasingly clear in the developed world that austerity alone will not provide the solution. Therefore, leaders must work to delicately balance the need for the immediate growth initiatives favored by France, Italy, Spain and Greece with economic restructuring and accountability demanded by the Northern European nations.

It would be unfair to criticize the political dysfunction of Europe without addressing the work of the two parties here in the US. The failure of Washington to put partisan issues aside to address the economic needs of the United States is shameful. It would be beneficial if the politicians stopped running for office for just long enough to focus on the critical issues facing the nation today—including creating a path to sustainable growth for the world’s most dynamic economy. Job creation, the fiscal cliff, the federal deficit, entitlement program costs and tax reform should all be priorities. Businesses and consumers need clarity on many of these issues in order to have the confidence to make effective investment and spending decisions, which in turn drive growth. Without sound fiscal policy, the burden has fallen on the Federal Reserve to use monetary policy to stimulate growth particularly over the past few months when US economic data has begun to show signs of slowing. However, the benefits of monetary stimulus only go so far, and ultimately greater visibility from a sound long-term fiscal plan will be required.

While the pending fiscal cliff is clearly a concern, we suspect that it has been the softening trend in US economic data that has had the bigger impact on markets. Therefore we see the potential for a more constructive investing environment if the economy begins to show signs of stabilization. Already we are seeing some positives including the slow improvement in housing markets, the continued resurgence in industrial America, the gradual return of manufacturing jobs to the US driven by higher wage inflation overseas and lower US natural gas prices and the overall new abundance of energy resources. Of particular note is the benefit to corporations and consumers of the lower cost of energy which has the same effect as a direct stimulus program or tax refund by putting incremental dollars into the pockets of consumers—a key benefit to an economy that is 70% consumer-driven. Oil prices peaked five months ago and have declined 20%, while natural gas remains well below its highs of last summer. The effects of these lower prices should start to be reflected in the economy in the second half of the year. Note that because of the importance of consumer discretionary income to the US economy, energy price trends bear watching in the coming months, as does the impact of the severe US drought on farm prices and food inflation.

In a year where a once-in-a-decade leadership transition is taking place, the top priority for the Chinese government is achieving sustainable growth to drive employment and rebalance the economy. China is in the process of shifting from an export-driven economy to one that is more balanced with greater participation from domestic consumption. During 2011, the increasing inflationary pressures in China forced the government to shift its emphasis from growing employment to fighting inflation by raising interest rates, tightening credit and redirecting or reducing fixed asset investment spending. The government had been targeting an orderly slowing of the country’s rapid growth to prevent overheating, but growth has now slowed to uncomfortable levels. The recent economic data indicates the Chinese government has overshot its target. In hindsight, the impact from China’s policy actions on growth was greater than we expected, which has been a factor in our underperformance. One of the critical implications of the problems of Europe is the fact that the region is one of China’s largest export markets and the slowdown there is creating multiple problems for the Chinese economy. This will lead to four important actions by the Chinese in our view: loosening of monetary policy, implementation of domestically-focused stimulus programs, redirection of reserve investments from devaluing currencies to the purchase of strategic assets, and weakening of its currency, which is currently pegged to a rising US dollar. Each anticipated action is briefly described below:

Shift Back to Pro-Growth Monetary Policy: Key to China’s outlook is the recent easing of inflation pressures. A year ago, China’s inflation rate was heading toward 6.5% and their government’s top policy goal was to prevent any over-heating. Chinese policy makers raised interest rates and tightened credit requirements, which succeeded in slowing growth (admittedly—more so than we expected). Importantly, inflation peaked last summer and has been steadily declining. Earlier this year, inflation rates fell below the key level of 4% that China’s leadership targets as a maximum, and most recently fell to 2.2%. The significant easing of inflation has given China the room to shift from a tight monetary policy to an easier one, and the PBoC has already implemented two interest rate cuts and multiple reductions in its banks’ reserve ratio requirements. These initiatives typically begin to flow through the economy with a two-quarter lag, suggesting a positive influence on China’s GDP later this year.

Domestic Stimulus Programs:China has introduced many small but important, initiatives to stimulate its domestic economy, while working to avoid falling into debt problems similar to those of the developed nations. China will likely engage in another stimulus program to meet its own growth goals. China is in the unique position to be able to afford to stimulate its economy both from a financial perspective and from a political one, as its command and control economy allows for the type of quick decision-making process that is missing from the US and European systems.

Redirect Reserve Investments to Strategic Assets: Without the support of effective fiscal policy, the ECB, the Federal Reserve and other central banks are attempting to devalue their currencies to preserve their competitive trading positions. As the world’s largest holder of currency reserves, China will look to find better use of its assets than to invest solely in depreciating currencies such as the Euro. China continues to build strategic reserves in energy (oil/gas/coal) and materials (grains, iron ore and rare earths) and its state-owned enterprises continue to acquire foreign natural resource companies. Additionally, we expect the Chinese government to continue to be a large buyer of gold with its currency reserves.

Currency Devaluation: China’s currency is roughly linked to the US dollar, and the recent US dollar strength versus the euro has weakened China’s trading position by making its exports more expensive. ARS believes that there is a high probability that China will resort to devaluation of its currency to protect its export industries as its domestic economy is not sufficiently developed to offset the weakening global economy. This will draw significant criticism from many in Washington, who have for years expressed concerns that China is a currency manipulator. China’s likely response will be that it is acting in its and its trading partners’ best interests.

Investors are coming to grips with the fact that the current deleveraging process will take many years to resolve. The 1930’s deleveraging process in the US, for example, took approximately 12 years. Since election cycles are significantly shorter than the deleveraging process, this makes the implementation of the necessary structural changes even more difficult. Similarly, the industrialization of the developing nations will take years, if not decades, to complete. Secular trends do not move in a straight line and the beneficiaries of global growth will evolve over time, particularly as supply catches up with demand in selected industries, such as we have seen in the steel sector. However, given the size of the populations of the developing economies, where hundreds of millions of people are moving into the middle class, we expect to see a strong tailwind of global demand for certain sectors for many years to come. Investors should be focused on understanding the dynamics of the global economy and identifying the opportunities that will result. Our research has identified many companies that are the beneficiaries of important secular trends and that are selling for compelling valuations. With many corporations flush with cash that earns little to no return, the case for dividend increases, share-buybacks and accretive acquisitions is powerful and continues to grow. ARS continues to place increased emphasis on the following areas:

Beneficiaries of the Revitalization of Industrial America: A sea change for US industry and corporate America is underway as wage increases from overseas competitors, low natural gas prices and for the first time in many years increasing oil and natural gas production in the United States are contributing to a resurgence in US manufacturing and its competitiveness. Key beneficiaries include energy-intensive manufacturers, users of energy feedstock, such as chemical and manufacturing companies, pipeline companies and transportation companies, among others. The current low interest rate environment also gives companies access to historically low-cost capital to finance expansion and pursue shareholder-friendly policies such as return of cash through dividends and share buybacks.

Select Technology Companies: Internet traffic continues to swell and is expected to grow by a factor of four in as many years. Mobility, cloud computing, machine-generated information and internet video are among the underlying drivers of internet use. Data center companies and owners of wireless spectrum will be key beneficiaries as businesses and consumers demand access to data anytime and anywhere. We also see opportunities in the media industry, which we believe is approaching an important inflection point and content companies are set to benefit from the emergence of novel distribution outlets. Netflix, Hulu and Amazon have been purchasing content licenses at a voracious pace. Other well-capitalized companies such as Apple, Google and Intel have also expressed a strong interest in video distribution. Content owners will benefit from an expanding customer base that can be serviced at negligible incremental costs. Further, in the face of internet-based competition, legacy distributors, such as Time Warner, Comcast and others, are likely to remain under pressure to absorb rising content costs. We believe that high-quality content owners are best positioned to benefit from the disruptive era in video distribution we see approaching.

Energy and Strategic Resource Opportunities: The energy sector appears to ARS to be particularly compelling at this time. Equities in this sector were hurt by several concurrent factors over the past few quarters, many of which are discussed in this Outlook, including: concerns over a soft patch in US economic data, a cyclical slowdown in developing markets such as China which accounts for the greatest increase in marginal demand for oil, increasing levels of natural gas supply resulting from the US shale gas revolution and temporary excess gas inventories resulting from the warmest US winter in several decades. Many of these factors are temporary in nature, but together they conspired to drive energy company valuations to the lowest levels in a decade when measured by valuations of cash flow and/or reserves, with several companies in ARS’ portfolios trading for less than 3x cash flow from operations. We believe that at these low valuations, energy companies are particularly well-positioned to benefit from a cyclical recovery in the US and the developing world as stimulus from lower commodity prices and lower interest rates begins to have an impact later this year. The attractive valuations also make these companies appealing acquisition candidates to strategic buyers.

Dividend Payers: In our view, the Federal Reserve is likely to keep short-term interest rates low well beyond its stated target of late 2014. With interest rates at historic lows and quite possibly set to stay there for longer than many anticipate, investors should look to benefit from the attractive dividends currently available from select US corporations with strong balance sheets and the ability to raise payouts over time.

Beneficiaries of Currency Devaluation: Currency devaluation or debasement occurs when governments manage debt service and other obligations through monetizing or printing currency. During such periods, as the purchasing power of fiat (paper) currency declines, tangible assets and productive businesses tend to maintain their relative values to society and appreciate in fiat currency terms. For this reason, gold has tended to be a standout performer during times of currency debasement. We believe that gold and undervalued mining companies with growth potential, low production costs and strong cash flows should continue to comprise some portion of ARS client portfolios.

Financials: Several forces are combining to lead us to gradually and selectively add financials to portfolios. While US and European banks continue to make headlines with trading losses, fines and regulatory issues, the news flow and negative sentiment towards the industry is offering potential opportunities to buy quality businesses at unusually attractive valuations. Research is identifying interesting opportunities to purchase banks that are selling for significantly less than tangible book value, which has historically suggested material undervaluation.

Opportunistic use of Cash: Because the business cycles have tended to be shorter in duration in the current environment of near-zero interest rates, it can be prudent to periodically hold higher cash balances in accounts, particularly during times of greater market complacency and lower margins-of-safety in company valuations. As importantly, it provides the buying power to be opportunistic and purchase shares of attractive companies at compelling valuations such as we have recently witnessed.

From time to time, the prices of the companies in portfolios will temporarily diverge from the true inherent values of the underlying businesses, and we have experienced such a period in recent quarters. During such times, a sound investment approach requires a combination of patience and judgment to identify those businesses whose values are not being properly reflected in the marketplace. ARS made adjustments this past quarter to shift portfolios to better align with the themes outlined in our April 24, 2012 Outlook. In particular, we reduced our exposure to some companies (primarily steel related) and at the same time, increased exposure to the beneficiaries of the areas listed above, particularly in data and content businesses as well as high dividend-paying companies. These incremental shifts, combined with significant undervaluations in many of our core holdings, should have portfolios well-positioned for the coming year.

Sign up to receive The Outlook — our timely newsletter featuring our investment and economic thinking — and highlights from our latest market insights will be emailed directly to your inbox.